-

Hulu Missed Its Window for Subscription Success

Unless Hulu has something very unpredictable up its sleeve in the $9.95/mo subscription service it's rumored to begin testing in May, the bad news for the site is that it has already missed its window of opportunity for subscription success. In a one sense it's not Hulu's fault; as a startup 3 years ago, it had to choose what strategy to focus on and execute. Hulu chose the free, ad-supported route, with widespread distribution that has made it the 2nd most-used video site.

success. In a one sense it's not Hulu's fault; as a startup 3 years ago, it had to choose what strategy to focus on and execute. Hulu chose the free, ad-supported route, with widespread distribution that has made it the 2nd most-used video site.

The problem is that the world has changed significantly since Hulu was started 3 years ago, and launching a successful online subscription service now is far harder to do now than it would have been then. Here are some of the top reasons why:

Subscription competition - 3 years the online video subscription field was wide open, but now there's Netflix to contend with. As the company's blowout Q1 '10 results amply demonstrate, Netflix is firing on all cylinders. By providing unlimited streaming as a value add even for its $8.99/mo subs, Netflix has muddied the waters for any would-be online-only subscription competitor, which has to articulate a value prop to prospects of why they should pay the same or more for online-only access, for what will likely be a smaller catalog initially. Netflix also has the device partnerships, 28-day studio deals for more content, well-baked UI/recommendations and deep financial resources. 3 years ago it had none of this; back then it was still imposing confusing online usage caps and pursuing its own set-top box with LG Electronics.

TV Everywhere - 3 years ago cable operators were contemplating their navels when it came to online video delivery, now with TV Everywhere they have a game plan (though admittedly not a lot of actual success just yet). For most cable networks, preserving their relationships in the cable ecosystem is paramount. Taking a leap by licensing content for a Hulu subscription service isn't going to be very appealing. Absent cable content, Hulu will be pitching a monthly subscription to archived commercial free broadcast network programs; that's a pretty narrow value prop.

Comcast-NBCU deal - 3 years ago Comcast was still licking its wounds from its ill-considered bid for Disney; now it has a deal to acquire NBCU, one of Hulu's original partners and a top-tier cable network owner. While Comcast will say all the right things during the deal's review process, I've wondered how long Comcast would even retain its Hulu stake once the deal is completed. Hulu's free "ad-lite" model is antithetical to Comcast's belief in subscriptions and bottom line accountability. A Hulu subscription service is unlikely to help either. Why would Comcast want another competing subscription offer in the market, much less one that would tempt would-be "cord-cutters?"

Lack of ownership will - 3 years ago, NBCU and News Corp were full of platitudes about their new online video baby. But in addition to NBCU's changed status, News Corp has become the most vocal content provider for the paid online content model. MySpace's travails are rumored to have soured Rupert Murdoch's appetite for chasing fickle online users. Meanwhile, Disney, the last partner to the Hulu venture, is plenty interested in subscriptions, but it wants to offer them directly. Then there's Hulu's key financial partner, Providence Equity Partners. I've never quite understood their investment decision given Hulu's limited exit opportunities, but one thing's for sure - they're unlikely to be motivated to help fund the considerable development and marketing expenses Hulu must undertake to make subscriptions succeed.

Retransmission consent - 3 years ago, the idea of broadcasters getting paid for their content still seemed like a stretch. But broadcasters are winning their chosen high-stakes battles, and given their success, are far more inclined to pursue a wholesale model (i.e. getting distributors to pay them monthly) than back a retail, subscription model. Plus, a Hulu subscription model departs from the message of free broadcast service that the broadcast lobby is using with the FCC and Congress to justify why it should retain its excess spectrum, rather than yielding it to mobile data providers under the National Broadband Plan's reclamation program.

User expectations - As if these weren't enough to contend with, the single biggest impediment Hulu faces is likely itself. Having invested its brand heavily in the free ad-supported positioning (and computer-based viewing only) Hulu lacks what experts would call "brand permission" to now pursue subscriptions. Companies are frequently chastened to find out what their customers really think when stretching for new products or business models. Moving customers from free to paid is one of the hardest things any company can do (just ask YouTube which is attempting to do the same); trying to pull it off from a cold start is nearly impossible in my mind. Hindsight is 20-20, but what Hulu probably should have done 3 years ago is offered a "freemium" model that would have immediately conditioned its users to thinking Hulu stands for both free and paid.

I've learned to never say never in this business, but to succeed, Hulu has to surmount the above challenges and more. If it can do so, it will be a significant win for the company. If it can't it will be yet another reminder of how treacherous things are even for well-funded startups trying to navigate a quickly-shifting competitive landscape.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators

Topics: Comcast, Disney, FCC, FOX, Hulu, NBC

-

VideoNuze Report Podcast #58 - April 23, 2010

Daisy Whitney and I are pleased to present the 58th edition of the VideoNuze Report podcast, for April 23, 2010.

In today's podcast Daisy and I focus on Netflix's Q1 '10 results, which were the best in the company's history. I posted an analysis here, and in our discussion we dig in further to the competitive dynamics Netflix finds itself in and what consumers can expect going forward. Then Daisy takes us on a quick tour of what she saw at Ad:Tech.

Click here to listen to the podcast (15 minutes, 19 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Aggregators, Podcasts

Topics: Ad:Tech, Netflix, Podcast

-

There's Still Time to Register for VideoSchmooze on April 26th in NYC

There's still time to register for VideoNuze's next "VideoSchmooze" Broadband Video Leadership Evening coming up this Monday, April 26th. The event runs from 6-9pm at the Hudson Theater in New York City and includes open bar, hors d'oeuvres and a full educational program.

The event runs from 6-9pm at the Hudson Theater in New York City and includes open bar, hors d'oeuvres and a full educational program.

The panel, which I'll moderate, is "Money Talks: Is Online Video Shifting to the Paid Model?" Our executive panelists bring multiple perspectives in this key debate:- Jeremy Legg - SVP, Business Development, Turner Broadcasting System, Inc.

- Damon Phillips - VP, ESPN3

- Avner Ronen - CEO and Co-founder, boxee

- Fred Santarpia - General Manager, VEVO

Click here to learn more and register

We'll also have a 15-minute stage-setting presentation by Emily Nagle Green, President and CEO of Yankee Group, a leading industry market research and consulting firm. Emily is the author of the recently published book, "Anywhere - How Global Connectivity is Revolutionizing the Way We Do Business." Emily will share key data from Yankee's research and her book, which will set the stage for the panel to follow.

From 6-7:30pm, prior to Emily's presentation, we'll have open bar (wine/beer/soda), hors d'oeuvres and networking. Registration is running strong, with executives from many key media companies like MTV Networks, Rainbow Media, HealthiNation, CBS Interactive, NBCU, Scripps, HBO, NBA, 5Min, Disney, Comcast, Epix, WWE, Fox Sports and many others, plus tons of industry technology providers.

Thanks to lead sponsor Akamai Technologies and supporting sponsors FreeWheel, Horn Group, Irdeto, NeuLion, Panvidea and ScanScout for their support. Once again VideoSchmooze is being held in association with NATPE. You can follow VideoSchmooze and get updates that evening on Twitter at hashtag #vidooze

If you're planning to attend with colleagues, more deeply discounted "5-Pack" and "10-Pack" tickets are also available.

I look forward to seeing you on Monday night!

(Note - At the end of the evening, I'll also be unveiling the first VideoSchmooze event in Los Angeles, a breakfast on June 15th featuring executives from Netflix, Warner Bros Home Entertainment, Disney/ABC Television, Digitalsmiths and Kyte)

Click here to learn more and register

Categories: Events

Topics: VideoSchmooze

-

Netflix Blows Away Q1 '10; Adds Almost 1.7 Million Subscribers

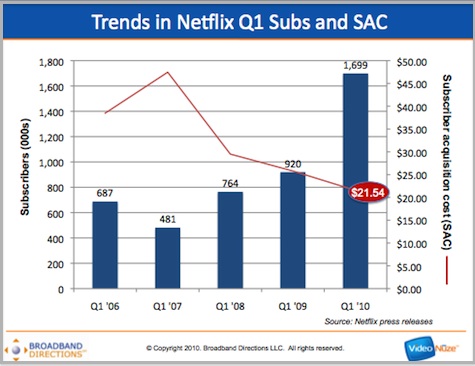

Netflix reported its Q1 '10 results yesterday and they're the best in the company's history, blowing away its own guidance for the quarter. Net subscriber additions totaled 1.699 million, above the high end of the company's own guidance range of 1.232 million to 1.532 million net subs. It's by far the biggest quarter the company has ever reported, and is 85% higher than Q1 '09 net sub adds of 920K. Netflix upped its full year guidance range for ending subs to 16.5 to 17.3 million, from the previous range of 15.5 to 16.3 million.

In addition, the company reported subscriber acquisition cost of $21.54 which is the lowest in the company's history. This continues the downward trend in SAC over the last 4 years. Churn came in at 3.8% which is also a record low, just below Q4' 09's 3.9%.

To get a sense of how big Q1 '10 was, look at the below chart showing net sub adds for the five first quarters back to 2006. Note that net sub adds in Q1 '10 were more than twice as much as just 2 years ago in Q1 '08. The SAC line shows the steady drop over the last 3 years. As I said yesterday, the record low churn in Q1 '10 is strong evidence that all this growth isn't coming at the expense of subscriber quality.

On the earnings call, CEO Reed Hastings and CFO Barry McCarthy gave a very upbeat report on the business and reiterated several themes from prior earnings calls. Increasing the streaming library is clearly the company's number one objective, and the recent 28-day DVD deals with Warner Bros, Universal, Fox and HBO, all serve this purpose. Hastings mentioned a number of times that savings on DVD purchases resulting from these deals is being plowed back into gaining more streaming content.

The company noted that subscribers using its Watch Instantly streaming feature for at least 15 minutes per month in Q1 '10 rose to 55% from 48% in Q4 '09. In fact, Hastings and McCarthy often referenced the positive interplay between improving the streaming value proposition and increasing subs, reducing churn and reducing SAC. This is the fundamental dynamic the company is now in. Three plus years since introducing Watch Instantly, the hybrid offer of DVD rental and streaming has reinvented Netflix's value proposition and propelled its unprecedented growth.

A few other interesting tidbits in no order, from the earnings call and commentary:- New subscribers are disproportionately choosing the $8.99 "1 DVD out" plan.

- A significant number of streaming users have connected their computers to their TVs.

- TV program content available for streaming has grown significantly in last 2 years and now accounts for a significant percentage of weekly viewing hours.

- iPad app has had minor effect on business, but being in Apple ecosystem has generated great PR.

- Wii launch in Q2 is expected to have big impact on streaming usage.

- 28-day DVD deals is prompting some consumer shifting to purchase and VOD, but that was expected and isn't harming Netflix's subscription value.

- Netflix has no interest in setting up a digital storefront for single-use rental or downloads. It believes Amazon, iTunes and others do that model well and it would cause partner conflicts. Subscription is Netflix's only focus.

- Netflix hasn't seen any upside from alleged "cord-cutting" of cable/satellite/telco services and doesn't see itself as a relevant substitute for these services.

- Plan is to continue as a distribution partner for pay channels like HBO, Showtime, Starz and Epix - not to compete with them, or introduce original programming like they do.

- 24% of households in Bay area now Netflix subscribers, and in spite of streaming's growth, DVD shipments in the area still increased in Q1 '10.

- Hastings swapped a large percentage of his cash compensation for stock awards in a vote of confidence in the business.

- Not concerned about reports of Hulu or Redbox subscription offers; Netflix's competitiveness is based on scale, UI, recommendations, content breadth.

- More news on international expansion later this year, but expected to start small.

As I said previously, Netflix is by far the most formidable "over the top" player, and with its continued strong growth is creating many interesting strategic options for itself down the road. The thing that continues to really surprise me about the Netflix story is that no meaningful competitor has emerged. How companies like Apple, Amazon, Walmart, Comcast, DirecTV and Microsoft plus big venture capital/private equity investors have sat on the sidelines and not aggressively introduced subscription DVD/streaming services of their own is both a mystery and a gigantic boon for Netflix. Given Netflix's size and formidable capabilities, it may already be "game over" for any of these potential competitors.

What do you think? Post a comment now (no sign in required).

Categories: Aggregators

Topics: Netflix

-

What to Look for in Netflix's Q1 '10 Results Later Today

Later today Netflix will report its Q1 '10 results which will be closely scrutinized to see if the company's strong momentum has continued following its blowout Q4 '09. Netflix is easily the most important "over the top" (OTT) contender and recently it announced further moves that will strengthen its position (e.g. launch of Wii streaming, Warner Bros., Universal and Fox 28-day DVD window deals, iPad app, more CE partners and additional indie content).

In January the company forecasted Q1 ending subscribers would be in a range of 13.5 to 13.8 million, which would represent net sub growth of 1.232 million to 1.532 subs over its Q4 '09 ending 12.268 million subs. The forecasts are a sign of how bullish Netflix management itself is; even the low end would represent the strongest quarterly net sub growth ever. Netflix's best Q1 was in '09 when it added 920K net subs meaning even the low end of the Q1 '10 forecast is 34% higher than the Q1 '09 actual. And a strong Q1 would also bode very well for full 2010 results; historically Q1 represents between 32-41% of Netflix's full year net sub adds.

As I explained in my Feb post, "It's Official: Netflix has Entered a Virtuous Cycle" there are several other key numbers to zero in on today. First is subscriber acquisition cost (SAC), which is what the company spends to add each new sub. SAC in Q4 '09 was $25.23, the second lowest ever (only Q2 '09 SAC of $23.88 was better). SAC has been falling dramatically (it was $47.46 in Q1 '07). I think this is a direct reflection of the company's unlimited streaming feature becoming better understood and valued as online video viewing has soared and convergence devices have proliferated. A continued decline of SAC in Q1 '10 would be very good news.

each new sub. SAC in Q4 '09 was $25.23, the second lowest ever (only Q2 '09 SAC of $23.88 was better). SAC has been falling dramatically (it was $47.46 in Q1 '07). I think this is a direct reflection of the company's unlimited streaming feature becoming better understood and valued as online video viewing has soared and convergence devices have proliferated. A continued decline of SAC in Q1 '10 would be very good news.

Churn is another number to focus on. In Q4 '09 it was 3.9%, matching the company's all time low. Churn is tightly related to sub growth. If new subs are low quality (e.g. responding to promotional offers, not understanding up-front what to expect, high delinquencies, etc.), churn will increase. If Netflix can sustain sub 4% churn in the face of unusually high sub growth that means sub quality is strong.

The percentage of subs using its streaming feature for at least 15 minutes/month is yet another number to focus on. In Q4 '09 it was 48%, up from 41% in Q3 '09 and 26% in Q4 '08. I'm sure we'll see an increase in this percentage in Q1 '10, the only question is to what. Last but not least, it will be interesting to see where gross margin comes in. Gross margin ticked up to 38% in Q4 '09, a level not seen since 2006, but it's not clear whether this will be sustained. Benefits of the 28-day DVD deals, which in part reduce the company's cost of acquiring DVDs from these studios will likely not be visible yet in Q1.

Netflix has a huge amount of momentum in its fundamentals, which the stock market seems to have woken up to recently. The company's stock price closed at $87.07 yesterday, up 58% from its 12/31/09 price of $55.09 and up 71% from $50.97, the level that it was at just prior to when it reported its blowout Q4 results. Investors will no doubt be looking at Q1 results to help justify the stock's big recent move. In particular, if sub growth beats the high end of the forecasted range, it could well trigger another strong move higher for the stock (and no that's not a recommendation to buy). Netflix has a wide open playing field, later today we'll find out how well it continues to capitalize on it.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators

Topics: Netflix

-

Widevine Announces Product Update, List of Supported Devices and New Customers

Widevine is announcing the 4.4.4 version of its video optimization and DRM platform today, with new features, a list of supported devices and new customers. Widevine's CEO Brian Baker brought me up to speed yesterday.

customers. Widevine's CEO Brian Baker brought me up to speed yesterday.

Widevine is supporting HTTP streaming and also adaptive bit rate streaming for live events and shows, not just on-demand. Devices supported include Apple products, Blu-ray players (Haier, LG, Philips, Samsung, Toshiba), connected TVs, Nintendo Wii, Windows PCs and 50 models of set-top boxes. As TV Everywhere services begin to roll out, secure delivery is a key to success, and Brian explained that Widevine is positioning itself to be in the middle of the action.

On the customer front, Netflix and Best Buy are being announced as new customers. Netflix has been aggressively rolling out new content and supported devices for its Watch Instantly streaming feature. Brian wouldn't confirm, but it seems fair to assume that Widevine is the DRM solution Netflix is using for streaming to the Nintendo Wii, which, given its massive installed base could quickly become a significant percentage of Netflix's streaming use (it just went live last week). In a related move, last week Irdeto announced that Netflix had licensed its Cloakware software as part of its DRM efforts.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Devices, DRM

Topics: Best Buy, Netflix, Widevine

-

Discovery and PointRoll Combine Editorial and Ads in "Dig@torial" In-Banner Video Unit

A new ad unit announced by Discovery and PointRoll and called "Dig@torial" (pronounced "digitorial") caught my attention a few weeks ago, and I've been meaning to write about it since. The unit intrigued me because it dynamically leverages Discovery's video library to enhance an advertiser's message in an easy-to-navigate rich media banner. I hadn't seen anything quite like it before and believe it is yet another indicator of how content and ads are blurring into one seamless experience.

To learn more, I talked to Michael Aronowitz, VP of Channel Development at PointRoll, which is owned by Gannett, and Brent Spitzer, VP and Leigh Solomon, Manager of Activation, both at Discovery Digital Media Advertising Sales.

PointRoll worked with Discovery to build a shell in the requested leaderboard and 160x600 skyscraper formats. In these examples 50% of the space promotes Montana Office of Tourism specifically and the other 50% offers opportunities to engage with Discovery content. When you roll over the ad it unfolds to show a mosaic of photos to look at in the Montana space (plus a link to visit www.visitmt.com), and a choice of relevant articles and videos from Discovery's library in its space. A video begins playing in-banner automatically with 4 thumbnails exposed below, plus a link to view more on a customized landing page. The videos play with a 10 second pre-roll for Montana that is frequency-capped.

Brent and Leigh explained that with the Dig@torial, Discovery works collaboratively with its advertising clients to select the most relevant content to incorporate into the ads. Discovery's team combs through its archive of video clips and proposes a playlist to the client. If the client has its own video that can be incorporated too. The video is fed dynamically into the Dig@torial unit, so it can be updated at any time. The key to making all this possible for Discovery is that it owns all of its programs, so it has a free hand to carve them up and integrate them into ads like these.

It's still early for the Dig@torial unit, but it appears to be succeeding. Michael said that the benchmark "interaction rate" for the PointRoll network (which is the first time someone interacts with a PointRoll ad) over the last 1 1/4 years is 6.4% with a 14 second engagement time. The Dig@torial press release says that regular rich media ads on Discovery's sites exceed the PointRoll benchmark by 70% and that the Dig@torial ads provide another 50% lift. That would imply an approximately 16% interaction rate and 36 second engagement time, both of which are very strong. Attesting to the Dig@torial's appeal, Brent and Leigh said that Dig@torial campaigns for 8 other clients have also recently launched or are being launched (I combed through Discovery's sites, but wasn't able to find them though).

Brands and sites are perpetually trying to identify ways to increase user engagement and conversion. By blending client messages with relevant and strongly branded content, the Dig@torial unit is breaking new ground in delivering value to all parties. It's also a reminder that for content providers, it's worth trying to secure re-use rights to programming and then archiving and tagging them for subsequent retrieval. Dig@torial is showing that content's value can extend well beyond its initial airing.

What do you think? Post a comment now (no sign-in required).Categories: Advertising, Cable Networks

-

NDS Leads $20 Million Investment in BlackArrow for Advanced Advertising

Amid all the coverage that online video advertising receives, it's also important to remember that advanced advertising in on-demand and pre-recorded TV continues to evolve. News today that NDS, one of the largest technology providers to multichannel video programming distributors ("MVPDs") is leading a $20 million Series C round in BlackArrow, a provider of advanced advertising solutions, is a reminder of progress. Last week I spoke to Todd Narwid, VP of New Media for NDS and Dean Denhart, BlackArrow's CEO, to learn more about the deal.

("MVPDs") is leading a $20 million Series C round in BlackArrow, a provider of advanced advertising solutions, is a reminder of progress. Last week I spoke to Todd Narwid, VP of New Media for NDS and Dean Denhart, BlackArrow's CEO, to learn more about the deal.

To put the deal and its upside in context, it's important to first understand there's a big difference between how online video advertising against free streams in the open Internet works vs. how advertising against VOD and DVR programs in paid, subscription-based services run by MVPDs works. In the Internet world, there are pretty well-established standards, allowing significant interoperability among sites and ad servers. While measurement challenges persist, the act of getting video ads inserted where they're supposed to be is now pretty straightforward.

Conversely, in the MVPD world, the first challenge is just getting ad serving systems approved and deployed. Because ads are served from within the MVPD's own infrastructure, new ad servers must be tested and integrated with existing video delivery infrastructure residing in distribution centers often called "headends" in the cable world. Unlike MVPDs' broadband deployments, much of MVPDs' TV delivery architecture pre-dates the Internet and therefore is heterogeneous and often difficult to integrate with. In addition, there are the tens of millions of deployed set-top boxes which also differ in their capabilities and openness. MVPDs have made significant progress in creating their own standards and in deploying advanced services, but as anyone who's ever tried to implement any kind of advanced service in the MVPD world can attest, it's hard work and has ground down many promising technology start-ups.

When I first wrote about BlackArrow, on its launch in Oct, '07, I liked its vision of delivering advanced advertising in VOD and DVR programs, but I noted the above challenges gave it a steep hill to climb. Since then, BlackArrow has made progress, deploying with Comcast in Jacksonville, FL and with other operators (though Dean isn't able to mention them due to MVPD restrictions). Still, MVPDs have so many priorities and their resources for testing and integrating new technology are limited. Further, there's a lingering sentiment that MVPDs have only made a half-hearted attempt to really monetize VOD and DVR.

Given these circumstance, the NDS deal appears to offer BlackArrow a lot of upside. As one of the largest technology providers to MVPDs globally ("conditional access" systems that provide secure MVPD video delivery are its main product line, among others), NDS immediately gives BlackArrow both credibility and significantly improved sales and support reach, particularly outside North America. The companies also announced a joint solution offering, which will be key to realizing actual sales Importantly, NDS gives BlackArrow improved financial footing for what promises to be a very long-term process of deploying advanced advertising by MVPDs. Conversely, for NDS, as Todd explained, BlackArrow provides the monetization piece of the puzzle that MVPDs need to create business cases to help them justify NDS's advanced technology delivery systems.

upside. As one of the largest technology providers to MVPDs globally ("conditional access" systems that provide secure MVPD video delivery are its main product line, among others), NDS immediately gives BlackArrow both credibility and significantly improved sales and support reach, particularly outside North America. The companies also announced a joint solution offering, which will be key to realizing actual sales Importantly, NDS gives BlackArrow improved financial footing for what promises to be a very long-term process of deploying advanced advertising by MVPDs. Conversely, for NDS, as Todd explained, BlackArrow provides the monetization piece of the puzzle that MVPDs need to create business cases to help them justify NDS's advanced technology delivery systems.

For MVPDs, who are witnessing the rapid adoption of online video and the threat of cord-cutting down the road, it is essential to be able to offer subscribers more flexible viewing options like VOD and DVR and to give their content partners opportunities to effectively monetize these views. This has been the Achilles heel of VOD and DVR to date, and the scarcity of ad-supported programs in VOD (particularly relative to what's available online) is a direct reflection of this.

Going forward, the challenge for MVPDs will only intensify as content providers face escalating choices about where to optimally monetize their programming. This is where BlackArrow fits in. Plus the company has always had a multi-platform vision, so once it's enabled for TV and DVR, BlackArrow could also provide a pathway to online monetization, which given MVPDs' TV Everywhere initiatives, is also a growing priority.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Cable TV Operators, Deals & Financings, DVR, Satellite, Technology, Telcos, Video On Demand

Topics: BlackArrow, Comcast, NDS