-

Seeking Your Ideas for VideoNuze Topics

A quick note to mention that I'm always eager to hear your ideas for subjects for VideoNuze posts and analyses.

As a reminder, from an editorial standpoint, VideoNuze is all about broadband-delivered video. That's a lot of ground to cover given the amount of activity in the market, and I do my best to select what I believe will be most compelling to you. But there's no "editorial board" here at VideoNuze, so I look to the community of VideoNuze readers to give me their input. Either post a comment here or drop me an email at wrichmondATvideonuze.com.

Thanks!

Categories: Miscellaneous

Topics: VideoNuze

-

EgoTV, Clearspring Show How Widgets Successfully Distribute Video

"Widgets" are an area that VideoNuze hasn't really touched on to date, yet they are quickly proving to be a potent way of distributing content in general and video in particular. I was pleased to get an email recently from Jimmy Hutcheson, president and founder of EgoTV, a broadband content startup, who wanted to share some details on their success distributing their "Malibu U" program through Clearspring's widget platform. In a subsequent call with Jimmy and Bill Rubacky, who leads Clearspring's marketing, I got a better handle on how the model works.

For those of you not familiar with widgets, they are small chunks of HTML code that essentially create a container into which content can be continuously pushed. Widgets have gained widespread popularity with the rise of web 2.0 social networking sites like Facebook and MySpace, as users can select different widgets for embedding in their personal pages. This allows both the user and visitors to easily view content there. A user can also embed widgets in personal content sites using PageFlakes, iGoogle or others, or can use widgets right on their desktop.

Content providers view widgets as a low-cost opportunity to dynamically distribute content to opted-in audiences. Similarly, advertisers look at widget advertising as an opportunity to reach targeted, engaged audiences.

As an example, EgoTV is now distributing "Malibu U," through Clearspring's widget and its site. Getting the widget is simple, you just click on it, find the social media platform to which you want to embed the widget and go. Jimmy explained that about 50,000-75,000 unique visitors/day can now see his widget. He's able to track video traffic across all places the widget is embedded and when he pushes a new episode, users are automatically notified. I put the widget on my rudimentary Facebook page and this is how it looks:

From an advertising standpoint, you'll notice in the upper right corner a little peel-back flap, which is one of the ways that Clearspring implements advertising. (In fact, VideoEgg's new AdFrames approach unveiled yesterday uses a similar peel-back, which in turn links to Clearspring's widget sharing capability.) Widget ads can work in all kinds of ways, including banners, pre/mid/post-rolls and overlays.

Clearspring's play is to create a "Widget Ad Network" by aggregating the content flowing through its widgets. With 4 billion pieces of content served through its widgets each month and working with many of the top 100 publishers, Bill explained that it is able to offer targeted inventory to media buyers who want to tap into the web 2.0 world.

In short, widget platforms from companies like Clearspring provide both large content providers and smaller ones like EgoTV yet another way of reaching and engaging their fragmented audiences on their terms. I fully expect more content companies, especially early stage ones looking to gain an audience toehold, to take advantage of this low-cost distribution option. Widgets will take their place as yet another distribution choice in the rapidly-evolving "syndicated video economy."

Categories: Indie Video, Technology, Video Sharing

Topics: Clearspring, EgoTV, Facebook

-

Join Me in LA for Syndicated Video Economy Panel Discussion

I'll be moderating an exciting panel at the NATPE LATV Festival's Digital Day on July 30th entitled, "The Syndicated Video Economy: Expanding Broadband's Reach" with a great group of panelists including:

Greg Clayman, Executive VP, Digital Distribution and Business Development, MTV Networks

Mike Hudack, Co-Founder, President and CEO, Blip.tv

Jonathan Leess, President and General Manager, Digital Media Group, CBS Television Stations

Brian Shin, Founder and CEO, Visible Measures

These companies are all leaders in building out the "Syndicated Video Economy" which I introduced back in March. It's a very cool space and I expect a lot more activity going forward. Please join us in LA for a stimulating panel discussion and overall event!

Categories: Events, Syndicated Video Economy

Topics: LATV Festival, NATPE

-

Ritz-Carlton's Short Films: Sleek, But Successful?

A recent marketing campaign from Ritz-Carlton and American Express featuring three short original online films serves as a reminder to brands - and others - that even great content needs strong promotion for it to fully succeed. Let me explain.

Back in Nov '07, a long WSJ article entitled, "Ritz-Carlton Web Films Play Down its Ritzy Image" caught my eye. The article provided the backstory of the famed luxury hotelier Ritz-Carlton's innovative marketing gambit to pitch its brand to younger guests with three 10 minute films from hot young director Shyam Madiraju. The films were especially noteworthy because they portrayed younger guests in somewhat risque situations a clear break from Ritz's staid tradition.

At the time I remember thinking broadband was well-suited to Ritz's challenge; broadband would allow Ritz to go well beyond what it could convey in 30 second TV spots, not to mention print ads. By gaining such prominent coverage in the WSJ, the campaign was off to a very good start. (Whoever Ritz's PR firm was, they more than earned their keep that day!)

I made a mental note to keep an eye out for promotions for the films. Yet months passed and I never saw any. While I'll readily concede I may have missed them, if I was looking for them and didn't see them, that suggests a pretty low likelihood that people who weren't on the lookout saw them. The WSJ article had indicated that the films would be promoted on Yahoo, MSN, YouTube, all sites I frequent, yet I never saw any promotions there. I also expected email notifications, given that I've stayed at Ritz locations and they no doubt had my email address (and if they didn't, Marriott, which owns Ritz, and where I've stayed repeatedly, certainly does). In addition, I've been an Amex cardholder for years and I get promotions from them all the time.

I finally received my first email a couple of weeks ago with the subject line "The Ritz-Carlton Films presents 'Heads or Tails' and Exclusive Offers." This was the third of the three short films, which debuted on June 1st. I clicked through watched it (and the previous two) and thought they were all expertly done. They were sleek and provocative, luxuriously set at Ritz properties and subtly incorporated the Amex card in each. I found a few nits (e.g. why no full screen option?), but from the standpoint of conveying a hipper image while not alienating traditional guests, I think the films all hit the mark.

So from a content perspective, it looks like Ritz succeeded. My concern is whether a lot of people were exposed to the campaign and actually saw the films. I don't have the data to back this up, but my "experience of one" suggests that Ritz's promotional efforts were under-powered. I'm not that surprised; given this is new territory for brands as they essentially try to figure out how to "market a marketing campaign."

My advice is for brands to heed what Hollywood learned a long time ago: even great films and TV programs need great marketing to match (a recent example is the marketing blitz AMC is putting behind the premiere of "Mad Men" for its upcoming second season). As brands like Ritz create their own films and branded entertainment experiences, they need to remember that producing compelling content is just the starting point of accomplishing their marketing objectives.

What do you think? Post a comment now!

Categories: Brand Marketing

Topics: AMC, American Express, Marriott, Ritz-Carlton

-

Metacafe's New Wikicafe Refines Metadata Process

Metacafe, the short-form video aggregator with 30 million monthly visitors, has unveiled a new feature called "Wikicafe" which addresses the daunting and ongoing problem of how to find exactly the video you're looking for and gain high-quality recommendations.

Now in beta and available to its registered users only, Wikicafe is philisophically similar to Wikipedia, which involves users in building the knowledge base around specific content. Similarly, Wikicafe's goal is to involve users in continually refining the metadata for specific videos. This in turn will yield improved search and discovery for subsequent users.

Wikicafe is an intriguing spin on video search which I have discussed a number of times. Last week I spoke to Eyal Hertzog, Metacafe's co-founder and now chief creative officer, who's leading the charge on Wikicafe. This was the first briefing Metacafe has given on the new Wikicafe feature.

Eyal notes that there are really two ways to tackle content navigation. One is through super-sophisticated algorithms and distributed hardware, an approach epitomized by Google. The other is community-based collaboration, an approach epitomized by Wikipedia. He is biased toward the latter because he believes that the likelihood that the original metadata assigned by the video's creator (and even subsequent metadata that may be produced by technology-based approaches) will never be as accurate as that which is produced by other humans with specific domain knowledge.

Thus the idea behind Wikicafe: if given the right tools, Metacafe's users will create and maintain the most accurate metadata for Metacafe's vast collection of videos. It's a classic "wisdom of crowds" approach. Of course, it also requires that users act appropriately or things could spin out of control very quickly.

Wikicafe is very straightforward to use. Once logged in, you simply click on "Editing Options" in the upper right corner of each video. Then you can start editing the video's title, tags, description and then save your changes. You can track your changes (and those that others add), be notified about subsequent changes and start a discussion about your changes. You can even translate your changes into other languages. As Eyal explains it, this "collaborative taxonomy" allows redirection between related terms ("PS3" and "Playstation3"), clarifies ambiguous words, resolves hierarchical terms and connects different languages.

In a sense, Wikicafe is a natural evolution for Metacafe, which has always emphasized community involvement in filtering which content gets added and promoted on the site. With a group of active, passionate users and Wikipedia as a model, it seems likely that Wikicafe will gain traction in the community.

What then becomes especially intriguing is the potential for carrying the Wikicafe approach outside of Metacafe's borders for the larger universe of broadband video. Could users eventually become an augment or even replacement to top-down driven video guides, the norm in today's cable and satellite offerings? It's an interesting vision to contemplate. First let's see how Wikicafe evolves in the Metacafe community.

What do you think? Post a comment now!

Categories: Aggregators, Technology, Video Search

Topics: Google, MetaCafe, Wikipedia

-

Viacom - Google/YouTube Litigation Moves Into Slippery Territory

If you were off the grid last week celebrating the July 4th holiday, there were some important fireworks in the ongoing Viacom - Google/YouTube litigation well worth paying attention to.

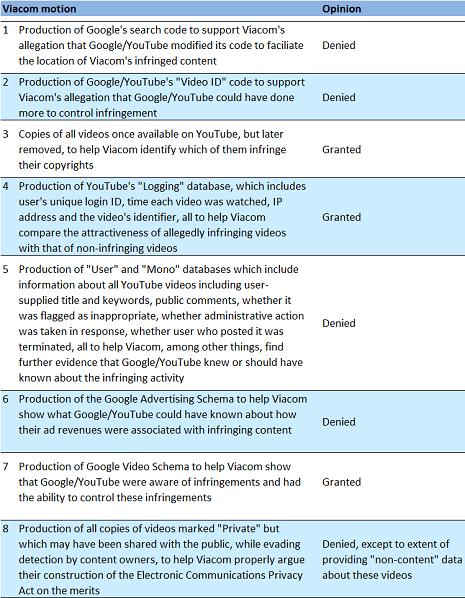

Judge Louis Stanton of the US District Court in New York, who is presiding over the litigation, handed down an opinion that granted and denied some of what each party was requesting. The opinion is here. I have read it and below is my synopsis (remember I'm not a lawyer):

The fourth item is the one that has gained the most attention and controversy. Privacy advocates are ballistic that this is a violation of users' privacy rights. Specifically they have cited Judge Stanton's characterization of Google/YouTube's objection to this particular Viacom request on the basis of privacy concerns as "speculative." A cottage industry of ridicule has broken out across the blogosphere regarding whether the 80 year-old Judge Stanton is sufficiently tech literate to grasp online privacy concerns. Many believe Viacom will use the data to sue individual users for viewing pirated copies of Viacom's programs on YouTube.

Like everyone else, I'm concerned about privacy here as well and recognize that Judge Stanton has moved this case into some very slippery territory. Yet, at a higher level, I'm feeling some resentment toward Google and YouTube, especially given its famous "do no evil" mantra. There is no question that they knew pirated versions of key Viacom (and other) programs were showing up on YouTube, yet at the time months went by without them candidly addressing the issue and doing something sufficiently proactive about it. To many, including me, the standoff then was (and continues to be) a high-stakes battle between two multi-billion dollar companies jockeying for negotiating leverage.

When we use various web sites (whether for broadband or other uses), there is an implicit and explicit understanding that our privacy will not be trifled with. Sites have a right to defend their business practices based on their interpretation of the existing laws, but they need to be balanced by what impact their actions may ultimately have for their users. Each of us has our own interpretation of whether Google/YouTube should have done more to protect Viacom's and others' copyrights, but as Judge Stanton's decision shows, to what extent YouTube's users' privacy is protected is now entirely up to his interpretation.

What do you think? Post a comment and let everyone know!

Categories: Cable Networks, Video Sharing

Topics: Google, Viacom, YouTube

-

Happy July 4th

I'm giving the keyboard a rest for a few days to celebrate the long July 4th weekend. I'll see you on Monday, July 7th. Enjoy!

Categories: Miscellaneous

-

Ralph Lauren's Broadband Mini-Site Supports Brand, Drives Sales

Ralph Lauren is the latest brand to harness broadband video as part of its marketing mix.

I discovered the company's lush "Sports of Summer" mini-site after noticing the same rich media skyscraper ad in the NYTimes.com's Wimbledon coverage. Clicking through brings you to the Lauren mini-site, which highlights 4 sports that Lauren is sponsoring this summer: Wimbledon, The Olympics, the US Open (tennis) and the Black Watch polo team. On closer inspection, I noticed that the mini-site has actually just become the main part of the regular Lauren web site.

The structure of the mini-site is consistent across the four sports with each containing both video and text/photo content. At the bottom are three panels offering a rotating choice of content, which when clicked play in the large center section of the page. The content includes interviews, old highlights reels and other sport-related information. The content is drawn from RL magazine, a quarterly the company puts out, and also from RLTV, which is a series of celebrity interviews, fashion show footage, sports, commercials and other video.

Broadband is particularly powerful for Lauren because the company's marketing strategy has always been focused on immersing customers in the highly-aspirational Lauren lifestyle. Lauren has been masterful at conveying those attributes through print ads. Broadband takes it to the next level. For example, when you click on the Wimbledon tab and see the very 1920's British-looking Lauren models frolicking to classical music (what is that piece?!), you really get the full impact of the brand's sensibilities. That the same 30 second piece plays over and over again however is a drawback; it would have been nice if Lauren had created at least 2 or 3 others to break the repetition....

Still, the point is that the broadband-centric mini-site lets Lauren go beyond what it ordinarily would have been able to do with TV ads, and surely at a fraction of the cost. By embedding the mini-site in the navigation of the regular Lauren web site, you can easily access the product catalog for all-important shopping. So thought of another way, the ad on NYTimes.com and the mini-site content are really just ways of setting the stage and driving traffic to the site for users to buy products. While most e-commerce companies might be running online ads blurting "SALE!" to drive traffic, Lauren's more subtle approach is in keeping with its brand image.

Broadband is opening up a whole new lever for brands to experiment with. I expect we'll continue to see a lot more activity from them. If you know of some good examples, send them along!

Categories: Brand Marketing

Topics: Ralph Lauren