-

Study: Tablet, Connected Devices Driving Higher Video Engagement and Longer Sessions

Let's face it: few people savor the idea of snuggling up with their desktop or laptop computer to watch long-form video entertainment. So even as online video consumption has surged, the industry is challenged by the fact that the vast majority of viewing is still locked to the computer. Now however, as video viewing via tablets along with connected devices and game consoles that allow TV-based viewing are beginning to go mainstream, new data from Ooyala suggests that engagement and session lengths are increasing as well. This is a positive sign for everyone involved in the online video ecosystem - brands, advertisers, content providers, distributors and device makers.

Categories: Devices

Topics: Ooyala

-

Q&A with Bismarck Lepe, president of products at Ooyala - 11/2/11

1. How important is video to a social media strategy and vice versa?

Social media is about sharing and discovering. We login to Facebook or Twitter or FourSquare because we want to share our latest pictures, videos, ideas, or items of interest, such as an article, video or song. We also login to find out what our friends and acquaintances are up to, or discover what they’re reading and watching. Adding social dimensions to video is an effective way to facilitate content discovery. Said another way, it’s an effective way to let your audience become your marketers.

At the same time, watching TV, movies and other video content is an inherently social experience. We go to the movies with friends, sit around the TV with family, and discuss the latest hit show with co-workers. By combining video with social media elements, a publisher can recreate in a digital setting the ways we already engage with content in the offline world. That creates a more engaging and “sticky” social media experience.

Categories: Advertising, Social Media

-

Recapping All of the Product and Partnership News from ELEVATE

At the ELEVATE conference on Tuesday a number of our partners made product and partnership announcements which I mentioned were coming in a teaser last Friday. Each helps move the online video advertising market forward in different ways. A brief recap of each follows:

Categories: Advertising, Events, Technology

Topics: Adap.TV, AdoTube, Conviva, ELEVATE, EyeView, Grab Networks, Innovid, Ooyala, Panache, RAMP, Tremor Video, Undertone, YuMe

-

Ooyala Pursues OTT Market With Ooyala Everywhere

Online video platform provider Ooyala jumped into the over-the-top space today, unveiling at the NAB Show "Ooyala Everywhere," a set of technologies and services to deliver premium content on mobile devices, connected TVs and browsers. Bismarck Lepe, Ooyala's co-founder and president of products updated me last week.

Categories: Technology

Topics: Ooyala

-

VideoNuze Report Podcast #89 - Feb. 25, 2011

I'm pleased to present the 89th edition of the VideoNuze Report podcast, for February 25, 2011.

In this week's podcast, Harold Geller, the SVP of Cross-Industry Workflow at the 4As (American Association of Advertising Agencies) joins me, sitting in for Daisy Whitney. Harold and I discuss the busy week online video platforms have had, including Ooyala's deal with Yahoo! Japan, thePlatform's with Telstra's BigPond TV, Brightcove's integration with LG's Smart TVs, and VBrick's acquisition of Fliqz.

One of the takeaways we see from this activity is that online video platforms and video delivery to connected TVs (and other devices) are starting to converge. Harold also notes a couple of recent conversations he's had which further suggest that OVPs and online video advertising players will be playing a greater role in ad insertion in video-on-demand offered by traditional pay-TV operators. That would be a pretty interesting new twist in the VOD story. More on this next week.

Click here to listen to the podcast (14 minutes, 55 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts, Technology

Topics: BigPond TV, Brightcove, Fliqz, LG, Ooyala, Telstra, thePlatform, VBrick, Yahoo! Japan

-

Ooyala Lands Yahoo! Japan In Big Customer Win

Online video platform Ooyala is announcing this morning a big customer win, with Yahoo! Japan. Under the multi-year deal, Yahoo! Japan will standardize on Ooyala across all of its hundreds of sites and will also sell and support the platform to its ecosystem and to the broader Japanese Internet market. Yahoo! Japan is majority-owned by Softbank and is affiliated with Yahoo!.

The deal is significant to Ooyala because of the size of the Japanese Internet market and the fact that Yahoo! Japan, with 80 million monthly unique visitors, is the dominant player. Ooyala's CEO Jay Fulcher brought me up to speed on the deal last week.

Though there wasn't a formal RFP, Jay said that Yahoo! Japan stress-tested the Ooyala platform with millions of streams. Jay believes that while robust content management and publishing capabilities are now table stakes in big deals like these, it was Ooyala's analytics and monetization tools that were the differentiators. Yahoo! Japan is looking to take insight around consumer behavior and use it to drive monetization strategy across PCs, mobile devices and connected TVs.

Categories: International, Technology

Topics: Ooyala, Yahoo! Japan

-

Ooyala Introduces Paywall Feature

Online video platform Ooyala is introducing "Ooyala Paywall" this morning, a feature that allows customers to charge for their video. Paywall is integrated with online payment processor PayPal so that selected videos can be paid for with a user's PayPal account or with a credit card. The demo makes it look pretty simple for Ooyala customers to set up and experiment with Ooyala Paywall; they choose which on-demand or live videos to include, how much to charge for rental, how long after start-time the paywall appears and how long the rental period will be. They can experiment with pricing and get reports on activity.

online payment processor PayPal so that selected videos can be paid for with a user's PayPal account or with a credit card. The demo makes it look pretty simple for Ooyala customers to set up and experiment with Ooyala Paywall; they choose which on-demand or live videos to include, how much to charge for rental, how long after start-time the paywall appears and how long the rental period will be. They can experiment with pricing and get reports on activity.

As the online video industry continue to mature, utilizing a range of different business models will be increasingly important. In particular, as connected devices proliferate, which allow familiar on-TV viewing and better experiences, I believe a perception change will begin to occur as users are more in the mindset that paying for content is the norm. In other words whereas many people equate the Internet with "free," with 90 million+ homes subscribing to multichannel video services, plus millions more buying or renting DVDs and or subscribing to services like Netflix, TV viewing is more associated with "paid." That's not to say getting users to pay for online video will be a slam-dunk, but connected devices are going to help a lot.

What do you think? Post a comment now (no sign-in required).

Categories: Technology

Topics: Ooyala

-

5 Items of Interest for the Week of Sept. 6th

Though it was a short week due to the Labor Day holiday, there was no shortage of online video industry happenings this week. As I've been doing each of the last few Fridays, following are 5-6 noteworthy industry stories for your weekend reading pleasure.

Ooyala Raises $22 Million to Accelerate Global Expansion

Online video platform Ooyala's new $22 million round is a bright spot in what's been a pretty slow quarter for online video industry private financings. Ooyala's new funds will help the company grow in the Asia-Pacific region. Ooyala said it is serving 550 customers, double the level of a year ago.

Google TV to Roll Out World-Wide Next Year

Even though the first Google TV-enabled devices have yet to be deployed, Google CEO Eric Schmidt said this week that he envisions a global rollout next year. The connected device landscape is becoming more competitive for Google TV given the growing number of inexpensive connected device options.

Business Groups Question Net Neutrality Rules

Three pro-business trade groups urged the FCC to drop its net neutrality initiative, citing the "flourishing" broadband market and concerns that regulations will curtail new investments and hurt the economy. It seems like everyone has a different opinion about net neutrality, so the consensus needed to move regulation forward is still down the road.

ESPN, YouTube Link Up for Promo Campaign

This week ESPN and YouTube kicked off their "Your Highlight" campaign, enticing ESPN viewers to upload their own sports clips, with the best ones to be shown on SportsCenter. Then the best of the best will win a trip to ESPN's studios to watch a SportsCenter taping. It's a great promotional concept, using online video to further invest ESPN viewers in the brand. Whoever thought it up deserves a shout-out.

Life Without a TV Set? Not impossible

Another interesting data point to tuck into your back pocket: according to a 2010 Pew study, just 42% of Americans feel a TV set is a "necessity," down from 64% in 2006. Pew interprets this as a loss of status for the TV, as other devices like computers and phones have become video capable. The perception of convergence is taking root.

Categories: Broadband ISPs, Cable Networks, Deals & Financings, Devices, Regulation, UGC

Topics: ESPN, FCC, Google TV, Net Neutrality, Ooyala, Pew, YouTube

-

Ooyala Supporting Monetization of HTML5 Video

Online video platform Ooyala is announcing this morning that its HTML5 video player is now supporting dynamic ad insertion for IAB-standard ads. This means that content providers using Ooyala's Backlot platform will be able to monetize video consumed by iPads and iPhones.

means that content providers using Ooyala's Backlot platform will be able to monetize video consumed by iPads and iPhones.

Categories: Advertising, Technology

-

Ooyala Integrates YouTube Access For Customers

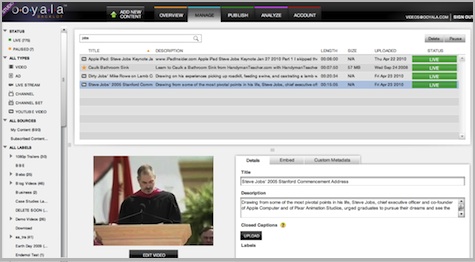

Online video platform Ooyala has unveiled an interesting new feature that allows its customers to add videos from YouTube to their Backlot account and then have them displayed right alongside their own videos in their Ooyala player. All of the analytics that are available for the customer's own videos extend to the YouTube videos as well. Alex Holub, senior product manager at Ooyala gave took me on a quick tour last week of how it works. It appears simple and well thought-out.

Alex explained that the impetus here was that a lot of Ooyala customers were already trying to incorporate YouTube videos, but there wasn't an easy or integrated way to do so. With the new feature, a customer can search and gather relevant YouTube videos from within the Backlot platform and then add them to their account, where they can subsequently add metadata. The videos can also be syndicated along with other owned video. The YouTube videos are displayed in a chromeless player, which means the Ooyala look and controls remain. The main thing that separates the YouTube videos is that per YouTube rules they cannot be directly monetized. So Ooyala's ad rules pre-empt any pre-roll or overlays; instead on-page ads only are allowed.

Ooyala's move is further recognition of valuable YouTube's library has become for many publishers. There is just so much content on YouTube, and tons more being added every day that is freely available that for many YouTube is an irresistible augment to their own content. The only other OVP that I'm aware of that has done something like this with YouTube and other sources is Magnify.net, with has been all about enabling its customers to curate the best video from around the web from the outset. I expect we'll see other OVPs offer this capability too.

Ooyala is offering the new YouTube feature free until May 31st for customers.

What do you think? Post a comment now (no sign-in required).Categories: Technology

-

Ooyala Expands Into Japan with NTT Partnership

Online video platform provider Ooyala unveiled a partnership yesterday with NTT SMARTCONNECT that expands the company into Japan. Under the non-exclusive deal, the two companies will collaborate to create a localized and co-branded version of Ooyala's Backlot platform. Marketing and sales are set to begin in February.

As part of the announcement Ooyala also provided some 2009 updates: contracted customers grew from 30

to 300, self-serve customers grew five-fold, the Ooyala player now delivers hundreds of millions of streams/mo to 50 million unique users/mo, it transcodes 60K hours of video/mo and the company now has 70+ employees.

to 300, self-serve customers grew five-fold, the Ooyala player now delivers hundreds of millions of streams/mo to 50 million unique users/mo, it transcodes 60K hours of video/mo and the company now has 70+ employees. Ooyala also said that 50% of its customers are marketers, and outside of the traditional media space. The company cited Electronic Arts, for which it powers video on 30 different properties, General Mills and Cerner. The non-media focus parallels what Brightcove recently told me, that over half its business now comes from non-media customers (e.g. business, government and education).

As I wrote recently, despite all the growth in the online video platform space, it's still relatively early days. To be in the top tier as the market matures will require providers to scale their operations, including international expansion and serving customers outside the core media market. It looks like Ooyala understands this as well.

What do you think? Post a comment now.

Categories: International, Partnerships, Technology

Topics: NTT SMARTCONNECT, Ooyala

-

As Episodic Launches, How to Make Sense of the Crowded Video Platform Space?

Surely one of the most enduring questions I and others who watch the online video industry are asked (and in fact often ask ourselves) is: How can video management and publishing platform companies continue to launch, even as the space already seems so crowded?

Personally I've been hearing this question for at least 6 years, going back to when I consulted with Maven Networks, whose acquisition by Yahoo was one of the few industry exits (and likely the best from an

investor ROI perspective, regardless of the fact that it was shut down little more than a year later as part of Yahoo's retrenching. With yesterday's launch of Episodic and the recent launch of Unicorn Media, plus last week's $10M Series C round by Ooyala, it's timely to once again try to make sense of all the activity in the platform space.

investor ROI perspective, regardless of the fact that it was shut down little more than a year later as part of Yahoo's retrenching. With yesterday's launch of Episodic and the recent launch of Unicorn Media, plus last week's $10M Series C round by Ooyala, it's timely to once again try to make sense of all the activity in the platform space. The best explanation I offer traces from my Econ 101 class: supply is expanding to meet demand. Over the past 10 years, there has been an enormous surge of interest in publishing online video by an incredible diversity of content providers. Importantly, interest by content providers has intensified in the last few years. I can vividly recall 2003 and 2004, trying to explain to leading content providers why online video was an important initiative to pursue. Still, their projects were often experimental and non-revenue producing. Contrast this with today, where every media company on earth now recognizes online video as a strategic priority.

But even as online video's prioritization has grown, many media companies don't have all the strategic technology building blocks in place. In fact, many continue to use home-brewed technology developed a while back. The range of video features needed continues to grow and evolve rapidly. Consider how requirements have expanded recently: live, as well as on-demand video; long-form programs as well as clips; paid, as well as ad-supported business models; mobile, as well broadband distribution; multiple bit rate, as well as single stream encoding; in-depth analytics as well as top-line metrics; widespread syndication as well as destination-site publishing; off-site, as well as on-site ad management. The list goes on and on.

As media company interest has grown, technology executives and investors have taken note. Venture capital firms continue to see online video as a high-growth industry (even if the revenue model for content providers is still developing, as are many of the platforms' own revenue models), with significant macro trends (e.g. changing consumer behavior, proliferation of devices, improved video quality, etc.) as fueling customer interest. Another important factor for platforms is rapidly declining development costs. As Noam Lovinsky, CEO of Episodic told me last week, open source and other development tools has made it cheaper than ever to enter the market with a solid product. With ever lower capital needs, a new video platform entrant that can grab its fair share of the market has the potential to produce an attractive ROI.

Of course all the noise in the platform space means media executives need to do their homework more rigorously than ever. I'm a strong believer that the only way to really understand how a video platform works, how well-supported it is and how well-matched it is to the content provider's needs is to vigorously test drive it. Hands-on use reveals how comprehensive a platform really is, or how comfortable its work flow is, or how well its APIs work. While I get a lot of exposure to the various platforms through the demos I experience and the questions I ask, I'll readily concede this is not the same as actually living with a platform day-in and day-out.

Another complicating factor is that while there are some companies purely focused on video management and publishing, there are many others who offer some of these features, while positioning themselves in adjacent or larger markets. When I add these companies in, then the list of participants that most often hits my radar would include thePlatform, Brightcove, Ooyala, Twistage, Digitalsmiths, Delve, KickApps, VMIX, Grab Networks, ExtendMedia, Cisco EOS, Irdeto, KIT Digital, Kaltura, blip.tv, Magnify.net, Fliqz, Gotuit, Move Networks, Multicast Media, WorldNow, Kyte, Endavo, Joost, Unicorn Media and Episodic (apologies to anyone I forgot). Again though, this list combines apples and oranges; some of these companies are direct competitors, some are partners with each other, some have a degree of overlap and so on.

There's a long list of platforms to choose from, yet I suspect the list will only get longer as online and mobile video continues to grow and mature. At the end of the day, who survives and succeeds will depend on having the best products, pricing the most attractively and actually winning profitable business.

What do you think? Post a comment now.

Categories: Technology

Topics: Brightcove, Cisco EOS, Delve, Digitalsmiths, ExtendMedia, Grab Networks, Irdeto, KickApps, Ooyala, thePlatform, Twistage, VMIX

-

Will Kaltura's Open Source Video Platform Disrupt the Industry?

This morning Kaltura takes the wraps off its "Community Edition" open source video platform, available as a free download, thereby threatening to disrupt its established proprietary competitors (e.g. Brightcove, thePlatform, Ooyala, Digitalsmiths, Fliqz, Delve, VMIX, etc.). Yesterday Kaltura's CEO Ron Yekutiel explained open source and Community Edition's opportunity. Later in the day I spoke to executives at many of its competitors to get their take what impact open source will have on the video platform market.

As a quick primer, open source isn't a novelty; it's a standard way that certain kinds of software are now developed. Successful companies like Red Hat have been built around open source. In fact many of today's web sites run on the open source software stack commonly known as "LAMP" - Linux (OS), Apache (web server), MySQL (database) and Perl/PHP/Python (scripts). Kaltura has been pioneering open source in the video platform industry which has been dominated by proprietary competitors. Ron believes the video platform industry is ripe for open source success because it has too many proprietary companies offering minor feature differences, all using a SaaS model only and competing too heavily on price.

Kaltura Community Edition's three big differentiators are that it's free for the base platform and offers greater control through self-hosting which can be behind the customer's firewall. Ron also believes that by tapping

into the open source community, CE can offer more flexibility and extensibility than its competitors.

into the open source community, CE can offer more flexibility and extensibility than its competitors. As with all open source options though, free isn't "free," because if you're interested in support and maintenance, professional services for customization and certain features like syndication, advertising, SEO and content delivery, these all cost extra. And you can't forget about the costs of the internal staff you'd need to run the video platform or the costs of the infrastructure itself (servers, bandwidth, storage, etc.). In the SaaS world, many of these costs are borne by the provider and then reflected in the monthly fee. Determining which approach is more cost-effective depends on your particular circumstances and needs.

All of this is why, as one competitor's CEO told me yesterday, the choice to go open source more often than not isn't primarily price-based; rather it's features-based. In fact, given the range of low cost proprietary alternatives (e.g. $100-$200/mo packages from companies like Fliqz and Delve), even free doesn't represent really significant savings.

When it comes to features, clearly the ability to download CE and self-host is a big differentiator, and will be valued by segments of the market. As Ron pointed out, there are government agencies, universities and others who have mandates to self-host. He also noted that by customers' gaining access to CE's code, their ability to integrate with other applications and customize is enhanced (though again, not without an additional cost).

Other industry executives countered that unless you have to self-host, these advantages are diminished by the fact that in this capex and opex budget constraints make SaaS more appealing than ever, especially for smaller customers with less in-house technical expertise. They added that they're rarely asked about self-hosting options (though that could well be due to self-selection).

Further, many of the leading video platform companies offer a slew of APIs, which open their platforms to 3rd party developers without needing to be open source per se (examples include Brightcove's and thePlatform's robust partner programs). Another industry CEO noted that while there's a gigantic and highly active open source community in the LAMP world, it remains to be seen just how vibrant it is in the video space. And it's important to remember that the intense competition among today's video platforms have already driven the feature bar quite high.

So the question remains: will Kaltura's CE open source approach truly disrupt the video platform industry, causing rampant customer switching and gutting today's pricing models? My sense is no, or at least not immediately. Instead, Kaltura will definitely grow the market, creating new video customers from those who have been dissatisfied with current choices or have not yet jumped into video, but inevitably will. CE will likely peel away some percentage of existing proprietary customers who have been eager for a self-hosted, open source alternative. For many others though, they'll be keeping an eye on open source and will successfully push their existing providers to adopt similar capabilities if they're valued.

What do you think? Post a comment now.

Categories: Technology

Topics: Brightcove, Delve, Digitalsmiths, Fliqz, Kaltura, Ooyala, thePlatform, VMIX

-

Ooyala Launches Updated Video Player as It Prepares for Strobe Entry

Today Ooyala is officially releasing its updated video player, named "Swift," with a lighter-weight, more modular design intended to deliver faster loading/playback for users and improved integration of advanced features for its content provider customers. Sean Knapp, one of Ooyala's 3 co-founders, and head of

technology shared more details of the new player with me last week, and also provided a perspective on the coming entry of Adobe's Strobe video player framework, which will undoubtedly impact all of the video player/content management companies.

technology shared more details of the new player with me last week, and also provided a perspective on the coming entry of Adobe's Strobe video player framework, which will undoubtedly impact all of the video player/content management companies.A key focus of the Swift's development has been modularizing its code, so that only what's required for that particular user experience is downloaded to the user. Faster response times and better playback are critical drivers in the user experience, as we've all no doubt endured the wait for a video, only to end up clicking away. It's no surprise that Ooyala - with a cadre of people from Google, where cutting milliseconds from the time to deliver search results is an obsession - should be focusing on response times.

Playback quality is another focus of the new player, with improved bandwidth detection that supports Ooyala's adaptive bit rate ("ABR") or "dynamic video" delivery. ABR/dynamic video has become a competitive battleground lately, with companies like Move Networks (an ABR pioneer), Microsoft, Adobe, Brightcove and others all touting ABR delivery.

ABR delivery detects on a moment-to-moment basis the user's available bandwidth and computer processing capability so that an appropriately encoded video file can be dynamically delivered. Sean said that via an HTTP delivery workaround it created over a year ago, Ooyala has been able to offer ABR in Flash, thereby preceding Flash Media Server 3.5 (FMS 3.5 was released last November as the first Flash server to support dynamic streaming; it has only recently been deployed by CDNs).

Sean explained that the new player's design approach aligns with the coming entry of Adobe's "Strobe" video player framework later this year, which he welcomes. From his perspective, Strobe has the potential to address a lot of the core video functions that Ooyala and other video player companies have had to develop themselves. If successful, Strobe will provide a standardized foundation layer ("getting us out of the muck" as Sean happily said) that would free up Ooyala to focus on supporting higher value components such as advanced monetization (e.g. micro-payments, subscriptions). Ooyala has not yet announced support for Strobe, but it plans to.

This is basically how Adobe itself would like Strobe to be perceived. In a recent conversation with Sumner Paine, Strobe's product manager, he explained to me that Strobe's tools and frameworks are intended to accelerate the development of custom Flash players, to better support content providers' specific objectives (and of course reinforce the Flash value proposition).

Key to Strobe are third party plug-ins from the growing video ecosystem meant to replace the duplicative process of each video player company having to integrate with each third party. Sumner sees video player companies with freed-up resources being able to move up the stack, for example, to provide tighter integrations with customers' content management systems.

Strobe's Q3 entry is going to be another milestone in the ongoing maturation of the broadband video industry. Adobe is trying to create additional industry scalability and drive further customization while defending its turf against Silverlight and other potential entrants. If Strobe is successful, the bevy of video players on the market will need to find new ways to innovate to differentiate themselves, such as Ooyala's trying to do here with Swift. With so many moving parts this is going to be a closely watched space.

What do you think? Post a comment now.

Categories: Technology

Posts for 'Ooyala'

Previous |