-

4 Items Worth Noting for the Nov 2nd Week (Q3 earnings review, Blu-ray streaming, Apple lurks, "Anywhere" coming)

Following are 4 items worth noting for the Nov 2nd week:

1. Media company and service provider earnings underscore improvements in economy - This was earnings week for the bulk of the publicly-traded media companies and video service providers, and the general theme was modest increases in financial performance, due largely to the rebounding economy. The media companies reporting - CBS, News Corp, Time Warner. Discovery, Viacom and the Rainbow division of Cablevision - showed ongoing strength in their cable networks, with broadcast networks improving somewhat from earlier this year. For ad-supported online video sites, plus anyone else that's ad-supported, indications of a healthier ad climate are obviously very important.

Meanwhile the video service providers reporting - Comcast, Cablevision, Time Warner Cable and DirecTV all showed revenue gains, a clear reminder that even in recessionary times, the subscription TV business is quite resilient. Cable operators continued their trend of losing basic subscribers to emerging telco competitors (with evidence that DirecTV might now be as well), though they were able to offset these losses largely through rate increases. Though some people believe "cord-cutting" due to new over-the-top video services is real, this phenomenon hasn't shown up yet in any of the financial results. Nor do I expect it will for some time either, as numerous building blocks still need to fall into place (e.g. better OTT content, mass deployment of convergence devices, ease-of-use, etc.)

2. Blu-ray players could help drive broadband to the TV - Speaking of convergence devices, two articles this week highlighted the role that Blu-ray players are having in bringing broadband video to the living room. The WSJ and Video Business both noted that Blu-ray manufacturers see broadband connectivity as complementary to the disc value proposition, and are moving forward aggressively on integrating this feature. Blu-ray can use all the help it can get. According to statistics I recently pulled from the Digital Entertainment Group, in Q3 '09, DVD players continue to outsell Blu-ray players by an almost 5 to 1 ratio (15 million vs. 3.3 million). Cumulatively there are only 11.2 Blu-ray compatible U.S. homes, vs. 92 million DVD homes.

Still, aggressive price-cutting could change the equation. I recently noticed Best Buy promoting one of its private-label Insignia Blu-ray players, with Netflix Watch Instantly integrated, for just $99. That's a big price drop from even a year ago. Not surprisingly, Netflix's Chief Content Officer Ted Sarandros said "streaming apps are the killer apps for Blu-ray players." Of course, Netflix execs would likely say that streaming apps are also the killer apps for game devices, Internet-connected TVs and every other device it is integrating its Watch Instantly software into. I've been generally pessimistic about Blu-ray's prospects, but price cuts and streaming could finally move the sales needle in a bigger way.

3. Apple lurks, but how long will it stay quiet in video? - The week got off to a bang with a report that Apple is floating a $30/mo subscription idea by TV networks. While I think the price point is far too low for Apple to be able to offer anything close to the comprehensive content lineup current video service providers have, it was another reminder that Apple lurks as a major potential video disruptor. How long will it stay quiet is the key question.

While in my local Apple store yesterday (yes I'm preparing to finally ditch my PC and go Mac), I saw the new 27 inch iMac for the first time. It was a pretty stark reminder that Apple is just a hair's breadth away from making TVs itself. Have you seen this beast yet? It's Hummer-esque as a workstation for all but the creative set, but, stripped of some of its computing power to cost-reduce it, it would be a gorgeous smaller-size TV. Throw in iTunes, a remote, decent content, Apple's vaunted ease-of-use and of course its coolness cachet and the company could fast re-order the subscription TV industry, not to mention the TV OEM industry. The word on the street is that Apple's next big product launch is a "Kindle-killer" tablet/e-reader, so it's unlikely Steve Jobs would steal any of that product's thunder by near-simultaneously introducing a TV. If a TV's coming (and I'm betting it is), it's likely to be 2H '10 at the earliest.

4. Get ready for the "Anywhere" revolution - Yesterday I had the pleasure of listening to Emily Green, president and CEO of tech research firm Yankee Group, deliver a keynote in which she previewed themes and data from her forthcoming book, "Anywhere: How Global Connectivity is Revolutionizing the Way We Do Business." Emily is an old friend, and 15 years ago when she was a Forrester analyst and I was VP of Biz Dev at Continental Cablevision (then the 3rd largest cable operator), she was one of the few people I spoke to who got how important high-speed Internet access was, and how strategic it would become for the cable industry. 40 million U.S. cable broadband homes later (and 70 million overall) amply validates both points.

Emily's new book explores how the world will change when both wired and wireless connectivity are as pervasive as electricity is today. No question the Internet and cell phones have already dramatically changed the world, but Emily makes a very strong case that we ain't seen nothing yet. I couldn't help but think that TV Everywhere is arriving just in time for video service providers whose customers increasingly expect their video anywhere, anytime and on any device. "Anywhere" will be a must-read for anyone trying to make sense of how revolutionary pervasive connectivity is.

Enjoy your weekends!

Categories: Aggregators, Books, Broadcasters, Cable Networks, Cable TV Operators, Devices

Topics: Best Buy, Bl, Cablevision, CBS, Comcast, DirecTV, Netflix, News Corp, Rainbow, Time Warner Cable, Time Warner. Discovery, Viacom

-

VideoNuze Report Podcast #39 - November 6, 2009

Daisy Whitney and I are pleased to present the 39th edition of the VideoNuze Report podcast, for November 6, 2009.

This week Daisy and I first dig into the research I shared about Netflix's Watch Instantly users that I wrote about earlier this week. The research, by One Touch Intelligence and The Praxi Group, indicated that 62% of respondents have used the Watch Instantly streaming feature, with 54% saying they use it to watch at least 1 movie or TV show per month. Daisy and I discuss the significance of these and other data from the research. As a reminder the research is available as a complimentary download from VideoNuze.

Daisy is in NY this week attending Ad:Tech, and she then shares observations from a couple of sessions she's attended. In particular she passes on the advice that Sir Martin Sorrell, head of large agency holding company WPP, about where the advertising business is heading and how he's preparing WPP for the future.

Click here to listen to the podcast (14 minutes, 45 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, Podcasts

-

YouTube As the Ultimate Brand Engagement Platform

Surfing over to YouTube the other day, I was struck by how the site could well become the ultimate brand engagement platform. Below is a screen shot of what I found - nearly all the visible real estate showcased 2 different brand contests encouraging users to submit videos for a chance to win prizes.

The first contest, the "Kodak True Colors: Video Portrait Challenge," was just kicking off, and therefore had prominent positioning. The contest urges users to submit as many 10-second videos as they'd like in pursuit of a grand prize including 2 tickets to a taping of the "Conan O'Brien" show. The other contest, "The Best of Us Challenge," by the International Olympic Committee, shows athletes doing something outside their specialty (e.g. Michael Phelps doing speed putting, Lindsey Jacobellis doing the hula hoop) and asks user to emulate these or create their own challenge. The winner receives a trip for 2 to the 2010 Vancouver winter games. The contest was featured in YouTube's "Spotlight," a section on the home page populated by YouTube's editors based on user ratings.

These types of brand contest are not necessarily new, nor are their inclusion in YouTube. Over a year ago I suggested there was real opportunity in what I called "purpose-driven user-generated video" - the idea that with YouTube turning millions of people into amateur video producers, their enthusiasm and skills could be channeled to specific purposes. The success of campaigns like Doritos' $1 Million Super Bowl challenge has amply demonstrated that great creative and great buzz can be generated from a well-executed UGV campaign.

What YouTube's home page that day demonstrated to me is that as brands continue embracing online video and user participation, the go-to partner will be YouTube. There's simply no better way to reach a broad audience of likely contestants than by making a big splash on YouTube. While YouTube's monetization challenges have become one of the most-talked about industry topics this year, I'd argue there's been insufficient focus on the fact that since May '08, YouTube's share of overall video viewing has stayed right around 40%, at least according to comScore. In that time, YouTube's videos viewed per month have more than doubled, from 4.2 billion, to 10.4 billion in September '09.

Even as sites like Hulu and others have launched and promoted new and innovative sites, YouTube continues to retain its share of the fast-growing online video market. YouTube has also matured considerably, with its Content ID system largely sanitizing the site from pirated video and helping change its perception among copyright owners. (Note that on my recent visit to YouTube I searched in vain for a video of Johnny Damon's double steal in Game 4 and found nothing but "This video is no longer available due to a copyright claim by MLB Advanced Media." In the old days a video like that would have been available all over the site.)

While YouTube has made headway adding premium content partners, a significant part of its appeal remains users uploading and sharing videos. YouTube's combination of massive audience, ubiquitous brand, user interactivity and promotional flexibility make it an ideal partner for brands looking to engage their audiences through video.

Last summer I got plenty of flak for my post, "Does It Actually Matter How Much Money YouTube Loses?" in which I argued that YouTube's long-term strategic value (and Google's financial muscle to support the site's short-term losses) superseded the company's current losses. While I didn't mean to suggest in that post that a company can afford to lose money forever, I was trying to contend that YouTube, the dominant player in a fast-growing and highly disruptive market will eventually find its way to profitability and is well worth Google's continued investment.

YouTube is a rare example of a "winner take all" situation; there is no other video upload and sharing site even on the radar. As video becomes ever more strategic for all kinds of brands, they will increasingly recognize that YouTube is a must-have partner. If Google can't figure out how to make lemonade out of YouTube's lemons, then shame on them. I'm betting, however, that they will.

What do you think? Post a comment now.

Categories: Aggregators, Brand Marketing, UGC

Topics: Doritos, Google, IOC, Kodak, YouTube

-

New Research on Netflix's "Watch Instantly" Shows Surging Usage

Netflix's "Watch Instantly" streaming video usage is surging, according to new research by One Touch Intelligence, in association with The Praxi Group. The firms surveyed a qualified online panel of 1,000 Netflix subscribers in October. I've been eagerly following the Netflix's streaming initiative and this is the first research I've seen which reveals Netflix subscribers' Watch Instantly usage patterns. I'm pleased to offer the top-line results and analysis as a complimentary download.

Click here to download the research

The research confirms that Watch Instantly ("WI") enjoys broad support, with 62% of respondents (extrapolated to approximately 6.9 million of Netflix's 11.1 million subscribers) reporting that they have used WI since it was introduced and 54% (extrapolated to approximately 6 million subs) saying that they use it to watch at least 1 movie or TV show per month. Netflix itself has only disclosed (on its recent Q3 '09 earnings call) that 42% of its subscribers streamed at least 15 minutes of a TV show or movie during the 3rd quarter.

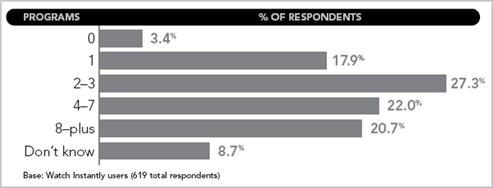

Netflix subscribers also appear to be using WI intensively, watching an average 6 titles per month. The following chart shows the distribution of usage from zero to 8+ titles per month.

WI usage is heavily tilted toward movie watching, with 92% saying they've used WI to stream a movie vs. 55% for a TV show. For each monthly usage level, more movies were watched than TV shows, likely reflecting the fact that movies are the majority of the 17,000 title WI catalog.

Though Netflix has made huge strides in embedding the WI client software in CE devices (e.g. Xbox, Roku, Blu-ray DVD players, PS3, etc.), over 60% of WI viewing still happens on the computer. Coming in second, with 13.4% is computers connected to a TV. Only then do the CE devices start showing up in the research: video game console (11.1%), DVD player (5.7%) and Roku (3.6%). Clearly we're still in the very early days of the "convergence era" where broadband is widely connected to the TV. The research does highlight that the 3.6% Roku figure could be extrapolated to suggest that about 400,000 Roku devices are being used by Netflix subscribers, a relatively strong showing by the company.

Meanwhile, if you thought Netflix WI would be leading to rampant "cord-cutting" of current video services (cable/satellite/telco), think again. Only 2% of the respondents said they've cancelled their incumbent video service, and it should be noted that the question asked if the disconnect was due to Netflix in general, not just WI in particular.

Further encouraging to current video service providers is that 67% of respondents say they prefer to have both a Netflix and a cable/satellite subscription. Asked if they had to give up one, 20% said they'd give up Netflix first vs. 13% who said they'd give up cable/satellite first. None of this is reason for incumbent for relax - especially as WI and other streaming video services are poised to improve - but it does suggest that at least for now, Netflix isn't an either/or proposition for most people.

This is just a quick summary of the findings; there's more available in the report. My view is that Netflix has made enormous progress with WI in a very short period of time. The decision to make it a value add to subscribers, rather than charging for it, has no doubt been key. In fact, TV Everywhere providers have wisely taken a cue from WI by also planning to offer TVE as a value add. Netflix has also made WI extremely easy to use, with only 15% of survey respondents saying it is "too complicated to use regularly." This too is a lesson for others to follow.

With WI offering the prospect of Netflix lowering its massive postage bill, reducing its DVD inventory, and providing greater convenience to its subscribers, we can expect the company to continue investing heavily in WI. The big challenge for Netflix, as I've noted many times before, is beefing up their content selection. With WI the company is running into the thicket of prevailing Hollywood release windows which are not going to dramatically change any time soon. Still, I continue to consider Netflix the best-positioned emerging player in broadband-only premium video delivery. This story is still in its earliest days.

(Thanks to One Touch's Stewart Schley for providing the research)

What do you think? Post a comment now.

Categories: Aggregators

Topics: Netflix, One Touch Intelligence, The Praxi Group

-

More on Comcast's "Excalibur" Project

Last week's piece in Cable Digital News, "Comcast Forges Excalibur for IPTV" generated a number of emails to my inbox. Despite an oddly misleading title using the primarily telco-oriented term "IPTV," the substance of the article caught lots of people's attention. It explained that Comcast, America's largest cable operator, has set up a new division, "Comcast Converged Products" (CCP) and that Comcast "...would put all IP services, including video, into a common provisioning and management system."

VideoNuze readers who contacted me interpreted Excalibur as being the basis for a potential out-of-market, over-the-top (OTT) plan by Comcast. These folks were referencing a post I wrote in September, "How TV Everywhere Could Turn Cable Operators and Telcos Into Over-the-Top's Biggest Players," in which I

asserted that the next phase of TV Everywhere - "TVE 2.0" as I called it - could well find incumbent service providers invading each others' geographical turf with an IP/broadband-only service. While this type of move would represent a major break from traditional industry norms, I suggested that it may be irresistible for growth reasons and inevitable for competitive reasons.

asserted that the next phase of TV Everywhere - "TVE 2.0" as I called it - could well find incumbent service providers invading each others' geographical turf with an IP/broadband-only service. While this type of move would represent a major break from traditional industry norms, I suggested that it may be irresistible for growth reasons and inevitable for competitive reasons. I talked to a Comcast spokesperson yesterday to learn more about Excalibur and to ferret out any indications that it could indeed be the basis for a Comcast OTT play. According to the spokesperson, Excalibur's mission is to "use IP to deliver cross-platform interactive services." The spokesperson noted that it would be a mistake to think of these as solely video-oriented. Comcast already uses IP technology extensively in its network and Excalibur is meant to find ways to "improve the consumer experience across platforms." One example cited was a feature like checking your voicemail from the Comcast.net portal.

When pressed for specifics on CCP deployments, new products or timelines, the spokesperson said there are no specific plans at this time. The spokesperson did confirm that Sam Schwartz (formerly the head of Comcast Interactive Capital) has been appointed president of CCP, but said the "core Excalibur team" is smaller than the 100 people that CDN reported. I referenced my recent OTT post and the spokesperson had no comment on my speculation Comcast would go out of footprint.

Admittedly that doesn't add a lot of new detail about Excalibur. From my perspective, I'm dubious that the company would reassign Schwartz to anything that wasn't highly strategic. While using IP to enhance the customer experience is worthwhile, Comcast has major competitive battles brewing that are critical to focus on. Yesterday's news that Apple is floating a $30 subscription offering is a reminder that the Steve Jobs lion will pounce at some point. Similarly, Netflix, which just reported superb Q3 results, broad usage of its streaming feature, an integration with PS3 (and a rumored one with the Wii) is looking more and more like a national cable competitor, leveraging myriad CE devices. Others to be mindful of include YouTube, Hulu and Amazon. These are of course in addition to fierce satellite and telco rivals.

Given all of this, Comcast's smartest move would in fact be to reassign its savviest tech-oriented executive, given him/her a large team and task him/her with ensuring the company's competitiveness in the face of new entrants. In particular, gaming how to compete with Apple should be near the top of the list. Apple has shown an uncanny ability to reinvent markets with its easy-to-use, ultracool devices. While gaining access to cable programming is far from a slam-dunk, Apple's ability to innovate is unmatched, potentially making it a totally new kind of cable competitor.

Last week, coming out of the CTAM Summit, I expressed concern that the cable industry was not fully recognizing online video as a bona fide new medium, which it needs to embrace and capitalize on. For now Excalibur's real agenda is murky; time will tell how aggressive it is.

What do you think? Post a comment now.

Categories: Cable TV Operators

Topics: Apple, Comcast, Excalibur, Netflix

-

Health-Related Video Vertical Poised for Growth

Last week brought two announcements suggesting that the health-related video vertical market is poised for growth: first, that HealthiNation will be distributing its videos on AT&T U-Verse and HealthGrades, and the second, that HealthCentral is partnering with 5Min to syndicate its videos across 5Min's distribution network.

I've been following HealthiNation for a while and last week CEO and co-founder Raj Amin told me that the AT&T deal brings to about 28 million the number of American homes where HealthiNation's content is

available on video-on-demand (VOD). Raj's enthusiasm for VOD distribution helps validate points I made last May in "Made-for-Broadband Video and VOD are Looking Like Peanut Butter and Chocolate," in which I suggested that rather than broadband video and VOD being competitive with each other, they can actually complement each other well.

available on video-on-demand (VOD). Raj's enthusiasm for VOD distribution helps validate points I made last May in "Made-for-Broadband Video and VOD are Looking Like Peanut Butter and Chocolate," in which I suggested that rather than broadband video and VOD being competitive with each other, they can actually complement each other well. In HealthiNation's case, Raj indicated that VOD distribution is particularly important for its sponsors, as they value views in the living room in addition to those on the computer, where most broadband video occurs today. The multiple ways that VOD is promoted by incumbent video providers given HealthiNation's content lots of visibility. The downside Raj noted is that VOD lacks the same interactivity/engagement opportunities as viewing online provides, and that inserting ads is not nearly as easy. The latter means that HealthiNation must manually attach ads to each of its VOD streams. This would be extremely laborious for content providers with hundreds or thousands of titles, but for HealthiNation, which offers dozens of VOD titles at a time, it is manageable. Raj emphasizes that VOD's ability to help surround the consumer with content and sponsor messages is a key differentiator for HealthiNation, and a key reason it has pushed hard into VOD.

HealthiNation's strategy is primarily to syndicate its content rather than be a destination site, and it has over 50 partners in its network now, with potential reach of about 40 million unique visitors/month. HealthiNation insists that its video be played in its player, and that it controls the ad inventory. This is primarily because of its commitments to its sponsors (mainly pharma) to deliver only highly targeted viewers, provide detailed performance metrics and use mostly display ads, not pre-rolls. All of these contribute to HealthiNation offering a differentiated value proposition relative to typical TV ads.

Separate, HealthiNation also announced a partnership last week with HealthGrades, which is the leading provider of ratings information on doctors, hospitals and nursing homes. Overall Raj said that at its peak, HealthiNation is now generating 3 million uniques/month. It has over 300 videos that are 2-3 minutes long (or longer for VOD) and growing. The company has raised $12.5 million in total, and Raj says it will be profitable in 2010.

Meanwhile last week also brought news that HealthCentral, a large online provider of health-related content and operator of a health-related online ad network, is partnering with 5Min, a video syndicator which I wrote

about here. Under the deal HealthCentral's videos will be added to 5Min's existing health library, for syndication to over 350 different sites. HealthCentral will take on exclusive ad sales responsibilities for pharma and OTC clients for 5Min's video focused on health, specific conditions, parenting, pregnancy, fitness and nutrition.

about here. Under the deal HealthCentral's videos will be added to 5Min's existing health library, for syndication to over 350 different sites. HealthCentral will take on exclusive ad sales responsibilities for pharma and OTC clients for 5Min's video focused on health, specific conditions, parenting, pregnancy, fitness and nutrition. The HealthCentral deal is similar to the recent deal 5Min did with Scripps Networks in the food and home & garden categories. In both, 5Min landed a large anchor content partner, to which it then gave exclusive ad sales responsibilities for part of the category. In this way 5Min gains both valuable content and also category-specific advertising expertise. I continue to like how 5Min is building out its model methodically across important content categories.

Even as Washington slogs through health care reform legislation, the health-related online video space is rapidly evolving. More than ever, individuals recognize the need to educate themselves. Video provides a breakthrough way to simply and completely explain complex ideas. As a result I see lots of growth ahead in this vertical.

What do you think? Post a comment now.

Categories: Indie Video, Telcos, Video On Demand

Topics: 5Min, AT&T U-verse TV, HealthCentral, HealthGrades, HealthiNation

-

4 Items Worth Noting for the Oct 26th Week (Counting online video views, Zappos prank videos, 3DTV, 2010 trends)

Following are 4 items worth noting from the Oct 26th week:

1. Online video viewership claims are murky - Props to Jim Louderback, CEO of Revision3, for his opinion piece in AdAge this week, "Where's the Outrage Over Online Video Viewership Claims" in which he cites multiple examples of how content providers' hyperbole and the media's lack of fact-checking/analysis allow all kinds of ridiculous viewership numbers to gain traction as fact. Compounding things is the inconsistent definition of what even constitutes a "view." Jim notes that a fraction-of-a-second play start often can be enough. For advertisers in particular, trying to understand where to place their spending in the emerging online video medium, it is "buyer beware." A great reminder of how immature the online video industry remains.

2. Zappos's "world's fastest nudist" viral video campaign adds to media's gullibility - The NY Times had a great item this week on Zappos's "world's fastest nudist" campaign, a series of humorous videos on YouTube showing a guy named Donnie streaking around the streets of New York with nothing but a fanny pack on.

While the videos are clever, the media that picked them up and ran with them as being real are now looking decidedly dim. CNN's Anderson Cooper surely tops the gullibility list, as he and anchor Erica Hill featured one of the videos (showing Donnie buying a taco at a food stand) on AC 360's nightly "The Shot" feature. Cooper blithely passes on that Donnie "holds over 400 nude speed records..." One suspects Walter Cronkite would have dug in and not have been duped by Zappos. However, I'm hardly one to talk, as I was taken in by the "Megawoosh Waterslide Video" this past summer. The old adage "don't believe everything you read" really needs to be updated to "don't believe everything you watch." Meanwhile, Zappos undoubtedly loves all the free publicity.

3. Enough of HDTV, get ready for 3DTV - Speaking of not believing what you watch, and shifting focus somewhat from online video, I got my first peek at what 3DTV looks like earlier this week. 3D has become a mini-rage recently, with various TV set manufacturers launching 3D-enabled models, looking to drive content creators to jump on the 3D bandwagon. The catch to 3D video is that it's much more expensive to produce because of the need for multiple cameras. That may be OK for movies where the extra cost can be recouped through higher ticket prices, but for regular TV shows it's been a serious obstacle.

However, the approach used by a small NJ-based company named HDLogix, whose demo I saw, introduces a workaround to this issue. Instead of requiring original production to be shot in 3D, the company runs existing video through its algorithms to dynamically generate 3D effects (I saw segments of the movie "300"). That means no additional production expense is incurred by the content creator. Don't ask me any more about how it works, as the technology is way outside my sweet spot. I will say this, it's pretty cool stuff and I could see 3D adding a lot of new value to online video, especially advertising.

4. What to look for in 2010 - One last follow-up to the CTAM Summit panel I moderated on Tuesday. My last question to the panelists was to name 1 thing that the 1,500+ cable industry attendees in the audience should be paying most attention to in 2010. These were their answers:

Paul Bascobert (Chief Marketing Officer, Dow Jones & Company) - e-book readers make huge advances, especially with a new Apple product hitting the market

Matt Bond (EVP, Content Acquisition, Comcast) - the "customer is king" - stay focused on that

Andy Heller (Vice Chairman, Turner Broadcasting System, Inc.) - the advent of 4G mobile networks and adoption of the "mobile Internet"

Jason Kilar (CEO, Hulu) - follow your companies on search.twitter.com to stay in touch with what your customers are saying

David Preschlack (EVP, Disney and ESPN Networks Affiliate U.S. Sales and Marketing) - the number of access points for content providers will continue to explode

Peter Stern (EVP & Chief Strategy Officer, Time Warner Cable) - make every interaction with customers an opportunity to build a positive relationship

Great food for thought.

Enjoy your weekends!

Categories: Brand Marketing, Indie Video, Predictions, Technology, Video Sharing

Topics: CNN, CTAM, HDLogix, Revision3, Zappos

-

VideoNuze Report Podcast #38 - October 30, 2009

Daisy Whitney and I are pleased to present the 38th edition of the VideoNuze Report podcast, for October 30th, 2009.

This week Daisy first shares her observations from the recent iMedia Summit, where Julie Roehm, the former CMO of Wal-Mart shared insights about the factors driving brands to shift their ad spending to digital media. Daisy also highlights reasons Roehm gave for why the shift isn't necessarily happening as quickly as it should.

Then I dig into 2 of my posts from earlier this week, "Seeking Cable's Formula for Success in Broadband Video," part 1 and part 2, which were based on panels I moderated at the CTAM Summit (an annual conference of cable industry marketers) in Denver. On the one hand my sense is that the cable industry is trying to get its arms around consumers' shift to broadband video usage, but on the other, I think it is focusing too much on its existing TV platform and not enough on embracing broadband video as a new medium. Listen in to learn more.

Click here to listen to the podcast (14 minutes, 38 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Cable Networks, Cable TV Operators, Podcasts

Topics: CTAM Summit, iMedia, Podcast