-

Fox's "Remote-Free TV" Seems to Fall Short

Two-and-a-half weeks ago, in "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks" I asserted that Fox's decision to cut in half the number of ads it will include in two new programs was influenced by the limited ads shown in networks' broadband initiatives.

By giving "RFTV" a try, Fox was catching on to the idea that fewer commercial interruptions improves the

viewer experience. I pointed out that the challenge RFTV posed is that cutting ad time in half means that Fox would have to double the CPMs it charged just to remain whole. Could Fox do that?

viewer experience. I pointed out that the challenge RFTV posed is that cutting ad time in half means that Fox would have to double the CPMs it charged just to remain whole. Could Fox do that?Yesterday's piece in Adweek provided at least a preliminary answer: No. Adweek, quoting unnamed media agency sources, reported that Fox is getting only a 35-40% premium for the "RFTV" ad inventory. If my math is right that would imply that Fox is grossing 30-33% less total ad revenue than it would have under its traditional ad model.

Broadcast networks, having moved much of their programming online, have engendered new viewer expectations for fewer ads. The early results from Fox's "RFTV" initiative may indeed be evidence that these new expectations are at odds with sustaining broadcasters' traditional margins and profits.

Categories: Advertising, Broadcasters

Topics: FOX

-

New York Times Highlights Clinton Video on Page One

Catching a train to NYC this morning to moderate at the Advertising 2.0 conference, I picked up a New York Times, something I rarely do anymore, having moved to the online version a long time ago. In a sign of the times (no pun) there on page one, under a huge picture of Barack Obama the caption identified him outside the Capitol yesterday, and continued, "A video looks at his party's long and grueling primary battle: nytimes.com/politics."

It's pretty cool to think that this is where things have progressed to: a major newspaper prominently highlighting a video it has fully produced as part of its news coverage. Talk about a blurring of the lines between different media segments. Going online I found the video, shot in documentary style with narration to be every bit as professional as something one would find on the networks.

My only gripe is that the video is woefully under-monetized. No pre-roll, post-roll or mid-rolls in a 10+ minute video. And even the accompanying display ad is a house ad for the Times's career columnist. If the Times is going to invest in creating great video, it should at least make money at it! Hopefully next time...Categories: Newspapers

Topics: NYTimes.com

-

Video Aggregators Have Raised $366+ Million to Date

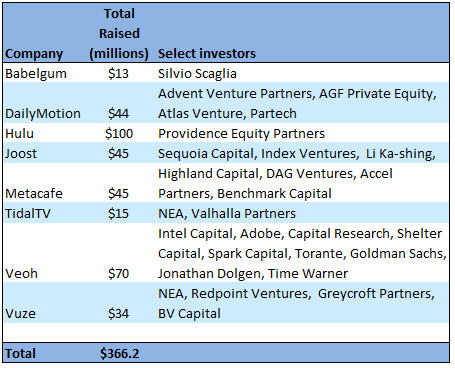

With this week's news that Veoh has garnered another $30 million in financing, by my count the total amount raised by the top broadband video aggregators now exceeds $366 million. The breakdown is below, according to publicly available data I've pulled together.

While definitions of who should be included in this category are admittedly fuzzy, I consider broadband aggregators to be companies that are providing a broad-based destination site that focuses mainly on professionally-created video. Often these sites include broadcast network and cable TV programming, but they don't have to. I'm sure plenty of readers have their own definitions and that I've overlooked some, so feel free to post a comment to add others to the list.

Savvy investors seem to have an enormous appetite for these kinds of companies. Veoh, with 28 million monthly unique visitors, and others have demonstrated their ability to attract lots of eyeballs. Yet all of these companies are solely reliant on advertising, and that of course makes begs the question how well these companies can convert their traffic to real revenue and therefore become profitable, sustainable businesses?

Since all of these companies are private it is hard to assess their momentum. Yet in a recent panel I moderated at Streaming Media East, Mike Henry, SVP of Ad Sales for Veoh explained the range of current challenges. Chief among them is getting traditional TV media buyers to clearly understand the broadband medium, how to buy into it and how to measure its performance. These are crucial matters since the biggest source of broadband ad dollars will no doubt come from brands shifting their TV spending to broadband.

Of course, to the extent that these companies can continue raising big money, they're buying themselves more runway. Complicating matters is that all of these sites live in the long shadow of YouTube, which alone still accounts for around 40% of all video views per month. Then there are big players like Yahoo, MSN and AOL and recent entrants like Adobe which are vying for their share of the video pie. But at some point these companies will have to show they can make money and survive.

With all these crosscurrents, it will be interesting to see how these companies' stories unfold.

Categories: Advertising, Aggregators, Deals & Financings

-

Revisiting The Long Tail and Broadband Video

Way back in the dark ages of March, 2005, I wrote a newsletter entitled, "The Long Tail of Video is About to Get Longer - What Role Will Cable Play?" I thought of it yesterday when I read an article in Multichannel News "Cable Bests Broadcast - Basic Networks Steamroll Into Summer with Lion's Share of Audience." I continue to believe that cable TV provides a lot of lessons for those thinking about broadband video's future.

First, a quick refresher on the idea of The Long Tail. In October, 2004, Chris Anderson, editor of Wired

magazine, wrote an article which later turned into a book, asserting that once physical limitations (e.g. manufacturing, distribution, inventory, etc.) are removed - thereby allowing all products with niche appeal to be readily available to consumers - it turns out that the aggregate sales of these niche products are greater than the few "mass" products which were always available in traditional distribution channels. When this effect is plotted on an XY graph, the line depicting the tiny sales per niche unit extends indefinitely, forming a "long tail."

magazine, wrote an article which later turned into a book, asserting that once physical limitations (e.g. manufacturing, distribution, inventory, etc.) are removed - thereby allowing all products with niche appeal to be readily available to consumers - it turns out that the aggregate sales of these niche products are greater than the few "mass" products which were always available in traditional distribution channels. When this effect is plotted on an XY graph, the line depicting the tiny sales per niche unit extends indefinitely, forming a "long tail."The Long Tail was an important contribution in understanding how the world of digital economics works. Anderson cited multiple examples where the Long Tail was evident (e.g. Amazon, Rhapsody, etc.). In my March '05 piece I explained that the Long Tail concept was familiar to anyone in the cable TV business: the traditional "head" content was the broadcasters, the long tail was the constellation of niche-oriented cable TV channels.

When I wrote the piece, as a group, basic cable TV's total audience had just nudged past the collective audience of the broadcasters for the first time (i.e. The Long Tail effect was becoming evident). While each cable channel's audience was small relative to each broadcaster's, cable's total audience was now greater. It had taken 30+ years for cable audience to reach this point.

Flash forward 3+ years to the Multichannel article revealing that in May sweeps period, cable's audience share had surged to 60%, compared with 40% for the broadcasters. And it's interesting to note that a key part of cable's May win is due to cable co-opting traditional broadcast programming: in May TNT's airing of NBA playoff games accounted for 12 of the month's top 20 most-watched programs.

What does all this have to do with broadband video? As I explained back in '05, in reality, broadband distribution is essentially extending the long tail of programming. Broadband allows startups and established players (including cable and broadcast networks!) to utilize newly available broadband infrastructure to reach their audiences. The result is a massive proliferation of new programming and new viewer behaviors, further fragmenting audiences to ever-smaller niches.

Today's cable channels will eventually be seen as the "mid-tail" with broadband as the hyper-niche long tail. Given their own first-hand experience of the last 30 years, cable operators, cable networks and broadcast networks should all have a pretty clear view of the challenges and opportunities that broadband creates. How well they respond will determine who will be the winners and losers of the next 30 years.

Categories: Broadcasters, Cable Networks, Cable TV Operators

Topics: The Long Tail

-

More Brands Experiment with Broadband Video

Question: What do condoms, mayonnaise, life insurance and hamburgers have in common?

Answer: Major brands in each of these product categories are looking to boost awareness and sales by using broadband video initiatives to inform and entertain audiences.

In the continuing round of experimentation about how to take greater control of their branding, at least 4 companies - Lifestyles Condoms, Hellmann's, MetLife and Carl's Jr. are pursuing, or considering pursuing their own video efforts. It's a further sign that brands are piling into broadband, eager to take advantage of the new benefits the medium offers.

These efforts are often grouped under the broad heading "Branded Entertainment." Though that's a handy catch-all, there's actually a wide range of projects underway including webisodes or standalone videos, each with their own specific objectives.

For example, Lifestyles has begun running a series called "Noah and Baron Talk Man Sh*t", depicting two comedians trekking around Europe and featuring humorous condom references. Back in a more G-rated Hellmann's, is introducing "Real Food Summer School" with Yahoo featuring chef Bobby Flay giving cooking lessons to amateurs. The videos will heavily feature Hellmann's mayonnaise. Meanwhile MetLife has created a single animated video, "Everyone Into the Pool" to help explain the concept of risk-pooling and the value of life insurance in a fun, straightforward way.

For all these brands video is a way of helping explain their products and benefits, in a far more entertaining, immersive and informative manner than typical 30 second TV spots allow. They follow previous initiatives from Nike, Cartier, Campari, Shell Oil, Dove and others.

While I think it's still early in the push for branded entertainment, there does seem to be a clear trend towards experimentation. Also agencies are quickly setting up units to assist in moving this forward (Digitas was the latest with "The Third Act" unveiled 2 weeks ago). I'd expect plenty more branded entertainment initiatives to come.

I'll be delving much deeper into all of at a session I'm moderating on branded entertainment at the OMMA Video Summit on June 16th. We have an excellent mix of panelists from the content and agency worlds including Avenue A, Digitas/The Third Act, Ogilvy, MyDamnChannel and ManiaTV.

-

Where's Project Canoe's New CEO?

At the recent Cable Show in New Orleans, Comcast's president Steve Burke said that Project Canoe's new CEO would be announced on June 1. However, June 1 has come and gone without any news. Project Canoe, which Mugs covered for VideoNuze recently, is the cable industry's new interactive ad system, meant to draw national advertisers to cable's VOD and other advanced video delivery platforms. A rumor has circulated widely that David Verklin, former CEO of Aegis North America (a large advertising service firm) would get the nod, but nothing has been made official. I haven't heard what is causing the delay. If you know, post a comment...

Categories: Advertising, Cable TV Operators

Topics: Comcast, Project Canoe

-

May '08 VideoNuze Recap - 3 Key Topics

Looking back over two dozen posts in May and countless industry news items, I have synthesized 3 key topics below. I'll have more on all of these in the coming months.

1. Broadband-delivered movies inch forward - breakthroughs still far out

In May there was incremental progress in the holy grail-like pursuit of broadband-delivered movies. Apple established day-and-date deals with the major studios for iTunes. Netlix and Roku announced a new lightweight box for delivering Netlix's "Watch Now" catalog of 10,000 titles to TVs. Bell Canada launched its Bell Video Store, complete with day-and-date Paramount releases, with others to come soon. And Starz announced a deal with Verizon to market "Starz Play" a newly branded version of its Vongo broadband subscription and video-on-demand service.

Taken together, these deals suggest that studios are warming to the broadband opportunity. This is certainly influenced by slowing DVD sales. Yet as I explained in "iTunes Film Deals Not a Game Changer" and "Online Move Delivery Advances, Big Hurdles Still Loom" broadband movies are still bedeviled by a lack of mass PC-TV connectivity, no real portability, well-defined consumer behavior around DVDs and the studios' well-entrenched, window-driven business model. Despite May's progress, major breakthroughs in the broadband movie business are still way out on the horizon.

2. Broadcast TV networks are embracing broadband delivery - but leading to what?

Unlike the film studios, the broadcast TV networks are plowing headlong into broadband delivery, yet it's not at all clear where this leads. In "Does Broadband Video Help or Hurt Broadcast TV Networks" and "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks?" I laid out an initial analysis about broadband's pluses and minuses for networks. I'll have more on this in the coming weeks, including more in-depth financial analysis.

On the plus side, in "2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow," "Sunday Morning Talk Shows Need Broadband Refresh" and "Today Show Interview with McClellan Showcases Broadband's Power," I illustrated some opportunities broadband is creating. On the other hand, "Bebo Pursues Distinctive Original Programming Model" and "More Questions than Answers at Digital Hollywood" explained how exciting new programming approaches are taking hold, challenging traditional TV production models. Broadcasters are in the eye of the broadband storm.

3. Advertising's evolution fueled by innovation and resources

Last, but hardly least, I continued on one of my favorite topics: the impact broadband video is having on the advertising industry. Over the last 10 years the Internet, with its targetability, interactivity and measurability has caused major shifts in marketers' thinking. With broadband further extending these capabilities to video, the traditional TV ad business is now ripe for budget-shifting. We'll be exploring a lot of this at a panel I'm moderating at Advertising 2.0 this Thursday.

In "Tremor, Adap.tv Introduce New Ad Platforms" and "All Eyes on Cable Industry's 'Project Canoe'" (from Mugs Buckley), key players' innovations were described along with how the cable industry plans to compete. Content providers are being presented with more and more options for monetizing their video, a trend which will only accelerate. Yet as I wrote in "Key Themes from My 2 Panel Discussions Last Week," many issues remain, and with so many content start-ups reliant on ads, there may be some disappointment looming when people realize the ad market is not as mature as they had hoped.

That's it for May. Lots more coming in June. Please stay tuned.

Categories: Advertising, Aggregators, Broadcasters, Cable TV Operators, Devices, Downloads, FIlms, Studios, Video Sharing

Topics: Adap.TV, Apple, Bell Canada, Canoe, iTunes, Netflix, Paramount, Roku, Starz, Tremor, Verizon, Vongo

-

For Conde Nast's CondeNet, "All Roads Lead to Broadband Video"

I've been a long-time advocate that broadband video offers print publishers such as newspapers and magazines a whole new strategic growth opportunity. In a recent briefing with Richard Glosser, CondeNet's Executive Director of Emerging Media, he went a step further, telling me that for Conde "all roads lead to broadband video." For those not familiar with CondeNet, it is the digital business unit of Conde Nast, the upscale magazine publisher (Vogue, Gourmet, Bon Appetit, GQ, Details, Wired, etc.).

CondeNet has been pursuing video on its 5 web sites (Style.com, Men.Style.com, Epicurious.com, Concierge.com and Wired.com, which are associated with its magazine brands and collectively generate around 12 million unique visitors/mo) since late '06. Coincidentally, Conde's approach to video is very aligned with how I described magazines' video opportunities in a report I released in Q2 '07, "The Top 40 U.S. Magazines and Broadband Video: Learning to Thrive in a Multi-Platform World."

Conde recognizes that many of the same skills and assets vital to a magazine franchise are transferrable to

video, and, when augmented with new video-specific capabilities and people, the combination significantly expands the brand's potential, especially with advertisers, in the digital era. Conde is now producing or licensing approximately 600 videos per year, with most in the 2-3 minute range. While insisting that the its video be high quality, it is very budget-focused, with target production of $1,000/minute.

video, and, when augmented with new video-specific capabilities and people, the combination significantly expands the brand's potential, especially with advertisers, in the digital era. Conde is now producing or licensing approximately 600 videos per year, with most in the 2-3 minute range. While insisting that the its video be high quality, it is very budget-focused, with target production of $1,000/minute.Since CondeNet is a separate unit, some of its videos stand alone on the site, unaffiliated with print stories. But often the video is related to what's in print, and that brings up one of the main challenges for magazines to successfully pursue video: evolving the editorial process to incorporate a video angle. Conde has hired video producers who now work closely with magazine editors to identify appropriate opportunities. The question guiding these decisions: "What do our audiences expect from us?"

Meanwhile, Conde's early video syndication efforts also show why video is so strategic. Though only distributing to 5 partners as yet (YouTube, iTunes, Sony Bravia, Verizon VCast and Adobe Media Player) - Richard shared that two-thirds of its overall video views now come from these 5 partners, with the other third generated from Conde's own sites, underscoring the opportunities I've previously written about concerning the "syndicated video economy."

Better yet, Richard cited a number of examples where a certain clip breaks out on a partner site, demonstrating that Conde's partners help it reach new audiences it doesn't typically attract on its own. One example was videos it placed on YouTube about Culinary Institute of America students Epicurious was tracking for a series. Video of one student in particular underperformed on Epi, but was off the charts on YouTube. Conde's thinking is that YouTube's younger audiences related better to this student's particular trials and tribulations and embraced her in a way that Conde's traditional audiences had not.

This is just one of Conde's many insights gained from its early video experience. Conde is showing that magazines should look at video as a logical and inevitable extension of their franchises. It is increasingly expected by their audiences and advertisers.

What do you think about magazines' video opportunities? Post a comment now!

Categories: Magazines

Topics: Conde Nast, CondeNet