-

WSJ Launches "Digits" Video Series; Continues to Lead Newspapers in Online Video

This week The Wall Street Journal launched a video companion series to its popular "Digits" blog, continuing to prove that online video opens up exciting new opportunities for newspapers. Airing at 1pm each weekday, and thereafter on demand, the series is hosted by MarketWatch's Stacey Delo and showcases others in the Dow Jones family like Walt Mossberg and Kara Swisher. The Digits video series follows last fall's launch of News Hub, a video news series which in January already accounted for 1 million of the WSJ Digital Network's 5.5 million streams.The Journal is right on the mark with its video strategy, and is nicely demonstrating how newspapers can leverage their brands, journalists and advertising relationships into online video. There's nothing fancy about any of this video as the Journal is using cost-effective technologies like Skype and personal video cameras, plus a simple, yet functional set in its newsroom. The Digits video series would not be mistaken for broadcast journalism, but for the web, where real-time original analysis is key, it's well above the quality bar. Obviously the WSJ is a unique property, and it is complimented by other DJ resources. Still, all newspapers should be looking closely at its video strategy and applying its lessons. I've insisted for a long while that online video is anything but a death knell for print publications; the Journal is proving it in spades.

What do you think? Post a comment now (no sign-in required).

Categories: Newspapers

Topics: WSJ

-

VideoNuze Report Podcast #51 - February 26, 2010

Daisy Whitney and I are pleased to present the 51st edition of the VideoNuze Report podcast, for February 26, 2010.

First up this week Daisy discusses the Beet TV online video roundtable in which she participated this week. Beet got a bunch of industry executives together for a discussion moderated by Kara Swisher of AllThingsD. Daisy talks about what she learned and the one-on-one interviews she conducted which will be available soon at the Beet site.

Then we discuss my post from yesterday, "Sezmi is Slick; Marketing It Will Be the Big Challenge," in which I reviewed the opportunities and challenges that Sezmi, the recently-launched next-gen video service provider is facing. Sezmi is now available in the entire LA area, with expansion to other U.S. geographies in store for later this year. I delve into why I think the skeptics are getting ahead of themselves in their downbeat assessments.

Click here to listen to the podcast (14 minutes, 52 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Cable TV Operators, People, Podcasts

-

Sezmi is Slick; Marketing It Will Be the Big Challenge

While in LA this week, I caught up with Phil Wiser, Sezmi's president and co-founder and got another good look at the Sezmi service, which just officially launched in the entire LA market with Best Buy. I've been covering Sezmi for over 3 years, and from a technical and product standpoint, I continue to be impressed with what it has accomplished, especially for a 1.0 launch. Out-of-the box set up is very straightforward and a series of intuitive menus quickly creates a personalized user profile complete with recommended shows based on your interests and selections from linear and on-demand channels.

Sezmi gained my attention early on because unlike other broadband-only devices (e.g. Roku, Vudu, ZillionTV, AppleTV, gaming consoles, etc.), Sezmi's goal has always been to become a full replacement for existing multichannel video programming distributors ("MVPDs"). That "boil the ocean" strategy has

required it to develop its own hybrid broadcast/broadband content delivery system, sign up local broadcasters for access to their bandwidth, ink carriage deals with cable networks and design the user experience from scratch, among other things. Having done much of that work (with a key exception being to still get the remaining cable channels from Disney/ESPN, Fox, Scripps and A&E into the line-up), Sezmi's next challenge is to actually market the service and add subscribers cost-effectively. This could well prove to be Sezmi's biggest challenge.

required it to develop its own hybrid broadcast/broadband content delivery system, sign up local broadcasters for access to their bandwidth, ink carriage deals with cable networks and design the user experience from scratch, among other things. Having done much of that work (with a key exception being to still get the remaining cable channels from Disney/ESPN, Fox, Scripps and A&E into the line-up), Sezmi's next challenge is to actually market the service and add subscribers cost-effectively. This could well prove to be Sezmi's biggest challenge.The market for multichannel video subscriptions has never been more competitive than it is today. Deep-pocketed cable operators, satellite operators and telcos (and in some places 3rd party "overbuilders" like RCN) are beating the hell out of each other in many U.S. geographies. For example, here in the Boston area we're bombarded daily with ads on radio, in newspapers, in direct mail, through door-hangers and other means, to switch providers. While there are a lot of noisy promotional offers, there are plenty of product and technology-based pitches as well - more HD channels, faster broadband speeds, better VOD and so on. The "triple play" bundle of video, voice and data is a significant marketing lever. I don't know what the marketing cost per acquired customer is for Comcast or Verizon these days, but I have no doubt it has never been higher.

This is battleground that Sezmi is now entering after nearly four years of development. Many people are skeptical about Sezmi's odds of success (read TDG president Michael Greeson's well-done piece from last week for a rundown of the issues), at least as Sezmi is currently configured. Some of these concerns are very valid, in particular Sezmi's $299 upfront equipment fee (which is pretty much unique in the industry), its currently incomplete channel lineup (note also that HBO, Showtime and Starz are also not available) and the $20/mo rate which is marginally better than alternatives (but is likely to increase anyway as more channels and especially expensive ones like ESPN are added).

No question, Sezmi faces a steep marketing challenge. Still, I believe there are reasons for optimism. First, as Sezmi has said many times, it is not a box company and Best Buy isn't its only route to market. It plans deals with telco and ISP partners who will not only bundle its pricing but also erase the upfront charge through a rental model. The rental could be very aggressive depending on the partner's goals, opening up more pricing competitiveness for Sezmi. Second, Sezmi's user interface and certain product features are very compelling differentiators. Granted, incumbent MVPDs are not standing still (see Cablevision's "Media Relay" announcement just yesterday), but the fact that Sezmi owns its whole system from end to end gives it more control and flexibility to enhance the product (for example in VOD it is not relying on traditional vendors).

Lastly, and I'll admit this is where things get fuzzy, but I do think there's a segment of existing MVPD customers who hunger for something new, better and lower cost than is currently available. I've made the analogy for Sezmi to what JetBlue has done in the airline industry and I think that still holds. Depending on how distinctive Sezmi's positioning and messaging is, I think it could really resonate with younger, urban, tech-savvy users. One Sezmi feature alone - access to all YouTube videos - is a totally new value proposition. Phil and I quickly searched YouTube yesterday for "Alec Baldwin Hulu Super Bowl Ad" and in seconds there it was. Can any other MVPD offer that today?

There are plenty of reasons to discount Sezmi's chances of success, but I think that's premature thinking, especially given how dynamic the video landscape is today. But even if Sezmi doesn't thread the needle and fully surmount the marketing challenges ahead, the company still has a lot of value in its technology and products. If Vudu fetched a reported $100 million from Wal-Mart, and Sling got $380 million from DISH as announced a couple years ago, then there should be a palatable financial exit in store for Sezmi as well, even with $75 million or so invested to date. Of course its investors and executives are hoping for far more than just a "palatable" final chapter. The real test of what's in store for Sezmi is just now beginning.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, Satellite, Telcos

Topics: Comast, SezMi, Sling, TDG, Verizon, VUDU

-

Why Did Online Video Consumption Spike in 2009?

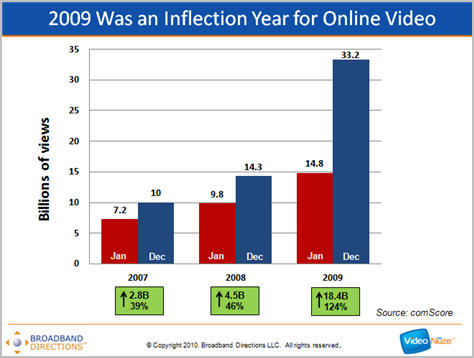

If you want to get a sense of how significant an inflection year 2009 was for online video, have a look at the chart below.

As you can see, according to comScore data, while Jan-Dec growth in 2007 (up 2.8 billion views or 39%) and 2008 (up 4.5 billion views or 46%) were impressive by any standard, the Jan-Dec 2009 growth of 18.4 billion views, up 124%, completely blows them away. Growth was so significant in 2009 that I think years down the road it will be pointed to as the year that online video really turned the corner.

But if that's the case, the question begs, "Why did growth accelerate so much in 2009 vs. prior years?" That's what I've been asked several times by industry colleagues since posting "comScore Data Shows 2009 Was a Blistering Year for Online Video" 2 weeks ago. It's a great question and though I don't have a really precise answer, here's my best sense of what happened.

No surprise, the most important contributor to the year's growth was YouTube. It zoomed from 6.3 billion views in Jan '09 to 13.2 billion in Dec. '09. That increase of 6.9 views accounts for 38% of the 18.4 billion delta between Jan and Dec. So what did YouTube do to generate such significant growth? Part of the reason is surely organic; more people uploading, sharing and viewing YouTube videos. But in 2009 YouTube also made strides in professionalizing the content on YouTube, broadening its value proposition to users. For example, its "Content ID" program, which lets media companies manage and monetize user-uploaded videos, has largely addressed the copyright infringement concerns from past years (the Viacom suit is a notable exception).

In 2009, among other things, YouTube also signed up Disney/ESPN, Univision and others as content partners, began implementing FreeWheel's ad system so 3rd party content providers could better monetize their views, engaged a number of leading brands to use it as a promotional platform, and with "YouTube Direct" engaged news organizations as partners. In short, YouTube continues to immerse itself into the fabric of the Internet. Whether users are viewing videos at its site or through its wildly popular embeds, YouTube has become omnipresent. YouTube now also claims to be the 2nd largest search site.

A second, but distant contributor to 2009's growth was Hulu, which saw its views increase by over 763 million from Jan to Dec, accounting for about 4% of the 18.4 billion increase in total views during that period. Hulu's mindshare leaped following its 2009 "Evil Plot" Super Bowl ad featuring Alec Baldwin and the subsequent ones. No doubt the addition of ABC programs throughout the year, plus other new content partners, also helped generate more viewership, along with the hugely popular SNL clips.

Once you get beyond these top 2 sites, the individual contributions to 2009's growth are more dispersed. The comScore data shows that across all video sites, usage intensified significantly during the year. For example, the number of videos viewed per viewer increased from 101 in Jan to 187 in Dec. The number of minutes watched jumped from 356 in Jan (almost 6 hours) to 762 in Dec (more than 12 1/2). There were also 31 million more U.S. Internet users watching video in Dec vs. Jan (178 million vs 147 million).

Looking beyond the numbers and thinking more qualitatively, it's also fair to conclude than in '09 online video reached a certain level of awareness that made it almost ubiquitous. There is just so much video online, and it is shared so widely, and highlighted so frequently by mainstream media, that it is unavoidable, even for the least technically-savvy among us. People are increasingly entertaining themselves with online video, but they're also finding new uses for it in their daily personal and professional lives.

I think it's unlikely we'll see the same level of growth in 2010 as in 2009, but I do believe the growth curve over the next 5 years will be very steep. The primary contributor will be convergence devices (e.g. game consoles, Blu-ray players, Roku, etc.) that are bridging online video to the TV where longer-form consumption will be the norm. Another key contributor will be TV Everywhere services, which are just now getting off the starting blocks. Lastly, I think growth in mobile consumption will be another important contributor. Add them all up and the 33.2 billion videos viewed in Dec. '09 will look relatively small 5 years from now.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators

Topics: comScore, Hulu, YouTube

-

Wal-Mart's Acquisition of Vudu Makes Little Difference

Yesterday's announcement by retailing giant Wal-Mart that it was acquiring Vudu, the on-demand movie service, generated a flurry of reactions from industry commentators. Some think it gives Wal-Mart the juice it needs to finally be a major digital media player. Others believe that Wal-Mart's miserable record in digital media suggests that the deal will be much ado about nothing. I'm in the latter camp, but not because of Wal-Mart's track record, but rather because of Vudu's own shortcomings.

Vudu's problem is that its value proposition is hamstrung by both the deals the Hollywood studios insist on to give Vudu access to their titles and by the current state of technology. Each of Vudu's 2 movie delivery

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.The rental model is primarily handicapped by the ongoing provision that the rental period "expires" 24 hours after the movie was started. That means that if real life (e.g. a crying child, a call from an old friend, a household emergency) interrupts the Vudu's users' planned viewing window, they're out of luck. It's an absurd restriction, but all online movie rentals are laboring under it. Then there's the provision that most new releases aren't available for rental until 30 days after they debut on DVD. This kind of delay doesn't mean as much for a subscription service like Netflix (which of course just agreed to a new 28-day "DVD sales window" with Warner Bros.), because it has a huge back catalog to offer. But for Vudu (and Redbox) these delays are very noticeable to users.

The download-to-own model is even more challenged. First off, tech-savvy and value-conscious consumers are increasingly focused on cost-effective rentals or subscriptions, not purchasing films. The demise of DVD sales is ample evidence of this. The idea of creating a movie "collection" in a fully on-demand world is already on the verge of seeming as archaic as creating a CD collection has been for a while. And with download-to-own prices of approximately $20, which are more than a DVD costs, consumers will be even more hesitant.

But the real killer for download-to-own is the technology limitations, more specifically the lack of portability and interoperability. Say you're actually inclined to own movies using Vudu. What do you do, download them to an external hard drive? And when you travel, do you lug that thing around with you? When you get to your destination, what device will actually let you play back your movie from your hard drive? The issues go on. The reality is that ubiquitous, cheap DVD players and the compact size of the discs themselves have created a very high bar for digital delivery to exceed. "Digital locker" concepts like DECE and Disney's KeyChest are desperately needed to move digital downloads along, but even they are just a part of a larger CE puzzle.

So, although the Vudu service is very impressive, with a slick user experience and really nice quality video, the reality is that unless Wal-Mart is able to break through these challenges, the Vudu service is going to be marginally attractive to consumers at best. That means the Wal-Mart acquisition, in fact, makes little difference.

Maybe Wal-Mart has the clout to move the studios, but given mighty Apple's own difficulties doing so, I'm skeptical that Wal-Mart will have better luck. I continue to believe that Netflix's model - which combines the full selection of DVDs with the convenience and growing selection of online delivery (including TV shows by the way) - is a far better approach. Netflix may not have all the HD and user interface bells and whistles that Vudu has, but it's a far better value proposition for consumers. This is partly why Netflix has doubled in size, to 12.3 million subscribers, in the last 3 years.

What do you think? Post a comment now (no sign-in required).

Categories: Deals & Financings, FIlms, Studios

Topics: Apple, DECE, Disney, KeyChest, Netflix, VUDU, Wal-Mart

-

Online Video Reaches the College Admissions Process

Settling in over breakfast yesterday with the Sunday Boston Globe (yes, I actually still read my hometown newspaper in print), I was intrigued by a story featured prominently on page 1 , detailing how Tufts University, a highly-selective college in the Boston area, has encouraged freshman applicants to submit one-minute "video essays" of themselves. Of the 15,436 applicants this year, over 1,000, or 6% submitted one.

Talk about a college in synch with the YouTube/Facebook generation. Not only does the idea cater perfectly to what kids today are already doing a lot of online, it provides the admissions office with an unvarnished insight into the kids, talking about what makes them special, in their own unique and creative way.

Video is an emotional medium in ways that text simply is not. That has never been truer than with these

submissions. I looked through all the videos that the Globe added to its gallery (you can also go to YouTube and enter "Tufts admissions" to see more) and they are priceless. There's aspiring engineer Michael Klinker flying a styrofoam elephant he designed (Tufts' mascot is the "Jumbo"), to the music from Disney's "Dumbo." And Amelia Downs, whose interests are math and dance, showing the moves she's invented to simulate different math concepts. Then there's Conor Buckley, pianist and Rubik's cube solver-extraordinaire, pursuing both of his passions on split-screen.

submissions. I looked through all the videos that the Globe added to its gallery (you can also go to YouTube and enter "Tufts admissions" to see more) and they are priceless. There's aspiring engineer Michael Klinker flying a styrofoam elephant he designed (Tufts' mascot is the "Jumbo"), to the music from Disney's "Dumbo." And Amelia Downs, whose interests are math and dance, showing the moves she's invented to simulate different math concepts. Then there's Conor Buckley, pianist and Rubik's cube solver-extraordinaire, pursuing both of his passions on split-screen. The videos are endearing and authentic. Most seem to have been made on a shoestring budget, featuring 17 and 18-year old kids just being themselves, doing what they love. And if you were thinking that the one-minute video idea biases toward wealthier kids, the Tufts director of admissions said that at least 60% of the videos that have been viewed were from kids applying for student aid. With video-ready digital cameras and cell phones, ubiquitous Flip videocameras plus ubiquitous low-end editing software, kids today are more video-capable then any generation in history.

I relate the Tufts admissions videos to Unigo, the Trip Advisor-like site for high school students to check out colleges through videos made by the students themselves, which I wrote about here. Both are perfect examples of what I've called "purpose-driven" user-generated video ("UGV"). What I mean by that is with millions getting comfortable making short videos just for fun and then posting them at YouTube and elsewhere, there's an opportunity to tap this experience, but direct it into specific pursuits. Other UGV examples include the Doritos Super Bowl ads and ExpoTV's "Kitchen Table Conversations" research service. I'm sure there are plenty of others.

I expect many more organizations will leverage purpose-driven UGV going forward.

What do you think? Post a comment now (no sign-in required).

Categories: UGC

Topics: Doritos, ExpoTV, Tufts University, Unigo

-

February Has Been a Red-Hot Month for Online Video Financings

February may be the shortest month of the year, but just less than 3 weeks in, the pace of online video financings has been the hottest since I started tracking this data over a year ago. By my count there have been at least 8 financings announced this month and I suspect I've likely missed a few (please let me know if so). This week brought financings from Clicker ($11M), YuMe ($25M) and TidalTV ($16M), adding to those announced previously: Encoding.com ($1.25M), IVT ($5.5M), Voddler ($3.5M), BrightRoll ($10M) and the big whopper of the month Ustream ($75M) though this one in two tranches.

Even with limited liquidity and choppy public markets, investors continue to make big bets across the online and mobile video ecosystems because of the massive shifts in consumer behaviors, business models and technology development. In 2009 I tracked at least 64 companies raising almost $470 million in the worst venture capital market in decades. Despite investors' enthusiasm, at least 2 big craters (Veoh - $70M and Joost - $45M) prove that even startups with blue-chip teams and promising headstarts can flop in this still nascent market.Update: Make that 9 financings in February, for a total of just under $150 millon, as Vook announced just today that it has raised a $2.5M round.What do you think? Post a comment now (no sign-in required).

Categories: Deals & Financings

Topics: BrightRoll, Clicker, Encoding.com, IVT, TidalTV, Ustream, Voddler, YuMe

-

Synacor Delivers NBC Olympics Video to 14 Cable Operators' 9 Million Subscribers

Overshadowed this week with the launch of HBO Go is that Synacor has been powering access to the

subscriber-only portion of NBC's Olympics video for 14 of its cable operator customers, reaching 9 million subscribers. As Synacor's CEO Ron Frankel told me earlier this week, this is the most extensive TV Everywhere authenticated access instance to date, though it is really just a continuation of the kinds of services Synacor has been offering for years.

subscriber-only portion of NBC's Olympics video for 14 of its cable operator customers, reaching 9 million subscribers. As Synacor's CEO Ron Frankel told me earlier this week, this is the most extensive TV Everywhere authenticated access instance to date, though it is really just a continuation of the kinds of services Synacor has been offering for years. Synacor has flown somewhat below the radar as it has steadily built out its content offerings, with deals with 60 different providers now in place (e.g. MLB, NHL, MTV, etc.). Synacor offers a portal to its customers which provides its cable operator customers with single sign-on access via pre-integrated billing and user ID management. This is the same way that TV Everywhere is intended to work as it rolls out. Given its experience, Synacor looks like it will be a key player in making TV Everywhere happen in 2010.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, Sports

Topics: NBC, Olympics, Synacor