-

ESPN Capitulates to Syndicated Video Economy

You'd have to have slept through yesterday to miss the big news that ESPN is now syndicating video clips from a cluster of its programs to AOL, its first-ever such deal. I interpret the deal as an extremely strong indicator that the "Syndicated Video Economy" (as I described this trend 3 weeks ago) is inexorable, even for the richest and most powerful video brands.

ESPN is one such brand. In 2007 it generated 1.2 billion video views from its own site, placing it in the top 10 of all sites. In January '08, ESPN generated 81 million views according to comScore, ranking it #9. And much

of ESPN's broadband video (aside from what it shows exclusively on ESPN360, its online subscription service) is essentially re-purposed from on-air, likely making the margins on ESPN's online efforts insanely profitable.

of ESPN's broadband video (aside from what it shows exclusively on ESPN360, its online subscription service) is essentially re-purposed from on-air, likely making the margins on ESPN's online efforts insanely profitable. Yet with the AOL deal, even the mighty ESPN has now capitulated to the lure of the syndicated video model. And the AOL deal is surely the first of many more deals to come. ESPN has likely come to the same conclusion as have scores of other video content providers, including the major broadcast networks: the future broadband video value chain is going to be more about "accessing eyeballs" - wherever they may live, at portals, social networks and devices - than about "acquiring eyeballs" by driving them to one central destination site. As the most stalwart proponent of the latter approach, other market participants should take heed of ESPN's strategy change.

The motivation behind video providers shifting from traditional scarcity-driven distribution strategies lies in the peculiar dynamics of the Internet: while audiences continue to fragment to a bewildering range of sites, they are simultaneously coalescing in a relatively small number of influential new brands such as YouTube, MySpace, Facebook and the traditional portals. Consider the comScore January stats again. The Google sites (dominated by YouTube) drove 3.4 billion video views or 42 times ESPN's video volume. A distant second was the Fox Interactive Media sites, including MySpace, which drove 584 million views, still 7 times ESPN's total.

These dynamics incent established video providers and startups in particular to get their video in front of all those eyeballs with more flexible business models. (For those interested in more detail on how the video distribution value chain is fast-changing due to these emerging players, I've posted slides from late '07 here. I'll have updated slides soon.)

The "Syndicated Video Economy" is creating both unprecedented opportunities and challenges for video providers. I continue to believe the future winners will be relentlessly flexible and willing to adopt new business approaches that keep them in synch with evolving consumer behaviors.

Categories: Cable Networks, Partnerships, Portals, Sports, Syndicated Video Economy

Topics: AOL, comScore, ESPN, Fox Interactive Media, MySpace, Syndicated Video Economy, YouTube

-

Modern Feed Jumps Into Video Navigation Space

With the proliferation of available broadband video comes a massive user navigation challenge. Modern Feed is launching today to address this. It is part search engine, part aggregator, with a specific focus on indexing professionally-produced programming, not user-generated video. It's also focused on actual programs, not promotional clips.

J.D. Heilprin, Modern Feed's founder/CEO told me yesterday that the company is targeting mainstream users providing the easiest way to find available, high-quality video. It employs a team of "Feeders" charged with curating the best videos to include on the site. The result is approximately 550 "networks" and 25,000 pieces of content now indexed, where "networks" is a loose term ranging from traditional broadcasters to indies new entrants like Boston Symphony or Architectural Digest.

Modern Feed is rights-holder friendly, not indexing any illegal or pirated video, and playing the video from the source's site (though sometimes with a thin Modern Feed navigation frame at the top of the screen). I played around with Modern Feed and found it to be easy-to-use and well-laid out. Modern Feed also offers an iPhone implementation that looks pretty cool, other devices are to follow.

The big challenge (and opportunity) for Modern Feed is that it's entering a very noisy space where user behavior is very undefined. There are myriad video search engines (Truveo, ClipBlast, blinkx, Veveo), portals (AOL, Yahoo, MSN), navigation sites (TV Guide, recently-launched PrimeTime Rewind) and of course the networks' own sites (and syndication efforts) offering users the ability to quickly find quality content. Then there's YouTube, the first stop for many users when it comes to video. And YouTube is increasingly moving up market by striking partnerships with premium providers.

Modern Feed's strong user experience, focus on mainstream users and device integrations are differentiators for the company. Whether these are ultimately success factors really depends on how user behavior unfolds in the nascent video navigation space. Modern Feed has raised several million dollars from angels and has 30 full-timers with aggressive growth planned.

What do you think? Post a comment and let everyone know!

See prior posts:

YouTube, C-SPAN Team Up for User-Generated, Multi-Platform Voter Project

Categories: Startups, Video Search

Topics: AOL, Blinkx, ClipBlast, Modern Feed, MSN, PrimeTime Rewind, Truveo, TV Guide, Yahoo, YouTube

-

YouTube, C-SPAN Team Up for User-Generated, Multi-Platform Voter Project

Broadband video's influence on Election Year 2008 grew further with today's announcement of the "YouTube Voter Video on C-SPAN" initiative.

To build momentum toward the Pennsylvania primaries on April 22nd, the companies are inviting viewers to upload to the C-SPAN channel on YouTube videos answering the questions "what issue in this election is most important to you, and why?" C-SPAN will air a selection of the videos on its "Road to the White House" program beginning April 13th.

I think this is a clever, fun idea to help drive awareness and share disparate views on the election. Though participation is completely self-selected, it will certainly offer much-needed dimension to the dry polling results constantly churning through the media. Combined with the CNN/YouTube debates from a couple months ago, Election Year 2008 continues to show how much more dynamic and inclusive the process becomes with broadband video's influence.

-

Brightcove Partners for Enhanced Video Syndication

The broadband video market's focus on content syndication continued this morning as Brightcove, a

leading video management platform, announced partnerships with Bebo, Meebo, RockYou, Slide and Veoh.

leading video management platform, announced partnerships with Bebo, Meebo, RockYou, Slide and Veoh. Enabling managed syndication is becoming an imperative for video management platforms like Brightcove as customers increasingly seek to proliferate their content to multiple distributors. In particular, social networks like Bebo and others are prime syndication targets. They have huge and highly engaged users who can drive huge volumes of video streams.

However, syndication raises a host of new operational issues, which in turn creates an opportunity for companies like Brightcove to add value to their platforms. Issues include rights management, monetization, tracking/reporting, business model implementation and others. Syndication is an exciting new push for many, but is already starting to pay off. One recent example is CBS Television Stations, which now derives more than 50% of its total monthly streams just through its syndication deal with Yahoo.

(Note: Brightcove is a VideoNuze sponsor)

Categories: Partnerships, Syndicated Video Economy, Video Sharing

Topics: Bebo, Brightcove, Meebo, RockYou, Slide, Veoh

-

What Media Planners Think of Online Video Advertising

Continuing VideoNuze's series of posts about the online video advertising industry, last week I spoke to Alistair Goodman, who's the VP of Strategic Marketing at Exponential Interactive, a media services company with hundreds of advertising clients and publishers in the digital media space.

Exponential recently released the results of a survey of 100 ad agency media planners' perceptions of online video advertising. To the best of my knowledge, the survey, "The Trials and Tribulations of Online Video

Advertising," is the first one focused on what the people actually responsible for spending money in this new medium think (the survey is evenly split between those who have bought and those considering buying). Most prior research has focused on users' or publishers' attitudes. The research confirms many things I hear each day, and also reveals some new insights on the market.

Advertising," is the first one focused on what the people actually responsible for spending money in this new medium think (the survey is evenly split between those who have bought and those considering buying). Most prior research has focused on users' or publishers' attitudes. The research confirms many things I hear each day, and also reveals some new insights on the market.I'm very pleased to offer a complimentary download of a subset of the Exponential's slides exclusively here at VideoNuze. If your business is reliant on video advertising, I highly suggest reviewing them. If you have questions or want to receive the full deck, there is contact info on the last slide.

The top 2 issues for planners who have actually bought video ads are operationally-oriented: "smooth delivery" and "detailed reporting." As Alistair described it, these factors (and others cited) confirm the complexity of executing a campaign at scale. The complexity results from lack of standards, multiple players/formats, fragmentation of viewership and non-standard metrics. None of this is unexpected in a market as nascent as online video; the challenge is addressing and resolving these quickly for online video to reach its full potential.

In the past I've mentioned repeatedly that monetization is the number 1 priority for both established and early stage video content providers. This is an urgent issue because lots of energy and money is being invested in creating online video content, but the financial returns are not there yet. These payoffs need to materialize if the enthusiasm around this new medium is to be sustained.

Click here to download the Exponential slides.

(Note: I have created a new section in VideoNuze to offer all downloads of all relevant market research. If you have complimentary industry data please contact me and I'll add it to the page.)

Categories: Advertising

Topics: Exponential Interactive, Tribal Fusion

-

BBC's iPlayer a Model for U.S. Networks?

Today, I'm pleased to welcome the first post from Colin Dixon, Practice Manager, Broadband Media at The Diffusion Group, who is also a longtime industry executive.

I also want to highlight that as part of The Diffusion Group's 4th anniversary today, it is offering a special promotion for new clients of 4 reports for $4,000 (reports are usually $2,500 apiece) which also includes a 30 minute consult with founder/principal analyst Michael Greeson. The opportunity will be available for 4 hours, 4 minutes, from 12 noon U.S. Central Time today. Enjoy!

BBC's iPlayer a Model for U.S. Networks?

by Colin Dixon, The Diffusion Group

There's a lot of angst in Hollywood at the moment over broadband video. With video advertising models online in their infancy, the content providers are rightfully concerned about cannibalizing their linear channel ad revenue for unproven broadband models. Will eyeballs follow if a content provider puts all of its shows online? What's the right balance between too little and too much online content? With the variable quality of broadband connections, should a viewer be able to download the show for free rather than streaming it? Questions such as these are the source of much hand-wringing.

But what would happen if a major network were to throw caution to the wind and put everything they broadcast online and let their viewers download the shows for free to watch when and where they liked? Perhaps we can learn some lessons from the UK where the BBC, unfettered by the profit motive, is doing just that.

Late last year the BBC released its iPlayer through broadband connections to the British public. This proprietary client, available on PCs and iPods throughout the UK, makes available for free download every show broadcast on all of the BBC's many radio and television channels. Once downloaded, a show can be watched, ad free, anytime over the following 30 days (although once you start to watch a show, you have 7 days to finish viewing it.)

The British public, apparently, love it. In January, they downloaded some 11 million shows with usage of the service peaking at over a half million downloads in one day. Over 2 million people are perfectly comfortable relaxing in front of the PC catching up with the latest episode of "Doctor Who" or "EastEnders." And because the show is downloaded, not streamed, the quality is always great and the shows can be watched when and where it's convenient.

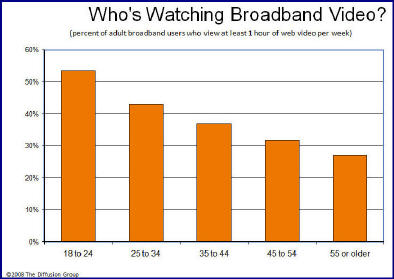

But perhaps this is just a British thing. Surely the same rules don't apply to the US market? Far from it. As we found when we surveyed broadband video users, there is strong evidence that US users will embrace online delivery with the same fervor as their UK brethren. When we surveyed nearly 2000 US broadband users, we found that 40% were watching an hour or more of broadband video. More amazing still is that 12% of broadband users were watching 25% or more of their television online. If you have a teenager in your home, I'm sure this will not come as a surprise to you!

Numbers like this are noteworthy in themselves. But it's important to remember that, in comparison to the BBC's iPlayer, the online viewing experience in the US is a mess. Shows are scattered over multiple websites and free ad supported show downloads are rare indeed. Broadband video viewing is an incredibly variable, often frustrating experience. What is clear is that given the same circumstances, the BBC's experience is likely to be repeated here.

The message for US content providers is clear: if you put it all online for free, and let people download and watch whatever, wherever and whenever they want, the eyeballs will follow. But with large numbers of people already devoting 25% or more of their TV viewing online, the issue of cannibalizing existing linear broadcast ad revenues is rapidly becoming irrelevant. The ad revenues will migrate to the Internet anyway!

One can only speculate what can happen when, as we predict for 2011, there are over 100 million households worldwide that are watching broadband video not from their PCs, but from broadband-enabled TVs.

What do you think? Post a comment and let everyone know!

Categories: Broadcasters, Downloads, International

Topics: BBC, iPlayer, The Diffusion Group

-

BobVila.com Illustrates Opportunities, Challenges for 'Mid-Tail' Content Providers

I frequently hear the same segmentation framework used to describe today's broadband video providers. Between the small group of premium providers (e.g. broadcasters) and user-generated sites (e.g. YouTube), lie the so-called "mid-tail" (in "Long Tail" terminology) providers such as newspapers, magazines, online publishers, and indie producers. BobVila.com is a perfect example of a mid-tail provider. Dan Newberry, the company's VP Advertising and Marketing, who I recently spoke with, discussed these opportunities and challenges.

Some of you may know that Bob Vila hosted a hugely popular PBS program from 1979-1989 called "This Old House." He then set up his own production company and produced 2 syndicated shows, "Bob Vila's Home Again" and "Bob Vila." At the end of the latter's run, he decided to shift his focus exclusively to online, to his BobVila.com web site which had been growing since the Internet's earliest days.

As Dan explains, one of the motivations (in addition to Bob Vila's personal reasons) was the improving climate for online advertising in general and video advertising in particular. The economics of creating quality programming for TV vs. for online, plus the CPMs available online, made the case for shifting to online only. The site now generates 1.7 million unique visitors/mo and 600K-700K video streams/mo, with 1,700 video clips available.

Responding to its audience's desires, BobVila.com now produces 5-7 minute step-by-step how-to videos for the site. It has created about 100 since June '07. While broadband enables this new model, Dan is clear about the challenges.

First and foremost is making the financial equation work. This involves producing videos on a disciplined budget and maximizing ROI. Their target cost to produce each video is $4-5K, which requires a different approach than with TV production. Given current viewership and CPMs, Dan calculates that break-even on an individual video is projected at 24 months.

To monetize their video, BobVila.com uses an internal sales team and is able to generate pre-and mid-roll CPMs in the $25-40 range. If there's unsold inventory then it uses a network to sell it, usually garnering $7-12 CPM. In addition, it also selectively uses overlay ads from Google AdSense. Setting the ad strategy to maximize revenue is key. As Dan noted, staffing and managing an internal sales team in this highly competitive environment is a challenge that startup sites need to fully recognize.

Increasing video views is another key challenge. Acknowledging the limitations of search and on-site generated traffic, BobVila.com is ramping up an aggressive syndication effort. While offering lots of upside, Dan explains that this syndication will present new operational and financial complexities such as ensuring BobVila.com gets paid, content is distributed where and when it should be, enforcing various rights issues, etc. Dan pointed out the importance of having a solid technology partner (BobVila.com used PermissionTV) which enables syndication, flexible players and content management.

When you put it all together, it's clear that while broadband offers mid-tail providers like BobVila.com huge new opportunities, it also creates new challenges and responsibilities that many content providers have not typically dealt with. Surmounting these will determine how well these mid-tail providers ultimately fare.

Categories: Advertising, Indie Video

Topics: BobVila.com

-

Cartier, Campari, CIT: Broadband-Driven Branding

Three exciting examples of how marketers are using broadband to drive their branding objectives recently hit my radar: Cartier, Campari and CIT.

Though the campaigns differ widely, they all strive to convey brand attributes by creatively using video. Interestingly, they also each use traditional print publications to drive awareness of their broadband efforts. This illustrates how important multi-platform marketing has become.

Cartier, the luxury products company, recently began re-promoting its mini-site supporting its "Love" line of jewelry. This campaign originally kicked off in '07 but I found it via a screen takeover ad at NYTimes.com. The mini-site includes 12 short videos from director Olivier Dahan (La Vie En Rose). Each video depicts a couple in various states of their relationship. Shot in black and white with low lighting and mood music, each evokes a luxurious sensibility that is consistent with the Cartier brand and "Love" line. Though purely entertaining, they create an engaging experience that would be impossible to replicate in traditional 30 second TV ads.

Meanwhile, Campari, the Italian liquor, is re-promoting its "Hotel Campari" min-site featuring Salma Hayek. I previously wrote about this last July, and once again found out about the site through an ad in The New

Yorker magazine. Campari uses a more overtly seductive approach than Cartier, featuring Ms. Hayek gliding down a hallway ignoring all kinds of enticements until settling on a Campari on the rocks. The video nicely supports Campari's exclusive positioning, introducing the brand to audiences via the well-known, yet still-exotic actress. With liquor ads barred from TV, Campari is making great use of the unregulated broadband medium.

Yorker magazine. Campari uses a more overtly seductive approach than Cartier, featuring Ms. Hayek gliding down a hallway ignoring all kinds of enticements until settling on a Campari on the rocks. The video nicely supports Campari's exclusive positioning, introducing the brand to audiences via the well-known, yet still-exotic actress. With liquor ads barred from TV, Campari is making great use of the unregulated broadband medium.Lastly, there's CIT, the financial services giant, which has updated its "CIT: Behind The Business" video interview series with leading business executives. This first caught my eye last November, and the current interview with Jon Luther, Chairman and CEO of Dunkin' Brands is promoted via a 4-page insert also in the latest New Yorker edition. CIT

differentiates itself by promoting how it brings "knowledge, expertise and creativity" to its client relationships. The interview series supports that positioning perfectly by eliciting insights in a low-key, yet engaging manner. Though clearly not as eye-catching as Cartier's and Campari's videos, CIT's videos and serialized nature serve its brand well.

differentiates itself by promoting how it brings "knowledge, expertise and creativity" to its client relationships. The interview series supports that positioning perfectly by eliciting insights in a low-key, yet engaging manner. Though clearly not as eye-catching as Cartier's and Campari's videos, CIT's videos and serialized nature serve its brand well.These three campaigns show how broadband video continues to be used by savvy brands to better engage their target audiences. They also demonstrate how entertainment programming and brand marketing continue to converge. I expect more of this to come.

Categories: Brand Marketing