-

Synacor and Grab Networks Partner to Increase TV Everywhere Content

Synacor, which provides technology that powers over 40 pay-TV operators' online portals and TV Everywhere initiatives, has partnered with Grab Networks, a syndicator of online video with over 200 different video publishers. With the deal, Synacor's customers will be able to augment their content lineups from Grab's verticals such as Food and Drink, Home and Family, Travel, Health and Relationships. In addition to being available online, Grab's content is also compatible with mobile devices running iOS and Android.

Categories: Cable TV Operators, Partnerships, Technology

Topics: Grab Networks, Synacor

-

Recapping All of the Product and Partnership News from ELEVATE

At the ELEVATE conference on Tuesday a number of our partners made product and partnership announcements which I mentioned were coming in a teaser last Friday. Each helps move the online video advertising market forward in different ways. A brief recap of each follows:

Categories: Advertising, Events, Technology

Topics: Adap.TV, AdoTube, Conviva, ELEVATE, EyeView, Grab Networks, Innovid, Ooyala, Panache, RAMP, Tremor Video, Undertone, YuMe

-

As Episodic Launches, How to Make Sense of the Crowded Video Platform Space?

Surely one of the most enduring questions I and others who watch the online video industry are asked (and in fact often ask ourselves) is: How can video management and publishing platform companies continue to launch, even as the space already seems so crowded?

Personally I've been hearing this question for at least 6 years, going back to when I consulted with Maven Networks, whose acquisition by Yahoo was one of the few industry exits (and likely the best from an

investor ROI perspective, regardless of the fact that it was shut down little more than a year later as part of Yahoo's retrenching. With yesterday's launch of Episodic and the recent launch of Unicorn Media, plus last week's $10M Series C round by Ooyala, it's timely to once again try to make sense of all the activity in the platform space.

investor ROI perspective, regardless of the fact that it was shut down little more than a year later as part of Yahoo's retrenching. With yesterday's launch of Episodic and the recent launch of Unicorn Media, plus last week's $10M Series C round by Ooyala, it's timely to once again try to make sense of all the activity in the platform space. The best explanation I offer traces from my Econ 101 class: supply is expanding to meet demand. Over the past 10 years, there has been an enormous surge of interest in publishing online video by an incredible diversity of content providers. Importantly, interest by content providers has intensified in the last few years. I can vividly recall 2003 and 2004, trying to explain to leading content providers why online video was an important initiative to pursue. Still, their projects were often experimental and non-revenue producing. Contrast this with today, where every media company on earth now recognizes online video as a strategic priority.

But even as online video's prioritization has grown, many media companies don't have all the strategic technology building blocks in place. In fact, many continue to use home-brewed technology developed a while back. The range of video features needed continues to grow and evolve rapidly. Consider how requirements have expanded recently: live, as well as on-demand video; long-form programs as well as clips; paid, as well as ad-supported business models; mobile, as well broadband distribution; multiple bit rate, as well as single stream encoding; in-depth analytics as well as top-line metrics; widespread syndication as well as destination-site publishing; off-site, as well as on-site ad management. The list goes on and on.

As media company interest has grown, technology executives and investors have taken note. Venture capital firms continue to see online video as a high-growth industry (even if the revenue model for content providers is still developing, as are many of the platforms' own revenue models), with significant macro trends (e.g. changing consumer behavior, proliferation of devices, improved video quality, etc.) as fueling customer interest. Another important factor for platforms is rapidly declining development costs. As Noam Lovinsky, CEO of Episodic told me last week, open source and other development tools has made it cheaper than ever to enter the market with a solid product. With ever lower capital needs, a new video platform entrant that can grab its fair share of the market has the potential to produce an attractive ROI.

Of course all the noise in the platform space means media executives need to do their homework more rigorously than ever. I'm a strong believer that the only way to really understand how a video platform works, how well-supported it is and how well-matched it is to the content provider's needs is to vigorously test drive it. Hands-on use reveals how comprehensive a platform really is, or how comfortable its work flow is, or how well its APIs work. While I get a lot of exposure to the various platforms through the demos I experience and the questions I ask, I'll readily concede this is not the same as actually living with a platform day-in and day-out.

Another complicating factor is that while there are some companies purely focused on video management and publishing, there are many others who offer some of these features, while positioning themselves in adjacent or larger markets. When I add these companies in, then the list of participants that most often hits my radar would include thePlatform, Brightcove, Ooyala, Twistage, Digitalsmiths, Delve, KickApps, VMIX, Grab Networks, ExtendMedia, Cisco EOS, Irdeto, KIT Digital, Kaltura, blip.tv, Magnify.net, Fliqz, Gotuit, Move Networks, Multicast Media, WorldNow, Kyte, Endavo, Joost, Unicorn Media and Episodic (apologies to anyone I forgot). Again though, this list combines apples and oranges; some of these companies are direct competitors, some are partners with each other, some have a degree of overlap and so on.

There's a long list of platforms to choose from, yet I suspect the list will only get longer as online and mobile video continues to grow and mature. At the end of the day, who survives and succeeds will depend on having the best products, pricing the most attractively and actually winning profitable business.

What do you think? Post a comment now.

Categories: Technology

Topics: Brightcove, Cisco EOS, Delve, Digitalsmiths, ExtendMedia, Grab Networks, Irdeto, KickApps, Ooyala, thePlatform, Twistage, VMIX

-

Video Companies Raised $64M in Q2 '09, Notching Another Stellar Quarter

In Q2 '09, 9 broadband and mobile video-oriented companies raised at least $64M, notching another stellar quarter. Here's what I tracked for the quarter (if I missed anything, please drop me a note). I've identified when new investors participated:

- TubeMogul (3M) 4/1 - Trinity Ventures

- ScanScout ($5.1M) 4/13

- FreeWheel ($12M) 4/30 - Foundation Capital

- Azuki Systems ($6M) 5/5

- EveryZing ($8.25M) 5/11 - Peacock Equity

- Grab Networks ($12M) 6/2

- beeTV ($8M) 6/3 - Innogest

-

YuMe ($2.9M) 6/12

-

Nokeena Networks ($6.5M) 6/25 - Mayfield

(Note that I've included beeTV, which offers a cross-platform TV recommendation system, so isn't a pure broadband or mobile video company. On the other hand, one might argue that Sugar's $16M round should also be included, since the company simultaneously announced the acquisition of video-oriented Shopflick.com and launch of Sugar Digital Entertainment. However, I haven't counted it since Sugar's more of a pure blog network.)

Excluding Sugar, the $64M comes on the heels of approximately $75M raised in Q1 '09 and over $80M raised in Q4 '08. That means over the last 3 quarters - arguably the heart of the current recession - at least 26 companies have raised a total of $219M. To be sure, everyone I've spoken to has told me these rounds have been hard work to raise, but these companies' successes demonstrate the appeal of the broadband video sector to investors and their anticipation for continued rapid growth.

One thing worth noting is that of the 26 companies, not a single one is a video producer itself, or even an aggregator of video. There has been a significant shift in investor sentiment away from content and towards the platforms and tools required to power video. While that's lamentable, it's also completely understandable. The bruising advertising environment, combined with ongoing business model uncertainty and the death of certain independent producers (e.g. 60Frames, Ripe Digital, etc.) has frozen new content investments. Aggregators aren't faring much better. Just today it was reported that Joost CEO Mike Volpi is stepping aside, as the company tries to relaunch itself as a technology provider. Veoh also restructured during the quarter, shedding half its staff and replacing CEO Steve Mitgang (in addition, just yesterday a VideoNuze reader emailed me saying he can't seem to find a working phone number for the company).

Couple all this with the rise of Hulu, the dominance of YouTube, the entry of cable operators and networks with TV Everywhere, and it's clear that on the content side at least, incumbents and earlier market entrants are ascendant, while more recent entrants and startups are having a tough time surviving the downturn. I anticipate this will continue to be the trend, at least until the economy rebounds.

What do you think? Post a comment now.

Categories: Deals & Financings

Topics: Azuki, beeTV, EveryZing, FreeWheel, Grab Networks, Nokeena, ScanScout, TubeMogul, YuMe

-

Digitalsmiths Launches VideoSense 2.0 Including New "Free Form" Video Search Capability

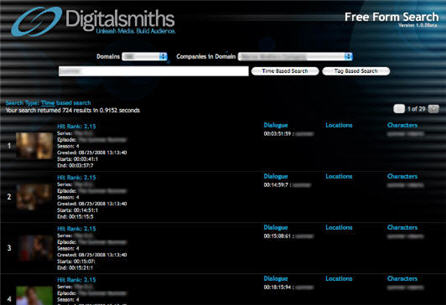

This morning Digitalsmiths, a leading video platform company, is launching VideoSense 2.0, a suite of content management, publishing, presentation and search products. In particular, the new release includes an innovative "free form" video search box that leverages Digitalsmiths' metadata creation capability. Last week I spoke to Ben Weinberger, Digitalsmiths' CEO to learn more.

A key Digitalsmiths' strength has always been its metadata tools, which use a broader, proprietary set of algorithms such as facial recognition, scene classification and object identification. With this release the metadata tags are being organized into what Digitalsmiths' calls a "MetaFrame" - a frame-by--frame analysis of the video file(s) that are all based on time stamps. A MetaFrame in turn enables more accurate video search, content organization and monetization both within a video and across a library of videos.

With respect to video search specifically, Ben explained that VideoSense's search technology matches the submitted term against a video library to return results based on criteria like names, locations, dialogue, objects within a scene or other criteria the content owner specifies. The content owner can also tweak the rules so that specific criteria receive higher weighting. Results are typically returned in half a second or less, providing a video search experience close to what we've come to expect in web search. There's also a "Did you mean?" prompt for more refined results. The free form search box can be integrated onto any web page via an API.

The below example shows the results of a search Ben ran in the demo against a customer's library (unfortunately blurriness is added here due to customer confidentiality).

Of course the more valuable the experience is, the more video is likely to be consumed, generating more streams and ad inventory. Ads too can gain better targeting through MetaFrame processing (and VideoSense is integrated with all the major video ad servers and networks). Deeper, richer search can also power B2B use of video clips, such as when a specific scene from one video is to be incorporated into another (think of a movie like "Forest Gump" that has myriad historical scenes interspersed).

From my perspective metadata is going to become more and more important as the sheer number of videos available explodes with both long-form and derivative short clips. Content owners' key challenge will be to manage these ever-larger libraries (Ben uses the notion of "metadata as the glue" holding libraries together; I think that's an apt description). Others like EveryZing, Grab Networks and Gotuit have also recognized the importance of metadata and have their own approaches. For Digitalsmiths, a differentiator is its focus on extremely large files and its focus on studio customers. It aims to function as a full-blown video platform provider for all forms of digital distribution.

Ben said Digitalsmiths has a slew of customers it will be unveiling in the coming weeks that are using MetaFrame and the VideoSense 2.0 suite.

What do you think? Post a comment now.

(Note Digitalsmiths is a VideoNuze sponsor)

Categories: Technology

Topics: Digitalsmiths, EveryZing, Gotuit, Grab Networks

-

Video Syndication Webinar Today

Today at 1:30pm EDT / 10:30am PDT, I'll be participating in a free webinar, "Demystifying Online Video Syndication." Video syndication continues to be one of the key trends in the online video market. I'll be sharing thoughts on where syndication is heading and where the main opportunities and challenges lie. We have over 500 people registered and it promises to be an exciting and educational session.

The webinar is sponsored by Grab Networks, whose co-president Marcien Jenckes will present information about its grabMediaOS solution that enables a "Create Once, Publish Anywhere" business model. Grab works with hundreds of content providers and is one of the primary players in driving the video syndication market.

If you're trying to understand the syndication opportunity and identify the right solutions to fit your needs, this webinar is for you!

Categories: Events

Topics: Grab Networks

-

June 24th Webinar on Online Video Syndication

Next Wednesday, June 24th at 1:30pm EDT / 10:30am PDT, I'll be presenting in a free webinar, "Demystifying Online Video Syndication." Video syndication continues to be one of the key trends in the online video market. I'll be sharing thoughts on where syndication is heading and where the main opportunities and challenges lie.

I've been writing about the emergence of the "syndicated video economy" for over a year now and during this time syndication has continued to grow in importance for all video content producers and technology providers.

The webinar is sponsored by Grab Networks, whose co-president Marcien Jenckes will present information about its grabMediaOS solution that enables a "Create Once, Publish Anywhere" business model. Grab works with hundreds of content providers and is one of the primary players in driving the video syndication market.

We have 260+ people registered for the webinar already, but there's plenty of room left. If you're trying to understand the syndication opportunity and identify the right solutions to fit your needs, this webinar is for you!

Categories: Events, Syndicated Video Economy

Topics: Events, Grab Networks, Webinar

-

June 24th Webinar on Video Syndication

Please join me on Wednesday June 24th at 1:30pm EDT / 10:30am PDT for a free webinar, "Demystifying Online Video Syndication." As VideoNuze readers know, I've been writing about the emergence of the "syndicated video economy" for over a year now. During this time syndication has continued to grow in importance for all video content producers and technology providers. I hear almost daily about how strategic syndication has become for reaching fragmented online audiences.

I'll be sharing updated trends and data on video syndication, as well as thoughts on where the market is heading. The webinar is sponsored by Grab Networks, whose co-president Marcien Jenckes will provide information on its grabMediaOS solution that enables a "Create Once, Publish Anywhere" business model. Grab was formed from the Fall '08 merger of Anystream and Voxant and it recently announced a $12M financing. Grab works with hundreds of content providers and is one of the key players in driving the video syndication market.

If you're trying to understand the syndication opportunity and identify the right solutions to fit your needs, this webinar is for you!

Categories: Events, Syndicated Video Economy

Topics: Grab Networks

-

Grab Networks Raises $12M

Grab Networks has announced a new $12M round of debt and equity financing from existing investors Softbank Capital, SCP Capital, Longworth Venture Partners and Court Square Partners. Horizon Technology Finance led the venture debt piece.

I've written about Grab (formed from the merger of Anystream and Voxant) several times on VideoNuze, and have been impressed with the demos I've seen of their new hosted solution which includes, among other things, auto-generated clips, metadata creation/management and syndication. For now the foundation of the business is still Anystream's traditional licensed transcoding product, but the new end-to-end solution pushes the company far beyond this base, into what I've called the "syndicated video economy." Among others, local broadcasters are a key target market.

This round continues the financing momentum that broadband video companies have experienced despite the financial meltdown. In Q1 '09, industry companies raised over $80M, which came on top of another $80M or so in the Fall '08. Skittish investors are clearly still optimistic about broadband's potential.

(Note, at the end of June I'll be participating in a webinar Grab Networks in organizing about video syndication. More details to come shortly.)

What do you think? Post a comment now.

Categories: Deals & Financings, Technology

Topics: Grab Networks

-

Grab Networks, Syndicaster, Others Offering Local TV Stations Opportunity to Reinvent Themselves

Last Friday, in "Broadcasters in Transition at NAB Show. But to What?" I painted a pretty downbeat picture of local broadcast TV stations' prospects in the broadband era. Coincidentally this week I had briefings with Syndicaster and Grab Networks, two companies offering technology solutions that could set local stations on the path to reinventing themselves and capitalizing on the Syndicated Video Economy.

Though quite different in the scale and scope of their product offerings, Syndicaster and Grab share a common starting point: local stations need to learn how to better leverage and distribute their video content into the broadband ecosystem. Doing so means local stations must have the right tools to ingest, prepare, distribute, track and monetize their content - all steps that go far beyond their traditional and well-understood broadcast work flows.

For its part, Syndicaster capitalizes on its parent company's (Critical Media) position of capturing and digitizing hundreds of local stations' broadcast signals. Syndicaster providers a web interface to transcripts

of each on-air segment, which an editor is then able to easily edit into clips, generate metadata and distribute online. The process is very straightforward, and in the demo I saw, clips from various stations already using Syndicaster were being added in real-time.

of each on-air segment, which an editor is then able to easily edit into clips, generate metadata and distribute online. The process is very straightforward, and in the demo I saw, clips from various stations already using Syndicaster were being added in real-time. More recently Syndicaster has added the ability to upload video directly from the field to further compress the time required to get video up online. It has also integrated with Brightcove, YouTube, Yahoo and others for one click 3rd party syndication. It plans for user-captured video to be incorporated into the video catalog and a widget distribution model. Yesterday the company announced Journal Interactive is using the platform, along with other customers Bloomberg Television, LIN TV and Bonneville.

Separately, Grab Networks, a company that was formed from the merger of Anystream and Voxant last Fall has in the last 60 days begun taking the wraps off its integrated solution, with plans for a formal announcement later this quarter.

Grab too, begins with multiple ingestion options. But a key difference is that Grab auto-generates clips from

the video feeds, assigning metadata to them and indexing them for editorial review or straight publication. This process, which Anystream has been working on for a long while, uses its own algorithms to analyze 40 different "tracks" of information about the video (e.g. speech-to-text, scene detection, facial recognition, close captioning, etc.). It then statistically distills the information gathered to generate the clips, metadata and index.

the video feeds, assigning metadata to them and indexing them for editorial review or straight publication. This process, which Anystream has been working on for a long while, uses its own algorithms to analyze 40 different "tracks" of information about the video (e.g. speech-to-text, scene detection, facial recognition, close captioning, etc.). It then statistically distills the information gathered to generate the clips, metadata and index. Grab believes this core proprietary process is the heart of its value proposition and persuading broadcasters of its efficacy has been a key part of its early sales efforts. Grab executives explained that many customers are initially skeptical that all of this can be done by without human intervention, but upon seeing the results have become believers. (I only saw a limited demo, but it looked pretty darn good). Recognizing that some producers will want to refine clips further, Grab offers an editing module. It's important to understand this process doesn't just make publishing clips more efficient, it also creates more inherent value in each clip as the greater intelligence each clip now has enhances its discovery and monetization potential.

Beyond clip generation, Grab's solution encompasses capabilities that many other companies offer as their primary business (transcoding, video CMS and player, ad insertion, DRM and rights control, pre-integrated syndication to multiple 3rd party distributors, etc.) And via the Voxant deal, Grab also offers a large (Feb comScore rank #26, 6M uniques) built-in syndication network for broadcasters to distribute into and obtain rights-cleared content from. Grab's executives said its comprehensive approach is a response to customers' requests for all-in-one solutions.

Grab is in trials with 5 large station groups and anticipates announcing its first deal for the solution in the next 30 days (remember though that Anystream is building off a core transcoding business that has 700+ customers). Beyond local broadcasters, Grab thinks it will be appealing to other media segments like newspapers, cable networks, magazines, etc. - basically anyone that needs a full solution to power their video efforts ("an operating system for the syndicated video economy" as Grab CEO Fred Singer puts it)

A bold vision indeed. But for local stations ready to acknowledge the urgency of their situations, quite possibly a technology lifeline.

What do you think? Post a comment now.

Categories: Broadcasters, Technology

Topics: Critical Media, Grab Networks, Syndicaster

-

Pixsy Premium Feed is Latest Entrant in the Syndicated Video Economy

Pixsy, a white label video search provider made an interesting announcement yesterday about the launch of its new "Premium Feed" service, which I think is another example of the Syndicated Video Economy that I've been talking about for a while now. I talked to Pixsy CEO Chase Norlin about Premium Feed to learn more.

For those of you not familiar with Pixsy, it has been quietly building one of the largest video indexes since its founding in 2005. To date it has mainly focused on licensing the index to partner sites which wanted to offer easy video discovery to their users. As more content providers have offered embedding, Pixsy also enabled found videos to be played right on its partners' sites. Even though activity has grown well, Chase is pretty candid about monetization to date being difficult.

Premium Feed takes embedding to the next level by creating a subset of Pixsy's video index that is both higher-than-average quality and has accompanying pre-roll and overlay ads. Then Pixsy is developing an economic relationship between the content provider and its publisher network by signing redistribution and revenue-sharing deals with both. Chase says that to date the publisher network has 45 million unique visitors/mo and that 1-2 million videos are in the Premium Feed.

One of those publishers is EgoTV, and I chatted with founder/president Jimmy Hutcheson to find out how they're implementing Premium Feed. If you look in the lower right corner of their home page you'll see 3 new "channels," Ego Cars, Ego Comedy and Ego Travel. Each of these are constructed solely of Pixsy Premium Feed videos that are curated by an EgoTV editor. In another example at Ego People, the 300x250 ad in the right column is now populated with the Premium Feed. This is a simple "highest-and-best-use" real estate decision: Jimmy explained that Premium Feed is yielding 2-4x as much net revenue for EgoTV as it would receive if it sold rich media ads in this position.

The concept of bundling content with ads (or vice versa?) and distributing them to sites seeking video and extra monetization is of course at the heart of the syndicated video economy. Much of what Pixsy is doing with Premium Feed is conceptually familiar to Google Content Network, Adconion TV, Voxant (now Grab Networks), Syndicaster, Jambo, Magnify.net, 1Cast and others.

Yet each of these initiatives has its own somewhat differentiated value proposition and underlying technology approach. As syndication grows in importance, sites with strong traffic and an interest in incorporating video will have many choices. As to how they'll decide, Chase makes a good point: simplicity and one-stop shopping are always valued by resource-constrained sites. Providers that can address as many of these sites' potential needs will be in a strong position.

What do you think? Post a comment now.

Categories: Advertising, Syndicated Video Economy, Video Search

Topics: 1Cast, Adconion, EgoTV, Google Content Network, Grab Networks, Jambo, Magnify.net, Pixsy, Syndicaster, Voxant

-

Adconion.TV: Trying to Do Google Content Network One Better

I've been very intrigued by two recent announcements from Adconion, which bills itself as the largest independent online advertising network.

First, in early October, it announced "AMG-TV," a video content syndication network now called "Adconion.TV" as well as its first deal, to distribute Vuguru's "Back on Topps." Then last week it acquired KTV Digital Media, a production studio and syndicator, to become a wholly-owned subsidiary called RedLever. Late last week I got a briefing from Adconion CEO/founder Tyler Moebius and Reeve Collins, CEO RedLever to learn more.

My take is that Adconion.TV/RedLever is emulating the same model as Google Content Network, except with a couple of interesting twists (for more on GCN, see "Google Content Network Has Lots of Potential, Implications"). Nevertheless, both are classic Syndicated Video Economy plays, which could have a huge impact on the fundamentals of broadband video's future business model.

For those not familiar with Adconion, it says it reaches 260M unique visitors/month, second only to Google.

Traffic is about evenly split between the U.S. and the rest of the world. It has 800+ publishers in its network, including 60-70 that it represents exclusively, primarily for international sales. The company made a big splash earlier this year when it raised a monster $80M round led by Index Ventures (the lead investor in Skype among others). It has grown from 30 employees in '06 to 285 in '08.

Traffic is about evenly split between the U.S. and the rest of the world. It has 800+ publishers in its network, including 60-70 that it represents exclusively, primarily for international sales. The company made a big splash earlier this year when it raised a monster $80M round led by Index Ventures (the lead investor in Skype among others). It has grown from 30 employees in '06 to 285 in '08. The similarities between Adconion.TV and GCN are as follows: both believe their vast network of publisher web sites - which were initially built to serve ads - can now be modified to also accept high-quality syndicated video content. Each leverages the same algorithms it used to optimize which ads to insert, so that video too will only be served to the most appropriate sites. One might think of both these companies as being in the real estate business. Each has colonized vast tracts of web property and is now trying to identify, as real estate pros would say, the "highest and best use" of its inventory: ads, video or some combination of the two.

At the core of both Adconion.TV and GCN is the conviction that content should be brought to users wherever they may live, as opposed to attempting to drive them to a destination site, a la the "must-see TV" model of old. This has been a key tenet of the Syndicated Video Economy concept I've been fleshing out in '08. With the fragmentation of users over the web, social networks, mobile devices, gaming consoles, etc. the way to build a franchise is to propagate video into all of the web's nooks and crannies. Note others like Grab Networks, Syndicaster, 1Cast, Jambo and others are also heavily pursuing the syndication opportunity, each with their own competitive angle.

In both initiatives content-distribution-brand advertising are the three legs of the business model stool. Consider: in Adconion.TV's launch deal it was a package of Vuguru/Back On Topps (content) - Adconion.TV (distribution) and Skype (brand), while GCN's was Seth MacFarlane/Cavalcade of Comedy (content) - GCN (distribution) - Burger King (brand). I asked Tyler whether this three-legged stool is the model for independent broadband content (whose nascent studios have been slammed by the down economy) to be funded in the future, he emphatically replied "yes."

This highlights one key difference between GCN and Adconion.TV. Google of course has been very clear in steering away from content creation, consistently declaring it's "not a content company." Adconion, on the other hand, specifically intends to custom produce brand-infused broadband video programming. That's where the KTV acquisition comes in. Tyler explained that it is deep into talks with numerous agencies and brands about creating programs that showcase the brand sponsors. Two deals are expected to be announced soon.

Another difference is that GCN tried to drive traffic back to YouTube to incent users to subscribe to ongoing program updates and get exposed to other related programs. In my GCN post, I wrote enthusiastically that the marriage of AdSense-powered video distribution as the "spokes" with YouTube as the "hub" was formidable because it gives GCN a mechanism to build ongoing viewership beyond the first exposure at the publisher site.

Today Adconion lacks a comparable destination site. Tyler doesn't think that's important since it offers ways to subscribe, get email alerts and share within the player itself. Plus he's not hearing demand for it from brands. Still I think as this story unfolds and Adconion.TV finds itself competing with GCN for the highest-potential content, a destination site compliment will become essential. Should it agree, an acquisition would make sense to fill this hole (Metacafe? DailyMotion?).

For now though, Adconion has an aggressive plan to build Adconion.TV as an exciting new entry on the Syndicated Video Economy landscape. With its resources, reach and new production capabilities, this is clearly one to keep an eye on.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Syndicated Video Economy

Topics: 1Cast, Adconion, Google, Google Content Network, Grab Networks, KTV Digital Media, Syndicaster, YouTube

Posts for 'Grab Networks'

|