-

6 Reasons Why the Disney-YouTube Deal Matters

Late yesterday's announcement that Disney-ABC and ESPN would launch a number of ad-supported channels focused on short-form content was yet another meaningful step in broadband video's maturation process. Here are 6 reasons why I think the deal matters:

1. It validates YouTube as a must-have promotional and distribution partner

For many content providers it's long since become standard practice to distribute clips, and often full-length content, on YouTube. Yet aside from CBS, no broadcast TV network has seriously leveraged YouTube.

That's been a key missed opportunity, as YouTube is simply too big to ignore. It's not just that YouTube notched 100M unique viewers in Feb. '09 according to comScore, it's that the site has achieved dramatically more market share momentum over the past 2 years than anyone else, increasing from 16.2% of all streams to 41% of all streams.

That's been a key missed opportunity, as YouTube is simply too big to ignore. It's not just that YouTube notched 100M unique viewers in Feb. '09 according to comScore, it's that the site has achieved dramatically more market share momentum over the past 2 years than anyone else, increasing from 16.2% of all streams to 41% of all streams. Increasingly, YouTube is not the 800 pound gorilla of the broadband video market; it's the 8,000 pound gorilla. Disney has acknowledged what has long been tacitly understood - as a video content provider, it's impossible to succeed fully without a YouTube relationship.

2. It creates a path for full-length Disney-ABC programming to appear on YouTube and elsewhere

While this deal only contemplates short-form video, and more than likely, mostly promotional clips, it almost certainly creates a path for full-length episodes to appear as well, as the partners build trust in each other and learn how to monetize. Full-length content is most likely to come from ABC, not ESPN (the release

pointedly states no long-form content from ESPN's linear networks is included) as part of a newly expanded distribution approach.

pointedly states no long-form content from ESPN's linear networks is included) as part of a newly expanded distribution approach.For YouTube, which has been aggressively evolving from its UGC roots in its quest to generate revenues, the current clip deal alone is a big win; gaining distribution rights to full-length programs would be an even more significant step. Underscoring YouTube's flexibility, the current deal allows ESPN's player to be embedded, and for Disney-ABC to retain ad sales. YouTube's reported redesign, which places more emphasis on premium content, is yet another way it is getting its house in order for premium content deals.

3. It opens up a new opportunity for original short-form video to flourish

When you think about broadcast TV networks and studios, you immediately think of conventional long-form content. Yet all of these companies have been producing short-form content that either augments their broadcast programs, or is originally produced for broadband, as Disney's own Stage 9 is pursuing. The levels of success of this content have been all over the board.

With YouTube as a formal partner, Disney can aggressively leverage it as its primary distribution platform, gaining more direct access to this vast audience. Facing unremitting market pressures on many fronts, broadcast TV networks themselves need to reinvent their business models. Short-form original content married to strong distribution from YouTube would be a whole new strategic opportunity.

4. It puts pressure on Hulu and other aggregators

It's hard not to see YouTube's gain as Hulu's - and other aggregators' - loss. For sure nothing's exclusive here, and as PaidContent has reported, discussions about Disney distributing full-length programs on Hulu (as well as YouTube) are also underway. But the Disney deal underscores something important that differentiates YouTube from Hulu: YouTube is both a massive promotional vehicle and a potential long-form distributor, while Hulu is really only the latter.

YouTube's benefit derives from its first-mover status. Hulu has done a tremendous job building traffic and credibility in its short life, but it is still distant to YouTube in terms of reach. I continue to believe it is far easier for YouTube to evolve from its UGC roots to become also become a premium outlet than it is for Hulu - or anyone else - to ever compete with YouTube's reach.

5. It raises threat warning to incumbent service providers by another notch

It's also hard not to see the Disney deal moving YouTube's threat level to incumbent video service providers (cable/satellite/telco) up another notch. We discussed YouTube's importance to these companies at the Broadband Video Leadership Evening 2 weeks ago (video here), and I thought the panelists generally did not give YouTube much credit as it deserves.

I continue to believe that of all the various "over-the-top" threats to the current world-order, YouTube is the most meaningful ad-supported one. It has massive audience, a potent monetization engine in Google's AdWords, and with the Disney deal, increased credibility with premium content providers. Especially for younger audiences, the YouTube brand means a lot more than any incumbent service provider's. If I were at Comcast, Verizon or DirecTV, I'd be keeping very close tabs on YouTube's evolution.

6. It exposes the absurdity of the ongoing Viacom-Google litigation

Two weeks ago at the Media Summit I listened to Viacom CEO Philippe Dauman describe the status of his company's $1 billion lawsuit against Google and YouTube. As he talked of mounds of data and reams of documentation being collected and reviewed, I found myself slumping in my chair, thinking about how well all the lawyers involved in the case must be doing, and yet how pointless it all seems.

The old adage "2 wrongs don't make a right" fits this situation perfectly. There is no question that in the past YouTube was lax about enforcing copyright protection on its site and cavalier about how it responded publicly to the concerns of rights-holders. But it has made much progress with its Content ID system and a good faith effort to become a trusted partner. All of this is evidenced by the fact that Disney wouldn't even be talking to YouTube, much less cutting a deal, if it didn't view YouTube as reformed. While the media world is moving on, adapting itself to the new rules of video creation, promotion and distribution, Viacom continues to waste resources and executive attention pursuing this case. To be sure, Viacom has been plenty active on the digital front, but it is long overdue that these companies figure out how to resolve their differences and instead focus on how to work together to generate profits for themselves, not their lawyers.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Partnerships, UGC

Topics: Disney, ESPN, Google, Viacom, YouTube

-

Viacom - Google/YouTube Litigation Moves Into Slippery Territory

If you were off the grid last week celebrating the July 4th holiday, there were some important fireworks in the ongoing Viacom - Google/YouTube litigation well worth paying attention to.

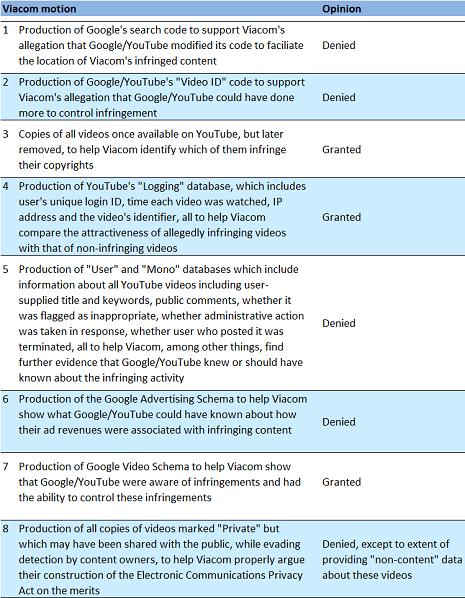

Judge Louis Stanton of the US District Court in New York, who is presiding over the litigation, handed down an opinion that granted and denied some of what each party was requesting. The opinion is here. I have read it and below is my synopsis (remember I'm not a lawyer):

The fourth item is the one that has gained the most attention and controversy. Privacy advocates are ballistic that this is a violation of users' privacy rights. Specifically they have cited Judge Stanton's characterization of Google/YouTube's objection to this particular Viacom request on the basis of privacy concerns as "speculative." A cottage industry of ridicule has broken out across the blogosphere regarding whether the 80 year-old Judge Stanton is sufficiently tech literate to grasp online privacy concerns. Many believe Viacom will use the data to sue individual users for viewing pirated copies of Viacom's programs on YouTube.

Like everyone else, I'm concerned about privacy here as well and recognize that Judge Stanton has moved this case into some very slippery territory. Yet, at a higher level, I'm feeling some resentment toward Google and YouTube, especially given its famous "do no evil" mantra. There is no question that they knew pirated versions of key Viacom (and other) programs were showing up on YouTube, yet at the time months went by without them candidly addressing the issue and doing something sufficiently proactive about it. To many, including me, the standoff then was (and continues to be) a high-stakes battle between two multi-billion dollar companies jockeying for negotiating leverage.

When we use various web sites (whether for broadband or other uses), there is an implicit and explicit understanding that our privacy will not be trifled with. Sites have a right to defend their business practices based on their interpretation of the existing laws, but they need to be balanced by what impact their actions may ultimately have for their users. Each of us has our own interpretation of whether Google/YouTube should have done more to protect Viacom's and others' copyrights, but as Judge Stanton's decision shows, to what extent YouTube's users' privacy is protected is now entirely up to his interpretation.

What do you think? Post a comment and let everyone know!

Categories: Cable Networks, Video Sharing

Topics: Google, Viacom, YouTube

-

Hulu Out-Executing Comcast in On-Demand Programming?

The crew over at Hulu must be gleefully fist-bumping each other this week as Hulu scored a key strategic and public relations coup in adding to its lineup two of Comedy Central's most popular programs, "The Daily Show with Jon Stewart" and "The Colbert Report." Though officially positioned as a test, Hulu still deserves big-time kudos as the deal is an endorsement of its value proposition.

The deal and Hulu's execution illustrate a larger point that I've been making for a while: one of broadband's three key disruptions is that it enables new aggregators to gain an edge on larger incumbents by changing the dynamics of competition. To be more specific, in this case, I think that Hulu has out-executed Comcast, America's #1 cable operator by delivering new value to consumers and gaining important PR momentum. Here's why:

Fancast, which is Comcast's online portal (in beta), actually announced a deal with Comedy Central back on May 19th for access to these same programs and others. Yet go to Fancast and search for "Daily Show" and, as shown below, you won't find any Daily Show full episodes available, just an assortment of short clips and times when it's on TV. A Comcast spokesperson told me that Comcast's implementation is imminent, but its delay in getting the programs up and running is accentuated when you consider that Comedy Central must have done its distribution deal with Fancast BEFORE its deal with Hulu.

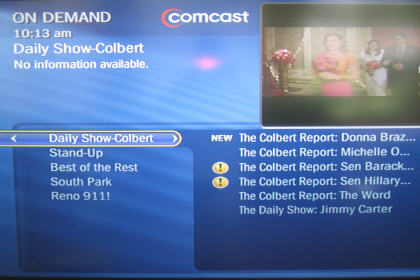

Second, and more concerning is that, as a Comcast digital subscriber, when I tried to find The Daily Show and Colbert in Comcast's VOD menu, all that is available are five older Colbert clips and 1 older Daily Show clip. My guess is these haven't been updated in a while. No full-length Daily Show or Colbert programs are available at all in VOD.

While the Comcast spokesperson told me that the company works closely with its programming partners like Viacom to figure out the optimal mix of programming to make available on VOD, I think an unavoidable conclusion here is that Comcast (and other cable operators) is constrained by its inability to monetize VOD programming with advertising (what this week's "Project Canoe" is meant to address) and to easily add new programming on the VOD menu. These programming gaps create opportunities for upstarts like Hulu to capitalize on.

It may be unfair to zero in so narrowly on Comcast's execution with Daily Show/Colbert, yet things weren't much different when I searched for MTV's popular "The Hills" on Hulu, Fancast and Comcast's VOD. While Hulu doesn't appear to have a deal for full episodes of "The Hills" it masks this cleverly by providing thumbail images and easy navigation back to MTV's site where the video lives, for over 50 episodes (this is tactic Hulu uses for ABC's shows as well). On the other hand, Fancast displays just 5 full episodes, 2 from this season and 3 from last. And on VOD there are also just 5 episodes, though all from this season.

I think it's pretty significant that Hulu, a site that only went live 3 months ago can not only gain access to hit Comedy Central programs like Daily Show/Colbert, but can execute quickly. Hulu is using its advantages - flexible technologies, interactive features (clipping, embedding, sharing), monetization capability, savvy PR and startup pluck to compete with far-larger incumbents like Comcast.

Of course Comcast racks up billions of VOD views each year and has vast resources, making it an important player in on-demand programming. Yet Hulu has managed to make Comcast's advantages look a little less intimidating. I asked the Comcast spokesperson about this. She acknowledged Hulu's progress, but maintained that Comcast believes its mulit-platform approach is stronger.

In the big picture that's true, but when it comes to winning consumers' hearts and minds, it's often execution, not broad strategy that carries the day. And don't forget, when Hulu is unshackled from the PC - with its content freely riding Comcast's broadband pipes all the way to the TV - execution will matter even more.

This week Hulu provided a textbook example of how broadband-only aggregators can gain a foothold against well-established incumbents. Comcast and other incumbents should be taking notice and getting their game on.

What do think? Post a comment and let everyone know!

Categories: Advertising, Aggregators, Cable Networks, Cable TV Operators

Topics: Comcast, Comedy Central, Fancast, Hulu, The Colbert Report, The Daily Show, Viacom

-

Disney/ABC's Stage 9 Launches, With YouTube

Disney/ABC Television Group's official announcement this morning of Stage 9 Digital Media, an experimental new media content studio, is another key milestone in the fast-moving broadband video industry.

I got a short briefing about Stage 9 late yesterday from Disney/ABC because it asked me to provide some analyst context to the LA Times' Dawn Chmielewski, who's done a great piece here. Stage 9 is Disney/ABC's key initiative to reach the coveted 18-34 audience in synch with this audience's unique media consumption patterns. Programming will be short, funny, well-produced, episodic, and widely distributed through popular broadband sites, social networks, mobile and download services.

I interpret Disney/ABC's move, when coupled with recent initiatives by other big media companies into original broadband video production, as further evidence of two key trends: that broadband video has come of age as a key priority for the largest media companies and that it is impossible to appeal to today's younger audiences simply by hewing to the traditional rules of the media game.

Also of significance is that Disney/ABC announced that "Squeegees," which is Stage 9's first release, will be co-exclusively premiered on ABC.com and YouTube starting today and sponsored by Toyota. Yes, you read that right. YouTube! The scruffy user-generated phenom that big media was threatening to sue out existence not so long ago, and which of course is now owned by Google, big media's most anxiety-inducing "frenemy," has been elevated to launch partner status for Stage 9's first program.

The "Squeegees" co-premiere is quite an accomplishment for YouTube. It shows that YouTube's methodical efforts to gain legitimacy (and a business model!) by establishing partner channels with media companies are beginning to pay off. David Eun, Google's VP of Content Partnerships has repeatedly explained this game plan to me, and others over the last year. The Stage 9 launch partnership should certainly be regarded as a major win for the young company. It is also another data point I'd use to support my contention that in the broadband age, traditional conceptions about copyright monetization need to be radically re-thought (Viacom, are you listening?).

I'm enthusiastic about the Stage 9 initiative, as I believe it holds lots of potential for Disney/ABC. It gives the company inroads to the elusive 18-34 set, offers the prospect of innumerable and invaluable insights about how to effectively program in the broadband age, provides a whole new internal breeding ground for developing new on-air programming (a possible double win, as this might help fix the broken and expensive traditional pilot process, though my enthusiasm on this point is tempered by news today of Quarterlife's NBC ratings fiasco) and creates new and exciting multi-platform sponsorship opportunities.

In short, the strategy is sound and the upside significant. Now for the hard part: Stage 9 needs to execute and actually deliver on all this potential.

What do you think? Post a comment now!

Categories: Broadcasters, Indie Video, UGC

Topics: ABC, Disney, Stage 9, Toyota, Viacom, YouTube

-

MTV Networks Dips Toe Into Syndication Waters

I was very happy to see news today of MTVN striking a big video syndication deal for its multiple networks' content with AOL Video.

Recently I praised Comedy Central's launch of TheDailyShow.com, but I took it to task for what appeared to be a destination-centric strategy, which was further supported by some executives' remarks. In this age of syndication, I thought that was a wrong-headed approach. Coupled with Viacom's misguided lawsuit against Google/YouTube, it felt like further evidence that MTVN was falling out of step with key broadband opportunities.

Today's news shows renewed hope that this may not be the case. I know these deals don't get done in a day, but I'd really like to see more syndication momentum from MTVN (and other content providers for that matter) to spread its content far and wide. Broadband Internet users don't expect to have to go to destination sites to get their favorite videos, they want them accessible where they already frequently visit. Hulu and CBS, to name two content providers that are solidly focused on syndication understand this, as do many others.

Categories: Cable Networks, Partnerships, Portals

Topics: AOL, CBS, Google, Hulu, MTVN, TheDailyShow.com, Viacom, YouTube

-

Dailyshow.com: Third-Party Distribution Isn't an Either/Or Decision

First things first, congrats to the folks at MTVN, Comedy Central and The Daily Show. The newly unveiled Dailyshow.com is fabulous. It is the best TV program-centric web site I have yet seen. As a long-time Jon Stewart fan, being able to see all the old clips is nirvana, and will no doubt send fans over the moon.

First things first, congrats to the folks at MTVN, Comedy Central and The Daily Show. The newly unveiled Dailyshow.com is fabulous. It is the best TV program-centric web site I have yet seen. As a long-time Jon Stewart fan, being able to see all the old clips is nirvana, and will no doubt send fans over the moon.However, a bigger picture question that Dailyshow.com's launch raises is how these direct-to-consumer initiatives work vis-a-vis third-party distribution deals. With media companies newly empowered to engage directly with their audiences using the Internet and broadband, many analysts have predicted the result will be diminishing relevance of third-party aggregators, including everyone from Comcast to Yahoo to Joost to you name 'em.

It's pretty apparent that MTVN/Comedy Central is coming down on the side of heavily emphasizing direct-to-consumer as its broadband video strategy when you combine Viacom's ongoing lawsuit against Google/YouTube, MTVN EVP Erik Flannigan's comment ("People should be reacting to 'The Daily Show' on its own site...God bless them for doing it everywhere else, but this should be the epicenter of it") and a company spokesman's comment ("that a few selected clips could become available on sites through syndication deals").

Count me among those who think this is both the wrong approach and one that will ultimately under-optimize the value of the Daily Show and other franchises in the broadband era. Quite simply, building out a strong direct-to-consumer presence like Dailyshow.com is NOT an either/or decision relative to also developing strong third-party distribution relationships.

In fact, the reality is that strong third-party distribution is essential in the Internet era, because Internet usage is both highly distributed among millions of web sites and also concentrated at a few large portals. Media companies' goal should be to proliferate their content (under the right deals of course) into all the nooks and crannies of the Internet while also striking deals with big portals to maximize exposure, usage and ad revenue.

But don't think distributors get a free ride in the Internet era. They need to prove they can leverage their audience devotion and traffic to drive value for content providers. Those that do will succeed. Proof of this is already emerging. One senior broadband executive recently told me that over 80% of his traffic comes from YouTube and other distribution partners, with his own site's traffic in the minority.

Not aggressively pursuing third-party distribution, as it appears is MTVN's plan, in essence requires that users reorient their behavior to come solely to one uber destination site like Dailyshow.com. To me this smacks of classic traditional media thinking where consumer convenience or preference gets short shrift in the name of what's supposedly "best" for the brand. My guess is if you asked Jon Stewart off the record what his preference is, he'd likely say, "make my stuff available everywhere!"

So kudos to the folks behind Dailyshow.com. But don't let your good works end now. Go out and find the best third-party distributors you can and let them help you extend the Daily Show franchise even further.

Categories: Cable Networks, Portals

Topics: Comedy Central, Daily Show, Google, Jon Stewart, MTVN, Viacom, YouTube

-

The Only Topic Anyone I Talked to This Week Cared About

Was of course Viacom's $1 billion suit against Google. I must say, all eyes are riveted on this one. My take is that it's hard to believe there isn't a business deal to be made between these two companies that wouldn't be better for both than having the lawyers slugging it out.

Sure YouTube traffic is up since pulling down many of the Viacom clips, but really what does that prove except that YouTube's rapid growth rate can compensate for these kinds of hiccups? For YouTube to maintain its position as the ultimate video destination, it can't afford to have gaps in its clips springing up here and there. So it should be motivated to make a deal, not just with Viacom, but with all big media companies.

As for Viacom, it's inconceivable to me that they are better off not being a part of YouTube. Exhibit A is the free promotion and exposure The Daily Show has received over the last year from YouTube. Viacom's going to have to lock a muzzle on Jon Stewart to prevent him from lambasting his corporate parent's decision.

None of us knows how courts will interpret the DMCA in this case. The legal scholars' comments I've followed this week certainly don't form a consensus. So I continue to believe, as I wrote about last November ("Big Media's Most Vexing Challenge"), that big media companies' traditional copyright control mentalities are causing them to underoptimize their broadband opportunities. The sooner they loosen their traditional copyright approaches, the sooner they'll be able to fully exploit broadband's potential.

Categories: Broadcasters, UGC

Topics: Daily Show, DMCA, Google, Viacom, YouTube

-

Dvorak and I in Agreement on Copyright Control

John Dvorak has a good post at MarketWatch regarding Viacom's take down notice to YouTube. Although he's harsher than I've been in the past ("The company is just clueless about new media"), his general point that this is a control issue is similar to what I said back in November in "Big Media's Most Vexing Challenge".Big media companies need to adjust their copyright control mindsets if they're going to exploit the power of new broadband distribution models. Distinguishing between use of their content that drives new promotion and awareness vs. use of their content that undermines their business models is the key. Just lumping everything into the latter category shows both paranoia and lack of understanding of how the market is shifting.Categories: Broadcasters, Cable Networks, UGC

-

Viacom-YouTube. The Gloves are Coming Off

Well not quite yet, as the lawsuits are not yet flying. But we're getting there. After some flip-flopping on this last fall, today Viacom officially told YouTube to take down its clips, reputed to number over 100,000. Obviously you'd need to be involved in these negotiations to know the details of what the offers and counter-offers have been, but it's a disappointment for both parties not to be able to work things out.

As I wrote back in November, "Big Media's Most Vexing Challenge (and How to Overcome It)", companies like Viacom are going through a painful adjustment process to the new broadband-dominated world. This flare-up with YouTube is yet another example.

Categories: Cable Networks, UGC

Topics: Google, Viacom, YouTube

Posts for 'Viacom'

Previous |