-

mPoint Becomes Panvidea, Streamlines Video Preparation and Post Production Processes

Yesterday mPoint, which had been a cloud-based video encoding platform, re-launched as Panvidea, with an expanded focus on streamlining video preparation and the post-production process for professional media companies. Panvidea also announced new customers A&E Television Networks, Fox Broadcasting and Getty Images. Chris Cali, CEO and co-founder and Doug Heise, VP of Marketing brought me up to speed and gave me a demo last week.

Yesterday mPoint, which had been a cloud-based video encoding platform, re-launched as Panvidea, with an expanded focus on streamlining video preparation and the post-production process for professional media companies. Panvidea also announced new customers A&E Television Networks, Fox Broadcasting and Getty Images. Chris Cali, CEO and co-founder and Doug Heise, VP of Marketing brought me up to speed and gave me a demo last week. Panvidea has done extensive product development to differentiate it from other on-demand, cloud-based encoding providers. The company is positioning itself as a full-scale alternative to expensive post-production house services or as an augment for customers who have some digital video preparation capabilities in-house but want to limit their additional capital outlays. Panvidea has expanded its offering to include a full suite of ingest, editing, encoding, metadata management, formatting, subtitling, and packaging/distribution to multiple platforms.

Chris explained that cloud-based video preparation services like Panvidea are gaining steam as media companies look to reduce the complexity and cost they are encountering in the broadband era. The proliferation of outlets and formats is making the preparation process more involved than ever.

In particular, Chris said that with Panvidea as an option, companies that are still relying on tape-based work flows can leapfrog the step of building out digital infrastructure and instead move directly to cloud-based services. Chris cited direct response TV companies as one such example. They have extensive needs to update phone #s, switch out offers and modify their distribution, both on-air and online. A number of DRTV companies are now using Panvidea for these work flows, bypassing expensive post-production houses they traditionally used.

Panvidea has also enhanced its system performance and changed its pricing model to emphasize HD quality video. The company is no longer pricing based on gigabytes in and gigabytes out; instead it is simply pricing on the basis of number of hours of video output. That change is important so that customers are not in effect penalized for wanting to do higher bit-rate (and therefore larger file) encoding.

Panvidea is further proof that even as online video consumption expands and complexity grows, the network is getting more robust, allowing traditionally high-end, expensive services to be delivered online. This self-reinforcing loop suggests that the quality and quantity of video moving online is poised for continued rapid growth.

What do you think? Post a comment now (no sign-in required).

-

thePlatform Rolls Out Social Media Features; Video Interviews Available

This morning thePlatform is rolling out its latest Player Development Kit (PDK) which offers its media customers the option of turning on a series of video sharing/social media features for their users. Marty Roberts, thePlatform's VP of Marketing, gave me a demo last week. One of my key reactions is that interest in the PDK by thePlatform's customers shows how much media companies' executives' mindsets have evolved in a very short time.

With the player enhancements, users are able to embed video into ten of the most popular social networks: Facebook, MySpace, Twitter, Digg, Reddit, Stumble Upon, Delicious, Windows Live, Yahoo! Buzz and Vodpod. All are pre-integrated by thePlatform so just a couple of clicks by the user places the video player, complete with its original branding, into these 3rd party sites. All of the advertising logic flows through to wherever the player is distributed, so ads run according to the same rules as they would on the destination site. All of the views are reported in the admin console, including detail on where the videos played.

An additional feature is the ability for users to clip a specific segment out of the underlying video and embed just that segment into these social networks. That means that users no longer have to say to their friends something like "check out the joke approximately 45 seconds into the attached 3 minute clip;" instead they can embed a new segment with just the joke itself. thePlatform has also handily integrated URL shortening, so embedding in Twitter is a snap. It also exposes hash tags in the meta data which are automatically added to the tweet.

Marty explained that thePlatform's customers, recognizing their users' interest in sharing clips, have pushed for these new social features. That's a pretty remarkable evolution in thinking by big media companies, which not that long ago were focused both on driving users only to their own destination sites for online viewing and also on bearing 100% of the promotional responsibility for doing so. By advocating for these new social/sharing features these companies are recognizing that online viewing should happen wherever users decide to hang out (this is the premise of the Syndicated Video Economy I've discussed many times) and that users themselves should be considered a critical ingredient in promoting content.

Gone too appears to be traditional concerns about the environment in which branded video would show up. I can't count how many times over the years I've heard content executives express worry about having their brands and programming end up in semi-pornographic or amateurish user-created sites. I asked Marty about this evolution in thinking and he said that even some of thePlatform's most conservative customers now seem to be over this perceived problem. Looks like Dylan was right, "The times, they are a-changin.'"

Separate, I recently conducted short interviews with a handful of industry executives who attended thePlatform's customer meeting in NYC, and I'm pleased to share them today. Browse below to see several minute-long Q&As with Bill Burke (Global Director, Online Video Products, AP), Ian Blaine (CEO, thePlatform), Channing Dawson (Senior Advisor, Scripps Networks), Kip Compton (GM, Video and Content Platforms, Cisco) and Stephen Baker (Chief Revenue Officer, RAMP). More interviews will be added in the days ahead, so please check back again.

Categories: Technology, Video Sharing

Topics: Delicious, Digg, Facebook, MySpace, Reddit, Stumble Upon, thePlatform, Twitter, Vodpod, Windows Live, Yahoo! Buzz

-

TiVo's New Boxes are Very Cool But Old Challenges Persist

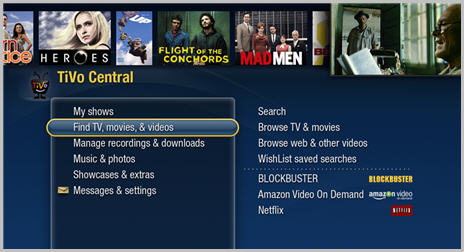

The two new boxes TiVo unveiled last night - the Premiere and the Premiere XL - go right to the top of my list of most impressive devices that handle both broadcast and broadband content in one seamless experience. The new boxes continue TiVo's pattern of always being one step ahead of the competition in delivering an outstanding user experience. All of that is the good news. The bad news is that unfortunately, nothing I learned in my briefing earlier this week with Jim Denney, TiVo's VP of Product Marketing, suggests that these boxes will find their way into any more than the relatively few homes that prior TiVo boxes have.

First the boxes themselves. The key Premiere innovation is that TiVo now elegantly recognizes broadband sources such as Netflix, Amazon, Blockbuster, YouTube and hundreds of others as bona fide content options, right alongside the customary broadcast and cable channels. That means that when you do a search for a specific TV program or movie, TiVo returns all the viewing options. Say for example it's Saturday night and you search for the classic movie "Raising Arizona." It may be on a cable channel the following Tuesday, but you want to watch it now. Well it is also available from Netflix's Watch Instantly. Assuming you've linked your Netflix account to the Premiere, a couple of clicks of the remote and you're watching right then. That type of all-in-one-box convenience isn't available elsewhere.

The TiVo browse and recommendation experience is tremendously improved also with a new "Discovery bar" - a strip of artwork and images from the programming that adds a lot of zip to the previously text-heavy browsing UI. Selecting an image triggers an expansion window with relevant details (program description, air time, cast, etc.) You can then immerse yourself in a "6 degrees of Kevin Bacon" IMDb-like experience by subsequently selecting an actor, subsequent movies, co-stars, etc, all in a rich, graphical interface. You can also select "Bonus Features" and immediately start reviewing accompanying clips from YouTube.

TiVo is also introducing "Collections," a set of curated categories like "Oscar Winning Films," "Sundance Award Winners" and "AFI's 10 Top 10" which, with accompanying artwork that are another quick, fun new way to browse for what's on (again these collections tap all broadcast and broadband sources). The gorgeous user experience is all built on Flash and is formatted for HD widescreen, to maximize the amount of real estate used. Another first for TiVo is a full QWERTY keyboard that slides out of the remote control for enhanced navigation.

That's a lot of new goodness from TiVo, which as expected comes at a price. The Premiere, with 320 GB of storage (enough for 45 hours of HD recording) is $299 and the Premiere XL, with 1 TB of storage is $499. Best Buy is again highlighted as a key marketing partner. Then of course there's the $13.95/mo TiVo service charge.

These are basically consistent with previous prices, suggesting that yet again TiVo will bump up against the brick wall of most consumers' resistance to buying expensive hardware. No matter how cool TiVo's boxes have been over the years, this is TiVo's traditional Achilles heel and it doesn't seem likely to lessen with the Premiere. When I highlighted this issue Jim allowed that the purpose of the standalone box is to be a "crucible of innovation" and that it is intended mainly for "discerning customers" (my interpretation: TiVo itself doesn't plan to sell a ton of Premiere boxes).

To address the sell-through problem, TiVo has worked hard to develop "TiVo-inside" relationships with video service providers, so that it can become more of a software and services company. For instance, I've been getting my TiVo service as part of my Comcast set-top box for a while now. With the Premiere announcements, TiVo said that RCN, a smallish American "overbuilder" and Virgin Media, a significant U.K. operator would include the Premiere features in their new set-top boxes, which is great.

However, no plans were revealed for what Comcast, by far the largest operator with TiVo inside, will do with the Premiere. In fact, one sticking point for Comcast is almost certainly the very access to broadband content that TiVo is trumpeting with the Premiere. My Comcast box frustratingly disables all of the previous "TiVoCast" broadband features I used to enjoy on my Series 2 box as Comcast seeks to maintain its "walled garden" approach. While RCN may be aggressive about providing access to 3rd-party broadband sources, I'm doubtful that Comcast will be given their own extensive TV Everywhere plans. That raises doubts about whether Comcast's TiVo customers will ever see the Premiere's full range of features.

And so all that brings us back to where TiVo always seems to find itself - with market-leading devices that have serious hurdles to widespread consumer adoption. I really hope there's a forthcoming breakthrough this time around for TiVo. Otherwise history will repeat itself yet again and TiVo will continue to be a well-respected, but relatively marginal player in the digital media landscape.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, Devices

Topics: Comcast, RCN, TiVo, Virgin Media

-

Netpulse is Bringing Online Video to a Gym Near You

Now there's really no excuse not to work out.

This morning Netpulse is unveiling an exclusive partnership deal with Town Sports International, operator of 158 fitness clubs in the Northeast, to bring its interactive media platform to 8,000 pieces of cardiovascular equipment. The deal is yet another example of online video's growing pervasiveness. It's also another reminder of how clever entrepreneurs are finding unique new online video applications and business models. Yesterday, Bryan Arp, Netpulse's CEO brought me up to speed on the company and how the TSI deal works.

When the Netpulse platform (which for TSI will be private labeled "Sports Clubs Active Network) is installed, the equipment user logs in and sees a customized view of their content choices. The user can

watch live TV from their personalized line-up, dock their iPhone/iPod/iTouch in a cradle and watch all their iTunes content on a widescreen HD TV, browse among hundreds of music videos, create their own playlists and gain access to tons of online-only video. In addition, the platform will record the key metrics of their exercise session so that when the user goes home he/she can log-in and download their stats for analysis. Bryan likened it to having a set-top box on each piece of equipment.

watch live TV from their personalized line-up, dock their iPhone/iPod/iTouch in a cradle and watch all their iTunes content on a widescreen HD TV, browse among hundreds of music videos, create their own playlists and gain access to tons of online-only video. In addition, the platform will record the key metrics of their exercise session so that when the user goes home he/she can log-in and download their stats for analysis. Bryan likened it to having a set-top box on each piece of equipment.Netpulse is focused on one of the increasingly rare moments left when people are not online or connected to their mobile devices. But that 30-60 minutes spent in a gym is a perfect time to offer users entertainment choices because it's a huge incentive for them to go to the gym in the first place. It's a time to watch that episode of "Lost" that you missed or sample some independent online video program that your friends keep talking about. No doubt TSI recognizes this, and is a key motivation for them to partner with Netpulse. It doesn't take much to imagine how TSI could create an advertising campaign that focuses on how you can be entertained while you work out.

For its part, Netpulse is clever about its approach to getting its platform into the gyms. It has signed deals to be integrated with manufacturers of screens that can be added to existing equipment and also with the manufacturers of the equipment itself. That means that Netpulse can be deployed when the fitness club upgrades existing equipment or when it does full replacements, which are done regularly. With the TSI deal, for example, any new equipment TSI purchases have to include the Netpulse platform.

While Netpulse is focused on license fees for its platform, advertising quickly becomes a really attractive proposition for the club. Bryan estimates that the TSI locations (which are branded NY Sports Club, Boston Sports Club, etc.) alone account for 4 million user sessions per month. That's a critical mass opportunity for any brand selling to people with active lifestyles. Further targeting can be done based on profile information users submit.

Netpulse is additional evidence of how online video is making it possible to offer consumers customized entertainment that fits their lifestyles. It also shows that by putting together an ecosystem of parties, each with their own motivations, everyone can benefit.

What do you think? Post a comment now (no sign-in required).

Categories: Miscellaneous

-

ABC.com is Now Achieving "DVR Economics" for Its Programs

Last week while I was in LA I had a chance to sit down for an extended chat with Albert Cheng, EVP of Digital Media for Disney-ABC Television. Aside from general catch-up, I wanted to dig into a comment I'd heard Albert make at the recent NATPE conference - that full-length programs on ABC.com are now achieving "DVR economics."

The comment caught my attention because, as I've written a number of times, I've been concerned that the broadcast networks' streaming initiatives (and Hulu specifically) could be undermining their traditional business models. The main reason for this is that the ad load in streaming programs is a small fraction vs. what it is in on-air. If all online viewing is incremental to on-air that wouldn't matter. But despite certain research that suggests online doesn't cannibalize on-air, for some viewers who have long since transitioned to time-shifted consumption, it surely does. More importantly, as convergence devices that link broadband to TVs gain penetration, the choice for viewers of how to watch a particular program - via online or via on-air - gets even more pronounced, putting further pressure on on-air.

Albert explained that ABC has been closely following the economics of programs' different viewing methods and recently concluded that it was more appropriate to compare online's economics to DVR's economics

than to on-air's. Their reasoning is that because online is a "catch-up" medium it should be weighed against other comparable opportunities, not against on-air. Importantly, ABC "windows" the online release of its programs by 4-6 hours, so that hard-core fans who have to watch immediately will skew to on-air, rather than waiting. (Of course the question arises - in our increasingly on-demand, time-shifted world, how sizable is the "must-see" audience for all but the most popular programs like "Lost?" But that's a question for another day.)

than to on-air's. Their reasoning is that because online is a "catch-up" medium it should be weighed against other comparable opportunities, not against on-air. Importantly, ABC "windows" the online release of its programs by 4-6 hours, so that hard-core fans who have to watch immediately will skew to on-air, rather than waiting. (Of course the question arises - in our increasingly on-demand, time-shifted world, how sizable is the "must-see" audience for all but the most popular programs like "Lost?" But that's a question for another day.)When looked at this way, ABC believes online delivery compares favorably to DVR. No surprise, Albert would not disclose ABC's revenues or research, but he did give me a wink-and-a-nod when I shared my estimate that the on-air revenue per program per viewer is in the $.50-$.75 range (of course specific programs and specific episodes are above and below this range). To be clear, this only means the revenue generated is in this range. Because of bathroom breaks, channel flipping, viewers chit-chatting, etc. obviously not all of the ads are actually viewed.

Estimating the revenue per program per viewer range for DVR playback, given its attendant ad-skipping, is more complicated. Ad-skipping is surely high, but it's unclear exactly how high. For example, last Nov, the NY Times reported Nielsen research that somewhat remarkably showed that 46% of viewers age 18-49 still watched a program's commercials when in DVR playback mode. A different story is told by TiVo, which released data last Sept saying that for the programs that won the top Emmy awards, somewhere between 55-83% of the audience viewing these programs in DVR mode skipped the ads.

Just to round off, if we say that 60% of the ads in DVR playback are skipped, then DVR economics - and therefore ABC.com's economics - are in the $.20-$.30 range on a per program per viewer basis (i.e. 40% of $.50-$.75). Even on the low side of that range, that's better than my previous estimate of $.15 per program per viewer for Hulu in particular (which in reality was probably a little high anyway).

Further, Albert said that there's plenty of room for improving online's economics. One key focus is increasing the ad load, possibly to as much as double the current 5 ads per program. ABC.com has experimented with this and its research shows that neither the viewer nor the advertiser experience is diminished. As a result, ABC is inclined to increase the ad load to continue improving online economics further, but is somewhat constrained by advertisers' desire to minimize clutter and their own desire to remain consistent with non-ABC sites' ad loads.

Online distribution of full-length programs is still in its relative infancy. Yet as consumers hunger for it, broadcast networks have little choice but to provide it. The key is how to make this new delivery method profitable and also not harmful to the traditional network P&L. The use of windows for example, seems like an effective tactic insofar as there exists an audience intent on watching a program the moment it's shown on-air. Based on last week's conversation with Albert, along with prior ones, it seems like ABC is balancing things well - taking steps to pursue online, but doing so in a well-researched and analytically sound manner.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Broadcasters

-

Cable's Faster Broadband Speeds Make Google's Fiber Project Look Even Sillier

Google's recently-announced fiber-to-the-home experiment (which I estimated could cost the company $750 million or more) looks even sillier in the context of continued announcements by cable operators of faster broadband deployments. As an example, this week brought news that Virgin Media, a large U.K. cable operator, is launching 100 megabit/second service by the end of this year, and also intends to expand its trial of 200 megabits/second service. Virgin's announcements came on top of Shaw Communications (a large Canadian cable operator) news from last week that it would soon test expanding its current 100 megabit/second service to 1 gigabit/second, a 10x increase. And big U.S. cable operators themselves continue deploying "DOCSIS 3.0" equipment to offer ever-faster broadband services.

Google's recently-announced fiber-to-the-home experiment (which I estimated could cost the company $750 million or more) looks even sillier in the context of continued announcements by cable operators of faster broadband deployments. As an example, this week brought news that Virgin Media, a large U.K. cable operator, is launching 100 megabit/second service by the end of this year, and also intends to expand its trial of 200 megabits/second service. Virgin's announcements came on top of Shaw Communications (a large Canadian cable operator) news from last week that it would soon test expanding its current 100 megabit/second service to 1 gigabit/second, a 10x increase. And big U.S. cable operators themselves continue deploying "DOCSIS 3.0" equipment to offer ever-faster broadband services.Google pegged one gigabit as the target for its fiber-to-the-home project, but doesn't the question beg - if cable operators (and telcos) themselves are continuing to improve the speeds of their broadband services to approach 1 gigabit, what is the point of a small, isolated Google experiment? As I pointed out, consumers have benefited from continuous improvements in bandwidth over the years and, even absent net neutrality regulations, enjoy open, unfettered access to all legal content and services. What Google is contributing to the broadband ISP business with its fiber trial remains a complete mystery to me. At some point I have to believe Google shareholders and Wall Street analysts covering the company are going to want more clarity too.

What do you think? Post a comment now (no sign-in required).

Categories: Broadband ISPs, Cable TV Operators, International

Topics: Google, Shaw, Virgin Media

-

Cablevision's "PC to TV Media Relay" Service Could Have Broad Implications

This week brought yet another new twist in the sizzling broadband-to-the-TV convergence space, as Cablevision unveiled a technical trial of its "PC to TV Media Relay" service. Cablevision didn't release a lot of details, but from what it said, it seems that users will download software to their computer which will allow them to then share content to their Cablevision digital set-top box for viewing on TV.

If it works - and of course that's an if for now - Media Relay could have broad implications, first and foremost for those trying to either sell standalone convergence boxes (e.g. Roku, soon Boxee, Apple TV, etc.) and other CE devices trying to leverage convergence functionality (e.g. gaming consoles, Blu-ray players,

Internet TVs). Depending on how Cablevision prices Media Relay, it may make a lot more sense for consumers to use it than to go buy a convergence device. Online content providers and aggregators like Netflix and Hulu would also benefit from seamless TV-based viewing. While TV Everywhere seeks to expand access to cable programming outside the home, Media Relay complements it by offering online content within the home, on the TV. It's a very interesting development and worth keeping an eye on to see if others emulate it.

Internet TVs). Depending on how Cablevision prices Media Relay, it may make a lot more sense for consumers to use it than to go buy a convergence device. Online content providers and aggregators like Netflix and Hulu would also benefit from seamless TV-based viewing. While TV Everywhere seeks to expand access to cable programming outside the home, Media Relay complements it by offering online content within the home, on the TV. It's a very interesting development and worth keeping an eye on to see if others emulate it. What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, Devices

-

U.K. Theaters Will Show "Alice in Wonderland" Ending DVD Early Release Flap

The brinksmanship between Disney and the 3 largest U.K. theater chains over whether they would show Tim

Burton's new "Alice in Wonderland" film is officially done, with all 3 chains now signed on. As I described last week in "In Trying to Preserve DVD Sales, Studios Are in a Tight Spot," in a bid to boost DVD sales, Disney was looking to trim the DVD release of "Alice" to just 12 1/2 weeks after its opening, from the customary 16 1/2. British and other European theaters revolted, angry that the move would diminish their box-office take, a particular hot-button in light of significant investments they've recently made in digital technologies.

Burton's new "Alice in Wonderland" film is officially done, with all 3 chains now signed on. As I described last week in "In Trying to Preserve DVD Sales, Studios Are in a Tight Spot," in a bid to boost DVD sales, Disney was looking to trim the DVD release of "Alice" to just 12 1/2 weeks after its opening, from the customary 16 1/2. British and other European theaters revolted, angry that the move would diminish their box-office take, a particular hot-button in light of significant investments they've recently made in digital technologies. Specific details of the Disney-U.K. deals aren't known, but as the Guardian reported, it appears that Disney has agreed to cap the number of movies that will get earlier-than-usual DVD releases and provided some improved financial terms. Despite the U.K. resolution, some other European chains are still holding out, as is the AMC chain in the U.S. Regardless of the final outcome of the "Alice" situation, early DVD releases are going to remain a priority for Hollywood studios who are desperate to stanch the fall-off in DVD sales brought about by the recession and the shift by consumers to rental, subscription and online viewing options. There are many more chapters to be written in this saga.

What do you think? Post a comment now (no sign-in required).

Categories: FIlms, International, Studios

Topics: Alice in Wonderland, Disney