-

Reviewing My 6 Predictions for 2008

Back on December 16, 2007, I offered up 6 predictions for 2008. As the year winds down, it's fair to review them and see how my crystal ball performed. But before I do, a quick editorial note: each day next week I'm going to offer one of five predictions for the broadband video market in 2009. (You may detect the predictions getting increasingly bolder...that's by design to keep you coming back!)

Now a review of my '08 predictions:

1. Advertising business model gains further momentum

I saw '08 as a year in which the broadband ad model continued growing in importance as the paid model remained in the back seat, at least for now. I think that's pretty much been borne out. We've seen countless new video-oriented sites launch in '08. To be sure many of them are now scrambling to stay afloat in the current ad-crunched environment, and there will no doubt be a shakeout among these sites in '09. However, the basic premise, that users mainly expect free video, and that this is the way to grow adoption, is mostly conventional wisdom now.

The exception on the paid front continues to be iTunes, which announced in October that it has sold 200 million TV episode downloads to date. At $1.99 apiece, that would imply iTunes TV program downloads exceed all ad-supported video sites to date. The problem of course is once you get past iTunes things fall off quickly. Other entrants like Xbox Live, Amazon and Netflix are all making progress with paid approaches, but still the market is held back by at least 3 challenges: lack of mass broadband-to-the-TV connectivity, a robust incumbent DVD model, and limited online delivery rights. That means advertising is likely to dominate again in '09.

2. Brand marketers jump on broadband bandwagon

I expected that '08 would see more brands pursue direct-to-consumer broadband-centric campaigns. Sure enough, the year brought a variety of initiatives from a diverse range of companies like Shell, Nike, Ritz-Carlton, Lifestyles Condoms, Hellman's and many others.

What I didn't foresee was the more important emphasis that many brands would place on user-generated video contests. In '08 there were such contests from Baby Ruth, Dove, McDonald's, Klondike and many others. Coming up in early '09 is Doritos' splashy $1 million UGV Super Bowl contest, certain to put even more emphasis on these contests. I see no letup in '09.

3. Beijing Summer Olympics are a broadband blowout

I was very bullish on the opportunity for the '08 Summer Games to redefine how broadband coverage can add value to live sporting events. Anyone who experienced any of the Olympics online can certainly attest to the convenience broadband enabled (especially given the huge time zone difference to the U.S.), but without sacrificing any video quality. The staggering numbers certainly attested to their popularity.

Still, some analysts were chagrined by how little revenue the Olympics likely brought in for NBC. While I'm always in favor of optimizing revenues, I tried to take the longer view as I wrote here and here. The Olympics were a breakthrough technical and operational accomplishment which exposed millions of users to broadband's benefits. For now, that's sufficient reward.

4. 2008 is the "Year of the broadband presidential election"

With the '08 election already in full swing last December (remember the heated primaries?), broadband was already making its presence known. It only continued as the year and the election drama wore on. As I recently summarized, broadband was felt in many ways in this election cycle. President-elect Obama seems committed to continuing broadband's role with his weekly YouTube updates and behind-the-scenes clips. Still, as important as video was in the election, more important was the Internet's social media capabilities being harnessed for organizing and fundraising. Obama has set a high bar for future candidates to meet.

5. WGA Strike fuels broadband video proliferation

Here's one I overstated. Last December, I thought the WGA strike would accelerate interest in broadband as an alternative to traditional outlets. While it's fair to include initiatives like Joss Wheedon's Dr. Horrible and Strike.TV as directly resulting from the strike, the reality is that I believe there was very little embrace of broadband that can be traced directly to the strike (if I'm missing something here, please correct me). To be sure, lots of talent is dipping its toes into the broadband waters, but I think that's more attributable to the larger climate of interest, not the WGA strike specifically.

6. Broadband consumption remains on computers, but HD delivery proliferates

I suggested that "99.9% of users who start the year watching broadband video on their computers will end the year no closer to watching broadband video on their TVs." My guess is that's turned out to be right. If you totaled up all the Rokus, AppleTVs, Vudus, Xbox's accessing video and other broadband-to-the-TV devices, that would equal less than .1% of the 147 million U.S. Internet users who comScore says watched video online in October.

However, there are some positive signs of progress for '09. I've been particularly bullish on Netflix's recent moves (particularly with Xbox) and expect some other good efforts coming as well. It's unlikely that '09 will end with even 5% of the addressable broadband universe watching on their TVs, but even that would be a good start.

Meanwhile, HD had a banner year. Everyone from iTunes to Hulu to Xbox to many others embraced online HD delivery. As I mentioned here, there are times when I really do catch myself saying, "it's hard to believe this level of video quality is now available online." For sure HD will be more widely embraced in '09 and quality will get even better.

OK, that's it for '08. On Monday the focus turns to what to expect in '09.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Brand Marketing, Devices, HD, Indie Video, Politics, Predictions, Sports, Technology, UGC

Topics: Amazon, Apple, AppleTV, Barack Obama, Hulu, iTunes, NBC, Netflix, Olympics, Roku, VUDU, XBox

-

7 Broadband/Mobile CEOs Explain How to Raise Money in the Down Economy

Amidst all the gloomy economic news, there are actually still some earlier stage companies that are raising new money. To learn more about their how they're doing it, I emailed the CEOs of seven broadband/mobile video companies which have collectively raised nearly $80M in the last 3 months. I asked 3 basic questions:

- What are the key success factors for raising money given the difficult economic climate?

- What are the biggest challenges?

- Is there any specific advice you'd offer to those trying to raise money these days?

While there were some common themes in their answers (many of which echoed the usual fundraising maxims), there was plenty of variety and a few outliers. Space constraints don't allow for me to share all of their specific answers, so I've tried my best to summarize the common themes and highlight key nuggets of wisdom below. If you have any questions, drop me an email.

The seven CEOs who graciously took time out of their busy days to contribute their thoughts (along with the recent rounds they've raised) are:

- Amir Ashkenazi, Adap.tv ($13M Series B, 9/23/08)

- Frank Barbieri, Transpera ($8.25M Series B, 11/13/08)

- Alex Blum, KickApps ($14M Series C, 11/25/08)

- Dean Denhart, BlackArrow ($20M Series B, 10/6/08)

- Keith Kocho, ExtendMedia ($10M Series C, 12/2/08)

- Steve Rosenbaum, Magnify.net ($750K Series A1, 11/21/08)

- Ben Weinberger, Digitalsmiths ($12M Series B, 11/13/08)

1. What are the key success factors for raising money given the difficult economic climate?

The answers that dominated were all around revenue, profitability and cash flow. All the CEOs mentioned, in one way or another, that being able to demonstrate real revenue growth and momentum is essential. Some noted that in the past traffic or usage may have been sufficient, but now the "premium is on paying customers," and how get to profitability and cash flow breakeven using reasonable assumptions. Several mentioned that investors are as risk averse as ever, which of course comes as no surprise. They want to see concrete, well thought-out plans.

Investors have also become more sophisticated about the whole broadband video sector and expect entrepreneurs to be able to explain where they fit into the ecosystem and what their points of differentiation are. Importantly, they are looking for proven models (unfortunately an oxymoron for a pure startup), or at least some minimal history of success that goes "beyond PPT slideware."

A couple of CEOs noted that investors have shifted from asking "how fast can you scale?" to "how will you get through this crisis?" They no longer expect a quick exit. They are looking for a real plan which includes contingency tactics if for example, competitors do something desperate like cut their prices in half.

2. What are the biggest challenges?

The prevailing theme here was uncertainty, starting with investors' own business models. They're focused on how much of their funds to hold in reserve to shore up existing portfolio companies. They're trying to gauge their own limited partners' appetite for venture investing given the credit squeeze. Then of course they're trying to understand the impact of broadband market drivers like ad spending and user adoption. One CEO lamented the difficulty of persuading people to put new money to work on the very day the stock market's dropping by 500 points. Still another noted that all of this can lead to a "self-fulfilling prophecy" where everything freezes and missed opportunities abound.

With respect to the broadband market specifically, one CEO said the key challenge is showing how "you monetize video for your clients." Absent that, "it will not only be hard to raise money, but harder still for your client to spend money with you."

Another said that the level of scrutiny has gotten so high that it's not even worth talking to any investor which doesn't have its own track record of investing in the broadband video sector. It's just too hard to educated people in this environment. Another CEO added that your model needs to be "brilliant and bulletproof, with an A-level management team already in place." Boy, there's a steep hurdle to clear.

3. Is there any specific advice you'd offer to those trying to raise money these days?

Many of the answers to this question reflected fundraising basics: understand your business thoroughly, put a balanced team in place, seek out investors you know first, have a solid plan, and bootstrap as much as possible first.

With respect to the raising money in the current lousy market, there was a broad range of sentiment. One CEO said "Don't...the terms are going to suck..." while another said to be "incredibly realistic about how much to raise, your burn rate and valuation." On the more optimistic end of the spectrum, one said "The market's poor performance means that investors are looking for new opportunities. Ignore all the negative energy and naysayers." And another remarked that "Even during the tech disaster of 2001-2003, angel investors, VCs and tech behemoths were still putting money to work in promising sectors." Another heavily emphasized the value of loyal and supportive existing investors (if there are any) in helping making the case to new investors.

More tactically, one CEO said that the more you "minimize uncertainty that surrounds your business specifically, the better off you'll be." Another said to make the transaction as simple as possible, and to "get the big items off the table first." Still another said to demonstrate "you're indispensable to customers, helping them weather the downturn." Finally one cautioned to be ready to take a lot more meetings than usual and expect a lot deeper follow up..."it may require you to go well beyond investors in your backyard to find the right fit."

Hopefully some of this is helpful to those of you trying to raise money right now, or thinking about doing so in the near future. Broadband video remains one of the hottest sectors out there; even still, if you're not getting a lot of love right now, you're not alone...

What do you think? Post a comment now.

Categories: Deals & Financings

Topics: Adap.TV, BlackArrow, Digitalsmiths, ExtendMedia, KickApps, Magnify.net, Transpera

-

Learning from Jeff Zucker's Example

The corporate seismograph measuring activity coming out of NBCU lately has shot off the charts.

NBCU's tectonic moves have included: the "mini-merger" of NBC Entertainment and Universal Media Studios, together with the ouster of Katherine Pope, UMS's president and others; ongoing job cuts as part of its previously-stated plan to reduce its workforce by 3% or 500 positions, a move that itself was part of a larger $500M expense reduction program; and the planned shift of Jay Leno to the 10pm slot, the first-time ever a "stripped" program has moved to prime-time. And one can bet the changes are far from over.

The moves indicate that NBCU's president and CEO Jeff Zucker has concluded not just that the traditional rules of the media game are over for good, but that nothing short of a radical transformation of NBCU's business will ensure its future survival.

I don't know Zucker or the executives he's shuffling around so I'm not in a position to say whether the

personnel actions he's taking are the right ones specifically. But what I can say fairly is this: Zucker's unvarnished realism and willingness to make wrenching organizational changes should be viewed as a model for other industry CEOs to follow.

personnel actions he's taking are the right ones specifically. But what I can say fairly is this: Zucker's unvarnished realism and willingness to make wrenching organizational changes should be viewed as a model for other industry CEOs to follow. I was impressed with Zucker back in January '08, upon listening to his keynote at NATPE. I wrote in "Zucker Preparing NBC for Broadband Era" that I appreciated him saying "technology is transforming every part of our business" and that the "historic economic model supporting broadcast TV is wounded." Most famously, he said that the "number one challenge for everyone in this industry is...not trading analog dollars for digital pennies." I concluded that Zucker "got it."

While I am very sympathetic to those being affected by the change underway throughout the NBCU empire, I am thrilled to see Zucker acting as a leader. One would assume that when an individual has ascended to the highest ranks of their organization, they must actually be a real leader. However, the sad truth is that real leadership has been in desperately short supply throughout corporate and federal America in recent times. In fact, if we'd had more real leaders over the last 30-odd years we wouldn't have a crippled U.S. auto industry, an avaricious, self-destructive financial services sector, a tragically warming planet or a country bloated by a large and ever-growing debt burden.

In short, leaders see the world as it is. Not as it used to be. Not as they wish it could be. And not as they manufacture it to be so that in the short term they can maximize their financial reward. Zucker's ability to be a clear-eyed realist, and his willingness to take the actions required for future success, are critical to tens of thousands of NBCU employees and their families, the vast web of suppliers reliant on the company's continued good health and myriad investors whose confidence is the lifeblood of NBCU's parent company GE.

From my parochial position, broadband is at the top of the list of the company's challenges. Broadband and on-demand digital distribution, together with DVRs and fragmenting consumer behaviors strike at the core of the broadcast industry's longstanding success formula. The recent economic crisis and accompanying ad spending slowdown have simply accelerated their importance.

On the broadband front, so far NBC has responded admirably. By co-founding Hulu as its broadband spear tip, hiring top-notch executives for it, funding it generously and providing it ample autonomy, NBC has given Hulu the room to get off to a strong start. Though I have my concerns with how Hulu's monetizing its streams and worry about its affect on NBC's P&L, I'm hopeful that the Hulu team understands the big picture. In '09 I expect there will be a shakeout among the online aggregators of premium-quality video but I'm confident Hulu will be among those left standing.

In the meantime, I don't envy Jeff Zucker, or any of the other big media CEOs who are tasked with navigating their proud organizations into an unfamiliar and deeply unsettling new era. Personally I wouldn't have the stomach for it. But, based on what I've seen to date, if I were an NBCU stakeholder, I'd be glad that Zucker is at the helm.

What do you think? Post a comment now.

Categories: Broadcasters

Topics: NBCU

-

New Thwoop.com Uses Broadband to Invert Content/Commerce Model

Brand Performance, a large player in the market for licensed character products for kids, is announcing Thwoop.com today, using broadband to invert the traditional model for content and commerce. I got a briefing from Ty Simpson, the company's CEO.

First a little background. Whenever you walk into a store like Toys-R-Us, you'll see rows and rows of products from hit kids programs like Ben10, Cars, Hannah Montana, etc. Licensing the characters and images from these shows to product manufacturers is a key source of revenue for program creators. If you have young kids as I do, you can attest to their popularity.

As Ty explains it, the industry is traditionally very hit driven. That means there is only a relatively small amount of room on TV for all of the character-driven programs that are produced. Similarly, big-box retailers allocate their finite shelf space to only the hottest properties. Ty recognized this latter scarcity several years ago and set up Tystoybox.com to focus exclusively on providing distribution for a broad range of licensed character products, many of which cannot get physical distribution. The site and its sister, AllAboardToys.com, have become the two largest independent online stores for these products.

With Thwoop.com, Ty is capitalizing on the scarcity of on-air shelf space for the programs themselves. The site aims to create a new kids entertainment experience, offering full program episodes of various kids programs along with trailers and other video. The first partner is NCircle, producer of Animal Atlas, Hermie & Friends and other shows. Thwoop.com's goal is to be a destination site where video can be seen and purchased, social networking and interactivity is promoted and user-generated product reviews are uploaded.

What's really unique here is that the whole site is supported by commerce, not advertising. On-air these programs are all ad-driven and the licensed products are considered ancillary. But Thwoop.com inverts the model, with commerce supporting the video. Ty explained that he's become a strong believer in broadband's potential to dramatically open up video availability, and that product sales will naturally follow. Presenting a strong user experience was a top priority, and Thwoop has partnered with Magnify.net to power the entire site. Magnify's CEO Steve Rosenbaum said his company is unveiling its "theater-mode" and full-screen player as part of the launch.

As a parent Thwoop.com raises some interesting questions. For example, my son is a Ben 10 fanatic. I like the idea of a site where he can watch the old episodes and immerse himself in the characters, and maybe even interact with other kids (assuming the right safeguards were in place). On the other hand, I have to admit, it scares the bejeezus out of me that he would get even more exposure to the licensed products. As my wife likes to remind me, we hardly need any more Ben 10 paraphernalia in our house...

Regardless, Thwoop.com is exactly the kind of new, innovative experience that broadband enables. Clever entrepreneurs like Ty recognize that broadband resolves traditional distribution scarcities, opening up completely new business models. When I put my VideoNuze hat on, I'm excited to see it launch.

What do you think? Post a comment.

Categories: Commerce

Topics: Brand Performance, Magnify.net, Thwoop.com

-

Brightcove Alliance Launches

Brightcove is unveiling "Brightcove Alliance" today, a wide-ranging ecosystem of technology, distribution and solution partners who have integrated with and/or are building applications on the the company's platform. Jeremy Allaire, Brightcove's CEO briefed me last week.

As he explained it, Brightcove 3, the recently released, latest generation of the company's platform,

represented a new push on openness and extensibility which are the key requirements for building out an ecosystem. Alliance partner benefits include platform APIs, training, support and improved access to Brightcove's long list of content provider customers through pre-built integrations.

represented a new push on openness and extensibility which are the key requirements for building out an ecosystem. Alliance partner benefits include platform APIs, training, support and improved access to Brightcove's long list of content provider customers through pre-built integrations. The company is announcing more than 80 partners today, covering just about every aspect of the broadband world. The press release includes supporting quotes from a dozen partners and customers and Jeremy added that many others expressed interest and will be included subsequently.

The only other large and formalized industry ecosystem I'm aware of is thePlatform's Framework program, which was announced last February and added to in September. It now totals over 60 companies and includes some overlapping names with Brightcove.

Having been involved in several alliance programs in the past, my take has always been that the litmus test for their success is whether they generate real revenue for partners. Too often what you get is the initial "Barney" press releases (i.e. "I love you, you love me") but little more in the way of actual new business.

Brightcove has two advantages to help it avoid a similar trap: (1) a lengthy list of existing customers who will likely welcome pre-integrated partner products and services that can be easily and inexpensively accessed and (2) a large group of partners, who, given the lousy economy, will be aggressive in pursuing Brightcove to identify customer opportunities. Brightcove should capitalize on both to expand its market position.

What do you think? Post a comment now.

Categories: Partnerships, Technology

Topics: Brightcove, thePlatform

-

Sony's Internet-to-the-TV Plans Are Confusing (and the NYTimes Coverage Isn't Helping Any)

Catching up on some reading last night, I got a chance to re-read a NYTimes piece by Saul Hansell from this past Tuesday rather sensationally entitled "How Comcast Controls Sony's Internet TV Plans." When I scanned it on Tuesday before posting a link to it from VideoNuze, I had one of those "This makes absolutely no sense, I need to read this again closer" reactions. Now, upon re-reading it, I'm having one of those "This really makes no sense" reactions.

The piece - which initially concerns Sony's efforts to bring broadband video to TVs, but then veers off into a somewhat unrelated discussion of the company's negotiations with the cable industry's tru2Way and CableCard technologies - quotes Sony Electronics U.S. president Stan Glasgow as saying: "We've worked with the cable companies for five years to develop a system that would allow us and the rest of the television manufacturers to have alternative content on the TV."

Why would Sony devote five years to such an undertaking? Because, again in Mr. Glasgow's words, "If you have to ask a consumer to switch sources constantly between cable and another source, it is not the normal consumer experience...There has to be a more integrated way to have cable and Internet content on the same user interface."

I'm all for making things easy on the consumer, but let's get this right: Sony devoted five years to negotiating with the cable industry so it could avoid viewers having to push the "Source" or "Input" button on their remote controls to toggle to broadband-delivered content via Sony devices?

Hello? According to comScore's recent numbers, 142 million people in the U.S. alone watched 558 million hours of online video. But amid that massive adoption, Sony thinks it might be setting the bar too high for its potential buyers if it asked them to push a button on their remotes so that they could enjoy some of that video on their TVs instead of on their PCs?

Is it just me, or does it appear that Sony completely misjudged both its potential buyers' technical aptitude and also their strong motivation to consume broadband-delivered video on their TVs?

While you consider those questions, let's also go back to basics: why is once-mighty Sony even bothering to integrate its Internet-to-the-TV products with the cable industry in the first place? The whole point of these kinds of Internet-to-the-TV devices is to disrupt the cable (and satellite and telco) industry's hold on consumer viewing time and spending for in-home video programming. Countless companies (Netflix, Hulu, Microsoft/Xbox, Apple/AppleTV, Vudu, Netgear, Sezmi, 2Wire, Blockbuster, LG, Samsung, Neuros, etc.) get this fundamental point and are implicitly or explicitly driving toward this goal each day.

That Sony doesn't seem to understand this suggests that the correct title of Saul's piece really should have been "Comcast Benefits by Exploiting Sony's Misguided Internet TV Plans."

What's profoundly different about the broadband era is that neither Comcast nor any other incumbent controls how consumers get video on their TVs, just as neither the NYTimes nor any other single news provider has ever controlled how we've gotten our news. If would-be "over-the-top" competitors don't get this basic idea - and instead waste precious time and resources on perpetuating the traditional world order - then shame on them.

What do you think? Post a comment now.

Categories: Cable TV Operators, Devices

-

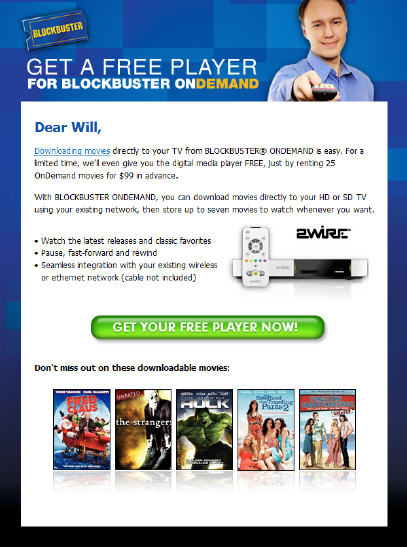

Blockbuster Online with New 2Wire MediaPoint Player Has a Tough Climb Ahead

Have you received the email pitch from Blockbuster Online yet, to rent 25 movies and get the new 2Wire MediaPoint Digital Media Player "free?" I've received a couple already this week (see below), and after reviewing the offer and its details, and comparing it to other alternatives, my conclusion is that the new service has a tough climb ahead.

The new 2Wire box itself is in the same general family as other single-purpose boxes such as AppleTV, Vudu and Netflix's Roku. There are some differences among them in hard drive size, pricing, outputs and streaming vs. downloading orientation. But they all serve the same basic purpose: connecting you via your home broadband connection to one source of "walled garden" premium-quality video content.

VideoNuze readers know I've been quite skeptical of the standalone box model, especially when box prices start in the $200-300 range. There's no question there's an upscale, early adopter audience that will buy in, but mainstream consumers will be uninterested for all kinds of reasons including: financial considerations (especially in this economy), resistance to connecting another box in already crowded consoles, perceived technical complexity, strong existing substitutes (e.g. cheap ubiquitous DVD players) and indistinct value propositions.

My judgment is based on a pretty simple set of criteria I rely on to gauge a new product or service's likelihood of success: Does it offer meaningful new value (some combination of better price, quality or speed) with minimal adoption effort required? Can a large target audience for this new value be clearly defined, served and acquired in an economically-reasonable manner? Is this new value attainable without sacrificing meaningful benefits of existing alternatives?

Miss on any one of these and the odds of success lengthen. Miss on any two and you're in long-shot territory. Miss on all three and you're dead on arrival. After evaluating the Blockbuster Online/MediaPoint current offer, my sense is that it misses on at least two and possibly all three.

Value: As explained below, for certain movies renters, the offer is valuable. It provides convenience at a relatively low financial commitment for the new device. But explaining these benefits just to the relevant target audience at an economic cost per acquisition is going to be nearly impossible. I'm dubious that even in-store promotions - which on the surface seem Blockbuster's strength - will work. First, there may be franchisee issues, as there were with previous "Total Access" promotions. And second, Blockbuster has closed so many stores in prime target neighborhoods - due to the rise of Netflix and other options eroding their business - that they'll be missing many prospects (example: in my upscale home town of Newton, MA there is not a single Blockbuster store left).

Audience: There's only one real target audience I can see for this offer, and it seems very narrow to me: low-volume renters of movies only, who are not iTunes users. Think about it - if you rent a lot of movies, you've likely been subscribing to Netflix for years (more so if you also rent TV shows). If you want to own your content instead of rent it, then you buy DVDs or maybe more recently have been buying digital version, most likely with iTunes primarily. If that's the case, then when it comes to watching on TV, you're going to buy an Apple TV (even then, few have done so to date), not a 2Wire MediaPoint. The eligible target audience left for Blockbuster/MediaPoint seems pretty slim.

Sacrificing existing benefits: Inevitably all digital distribution options need to be compared to the incumbent DVD format, which is remarkably strong (no wonder a billion units have been shipped to date). Against the DVD standard, Blockbuster/MediaPoint is inferior in a number of ways: limited viewing windows (the usual online limitations of 24 hour expiration after starting, and 30 day automatic file deletion), no portability to view rented movies on other TVs not connected to a MediaPoint, no TV shows available for rent, and at this point, smallish storage that only keeps up to 5 movies at a time.

Add it all up, and it's a pretty daunting set of issues. To be sure, much of this isn't specific to Blockbuster. To succeed, all new digital delivery options must be mindful of the above criteria as well.

What do you think? Post a comment now.

Categories: Aggregators, Devices

Topics: 2Wire, AppleTV, Blockbuster, Netflix, VUDU

-

5Min Unveils VideoSeed, a Clever Syndication Tool

5Min, one of the many well-funded entrants in the video-based how-to/knowledge space which I wrote about last Feb, has recently introduced VideoSeed, a clever syndication tool that has already helped drive its video to dozens of partner sites aggregating 110 million unique visitors per month. VideoSeed is another indicator that the Syndicated Video Economy is helping shape product development priorities throughout the broadband industry. I spoke to Ran Harnevo, 5Min's CEO/co-founder yesterday to learn more.

VideoSeed's goal is to give 5Min's partners relevant and complimentary video that can be easily inserted into

text-oriented pages with little-to-no editorial oversight. As Ran explained it, a partner signs up, specifies which pages it wants video inserted into, selects parameters of 5Min video it wants to allow and templates for how the video should appear. 5Min editors rank all of its videos 1-5 according to an internal quality scale while rigorously assigning metadata to each.

text-oriented pages with little-to-no editorial oversight. As Ran explained it, a partner signs up, specifies which pages it wants video inserted into, selects parameters of 5Min video it wants to allow and templates for how the video should appear. 5Min editors rank all of its videos 1-5 according to an internal quality scale while rigorously assigning metadata to each.VideoSeed semantically scans all of the partner-submitted pages and matches and inserts relevant 5Min video. (Examples can be seen at Answers.com and wikiHow) As new, relevant videos are added to 5Min, they automatically rotate into the partners' pages. Videos can be viewed on the site or through 5Min's "SmartPlayer" which has features like super slow motion, zooming, etc.)

5Min currently has a library of about 40K videos, of which Ran thinks 80% are sufficiently high quality to be of interest to partners. 5Min commissions some videos and aggregates others. Ran eschews terms like "premium" and "UGC" as they've found some of the best videos come from pure amateurs.

5Min sells ads across the syndication network, using its own team and third-party ad networks. It's using overlays and pre-rolls to date. Revenue is shared with the content providers and publishing partners. Advertisers benefit by reaching a targeted, engaged audience across dozens of sites while only having to make one buy decision.

Text-oriented how-to/knowledge-based sites and subject-driven specialty sites lend themselves perfectly to accepting complimentary syndicated video. But as Ran points out, shooting video, hosting/serving it and selling ads against it is a lot of effort for most text-oriented sites. This is especially true in a down economy when resources are tight. These factors have helped contribute to 5Min expanding its partner audience rapidly to 110 million uniques, with 2-3 new partners coming on board daily.

I could also see the VideoSeed technology being interesting in other categories (celebrity video comes immediately to mind), though for now Ran says 5Min's staying focused on knowledge, and also isn't looking to license VideoSeed externally. No doubt others will watch its progress and look to emulate it. But as Ran notes, to really succeed, they must first focus on assigning highly accurate metadata so the matching process works as intended and users truly get relevant, high quality video.

What do you think? Post a comment now.

Categories: Aggregators, Indie Video, Syndicated Video Economy

Topics: 5Min