-

VideoNuze Report Podcast #30 - September 4, 2009

Daisy Whitney and I are pleased to present the 30th edition of the VideoNuze Report podcast, for September 4, 2009.

This week Daisy shares more detail from her most recent New Media Minute, concerning what broadcast networks are doing this Fall with online video extensions of their shows. For example, CW is launching an original series in conjunction with "Melrose Place." ABC is doing a 3rd season of an "Ugly Betty" web series and a tie-in for "Lost." CBS is launching its first web series, via TV.com, with Julie Alexandria, focused on recapping highlights from various shows. Daisy notes that these efforts are focused mainly on marquee shows and when advertisers are already on board.

In the 2nd part of the podcast we discuss my post from yesterday, "2009 is a Big Year for Sports and Broadband/Mobile Video." In that post I observed that many big-time sports, and the TV networks that have the rights to televise them have realized this year that broadband and mobile distribution are friend, not foe. As a result they've rolled out many different initiatives. We also touch on the various lessons other content providers can take away from what's happening with sports and broadband/mobile distribution.

Click here to listen to the podcast (13 minutes, 54 seconds)Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Podcasts, Sports

Topics: ABC, CBS, CW, Podcast, TV.com

-

2009 is a Big Year for Sports and Broadband/Mobile Video

Pick your favorite sport - baseball, basketball, football, golf, tennis, auto racing, etc. and it's likely that in 2009 some part of the action has been available via broadband or mobile video. 2009 is looking like the year that sports executives - and the TV network honchos that pay dearly for sports' broadcast rights- concretely realized that broadband and mobile complement traditional sports broadcasting and that they should be embraced, not spurned.

In VideoNuze's News Roundup, I've been keeping track of all the broadband and mobile sports headlines this year. Here's just a partial list of what I've captured, along with links:

- PGATour.com to Offer Live Video Streams of Key Holes for Tour Playoffs (B&C)

- U.S. Open to Stream Almost All Matches Online (PaidContent)

- DirecTV Offers NFL Sunday Ticket via Internet in NY Trial (USA Today)

- "Live at Wimbledon" Streaming Coverage Announced by NBC (Sports Media News)

- Cablevision Subs Will Gain Access to In-Market Streaming of YES's Yankee Telecasts (Multichannel News)

- MLB.com Streams Live Baseball Games to the iPhone (NYTimes Bits)

- NBA Playoffs to Stream on Android App (Online Media Daily)

- Speedtv.com to Stream Part of Le Mans 24 Hours (Multichannel News)

- NHL to Launch Daily Stanley Cup Pre-game Web Series (Mediaweek - reg required)

- Follow the Masters on Your iPhone (Electronic House)

- March Madness! YouTube Gets Live Video via Silverlight (NewTeeVee)

In some cases the initiatives provide specially-produced video, while in other cases they offer streams that are already available on TV. The former type isn't that surprising as supplementary video can add a lot of value to the main event (the analog in entertainment are the popular "behind-the-scenes" extras that come with DVDs).

It's the latter type - where broadcast streams are delivered via broadband or mobile, either live or on-demand - that is much more intriguing as it represents a big step forward in sports and TV network executives' thinking about multi-platform distribution. Traditionally the approach has been to tell fans when the sporting event was on and on which network to find it. But with these broadband and mobile efforts, increasingly we're seeing executives scrap that model and replace it with a more fan-friendly approach that seeks to bring the action to fans, on-demand and wherever they might be.

In my view, this is a welcome change. Regrettably, big-time sports are now all about big-time money. To understand the stakes, I'm fond of reminding people to do the math on what just ESPN rakes in on just its U.S. monthly affiliate fee of approximately $3.75 from cable operators, satellite operators and telcos carrying the channel into 90 million + homes (your calculator may run out of zeros if you try). With that kind of money on the line, it's imperative that networks and sports themselves figure out how to harness new technologies to deliver more value. From the looks of 2009's initiatives, they appear to be well on their way.

What do you think? Post a comment now.

Categories: Broadcasters, Cable Networks, Sports

Topics: ESPN

-

First Intel-Powered Convergence Device Being Unveiled in Europe

Convergence devices that bring broadband video and Internet applications to the TV (e.g. Roku, Xbox, Apple TV, Vudu, etc.) are a white-hot area of interest as many industry participants - including me - believe their eventual mass adoption will provide a major catalyst to broadband video usage and prompt further disruption in the value chain.

Intel has eyed a big role in this emerging market for a while, becoming a strong public proponent of the "digital home" concept. Building momentum over the past year, Intel has made announcements with Yahoo (for the "Widget Channel" framework), Adobe (to port and optimize Flash for TV viewing) and with a number of large content providers (demonstrating enhanced viewer experiences).

At the heart of Intel's early initiatives is the company's much-heralded Media Processor CE3100, the first in a family of "system on a chip" convergence-oriented processors. Next week the first CE3100-powered device, the "Mediaconnect TV" will be shown at the IBC show in Amsterdam. The box is a collaboration between a Dutch company, Metrological Media Innovations and a British interactive services provider, Miniweb (a spinoff of BSkyB). This has been previewed recently and is sure to gain more visibility next week. To learn more about Intel's convergence vision, yesterday I spoke to Wilfred Martis, the GM of Connected AV Products for Intel's Digital Home Group.

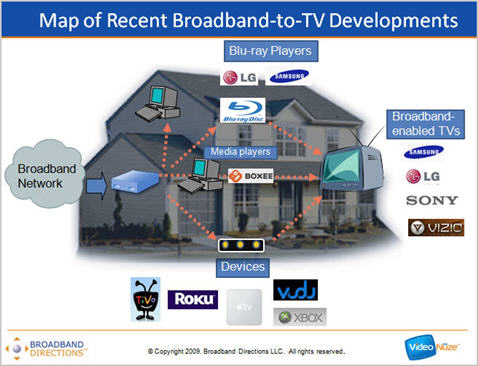

Intel sees 4 different types of home products that can be fitted with its media processor chips: set-top boxes, digital TVs, optical players (e.g. Blu-ray devices) and "connected AV" products, which are defined as standalone boxes that connect broadband to the TV, but without any guaranteed quality of service (QoS) for the video. This segmentation actually closely follows a slide I've been presenting lately which maps the various efforts for bringing broadband to the TV.

The connected AV devices are of course what "over-the-top" providers like Netflix, Amazon, iTunes, YouTube, etc. are counting on to deliver their services into the home over open broadband connections. On the one hand, Intel seems to be looking to empower these providers. As Wilfred says, Intel is trying to create a standard toolset and app environment akin to what we've seen on leading smartphones (mainly the iPhone) that helps drive creative new TV-based applications. Yet at the same time, as Wilfred notes, Intel wants to be a friend to incumbent video service providers, allowing them to deliver broadband content side-by-side with their walled-garden channels in their set-top boxes.

While Intel is clearly in this for the long haul, and has the resources to cultivate the market, other non-Intel devices continue to get a foothold. It's interesting to contrast, for example, the success that Roku is enjoying to date and ponder how the convergence device market will develop over the next several years. As I detailed a few weeks ago, Roku is successfully pursuing a classic "Crossing the Chasm" strategy, leveraging low pricing and loyalty to its content partners' brands to move lots of its product.

Still, integrating with Roku - and other current convergence devices - requires a one-off integration that assumes resources and prioritization (even when APIs exist). Some content providers will determine integrating is worthwhile, while others will not.

Intel's strategy is meant build on existing technologies and applications, making it more straightforward for content providers and applications developers to deploy on its devices (it's worth noting that Amazon, Blockbuster, Facebook and others plan to launch Widget Channel apps imminently). As Wilfred explains, when Intel's architecture is in convergence devices, incumbent software like browsers, plug-ins, drivers and the like are intended to work seamlessly. In addition, by providing abundant processing power, developers don't have to go through the arduous task of de-optimizing their apps for slower environments. And they get the performance headroom to continuously add updates.

The price for all this is of course, price. I don't know what the unit cost of the CE3100 is at volume, but my guess is that whatever it is would quickly sink any manufacturer's prospects of selling their box at anything close to a $99 price point, as Roku is. It's an age-old computing dilemma: beneficial as it is to have lots of processing power, there's a cost to it.

This raises the fundamental question of how the convergence device market will shape up over the next several years: will low-cost, "powerful-enough" devices continue to gain, or will boxes with robust processing render them obsolete at some point soon? My guess is that in the short term at least, low cost is going to lead the way. However, over the long term, it's hard to avoid the idea of significant computing power sitting next to the TV. However the business model for who pays to get it there remains in question.

What do you think? Post a comment now.

Categories: Devices, International

Topics: Adobe, Intel, Metrological Media Innovations, Miniweb, Roku, Yahoo

-

As Summer Ends, A Time to Say Thanks

With September's start, the kids heading back to school and overnight lows in the chilly 40s here in the Boston area, it is time to recognize, reluctantly, that this unusually long (and wet!) summer is coming to an end. As many of you, like me, prepare to return to your "regular" routines, I'd like to pause and say a few words of thanks.

First, a huge thanks to VideoNuze's many thousands of readers who give purpose to my daily work. Nearly two years since launching VideoNuze, readership continues to build, with over 9,000 industry participants now receiving the daily VideoNuze email and over 100,000 unique visitors coming to the web site each month. I'm delighted at how VideoNuze has found its place as a trusted source of analysis and news for many in the industry.

This summer has been very productive: 82 analyses comprising almost 50,000 words, 490 industry news items posted to the site from over 25 sources and 11 podcasts with my partner Daisy Whitney. While other sites crank out a far greater quantity than VideoNuze, I'd like to think none offer higher quality. This summer I also managed to squeeze in a couple of consulting projects, 4 speaking engagements, 3 panels I moderated and a 10 day vacation in Israel. Last but not least, VideoNuze's next 2 events coming up in October took shape (registration for the Oct. 13th "VideoSchmooze" NYC event is now live). Whew!

I always welcome readers' emails or calls, whether they're to agree or disagree with what I've written. Though I'm not a hound for compliments, I will admit that I greatly enjoy the emails I receive saying things like, "Thanks for the consistently high quality analysis," "Just wanted to say how useful VideoNuze has been here in the U.K." "Your stuff is consistently enlightening" or "I enjoy your writing and the thoughtfulness your perspective brings to what is typically an over-hyped and under-analyzed topic."

These types of emails help answer some variant of a question I've been asked more than any other in the past two years: "How the hell do you churn this thing out every single day?!" Beyond the pat answer that "every job requires a certain discipline," the real explanation is that for me, VideoNuze is what Malcolm Gladwell, in his superb third book, "Outliers," describes simply as "meaningful work." I love analyzing and writing about the technology and media industries and the change that broadband and mobile are bringing to the video landscape. It's painstaking yet intellectually stimulating to try putting the puzzle pieces together and gratifying to know I have a role in influencing how industry executives determine their strategies and execute their plans.

Second, a huge thanks to VideoNuze's sponsors. From VideoNuze's original 8 charter sponsors, there have now been over 30 companies that have sponsored VideoNuze at one time or another. There isn't room to acknowledge them all, but I encourage you to visit the sponsors' page of the web site and to click through and learn more about each. Beyond the important technology and services each is offering to the industry, many also provide education in the form of free webinars, white papers, etc. As VideoNuze's traffic has grown, the value of sponsoring has as well. I've tried to keep rates reasonable, ensuring a strong ROI along many different metrics (as always, if you're interested in sponsoring VideoNuze, please contact me).

Lastly, thanks to many partners who play a key role in VideoNuze's ongoing success. These include NATPE, The Diffusion Group, my fine overseas technology firm and several PR firms (e.g. Horn Group, Blue Point Venture Marketing, October Strategies) and design firms which have assisted with VideoNuze's events, along with my excellent general counsel (and lovely wife!). Thanks also to many in industry who have shared a particular statistic I've been in search of, or who have made an introduction to someone I was eager to speak to.

I look forward to continuing to explore broadband and mobile video's future with all of you.

Categories: Miscellaneous

Topics: VideoSchmooze

-

comScore's Online Video Data Charts for Jan '07-July '09 Available for Download

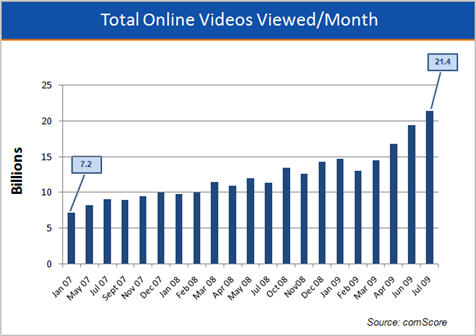

Last Thursday comScore released July 2009 data from its Video Metrix service showing record online video usage for the month. I've been charting comScore's data for 2 1/2 years, making updates each month when comScore provides new data. Today I'm offering these charts as a complimentary download (if you incorporate them into your presentations please identify comScore as the source). Here's an example slide for total online videos viewed per month:

Not surprisingly, a number of content providers have informally told me that their internal data and what comScore reports for them doesn't neatly tie out (anyone who's ever tried to reconcile number from internal analytics, ad servers and external measurement sources can relate to these discrepancies). Nonetheless, comScore's data provides at least one consistently-measured data set on the industry, which is quite useful.

Some of the record July numbers benefit from Michael Jackson's death and also from the lull in original TV episodes. Still, the comScore trendlines are pretty impressive. I share these charts at the beginning of presentations that I often make to industry executives to underscore broadband video's rapid growth. Some of the more noteworthy numbers that are highlighted on the slides include:

- A near tripling of total videos viewed per month from 7.2 billion in Jan '07 to 21.4 billion in July '09.

- A 229% increase in the average number of online videos watched per viewer per month from 59 in Jan '07 to 135 in July '09.

- A 331% jump in the number of minutes of video watched per average viewer per month from 151 minutes (2 hours 31 minutes) in Jan '07 to 500 (8 hours 20 minutes) in July '09.

- Looking just at YouTube, its share of all videos viewed has increased from 16.2% in Jan '07 to 41.9% in July '09. YouTube is the 800 pound gorilla of the market month in and month out. For example, in July '09, the #2 ranked video provider was Viacom Digital with 3.8% share of views, less than a tenth of YouTube's. YouTube accounts for nearly all of Google's 8.9 billion monthly views. To help put that number in perspective, it roughly equals the industry's total views in Sept '07. YouTube is also used more intensively than any other video site, with 74.1 average videos per viewer vs. #2 Viacom Digital with 19.2 average videos per viewer.

- Hulu's monthly videos viewed have increased from 88 million in May '08 to 457 in July '09, a greater than 5x increase in just its first 15 months in existence.

By virtually every measure the industry continues to experience rapid adoption. As I've noted before, in addition to continuing to grow viewership, the industry's key challenge is to further monetize all this video, either through advertising or paid models (subscriptions, pay-per-use or as a value add to other paid services).

What do you think? Post a comment now.

Categories:

Topics: comScore, Hulu, YouTube

-

4 Items Worth Noting from the Week of August 24th

Following are 4 news items worth noting from the week of August 24th:

1. Time Warner Cable, Verizon launch TV Everywhere trials - Little surprise that Time Warner Cable announced its own TV Everywhere trial yesterday, given that former sister company Time Warner has been one of its biggest proponents. More interesting was Verizon launching a TV Everywhere initiative, which I regard as a pretty strong indicator that most or all service providers will eventually get on board. (The Hollywood Reporter has a story that DirecTV is in talks too for online distribution of TBS and TNT to start).

I have to give credit to Time Warner CEO Jeff Bewkes, TV Everwhere's key champion, who's clearly generated a groundswell of support. While some critics see TV Everywhere as being at odds with the "open Internet" ethos, I continue to think of it as a big win for consumers eager to get online access to their favorite cable programs. Assuming authentication is proven in during the trials I expect a speedy rollout.

2. Conde Nast distributes through boxee - I was intrigued by news that Conde Nast Digital will begin distributing video from its Wired.com and Style.com sites through boxee. boxee and others who connect broadband to TVs are valuable for magazines and other content providers who have long been shut out of the cable/satellite/telco distribution ecosystem, thereby unable to reach viewers' TVs. Years ago special interest magazines missed big opportunities to get into cable programming, allowing upstart cable networks to grow into far larger businesses (consider ESPN vs. Sports Illustrated, Food Network vs. Gourmet or CNBC vs. Forbes). Broadband gives magazines, belatedly, an opportunity to get back into the game.

3. Amazon announces 5 finalists in UGC ad contest - Have you seen the 5 finalists' ads in Amazon's "Your Amazon Ad" contest, announced this week? They're quite clever, with some amazing special effects. The contest is another great example of how brands are tapping users' talents, posing new competition to ad agencies. I haven't written about this in a while, but I continue to be impressed with how different brands are pursuing this path. Doritos has been the most visible and successful with its user-generated Super Bowl ads.

4. Microprojectors open up mobile video sharing opportunities - Maybe I've been living under a rock because I just read about "microprojectors" for the first time this week (I have a decent excuse since as I non-iPhone owner I wouldn't have a use for one, yet). As the name suggests, these are pocket-size projectors that allow you to output the video from your iPhone to project onto a large surface like a wall or ceiling. According to this NY Times review the quality is quite respectable, and is no doubt only going to improve. The mind boggles at what this could imply for sharing mobile video. Imagine bringing a kit - consisting of an iPhone, portable speakers and microprojector - to your friend's house, then plugging in and projecting either a live stream or an on-demand program for all to see.

Enjoy your weekend!

Categories: Cable Networks, Cable TV Operators, Commerce, Devices, Magazines, Telcos, UGC

Topics: Amazon, Comcast, Conde Nast, Time Warner Cable, Verizon

-

VideoNuze Report Podcast #29 - August 28, 2009

Daisy Whitney and I are pleased to present the 29th edition of the VideoNuze Report podcast, for August 28, 2009.

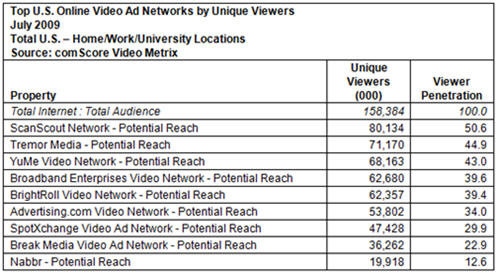

In this week's podcast we discuss comScore's rankings of video ad networks' potential reach for July, 2009. I offered a first look at these rankings in Wednesday's post. As I pointed out, these rankings represent the aggregate reach of each ad network's publisher list. This is different from a ranking of actual reach, which comScore is working on, and plans to begin releasing at some point in the near future. Daisy and I remind listeners that potential reach is an imperfect measure, but it is still an important filter for media buyers trying to gain insight into who the major video networks are.

Unrelated, I touch base on last week's podcast in which Daisy and I discussed the Southeastern Conference's shortsighted ban on fan-generated video in stadiums. I raise the topic because earlier this week I had the pleasure of taking my 9 year-old daughter to Fenway Park to see a Red Sox-White Sox game. All around us were people taking pictures and video. And go to YouTube and you'll find plenty of fan video of key Red Sox moments.

Somehow fan video doesn't seem to bother MLB as it does the SEC. I don't claim to understand the difference in thinking, but Daisy notes that MLB has been among the most forward-looking sports leagues around. Daisy is so peeved at the SEC that she's protesting by vowing never to attend an SEC game (a relatively insignificant threat since she's in fact never attended an SEC game and lives on the other side of the country!)

Click here to listen to the podcast (13 minutes, 53 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts, Regulation, Sports

Topics: comScore, MLB, Southeastern Conference

-

First Look at comScore's July '09 Video Ad Networks' Rankings

Below is a first look at comScore's rankings for video ad networks' "potential" reach for July '09. The rankings, which have not yet been publicly shared, reveal a relatively tight clustering of 5 video ad networks - ScanScout, Tremor Media, YuMe, Broadband Enterprises and BrightRoll - with ScanScout capturing the number 1 spot in its first month being fully measured by comScore.

The "potential reach" aspect of these rankings is important to understand. As I explained in June in "Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks," the potential reach numbers account for the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However, as I discussed with Tania Yuki, comScore's director of product management, it's not a perfect measure, though comScore is continually trying to improve it.

The rankings are determined through a combination of the ad networks' self-reported publisher list and comScore's own tracking. If a video network reports that any one publisher accounts for 2% or more of its viewers, comScore requires a letter proving the business relationship. There is also a self-policing mechanism as comScore provides a "dictionary" of all publishers that each ad network reports. Competitors can review the dictionary and appeal to comScore if something appears amiss. Still, there's some looseness in the methodology, and having spoken to a number of industry executives, also a fair amount of concern that it is accurately portraying the industry's true performance.

comScore recognizes the limitations of the potential reach approach and that it is just one way of understanding a video ad network's value. Actual monthly performance is equally important, and comScore has been working with ad networks to implement this reporting as well. As I wrote in June, the "hybrid" approach requires ad networks to insert a 1x1 beacon in their video players. Though this approach also has its limitations, many of the biggest video ad networks are now implementing the beacon, and soon comScore will likely begin reporting actual as well as potential reach.

Video ad networks are a very important part of the online video ecosystem, responsible for placing millions of dollars of ads each month. Importantly they allow a level of targeting and reach that brands seek, but are often unable to attain on their own with a handful of direct site relationships. With the online video medium still relatively new, buyers require data helping them understand their options. However, the comScore data is just a first filter, diligent buyers still must dig in to understand how each network, or individual site meets their needs.

What do you think? Post a comment now.

Categories: Advertising

Topics: BrightRoll, Broadband Enterprises, ScanScout, Tremor Media, YuMe