-

Taking a Holiday Break

I'm heading out of the country for a 10 day family vacation starting tonight. I'll be online sporadically and will post a few times next week if there's something interesting happening. Otherwise, I'll be back in the saddle on Mon, July 13th, refreshed and recharged. I suspect many of you will also be taking advantage of the July 4th holiday to take some time off. Enjoy!

Categories: Miscellaneous

-

VideoNuze Report Podcast #23 - July 2, 2009

Below is the 23rd edition of the VideoNuze Report podcast, for July 2, 2009.

This week Daisy shares additional information about ESPN's Ad Lab for emerging media. The Ad Lab, which was first disclosed by ESPN last year, is intended to various ad formats in the ESPN video player. It is one of many different tests and research projects in the market. As Daisy and I say, everyone's trying to learn how best to monetize the nascent online video; this creates a lot of valuable data, which market participants then need to parse through to fully understand.

I get into further details on my post yesterday, "Video Companies Raised $64M in Q2 '09, Notching Another Stellar Quarter." Despite the recession and the slowdown in venture capital investments, at least 26 industry companies have raised at least $219M over the last 3 quarters, which is impressive by any measure. Still, it hasn't been easy, and one indicator of what investors prefer is that not one of the 26 investments is in a content provider or video aggregator.

Click here to listen to the podcast (14 minutes, 24 seconds)

(Note, with vacations planned, our next podcast will be July 24th)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Cable Networks, Deals & Financings

-

4 Industry Items from this Week Worth Noting - 7-2-09

Clearleap announces Atlantic Broadband as first public customer - Clearleap, the Internet-based technology firm I wrote about here, announced Atlantic Broadband as its first public customer. Atlantic is the 15th largest cable operator in the U.S. I spoke with David Isenberg, Atlantic's VP of Products, who explained that Clearleap was the first packaged solution he's seen that allows broadband video to be inserted into VOD menus without the need for IT resources to be involved. Atlantic initially plans to use Clearleap to insert locally-oriented videos into its local programming lineup. It also has special events planned like "Operation Mail Call." which allows veterans' families to upload videos, plus coverage of local sports, and eventually filtered UGC. By blending broadband with VOD, Isenberg thinks Clearleap gives him a "giant marketing tool" to raise VOD's visibility. As I've said in the past, VOD and broadband are close cousins which can be mutually reinforcing; Clearleap facilitates this relationship.

New Balance's "Made in USA" video - Have you seen the new 3 minute video from athletic shoemaker New Balance? Yesterday I noticed a skyscraper ad for it at NYTimes.com and a full back-page ad in the print version of the Boston Globe. New Balance's video promotes the fact that it's the only athletic shoemaker still manufacturing in the U.S. (though it says only 25% of its shoes are made here). There's also a fundraising contest to win a trip to one of its manufacturing facilities. Taking ads in online and offline media to drive viewership of a brand's original video is another way that advertising is being reimagined and customers are being engaged.

Joost - R.I.P.-in-Waiting - There's been a lot written this week about Joost's decision to switch business models from content aggregation to white label video platform provider. Regrettably, I think this is Joost's last gasp and they are in "R.I.P.-in-waiting" mode. Joost, which started off with lots of buzz and financing ($45M) by the co-founders of Skype and Kazaa, is a cautionary tale of how quickly the broadband video market is moving, and how those out of step can get shoved aside. Joost made a critical strategic blunder insisting on a client download based on P2P delivery when the market was already moving solidly in the direction of browser-based streaming. It never recovered. Given how crowded the video platform space is, I'm hard-pressed to see how Joost will carve out a substantial role.

Cablevision wins its network DVR case - Not to be missed this week was the U.S. Supreme Court's decision to refuse to hear an appeal from programmers regarding cable operator Cablevision's "network DVR" plan. The decision means Cablevision can now deploy a service that allows subscribers to record programs in a central data center, rather than in their set-top boxes. This leads to lower capex, fewer truckrolls, and more storage capacity for consumers. There's also an intersection point with "TV Everywhere," as cable subscribers will potentially have yet another remote viewing option available to them. Content is increasingly becoming untethered to any specific box.

Categories: Aggregators, Brand Marketing, Cable TV Operators, DVR, Technology, Video On Demand

Topics: Atlantic Broadband, Cablevision, Clearleap, Joost, New Balance

-

Video Companies Raised $64M in Q2 '09, Notching Another Stellar Quarter

In Q2 '09, 9 broadband and mobile video-oriented companies raised at least $64M, notching another stellar quarter. Here's what I tracked for the quarter (if I missed anything, please drop me a note). I've identified when new investors participated:

- TubeMogul (3M) 4/1 - Trinity Ventures

- ScanScout ($5.1M) 4/13

- FreeWheel ($12M) 4/30 - Foundation Capital

- Azuki Systems ($6M) 5/5

- EveryZing ($8.25M) 5/11 - Peacock Equity

- Grab Networks ($12M) 6/2

- beeTV ($8M) 6/3 - Innogest

-

YuMe ($2.9M) 6/12

-

Nokeena Networks ($6.5M) 6/25 - Mayfield

(Note that I've included beeTV, which offers a cross-platform TV recommendation system, so isn't a pure broadband or mobile video company. On the other hand, one might argue that Sugar's $16M round should also be included, since the company simultaneously announced the acquisition of video-oriented Shopflick.com and launch of Sugar Digital Entertainment. However, I haven't counted it since Sugar's more of a pure blog network.)

Excluding Sugar, the $64M comes on the heels of approximately $75M raised in Q1 '09 and over $80M raised in Q4 '08. That means over the last 3 quarters - arguably the heart of the current recession - at least 26 companies have raised a total of $219M. To be sure, everyone I've spoken to has told me these rounds have been hard work to raise, but these companies' successes demonstrate the appeal of the broadband video sector to investors and their anticipation for continued rapid growth.

One thing worth noting is that of the 26 companies, not a single one is a video producer itself, or even an aggregator of video. There has been a significant shift in investor sentiment away from content and towards the platforms and tools required to power video. While that's lamentable, it's also completely understandable. The bruising advertising environment, combined with ongoing business model uncertainty and the death of certain independent producers (e.g. 60Frames, Ripe Digital, etc.) has frozen new content investments. Aggregators aren't faring much better. Just today it was reported that Joost CEO Mike Volpi is stepping aside, as the company tries to relaunch itself as a technology provider. Veoh also restructured during the quarter, shedding half its staff and replacing CEO Steve Mitgang (in addition, just yesterday a VideoNuze reader emailed me saying he can't seem to find a working phone number for the company).

Couple all this with the rise of Hulu, the dominance of YouTube, the entry of cable operators and networks with TV Everywhere, and it's clear that on the content side at least, incumbents and earlier market entrants are ascendant, while more recent entrants and startups are having a tough time surviving the downturn. I anticipate this will continue to be the trend, at least until the economy rebounds.

What do you think? Post a comment now.

Categories: Deals & Financings

Topics: Azuki, beeTV, EveryZing, FreeWheel, Grab Networks, Nokeena, ScanScout, TubeMogul, YuMe

-

Rhett and Link Are Another Example of YouTube's Franchise Value

If you haven't heard of Rhett and Link, you need to check them out to understand another of the myriad ways that video is being democratized, advertising is being reimagined and value is being built in YouTube. My wife brought Rhett and Link to my attention after hearing a report about them on National Public Radio last night.

Rhett and Link are two engineers and lifelong friends who operate out of a North Carolina basement writing and performing short comedic songs. Emboldened by family and friends they've created over 200 videos that have generated 16 million views and a loyal following on YouTube and their own site rhettandlink.com. No doubt you'll agree their songs and videos are funny, clever and very memorable.

Calling themselves "internetainers" and having generated a signature style, they are now being contracted by advertisers to turn their talent toward developing promotion songs. Their folk song drive-through order for Taco Bell has generated almost 1 million views on YouTube. And their hilarious spot for Red House furniture store in Highpoint, NC, which spoofs race relations, has generated almost 1.5 million views. There will certainly be more of these promotional songs in the hopper. That's because given what these advertisers are probably paying for these spots, their ROIs must be off the charts, especially compared to traditional advertising tactics. And with Rhett and Link's following, all new promotional songs now have a built in viral tailwind.

Rhett and Link remind me of Lee and Sachi LeFever of Common Craft, who I recently wrote about. They are all part of an emerging group of talent who would be considered "non-professionals" by the traditional standards of entertainment, advertising and communications. But with their own authentic and engaging approaches and direct access to audiences, they have been able to break through and attract large followings.

A key linchpin to all of their success is YouTube, whose massive audience and viral sharing is unmatched. Even as it strives for partnerships with premium quality video providers, YouTube's value to the Common Crafts and Rhett and Links of the world is undeniable. If leveraged properly, as it has been by these creators (and by others like Demand Media), it can also lead to genuine businesses opportunities.

When I repeatedly say that YouTube has massive franchise value - even though it is currently unprofitable - it's these kinds of examples, which put YouTube in the center of an emerging grassroots video ecosystem, that I'm thinking of. There's no other site that comes close to YouTube's reach, brand awareness or viral sharing potential.

If you have other examples along these lines, please send them along!

What do you think? Post a comment now.

Categories: Advertising, Indie Video

Topics: Common Craft, Rhett and Link, YouTube

-

R.I.P. Maven Networks

Well, it looks as though it's official: as reported by TechCrunch and others, Yahoo is discontinuing Maven Networks's third party video publishing activities though Yahoo's statement says it will use Maven technology for internal video efforts. As I've mentioned periodically, I was an early consultant to Maven, which was a pioneer in the video platform space.

Way back then (!) in 2003 most people in the media business still had a difficult time imagining why broadband video was so strategic and game-changing. Maven's team did a lot of the early spadework in evangelizing broadband's potential and building market momentum. Its reward was being acquired for $160M by Yahoo in February, 2008 in what I believe is still the largest pure play broadband deal.

However, the Yahoo acquisition was never a perfect strategic fit, even before factoring in the well-documented chaotic mess that Yahoo has become in recent years. The problem was that Yahoo is a media company, deriving the majority of its revenue from advertising. On the other hand, Maven was a technology/products company (though some in the industry always questioned the true proprietary value of Maven's technology). The most strategic deal for Maven would have been with a larger technology/products company, where it would have become part of broader suite of video products and services. Yahoo was never really well-suited to support Maven's third party video customers (and in reality it hasn't for a while now), and with all its other troubles, this move was widely expected.

For Maven's founders and investors, the company's acquisition marked a successful exit that others in the industry envy, particularly in this crummy M&A market. Still, the Yahoo-Maven deal is yet another example that when selling a company, price isn't the sole criteria for longer-term success.

Categories: Deals & Financings, Portals, Technology

-

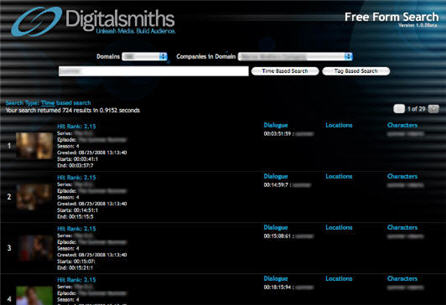

Digitalsmiths Launches VideoSense 2.0 Including New "Free Form" Video Search Capability

This morning Digitalsmiths, a leading video platform company, is launching VideoSense 2.0, a suite of content management, publishing, presentation and search products. In particular, the new release includes an innovative "free form" video search box that leverages Digitalsmiths' metadata creation capability. Last week I spoke to Ben Weinberger, Digitalsmiths' CEO to learn more.

A key Digitalsmiths' strength has always been its metadata tools, which use a broader, proprietary set of algorithms such as facial recognition, scene classification and object identification. With this release the metadata tags are being organized into what Digitalsmiths' calls a "MetaFrame" - a frame-by--frame analysis of the video file(s) that are all based on time stamps. A MetaFrame in turn enables more accurate video search, content organization and monetization both within a video and across a library of videos.

With respect to video search specifically, Ben explained that VideoSense's search technology matches the submitted term against a video library to return results based on criteria like names, locations, dialogue, objects within a scene or other criteria the content owner specifies. The content owner can also tweak the rules so that specific criteria receive higher weighting. Results are typically returned in half a second or less, providing a video search experience close to what we've come to expect in web search. There's also a "Did you mean?" prompt for more refined results. The free form search box can be integrated onto any web page via an API.

The below example shows the results of a search Ben ran in the demo against a customer's library (unfortunately blurriness is added here due to customer confidentiality).

Of course the more valuable the experience is, the more video is likely to be consumed, generating more streams and ad inventory. Ads too can gain better targeting through MetaFrame processing (and VideoSense is integrated with all the major video ad servers and networks). Deeper, richer search can also power B2B use of video clips, such as when a specific scene from one video is to be incorporated into another (think of a movie like "Forest Gump" that has myriad historical scenes interspersed).

From my perspective metadata is going to become more and more important as the sheer number of videos available explodes with both long-form and derivative short clips. Content owners' key challenge will be to manage these ever-larger libraries (Ben uses the notion of "metadata as the glue" holding libraries together; I think that's an apt description). Others like EveryZing, Grab Networks and Gotuit have also recognized the importance of metadata and have their own approaches. For Digitalsmiths, a differentiator is its focus on extremely large files and its focus on studio customers. It aims to function as a full-blown video platform provider for all forms of digital distribution.

Ben said Digitalsmiths has a slew of customers it will be unveiling in the coming weeks that are using MetaFrame and the VideoSense 2.0 suite.

What do you think? Post a comment now.

(Note Digitalsmiths is a VideoNuze sponsor)

Categories: Technology

Topics: Digitalsmiths, EveryZing, Gotuit, Grab Networks

-

4 Industry Items from this Week Worth Noting

YouTube mobile video uploads exploding; iPhones are a key contributor - The folks at YouTube revealed that in the last 6 months, uploads from mobile phones to YouTube have jumped 1,700%, while in the last week, since the new iPhone GS was released, uploads increased by 400% per day. I didn't have access to these stats when I wrote on Monday "iPhone 3GS Poised to Drive User-Generated Mobile Video," but I was glad to see some validation. The iPhone 3GS - and other smartphone devices - will further solidify YouTube as the world's central video hub. I stirred some controversy last week with my "Does It Actually Matter How Much Money YouTube is Losing?" post, yet I think the mobile video upload explosion reinforces the power of the YouTube franchise. Google will figure out how to monetize this over time; meanwhile YouTube's pervasiveness in society continues to grow.

Nielsen study debunks mythology around teens' media usage - Nielsen released a new report this week "How Teens Use Media" which tries to correct misperceptions about teens' use of online and offline media. The report is available here. On the one hand, the report underscores prior research from Nielsen, but on the other it reveals some surprising data. For example, more than a quarter of teens read a daily newspaper? Also, 77% of teens use just one form of media at one time (note, data from 2007)? I'm not questioning the Nielsen numbers, but they do seem out of synch with everything I hear from parents of teens.

Paid business models resurfacing - There's been a lot of talk from media executives about the revival of paid business models in the wake of the recession's ad spending slowdown and also the newspaper industry's financial calamity. For those who have been offering their content for free for so long, putting the genie back in the bottle is going to be tough. Conversely for others, like those in the cable TV industry, who have resisted releasing much content for free, their durable paid models now look even more attractive.

Broadcast TV networks diverge on strategy - Ad Age had a good piece this week on the divergence of strategy between NBC and CBS. The former is breaking industry norms by putting Leno on at 10pm, emphasizing cable and avidly pursuing new technologies. Meanwhile CBS is focused on traditional broadcast network objectives like launching hit shows and amassing audience (though to be fair it is pursuing online distribution as well with TV.com). Both strategies make sense in the context of their respective ratings' situations. Regardless, broadcasters need to eventually figure out how to successfully transition to online distribution, something that is still unproven (as I wrote here).

Categories: Aggregators, Broadcasters, Mobile Video, UGC

Topics: Apple, CBS, iPhone, NBC, Nielsen, YouTube