-

15 Seconds of Fame (15sof.com): A Broadband, Social Media-Based Version of "American Idol"

Andy Warhol's famous quote that "everyone gets their 15 seconds of fame" is the inspiration behind a new web site called 15sof.com that is like a broadband, social media-based version of the hit show "American Idol," but created and promoted at a fraction of the cost.

15sof.com is meant to capitalize on the growing subculture of society (that tends to skew younger) who are either seeking fame and fortune or want to influence the process of who attains it. These motivations have been the key forces behind the explosion of reality-based contest shows now running and arguably drive many of the most outlandish stunts seen on YouTube.

15sof.com's founder/CEO John Bonaccorso explained to me that the site offers aspiring contestants a simple but novel proposition: pay $1 to submit your 15 second (max) video to one of the myriad contests running at any one time on 15sof.com. The community then votes on the submissions and moves a handful of contestants on to subsequent rounds where lengthier videos are accepted. The prize money is funded from the contestants' fees. Contestants can enter as often as they'd like, but precautions are in place to prevent voting fraud. 15sof uses a white-label social media platform from Reality Digital, which I last wrote about here.

With current top prizes in the $25-$100 range, nobody's going to get rich, but they will gain visibility and of course psychic gratification. As John explained, particularly for the high school and college-aged drama crowd, 15sof.com offers them an opportunity to show their stuff, which is plenty enough.

15sof.com is itself a pure social media creation: John said the site hasn't spent any money yet on conventional marketing. Instead it has built awareness and participation solely through Facebook, MySpace, Twitter and other social media platforms. In the world of 15sof.com - and many other social sites and apps launching today - there's no need for tune-in ads, billboards or other expensive marketing tactics. Sites like 15sof.com grow out of the burgeoning social community, dominated by the young. John wouldn't disclose numbers, but said the site beat its first month traffic goal in the first 3 weeks. That's no indication of future success, but it's a good start.

For me, there are 2 other noteworthy aspects of 15sof.com. First, the site reflects yet another example of "purpose-driven" user-generated video, a concept I've explored in the past in connection with Unigo, a start-up trying to use student-created videos to disrupt the college guidebook industry. The "purpose-driven" video idea is to get the multitudes of amateurs whom YouTube introduced to video to turn their newfound skills and passion toward something more remunerative and possibly productive. Purpose-driven video concepts are proliferating. Most notable are the myriad brand-sponsored consumer video contests and also the many sites featuring user-created how-to videos. I continue to believe there will be many bona fide business opportunities based on purpose-driven video.

Second, 15sof.com also illustrates the evolving interplay between online and on-air programming. We are starting to see how programs born in one of the mediums can create a variation in the other, or where a concept can migrate from one medium to the other. For example, John's vision is that 15sof.com - the spawn of American Idol - could itself eventually become a TV show. Another example of this phenomenon is Scripps Networks' Food2, where new talent being showcased could eventually graduate to programs on the Food Network itself. I suspect some of this multi-platform thinking is behind Ben Silverman's new venture with IAC. My point is that broadband is giving programmers a lot of new flexibility in how they bring their creative concepts to market.

Meanwhile, if you're expecting to find yours truly belting out a song on 15sof.com, you'll have to keep waiting. I'll be here hiding behind my keyboard.

What do you think? Post a comment now.

Topics: 15sof.com, Food2, Reality Digital, YouTube

-

Blip.TV's New Deals Give Broadband Producers a Boost

Broadband-only producers got a boost yesterday as blip.tv, which provides technology, ad sales and

distribution for thousands of online shows, announced a variety of new deals as well as product improvements. The deals offer blip's producers new distribution, new monetization and new access to TVs. In order:

distribution for thousands of online shows, announced a variety of new deals as well as product improvements. The deals offer blip's producers new distribution, new monetization and new access to TVs. In order:Distribution: blip's new deal with YouTube means that producers using blip can deliver their episodes directly to their YouTube accounts, eliminating the two step process. With YouTube's massive traffic, getting in front of this audience is critical to any independent producer. Since my first conversation with blip's co-founder Mike Hudack several years ago, the company's mantra has been widespread syndication. Blip already distributed its producers' shows to iTunes, AOL Video, MSN Video, Facebook, Twitter, and others. Vimeo is another new distribution partner announced yesterday.

Monetization: A new integration with FreeWheel means that ads blip sells can follow the programs it distributes wherever they may be viewed. I've written about FreeWheel in the past, which offers essential monetization capability for the Syndicated Video Economy. With the blip deal, FreeWheel delivered ads can be inserted on YouTube. This follows news earlier this week that YouTube and FreeWheel had struck an agreement which allows content providers that use FreeWheel and distribute their video on YouTube can have FreeWheel insert their ads on YouTube (slowly but surely YouTube is opening itself up to 3rd parties).

Access to TVs - Last but not least is blip's integration with the Roku player which will help bring blip's shows directly to TVs (adding to deals blip already had with TiVo, Sony Bravia, Verizon FiOS, Boxee and Apple TV). While Roku's footprint is still modest, it is positioned for major growth given current deals with Netflix and Amazon, and others no doubt pending. At $100, Roku is an inexpensive and easy-to-operate convergence device that is a great option for consumers trying to gain broadband access on their TVs. Gaining parity access to TV audiences for its broadband producers is a key value proposition for blip.

In addition to the above, blip also redesigned its dashboard and work flow, making it easier for producers to manage their shows along with their distribution and monetization. An additional deal with TubeMogul announced yesterday allows second by second viewer tracking, providing more insight on engagement.

Taken together the new deals help blip further realize its vision of being a "next generation TV network" and provide much-needed services to broadband-only producers. This group has taken a hit this year, given the tough ad sales and funding environments, so they need every advantage they can get.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Analytics, Devices, Indie Video, Syndicated Video Economy

Topics: blip.TV, FreeWheel, Roku, TubeMogul, Vimeo, YouTube

-

Subscription Overload is on the Horizon

One might think that the depths of the worst economic recession in decades would be a lousy time to begin asking penny-pinching consumers for additional payments to access content. Yet this is exactly what many video providers plan to do, as a variety of broadband-delivered video subscription plans are beginning to take shape. Based on conversations I've been having with industry executives and what I've been reading, various subscription plans are now underway. This leads me to think that "subscription overload" is on the horizon.

Interest in getting consumers to pay has several sources. Many executives have concluded that advertising alone is an insufficient model, even as the cost of delivering broadband video is actually plummeting. Some of this concern relates to the widespread advertising slowdown, where even established players like the big broadcast networks are being forced to accept rate cuts. These declines cannot be made up with greater ad quantity as there's prevailing worry about just how many ads can be loaded into a broadband-delivered program before the viewer gets turned off.

There is also significant fear of not learning from the demise of the U.S. newspaper industry, which largely adopted an ad-only online business model that hasn't worked (causing some like the NY Times to now consider reinstituting subscription services). Newspapers' woes have become a touchstone in practically every conversation I've participated in recently. Last, but not least, there's no small amount of envy toward cable networks, whose dual subscription/advertising revenue model has allowed them to weather the recession better than most.

Subscription plans seek some combination of differentiators: offering premium video in better windows, at better-quality, with deeper selection, across multiple devices and with some degree of exclusivity. The thinking is that these enhancements will allow subscription services to be distinguished from and co-exist with free ad-supported services. The implicit bet is that these differences will be understood and valued by consumers.

Subscription plans are beginning to leak out, as happened last week in remarks by Disney CEO Bob Iger. Many in the industry (including me) anticipate that Hulu will launch a subscription service soon, particularly as it seeks to become a part of cable operators' TV Everywhere initiatives (which themselves seek to enhance the value of current cable subscriptions).

Other plans are on the drawing board. When I read yesterday, for example, about NBC's Ben Silverman jumping to IAC to form a new video venture, I suspect it's almost a given that the venture will consider some type of premium model. The growth of mobile video is another factor fueling subscriptions. This is what MLB is doing with its new At Bat 2009 subscription app for the iPhone, which builds on its highly successful MLB.TV broadband subscription service.

With so many subscription services underway, it's inevitable that many of them won't get traction. I mean, is it likely that consumers will pay extra so they can see a program online just hours after it airs, instead of a day later? Or so they can receive 1080-equivalent HD quality online, when 720-equivalent HD is available for free? I'm skeptical, even before factoring in the recession-driven belt-tightening many consumers have adopted. The bar for a subscription service to succeed is very high.

Still, with broadband allowing video providers direct access to their target audiences, their well-known brands as powerful enablers, and the crummy advertising climate showing no letup, it is no surprise that the pendulum is swinging heavily toward subscriptions.

What do you think? Post a comment now.

Categories: Advertising, Newspapers, Sports

-

Hubris Cursed AOL But Broadband Crushed It

I highly recommend reading Saul Hansell's piece in last Friday's NY Times, recapping the ridiculously optimistic quotes senior executives at AOL and Time Warner have made over the years (and be sure to peruse readers' consistently vitriolic comments). For anyone who's watched AOL's rise and fall, the quotes are a stroll down memory lane. But while the picture that emerges is that hubris cursed AOL and contributed mightily to its downfall, in reality it was broadband, and AOL's colossal mismanagement in transitioning to it, that crushed the company.

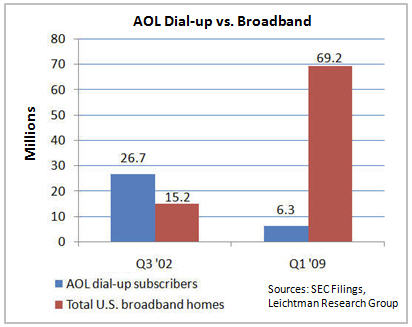

The chart below shows that AOL's dial-up subscribers topped out in Q3 '02 at 26.7 million, and have been in a free-fall ever since, sitting at just 6.3 million at the end of Q1 '09, a drop-off of 20.4 million or 76%. Where did those 20.4 million dial-up subs go, along with tens of millions of other dial-up and new Internet users? To broadband Internet access, supplied by cable companies and telcos. These companies have grown their U.S. broadband subs from 15.2 million in Q3 '02 to 69.2 million in Q1 '09, an astonishing increase of 54 million subscribers in just 7 years.

Cable and telco broadband providers have feasted on the carcasses of AOL and other dial-up services like MSN and Earthlink. But, here's what's both incredible and really sad: had AOL management been less arrogant and more strategic in its approach to broadband, it's quite possible that things could have turned out quite differently.

Back in the mid-to-late '90s, I had a front-row seat at AOL's initial reactions to broadband. In that period I was VP Business Development at Continental Cablevision, then the 3rd largest cable operator in the U.S. with over 5 million video subscribers. We were one of the pioneers in testing and rolling out "high-speed" Internet service. While we thought our speedy and always-on broadband connections were a better mousetrap vs. dial-up, we were very concerned about our lack of online content, video-centric branding and ability to effectively market this exciting new service.

In the pre-@Home days, I pushed to explore how we could partner with AOL to help us get our service off to a faster start. A deal with AOL would have had significant advantages to them as well. AOL at the time had a huge capex burden building out more modem banks to keep up with its swelling subscriber ranks. Even still, there was already plenty of AOL subscriber frustration with the slowness of the AOL network, and often you couldn't even get connected on your first or second tries. At least in our geographic footprint we could unburden them of their network build-out, offer better-quality connections and allow them to focus on content and brand-building. As the 3rd largest cable operator, we also offered them a valuable proof-point that they could use to build industry-wide relationships.

After much preparation and scheduling, we met with one of AOL's most senior executives. After articulating our broadband vision and opportunity to work together, he arrogantly dismissed us as if we were precocious children. To him the opportunity we were describing was far too small, and to illustrate his point he asserted that AOL would have 10 million subscribers before we had our first 100,000 (a prediction that was probably correct!).

Needless to say, no meaningful deal with us - or any other cable operator - every materialized. AOL went on to flounder around with various incarnations of AOL Broadband, none of which ever got any traction. AOL continued to grow its subscribers for a number of years and capitalized on its reach by extracting hundreds of millions of dollars from VC-backed startups eager for access to its massive captive audience (some of those deals would later come under scrutiny, as would AOL's accounting treatment for its subscriber business). AOL then bought Time Warner, and the rest as we know is history.

But what if things had gone differently? What if that AOL executive and others had seen the handwriting on the wall - that broadband would eventually render dial-up obsolete - and decided that AOL needed to figure out how to transition to it, instead of dismissing it? Had that happened, it could have forged partnerships throughout the cable and telco industries that would have let it focus on content and services in an open, broadband environment. In fact, I think it's quite possible that AOL could have pre-empted @Home and the RoadRunner venture that Continental eventually joined from getting traction (why start over when AOL, the 800 pound gorilla is in your corner?).

Instead AOL fell victim to its own arrogance and limited strategic vision. Broadband went on to become the single most powerful enabler of the Internet as we know it today (e.g. billions of spontaneous Google searches, Tweets, Amazon purchases, and more recently video views). AOL is now a crippled mish-mash of mostly second-rate properties, on its umpteenth management team, led by new CEO Tim Armstrong.

In retrospect, those fateful decisions AOL made about broadband 10-15 years ago set the stage for the company's eventual demise.

What do you think? Post a comment now.

Categories: Broadband ISPs, Cable TV Operators, Portals, Telcos

-

4 News Items Worth Noting from the Week of July 20th

Following are 4 news items worth noting from the week of July 20th:

Apple reports blowout iPhone sales in Q2, continuing to drive market - It was another record quarter, as Apple reported selling 5.2 million iPhones, bringing to 21.4 the total sold to date. This despite acknowledging temporary shortages during the quarter. The iPhone continues to revolutionize the mobile market, and from my standpoint is the key catalyst for both recording and consumption of mobile video. This market is poised for significant growth as new smartphones hit the market along with fixed monthly data plans. Apps like MLB.com At Bat 2009, which offers live streams of games, are certain to be hits and emulated widely.

8 minute video of Amazon's Jeff Bezos discussing lessons learned and Zappos acquisition - You couldn't miss news this week of Amazon acquiring Zappos for around $900M, its largest deal ever. Interestingly, Amazon posted a video on YouTube of Bezos discussing the deal, but not until he walked through several maxims of Amazon's success (obsess over customers, think long term, etc.). The video is extremely informal, with Bezos flipping hand-scrawled notes on an easel and improvising funny anecdotes. It has a slightly random feel (until he gets to the Zappos part, you start to wonder, what's the point of all this?), but I give Amazon and Bezos lots of credit for using video in a totally new way to communicate with stakeholders. I'd love to see more CEOs do the same.

Is Disney CEO Bob Iger serious about creating a subscription site for its online video? This week at Fortune's Brainstorm conference, Iger floated the idea that Disney will offer movies, TV shows and games for paying subscribers. The timing seems more than coincidental as Comcast gears up for its On Demand Online trial. Is Iger serious about this, or is it a head fake from Disney so it can try to negotiate incremental payments from Comcast and others seeking to distribute Disney content online? It's hard to tell, but I'd be curious to see what Disney has in mind for its possible subscription service. Consumers hate the idea of paying twice for anything (even paying once is not so popular), so if Disney is somehow going to create another window where they charge for access to content that's still on, or was recently on cable, that would be an awkward model.

"Mad Men" coming to Comcast's On Demand Online trial - Speaking of the Comcast trial, I was thrilled to hear from David Evans, SVP of Broadband at Rainbow Media (owners of AMC, the network behind Mad Men) at yesterday's CTAM Teleseminar that the show will be included in Comcast's trial and presumably in rollout. David is very bullish on online distribution and the larger TV Everywhere concept, though cautioned that there are many rights-related issues still hanging out there. I'm a huge Mad Men fan (whose new season starts on Aug 16th) and the idea that I don't have to worry about recording each episode or managing space on my DVR, and that I can watch remotely when I'm on the road, all underscore TV Everywhere's value.

Categories: Cable Networks, Cable TV Operators

Topics: Amazon, AMC, Apple, Comcast, Disney, iPhone, MLB, Rainbow Media, YouTube, Zappos

-

VideoNuze Report Podcast #24 - July 24, 2009

After several weeks of holidays and vacations, Daisy Whitney and I are back on track this week with our 24th podcast of the year, for July 24, 2009.

This week Daisy and I dig into YouTube from two different angles. Daisy picks up on a piece she wrote that explains the success YouTube is having attracting brands to set up their own channels within the site. These channels can cost up to $200K or more per year. However, there are lots of less expensive ways to work with YouTube, and as Daisy explains, with video helping drive purchase intent, it's a prerequisite that every brand should now have some type of a video presence there.

Despite this, as I wrote earlier this week in "Google is Being Clumsy in Explaining YouTube's Performance," I think YouTube's progress isn't being messaged very well to the market. In its recent Q2 earnings call, a supplementary analyst call and a blog post earlier this week, Google executives sent confusing and sometimes unsupported messages about how far along they are in figuring out to monetize YouTube's premium content-oriented traffic. Given YouTube's bellwether status in the industry, it is being closely watched by many for signs of success or failure.

Click here to listen to the podcast (14 minutes, 6 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Aggregators, Brand Marketing, Podcasts

-

Video Syndicator 5Min Raises $7.5 Million Series B Round

5Min, a video syndication company specializing in "how-to" content, is announcing this morning that it has raised a $7.5 million series B round, led by new investor Globespan Capital Partners with participation from prior investor Spark Capital. The new round comes on top of the $5 million first round the company raised in January '08. I spoke with CEO Ran Harnevo yesterday to learn more about the company's progress.

5Min, which I last wrote about in Dec. '08, is a textbook Syndicated Video Economy company. As Ran

explained, its key value proposition is an automated, comprehensive solution for sites seeking to incorporate high-quality relevant video that also offers content providers viewership reach and awareness beyond their own destination sites. There is no cost to either distributors or content providers to participate and resulting ad revenues are split among the parties.

explained, its key value proposition is an automated, comprehensive solution for sites seeking to incorporate high-quality relevant video that also offers content providers viewership reach and awareness beyond their own destination sites. There is no cost to either distributors or content providers to participate and resulting ad revenues are split among the parties. The model is enabled by 5Min's VideoSeed syndication platform, which matches video from 5Min's 100,000+ title catalog to pages that its distribution network's sites specify. The matching is based on the video's metadata which 5Min has assigned and a semantic understanding of the pages themselves. 5Min's video player is embedded on these pages, providing content and ads. The network now consists of hundreds of horizontal (e.g. Answers.com, Wikia, etc.) and vertical sites that reach over 200 million unique visitors/mp generating 14 million unique viewers/mo. This is in addition to the 3.5 million unique visitors to its 5Min.com site. Ran wouldn't specify how many actual video views the network is driving, but said it's in the "tens of millions per month."

5Min focuses on key categories in lifestyle, knowledge and instructional and has built critical mass important for advertisers seeking to contextually target these viewers. 5Min has its own sales team and also uses 3rd party ad networks. Primary units are pre-rolls and overlays. Ran says the company has sold out 100% of its inventory, but would only say CPMs are on the "high end of the market."

5Min continues to aggressively grow its content library, but without producing any of its own content. Ran believes strongly that there's plenty of great content out there already, the challenge producers have is getting it more widely distributed, viewed and monetized (all the things 5Min focuses on).

Historically the company has sourced mainly from DVDs, small-to-medium sized video producers and semi-professionals (all with agreements). 5Min is also starting to offer branded content from partners like UGO Entertainment, Motor Trend, Ford Models, Kiplinger's and others. Ran also alluded to upcoming deals with tier 1 video brands. The how-to category itself is chock full of competitors like Demand Media, Howcast and VideoJug that are producing their own video, but at this point the only how-to specific provider 5Min has a deal with is MonkeySee.com.

I'm not surprised by 5Min's success. It is playing to many of the most important trends in the online video space I've written about repeatedly: fragmentation of audiences, the importance of search and SEO for discovery, higher CPMs through targeted advertising, technology to drive distribution scale and the superior value to consumers in certain categories (especially how-to) of video-based content over traditional text-based alternatives. As more and more sites recognize they need video to stay competitive, but that producing it themselves is an expensive and uneconomic proposition, syndicators like 5Min will enjoy ongoing success.

What do you think? Post a comment now.

Categories: Deals & Financings, Syndicated Video Economy

Topics: 5Min, Globespan Capital Partners, Spark Capital

-

Will Kaltura's Open Source Video Platform Disrupt the Industry?

This morning Kaltura takes the wraps off its "Community Edition" open source video platform, available as a free download, thereby threatening to disrupt its established proprietary competitors (e.g. Brightcove, thePlatform, Ooyala, Digitalsmiths, Fliqz, Delve, VMIX, etc.). Yesterday Kaltura's CEO Ron Yekutiel explained open source and Community Edition's opportunity. Later in the day I spoke to executives at many of its competitors to get their take what impact open source will have on the video platform market.

As a quick primer, open source isn't a novelty; it's a standard way that certain kinds of software are now developed. Successful companies like Red Hat have been built around open source. In fact many of today's web sites run on the open source software stack commonly known as "LAMP" - Linux (OS), Apache (web server), MySQL (database) and Perl/PHP/Python (scripts). Kaltura has been pioneering open source in the video platform industry which has been dominated by proprietary competitors. Ron believes the video platform industry is ripe for open source success because it has too many proprietary companies offering minor feature differences, all using a SaaS model only and competing too heavily on price.

Kaltura Community Edition's three big differentiators are that it's free for the base platform and offers greater control through self-hosting which can be behind the customer's firewall. Ron also believes that by tapping

into the open source community, CE can offer more flexibility and extensibility than its competitors.

into the open source community, CE can offer more flexibility and extensibility than its competitors. As with all open source options though, free isn't "free," because if you're interested in support and maintenance, professional services for customization and certain features like syndication, advertising, SEO and content delivery, these all cost extra. And you can't forget about the costs of the internal staff you'd need to run the video platform or the costs of the infrastructure itself (servers, bandwidth, storage, etc.). In the SaaS world, many of these costs are borne by the provider and then reflected in the monthly fee. Determining which approach is more cost-effective depends on your particular circumstances and needs.

All of this is why, as one competitor's CEO told me yesterday, the choice to go open source more often than not isn't primarily price-based; rather it's features-based. In fact, given the range of low cost proprietary alternatives (e.g. $100-$200/mo packages from companies like Fliqz and Delve), even free doesn't represent really significant savings.

When it comes to features, clearly the ability to download CE and self-host is a big differentiator, and will be valued by segments of the market. As Ron pointed out, there are government agencies, universities and others who have mandates to self-host. He also noted that by customers' gaining access to CE's code, their ability to integrate with other applications and customize is enhanced (though again, not without an additional cost).

Other industry executives countered that unless you have to self-host, these advantages are diminished by the fact that in this capex and opex budget constraints make SaaS more appealing than ever, especially for smaller customers with less in-house technical expertise. They added that they're rarely asked about self-hosting options (though that could well be due to self-selection).

Further, many of the leading video platform companies offer a slew of APIs, which open their platforms to 3rd party developers without needing to be open source per se (examples include Brightcove's and thePlatform's robust partner programs). Another industry CEO noted that while there's a gigantic and highly active open source community in the LAMP world, it remains to be seen just how vibrant it is in the video space. And it's important to remember that the intense competition among today's video platforms have already driven the feature bar quite high.

So the question remains: will Kaltura's CE open source approach truly disrupt the video platform industry, causing rampant customer switching and gutting today's pricing models? My sense is no, or at least not immediately. Instead, Kaltura will definitely grow the market, creating new video customers from those who have been dissatisfied with current choices or have not yet jumped into video, but inevitably will. CE will likely peel away some percentage of existing proprietary customers who have been eager for a self-hosted, open source alternative. For many others though, they'll be keeping an eye on open source and will successfully push their existing providers to adopt similar capabilities if they're valued.

What do you think? Post a comment now.

Categories: Technology

Topics: Brightcove, Delve, Digitalsmiths, Fliqz, Kaltura, Ooyala, thePlatform, VMIX