-

Words Matter: Rethinking Messaging for Home Networks

I am pleased to welcome Michael Greeson's second contribution to VideoNuze. Michael is president of The Diffusion Group, a leading analytics and advisory firm helping companies in the connected home and broadband media markets.

Words Matter: Rethinking Messaging for Home Networks

Michael Greeson, President, The Diffusion Group

Since its arrival in the consumer market earlier this decade, the home network has been envisioned as a linchpin for the delivery of all types of IP-based residential services including video, data, entertainment, control, and communications. Despite this lofty vision, however, home network diffusion has fallen far short of expectations. Why has this happened?

For mainstream consumers, the phrase "home network" still spurs comments such as "never heard of them," "sounds too complex for me," or (worst of all) "don't see much value in having one." So how can these perceptions be changed? Here are a few thoughts that, while far short of being exhaustive, are no doubt relevant to this discussion.

(1) Ease-of-use must be a common property of every device and service. We've been talking about plug-and-play forever yet we're light-years away from making it a reality. A "solid-state experience" is essential to mainstream diffusion, meaning that home networks must be as easy to connect and use as yesterday's consumer electronics.

(2) There must be a compelling array of benefits uniquely enabled by home networking such that consumers feel they must have one. In this area, bridging broadband video directly to the TV could be particularly valuable.

(3) Market messages must reject the language of networking - in other words, stop calling it a "home network."

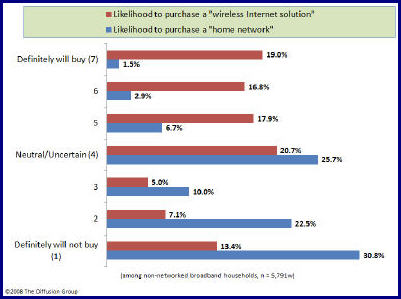

This last aspect is especially important, for regardless of how the technology and cost structures improve, if marketers aren't crafting their messages in language that speaks to consumers, all this innovation is for naught. To give you an example of just how important the issue of messaging is for the future of home networks, consider the following. During a recent national survey we conducted, consumers were informed of what a home network is and does (and in very simple language), then asked how likely they would be to purchase a home network in the next six months. The phrase "home network" was used three separate times in the description. The result? Only 11.1% expressed any degree of interest, with only 4.4% being highly or extremely likely to purchase.

Right after this first question, we asked their interest in purchasing a solution that enabled them to wirelessly connect their desktop and notebooks PCs to the Internet from any room in their home - we didn't use the phrase "home networking" nor did we explain in any detail the virtues of owning a home network. We simply asked about the likelihood that they would purchase a "wireless Internet solution" sometime in the next six months. The results? More than 54% expressed an interest in purchasing, with 36% being highly or extremely likely to purchase. That's a five-fold increase in total interest and an eight-fold increase in high levels of interest - simply by removing the phrase "home network" and focusing on one particular application that we believed to be of primary importance to today's consumer.

Think of it this way: I might have no interest in a home network (assuming I actually know what a "home network" is and does), but I am extremely interested in an inexpensive, easy-to-set/easy-to-use solution that allows me to wirelessly connect to the Internet regardless of where I am in my home. This may be particularly true for mainstream apps like video.

Whether in marketing CE devices or political candidates, sometimes we need to be reminded of just how much words do matter.

Click here to learn more about TDG's new report, "The Future of Home Networks"

Categories: Devices

Topics: Home Networks, TDG

-

New Broadband Video Research Results

One of my continuing goals for VideoNuze is to bring relevant research about broadband video to your attention. Today I'm pleased to share a short interview with Bruce Leichtman, president of Leichtman

Research Group, Inc. regarding a new survey his firm just released to its clients, "Emerging Video Services II." Bruce is a veteran media market researcher who I've known for many years since we were colleagues at Continental Cablevision.

Research Group, Inc. regarding a new survey his firm just released to its clients, "Emerging Video Services II." Bruce is a veteran media market researcher who I've known for many years since we were colleagues at Continental Cablevision. Bruce has generously provided slides from his new survey exclusively at VideoNuze. The download is available here.

Following is an edited transcript of my interview:

VN: Please provide some background on your firm's new study.

BL: This is the second annual Emerging Video Services study that my company has done. The study is focused on non-TV-based services such as broadband video, mobile video and portable video (example iPod). This is one of five annual syndicated studies.

The survey was conducted in December '07 and January '08 with 1,250 people who were surveyed by phone. The reason that's important is that we're trying to reflect the entire population of the U.S. Remember about a quarter of U.S. homes are still not online, so when I'm doing these studies, I'm trying to project to the entire U.S., and so the studies are also pre-weighted to reflect the age and gender makeup of the U.S. population over 18 years of age.

VN: Talk about some of the study's high level conclusions.

BL: Not surprisingly, when compared to last year's study, online video usage is growing. But what's more important is the detail: who's using it, how are they using it, why are they using it? Today there is not across-the-board usage. It's still very weighted to young, 18-34 year-old males. So this has huge implications for players in this market. You need to know who's really using online video so you can better tailor your product to fit that demographic and the ones that may follow.

Another interesting finding is that the growth in the past year was in fact among the young. So online video's use is continuing to penetrate this demographic more and more deeply.

Yet another is that online video is really a medium unto itself, and consumers don't see it as a replacement for traditional TV, but rather for what it can do uniquely as a new medium. So it's important that companies not see online video as just a replication of TV.

VN: What are the implications of the growing intensity of broadband video adoption by the young?

BL: For companies targeting this demo the key is how to tailor product appropriately. There's a ton of multi-tasking going on, so younger people don't even necessarily see online video or TV as one OR the other, sometimes it can be both at the same time. They obviously live lives that are different than preceding generations. But given they're just one segment, we shouldn't conclude that everything is going to change in the next 3-5 years.

VN: Can you discuss actual usage time?

BL: Across the whole population, people still spend twice as much time watching TV as being online. However, among young males the gap is being squeezed. I don't want to read too much into this data, but TV watching is beginning to decline a bit in the group. Their use of media is changing, but we don't see that across all age and gender groups. The same is true on an income basis. The traditional gap remains for lower income groups.

As with so many things in consumer adoption, it's more about evolution than revolution. Basically what we're seeing is a market evolving. Increase in the number of broadband subscribers, increase in the content that's out there, and an increase in usage. But it's still just a small percentage compared to TV.

VN: What does the study find regarding session lengths?

BL: Over half of those who consume online video say they do it less than 10 minutes at a time. comScore talks about the average session as 2.8 minutes. Today it's really bite-sized morsels, its news clips, UGC, YouTube, comScore says one-third of all legal video is YouTube.

VN: How about in longer-form?

BL: Certainly there's interest in TV and movies, but the challenge is that in reality consumers have choices. And I always like to say "TV is a good place to watch TV." Given a choice of watching a TV show on TV, that is their choice vs. watching online. So there has to be a compelling reason for them to watch online that's differentiated.

VN: Did the survey offer any insight about consumers' interest in dropping cable subscriptions in favor of broadband-only options?

BL: From a consumer's standpoint it's not either/or. Just 4% say they'd switch to online only. The overwhelming majority of people, 87%, would not consider switching.

VN: Did you ask about what kind of broadband video consumers would like to watch on TV?

BL: We really only asked about YouTube and UGC. Do people want to see it on TV? Generally they said no. Just 13% said yes. So maybe this confirms that online is a better medium for this stuff. Those most interested are young men: 29% of men 18-34 said yes, they want it, with 17% of women in the age bracket saying they want to see it.

VN: Thanks for sharing information about this new study.

Categories:

Topics: Inc., Leichtman Research Group

-

5 Conclusions from Broadband Ad Webcast

Yesterday's Internet TV Advertising Forum/Maven Networks webcast "Pre-Roll vs. Overlay: Consumer Reaction to New Online Video Advertising Formats" yielded a lot of interesting usability information about various broadband video ad formats. For any content provider or aggregator who's relying on advertising as their business model of choice, it's clear that there are some significant opportunities and challenges ahead.

Below is a summary of the 5 key usability conclusions I heard in the webcast along with my take on each:

1. Users hate pre-rolls. Respondents overwhelmingly agreed that video ads are annoying and have developed the same kinds of coping techniques (tuning out, bailing out, etc.) they use to avoid TV ads.

My take: Yes, but unfortunately for users, I don't see pre-rolls going away any time soon. They're easy to execute, fit media buying habits well, are selling strongly especially for high-quality long-form video and best for advertisers seeking a tonic from DVR behaviors, pre-rolls can't be outright skipped by users. Given all this, let's all hope that targeting improves and publishers use them with some discipline, so users don't preemptively turn off to the broadband video medium.

2. Overlay ads' effectiveness is correlated to content fit, not demographics. Testing showed that users welcomed ads for products that were highly related to the content itself, and lost interest the less related the two were. Demos were less important.

My take: This point reinforces the importance of contextual targeting, which of course has worked well on the Internet as a whole. Yet as Bob Kernen at Maven says, a lot of content is "non-endemic" (i.e. doesn't lend itself to specific products or ads), so my guess is that this correlation opportunity is going to be lost for many content providers. Network programs in particular seem non-endemic and therefore will need to rely mainly on demo-based and possibly behavioral targeting.

3. Overlay ads need better execution to work well. Jeff Rosenblum from Questus summarized 8 best practices for executing overlay ads, such as appropriate frequency and duration, user control, calls-to-action, navigation and the like. For anyone looking to run an overlay campaign (and even for those who have), these serve as a great roadmap of do's and don't's.

My take: As always, executing right can make the difference between a campaign's success and failure. If you're planning to run an overlay campaign, I highly suggest you review this checklist against your plans to make sure you haven't overlooked anything.

4. It's difficult to engage an audience. The testing again showed how hard it is to engage online audiences, regardless of approach. Bob laid out a handy engagement hierarchy, Impression, Interaction and Immersion (from least to most engaging). Knowing what level of engagement your campaign aspires to must guide specific tactics and execution.

My take: Getting the consumer's attention and prompting them to act is the ad industry's oldest goal. It's even harder in the broadband sector. People have shorter attention spans than ever, so grabbing them and getting them to do what you hope gets more difficult all the time. Fortunately video offers emotional appeal unlike any text or graphical ad in the Internet world, so broadband offers new engagement techniques previously unavailable.

5. More research needed. While this first round of usability testing from the Internet Ad Forum shed a lot of new light on the broadband ad opportunity, it's clearly just a first step. The Forum has ambitious goals to keep researching and testing, continuously educating the market.

My take: As I mentioned in my remarks at the beginning of the webcast, everyone has a vested interest in solidifying the ad model as soon as possible. The enthusiasm around broadband will soon dry up if participants don't earn an acceptable ROI for their efforts.

Categories: Advertising, Events

Topics: Internet TV Advertising Forum, Maven Networks

-

Horowitz Study: Broadband Video Usage Jumps

At least once a week or so I try to sort through all the research-related press releases I get to see if there was any new information of note. One report that caught my eye was from Horowitz Associates, "Broadband Content and Services 2007." I haven't read the study, but there are some pretty juicy morsels in the release about how pervasive broadband video is becoming.

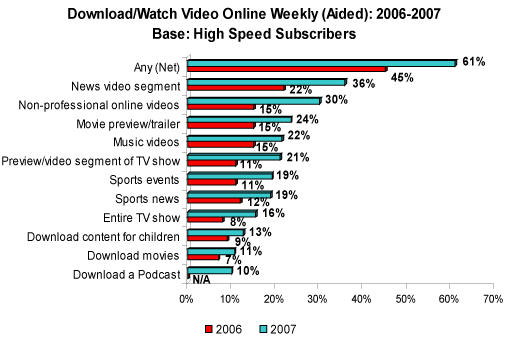

Below is a graph that summarizes some of the key data.

Look at the top line - a whopping 61% of high speed Internet users watch or download broadband video content at least once per week, up from 46% last year. The number jumps to 86% for users who watch at least once per month. These are very impressive numbers and they speak to how significant broadband video has become and how quickly it has gotten there.

Beyond the top line, one can see that every category of video experienced an increase in usage over the past year. Not surprisingly, news leads the way, with 36% usage, but non-professional online videos are not far behind at 30%. YouTube and the like are obviously showing ongoing appeal, even in the face of all the professional video that's come online recently.

Further down the list, how about the fact that 16% of high speed users are now watching an entire TV episode online at least once per week, double what it was a year ago? TV networks have been aggressively promoting their hit programs online, and these efforts seem to be paying off.

One of the conclusions stated in the press release is that "television is still the preferred platform for traditional TV content." I think that makes sense, but dig a little deeper and consider what happens when broadband-accessed programs can easily be viewed on TVs. I continue to say that viewers don't care how the programming gets into their house, as long as it's high-quality, available on their terms and priced correctly. Once broadband-delivered network programs can be viewed on TVs, everyone who has a stake in the status quo (local TV stations, cable & satellite operators, etc.) is going to be facing a very different landscape. See this post for more on that.

Studies like this that chart the continued adoption of broadband video are well worth following. In the past year I've heard industry executives make sweeping statements like "pay TV isn't going away" or "there will always be a place for the networks." This may be true, but as this study shows, day-after-day, week-after-week, month-after-month broadband is chipping away at how all media businesses operate.

Categories:

Topics: Horowitz Associates

-

Survey Says Broadband To Lag TV in 2012. Forget About It.

This piece in today's Hollywood Reporter about a newly-released survey ("Broadband Won't Overtake TV, Execs Say") caught my eye because it continues a highly speculative, and largely irrelevant debate pervasive throughout the industry about future video consumption patterns.

Why's the debate highly speculative? Because truly, none of us has any idea how people will consume video in 2012. There are just too many variables and too many unknowns to make an accurate prediction. Here's a point of comparison: let's say 5 years ago, in 2002, you were asked what percentage of Americans would consume broadband video in a given month? How many (or few!) of us would have predicted a whopping 75%? (the correct answer according to comScore in July '07). Better yet, how many of us would have guessed that over 25% of this consumption would be at just one site (YouTube) - a site that didn't even exist in 2002? Given these examples, who's to predict what 2012 will bring?

And why's the debate largely irrelevant?

Categories: Broadcasters

Topics: blip.TV, comScore, MetaCafe, MySpace, NBC, Veoh, YouTube

-

Survey: Broadband To Lag TV in 2012. Forget It.

This piece in today's Hollywood Reporter about a newly-released survey ("Broadband Won't Overtake TV, Execs Say") caught my eye because it continues a highly speculative, and largely irrelevant debate pervasive throughout the industry about future video consumption patterns.

Why's the debate highly speculative? Because truly, none of us has any idea how people will consume video in 2012. There are just too many variables and too many unknowns to make an accurate prediction. Here's a point of comparison: let's say 5 years ago, in 2002, you were asked what percentage of Americans would consume broadband video in a given month? How many (or few!) of us would have predicted a whopping 75%? (the correct answer according to comScore in July '07). Better yet, how many of us would have guessed that over 25% of this consumption would be at just one site (YouTube) - a site that didn't even exist in 2002? Given these examples, who's to predict what 2012 will bring?

And why's the debate largely irrelevant? Because, in my opinion, it presupposes a continuation of the existing paradigm: an either/or choice of TV consumption OR broadband consumption. Yet these traditional lines of demarcation are already fading. Broadband programming is starting to migrate to networks, as in the recent case of Quarterlife's move from MySpace to NBC, while at the same time network TV programming is increasingly being consumed online. Meanwhile shorter form programming, not bound by traditional advertising pods is on the rise, further confusing industry definitions. Sites like Metacafe, blip.tv, Veoh and others are driving a whole new category of video that could eventually be a more popular format than 30 or 60 minute programs.

These days consumers themselves are driving this "broadband or TV" debate into irrelevance. They're busy accessing programming on demand - whether "broadband" or "TV" - through a host of devices and services whose popularity is only going to skyrocket in the future. These include TiVo, Xbox, Netflix, Amazon Unbox and many others. Yet traditional thinking is still pervasive. For example, just this week, the chairman of the FCC has attempted to enact new regulations governing how cable programming might be unbundled. Fortunately this initiative collapsed, but take heed, market forces will eventually cause cable operators to offer programming as consumers want it, not how tradition dictates.

I think Jim Denney, a TiVo product management VP whom I spoke with yesterday hit the nail on the head. Jim said TiVo's philosophy is to have their users "not worry about where any particular video's coming from, but rather just have all choices easily available." That strikes me as a winning business approach for the turbulent and converging 5 years that lie ahead. In my view, those companies which think about how to deliver value to consumers on their terms, rather than being guided by increasingly artificial distinctions, will be the ones to emerge as the winners in 2012.

Categories: Broadcasters

Topics: blip.TV, comScore, MetaCafe, MySpace, NBC, Veoh, YouTube

-

Broadband Video vs. IPTV, The Differences Do Matter

It's funny how often I'll be talking to someone and they will casually start interchanging the terms "IPTV" and "broadband video/online video/Internet TV".

The fact that many people, including some that are actually well-informed, continue doing so is a reminder of how nascent these delivery platforms still are, and how common terms of use and understandings have yet to be established.

Yet it's important to clarify that there are differences and they do matter. While some of the backend IP transport technology is common between IPTV and broadband video, the front end technology, business models and content approaches are quite different.

In presentations I do, I distinguish that, to me at least, "IPTV" refers to the video rollouts now being pursued by large telcos (AT&T, etc.) here in the U.S. and internationally. These use IPTV-enabled set-top boxes which deliver video as IP packets right to the box, where they are converted to analog video to be visible to the viewer. IPTV set tops have more capabilities and features than traditional MPEG set-tops, and telcos are trying this as a point of differentiation.

However, at a fundamental level, receiving IPTV-based video service is akin to subscribing to traditional cable TV - there are still multi-channel tiers the consumer subscribes to. And IPTV is a closed "walled garden" paradigm - video only gets onto the box if a "carriage" deal has been signed with the service provider (AT&T, etc.). IPTV can be viewed as an evolutionary, next-gen technology upgrade to existing video distribution business models.

On the other hand, broadband video/online video/Internet TV (whatever term you prefer) is more of a revolutionary approach because it is an "open" model, just like the Internet itself. In the broadband world, there's no set-top box "control point" governing what's accessible by consumers. As with the Internet, anyone can post video, define a URL and quickly have video available to anyone with a broadband connection.

The catch is that today, displaying broadband-delivered video on a TV set is not straightforward, because most TVs are not connected to a broadband network. There are many solutions trying to solve this problem such as AppleTV, Microsoft Media Extender, Xbox, Internet-enabled TVs from Sony and others, networked TiVo boxes, etc. Each has its pros and cons, and while I believe eventually watching broadband video on your TV will be easy, that day is still some time off.

Many people ask, "Which approach will win?" My standard reply is there won't be a "winner take all" ending. Some people will always prefer the traditional multichannel subscription approach (IPTV or otherwise), while others will enjoy the flexibility and features broadband's model offers. However, for those in the traditional video world, it's important to recognize that over time broadband is certainly going to encroach on their successful models. Signs of change are all around us, and many content companies are now seizing on broadband as the next great medium.UPDATE: Mark Ellison, who is the SVP of Business Affaris and General Counsel at the NRTC (National Rural Telecommunications Cooperative, an organization which delivers telecom solutions to rural utilities) emailed to clarify that it's not just LARGE telcos that are pursuing IPTV, but many SMALLER ones as well. Point well taken Mark, it was an oversight to suggest that IPTV is solely the province of large telcos like AT&T.Categories: Cable TV Operators, IPTV, Technology, Telcos

Topics: Apple, AppleTV, Media Extender, Microsoft, Sony, TiVo, XBox

-

Akamai Analyst Day Tomorrow

Tomorrow I'll be at Akamai's annual analyst day (disclaimer: Akamai is a VideoNuze sponsor). The morning

speaker line-up includes Paul Sagan, President and CEO, Tom Leighton, Chief Scientist and Co-Founder and Mike Afergan, CTO. I attended last year and found it to be an extremely informative day, especially since Akamai is the leading CDN and has been very focused on the media and entertainment space.

speaker line-up includes Paul Sagan, President and CEO, Tom Leighton, Chief Scientist and Co-Founder and Mike Afergan, CTO. I attended last year and found it to be an extremely informative day, especially since Akamai is the leading CDN and has been very focused on the media and entertainment space.I'll be listening for information on 3 specific areas:

- Update on pricing pressure and what this means for customers?

- How Red Swoosh P2P integration is coming along and are any customers using it yet?

- Any insight on service providers' (cable operators and telcos) motivation to build out their own private CDNs with gear like Cisco's CDS?

I'll try to provide an update before hopping a plane to Dallas to speak about broadband video trends at a large broadcasters' executive offsite.

Categories: CDNs

Topics: Akamai, Cisco, Red Swoosh

-

New iSuppli Report on Broadband TV is Relevant for Apple TV and Others

A new report out by iSuppli, written up in EETimes, caught my attention yesterday. I haven't read the report, but the highlights are that an iSuppli survey showed that "61% of respondents agreed or strongly agreed that they wanted the ability to network the Internet to their televisions, while 71% of male respondents agreed or strongly agreed. How is this relevant to Apple TV?Last December, in my "7 Trends for '07" newsletter, I argued that Apple TV would only succeed if Apple adopted an "open" content model. In fact I suggested that Apple TV's key value proposition would be allowing users to access web-based content easily and quickly. Unfortunately Apple chose the opposite approach and made Apple TV essentially an extender of the closed, "walled-garden" iTunes. More recently it has opened open slightly, incorporating YouTube videos.I continue to believe that Apple TV would rule if the product gave users what the iSuppli report underlines - i.e. a way to see their favorite broadband video right on their TVs. This is a problem begging to be solved. Untangling the UI, hardware and software issues is what Apple excels at. I really hope they see the light on this soon. It would help convert Apple TV from a "hobby" as Steve Jobs recently put it, to a product with real potential. If Apple doesn't do this soon, someone else will.

A new report out by iSuppli, written up in EETimes, caught my attention yesterday. I haven't read the report, but the highlights are that an iSuppli survey showed that "61% of respondents agreed or strongly agreed that they wanted the ability to network the Internet to their televisions, while 71% of male respondents agreed or strongly agreed. How is this relevant to Apple TV?Last December, in my "7 Trends for '07" newsletter, I argued that Apple TV would only succeed if Apple adopted an "open" content model. In fact I suggested that Apple TV's key value proposition would be allowing users to access web-based content easily and quickly. Unfortunately Apple chose the opposite approach and made Apple TV essentially an extender of the closed, "walled-garden" iTunes. More recently it has opened open slightly, incorporating YouTube videos.I continue to believe that Apple TV would rule if the product gave users what the iSuppli report underlines - i.e. a way to see their favorite broadband video right on their TVs. This is a problem begging to be solved. Untangling the UI, hardware and software issues is what Apple excels at. I really hope they see the light on this soon. It would help convert Apple TV from a "hobby" as Steve Jobs recently put it, to a product with real potential. If Apple doesn't do this soon, someone else will.Categories:

Topics: AppleTV, iSuppli, iTunes

-

Forrester’s New Report on Paid Downloads: Right on TV Shows, Wrong on Movies

Forrester released a new report last week entitled, “Paid Video Downloads Give Way To Ad Models”. Since I’ve had some requests to comment on it (and the paid video market as a whole), I’m weighing in here.I was able to read the full report, but if you can’t, then their press release is here. It provides the gist. In short, I think Forrester’s conclusion that “The paid download market is, however, ultimately a dead end” is mostly right regarding TV shows, but completely wrong for movies. Lately broadcast and cable TV networks have ramped up deals with many aggregators to distribute streaming versions of their programs. And with advertisers falling all over themselves to support these, it is certainly likely that the concept of paying to download and own a TV program is heading for a decline.However, when it comes to movies, it’s a different story altogether. First off, at a minimum, today’s $15+ billion/year home video market (DVD sell through only) more than demonstrates that people want to own certain content (i.e. mainly movies). This provides a pretty rich pot of revenues for paid downloads to tap for growth. Paid downloads (or “electronic sell-through” as some call this activity), hold the potential to be a far more efficient and flexible way to get content into the hands of those willing to pay for it. Granted there are some current usability issues (namely broadband-to-TV connectivity) to overcome, but these will certainly be resolved in the near future. Ignoring this dynamic (as Forrester does by neglecting to mention, even once, how it expects home video market to evolve in the digital era) is a significant omission.It leaves me wondering how Forrester thinks this vital revenue stream fits into its conclusions. Piggy-backing on this omission, the report also concludes (absent an explanation that I can find) that “Movie studios whose content only makes up a fraction of today’s paid downloads, will put their weight behind subscription models that imitate premium cable channel services." I think this conclusion is way off base. Studios love home video revenues. For many movies, home video revenues ARE the business model, long since displacing theatrical revenues as the main source of profitability. It’s inconceivable to me that, in the digital age, studios are going to move away from emphasizing a la carte purchases to instead take a share of a 3rd party’s monthly subscription revenues, as Forrester believes.That’s not to say there won’t be a place for subscription services (e.g. Netflix). But studios have rich e-commerce-based business opportunities ahead (fueled by all the merchandising tricks folks like Amazon have mastered in other product categories). These have been limited to date by lack of instantaneous product fulfillment (i.e. broadband-delivered downloads). On the cusp of pursuing these opportunities, to suggest that, instead, studios will forsake them for subscriptions, just doesn’t make sense.Finally, Forrester’s prediction that because “only 9% of online users have ever paid to download a movie or TV show”, there is unlikely to be a mass market for paid downloads, is very tenuous, given that broadband video delivery itself has only burst into the public’s conscious in the last year or two. Scant adoption of any new technology in its early days is a pretty unreliable indicator of future potential. For example, consider how few people owned a cell phone in the early days when they were expensive and brick-like. Now cheap and sleek, they are ubiquitous.Paid downloads are not a “dead end” as Forrester asserts. Rather, they are an early-stage business opportunity evolving from an existing business model -- namely home video. While key catalysts are still needed to fuel paid downloads’ growth, these will inevitably come. Digital strategists at studios who dismiss paid downloads’ potential for movies in particular at this early juncture do so at their peril.Topics: Forrester

-

Bandwidth Issue Looms as Video Usage Rises

This article in today's Boston Globe points out the looming bandwidth issue that cable ISP customers will be facing as usage of video becomes more widespread. Most people don't realize there are "acceptable use" policies in the user agreements we all sign. That's because today the vast majority of us (99%+) don't come anywhere close to crossing the maximum usage line. However, as this story points out, some people are getting snagged. How many more will cross the line as video usage (particularly from P2P services like Joost and BitTorrent) rises in the coming years?

Categories: Broadband ISPs, P2P

Topics: BitTorrent, Joost

Posts for 'Research'

Previous |