-

Scripps Networks Dips Into Syndication with AOL Video Deal

Scripps Networks, owner of the powerhouse cable brands HGTV and Food Network plus niche brands DIY, Fine Living and GAC, is joining the syndication fray, today announcing a deal with AOL Video for distribution of clips from at least 25 of its programs. The deal stops short of full program syndication along the lines of last week's Comedy Central-Hulu deal and others, but is still a meaningful step in extending these brands beyond the borders of their respective web sites.

I've been following Scripps Networks for a long while and recently got a briefing from Deanna Brown, who serves as president of the Interactive Group which handles all Internet-related activities at Scripps Networks. Brown joined the company a little over a year ago and is an online veteran, having served as an executive at both Yahoo and AOL previously.

Scripps was one of the early adopters of broadband video, initially seeding its site with program clips from HGTV and Food and more recently creating standalone broadband properties (e.g. HGTV KitchenDesign, HGTV BathDesign, others). Brown explained that Scripps views video as part of the overall user experience, not to be positioned as standalone. Contextualization drives more video consumption and page views. For the most recent 3 months Scripps averaged almost 10 million video views/month, up about 36% from the prior year's period. HGTV was a big part of that, doubling its video views year over year.

I've long thought that broadband is a huge win for Scripps because its lifestyle brands and programs are part information, part entertainment and presented in short segments. This is about as good a fit for online consumption as possible. In fact, over the years when content startups have sought my input, I've often referred to Scripps as an example of content having a highly actionable content model and a "natural base" of advertisers, a model for others to emulate in further product categories.

With Scripps, advertisers reach an audience that is both targeted and action-oriented. Given the massive size of the home and kitchen-related products markets, Scripps is in an enviable position. Yet once again reflecting the early state of the broadband video ad market, Brown explained that they're continuing to test what works in video advertising, particularly mid-rolls and overlays recently. Brown cited monetization flexibility as a key part of Scripps' recent decision to standardize on Maven Networks' platform. Note that in the AOL deal, Scripps will sell ads against its inventory.

Though Brown described herself as partnership-driven, most of Scripps broadband efforts have centered on building out its sites. She explained that they haven't felt pressure to do a lot of deals quickly, instead tending to be methodical about which distributors offer the best ROI potential. A key goal of its distribution deals is to reach younger audiences and video is seen as a way to speak to this audience. A slew of social networking initiatives are underway as well to tap this demo's online behavior.

With Scripps Networks poised to be separated on July 1st from the larger newspaper and broadcast businesses at E.W. Scripps, online will be a critical growth driver. That suggests we can expect plenty more video activity going forward.

Categories: Cable Networks

Topics: DIY, Fine Living, Food Network, GAC, HGTV, Scripps Networks

-

Understanding "Branded Entertainment"

At the OMMA Video Summit yesterday in NYC, I moderated a panel entitled "Branded Entertainment." Readers of VideoNuze know that I have been tracking brand marketers' varied broadband initiatives which are whittling away traditional demarcations between advertising and content. Broadband is opening up a whole new frontier for brands to engage their audiences.

We had a stellar group of panelists who have been on the front lines of branded entertainment, including

three from agencies (Jeremy Lockhorn from Avenue A Razorfish, Joe Frydl from Ogilvy Entertainment and John McCarus from Digitas/The Third Act) and two from independent video sites making a strong push into this area (Rob Barnett from MyDamnChannel and Peter Hoskins from ManiaTV).

three from agencies (Jeremy Lockhorn from Avenue A Razorfish, Joe Frydl from Ogilvy Entertainment and John McCarus from Digitas/The Third Act) and two from independent video sites making a strong push into this area (Rob Barnett from MyDamnChannel and Peter Hoskins from ManiaTV). The whole area of branded entertainment is still in its infancy, meaning different things to different people. The panel's consensus was that these projects must provide "entertaining consumer experiences in which brands receive 'permission' to market their products." Joe, who's produced the Hellmann's "Real Food" campaign (now back for its second season on Yahoo), emphasized the importance of presenting content that's authentic to the brand while also finding partners who can deliver big audiences.

Those partners can vary as John mentioned that in a recent 45 webisode series it created for Holiday Inn Express, 90% of the series' views came from 10% of its overall distribution sites and that these were mainly smaller outlets. That sparked a consensus that when picking distribution partners, those with narrower but more passionate audiences were preferred to larger, but less focused outlets. Peter and Rob both noted that there smaller size and focused audiences allow them work more closely with brands to tailor content for their audiences' interests.

That synched up with advice from Jeremy (and seconded by others) that when it comes to branded entertainment, brands must be involved from the start of the creative process. Content companies still tend to look upon brands as little more than checkbooks, with products to be written into scenes after the creative is essentially complete. That bias needs to change fast if branded entertainment is to succeed. To increase the odds of success, Peter noted that ManiaTV focuses on episodic content, as consumer relationships build slowly over time.

The role of agencies is certain to change as branded entertainment gets more traction. Since it's still so early, panelists concurred that agencies need to "embrace ambiguity" and focus on "earning attention, not buying attention" for their clients. Listening to the panelists, it seemed to me that agencies looking to operate successfully in this area will also need significant business development/partnership skills as pulling distribution into these campaigns is quite important.

Branded entertainment is yet another greenfield opportunity that broadband is opening up. Given how many agencies and others are setting up branded entertainment specialty units, it's certain to get more priority by brands.

Categories: Brand Marketing, Events

Topics: Avenue A Razorfish, Digitas, ManiaTV, MyDamnChannel, Ogily Entertainment, OMMA Video Summit, The Third Act

-

Overview of New Brightcove 3 Beta Release

Today Brightcove is announcing the beta version of its Brightcove 3 platform. Last week CEO/Founder

Jeremy Allaire briefed me on what he called a "pretty dramatic new version of the platform." There are three new areas:

Jeremy Allaire briefed me on what he called a "pretty dramatic new version of the platform." There are three new areas:1. Contextualization - Brightcove is changing how its customers display their video from the current standalone video player/index environment to one where the player window is embedded within in an HTML page with surrounding contextual content and ads. In tests it has done, Brightcove has found that, no surprise, integrating the video window results in more video and page views. Also by surfacing video in context, it enhances search engine optimization. This is similar to EveryZing's SEO-focused approach. (see my profile). Brightcove has new APIs that work with existing content management systems to match relevant non-video content.

2. Dynamic delivery - Brightcove is upping its emphasis on high-quality long-form content by introducing a dynamic delivery feature that modulates the quality of the video delivered based on detection of the user's bandwidth. This adaptive bit rate streaming idea was pioneered by Move Networks and allows on-the-fly video file delivery adjustments. Brightcove is doing this on top of Flash with no new plug-in required by users. It will also automatically generate various encoded files for customers.

3. Producer tools overhaul - Brightcove is updating the back-end work flow tools that its customers' producers use, so they can more quickly do things like upload large video files, create tags, generate business rules, transcode files and so forth. Jeremy demo'd it for me; it's a complete drag and drop environment that looked pretty straightforward.

All-in-all these look like positive steps. Since Brightcove had invested heavily in its earlier versions, I give them credit for emphasizing continuous improvement and not sitting still. Brightcove 3 is in beta (Showtime is one site that's already using it) with wider deployment in the fall. Jeremy added that other updates are expected then too. I pried out of him that these will include monetization and distribution/syndication among others.

Categories: Technology

Topics: Brightcove, EveryZing, Move Networks, Showtime

-

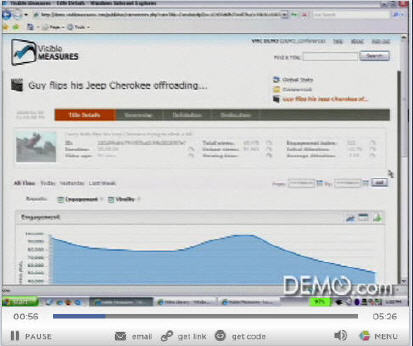

Visible Measures: Ultimate Broadband Video Measurement

If you've ever hungered for insight about a specific video's performance beyond just how many views it has received, Visible Measures is a company after your heart. An independent firm that measures the reach and engagement of broadband video across the Internet, VM heralds an era of ultimate insight into how each and every video performs when it enters the Internet's fast-moving current.

By integrating its code with the video player, VM collects data on session length, drop-out points, rewind activity, click-throughs, viral distribution, geographic usage and other metrics. Think of VM as "big brother-esque" (in a positive way) in tracking a video's "true reach" as VM puts it, supplying a dizzying array of data to content providers and advertisers. The data is presented in intuitive, graphical formats that analysts can parse and sort to understand the video's ROI and what can be done to improve performance next time around. The company is already tracking over 80 million videos in its database.

I recently spent time with Matt Cutler, VM's VP of Marketing and Analytics who gave me a demo of the system and how it's being brought to market. VM is targeting established and early stage media companies, advertisers and ad agencies, all of whom have a critical stake in developing business cases for video deployments and ad campaigns. VM's tracking capabilities are especially meaningful given how pervasive the "syndicated video economy" is becoming.

None of this is to suggest that VM's data will replace programmers' and advertisers' creative instincts, but it would surely provide some real world augments to help offset the inherent guesswork involved in the creative process. (for more specifics about how VM works, see the below video from DEMO '08)

For advertisers specifically, today VM is announcing both its "VisibleCampaign" solution to measure ad campaigns' performance and also a collaboration with Dynamic Logic to track how these campaigns affect a brand's perception. Both initiatives are important in helping advertisers and agencies gain more insight about the broadband video medium and why it's important to invest. As someone who has expressed concern that the broadband ad business needs to mature quickly to support the myriad startup and established media companies relying on it, VM's will surely help decision-makers across the board gain comfort in shifting over more of their budgets.

VM is a perfect example of innovation needed to help optimize a new medium as it takes root. The company has raised $19 million through three rounds and is based in Boston. Based on what I've seen I'm quite enthusiastic about its odds of success.

Categories: Advertising, Startups, Technology

Topics: Dynamic Logic, Visible Measures

-

Hulu Out-Executing Comcast in On-Demand Programming?

The crew over at Hulu must be gleefully fist-bumping each other this week as Hulu scored a key strategic and public relations coup in adding to its lineup two of Comedy Central's most popular programs, "The Daily Show with Jon Stewart" and "The Colbert Report." Though officially positioned as a test, Hulu still deserves big-time kudos as the deal is an endorsement of its value proposition.

The deal and Hulu's execution illustrate a larger point that I've been making for a while: one of broadband's three key disruptions is that it enables new aggregators to gain an edge on larger incumbents by changing the dynamics of competition. To be more specific, in this case, I think that Hulu has out-executed Comcast, America's #1 cable operator by delivering new value to consumers and gaining important PR momentum. Here's why:

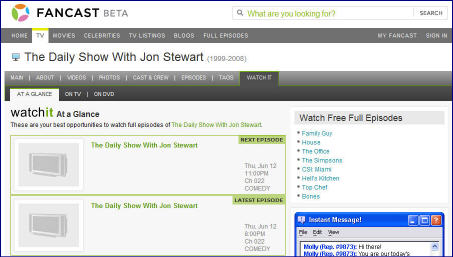

Fancast, which is Comcast's online portal (in beta), actually announced a deal with Comedy Central back on May 19th for access to these same programs and others. Yet go to Fancast and search for "Daily Show" and, as shown below, you won't find any Daily Show full episodes available, just an assortment of short clips and times when it's on TV. A Comcast spokesperson told me that Comcast's implementation is imminent, but its delay in getting the programs up and running is accentuated when you consider that Comedy Central must have done its distribution deal with Fancast BEFORE its deal with Hulu.

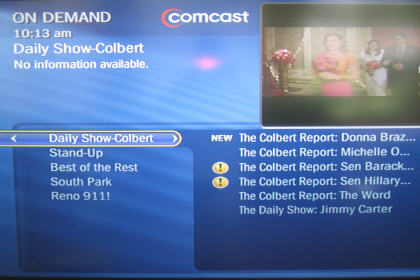

Second, and more concerning is that, as a Comcast digital subscriber, when I tried to find The Daily Show and Colbert in Comcast's VOD menu, all that is available are five older Colbert clips and 1 older Daily Show clip. My guess is these haven't been updated in a while. No full-length Daily Show or Colbert programs are available at all in VOD.

While the Comcast spokesperson told me that the company works closely with its programming partners like Viacom to figure out the optimal mix of programming to make available on VOD, I think an unavoidable conclusion here is that Comcast (and other cable operators) is constrained by its inability to monetize VOD programming with advertising (what this week's "Project Canoe" is meant to address) and to easily add new programming on the VOD menu. These programming gaps create opportunities for upstarts like Hulu to capitalize on.

It may be unfair to zero in so narrowly on Comcast's execution with Daily Show/Colbert, yet things weren't much different when I searched for MTV's popular "The Hills" on Hulu, Fancast and Comcast's VOD. While Hulu doesn't appear to have a deal for full episodes of "The Hills" it masks this cleverly by providing thumbail images and easy navigation back to MTV's site where the video lives, for over 50 episodes (this is tactic Hulu uses for ABC's shows as well). On the other hand, Fancast displays just 5 full episodes, 2 from this season and 3 from last. And on VOD there are also just 5 episodes, though all from this season.

I think it's pretty significant that Hulu, a site that only went live 3 months ago can not only gain access to hit Comedy Central programs like Daily Show/Colbert, but can execute quickly. Hulu is using its advantages - flexible technologies, interactive features (clipping, embedding, sharing), monetization capability, savvy PR and startup pluck to compete with far-larger incumbents like Comcast.

Of course Comcast racks up billions of VOD views each year and has vast resources, making it an important player in on-demand programming. Yet Hulu has managed to make Comcast's advantages look a little less intimidating. I asked the Comcast spokesperson about this. She acknowledged Hulu's progress, but maintained that Comcast believes its mulit-platform approach is stronger.

In the big picture that's true, but when it comes to winning consumers' hearts and minds, it's often execution, not broad strategy that carries the day. And don't forget, when Hulu is unshackled from the PC - with its content freely riding Comcast's broadband pipes all the way to the TV - execution will matter even more.

This week Hulu provided a textbook example of how broadband-only aggregators can gain a foothold against well-established incumbents. Comcast and other incumbents should be taking notice and getting their game on.

What do think? Post a comment and let everyone know!

Categories: Advertising, Aggregators, Cable Networks, Cable TV Operators

Topics: Comcast, Comedy Central, Fancast, Hulu, The Colbert Report, The Daily Show, Viacom

-

More on Heavy's Spinout of Husky Media

Late last week, news broke that Heavy Media, which operates Heavy.com, one of the leading destination sites for men 18-34 was spinning off its Husky Media unit as a standalone ad management and network company. I found the deal intriguing and followed up with David Carson, co-CEO to learn more and see how it plays into larger trends I've been tracking.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.With this context in mind, a key question is "does the world really need another video ad management and network?" David patiently explained that they've received a lot of outside interest in their units, namely the "barn doors" that are shown before the video plays, the subsequent skin that remains on the sides while the video plays, and the playlist-like queuing of video with ads judiciously interspersed (which Heavy calls its Video Guide). Heavy has avoided pre-rolls entirely. This interest spurred them to separate Husky.

David believes that each of these units offers superior value. As compared with pre-rolls, where David said "bounce" or early termination rates can be 50% (resulting in the actual content never being seen), with Husky's approach, there's a 90% completion rate, and particularly when users come through the Husky "Video Guide", the number of videos consumed can be 3-6 times greater. David also said they're seeing click-throughs averaging 1.6%, above industry norms.

So of course the next question is, if these units perform so well, what's to stop others from introducing them as well? In fact, David would encourage this, as he believes it would help educate the market and maybe help establish these as preferred units. As long as Husky continues to get its fair share that would be a win. Husky has patents on the skin, and how it works with various video players.

David said investor meetings are underway and he anticipates the company completing its own financing. Husky will have its own separate management team. Heavy also announced last week a syndication deal for its Burly Sports show to CBSSports.com, and, no surprise, Husky will be the ad platform. To the extent that Heavy can do other syndication deals where Husky gets included, that will help it gain market share.

Clearly there continues to be a huge amount of experimentation in the broadband video ad market. The Husky deal further shows that sometimes developing technology for your a site's own use can, if successful, end up creating larger financial value.

Categories: Advertising, Deals & Financings, Indie Video

Topics: Adap.TV, CBSSports.com, Heavy.com, Husky, Tremor

-

Cable's Sub Fees Matter, A Lot

In my recent post "Revisiting the Long Tail and Broadband" I explained how broadband is the next step in an evolution of video distribution systems and that now, after many years of growth, cable networks' niche, but collective audiences are exceeding those of the broadcasters.

Several readers emailed suggesting I append an important footnote to this analysis: there is a key business model difference between today's fledgling broadband video providers and cable networks. That difference is that cable networks benefit from monthly "sub fees" or "affiliate fees" that all distributors (cable TV and satellite operators, telcos, etc.) must pay to carry cable's programming. These fees are collected in addition to the advertising these networks sell. No such sub fees are available to broadband video providers (or broadcasters for that matter), at least not yet.

Having been in and around the cable industry for 20 years, I fully appreciate that sub fees matter a lot to cable networks. Since the beginning of the cable industry, they have served as a financial firewall for networks. Sub fees now range from pennies per month to over $3 for ESPN. Even on the low-end a "fully distributed" cable network (reaching approximately 80 million+ U.S. homes) reaps millions of sub fee dollars per month. And remember, that money comes in regardless of how well the network's ratings were that month. (btw, for an explanation of the genesis of sub fees, have a look at "Cable Cowboy," Mark Robichaux's biography of TCI's John Malone).

Cable networks' financial security continues to be translated into improved programming quality. Recently, in "Golden Age for TV? Yes, on Cable," the NY Times' David Carr lamented that broadcast TV seems to be on a degenerative slide to offer "all manner of contests and challenges," yet noted that cable is ascendant with Emmy and Oscar-winning talent dotting its innovative new dramas. No surprise to anyone, financial muscle translates into programming quality.

All this helps to explain why, whenever I moderate a panel including cable network executives, they fall all over themselves to declare their allegiance to their current, paying distributors. Cable networks are stepping gingerly into the broadband era, careful not to upset their enviable business model.

Conversely, broadband upstarts have no incumbent customers to consider. While this frees them to strike creative and wide-ranging distribution deals, as best I can tell, they're going to be totally dependent on advertising for a long time to come. This is why I continue urging that broadband video advertising must mature further, and fast.

While broadband upstarts scramble and broadcasters struggle, cable networks will keep chugging along, nicely fueled by their consistent sub fees.

Categories: Broadcasters, Cable Networks, Cable TV Operators, Indie Video

Topics: ESPN

-

SF Chronicle Provides Video Compilation of Clinton Campaign

Last Thursday I remarked on a really professional documentary video that the NY Times produced which offered a retrospective on Hillary Clinton's candidacy. The Times promoted it on page one, which I thought was pretty significant evidence of how newspapers are capitalizing on broadband video's news opportunities.

I just noticed another great example of a newspaper's involvement with video. Check out what the SF Chronicle posted on its SFGate.com site last Friday. Rather than producing their own documentary video,

they culled about a dozen videos (mainly from YouTube) that were turning points in the campaign.

they culled about a dozen videos (mainly from YouTube) that were turning points in the campaign. The accompanying article makes great points about how important broadband video is becoming in the political process. It also notes that video's uncontrolled and unscripted nature are important differences that candidates need to understand and embrace. The article is spot on and well-worth a read.

Categories: Newspapers

Topics: San Francisco Chronicle, SFGate