-

Adobe Primetime Launches, With NBC Sports and Comcast As First Customers [VIDEO]

Adobe Primetime (formerly "Project Primetime") has officially launched in general availability. Adobe Primetime is positioned as a full video publishing and monetization platform that includes publishing, player, DRM, advertising and analytics components for use by both content providers and pay-TV operators across multiple screens. At the NABShow this week I interviewed Ashley Still, director of product management for Adobe Primetime, who explained its key benefits (see video below).

Categories: Technology, TV Everywhere

Topics: Adobe

-

Adobe Showcases Project Primetime at VideoSchmooze [VIDEO]

At the recent VideoSchmooze, Noah Levine, Senior Manager, Product Evangelism at Adobe Auditude delivered a short, high-impact presentation on the key technology and consumer behavior changes sweeping through the TV industry, and the business challenges these are creating.

He also provided a high-level overview of Adobe's Project Primetime, a suite of product and services to deliver, monetize and measure video across devices. Below is a video of Noah's presentation. If you'd like a copy of the slides, please contact Noah directly at his email address on the final slide.

Categories: Events, Technology

Topics: Adobe

-

Adobe Releases Full "Project Primetime" in Beta, Introduces MediaWeaver and Media Player

Adobe has announced the beta release of its full Project Primetime publishing, monetization and analytics platform for video delivered to connected devices. Adobe is also introducing two new Primetime components, MediaWeaver, a dynamic ad insertion service and Primetime Media Player, a cross-platform player tightly integrated with analytics components of Primetime.

Adobe is positioning Primetime as a comprehensive solution for professional content providers eager to move past cobbling together multiple products that often result in sub-optimal user experiences with online and mobile video. Primetime was originally unveiled in February, with the Highlights component that allowed quick clip and metadata creation from live programming.Categories: Advertising, Technology

Topics: Adobe

-

Adobe Pass Notches 10x Increase in TV Everywhere Authentications in 2012

Adobe has announced that its Adobe Pass technology notched a 10x increase during the first half of 2012 in the number of video streams it authenticated. Big contributors included NCAA March Madness, UEFA Euro 2012 soccer and the NBA playoffs, along with entertainment content from Disney and Turner cable networks. Adobe Pass also powered authentication for the London Olympics, which drove 88 million authenticated streams.

Adobe Pass is now used by 40+ sites and mobile apps from 25 content providers, and is integrated by 150 pay-TV operators covering 98% of U.S. homes. That's considerable progress for a technology which was only announced a year-and-a-half ago.Categories: Technology, TV Everywhere

Topics: Adobe

-

Adobe Lands BBC For Olympics Streaming As Project Primetime Gains Steam

Adobe announced last evening that the BBC will be using the company's "Project Primetime" video platform to deliver live and VOD streaming coverage of the London Olympics, which start tomorrow evening. The BBC win follows news from 2 weeks ago that Adobe is also powering NBC's ambitious NBC Olympics Live Extra app, which will offer 3,500 hours of video. If all goes well from the NBC and BBC efforts, Project Primetime will gain significant credibility from the Olympics, helping position Adobe as a major player in the intensely competitive online video platform space.

For its Olympics coverage, the BBC is using "Primetime Simulcast" which allows it to live stream events across the web, mobile devices and connected TVs. Specifically, a new HTML5 app has been developed using Adobe PhoneGap, a cross-platform toolset. Video is prepared and delivered by Adobe Media Server for both HTTP Dynamic Streaming (HDS) and HTTP Live Streaming (HLS) adaptive bit rate streaming formats. The video player uses the Open Source Media Framework (OSMF).Categories: Sports, Technology

-

Adobe Ready for "Primetime" With New Integrated Video Platform

Adobe is raising the curtain on Project "Primetime" this morning, an integrated video platform positioned to be a single workflow for premium video providers deploying across multiple devices. Primetime combines Adobe's traditional streaming and publishing technologies with video ad management from Auditiude (acquired last November) and analytics/optimization from Omniture (acquired in Oct. '09). Primetime will rollout throughout 2012, but today Adobe is making available the first piece - "Primetime Highlights," a web-based video clip editor integrated with Auditude so that media companies can quickly create and publish ad-supported clips from live events.

As Ashley Still, Adobe's director of product management, video solutions, explained to me last week, Primetime's key goal is to enable premium video providers to deliver the highest-quality "TV-like" experiences with seamless, dynamic ad insertion into linear/live/on-demand streams on any connected device. Adobe believes that today's content and ad delivery model, which often requires multiple workflows and products to interoperate, will not allow premium online and mobile video to effectively scale and monetize.Categories: Advertising, Technology

-

Adobe Expands Into Online Video Advertising Through Auditude Acquisition

Adobe is expanding into the surging online video advertising space, announcing that it has acquired video ad manager Auditude, whose Connect platform is used by customers such as Comcast, Major League Baseball Advanced Media, Dailymotion and others. Adobe views Auditude as providing the monetization piece of an integrated Adobe solution that already includes video creation, publishing and optimization across all IP-enabled devices. Auditude had raised approximately $40 million to date.

The overall solution is targeted to premium video publishers and distributors where Adobe already has a strong footprint through its Flash Media products and Digital Marketing Suite (i.e. Omniture). The deal seems like a pretty smart move since at a minimum Auditude will benefit from exposure to Adobe's large customer base. Adobe's positioning of the deal as streamlining work flows from creation through monetization/measurement will also resonate with publishers who are swamped trying to keep up with myriad new devices, platforms and social media opportunities.

Categories: Advertising, Deals & Financings

-

Adobe Pass Boosts Cable Networks' TV Everywhere Role

Adobe is announcing a new service this morning called Adobe Pass, which is intended to streamline how pay-TV subscribers gain access to authenticated premium content online. While Adobe Pass offers a key benefit to users in the ability to have "single sign-on" across multiple devices and web sites, a more critical upside is that with Adobe Pass, cable networks gain far greater control over their relationships with viewers as TV Everywhere efforts ramp up. In this respect Adobe Pass is a potentially significant building block in helping make TV Everywhere a reality. Todd Greenbaum, senior product manager at Adobe, briefed me earlier this week.

First, from a technical perspective, Adobe Pass looks like a pretty elegant solution that positions it well to be the glue that hold TV Everywhere authentication together. The idea is that when a user visits a content provider's web site they'll still see freely available content, but they'll now also see some that is for paying subscribers only (see TNT example below). If the site has added the Adobe Pass software, then when the user clicks on the authenticated content, a selection of pay-TV operators who have integrated the Adobe Pass API will appear (currently Comcast, Cox, DISH and Verizon are all on board). The user selects their pay-TV provider and is then asked for the user name and password they use with their pay-TV operator.

Categories: Cable Networks, Cable TV Operators, Technology

Topics: Adobe, Time Warner Cable

-

thePlatform and Adobe Partner For Secure Flash Video Delivery

Premium content providers seeking to securely publish video using Flash will get a hand from thePlatform and Adobe, which are announcing a new partnership. Under the deal, customers of thePlatform's mpx video management system who use Adobe's Flash Access software for content protection will be able to use it via an integrated workflow. Flash Access also provides HTTP dynamic streaming (adaptive bit rate) and monetization options like VOD, subscription, EST and rental.

management system who use Adobe's Flash Access software for content protection will be able to use it via an integrated workflow. Flash Access also provides HTTP dynamic streaming (adaptive bit rate) and monetization options like VOD, subscription, EST and rental.

Another aspect of the collaboration focuses on Android-powered mobile devices. Users of these devices accessing content delivered via thePlatform will have their video player using Flash optimized for their device. thePlatform's customers can also use Adobe's OSMF (Open Source Media Framework) and thePlatform's "Feeds Service" so that video can be delivered in multiple playback circumstances. Lastly, thePlatform's mpx console used Flash Builder 4 and has an AIR client so that file uploads are more efficient.

Categories: Technology

Topics: Adobe, Flash, thePlatform

-

New Flash Media Server 4 Targets Enterprise Users

Adobe is releasing Flash Media Server 4 today and an important new addition to the lineup is the Flash Media Enterprise Server, with specific features targeted to the enterprise customer segment.

These features include peer-assisted delivery using Flash's Real Time Media Flow protocol and IP multicast, the first time these have been offered. Both are meant to reduce enterprises' bandwidth expense and they can work in tandem with each other through what Adobe calls "Multicast Fusion." For the peer-assist feature, FMS works with the Flash Player 10.1 to help seed and distribute content. The enterprise focus reflects the growing use of video outside mainstream media business. Pricing wasn't released and is available for quote by Adobe reps.

IP multicast is also available in the Flash Media Interactive Server. It also supports real-time interactive applications like video chat and other social media apps. And it also incorporates HTTP Dynamic Streaming, which was previously announced in May, allowing CDNs and others to leverage their HTTP infrastructure. HTTP streaming has become a key competitive area since Microsoft introduced Smooth Streaming, for adaptive bit rate streaming to Silverlight clients over HTTP. The Flash Media Interactive Server pricing stayed constant at $4,500. Pricing for the basic Flash Media Streaming Server also stays at $995.

Categories: Technology

Topics: Adobe, Flash, Silverlight

-

KickApps Extends App Studio to Support HTML5

Social software provider KickApps is announcing this morning that its App Studio will now support HTML5, in addition to Flash.

App Studio is a drag-and-drop authoring tool for creating customized video players. With App Studio, users can select from a range of pre-integrated plug-ins from KickApps' partners. KickApps CEO Alex Blum explained to me yesterday that users will now be able to author once in App Studio and have end-user devices playback in whichever video format they detect is appropriate (e.g. Flash when viewing online or HTML5 when viewing on an iPad or iPhone).

KickApps' partners. KickApps CEO Alex Blum explained to me yesterday that users will now be able to author once in App Studio and have end-user devices playback in whichever video format they detect is appropriate (e.g. Flash when viewing online or HTML5 when viewing on an iPad or iPhone).

Categories: Technology

-

Adobe Launches Flash Access 2.0 and HTTP Dynamic Streaming, Partners with KickApps for OSMF Player Development

Adobe is taking the wraps off a new content protection solution today dubbed Flash Access 2.0, as well as introducing new HTTP dynamic streaming. In addition, Adobe and KickApps are partnering to introduce OSMF App Studio, which allows drag-and-drop Flash media experiences (OSMF is Adobe's Open Source Media Framework, a collection of components to improve video playback experiences).

As Ashley Still, Adobe's Group Product Manager for Flash Media Distribution explained to me last week, Flash Access 2.0 enables flexible business models for premium content. The move underscores the desire by content providers to move beyond purely ad-supported online video delivery to hybrid or solely paid approaches. Flash Access 2.0 succeeds Flash Media Rights Management Server. It also supports output protection, so that video viewed on multiple screens is also protected. Ashley noted that Flash Access 2.0 has been approved by the DECE, Hollywood's main security consortium.

With HTTP dynamic streaming, Adobe is stepping outside of Flash Media Server-only delivery to capitalize on CDNs' large existing networks of HTTP servers. It includes live and on-demand delivery including adaptive bit rate and network DVR playback. I asked what this means for FMS revenues, and Ashley maintained that the move may change the revenue mix from CDNs, but that any slack will likely be picked up by Flash Access 2.0; in addition, Adobe doesn't see things changing much for enterprises using FMS.

Last but not least, as KickApps' CEO Alex Blum told me last week, its new partnership with Adobe means that non-technical staff will now be able to create Flash media experiences without writing any code. The OSMF App Studio is a co-branded interface that give users the ability to drag and drop pre-integrated 3rd party functionality like analytics, ad networks, delivery while also customizing the look and feel of their players. I saw the full App Studio demo recently at NATPE and it was impressive. Adobe's decision to standardize exclusively on KickApps App Studio gives the company broad new distribution though Adobe.com and a solid partnership win. According to Alex, it is also the first productization of OSMF.

What do you think? Post a comment now (no sign-in required).

Categories: Technology

Topics: Adobe, Flash Access 2.0, KickApps, OSMF

-

Jobs on Flash - There's No Turning Back Now

Definitely make time to read Steve Jobs's blog post from yesterday, "Thoughts on Flash" - no doubt you'll conclude as I did that there's no turning back in this battle. Over the past few weeks the war of words between Adobe and Apple over the latter's lack of Flash support in iPhones, iPods and iPads has flared to new levels. Now Jobs's new post kicks things up another notch. Jobs's argument is mostly a technical/product one - "open" vs. "closed" systems, reliability, performance, security, battery life, touch attributes, etc. (Adobe posted a short response here)

But Jobs's last point is clearly the most important, as he acknowledges. Apple wants to control its own destiny to provide the best products possible and doing so requires eliminating any dependency on 3rd party tools. Lack of dependency on others is a hallmark of Apple's model more generally, but when it comes to the Flash war, the number of penalties Apple is imposing due to its uncompromising position is pretty remarkable: users' inability to view video at some of the web's most popular sites like Hulu, forcing these sites to offer their video in HTML5, marginalizing smaller content providers that don't have the resources to make the change, etc.

However, Apple's products are loved and only Jobs would have the single-mindedness and guts to force a pretty wrenching change in the video ecosystem. Until we see Android or other smartphones emerge as a counter-weight to the iPhone's hegemony, Adobe's role in video is bound to wane.

What do you think? Post a comment now (no sign-in required).Categories: Devices, Technology

-

Spotlight is on Video as Mobile World Congress Begins

As the biggest annual mobile conference - the Mobile World Congress - gets underway today in Barcelona, new initiatives from some of the biggest names in technology underscore the growing importance of smartphones and of mobile video specifically. Among the most important headlines:

- Microsoft's CEO Steve Ballmer is unveiling Windows Phone 7 which includes Xbox LIVE games, Zune video and audio, plus enhanced sharing. With Phone 7 Microsoft is continuing to vie for position in a crowded smartphone operating system landscape.

- Sony Ericsson is launching "Creations" allowing users to create and publish video, audio and images from their mobile phones in collaboration with professional developers.

- AT&T and 11 other mobile service providers, which together have about 2 billion subscribers, are introducing a new applications store designed to appeal to developers and compete head-on with Apple's App Store.

- Symbian is taking the wraps off its new Symbian 3 open source release, which includes support for HDMI, so that users can connect their Symbian phones to their TVs and watch 1080p video, in effect creating a Blu-ray player in your pocket.

- Intel and Nokia are merging their respective Moblin and Maemo software platforms to create MeeGo, a unified Linux platform to run across multiple devices.

- Adobe is providing an update that by mid-2010, its AIR runtime for building rich applications will be available for Android and that Flash 10.1 will be generally available for various mobile platforms, including Android. In addition, Adobe is announcing that Omniture, which Adobe recently acquired, will add mobile video measurement within its SiteCatalyst product.

While each announcement, plus countless others, have their own significance in the burgeoning mobile ecosystem, the one that's most relevant to mobile video specifically is the coming availability of Flash 10.1, especially for Android. Mobile video has been hampered to date with the lack of Flash player support on iPhones, so its pending launch on Android phones threatens to scramble the relative appeal of these devices for users eager to watch video from sites like Hulu on their smartphones.

Late last week I got a glimpse of how significant Flash on smartphones is from Jeff Whatcott, SVP of Marketing at Brightcove, which today is announcing an optimized version of its platform for Flash 10.1, to be released in the middle of 2010. Adobe has made the beta of Flash 10.1 available to content providers, and Jeff has a video showing how it works with Brightcove for its customers like NYTimes.com and The Weinstein Company.

Brightcove has done 3 things - optimized its template for mobile devices (so navigation and interactivity is seamless on the small screen), enabled auto-detect of mobile devices (so the correct Brightcove template is served) and leveraged cloud-based transcoding (so a mobile-ready H.264 encoded video is streamed). The goal is for Brightcove's customers to be able to deliver an optimized mobile and Flash experience identical to their online experiences, with minimal additional work flow. Brightcove provides the appropriate logic for mobile templates to its customers which they embed in their pages. When a user visits from a mobile device and clicks to watch video, the right Brightcove-powered experience is delivered.

All of the above activity is happening in the shadow of the now-dominant iPhone (and coming release of the iPad) which do not support Flash. As non-iPhone devices - and content providers - progressively incorporate Flash this year, it seems like the smartphone market is poised for another new turn. Flash is the dominant video player and as users look to replicate their online experiences on their smartphones, the void of Flash on iPhones will become even more pronounced. I don't underestimate Steve Jobs or Apple's ability to compete, but this will be one place where it feels like the iPhone will be at a real disadvantage. Apple is keen to prevent Flash from extending its online hegemony to mobile as well, so it will be interesting to see how it chooses to play this.

What do you think? Post a comment now (no sign-in required).

Categories: Mobile Video, Technology

Topics: Adobe, AT&T, Brightcove, Intel, Microsoft, Nokia, Sony Ericsson, Symbian

-

Brightcove Appoints David Mendels President and COO

Brightcove has appointed David Mendels as president and COO, a new executive position at the company.

Mendels has been on Brightcove's board of directors since late 2008 and for the last several months has been its acting head of sales. He was most recently the EVP and GM of Adobe's $1 billion enterprise software and business productivity division which includes Acrobat, Connect, LiveCycle and Flex. Prior, he was an early employee and spent many years at Macromedia, where he helped the company expand internationally, ran business development and alliances and managed a number of the company's key products.

Mendels and Jeremy Allaire, Brightcove's founder, Chairman and CEO, briefed me over the holidays on the appointment. The two worked together following Macromedia's acquisition of Allaire back in 2001. From Jeremy's perspective, bringing on Mendels won't prompt any radical changes. Rather, the goal is to

strengthen the company operationally and help it scale to capture opportunities both see in its 3 target markets: core media, non-media (i.e. business, government and education, which Jeremy said already account for over half the company's revenues) and small organizations (which Brightcove is pursuing with its recently launched Express product). Both also envision Mendels further globalizing Brightcove's business and also building out its channel sales efforts.

strengthen the company operationally and help it scale to capture opportunities both see in its 3 target markets: core media, non-media (i.e. business, government and education, which Jeremy said already account for over half the company's revenues) and small organizations (which Brightcove is pursuing with its recently launched Express product). Both also envision Mendels further globalizing Brightcove's business and also building out its channel sales efforts.For his part, Mendels thinks of Brightcove as being comparable to Macromedia back in 1993 when he joined it - still relatively small but profitable, with a strong management team in place and operating in a product area with huge mainstream opportunities ahead, yet where no single company or larger enterprise has established a dominant position. Mendels said he's not coming to Brightcove with a big agenda for change, but instead to help drive execution, create efficiencies and further penetrate newer market segments. One important area of emphasis is building out a developer program to help proliferate video applications based on Brightcove's APIs. As part of Mendels' transition, Brightcove is also searching for a head of North American sales and a head of Asia Pacific sales (Japan excluded).

The two believe that a continuing preference by many organizations to build vs. buy is Brightcove's biggest source of competition, though they see this starting to soften as video becomes more integral to customers' overall operations. Both are also very mindful of the plethora of other online video platforms in the market, as well as new startups that continue to spring up. As Jeremy and other Brightcove executive have told me in the past, the company believes it distinguishes itself from others not only on the basis of its platform, but also by its breadth of offerings, international presence and simultaneous pursuit of numerous market segments.

Brightcove is indeed well-positioned, though as I pointed out recently, I don't foresee there being any single, truly dominant provider in the video platform market any time soon. It is still relatively early days in the industry and there will be lots of competitors. I continue to believe that the best way for prospective customers to determine which provider meets their own particular requirements is to intensively demo various products and see how they each perform.

However, as the market inevitably matures, requirements converge and video becomes more mission critical, video platform providers' ability to effectively scale all aspects of their operations is going to become an increasingly important differentiator. In this respect, Mendels' Macromedia and Adobe experience is going to be extremely valuable to Brightcove's ongoing success.

What do you think? Post a comment now.

(note: Brightcove is a VideoNuze sponsor)

Categories: People, Technology

Topics: Adobe, Brightcove, Macromedia

-

Lots of News Yesterday - Adobe, Hulu, IAB, Yahoo, AEG, KIT Digital, VBrick, Limelight, Kaltura

Yesterday was one of those days when meaningful broadband video-related news and announcements just kept spilling out. While I was writing up the 5Min-Scripps Networks deal, there was a lot of other stuff happening. Here's what hit my radar, in case you missed any of it:

Adobe launches Flash 10.1 with numerous video enhancements - Adobe kicked off its MAX developer conference with news that Flash 10.1 will be available for virtually all smartphones, in connection with the Open Screen Project initiative, will support HTTP streaming for the first time, and with Flash Professional CS5, will enable developers to build Flash-based apps for the iPhone and iPod Touch. All of this is part of the battle Adobe is waging to maintain Flash's lead position on the desktop and extend it to mobile devices. The HTTP streaming piece means CDNs will be able to leverage their HTTP infrastructure as an alternative to buying Flash Media Server 3.5. Meanwhile Apple is showing no hints yet of supporting Flash streaming on the iPhone, making it the lone smartphone holdout.

Hulu gets Mediavest multi-million dollar buy - Hulu got a shot in the arm as Mediaweek reported that the Publicis agency Mediavest has committed several million dollars from 6 clients to Hulu in an upfront buy. Hulu has been flogged recently by other media executives for its lightweight ad model, so the deal is a well-timed confidence booster, though it is still just a drop in the bucket in overall ad spending.

IAB ad spending research reports mixed results - Speaking of ad spending, the IAB and PriceWaterhouseCoopers released data yesterday showing overall Internet ad spending declined by 5.3% to $10.9B in 1H '09 vs. 1H '08. Some categories were actually up though, and online video advertising turned in a solid performance, up 38% from $345M in 1H '08 to $477M in 1H '09. Though still a small part of the overall pie, online video advertising's resiliency in the face of the recession is a real positive.

Yahoo ups its commitment to original video - Yahoo is one of the players relying on advertising to support its online video initiatives, and so Variety's report that Yahoo may as much as double its proportion of originally-produced video demonstrates how strategic video is becoming for the company. Yahoo has of course been all over the map with video in recent years including the short tenure of Lloyd Braun and then the Maven acquisition, which was closed down in short order. Now though, by focusing on short-form video that augments its core content areas, Yahoo seems to have hit on a winning formula. New CEO Carol Bartz is reported to be a big proponent of video.

AEG Acquires Incited Media, KIT Digital Acquires The FeedRoom and Nunet - AEG, the sports/venue operator, ramped up its production capabilities by creating AEG Digital Media and acquiring webcasting expert Incited Media. Company executives told me late last week that when combined with AEG's venues and live production expertise, the company will be able to offer the most comprehensive event management and broadcasting services. Elsewhere, KIT Digital, the acquisitive digital media technology provider picked up two of its competitors, Nunet, a German company focused on mobile devices, and The FeedRoom, an early player in video publishing/management solutions which has recently been focused on the enterprise. KIT has made a slew of deals recently and it will be interesting to watch how they knit all the pieces together.

Product news around video delivery from VBrick, Limelight and Kaltura - Last but not least, there were 3 noteworthy product announcements yesterday. Enterprise video provider VBrick launched "VEMS" - VBrick Enterprise Media System - a hardware/software system for distributing live and on-demand video throughout the enterprise. VEMS is targeted to companies with highly distributed operations looking to use video as a core part of their internal and external communications practices.

Separate, Limelight unveiled "XD" its updated network platform that emphasizes "Adaptive Intelligence," which I interpret as its implementation of adaptive bit rate (ABR) streaming (see Limelight comment below, my bad) that is becoming increasing popular for optimizing video delivery (Adobe, Apple, Microsoft, Apple, Akamai, Move Networks and others are all active in ABR too). And Kaltura, the open source video delivery company I wrote about here, launched a new offering to support diverse video use cases by educational institutions. Education has vast potential for video, yet I'm not aware of many dedicated services. I expect this will change.

I may have missed other important news; if so please post a comment.

Categories: Advertising, Aggregators, CDNs, Deals & Financings, Enterprises, Portals, Technology

Topics: Adobe, AEG, Hulu, IAB, Kaltura, KIT Digital, Limelight, Nunet, The FeedRoom, VBrick, Yahoo

-

Akamai to Launch "Akamai HD Network" Today

Akamai is announcing its new "Akamai HD Network" this morning, and planning a 1pm webcast to explain the details. Akamai is positioning the network as the first to deliver HD-quality live and on-demand streaming for broadcast-sized audiences. The Akamai HD Network supports Flash, Silverlight and iPhone.

Key to the Akamai HD Network is support for adaptive bit rate ("ABR") streaming, which adjusts the quality

of the video delivered based on prevailing network conditions, instant response for pause, rewind, startup, etc, an open standards HD video player and user authentication. Adobe has also optimized Flash to be delivered over Akamai's HTTP network, which appears to be a first. This allows Akamai to fully leverage its 50,000 HTTP edge-server network.

of the video delivered based on prevailing network conditions, instant response for pause, rewind, startup, etc, an open standards HD video player and user authentication. Adobe has also optimized Flash to be delivered over Akamai's HTTP network, which appears to be a first. This allows Akamai to fully leverage its 50,000 HTTP edge-server network.The evolution toward HD-quality delivery has been building steam recently, as content providers increasingly recognize that TV-quality video is becoming the expected norm for online video users. This is particularly true for heavy users who substitute online viewing for TV-viewing, but don't want a degraded experience. As convergence devices, which bridge broadband to the TV in the home take off, the quality bar will rise for all users. This means that all CDNs that want to be players in video delivery will need to be able to deliver HD quality at scale. Move Networks, which I've written about before, is another company playing an important role in enabling high-quality broadband-delivered video to the TV; others will no doubt follow.

More details coming in the webcast today at 1pm ET.

Categories: CDNs, HD, Mobile Video

Topics: Adobe, Akamai, Flash, iPhone, Microsoft, Silverlight

-

Adobe-Omniture Could Work, But I'm Waiting to See the Proof

Late yesterday Adobe surprised the market by unveiling a $1.8 billion cash acquisition of Omniture, the web analytics and optimization company. With Omniture's trailing 4 quarter revenues of $335 million, the deal was done at a little over 5x revenues and a 45% premium to Omniture's average stock price over the last 30 days - not ridiculous bubble-era terms by any stretch, but still plenty rich in this down economy.

I listened to yesterday's investor relations call explaining the rationale for the deal, talked to a number of industry executives for their reactions, and read some of the online coverage. My takeaway is that while the deal could work out, I'm somewhat skeptical until I see actual proof.

First, when I look at Adobe, I'm focused narrowly on its video-oriented products and strategy (Flash, Flash Media Server, Strobe its open player framework, etc). While a leader currently, Adobe has significant

challenges ahead in the video space. It faces major competitive threats from Microsoft, which is ramping up a Silverlight and Smooth Streaming onslaught (we've seen this movie before and know how it ends) and Apple, which has frozen Flash out of its world-beating iPhones in an attempt to thwart the advance of Flash's desktop hegemony to mobile devices. From my perspective, an acquisition the size of Omniture must provide specific differentiated value to Flash, in order to help Adobe compete in the video space.

challenges ahead in the video space. It faces major competitive threats from Microsoft, which is ramping up a Silverlight and Smooth Streaming onslaught (we've seen this movie before and know how it ends) and Apple, which has frozen Flash out of its world-beating iPhones in an attempt to thwart the advance of Flash's desktop hegemony to mobile devices. From my perspective, an acquisition the size of Omniture must provide specific differentiated value to Flash, in order to help Adobe compete in the video space. I hear the top-line rationale being provided for the acquisition: that integrating Omniture's measurement and analysis tools into the front-end creative process will help digital media executives more effectively monetize content and improve advertising ROIs. In Adobe CEO Shantanu Narayen's words, the deal "completes the loop of content creation, delivery and optimization." Omniture's CEO Josh James put the goal simply: "to drive ad dollars from offline to online."

That's an incredibly important goal; I have written many times that advertising, particularly for long-form online video, is not remotely close yet to supporting the high cost of creating premium-quality programs. To the extent that eyeballs shift from offline to online without a parity (or better) economic model, content providers will be in a death spiral - racking up profitless online viewership.

While the deal's high-level rational makes some sense, I have 3 concerns about whether it's robust enough to ultimately pay off for Adobe, and more specifically strengthen their hand in the video space: (1) Are there actually incremental product integration opportunities beyond those already being pursued through the companies' existing partnership? (2) Are there actually incremental sales to be gained (and for which products), by putting the companies together? (3) Is this the optimal use of Adobe's resources given current and future market conditions for video?

The product integration issue received a lot of attention in the analyst Q&A portion of the investor call. Yet, despite the number of times both CEOs answered it, few specifics were ever revealed, leaving what I perceived as a sense among the analysts and me (manifested by repeated similar questions), that the product benefits might not be well-understood, or worse, overblown.

In my mind optimal product integration requires that the same person or team in an organization gets value from the 2 products being put together. Yet today the creative people using Flash are different from the marketing people using Omniture. In the organizations I've worked with there's already significant interaction between these groups as they continually modify apps to enhance user engagement and monetization. Maybe more can be achieved here, but with different audiences for the respective products, I'd want to see evidence.

Incremental sales were another area of intense analyst interest. Typically in acquisitions a key deal driver is that one (or both) of the companies' products can be put through the others' sales channels to increase volume. Yet, per the above, Adobe's creative tools are typically purchased in the creative group, not the marketing organization (sometimes it's even more complicated as a whole different entity is the buyer, as with CDNs and Flash Media Server). However there is a case to be made that as digital revenues become more important to companies, marketing will exert more influence.

But still, is it likely that notoriously autonomous creative types are going to be swayed to use Adobe's tools because marketing types say that improved integration with Omniture makes analysis/tracking better? Conversely, is a marketing executive going to be persuaded to use Omniture because the creative group insists it must use Flash? Looming also is the question of whether one sales team and channel versed in selling packaged software (Adobe) can effectively help sell SaaS analytics (Omniture) and vice versa.

These questions ultimately raise the final one - is this the best use of Adobe's resources? On the one hand,

Omniture helps diversify Adobe's revenue and product base, opening up new markets for it. Diversification isn't a bad thing per se, but if the acquired products don't help the core business, it can quickly turn into a distraction, changing the organization into cluster of silos. Plus, while Omniture's revenues have quadrupled in 3 years, it has already forecast slowing growth. Generally I'm very skeptical of big acquisitions. Evidence has shown they rarely deliver the intended results, and often (as in the case of Ebay-Skype) they can actually be a value destroyer.

Omniture helps diversify Adobe's revenue and product base, opening up new markets for it. Diversification isn't a bad thing per se, but if the acquired products don't help the core business, it can quickly turn into a distraction, changing the organization into cluster of silos. Plus, while Omniture's revenues have quadrupled in 3 years, it has already forecast slowing growth. Generally I'm very skeptical of big acquisitions. Evidence has shown they rarely deliver the intended results, and often (as in the case of Ebay-Skype) they can actually be a value destroyer. My guess is that much of what Adobe will eventually achieve with Omniture could have likely been achieved through expanding its current partnership. But I stand ready to be proven wrong as it's quite possible I just don't get it. Both leadership teams are intelligent and savvy about the market. They obviously see the benefits of the deal. We'll eagerly await the proof.

What do you think? Post a comment now.

Categories: Analytics, Deals & Financings, Technology

-

First Intel-Powered Convergence Device Being Unveiled in Europe

Convergence devices that bring broadband video and Internet applications to the TV (e.g. Roku, Xbox, Apple TV, Vudu, etc.) are a white-hot area of interest as many industry participants - including me - believe their eventual mass adoption will provide a major catalyst to broadband video usage and prompt further disruption in the value chain.

Intel has eyed a big role in this emerging market for a while, becoming a strong public proponent of the "digital home" concept. Building momentum over the past year, Intel has made announcements with Yahoo (for the "Widget Channel" framework), Adobe (to port and optimize Flash for TV viewing) and with a number of large content providers (demonstrating enhanced viewer experiences).

At the heart of Intel's early initiatives is the company's much-heralded Media Processor CE3100, the first in a family of "system on a chip" convergence-oriented processors. Next week the first CE3100-powered device, the "Mediaconnect TV" will be shown at the IBC show in Amsterdam. The box is a collaboration between a Dutch company, Metrological Media Innovations and a British interactive services provider, Miniweb (a spinoff of BSkyB). This has been previewed recently and is sure to gain more visibility next week. To learn more about Intel's convergence vision, yesterday I spoke to Wilfred Martis, the GM of Connected AV Products for Intel's Digital Home Group.

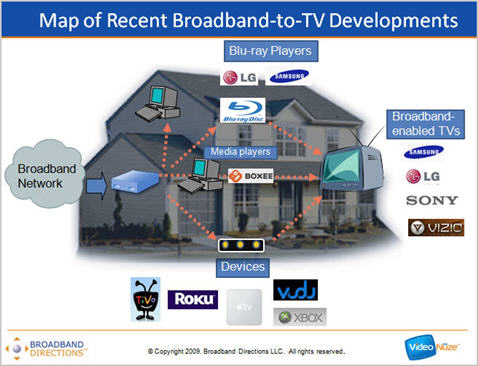

Intel sees 4 different types of home products that can be fitted with its media processor chips: set-top boxes, digital TVs, optical players (e.g. Blu-ray devices) and "connected AV" products, which are defined as standalone boxes that connect broadband to the TV, but without any guaranteed quality of service (QoS) for the video. This segmentation actually closely follows a slide I've been presenting lately which maps the various efforts for bringing broadband to the TV.

The connected AV devices are of course what "over-the-top" providers like Netflix, Amazon, iTunes, YouTube, etc. are counting on to deliver their services into the home over open broadband connections. On the one hand, Intel seems to be looking to empower these providers. As Wilfred says, Intel is trying to create a standard toolset and app environment akin to what we've seen on leading smartphones (mainly the iPhone) that helps drive creative new TV-based applications. Yet at the same time, as Wilfred notes, Intel wants to be a friend to incumbent video service providers, allowing them to deliver broadband content side-by-side with their walled-garden channels in their set-top boxes.

While Intel is clearly in this for the long haul, and has the resources to cultivate the market, other non-Intel devices continue to get a foothold. It's interesting to contrast, for example, the success that Roku is enjoying to date and ponder how the convergence device market will develop over the next several years. As I detailed a few weeks ago, Roku is successfully pursuing a classic "Crossing the Chasm" strategy, leveraging low pricing and loyalty to its content partners' brands to move lots of its product.

Still, integrating with Roku - and other current convergence devices - requires a one-off integration that assumes resources and prioritization (even when APIs exist). Some content providers will determine integrating is worthwhile, while others will not.

Intel's strategy is meant build on existing technologies and applications, making it more straightforward for content providers and applications developers to deploy on its devices (it's worth noting that Amazon, Blockbuster, Facebook and others plan to launch Widget Channel apps imminently). As Wilfred explains, when Intel's architecture is in convergence devices, incumbent software like browsers, plug-ins, drivers and the like are intended to work seamlessly. In addition, by providing abundant processing power, developers don't have to go through the arduous task of de-optimizing their apps for slower environments. And they get the performance headroom to continuously add updates.

The price for all this is of course, price. I don't know what the unit cost of the CE3100 is at volume, but my guess is that whatever it is would quickly sink any manufacturer's prospects of selling their box at anything close to a $99 price point, as Roku is. It's an age-old computing dilemma: beneficial as it is to have lots of processing power, there's a cost to it.

This raises the fundamental question of how the convergence device market will shape up over the next several years: will low-cost, "powerful-enough" devices continue to gain, or will boxes with robust processing render them obsolete at some point soon? My guess is that in the short term at least, low cost is going to lead the way. However, over the long term, it's hard to avoid the idea of significant computing power sitting next to the TV. However the business model for who pays to get it there remains in question.

What do you think? Post a comment now.

Categories: Devices, International

Topics: Adobe, Intel, Metrological Media Innovations, Miniweb, Roku, Yahoo

-

Unveiling Move Networks's New Strategy

Move Networks, the well-funded Internet television technology company which has been virtually silent for the last 60 days since acquiring Inuk Networks and bumping former CEO John Edwards to Executive Chairman, is pursuing a major repositioning. Earlier this week I met with Marcus Liassides, Inuk's former CEO and founder who joined Move's management team, who previewed the company's new strategy to be a wholesale provider of IPTV video services delivered over open broadband networks.

Broadband video industry participants know Move best for its proprietary adaptive bit rate (ABR) technology and player, which power super-high quality live and on-demand video streams for broadcasters

like ABC and Fox. Move gained a lot of attention by raising over $67M, including a $46M Series C round in April '08 from blue chip investors.

like ABC and Fox. Move gained a lot of attention by raising over $67M, including a $46M Series C round in April '08 from blue chip investors.Despite all this, Marcus explained that coming into 2009 Move had at least 3 significant problems, symbolic of how fluid the broadband video market remains.

First, its core business of charging content providers in the range of $.30/GB of video delivered was being pressured by the fact that advertising-only business models couldn't support this pricing. Content providers loved Move's quality; they just couldn't afford it, particularly given the alternative of plunging CDN delivery rates.

Second, Move's pricing and business model were being challenged by both Microsoft and Adobe entering the market with ABR streaming features of their own (I wrote about this here). But because both were enabled on the server side (IIS and FMS respectively), the cost of ABR moved from content providers to CDNs, who might or might not choose to charge extra for these features. Either way, Move's direct cost looked comparatively more expensive, especially as the recession pounded ad spending.

Last, but not least, Marcus explained that Move's product development approach was undisciplined, leading to resources being spread too thin in too many directions. That was reflected by the market's ongoing difficulty in categorizing which business Move was really in.

Meanwhile, U.K.-based Inuk, which had been on its own funding and product development roller-coaster, was delivering its Freewire IPTV service to about 200K university students in the UK, Ireland and Canada. Because Inuk needed to serve these students when they were off campus, it had developed a "virtual set-top box" application that duplicates on the PC the IPTV service that had traditionally been delivered via an expensive IPTV set-top box. Inuk was using Move's ABR technology to power video delivery to the PC. Recognizing potential synergies and trying to address its other issues, Move acquired Inuk in April.

Move's new positioning as a provider of IPTV video services delivered over open broadband networks essentially replicates what Inuk has been doing, except that going forward services will be offered wholesale, not retail like with Freewire. Move's strategy starts from the proposition that to get cable TV networks online requires that they be paid consistent with the norms, rather than expecting them to free and ad-supported only. It also anticipates that consumers demand not just VOD offerings, but a full linear lineup as well (as an aside, that aligns with Sezmi's thinking too). While Move will continue supporting existing customers like ABC and others, its new wholesale model is a major shift in that it uses the company's core technology to support packaged multichannel video services, instead of a la carte web-based video.

Marcus explained that Move is targeting 3 verticals: (1) telcos which haven't traditionally offered video services (or have through direct satellite partnerships), (2) broadband ISPs looking to get into the video business, and (3) existing video service providers looking for a lightweight capex approach for extending their service either for remote access (a la "TV Everywhere") or in other rooms in the house (a model which has traditionally required another set-top box and truck roll for installation).

Marcus demo'd the Freewire service to me using his PC and a large monitor, and it looks great. There's instant channel changing, HD (when available), a great looking guide and auto-DVR of every program, all in the cloud. Freewire also offers targeted advertising, and HTML-based apps like Twitter integration, etc. My caveat is that I have no idea how well the service would scale to millions of homes.

Move's new positioning puts it in the middle of tectonic video industry shifts. For example, what's the appetite of 3rd parties like telcos and ISPs for new video solutions? Will other, well-suited consumer brands like Google, Netflix, Yahoo enter the multichannel video business, and if so how? What approach will cable operators like Comcast use for emerging, "TV Everywhere" services that would benefit from Move's lightweight capex model (note Comcast said it was using Move in its 5,000 subscriber technical trial yesterday)? How will major cable TV networks expect to get compensated in the broadband era where individuals, not homes, are the new unit of measurement? How will local ISPs, over whose networks remotely-accessed video will run, expect to be compensated? It's way too early to know the answers, but if Move's technology works as intended, and its costs are reasonable, it will likely find itself in the middle of a lot of very strategic industry discussions.

Another big change is that Marcus said the company's messaging will be focused more around business cases and services than its specific technologies. That seems smart given giants like Microsoft and Adobe are closely circling these waters with lots of their own technology, which could easily swamp Move. If all this wasn't enough, Move is also in the midst of hiring a new CEO and implementing a new management team, all of which will be announced imminently. One thing Move isn't doing for now is raising additional capital, which Marcus said is not needed.

What do you think? Post a comment now.

(Note: Move Networks is a current sponsor of VideoNuze)

Categories: Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings, IPTV, Technology, Telcos

Topics: ABC, Adobe, FOX, Microsoft, Move Networks