-

Will Kaltura's Open Source Video Platform Disrupt the Industry?

This morning Kaltura takes the wraps off its "Community Edition" open source video platform, available as a free download, thereby threatening to disrupt its established proprietary competitors (e.g. Brightcove, thePlatform, Ooyala, Digitalsmiths, Fliqz, Delve, VMIX, etc.). Yesterday Kaltura's CEO Ron Yekutiel explained open source and Community Edition's opportunity. Later in the day I spoke to executives at many of its competitors to get their take what impact open source will have on the video platform market.

As a quick primer, open source isn't a novelty; it's a standard way that certain kinds of software are now developed. Successful companies like Red Hat have been built around open source. In fact many of today's web sites run on the open source software stack commonly known as "LAMP" - Linux (OS), Apache (web server), MySQL (database) and Perl/PHP/Python (scripts). Kaltura has been pioneering open source in the video platform industry which has been dominated by proprietary competitors. Ron believes the video platform industry is ripe for open source success because it has too many proprietary companies offering minor feature differences, all using a SaaS model only and competing too heavily on price.

Kaltura Community Edition's three big differentiators are that it's free for the base platform and offers greater control through self-hosting which can be behind the customer's firewall. Ron also believes that by tapping

into the open source community, CE can offer more flexibility and extensibility than its competitors.

into the open source community, CE can offer more flexibility and extensibility than its competitors. As with all open source options though, free isn't "free," because if you're interested in support and maintenance, professional services for customization and certain features like syndication, advertising, SEO and content delivery, these all cost extra. And you can't forget about the costs of the internal staff you'd need to run the video platform or the costs of the infrastructure itself (servers, bandwidth, storage, etc.). In the SaaS world, many of these costs are borne by the provider and then reflected in the monthly fee. Determining which approach is more cost-effective depends on your particular circumstances and needs.

All of this is why, as one competitor's CEO told me yesterday, the choice to go open source more often than not isn't primarily price-based; rather it's features-based. In fact, given the range of low cost proprietary alternatives (e.g. $100-$200/mo packages from companies like Fliqz and Delve), even free doesn't represent really significant savings.

When it comes to features, clearly the ability to download CE and self-host is a big differentiator, and will be valued by segments of the market. As Ron pointed out, there are government agencies, universities and others who have mandates to self-host. He also noted that by customers' gaining access to CE's code, their ability to integrate with other applications and customize is enhanced (though again, not without an additional cost).

Other industry executives countered that unless you have to self-host, these advantages are diminished by the fact that in this capex and opex budget constraints make SaaS more appealing than ever, especially for smaller customers with less in-house technical expertise. They added that they're rarely asked about self-hosting options (though that could well be due to self-selection).

Further, many of the leading video platform companies offer a slew of APIs, which open their platforms to 3rd party developers without needing to be open source per se (examples include Brightcove's and thePlatform's robust partner programs). Another industry CEO noted that while there's a gigantic and highly active open source community in the LAMP world, it remains to be seen just how vibrant it is in the video space. And it's important to remember that the intense competition among today's video platforms have already driven the feature bar quite high.

So the question remains: will Kaltura's CE open source approach truly disrupt the video platform industry, causing rampant customer switching and gutting today's pricing models? My sense is no, or at least not immediately. Instead, Kaltura will definitely grow the market, creating new video customers from those who have been dissatisfied with current choices or have not yet jumped into video, but inevitably will. CE will likely peel away some percentage of existing proprietary customers who have been eager for a self-hosted, open source alternative. For many others though, they'll be keeping an eye on open source and will successfully push their existing providers to adopt similar capabilities if they're valued.

What do you think? Post a comment now.

Categories: Technology

Topics: Brightcove, Delve, Digitalsmiths, Fliqz, Kaltura, Ooyala, thePlatform, VMIX

-

Google is Being Clumsy in Explaining YouTube's Performance

Yesterday's "YouTube myth busting" post on its YouTube Biz Blog had the opposite of its intended effect: rather than providing more transparency about YouTube's performance as it hoped to do, it only set off

another round of frustrated posts in the blogosphere imploring Google to release actual YouTube numbers.

another round of frustrated posts in the blogosphere imploring Google to release actual YouTube numbers. The post came on the heels of last week's Q2 '09 earnings call and supplementary briefing call (transcripts here and here) which were full of optimistic, yet confusing comments about YouTube's "trajectory" from a handful of Google's senior executives.

Here's what CFO Patrick Pichette said on the supplementary call: "I think that it is true that we are pleased with YouTube's trajectory. And in part the reason why we're communicating it to the Street is there's been so much press over the last quarter with all of these documentations of, you know, massive cost and no business models and all kind of negative press that we've read a lot about. And we just wanted to kind of reaffirm to the Street that this is a very credible business model and it's one that's got trajectory. So in that sense it's just to kind of tell everybody that we're on progress on the plan that we had made for it."

But what plan is he referring to? In almost 3 years of owning YouTube, Google has never publicly disclosed a specific plan for YouTube or laid out its business model, so attempts at reaffirming it fall flat because there's nothing against which progress can be judged. Here are other comments, with my reactions in parentheses.

Pichette on the earnings call: "We are really pleased both in terms of its (YouTube's) revenue growth, which is really material to YouTube and in the not long, too long distance future, we actually see a very profitable and good business for us, so from that perspective, we are really pleased with the trajectory." (WR: that sounds pretty bullish)

Jonathan Rosenberg, SVP of Product Management on the earnings call: "I think what I said - or what I meant to say was that monetizable views have tripled in the last year and that we are monetizing billions of views every month." (WR: that sounds bullish too, but wouldn't some actual numbers really bolster this point?)

Rosenberg on the supplementary call: "And that's part of why I think it's taken us time to kind of triangulate toward what works, and I think some of the things that we have now are still in the pretty nascent stages..." (WR: nonetheless, per earlier comment, profitability can already be forecast in the not too distant future?)

Nikesh Arora, President of Global Sales Operations and Business Development on the earnings call: "So we are seeing significant sell-through in most of our major markets where we have YouTube homepage for sale." (WR: of what ad unit - pre-rolls or display?)

Arora on the earnings call: "So I think the next phase of YouTube is going to be toward pre-roll video on short clips and long form video (which we are in the process of doing) various deals in, which we've announced in the past." (WR: that's new news, YouTube's spoken primarily of overlays in the past)

Rosenberg on the supplementary call: "I would not say our overall optimism that we expressed with respect to YouTube is primarily a function of one specific format. We've actually been testing pre-rolls, I think, for quite a while. So if you interpret that one single comment to pre-rolls to imply the broad conclusion with respect to optimism on YouTube, I think that's probably a mistake." (WR: so maybe pre-rolls aren't actually the next big thing?)

Yesterday's post: "Myth 5 YouTube is only monetizing 3-5% of the site. This oft-cited statistic is old and wrong, and continues to raise much speculation." (WR: what is the percentage then?)

CEO Eric Schmidt on the earnings call: "The majority of YouTube views are not professional content. They are user generated content because that's the majority of what people are watching." In response to whether YouTube is able to monetize user-generated content: "Has not been our focus." (WR: again, letting us know what percentage is professional and the focus of monetization would be very helpful)

These comments raise lots of questions about how far along Google actually is in understanding YouTube's traffic and its ability/plan to monetize it. I think Google is being clumsy in explaining YouTube's performance because it got nervous about the eye-popping estimates that have been floating around lately about how much money YouTube is losing and rushed to try to mitigate this perception, but without being ready to present real numbers as backup. Further, I don't think it rehearsed its executives very well about what to say or how to say it, so the improvised comments did not convey a clear consistent message.

As someone who believes YouTube has enormous long-term value for Google, my advice is that its executives should just stay mum on YouTube until they're ready to make a logical case backed by facts and data. That may take longer than Google or the market hoped, allowing the rumor mill to continue to churn. But continuing to make unsupported statements will only rile YouTube followers further, and eventually sap Google's credibility.

What do you think? Post a comment now.

Categories: Aggregators, UGC

-

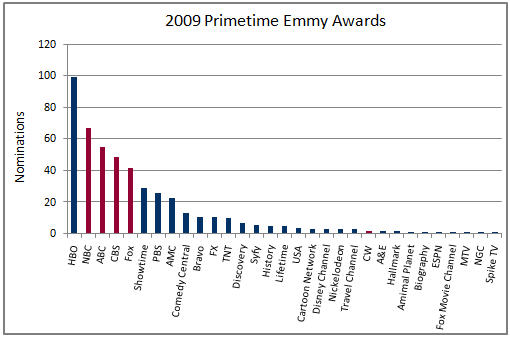

Cable's Emmy Nominations Illustrate Cord-Cutting's Challenge

Last week when the primetime Emmy award nominees were announced, cable programs turned in another strong performance, garnering 272 of the 487 nominations. The Emmys and other awards illustrate one of the key challenges for would-be cord-cutters: outside of per-program download options (e.g. iTunes) that will persist, in the coming TV Everywhere world, virtually none of cable's award-winning programming will be accessible online unless you subscribe to a cable/satellite/telco service provider. This is a critical fact in understanding how the broadband video world is going to unfold.

One of the reasons TV Everywhere is so compelling is that it offers cable networks an on-ramp to online distribution while preserving their existing - and increasingly valuable - dual revenue (monthly affiliate fees and advertising) business model. As more content executives are concluding that advertising alone will not be sufficient for profitable long-form program distribution online, the payments cable networks receive from cable/satellite/telco providers is more valuable than ever. TV Everywhere's online access will inevitably lead to heavier viewership and enhanced loyalty.

The Emmy nominations show the expanding breadth of cable's quality. As the below chart depicts, this year 26 different cable networks' programs were nominated, with HBO, the perennial leader picking up 99 nominations (it should be noted that last week HBO signed on to Comcast's On Demand Online technical trial, further entrenching HBO in the cable world, therefore dimming the notion that HBO will ever be available outside the traditional premium subscription model).

Cable's strength is even better understood by looking at the major Emmy award categories. For example, in the outstanding drama series category, cable got 5 of 7 nominations (AMC-2, FX, HBO, Showtime). In the outstanding children's program category, cable got all 3 nominations (Disney Channel-2 and Nickelodeon). In the outstanding reality program series category, cable got 5 of 6 nominations (A&E, Bravo, Discovery-2, NGC). Even in outstanding comedy series, cable got 3 of 7 nominations (HBO-2, Showtime).

When TV Everywhere gets fully rolled out, cable networks will have little-to-no incentive to make much of their programming available to non-paying video subscribers. That means that the Hulus of the world will have to content themselves with a catalog of broadcast programs, older movies and made-for-broadband series. As broadcast's Emmy nominations show, that still means there's plenty of popular content to drive online audience. But until Hulu figures out a subscription model, it (and its content suppliers) will be economically disadvantaged to cable both on-air and online. This is no small issue given each TV program episode now costs $2-3 million to produce.

Meanwhile, consumers will make their own video choices. If they choose to cut the cord they won't have subscription-based online access to programs like Entourage, Weeds, MythBusters, Hannah Montana, Mad Men or Dexter, not to mention top-shelf sports from ESPN, TNT and others. For some people eager to cut the cord, that will be just fine. But I'm betting that for the majority of viewers that would be unacceptable and they'll continue to choose to subscribe. TV Everywhere can use cable programs' popularity to blunt cord-cutting before it ever takes off and cement cable's appeal in the broadband era.

What do you think? Post a comment now.

Categories: Broadcasters, Cable Networks, Cable TV Operators

Topics: Comcast, HBO, TV Everywhere

-

4 News Items Worth Noting from the Week of July 13th

Following are 4 news items worth noting from the week of July 13th:TV Everywhere survey should have cable industry clicking their heels - I wasn't at all surprised to read results of a new Solutions Research Group survey fielded to 500 Comcast and Time Warner Cable subscribers giving the concept of TV Everywhere positive reviews. As Multichannel News reported, in the overall survey 28% of respondents said the idea was "excellent" and 45% said it was "good." Digging in further though, among those 18-49 the "excellent" score surged to 80%, while 87% of Hulu and Fancast users approved of the idea. Unprompted, respondents cited benefits like convenience, remote viewing, getting better value from their cable subscriptions, watching on PCs in rooms without TVs and catching up on missed programs. My take: consumers "get" what TV Everywhere is all about and already have positive initial reactions, meaning there's very significant upside for the cable industry.Paid video forecast to surpass free - A Strategy Analytics forecast that got attention this week says that the global paid online video market will be worth $3.8B in 2009, exceeding the global free online video segment which will total $3.5B. I haven't seen the details of the forecast, but I'm very curious what's being included in each of these numbers as both seem way too high to me. The firm forecasts the two segments to grow at comparable rates (37% and 39%), suggesting that their size will remain relatively even. I suspect we're going to be seeing a lot of other research suggesting the paid market is going to be far larger than the ad-supported market as sentiment seems to be shifting toward subscriptions and paid downloads.

Consumer generated video contests remain popular - VideoNuze readers know I've been intrigued for a while now about contests that brands are regularly running which incent consumers to create and submit their own videos. Just this week I read about two more brands jumping on the bandwagon: Levi's and Daffy's retail stores. NewTeeVee had a good write-up on the subject, citing new research from Forrester which reviewed 102 different contests and found the average prize valued at $4,505. I see no end in sight for these campaigns as the YouTube generation realizes it's more lucrative to pour their time into these contests than training their cats to skateboard. Brands too are recognizing the wealth of amateur (read cheap!) talent out there and are moving to harness it.

MySpace has lots of work ahead to become a meaningful entertainment portal - The WSJ ran a piece on Monday based on an interview with Rupert Murdoch in which he was quoted as saying MySpace will be refocused "as an entertainment portal." That may be the winning ticket for MySpace, but I'm not totally convinced. MySpace has been in a downward spiral lately, with a 5% decline in audience over the past year, a 30% headcount reduction and an executive suite housecleaning. While always strong in music, according to comScore, its 48 million video viewers in April '09 were less than half YouTube's 108 million, while its 387 million video views were about 5% of YouTube's 6.8 billion. Clearly MySpace has a very long way to go to give YouTube serious competition. It will be interesting to see if the new management team Murdoch has installed at MySpace can pull off this transition.

Categories: Aggregators, Brand Marketing, Cable Networks, Cable TV Operators, UGC

Topics: Comcast, Forrester, MySpace, Strategy Analytics, Time Warner

-

MTV Unveils Research on Short-Form Video Advertising

MTV Networks released some interesting research yesterday on the optimal way to present advertising in short-form online video. Its "Project Inform" looked at how multiple ad presentations from 3 blue chip

advertisers performed and were liked by users across 50 million video streams on MTV.com, ComedyCentral.com, VH1.com, NickJr.com and CMT.com. The research was conducted in partnership with InsightExpress using Panache's video ad platform.

advertisers performed and were liked by users across 50 million video streams on MTV.com, ComedyCentral.com, VH1.com, NickJr.com and CMT.com. The research was conducted in partnership with InsightExpress using Panache's video ad platform. The research found that the most effective ad product was a "lower 1/3 product suite" consisting of a 5 second pre-roll combined with a 10 second lower 1/3 semi-transparent Flash overlay that began about 10 seconds after the video itself began. Effectiveness was defined as brand lift, measured by metrics like unaided awareness, aided awareness and purchase intent. The research also measured consumers' likeability of each ad product. This finding provides support for why overlays seem to keep popping up; for example I now see overlays on most of the video clips I watch on YouTube.

In second place was a conventional 30 second pre-roll which did well on both effectiveness and consumer likeability. That surprises me somewhat because I've believed for a while that 30 seconds is way too long for an ad where the content itself may only be 1-3 minutes in length. Granted it's a subjective judgment, but my personal experience has been that 30 seconds feels like an eternity when I know the content I'm accessing is going to be pretty brief. In fact I've noticed a clear trend toward 15 second pre-rolls accompanying short video clips, which I assumed suggested content providers had thankfully come to a similar conclusion.

In third place in the MTV research was a "sideloader product suite", which included a 5 second pre-roll with a 10 second custom unit that slides out of the right side of the video window 10 seconds after the video itself began (so it sounds like the lower 1/3 product suite except the overlay is on the right instead of the bottom). I've never seen a unit like this, but to the extent that it may block valuable content in the right side of the window I could see users feeling it was intrusive.

There's lots of research underway about different ad formats' effectiveness, and the MTV research adds to the industry's collective knowledge about best practices. There's still a ways to go though as industry participants launch and test new types of ad formats in search of the ultimate ad presentation.

What do you think? Post a comment now.

Categories: Advertising, Cable Networks

Topics: InsightExpress, MTV, Panache

-

CTAM TeleSeminar Next Thursday, July 23rd

Next Thursday, July 23rd at 12pm noon ET, I'm going to be moderating a teleseminar for CTAM, titled "Understanding Viewers' Multi-Screen Migration." We'll be digging into the impact of 3 screen (TV, PC, Mobile) user behavior and what the implications are for the cable industry specifically and the media

industry in general. CTAM has recently released new proprietary research on 3 screen usage which we'll be using to guide the discussion. With broadband video consumption surging and the iPhone sparking significant mobile video interest, the teleseminar is very timely.

industry in general. CTAM has recently released new proprietary research on 3 screen usage which we'll be using to guide the discussion. With broadband video consumption surging and the iPhone sparking significant mobile video interest, the teleseminar is very timely.Panelists include Amy Banse, President of Comcast Interactive Media and SVP, Comcast Corporation, Dallas Clement, SVP, Strategy and Product Management, Cox Communications, David Evans, SVP, Broadband, Rainbow Media and Perkins Miller, SVP, Digital Media, NBC Universal Sports & Olympics.

The teleseminar follows a unique format; I'll be moderating from Fuse TV's studio in NYC in front of a live audience and the session will be uplinked via satellite for simultaneous viewing at over 35 CTAM chapter locations around the U.S. and Canada. Questions will be taken from both the studio audience and the remote viewers. It promises to be a fascinating discussion.

Click here for more information and registration or email Lisa Jackson at CTAM (lisa@ctam.com)

Categories: Events

Topics: CTAM

-

Is My Prediction That Microsoft Will Acquire Netflix Going to Come True?

Amid the chatter over the past few days about Amazon possibly buying Netflix, Kara Swisher at All Things Digital today instead suggested that Microsoft would make a better Netflix acquirer. Her sentiments echoed my Dec '08 prediction that Microsoft would acquire Netflix at some point in '09. It was admittedly a "long ball" call on my part (especially since I had zero inside dope), but one which actually makes even more sense 7 months later.

Why? Because Comcast and the cable industry's aggressive new TV Everywhere/On Demand Online initiatives make Netflix more valuable than ever for any company looking to offer a subscription-based,

broadband-delivered video service. Outside the cable/satellite/telco industries themselves, Netflix - with its 10 million+ current DVD-by-mail subscribers - is the only serious subscription video provider. Its recent stellar performance shows the durability of its model even in the face of the ongoing recession. And it continues to build out its streaming service with various device partners (including notably Xbox 360).

broadband-delivered video service. Outside the cable/satellite/telco industries themselves, Netflix - with its 10 million+ current DVD-by-mail subscribers - is the only serious subscription video provider. Its recent stellar performance shows the durability of its model even in the face of the ongoing recession. And it continues to build out its streaming service with various device partners (including notably Xbox 360).If Comcast succeeds with On Demand Online (and since the technical trial hasn't even begun yet, that's still a big "if"), and other cable operators quickly follow suit, the broadband video industry is poised for a fundamental shift away from ad-only business models to hybrid models where subscriptions are key. Any current or aspiring premium video provider that does not have an established subscription approach is going to be disadvantaged in its access to high-quality programming and ongoing product development resources. CBS's addition to Comcast's trial shows that even broadcasters are beginning to position themselves in the subscription mix.

My full rationale for why Netflix is so appealing for Microsoft is laid out in the Dec post, so I won't restate it here. Of course nobody outside the companies involved knows if any of the M&A chatter is for real. But if it is, my bet is still that Microsoft is the acquirer to watch, not Amazon. I suspect we'll see other analysts making a similar case if things heat up.

What do you think? Post a comment now.

Categories: Aggregators, Deals & Financings

Topics: Amazon, Comcast, Microsoft, Netflix

-

Comcast Adds CBS and 17 More Cable Nets to On Demand Online Trial

Another day, another flurry of announcements from Comcast with news of more networks participating in its On Demand Online technical trial. Newly on board are CBS (also the first broadcast network to participate) and 17 more cable networks such as A&E, AMC, BBC America, Food Network, History Channel, Sundance and others. Together with those already announced, there are now over 20 networks in the trial.

The cable networks' interest isn't surprising. I've been saying for a while that On Demand Online will be a real boon to them, providing a secure, scalable on-ramp to online distribution, new ad impressions and most important, significant enhanced value to their viewers. Still, despite all of Comcast's progress, most of the big cable network groups (e.g. NBCU, Fox, Disney, Viacom, Discovery) have not yet publicly signed on. I think that's just a matter of time.

There's no question Comcast is building real industry momentum for On Demand Online. But given the trial hasn't even begun yet, all of these announcements are really raising the visibility of the trial - and of course

the pressure to make sure its "authentication" processes work as intended. No doubt each of these announcements is creating a lot of sweaty palms among Comcast's technical staff - the people who are responsible for proving authentication works. With all the PR buildup, if for some reason all does not go according to plan, Comcast will have lots of people looking for answers.

the pressure to make sure its "authentication" processes work as intended. No doubt each of these announcements is creating a lot of sweaty palms among Comcast's technical staff - the people who are responsible for proving authentication works. With all the PR buildup, if for some reason all does not go according to plan, Comcast will have lots of people looking for answers.From my perspective though, I'd like to see Comcast tamp down the PR machine for now and focus on executing the trial itself. The point has now been amply made that the cable network community wants to play ball with On Demand Online. Comcast needs to make the trial a resounding success and then fill in details about how the rollout will proceed.

What do you think? Post a comment now.

Categories: Broadcasters, Cable Networks, Cable TV Operators