-

Catching Up on Last Week's Industry News

I'm back in the saddle after an amazing 10 day trip to Israel with my family. On the assumption that I wasn't the only one who's been out of the office around the recent July 4th holiday, I've collected a batch of industry news links below so you can quickly get caught up (caveat, I'm sure I've missed some). Daily publication of VideoNuze begins again today.

Hulu plans September bow in U.K.

Rise of Web Video, Beyond 2-Minute Clips

Nielsen Online: Kids Flocking to the Web

Amid Upfronts, Brands Experiment Online

Clippz Launches Mobile Channel for White House Videos

Prepare Yourself for iPod Video

Study: Web Video "Protail" As Entertaining As TV

In-Stat: 15% of Video Downloads are Legal

Kazaa still kicking, bringing HD video to the Pre?

Office Depot's Circuitous Route: Takes "Circular" Online, Launches "Specials" on Hulu

Upload Videos From Your iPhone to Facebook Right Now with VideoUp

Some Claims in YouTube lawsuit dismissed

Concurrent, Clearleap Team on VOD, Advanced Ads

Generating CG Video Submissions

MJ Funeral Drives Live Video Views Online

Why Hulu Succeeded as Other Video Sites Failed

Invodo Secures Series B Funding

Comcast, USOC Eye Dedicated Olympic Service in 2010

Consumer Groups Push FTC For Broader Broadband Oversight

Crackle to Roll Out "Peacock" Promotion

Earlier Tests Hot Trend with "Kideos" Launch

Mobile entertainment seeking players, payment

Netflix Streams Into Sony Bravia HDTVs

Akamai Announces First Quarter 2009 State of the Internet Report

Starz to Join Comcast's On-Demand Online Test

For ManiaTV, a Second Attempt to be the Next Viacom

Feeling Tweety in "Web Side Story"

Most Online Videos Found Via Blogs, Industry Report

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, CDNs, Deals & Financings, Devices, Indie Video, International, Mobile Video, Technology, UGC

Topics: ABC, C, Clearleap, Clippz, Comcast, Concurrent, Hulu, In-Stat, Invodo, iPod, Kazaa, Nielsen, Office Depot, Qik, VideoUp, YouTube

-

4 Industry Items from this Week Worth Noting

YouTube mobile video uploads exploding; iPhones are a key contributor - The folks at YouTube revealed that in the last 6 months, uploads from mobile phones to YouTube have jumped 1,700%, while in the last week, since the new iPhone GS was released, uploads increased by 400% per day. I didn't have access to these stats when I wrote on Monday "iPhone 3GS Poised to Drive User-Generated Mobile Video," but I was glad to see some validation. The iPhone 3GS - and other smartphone devices - will further solidify YouTube as the world's central video hub. I stirred some controversy last week with my "Does It Actually Matter How Much Money YouTube is Losing?" post, yet I think the mobile video upload explosion reinforces the power of the YouTube franchise. Google will figure out how to monetize this over time; meanwhile YouTube's pervasiveness in society continues to grow.

Nielsen study debunks mythology around teens' media usage - Nielsen released a new report this week "How Teens Use Media" which tries to correct misperceptions about teens' use of online and offline media. The report is available here. On the one hand, the report underscores prior research from Nielsen, but on the other it reveals some surprising data. For example, more than a quarter of teens read a daily newspaper? Also, 77% of teens use just one form of media at one time (note, data from 2007)? I'm not questioning the Nielsen numbers, but they do seem out of synch with everything I hear from parents of teens.

Paid business models resurfacing - There's been a lot of talk from media executives about the revival of paid business models in the wake of the recession's ad spending slowdown and also the newspaper industry's financial calamity. For those who have been offering their content for free for so long, putting the genie back in the bottle is going to be tough. Conversely for others, like those in the cable TV industry, who have resisted releasing much content for free, their durable paid models now look even more attractive.

Broadcast TV networks diverge on strategy - Ad Age had a good piece this week on the divergence of strategy between NBC and CBS. The former is breaking industry norms by putting Leno on at 10pm, emphasizing cable and avidly pursuing new technologies. Meanwhile CBS is focused on traditional broadcast network objectives like launching hit shows and amassing audience (though to be fair it is pursuing online distribution as well with TV.com). Both strategies make sense in the context of their respective ratings' situations. Regardless, broadcasters need to eventually figure out how to successfully transition to online distribution, something that is still unproven (as I wrote here).

Categories: Aggregators, Broadcasters, Mobile Video, UGC

Topics: Apple, CBS, iPhone, NBC, Nielsen, YouTube

-

VideoNuze Report Podcast #18 - May 29, 2009

Below is the 18th edition of the VideoNuze Report podcast, for May 29, 2009.

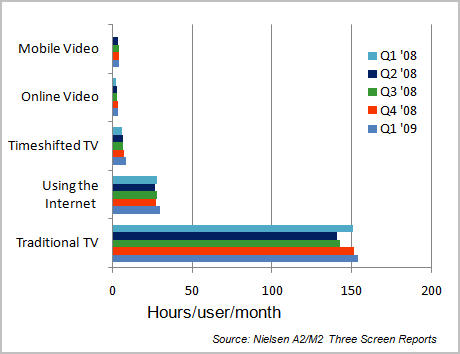

This week I review the Q1 '09 Nielsen A2/M2 Three Screen Report data recently released, comparing it to Q1 '08 data. My comments pick up on a post I wrote earlier this week, "Video Behavior Changes Suggest Evolution, Not Revolution For Now."

Don't get me wrong, video consumption on alternative platforms (i.e. broadband, mobile, DVR) is continuing to grow briskly. But the reality is that when you look at the numbers, they suggest steady rather than dramatic, overnight change is what's really happening in the market. This reality is sometimes missed in the ongoing hype.

Meanwhile Daisy adds more detail to a post she wrote, "Fox's Prison Break Finale Demonstrates the Power of Social Media," which describes how Fox cleverly used social media to promote a DVD with 2 additional episodes following the on-air finale. Fox used various social media sites to release a teaser picture from the new episodes and began promoting the DVD which will be available on July 21 on DVD and for purchase on iTunes. It's an intriguing way for the studio to migrate users beyond traditional TV consumption and generate additional revenue.

Click here to listen to the podcast (13 minutes, 37 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Podcasts

-

Video Behavior Changes Suggest "Evolution," Not "Revolution" For Now

Last week's latest Nielsen A2/M2 Three Screen Report confirmed what I've been saying for a while: when it comes to characterizing changes in consumers' overall video behaviors, "evolution" is a better descriptor than "revolution." To be sure there are certain age segments and behaviors where change is happening very fast. But the overall Nielsen tracking data suggests that until a significant catalyst comes along, major market changes will play out quite gradually.

I've been tracking Nielsen's periodic releases of its Three Screen reports since last year, and the graph below captures the data during this period.

No surprise, time spent watching online video experienced the biggest year-to-year jump (53%) to 3 hours/month. That's solid growth, but even at this rate, it would be a long time before online video viewing takes a significant overall share of the video market. Part of the reason is that time spent on traditional TV just keeps on increasing, nudging up almost 3 hours in the last year to almost 153 1/2 hours/month. That trend has to keep a lot of TV executives smiling.

Still, industry participants have to be watching younger viewers, where adoption of alternate viewing platforms is on the leading edge. For example, 18-34 year olds consume 70% more online video (5 hours, 7 minutes per month) than average, 12-17 years consume 85% more mobile video (6 hours, 30 minutes per month) than average and 25-34 year olds consume 109% more timeshifted TV (12 hours, 12 minutes per month) than average. All of these segments are most coveted by advertisers and their more-rapidly shifting behaviors are clearly (and correctly) driving major media to experiment with new broadband and mobile models.

The "x factor" that would scramble these trends is the introduction of significant market catalyst, like the iPhone, which has ignited mobile video market. In online video viewing specifically, a market catalyst would be a convergence device or enabler that would allow seamless broadband connectivity to TVs. I've talked about this a lot on VideoNuze, and there are many different approaches underway. When one begins experiencing serious adoption, as the iPhone has, I expect Nielsen Three Screen Data will reflect it.

Until then we can expect broadband, mobile and timeshifting to have a significant, yet gradual impact on the overall market.

What do you think? Post a comment now.

Categories:

Topics: Nielsen

-

New Nielsen Numbers Reveal Key Video Behaviors by Age Group

Yesterday Nielsen released the Q4 version of its A2/M2 Three Screen Report, which measures video usage across TV, online and mobile. The report is here, and Nielsen does a nice job of summarizing some of the key numbers and trends. In particular, for those concerned about traditional TV's potential demise, the new data should provide some comfort. Nielsen reports that TV viewership was at a record 151 hours per month per average viewer in Q4, up from 140 hours in Q3 (a jump that Nielsen doesn't explain, but which I can only ascribe to the growing ranks of the unemployed spending more time in front of the tube).

I looked at the data Nielsen released and there are additional key insights that I think are worth noting. I always find it most useful to focus on the changes in younger people's consumption habits. That's because

younger people are generally more comfortable with technology and what they do today is often a leading indicator of what older cohorts will be doing tomorrow. For marketers in particular, younger people's behavior is crucial because it reveals the preferences of a greater and greater share of would-be buyers in the years to come.

younger people are generally more comfortable with technology and what they do today is often a leading indicator of what older cohorts will be doing tomorrow. For marketers in particular, younger people's behavior is crucial because it reveals the preferences of a greater and greater share of would-be buyers in the years to come. With that context, I was interested in the consumption of three newer forms of video Nielsen is measuring (timeshifted/DVR-based video, Online video and Mobile video) as a ratio of traditional TV consumption. While not exact, I believe these respective ratios give us a glimpse into the emerging viewing preferences by age group, and what trends may lie ahead. When looked at this way, I found three interesting things.

First, the ratio of mobile video consumed to traditional TV consumed for the 12-17 age group is off the charts compared to all other age groups. For those in this age group that watch mobile video, they watch about 6:38 hours/minutes per month, compared to their average of 103.48 hours/minutes of traditional TV per month. That ratio of 6.2% far outpaces all other age groups; the next nearest one is 25-34 year olds which watch 2.4%. The youngest are clearly embracing mobile video and will no doubt expect more out-of-home options and value as they mature.

Second, the ratio of online video consumed to traditional TV consumed for the next youngest age group, 18-34 is significantly higher than for all other age groups. 18-34 year olds watch 5:03 hours/minutes of online video per month on average, compared with just 118:28 hours/minutes of traditional TV per month on average, for a ratio of 4.3%. No other age group exceeds a 3% ratio. Further, 18-34 years watch slightly more online video than time-shifted video. Clearly this group views online as a bona fide on-demand platform and is likely most primed for "cord-cutting." Cable operators' moves to offer programs online will likely resonate strongly.

Lastly, the ratios of timeshifted/DVR video consumed to traditional TV consumed for the 25-34 and 35-44 age groups are far higher than for all the other age groups. 25-34 year olds watch 10:50 hours/minutes of timeshifted TV per month on average, compared to 142:29 hours/minutes of traditional TV per month on average for a 7.4% ratio. For 35-44 year-olds its 9:44 hours/minutes of timeshifted compared to 147:21 hours/minutes of traditional TV for a 6.4% ratio. No other age group even reaches a ratio of 5%. Time-shifting and its ad-skipping - its frequent companion behavior - are becoming increasingly prevalent for these age groups.

On the surface the Nielsen data suggests that traditional TV consumption is quite durable even as newer viewing platforms are introduced. Yet when numbers like those above are factored in, it becomes apparent that for certain age groups, behavioral change is well underway. This is data that market participants need to pay close attention to and then plan accordingly.

What do you think? Post a comment now.

Categories:

Topics: Nielsen

-

January '09 VideoNuze Recap - 3 Key Themes

Following are 3 key themes from VideoNuze in January:

Broadband video marches to the TV - At CES in early January there were major announcements around connecting broadband to TVs, either directly or through intermediary devices (a recap of all the news is here). All of the major TV manufacturers have put stakes in the ground in this market and we'll be seeing their products released during the year. Technology players like Intel, Broadcom, Adobe, Macrovision, Move Networks, Yahoo and others are also now active in this space. And content aggregators like Netflix and Amazon are also scaling up their efforts.

Some of you have heard me say that as amazing as the growth in broadband video consumption has been over the last 5 years, what's even more amazing is that virtually all of it has happened outside of the traditional TV viewing environment. Consider if someone had forecasted 5 years ago that there would be this huge surge of video consumption, but by the way, practically none of it will happen on TVs. People would have said the forecaster was crazy. Now think about what will happen once widespread TV-based consumption is realized. The entire video landscape will be affected. Broadband-to-the-TV is a game-changer.

Broadband video advertising continues to evolve - The single biggest determinant of broadband video's financial success is solidifying the ad-supported model. For all the moves that Netflix, Amazon, iTunes and others have made recently in the paid space, the disproportionate amount of viewership will continue to be free and ad-supported.

This month brought encouraging research from ABC and Nielsen that online viewers are willing to accept more ads and that recall rates are high. We also saw the kickoff of "the Pool" a new ad consortium spearheaded by VivaKi and including major brands and publishers, which will conduct research around formats and standards. Three more signs of advertising's evolution this month were Panache's deal with MTV (signaling a big video provider's continued maturation of its monetization efforts), a partnership between Adap.tv and EyeWonder (further demonstrating how ecosystem partners are joining up to improve efficiencies for clients and publishers) and Cisco's investment in Digitalsmiths (a long term initiative to deliver context-based advanced advertising across multiple viewing platforms). Lastly, Canoe, the cable industry's recently formed ad consortium continued its progress toward launch.

(Note all of this and more will be grist for VideoNuze's March 17th all-star panel, "Broadband Video '09: Building the Road to Profitability" Learn more and register here)

Broadband Inauguration - Lastly, January witnessed the momentous inauguration of President Barack Obama, causing millions of broadband users to (try to) watch online, often at work. What could have been a shining moment for broadband delivery instead turned into a highly inconsistent and often frustrating experience for many.

In perspective this was not all that surprising. The Internet's capacity has not been built to handle extraordinary peak load. However on normal days, it still does a pretty good job of delivering video smoothly and consistently. As I wrote in my post mortem, hopefully the result of the inauguration snafus will be continued investment in the infrastructure and technologies needed to satisfy growing demand. That's been the hallmark of the Internet, underscored by the fact that 70 million U.S. homes now connect to the 'net via broadband vs. single digit millions just 10 years ago. I remain confident that over time supply will meet demand.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Devices, Politics, Technology

Topics: ABC, Adap.TV, Adobe, Amazon, Broadcom, EyeWon, Intel, Macrovision, Move Networks, MTV, Netflix, Nielsen, Panache, VivaKi, Yahoo

-

What Impact Does Broadband Have on TV Viewing?

Want to get your head spinning? Try making sense of the various research data that keeps spilling out about current TV consumption, and how it is being impacted by broadband video's rising popularity.

For those who think TV is largely unaffected, consider this: Last month, Nielsen reported that the average person in the U.S. watched approximately 142 hours of TV a month, which was 5 hours more than last year. Though Nielsen also said that watching video online and watching video on a mobile phone also clocked in new records at 2 hours, 31 minutes per month and 3 hours, 37 minutes per month, respectively (though, more mobile video use than online video use? That seems odd to me...).

These positive TV numbers echo what Multichannel News reported CBS research head David Poltrack recently shared: that even though 75% of TV viewers have now watched some video online, TV viewing in all demographics have gone up 8% since 2000. So maybe TV viewing isn't being hurt much.

But on the flip side is evidence that, particularly among young people, TV has already been hurt by broadband and other alternatives. Just yesterday Adweek reported upcoming numbers from Deloitte showing that viewing among 14 to 25-year-olds is now down to 10.5 hours per week, while their time spent watching video on computers continues to rise. These numbers build on research from IBM released last month that among the 76% of people they surveyed, 15% said they watched "slightly less" TV and 36% watch "significantly less" TV (note this was a 6 country study). There are other reports which have showed similar trends.

What should one conclude? My take is that broadband and other outlets are certainly having an impact among younger people, where the digital lifestyle is most pervasive. However, there are still a whole lot of people living a mainly analog lifestyle. While that provides the TV industry some short-term comfort, the long-term trends almost certainly favor less TV viewing.

What do you think? Post a comment now.

Categories: Broadcasters

-

Key Themes from My 2 Panel Discussions Last Week

Last week I moderated 2 panel discussions, one for Streaming Media East in New York, and the other for MITX, the Massachusetts Innovation and Technology Exchange, in Boston. In the former, "Reinventing the Ad Model Through Discovery and Targeting" and the latter, "Driving Audiences to Your Online Video Content: Strategies for Success in a Crowded Market" panelists discussed many of the key themes I continue observing in the broadband video market.

Early adopters are heaviest broadband usersDespite research that continues to show broadening adoption of broadband video usage (11.5 billion videos viewed in March, according to comScore), at SME, Nielsen's Jon Gibs confirmed that the vast majority of the market is still very casual users, with only 5-8% of overall users showing more habitual and long-form viewing. For many today, the viewing experience is still limited to watching a YouTube clip emailed to them or found in a friend's MySpace or Facebook page. Plus user attention spans remain short. At MITX, Visible Measures' Brian Shin showed how viewership drops off a cliff following the climactic moment of a hilarious user-generated clip. Broadband is driving significant behavioral change for a segment of the market, but transitioning to a heavily-used mainstream medium will take years.Video proliferatesNonetheless, the number and range of video producers continues to expand, as all kinds of organizations recognize that video is a totally new opportunity to connect with their audiences, whoever that may be. At the MITX event, panelists showed examples from politicians, cultural organizations, small businesses, schools, brands and users themselves. I've said for a while that we're entering a "golden age" of video, with a massive proliferation of the quantity and range of sources. The market is already well into this phase.Discovery is a huge problemWith this massive proliferation comes the huge problem of how users will actually find what they're looking for. At SME, Mike Henry from Veoh discussed promising results of Veoh's proprietary behavioral recommendation engine. At MITX, Tom Wilde from EveryZing showed how it can surface video for search engine discovery by using its speech-to-text engine; while Murali Aravamudan from Veveo explained how its algrorithms can quickly distinguish the video users are truly searching for. All of these approaches improve the users' experience. Yet what's equally clear is that, having never experienced the explosion of video choices we're now witnessing, it's impossible to know what will ultimately end up working. Discovery is an ongoing problem to be solved.Ad market still immatureLast but not least, for the many fledgling and established video providers relying on advertising, the good news is that there's a lot of buyer interest, but the bad news is that it's still a very immature market. At SME we discussed how many media buyers look at broadband video through their traditional TV lenses, leading to a focus on TV's "Gross Rating Points" or GRPs model. But this undervalues the real engagement opportunities that broadband enables. At MITX, Bob Lentz of PermissionTV discussed how broadband is changing the role of ad agencies, traditional stewards of the creative process, allowing them to now do much more. Advertising is the primary business model for content providers, yet the shift of dollars the medium is anything but straightforward.These were four of the key themes from these two sessions. There was plenty more information exchanged, if you're interested, drop me a line and I'll be happy to discuss.

Categories: Advertising, Events

Topics: EveryZing, MITX, Nielsen, PermissionTV, Streaming Media East, Veoh, Veveo, Visible Measures

Posts for 'Nielsen'

Previous |