-

New Statistics Address Video Piracy, Importance of Quick Online Release of TV Programs

During very informative presentations at my NAB panel discussion yesterday, there were 2 slides that really caught my attention. Both shared statistics, new to me, about video piracy and user behavior patterns. These statistics illustrate the important early online window just following when a TV program is aired. Capturing this audience spike can dampen video piracy and also be a big revenue opportunity for providers.

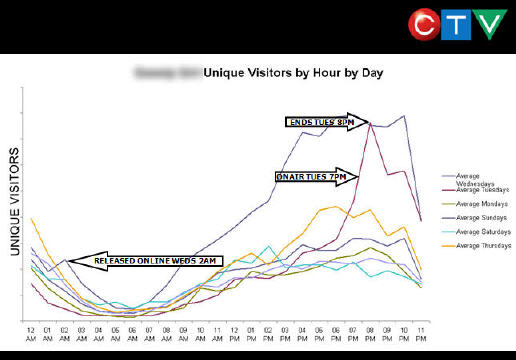

The first slide, shown below, was presented by Rob Adams, director of digital media operations at CTV, Canada's largest broadcaster. CTV offers both clips and full-length streaming episodes from its networks and select partner networks. In the slide below each line represents a single day's unique visitors for a specific TV series CTV offers.

I know the slide is a bit of an eye chart, so I'll summarize the phenomenon Rob explained. In this example a popular network show airs at 7pm on Tuesday. Notice how the purple usage line spikes during the hour of its run. Rob explained that users who go online to find the episode being aired realize it's not yet available and instead begin catching up on previous episodes. That new episode is posted around 2 am, and the spike in usage the following day is shown by the blue line.

Note the far lower behavior in the other lines and it is clear that the 24 hour window during and after airing a new episode is critical. It's also interesting to speculate on whether some users are beginning to look at online availability as pure VOD. If so, that would have implications on DVRs (i.e. why record a show when you've come to expect they'll all be posted quickly online?)

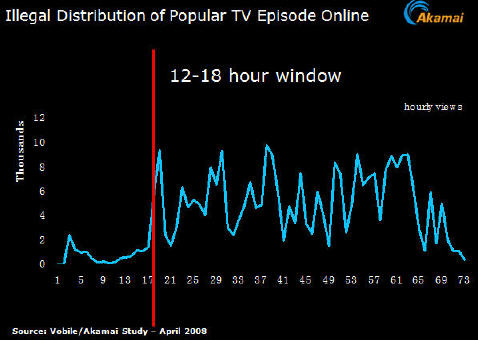

The second attention-getting slide was based on recent research by Akamai and Vobile, which used its digital fingerprinting technology to track the availability of illegal copies of an episode a popular program and their download volume. In the slide below, it is clear that although illegal copies are available immediately, the volume of downloads jumps by more than 500% the following morning (13 hours after broadcast).

What all of this demonstrates is that there is a real window of opportunity for premium video providers to slow video piracy and drive many new video views. By satisfying the obvious demand that users have for this content with legitimate distribution, providers can chip away at, though admittedly not eradicate, illegal sharing. If users gain confidence over time that their favorite programs will be available quickly, in high-quality and with a positive user experience (i.e. not overburdened with ads), the rationale to pursue the illegal route lessens. Conversely, video providers not responding to these viewer needs continue to leave themselves highly vulnerable to illegal behavior.

Categories: Broadcasters, P2P

-

Broadband, Broadcast Converge at NAB

Any question you may have had about whether the broadcast and broadband worlds are converging would be put to rest after spending a couple of days at the NAB Show being held in Las Vegas this week.

This year's NAB Show heavily emphasizes content in a technology-transformed world. For starters, NAB has set up "Content Central" a showcase section in the Main Central Hall featuring a cluster of new media

vendors. Within the Content Central area is a specially created "Content Theater" where back-to-back discussion panels run throughout the show, including one I'll be moderating this morning entitled "Broadband Media Workflow: Hitting the Viewing Window," with executives from MTV, CTV and Akamai.

vendors. Within the Content Central area is a specially created "Content Theater" where back-to-back discussion panels run throughout the show, including one I'll be moderating this morning entitled "Broadband Media Workflow: Hitting the Viewing Window," with executives from MTV, CTV and Akamai.Elsewhere at the show, there are numerous sessions with titles like "The New Hollywood! A New World of Entertainment!", "TV 2.0 - Video When, Where and How You Want It" and "Video Search for Unlimited Channels." In short, NAB has gone full throttle toward content, which in my opinion is a very good thing. That's because a key NAB constituency, local television broadcasters, have seen their market positions impacted by broadband, particularly as network TV programs are now widely accessible online. Broadcasters today are feeling the beginning of what local newspapers have felt as the Internet's use has become pervasive.

But by elevating the focus on content, NAB is helping local TV broadcasters better understand how broadband presents opportunities, not just challenges. With strong expertise in video production, deep local roots and longstanding advertising relationships, local TV broadcasters are in some ways actually well-positioned to benefit from broadband.

The key challenge for local broadcasters is to take a fundamentally different view of their businesses. No longer constrained by their local market's boundaries, local broadcasters can play on a bigger stage, distributing compelling content to viewers living thousands of miles away. One syndication example, between CBS's stations and Yahoo, already generates over 13 million video views per month, all incremental to those at CBS's own site.

NAB's focus on content in a technology-driven world, follows a similar focus by the Consumer Electronics Association and NATPE at their respective shows over the past few months. Taken together, local broadcasters are being given many opportunities to understand the changing video landscape and how to profit from it.

Categories: Broadcasters, Events

-

Video Ad Networks Coverage Continued: SpotXchange, YuMe

As evidence of the market's bullishness on ad-supported video, video-focused ad networks continue to flourish. I recently spoke to CEO/co-founders of two of the larger ones, SpotXchange and YuMe to learn more about their respective differentiators.

SpotXchange CEO Mike Shehan explains that his company has focused on building a real-time auction model for publishers to offer inventory and advertisers/agencies to bid on it. The 2 main verticals

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay.

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay. Though it's a fully self-service model, SpotXchange offers client service model as well for larger brand advertisers. Michael says there are now 300 publishers in the networks, reaching 50 million unique visitors per month. The company grew out of Booyah Networks, a search and interactive agency which has fully-funded its development.

Meanwhile, Jayant Kadambi, CEO of YuMe explains that the company spent the first 2 1/2 years from its

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo).

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo). Jayant says he's been pleasantly surprised at how much video content is monetizable, though he's not suggesting user-generated video will be monetized any time soon. YuMe's CPMs are in the $10-30 range. The company is now in the mode of building scale, which could involve marrying its ad management platform to others' networks using its "Adaptive Campaign Engine." In fact, one recent partnership that was announced to do this was with SpotXchange. YuMe has raised $16M from investors including Khosla Ventures, Accel Partners, BV Capital and DAG Ventures.

I'll have more on other video ad networks and how they fit into the larger broadband industry in the coming weeks.

Categories: Advertising, Technology

Topics: SpotXchange, YuMe

-

News from NAB

The press releases began flying today, timed with NAB's kickoff. Here are a few that caught my eye:

Move Networks Raises $46 Million

Move continues its fund-raising prowess, raising a large C round. As more content providers push the HD quality bar, Move's content delivery services have increased appeal.

Signiant Powers Hulu's Distribution Efforts

Hulu, the NBC-Fox aggregator is using Signiant's media management platform to ingest content from the various content partners it works with.

Widevine Provides Content Security for Microsoft's Silverlight

For the first time Microsoft has used a third-party content security system to add a layer of protection for content providers using the company's new rich media plug-in.

EveryZing Introduced "RAMP," Signs Up Cox Radio

Building on its recent launch of EZSearch and EZSEO to enable video discovery, EveryZing has introduced a management console for the products for which Cox Radio will be the first customer.

Live Streaming Quality Bar Raised Via Mogulus-Kulabyte Partnership

Live streaming gains further traction as Mogulus and Kulabyte announce deal to bring high-quality live Flash streaming to producers.

No doubt there will be plenty more over the next couple of days.

Categories: Aggregators, Broadcasters, CDNs, HD, Mobile Video, Technology

Topics: EveryZing, Hulu, Kulabyte, Microsoft, Mogulus, Move Networks, Signiant, Silverlight, Widevine

-

Insights Aplenty from How-to Video Category

One of the hottest corners of the broadband video market is the ad-supported "how-to" category. How-to lends itself well to video because, if a picture's worth a thousand words, a video is surely worth a million. Recognizing this, there's now a host of start-ups in this category which together have raised tens of millions of dollars. I wrote about some of this a couple months ago.

Several recent calls with industry participants got me to thinking the how-to category actually offers many valuable insights for all broadband industry participants. These fall into 3 key areas: content development, traffic acquisition and monetization.

1. Content: "Build Our Own" or "Offer a Superstore of Others' Videos"?

Players like Expert Village, 5Min, VideoJug and MonkeySee are pursuing the "build our own" video library approach, incenting individual "experts" to contribute to their sites. On the other hand, sites like WonderHowTo (WHT) and SuTree rely primarily on scouring user-generated video sites like YouTube, plus those above to aggregate the best videos available. With how-to being the ultimate "Long Tail" space,

WHT's Stephen Chao told me in a recent briefing that trying to cover the infinite number of niches would be impossible. So to be comprehensive, relevant and high-quality, WHT curates what its crawlers return with a small in-house team and presents the cream of the crop to users, complete with a range of community-building features.

WHT's Stephen Chao told me in a recent briefing that trying to cover the infinite number of niches would be impossible. So to be comprehensive, relevant and high-quality, WHT curates what its crawlers return with a small in-house team and presents the cream of the crop to users, complete with a range of community-building features. Here's one non-statistically significant example that illustrates the two approach's results: I did a search for "bbq steak video" on Expert Village, which bills itself as the "World's Largest How-to Video Site" and on WHT. EV returned 15 results, regrettably not one of which was relevant. WHT returned 357 results, and on the first page of 20 results alone, at least 12 looked relevant. These came from a wide variety of sources. Try doing a few searches and see what you find - my guess is your experience will be consistent with mine.

2. Traffic acquistion: Syndication or SEO?

All of these sites are ad-supported, so traffic is key. The sites with private libraries can syndicate to heavily-trafficked partners. Ordinarily, as a big syndication fan, I'd say that sounds like an advantageous traffic generating plan. But how-to may have a different traffic acquisition dynamic. It may well be that far more traffic will always come to these how-to video sites via searches at Google and other search sites, as compared with the sum of various syndication deals. That's because, absent a household brand-name in how-to, default consumer behavior may well be to simply type their how-to video query into Google.

If that's the case, then it will actually be those sites which have the most highly-optimized pages for all the

niche videos that will gain greater traffic. Though I'm not an SEO expert, it seems to me that, taking my "bbq steak videos" example, WHT, with 357 related videos can optimize better than say EV with 15. And sure enough, when I ran the "bbq steak video" search on Google, right on the first page is a result from WHT, whereas nothing shows up for EV even after 5 pages. Bottom line: more relevant videos = more zero cost, Google-driven traffic.

niche videos that will gain greater traffic. Though I'm not an SEO expert, it seems to me that, taking my "bbq steak videos" example, WHT, with 357 related videos can optimize better than say EV with 15. And sure enough, when I ran the "bbq steak video" search on Google, right on the first page is a result from WHT, whereas nothing shows up for EV even after 5 pages. Bottom line: more relevant videos = more zero cost, Google-driven traffic. 3. Monetization: Video ads or Keyword-driven text/display ads?

Last but not least is monetization. How-to sites have lots of contextual ad potential. In my "bbq steak" example, any company that sells grills, steaks, sauces, etc, would love to advertise to me. It's tempting to believe that those with their own video libraries have more profit potential, because they can sell pre-roll or overlay ads, whereas a superstore site like WHT or SuTree cannot, because they're linking off to the source sites.

But consider this: how many of these potential advertisers will actually have video ads or the budget to create them? Unlike entertainment video, how-to, with its Long Tail character, seems to lend itself more to a low cost keyword ad approach which can be pursued by even the smallest advertiser. So say WHT or SuTree can build traffic in all those video niches and surround the video with keyword-driven text or display ads, all automated through a bidding system. Though yielding lower revenue per ad, my bet is that the total revenue for all ads with the keyword approach would be greater.

Summary

The how-to category is nascent and dynamic. I'm not suggesting for a second that it's a winner-take-all space or that all of the above are strictly "either/or." But I do believe the above analysis raises valuable points all industry participants should consider when developing their content, traffic and monetization strategies.

What do you think? Post a comment now!

Categories: Advertising, Indie Video, Startups, Strategy, Video Search

Topics: 5Min, Expert Village, MonkeySee, SuTree, VideoJug, WonderHowTo, YouTube

-

The Reality of Web Video Advertising Just Doesn't Seem to Add Up

Today's post is from TDG's Mugs Buckley, who discusses the confusing state of video advertising projections.

The Reality of Web Video Advertising Just Doesn't Seem to Add Up

by: Mugs Buckley, Contributing Analyst, The Diffusion Group

I used to think I was pretty good at math, but after trying to make sense of recent forecasts regarding web video advertising, I'm beginning to doubt my skills. Let it be known that I'm a big believer in the growth potential of the Internet video ad business; I'm simply struggling to follow the numbers that have been reported. Since no single analysis offers an "apples-to-apples" industry comparison, I thought I'd offer up some of the available forecasts and offer a few thoughts.

So here's where I'm stuck.

The estimates and forecasts for only video ads are all over the place. For example:

- eMarketer estimates that US marketers spent $775M in 2007 and will spend $1.3B in 2008 for online video streaming and in-page ads.

- Jupiter Research predicts that 2008 online video ads in the US will yield $768M.

- comScore reported that online viewers consumed 9.8B videos in January 2008 (down from December 2007's 10.1B) of which 3.4B were Google/YouTube videos.

- In a November 2007 Financial Times article, a leading media buyer for Starcom Media Group (who is well aware of her buys and rates) predicted that the 2007 market for "The Big Four" broadcast networks was likely to generate around $120M.

So here's where it gets a bit confusing.

- If we use the 3.4B monthly view Google/YouTube view estimate for January and run that out for a 12-month period, add some growth for fun, we come up with about 45B views for all of 2008.

- YouTube charges $15 CPMs for their in-video overlay ads (down from the initial $20 CPMs used during beta testing).

- If 100% of the 45B Google/YouTube videos were sold at $15 CPMs, that would yield revenue of $675M. But that assumes 100% inventory sold, which won't happen for a variety for reasons (in particular because YouTube only sells overly ads on their contracted partner deals, not user-generated content).

- According to Bear Stearns, YouTube is set to generate $22.6M in revenue for video ads, about 3.3% of the possible $675M at 100% inventory sold.

Hmmm. So if YouTube (at 34% of all web video consumed) could generate $22.6M in revenue in 2008, and the Big Four were running about $120M in 2007, how does one arrive at these impressive near-billion dollar predictions? Where else is this revenue coming from?

Let's not rule out operator error - I'll quickly admit that I may have misinterpreted how these numbers were derived and what they represent. That being said, however, there doesn't seem to be a rational way to reconcile these disparate estimates. Can anyone out there help to square these numbers? Is it simply a matter of under- or over-reporting? Are the measurement systems currently in place so poor and mutually exclusive in methodology that they necessarily offer conflicting estimates?

Something just isn't adding up. Yes, this may seem to be a bit nit-picky on my part; the rambling of an analyst with too much time on her hands. Then again, without accurate revenue and usage estimates, it is impossible to know the real value of any form of advertising, much less an emerging model such as web-based video advertising.

Please let us know what you think!

Categories: Advertising

Topics: comScore, eMarketer, Jupiter Research, The Diffusion Group, YouTube

-

Meet Up at NAB Show

Next week I'll be at the NAB Show in Las Vegas on Tues and Wed and still have a few gaps in my schedule if

you're interested in meeting up. I'll be moderating a session on Wed morning at 9:30 in the Content Theater entitled, "Broadband Media Workflow: Hitting the Viewing Window." We have an excellent group of panelists from CTV, MTV and Akamai and we'll be doing a deep dive into the opportunities and challenges of melding on-air and online video. If you're attending NAB Show, give me a shout and let's try to find time to meet up. Separately, I'll also be writing some posts for the NAB Show blog located here.

you're interested in meeting up. I'll be moderating a session on Wed morning at 9:30 in the Content Theater entitled, "Broadband Media Workflow: Hitting the Viewing Window." We have an excellent group of panelists from CTV, MTV and Akamai and we'll be doing a deep dive into the opportunities and challenges of melding on-air and online video. If you're attending NAB Show, give me a shout and let's try to find time to meet up. Separately, I'll also be writing some posts for the NAB Show blog located here. Categories: Events

Topics: NAB Show

-

Why Adobe Media Player Could Matter

Yesterday brought the public release of Adobe Media Player 1.0, first announced almost a year ago. AMP enters a very crowded space of other media players including its own Flash player, plus Windows Media Player, RealPlayer, QuickTime, SilverLight and others.

At a time when the broadband video industry in general and mainstream users in particular crave

standardization and simplicity, can another media player, with a "walled garden" content strategy to boot, add new value? While it's awfully tempting to say "no," I think there are reasons why AMP could well matter, subject to how well Adobe delivers on its vision. Here's why:

standardization and simplicity, can another media player, with a "walled garden" content strategy to boot, add new value? While it's awfully tempting to say "no," I think there are reasons why AMP could well matter, subject to how well Adobe delivers on its vision. Here's why:AMP offers 2 things that, in my opinion, the market still needs. First, a widely used downloadable app that specializes in delivering on FREE video content. Before some of you jump up and say, "Will, what about iTunes?" keep in mind that iTunes offers primarily a PAID video catalog (though to be sure there are some free video podcasts). Second, and related, AMP' provides a download environment in which advertising can be properly inserted, measured and reported on.

These are important because together they open up an entirely new consumer use case for broadband video: offline, free, ad-supported viewing. I've been saying for a while that an odd dichotomy has taken root in the broadband industry, particularly for network programs: users can get either free, ad-supported streamed video at lots of places (provided they're online) OR they can get paid, downloaded video (iTunes model) which allows offline viewing. But this has meant that someone who wants to watch a show offline, but isn't willing to pay for the pleasure of doing so is out of luck (one exception is NBC Direct). Having media stored locally in AMP would allow the offline, free use case I'm describing. This would open up a boatload of premium ad inventory that advertisers savor.

If that's AMP's opportunity, then the question is how well are they executing on it? Though it's never fair to judge a version 1.0 on its first day, my experience with AMP shows there's room for improvement. First is the currently thin content selection that needs to be massively built out to be appealing and competitive. Second is an inconsistent user experience in which some shows are downloadable, yet many are not (e.g. CSI, Hawaii Five-O, Melrose Place). Third are getting the basics right. In my case, when I did download some episodes successfully (blip.tv's "DadLabs" and "Goodnight Burbank") they didn't show up in my download section at all. Ugh. I'm hopeful that Adobe will be able to address all of these.

On the ad side, I think there will be plenty of enthusiasm from ad technology firms to integrate with AMP as Adobe proves it can drive millions of AMP downloads (in fact Kiptronic announced its integration yesterday and other will surely follow). Plus, advertisers should be expected to get on board.

It should be noted however, that even for a mighty brand like Adobe, winning the hearts and minds of users to download and use AMP isn't a trivial undertaking. I have some personal experience with this from my early days consulting at Maven Networks, which offered an eerily similar download app as AMP when the company started up. Though that was in the Mesozoic broadband era of 2003 and Maven was an unknown entity, the company never got much traction with its download app and eventually transitioned over to a streaming model. Since then I've come to believe that premium content must drive the download process, not vice-versa. One successful example of this is ABC.com using its shows to drive millions of downloads of the Move Networks player.

Net, net, AMP is a timely product that could well matter. How well Adobe executes on its vision will determine to what extent it does.

Categories: Advertising, Broadcasters, Downloads, Technology

Topics: ABC, Adobe, Adobe Media Player, Kiptronic, Maven Networks