-

Apple Approves SlingPlayer Mobile App with 3G; Milestone for Long-Form Mobile Streaming

One other noteworthy tidbit to come out of Mobile World Congress earlier this week was that Sling Media announced it got final approval from Apple to offer its SlingPlayer Mobile App in the App Store. SlingPlayer had been held up due to network concerns, but 2 weeks ago AT&T announced that it would let the SlingPlayer app stream live over its 3G network.

Though there aren't that many Sling users, and only a subset of them will pay the hefty $29.99 price for the SlingPlayer app, its clearance is a milestone because it truly enables high-quality place-shifting of long-form programming to a mobile device. It also steals some thunder from the FLO TV value proposition and offers a

meaningful precedent to others who might like to stream long-form programs to iPhones and other mobile devices down the road (Netflix? Hulu? Amazon?). It's somewhat of a mystery to me how AT&T's overtaxed 3G network can now support long-form video streaming when complaints are still rampant about call quality. I don't have an iPhone or a Sling box, but if a VideoNuze reader does, and downloads the SlingPlayer app, I would be very interested in hearing about your viewing experience.

meaningful precedent to others who might like to stream long-form programs to iPhones and other mobile devices down the road (Netflix? Hulu? Amazon?). It's somewhat of a mystery to me how AT&T's overtaxed 3G network can now support long-form video streaming when complaints are still rampant about call quality. I don't have an iPhone or a Sling box, but if a VideoNuze reader does, and downloads the SlingPlayer app, I would be very interested in hearing about your viewing experience.What do you think? Post a comment now (no sign-in required).

Categories: Devices, Mobile Video

Topics: Apple, AT&T, iPhone, Sling

-

Demo of Wired Magazine Highlights iPad's Appeal

As I wrote several weeks ago, I'm skeptical of the new Apple iPad because it seems like an expensive gadget that will be hard to find mainstream buyers given its price points. Nonetheless, I thought it was a really slick device, and this week's demo of Wired magazine running on it reinforces my belief. The Wired demo, like an earlier one for Sports Illustrated, shows very tangibly how revolutionary iPad - and other tablet computers - are for print publishers. The way the editorial and advertising comes to life and readers can engage with it is quite compelling.Of course, the question still looms, will people pay $500-$800 for all that iPad coolness? Apple itself appears sensitive to the issue, clearly softening the market for possible price reductions soon after the iPad's release if volumes don't materialize. Going out on a limb a little, I for one believe we'll see an approximately $200 price reduction by holiday season '10, if not sooner. The iPad is too important to Apple and Steve Jobs to be allowed to flounder and the coming release of numerous lower-priced tablets from competitors will only add to the pressure on Apple. If iPad prices fall, it could indeed become a game-changer for Wired and other print publishers.

What do you think? Post a comment now (no sign-in required).

Categories: Devices, Miscellaneous

Topics: Apple, iPad, Sports Illustrated, Wired

-

VideoNuze Report Podcast #50 - February 19, 2010

Daisy Whitney and I are pleased to present the 50th (woohoo!) edition of the VideoNuze Report podcast, for February 19, 2010.

This week Daisy first walks us through a piece she's writing for AdAge focused on viral video. In reviewing data on which videos have broken out online, Daisy concludes that invariably they are also supported by related advertising. In other words, viral video isn't accidental any more (if it ever was) - now it must be stoked by paid support. An example Daisy provides is for Evian's "Live Young" babies ad which has been seen online 76 million times. Evian initially promoted the ad with YouTube takeover ads. Daisy also discusses the online performance of Super Bowl ads based on Visible Measures' new Trends application, which shows a big disparity between ads that were viewed heavily online vs. rated highly when seen on TV.

Then we discuss my post, "In Trying to Preserve DVD Sales, Studios are in a Tight Spot," in which I described the lengths to which Hollywood studios are going to squeeze out the last remaining profits from DVD sales. As I explain, while the recession has had a dampening effect on DVD sales, the larger problem is that rather than buying them, increasingly consumers are expecting films to be available for rental or subscription or even for free, with ad support. A number of moves from Disney, Sony and Warner Bros. in the last week underscore the consequences studios face as they try to shore up DVD sales.

Click here to listen to the podcast (14 minutes, 8 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, FIlms, Studios

Topics: Disney, Podcast, Sony, Visible Measures, Warner Bros.

-

In Trying to Preserve DVD Sales, Studios Are in a Tight Spot

It's not news that DVD sales - the lifeblood of Hollywood studios' P&Ls - are in a freefall. In response, the studios are doing all sorts of things to eke out just a little more profitability from the sales of the shiny discs. But as several news items over the last week underscore, the studios have little wiggle room before their efforts to shore up DVD sales have real or perceived consequences for key business partners.

Exhibit A is the brouhaha over Disney's new plan to release Johnny Depp's "Alice in Wonderland" on DVD 12 1/2 weeks after its theatrical opening, instead of the usual 16 1/2 weeks, regardless of whether it's still playing in theaters. In the past, when a film's "release windows" were distinct and well-separated, everyone in the distribution chain knew they'd have their separate bite of the apple. With collapsing windows, those bites are converging, leaving some feeling they're not going to get their fair share. In the U.S. there has mostly been just grousing about Disney's plan among theater owners, but in Europe there are threats by large theater chains of an all-out boycott of the film.

It's hard not to feel some sympathy for the theater owners as the "Alice" plan isn't a random event. Sony recently ran a misguided promotional campaign giving away "Cloudy with a Chance of Meatballs" DVDs to certain Bravia buyers while the film was still playing in theaters. And it attempted to accelerate the release of the Michael Jackson "This Is It" DVD until theater owners drew the line. No doubt there are plenty of other examples being floated privately in Hollywood.

Meanwhile, news also broke this week that Redbox, the $1 a day rental kiosk chain had acceded to Warner Bros.' demand that it not rent any films until 28 days after their DVD release, in order to help preserve initial sales. As part of the deal Warner dropped its lawsuit against Redbox. In return, Redbox got lower pricing on its Warner DVD purchases. The deal mirrors the 28-day deal Netflix did with Warner last month, which I thought was a win for everyone. But the key difference in that deal vs. Redbox's is that Netflix has a huge rental catalog available for its subscribers to choose from, meaning new releases are far less important (Netflix says only 23% of rental requests are for new releases). On the other hand, Redbox's whole value proposition rests on low prices and selection of new releases. What is Redbox's fate if it does similar deals with other studios?

Putting the squeeze on Redbox and its kiosks seems like a dubious strategy by studios. In an age where piracy looms large, studios should be focused on enhancing, not diminishing the accessibility of their product (as a Coke executive once famously explained the company's marketing goal: "always within an arm's length of desire"). While Hollywood doesn't like Redbox's lower margins, focusing on that issue excessively when the product is clearly in decline is missing the forest for the trees.

Studios' desire to preserve DVD sales is going to further intensify, but defending them is only going to get harder. Certainly part of the reason is that the ongoing recession is forcing many consumers to cut back on their discretionary purchases. But the larger issue is that there's huge momentum behind the shift to online subscription/rental and even free models. The data shows that online viewing hit an inflection point in 2009, with free premium sites like Hulu experiencing extraordinary growth.

And the data showing online's appeal pours in almost daily; yesterday it was The Diffusion Group reporting results of a study of Netflix users showing that two-thirds of them that have a broadband connection are now using the "Watch Instantly" streaming feature. This week's launch of HBO Go, the premium channel's site for its subscribers, and its distribution deal with Verizon, are evidence that even the mighty HBO can't resist online's allure. Last but not least, in 2010 TV Everywhere rollouts will gain steam.

There's no denying the truth that DVD sales are under assault from all sides. Studios, desperate to hold on to DVDs' precious profits, are increasingly contorting themselves to keep the DVD cash cow alive a little longer. No surprise though, their efforts are not without consequences. At what point do the studios capitulate and throw DVD sales under the bus? We'll have to wait and see.

What do you think? Post a comment now (no sign-in required).

Topics: Disney, Netflix, Redbox, Sony, Warner Bros.

-

Panache Unveils "Ad Flow" Tool for Streamlined Fulfillment

Panache has unveiled Ad Flow, a new work flow tool for online video ads intended to streamline the process for publishers adding and approving new video campaigns. I got a short demo of Ad Flow from the Panache team and it looked intuitive and thorough.

According to Panache's EVP Cheryl Kellond, who was formerly a VP of Advertising at Yahoo, ordinarily this process is very manual and is based on home-brewed work flow tools which can result in a lot of emails back

and forth among the publisher's team members. The result is that it can take up to 6 weeks and end up costing 25-40% of the value of the campaign with all the personnel time involved. With these delays, Cheryl said Yahoo sometimes had to turn business away because they couldn't process the ads quickly enough.

and forth among the publisher's team members. The result is that it can take up to 6 weeks and end up costing 25-40% of the value of the campaign with all the personnel time involved. With these delays, Cheryl said Yahoo sometimes had to turn business away because they couldn't process the ads quickly enough.Though I've never personally been involved in this type of process at a major publisher, I have a glimpse into how complicated it must be from my own experience with VideoNuze's ads. First I receive sponsors' creative which was to have been developed according to published specs. Then I load the ads into my ad system and test them along a number of different dimensions. For one reason or another, frequently there are 1-2 rounds of revisions before they finally go live.

Even for a relatively simple site like VideoNuze which accepts Flash ads, though not video ads, there are a number of things that can cause deviations, resulting in delays for the campaign's start date. Mind you I'm not complaining, I've just come to understand that all of this is part of being in an ad-supported business.

With Ad Flow, the publisher's ad sales, ad product strategy, operations and creative teams can all monitor the step-by-step progress of new campaigns from initially being loaded through testing and to final approval. Rather than using email to monitor progress, everyone gets access to the tool for their specific tasks. Importantly, testing can be in the publisher's video player offline, which has been hard in the past. Ad Flow is another element in online video's foundation which will reduce the friction involved in getting ads live so that more TV ad budgets can be shifted to online video.

What do you think? Post a comment now (no sign-in required)

Categories: Advertising, Technology

Topics: Panache

-

New "Trends" Application from Visible Measures is Invaluable - and Addictive

Visible Measures, the third-party measurement firm for online video, is taking the wraps off its new "Trends" web-based application this morning. I've been playing around with it for the last couple of days with a courtesy login and not only does it pack a ton of value, it's also really addictive.

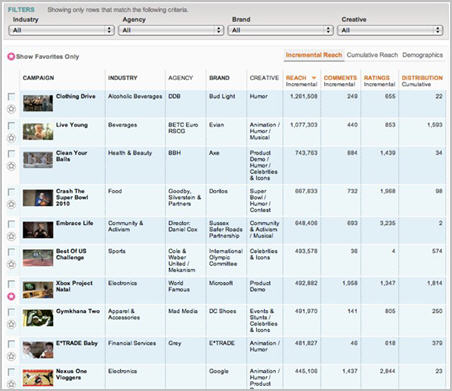

Trends offers access to videos in 3 different data sets, or "collections": Social Video (currently 165 online ad campaigns that have gone viral), Film Trailers (currently 115, and growing by 3-4 per week), and all the recent 2010 Super Bowl ads. The results table for a query displays the campaign's thumbnail image and its name, along with its views or "reach" based on Visible Measures' "True Reach" data (either incremental or cumulative) plus the number of comments, ratings and points of distribution. The table also displays each ad's industry categorization, ad agency, brand name and type of creative type (humor, contest, product demo, etc.). Viewing any particular ad is also just one click away.

Users can take advantage of Trends in any number of ways, depending on their particular interest. As one example, I started by choosing the Social Video collection and "Cumulative Reach" for the current time period. I was interested to see just campaigns for beverages, so I chose that category, but allowed all agencies, brands and creative types to be displayed. In an instant I was presented with a table of 20 results on 2 pages, starting with Evian's hilarious "Live Young" campaign featuring the dancing babies that has garnered almost 74 million views to date. After looking it over, I also reviewed the other campaigns in the top 5, from Pepsi, AMP and Anheuser-Busch. Click on the image below if you'd like to see a 4 minute video demo.

In the social and online video-dominated world we now live in, Trends data is invaluable for brand advertisers and their agencies. It allows them to customize their views of the database, compare different campaigns and analyze what worked online and what didn't. Online distribution is now a key part of calculating the ROI on a campaign, so being able to benchmark the performance of past campaigns provides insight not normally available in traditional TV advertising.

For example, say an agency is formulating a plan for its client's new shampoo - Trends lets its creative executives understand whether prior campaigns featuring product demos, humor or celebrities worked best online. A few quick queries will yield data that can be exported to create charts and graphs for everyone on the team to review. Of course past experience can perfectly predict the future, but Trends provides hard data that lets the creative discussion quickly move beyond gut instinct.

The Visible Measures team told me last week that they've been gradually exposing more and more of their data, through top 10 lists with media partners like AdAge, Variety, Mashable and Motor Trend. With Trends, the data is even more accessible. Visible Measure is also making a public beta of Trends available, though just for the Social Video collection. It's free and it's fun - I recommend giving it a try.

What do you think? Post a comment now (now sign-in required).

Note - Visible Measures is a VideoNuze sponsor.

Categories: Advertising, Analytics, FIlms

Topics: Visible Measures

-

Conviva Addresses Video Quality Problems Impressively

Undoubtedly we've all had the experience at one time or another of watching (or trying to watch) a particular online video, only to have some problem arise that interrupts our experience. To the average user, it's a mystery what might have happened. Is it a problem with my computer? With my personal Internet connection? With my Internet service provider? With the source of the content?

Regardless, it causes user frustration, which can lead to clicking away from the video, possibly never to return. More often than not, the content provider isn't even aware of these user problems. As online video becomes more central to content providers' strategies and P&Ls, inferior user experiences are a growing concern for content providers. And given the vagaries of the Internet and the exploding volume of video being consumed, it's an issue unlikely to go away anytime soon.

That's where Conviva comes in. Conviva gives content providers unprecedented insight into their users' viewing behaviors as well as tools to quickly identify and resolve problems. As Darren Feher, Conviva's new

CEO explained to me when I met up with him recently, and in a subsequent demo, the company's studies show that at least 25% of all streams suffer one problem or another. Affected users watch between 30-80% less video than those who don't have problems.

CEO explained to me when I met up with him recently, and in a subsequent demo, the company's studies show that at least 25% of all streams suffer one problem or another. Affected users watch between 30-80% less video than those who don't have problems.Here's how Conviva works: a small bit of its code is integrated by the content provider alongside the Flash or Silverlight player, whichever is used (in either case no user download involved). Conviva is also integrating with online video platforms (so far just thePlatform, but others to come), so the step is eliminated for the content provider. When deployed, Conviva's code monitors the user's video experience and sends back "heartbeat" reports every 10 seconds to the Conviva console. The console gives the content provider multiple views of their users' experiences, including things like a geographic distribution of current viewing, what player's being used, the average time it's taking to start streaming, the average duration of viewing, the amount of buffering, and so on. Conviva shares the science behind all of this if you're so inclined.

Conviva's secret sauce is mashing up all that in-bound data in real-time and detecting if/where problems exist, and when they do, what the source is. Problems could include buffering on the user's machine, issues with the currently-used CDN, congestion in the local ISP, etc. In addition to these telemetry/analytics services, the company also offers a service it calls "Conviva Distribution" which will seek to remedy problems as they arise based on a set of pre-configured policies. For example, if the user's machine is buffering, Conviva will adjust the stream being sent to a lower bit rate. Or if the CDN being used is the problem, Conviva will switch to another CDN (of the content provider's choosing) in mid-stream, unbeknownst to the user. The content provider gets real-time visibility into what troubleshooting is happening.

In addition to improving the user experience, Darren believes this degree of insight opens up new opportunities for content providers. For example, say there's a higher value set of streams, maybe for a subscription service or a live event. Those streams can be tagged and monitored separately, and have greater resources allocated to them to ensure up-time. Improved visibility into videos that are going viral means their placement on the site and their monetization can be enhanced. Another example is better-informed customer service agents responding to issues specific to a certain set of videos.

Some of what Conviva does is similar to analytics products like Omniture, performance measurement from companies like Keynote and Gomez and some of the reporting CDNs themselves provide to customers. But Conviva seems to bring together user viewing data in a unique and far deeper way than any of these. This week Conviva is helping NBC better understand its Olympics streaming using Silverlight. Conviva also counts Fox, ABC, NFL and others as customers. Conviva started life as Rinera Networks, pursing managed P2P distribution. It has raised $29 million to date from UV Partners, New Enterprise Associates and Foundation Capital.

What do you think? Post a comment now (no sign-in required).

Categories: Analytics, Technology

Topics: Conviva, Flash, NBC, Silverlight

-

Spotlight is on Video as Mobile World Congress Begins

As the biggest annual mobile conference - the Mobile World Congress - gets underway today in Barcelona, new initiatives from some of the biggest names in technology underscore the growing importance of smartphones and of mobile video specifically. Among the most important headlines:

- Microsoft's CEO Steve Ballmer is unveiling Windows Phone 7 which includes Xbox LIVE games, Zune video and audio, plus enhanced sharing. With Phone 7 Microsoft is continuing to vie for position in a crowded smartphone operating system landscape.

- Sony Ericsson is launching "Creations" allowing users to create and publish video, audio and images from their mobile phones in collaboration with professional developers.

- AT&T and 11 other mobile service providers, which together have about 2 billion subscribers, are introducing a new applications store designed to appeal to developers and compete head-on with Apple's App Store.

- Symbian is taking the wraps off its new Symbian 3 open source release, which includes support for HDMI, so that users can connect their Symbian phones to their TVs and watch 1080p video, in effect creating a Blu-ray player in your pocket.

- Intel and Nokia are merging their respective Moblin and Maemo software platforms to create MeeGo, a unified Linux platform to run across multiple devices.

- Adobe is providing an update that by mid-2010, its AIR runtime for building rich applications will be available for Android and that Flash 10.1 will be generally available for various mobile platforms, including Android. In addition, Adobe is announcing that Omniture, which Adobe recently acquired, will add mobile video measurement within its SiteCatalyst product.

While each announcement, plus countless others, have their own significance in the burgeoning mobile ecosystem, the one that's most relevant to mobile video specifically is the coming availability of Flash 10.1, especially for Android. Mobile video has been hampered to date with the lack of Flash player support on iPhones, so its pending launch on Android phones threatens to scramble the relative appeal of these devices for users eager to watch video from sites like Hulu on their smartphones.

Late last week I got a glimpse of how significant Flash on smartphones is from Jeff Whatcott, SVP of Marketing at Brightcove, which today is announcing an optimized version of its platform for Flash 10.1, to be released in the middle of 2010. Adobe has made the beta of Flash 10.1 available to content providers, and Jeff has a video showing how it works with Brightcove for its customers like NYTimes.com and The Weinstein Company.

Brightcove has done 3 things - optimized its template for mobile devices (so navigation and interactivity is seamless on the small screen), enabled auto-detect of mobile devices (so the correct Brightcove template is served) and leveraged cloud-based transcoding (so a mobile-ready H.264 encoded video is streamed). The goal is for Brightcove's customers to be able to deliver an optimized mobile and Flash experience identical to their online experiences, with minimal additional work flow. Brightcove provides the appropriate logic for mobile templates to its customers which they embed in their pages. When a user visits from a mobile device and clicks to watch video, the right Brightcove-powered experience is delivered.

All of the above activity is happening in the shadow of the now-dominant iPhone (and coming release of the iPad) which do not support Flash. As non-iPhone devices - and content providers - progressively incorporate Flash this year, it seems like the smartphone market is poised for another new turn. Flash is the dominant video player and as users look to replicate their online experiences on their smartphones, the void of Flash on iPhones will become even more pronounced. I don't underestimate Steve Jobs or Apple's ability to compete, but this will be one place where it feels like the iPhone will be at a real disadvantage. Apple is keen to prevent Flash from extending its online hegemony to mobile as well, so it will be interesting to see how it chooses to play this.

What do you think? Post a comment now (no sign-in required).

Categories: Mobile Video, Technology

Topics: Adobe, AT&T, Brightcove, Intel, Microsoft, Nokia, Sony Ericsson, Symbian