-

2009 Prediction #5: Microsoft Will Acquire Netflix

As I promised, I've tried to make my 2009 broadband predictions bolder as the week has progressed. So to cap off the week, I'm offering up a doozy: my 2009 prediction #5 is that Microsoft will acquire Netflix sometime next year.

Before I get into my rationale, I want to be perfectly clear that I have absolutely no insider information, nor have I talked to anyone at either company about this prediction, which is solely my own personal opinion. I don't directly own stock in either company, though I may have some in various mutual funds I own. This prediction doesn't constitute advice to purchase stock in either company. I'm an industry analyst who happens to believe that this deal would make a lot of strategic sense for both companies based on my assumptions about broadband video's future.

First, it's important to understand that the single biggest consumer market opportunity in the next 10 years will be delivering premium-quality video (mainly hit TV programs and movies) over broadband Internet connections to TVs. Broadband is poised to disrupt the current providers of multichannel video (cable/satellite/telco) which generate about $80-100 billion of annual revenue in the U.S. alone. Rich potential rewards await successful new broadband-only or "over the top" entrants.

While Microsoft has an impressive portfolio of consumer-facing products (e.g. Xbox, Silverlight, WMP, IE,

MSN, etc.), the reality is that today it lacks a well-branded service offering with sufficient consumer traction to credibly vie for a piece of the multichannel video market that will be up for grabs. It is unimaginable to me that Microsoft will continue to content itself with focusing only on the enablers like those listed above, along with its Mediaroom IPTV software platform, while others launch new broadband video services to consumers. Further, since the race is actually already well underway, the classic "build vs. buy" analysis tilts heavily toward "buy," especially if a jewel like Netflix is possibly available.

MSN, etc.), the reality is that today it lacks a well-branded service offering with sufficient consumer traction to credibly vie for a piece of the multichannel video market that will be up for grabs. It is unimaginable to me that Microsoft will continue to content itself with focusing only on the enablers like those listed above, along with its Mediaroom IPTV software platform, while others launch new broadband video services to consumers. Further, since the race is actually already well underway, the classic "build vs. buy" analysis tilts heavily toward "buy," especially if a jewel like Netflix is possibly available. Another Microsoft motivator is that its two keenest competitors in the consumer space, Apple and Google, also happen to be the two best-positioned companies to deliver premium video to the TV using broadband. In iTunes, Apple has by far the most successful consumer-paid download store which is already highly relevant to studios and networks (witness NBC's decision to return to iTunes earlier this fall), not to mention the most successful devices (iPod and iPhone). iTunes is Apple's springboard into disrupting the traditional multichannel video model, though exactly how the company will do so is yet to be determined. Its initial foray with Apple TV is hardly the company's final word. And with Steve Jobs' personal stake in Disney, Apple has a lot of insight and leverage to get things done in Hollywood.

Meanwhile Google, when combined with YouTube, has the highest potential for delivering an ad-supported premium broadband video service. I recognize that the operative word in that sentence is "potential." YouTube still has lots of monetization challenges. And though it has made great strides adding premium video to its site in '08, I doubt many users yet associate YouTube with premium video the way they do with Hulu for example, or any of the network sites for that matter. Further, YouTube has made little progress in articulating a strategy for getting to the TV. In a post I did earlier this year, "YouTube: Over-the-Top's Best Friend" I suggested that it would be an appealing partner for all of the over-the-top device makers, who desperately need content and a brand to penetrate the market.

Despite these shortcomings, when you consider the upside of Google Content Network and the reality that YouTube dominates video usage with 40% share of all monthly streams, its potential from an ad-supported standpoint is impressive.

Meanwhile Netflix, with over 8 million subscribers, is the most successful video subscription service outside

of the cable/satellite/telco industry. Nobody else is even close. Netflix's big opportunity is to morph its DVD-by-mail business into an online delivery model. If it succeeds it could pose significant new on-demand competition to today's multichannel providers (something that cable operators now well appreciate according to several people I've spoken to).

of the cable/satellite/telco industry. Nobody else is even close. Netflix's big opportunity is to morph its DVD-by-mail business into an online delivery model. If it succeeds it could pose significant new on-demand competition to today's multichannel providers (something that cable operators now well appreciate according to several people I've spoken to).2008 has been a very good year for Netflix in broadband. It has beefed up its WI catalog to 12,000 titles by doing deals with Starz, CBS and Disney. It has gained a toehold in the home with its Roku box, and by integrating with Xbox 360 and LG and Samsung Blu-ray players. By offering WI as a value add instead of an extra charge, it has further strengthened its customer relationships and begun collecting valuable data about what impact WI can have on future subscriber acquisition costs and retention tactics.

As I've pointed out previously, Netflix's problem is that growing its WI catalog, so that it can be perceived as a bona fide replacement for DVDs-by-mail, is a tough challenge. In most of its content deals, Netflix has DVD-based subscription rights, but not electronic or online subscription rights. That's why it only offers 12,000 titles on WI out of its total catalog of 100,000+ titles on DVD.

The major pay TV channels (HBO, Showtime and Starz) have paid billions of dollars for these exclusive electronic rights. Though Netflix was able to do a content deal with Starz, I think similar deals with HBO or Showtime are highly unlikely. Neither network is nearly as committed to online, and both no doubt view Netflix as an eventual competitor.

Reviewing Netflix's recent "Investor Day" presentation, it is clear that the company is taking a concerted, yet gradual approach to online distribution, at one point stating that the evolution to full streaming will happen over 20 years. Since Netflix is a public company and has to manage Wall Street's expectations and its quarter-to-quarter earnings, it must emphasize gradual, not disruptive, change. One look at the gorgeous hockey stick graphs of Netflix's historical revenue and earnings growth over the years attests to its "steady-Eddie" approach.

Indeed, while that approach is admirable, I think broadband represents a game-changing opportunity for Netflix. As such, rather than easing into it as the company appears to be doing, it should instead be pursuing it full bore, capitalizing on the opening competitors like Apple and Google have currently created. However, doing so will require vastly more resources, as well as insulation from public market pressures. So here are some of the appealing points of a Microsoft acquisition:

- Microsoft would instantly give Netflix new economic clout in Hollywood to compete with the pay TV networks' studio deals as they come up for renewal, scrambling the traditional "windowing" paradigm and clearing a path to a far stronger future WI catalog.

- Microsoft would also allow Netflix to build a business model where it pays broadcast networks a fee for their programs. Over time these payments could become an important adjunct to broadcasters' traditional advertising model (much like cable networks' rely on both affiliate fees and advertising). If successful, Netflix could possibly even gain preferred terms relative to broadcasters' distribution to ad-supported online aggregators.

- As the WI model takes shape, Netflix would also be in a totally new position to approach certain cable networks - who are among the most reluctant to embrace broadband delivery for their full episodes - with financial incentives that could rival what they currently collect from their cable/satellite/telco affiliates. Deals with cable networks would give potential "cord cutters" more comfort in doing so, while also pressuring the close ties between cable networks and operators.

- Just as Google has given YouTube financial cover for its spiraling bandwidth/delivery costs, Microsoft could do the same for Netflix, as it encourages its subscribers to use WI more heavily.

- Last but not least, there's Microsoft's MSN, which not only represents a solid intra-company promotional platform for Netflix's subscriber acquisition, but also the possibility of a new Netflix ad-supported service. This isn't something the company has ever pursued, but is an intriguing as a possible competitor to the likes of Hulu and others. It would give Netflix a unique hybrid paid/free model.

So that's the strategic rationale. Then there's a lot of other existing inter-company stuff that lays nice groundwork for a deal: Netflix CEO Reed Hastings is on Microsoft's board, Netflix is now using Silverlight for WI, XBox has recently integrated WI in it NXE release, etc. In short, these are two companies that already know each other well. And on the financial front, with a current market cap of $1.6B, even with an acquisition premium, Netflix would be a relatively small bite for Microsoft (particularly compared with $45B, which Microsoft was prepared to shell out for Yahoo!).

Successful as Netflix is, it is still a relative minnow swimming in a sea of whales that will be competing for the biggest consumer prize of the next 10 years. Netflix has an impressive track record and it could very well succeed by remaining independent. But it (and its stock price) will be under continuous scrutiny as everyone from Apple to Google to Comcast to Amazon to Hulu to countless others launch broadband initiatives that pressure Netflix's model.

Meanwhile, Microsoft has significant financial resources, but it lacks the ability to be a credible competitor in the broadband-to-the-TV race. Together, I believe they could turn Netflix into the single-most potent broadband competitor to today's multichannel video providers. My bet is that in '09 the two companies will come to the same conclusion.

What do you think? Post a comment now.

2009 Prediction #1: The Syndicated Video Economy Accelerates

2009 Prediction #2: Mobile Video Takes Off, Finally

2009 Prediction #3: Net Neutrality Remains Dormant

2009 Prediction #4: Ad-Supported Premium Video Aggregators Shakeout

Categories: Aggregators, Deals & Financings

-

2009 Prediction #4: Ad-Supported Premium Video Aggregators Shakeout

"Look to your left, look to your right. One of you won't be here next year."

- Professor Charles Kingsfield, The Paper Chase

Professor Kingsfield's famous admonition to incoming Harvard Law School students applies equally well in 2009 to the ad-supported aggregators of premium video. My prediction #4 for the new year is that a shakeout is coming to this space.

As I wrote last summer in "Video Aggregators Have Raised $366+ Million to Date," there has been a lot of enthusiasm around broadband-only aggregators, especially those that focus on premium-quality video. Part of the excitement is based on the idea that they could eventually snatch a chunk of the $100 billion/year that today's cable, satellite and telco video distributors generate. This vision is enhanced by the inevitability of broadband connecting seamlessly to millions of consumers' TVs, enabling a pure on-demand, a-la-carte experience. The result has been many well-funded startups (e.g. Joost, Veoh, Vuze, etc.) as well as offensive/defensive initiatives backed by large media companies (e.g. Hulu, Fancast, portal sites, etc.).

However, ad-supported video aggregators face multiple challenges. First and most is that as their ranks have grown, the audience they're commonly targeting fragments. Not only does this make it hard to achieve scale, it makes it hard to identify meaningful audience differences that advertisers seek when allocating their budgets. The recent economic collapse and ad spending slowdown only exacerbate these audience-related issues.

The next big problem is that it is very difficult for aggregators to differentiate themselves. As with most web sites, there are really two main drivers of differentiation: content and user experience. On the content side, there is a finite amount of premium video available for ad-supported online distribution and there's no such thing as exclusivity (except to some extent with Hulu and its rights to NBC and Fox shows).

Increasingly broadcast programs are available in lots of places online, (starting with the broadcasters' own sites), while cable programs are in short supply (more on why that's the case and why it will stay that way in "The Cable Industry Closes Ranks"). Though there is lots of other quality video being produced, the reality is that once you get away from hit TV shows and recently-released movies (which themselves are not available except as paid downloads), little else has the same audience-driving appeal.

User experience is certainly a bona fide differentiator, and as I have spent time at all these sites, it's evident which sites are better and easier to use than others. But user experience differences are hard to maintain; it's all too easy for one site to emulate what another one does, and with cheap, open technology there are few barriers to doing so. Over time, most of the really important differences melt away (ample evidence of this is found in the ecommerce world, where checkout processes have long since gravitated to a set of best practices).

Another problem is customer acquisition and retention, which is a particular issue for the independent aggregators, who don't have incumbent advantages to leverage. With premium video only coming online relatively recently, users' video search processes are not yet well understood. Suppose someone is looking for a missed episode of Lost and don't want to pay for it. Do they start with a Google search for "Lost?" Or for "ABC?" Or do they reflexively go to ABC.com? Or maybe they're a heavy YouTube user, so they start by heading over to YouTube.com? Still others no doubt start by going to video search sites like blinkx or Truveo. Video aggregators need to insert themselves in the flow of an online user's video search process. But doing effectively is not yet anywhere close to the reasonably well-understood world of web-based optimization techniques.

I believe all of this leads to the inevitable result that not all of today's video aggregators are going to make it to the end of '09. Some will be bought or merged, others will simply close down. You're no doubt wondering which ones I think will fall into these categories. Though I have my hunches, for now I just can't offer an informed answer. There are just too many variables in play: actual performance (which only the sites themselves know), cash burn rates, strength of commitment by investors/owners, etc. What I will say though is that the list of survivors will include at least Hulu and Fancast. Both are highly strategic to their parent companies, have significant financial backing, and enjoy content or feature differentiation that is hard to replicate and/or is valued by users.

The landscape for video aggregators is still pretty wide open, so some winners will emerge. But there are just too many entrants chasing the same prize. I'll be keeping close track of the aggregator space on VideoNuze as '09 unfolds, and will keep you apprised of all developments.

What do you think? Post a comment now.

2009 Prediction #1:The Syndicated Video Economy Accelerates

2009 Prediction #2:Mobile Video Takes Off, Finally

2009 Prediction #3:Net Neutrality Remains Dormant

Tomorrow, 2009 Prediction #5

Categories: Aggregators

Topics: Fancast, FOX, Hulu, Joost, NBC, Veoh, Vuze

-

2009 Prediction #3: Net Neutrality Remains Dormant

As promised, I'm continuing to push further out onto the limb with my five '09 broadband predictions as the week progresses. Today's prediction is that net neutrality legislation will remain dormant for at least another year. Given Barack Obama's campaign statements pledging support for net neutrality, many who hoped it was finally at hand will no doubt be quite disappointed.

I suspect many of you may not even be familiar with net neutrality or why it's relevant so let me offer a short primer. As I wrote back in November of '07, in "Net Neutrality in '08? Let's Hope Not," the Internet has functioned as a level playing field of sorts. Broadband Internet Service Providers have not biased in favor of delivering one web site's content over another's (i.e. their networks have remained neutral). Since the government has maintained a laissez-faire Internet regulatory stance, broadband ISPs' own self interests have aligned nicely with staying neutral. In other words, it made good business sense for them to behave this way.

To simplify somewhat, net neutrality advocates believe that in the broadband video era, "good business sense" cannot be counted upon to ensure ISPs' continued neutrality; hence the need for regulatory intervention. Their concern is that because large ISPs' (namely cable operators and telcos) also operate incumbent multichannel video services and have financial stakes in certain content providers - both of whose financial health would be threatened by open broadband delivery - these ISPs will start to bias toward better delivery of sites in which they have some financial interest or with whom they have a particular deal. This would in turn disadvantage sites outside the ISPs' financial orbit, hurting not just these sites, but also larger democratic goal of consumer choice.

All of these concerns are hypothetically valid. But the problem is that these concerns have not translated into any provable pattern of ISP misbehavior as yet. Having sat through an FCC hearing earlier this year meant to surface such evidence, I can say first-hand that while there are isolated instances of bias which have been compounded by bungled ISP explanations and sophomoric PR miscues, net neutrality advocates have little more than their concerns and assumptions about ISPs' future behavior on which to base their argument for preemptive legislation. And this is precisely the reason why net neutrality will remain dormant for another year, at least.

Net neutrality remains largely a solution in search of a problem. I believe this will put it outside the guiding philosophy of Mr. Obama's regulatory forces. Having read both of Mr. Obama's books and listened to his words intently, I've long since concluded that he's what I call a "principled pragmatist." Mr. Obama has a core set of beliefs about how the world should work, but he chooses his battles wisely and with a focus on solving real, not imaginary problems. Mr. Obama and his team have plenty on their plates addressing the economic mess they're inheriting. Time will not be made available to create rules in any area of business where there's no evident harm to anyone.

This pragmatic approach means that when the rubber meets the road on net neutrality, Mr. Obama and his policy advisors are unlikely to be swayed by the free-speechers and academics who form the core of the net neutrality advocacy camp, unless they're able to bring far more supporting data (note, as the WSJ pointed out earlier this week, net neutrality support even among some content companies like Google, Microsoft and Yahoo is either waning or becoming ambiguous).

All of this said, it may be politically expedient to throw a small bone to net neutrality's advocates. So we may see some new guidelines introduced, but nothing approaching the level of what some are seeking. The only exception is if broadband ISPs themselves acquiesce, possibly in exchange for infrastructure subsidies that may be part of the planned trillion dollar stimulus program.

Though politics is a notoriously hard business to protect, if in 2009 if broadband ISPs do a good job of behaving themselves, they will likely see net neutrality backburnered. The FCC should be vigilant in monitoring the industry for signs of bias. And if they are able to prove the case, net neutrality will rightly get moved up in prioritization.

What do you think? Post a comment now.

2009 Prediction #1 - The Syndicated Video Economy Accelerates

2009 Prediction #2 - Mobile Video Takes Off, Finally

Tomorrow, 2009 Prediction #4

Categories: Broadband ISPs, Predictions

Topics: Barack Obama, FCC

-

2009 Prediction #2: Mobile Video Takes Off, Finally

As promised, each day this week I'm sharing one prediction for 2009, with each one getting progressively bolder as the week progresses (and yes, I'll concede - as a number of you privately pointed out to me - yesterday's forecast that the Syndicated Video Economy would grow in '09 was a pretty wimpy start). So moving out a little further on the limb, today's prediction #2 is that video delivered directly to mobile/wireless devices will take off in '09, finally.

For those of you who have been following mobile/wireless video delivery, this has been a market that's perpetually been "just around the corner." In fact, a little over a year ago when I was planning VideoNuze, several people suggested that I shouldn't just focus on broadband delivery (as I define it to mean high-speed wired delivery of video to a home or business), but also mobile/wireless video. But after doing some due diligence I concluded that the market wasn't there yet, and that the vast majority of new video activity would be focused on wired broadband. Indeed, I think that's how '07 and much of '08 have shaped up.

However, having tracked recent activity in the mobile video space, I think '09 is going to be a big year of growth and recognition for this new medium (in fact, an old friend gently chastised me over lunch last week for even drawing a distinction between wired and wireless delivery, saying, "come on, it's ALL broadband!" I think he makes a very fair point.)

What has traditionally held back mobile delivery are a lack of video-capable devices, voice and text-focused wireless networks and a closed "on-deck" paradigm, which is the wireless carrier's version of the cable and satellite industry's proverbial walled-garden.

These limitations have now been mostly addressed, or are in the process of being addressed. On the device side, the most notable video-capable device is of course the iPhone, which by my calculations has already sold over 13 million units and is on its way to almost 20 million by the end of the year. Everyone I know who has an iPhone - especially kids - are infatuated with the video feature (if you've never seen it, especially now using AT&T's 3G network, get thee to an Apple store immediately!). In '09, the iPhone is poised for even greater popularity as Wal-Mart begins stocking it, possibly for just $99. Recession or not, the iPhone is going to remain white hot.

Not to be lost in the iPhone's phenomenal wake are many other new video-capable phones. There's of course the new G1 from T-Mobile, powered by Android, Google's new mobile OS. I got my first look at one last week, and though not as sleek as the iPhone, I was able to watch excellent YouTube video. There are plenty of others to choose from as well, including the Samsung Propel, the LG Incite, the new BlackBerry Storm and the latest mother-of-all-phones, the Nokia N64, which comes with 16GB of internal memory (enough for 40 hours of video). Whereas many of us today carry phones incapable or barely capable of viewing video, in '09 the replacement process will be in full swing.

Of course, all the cool devices in the world don't matter unless you have a robust underlying network and the freedom to view what you want. On this front, the wireless carriers' push to build out their next generation 3G networks finally allows sufficient bandwidth to view high-quality video (though not HD yet). Next up is 4G, first from Clearwire, the SprintNextel-Intel-Google-cable industry consortium that's deploying its WiMax network with speeds of up to 6 Mbps downstream being promised. There's also MediaFLO, Qualcomm's mobile broadcasting platform that has steadily built out an ecosystem of technology, carrier and content partners.

Last but not least are the consumer-focused services and applications. Until recently, this market has mainly consisted of packaged subscription services like Verizon's VCast and MobiTV, which itself recently announced more than 5 million subscribers. The combination of new devices and networks promises to bring an increase in on-demand, web-based, ad-supported video consumption (plus paid downloads to be sure, courtesy of the iPhone mainly). Another interesting twist is the advent of live broadcasting from mobile devices, powered by providers like Qik, Kyte and Mogulus. These all supercharge the Twitter micro-blogging phenomenon.

All of this underscores why the distinction between wired and wireless broadband really becomes meaningless over time. The mobile experience is going to seem more and more like the one you have sitting at your computer, with the added benefit of portability. To throw a blue-sky variable into the mix, one wonders if at some point you'll simply plug your phone into your TV and watch streamed or downloaded video that way, rather than through a set-top box or a wired broadband connection. There's a convergence concept for you!

Years in the making, mobile/wireless video is finally upon us, and '09 is going to be a big year. That's good news for all of us as consumers, and it surely means I'll be working a lot harder to stay on top of things.

What do you think? Post a comment now.

Previous, Prediction #1: Syndicated Video Economy Grows

Tomorrow, 2009 Prediction #3

Categories: Devices, Mobile Video

Topics: Android, Apple, AT&T, BlackBerry, Clearwire, Google, iPhone, LG, Medi, Nokia, Samsung, SprintNextel, T-Mobile, Verizon, Wal-Mart

-

2009 Prediction #1: The Syndicated Video Economy Accelerates

To kick off my 2009 broadband video predictions, here's one that won't surprise loyal VideoNuze readers: the "Syndicated Video Economy" will accelerate in the new year.

This is hardly a controversial assertion given how much I've written in '08 about the SVE, which I first introduced last March. As a refresher, the SVE describes an ecosystem of content providers, distributors and all those who facilitate their relationships. In the SVE, content providers seek widespread distribution of their video. They understand that the Internet itself is a highly fragmented medium and that to optimize viewership, they must shift from "aggregating eyeballs" to a central destination site to instead focus on "accessing eyeballs" wherever target viewers may spend their time: on social networks, with portable devices or game consoles, on personalized portal pages, on vertical subject-driven web sites and myriad other places.

Underlying this transition to widespread distribution is the recognition that, at least for now, advertising is the primary business model for the vast majority of broadband video content providers. Massive scale and accurate targeting are the two key ingredients to optimizing the ad model. While the SVE is still nascent and its ultimate potential is still far off, in '08 a diverse array of SVE enablers began laying the foundation for its future success.

Two of the more interesting initiatives kicked off in '08 were Google Content Network and Adconion.TV, both of which seek to blend content, distribution and advertising into one scalable bundle. I expect more of these kinds of initiatives in '09, especially from ad networks, which are ideally positioned to distribute video to their partner sites. Plenty of others are also distributing premium video into the "mid tail" and "long tail" of web sites such as Grab Networks (a company formed by the Sept '08 merger of Anystream and Voxant), 1Cast, Jambo Media, ClipBlast, Magnify.net and Syndicaster.

An important part of understanding the SVE is that, unlike traditional distribution which was focused on long-form episodes, the SVE is particularly well-suited to targeted distribution of video clips or short series. Creating, bundling and matching these clips to their appropriate audiences is where companies like 5Min, EveryZing, Digitalsmiths, Gotuit and others all play roles. Of course these clips must be managed coherently as part of a content providers' larger catalog, which is why many of the leading content management and publishing platforms like Brightcove, thePlatform, WorldNow, VMIX and others that cater to large media companies also offer syndication features.

With the explosion of video syndication, content providers need the ability to enforce their business rules, measure usage and accurately carry ads even when video is played offline or on mobile devices. These needs are being filled by companies like FreeWheel, Visible Measures, comScore, WebTrends, Kiptronic, Volo Media, Transpera and Azuki Systems. As video is further married to the burgeoning social media landscape, companies like YouTube, KickApps, blip.tv, Slide, RockYou, ClearSpring, Facebook, MySpace and others are all pioneering innovative new forms of community building and user participation.

Thought much of this activity only just started in '08, some of the SVE's rewards are already becoming clear. As one example, Hulu's October traffic as measured by comScore attests to how syndication is powering Hulu's impressive growth.

The innovation and product development that's happening in the SVE, coupled with the broad investment focus on it cause me to be confident about syndication's future. I expect much more activity from all of the companies mentioned above, plus plenty of others I haven't been exposed to yet. In '09 the SVE's foundation will continue to get built out, with users being the ultimate beneficiaries.

What do you think? Post a comment now.

Categories: Syndicated Video Economy

Topics: Syndcated Video Economy

-

NFL.com's "Game Rewind" Feature is Pretty Cool

I got a tip yesterday about "Game Rewind," a feature that NFL.com has apparently launched in the last week or so. For a mere $20/season, you can now watch full, commercial-free replays of all the season's games. The video is delivered in terrific quality by Move Networks, and as seen below, also offers a side window that shows a synopsis of the game's scoring. I'm not a huge football fan, but since I missed the exciting end of last week's Patriots-Seahawks game, I simply dragged to the fourth quarter and sat back and enjoyed (btw, how nice is it to watch commercial-free?!).

One suggestion for the NFL team: introduce EveryZing's MetaPlayer, Gotuit VideoMarkerPro or Digitalsmiths (or someone else's metadata-based search technology) so that fans can quickly retrieve only the highlights they care about (especially for the fantasy crowd). If I just want to see Matt Cassel's touchdown passes, it would sure be nice to enter that phrase and be shown those specific highlights only. Still, Game Rewind is a very cool new feature, of course only possible courtesy of broadband delivery.

What do you think? Post a comment now.

Categories: Sports

Topics: Digitalsmiths, EveryZing, Gotuit, Move Networks, NFL

-

Hulu's Impressive 2008 Growth

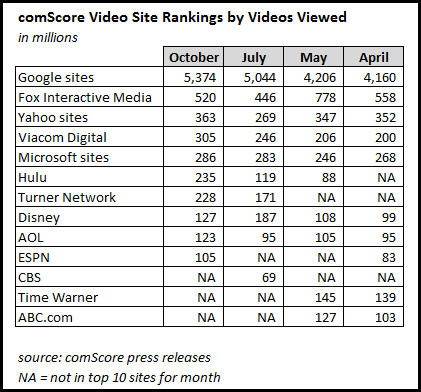

comScore's latest video traffic rankings came out earlier this week, and it was hard to miss Hulu's big growth in 2008. As the chart below show, the site, which only launched officially in March landed in the #6 spot with 235 million video streams in October, up from 119 million in July, 88 million in May and not in comScore's top 10 in April.

While Hulu's latest stats benefited from the SNL political skits, it's worth noting that in October Hulu delivered more streams than Viacom, Disney, AOL, ESPN, Time Warner and ABC.com as recently as April (when Hulu wasn't yet in the top 10). As Todd Spangler points out, Hulu's success is also a very significant syndication data point: in October it generated "only" 5.3 million uniques on its own site with the remainder of its 24 million uniques coming from partners.

By anyone's standards Hulu's off to a pretty amazing start. Hulu's pre-launch naysayers have been proven dead wrong. A year ago I gave Hulu's beta a solid B+; it has now become one of the best out there. In '09 its key challenge is to maximize the revenue from all that traffic.

What do you think? Post a comment now.

Categories: Aggregators

Topics: Hulu

-

Local Broadcast TV Stations are Hurting

To get a sense of how grim these last two weeks have been in the local broadcast TV industry, do a quick scan of the "Stations" section of TVNewsday, one of my favorite aggregators of broadcast-related news. Layoffs are rampant as stations are buffeted by the economic slowdown, which has only added to their long list of woes, topped by declining network ratings, massive audience fragmentation and steady migration to online/DVR viewing.

I've long thought that local broadcasters are among the most vulnerable industries in the digital era, as broadband has created many similar challenges as the Internet itself created for their local newspaper brethren. Back in April I wrote in "Broadband, Broadcast Converge at NAB" that local broadcasters needed to reimagine their businesses to capture opportunities broadband offers beyond their local geographies. The urgency needle is now in the red zone. This industry's fundamentals have permanently changed.

What do you think? Post a comment now.

Categories: Broadcasters

Topics: NAB