-

Visible Measures: Ultimate Broadband Video Measurement

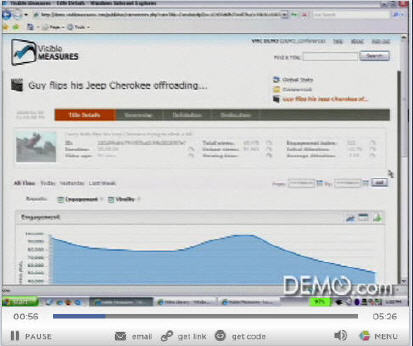

If you've ever hungered for insight about a specific video's performance beyond just how many views it has received, Visible Measures is a company after your heart. An independent firm that measures the reach and engagement of broadband video across the Internet, VM heralds an era of ultimate insight into how each and every video performs when it enters the Internet's fast-moving current.

By integrating its code with the video player, VM collects data on session length, drop-out points, rewind activity, click-throughs, viral distribution, geographic usage and other metrics. Think of VM as "big brother-esque" (in a positive way) in tracking a video's "true reach" as VM puts it, supplying a dizzying array of data to content providers and advertisers. The data is presented in intuitive, graphical formats that analysts can parse and sort to understand the video's ROI and what can be done to improve performance next time around. The company is already tracking over 80 million videos in its database.

I recently spent time with Matt Cutler, VM's VP of Marketing and Analytics who gave me a demo of the system and how it's being brought to market. VM is targeting established and early stage media companies, advertisers and ad agencies, all of whom have a critical stake in developing business cases for video deployments and ad campaigns. VM's tracking capabilities are especially meaningful given how pervasive the "syndicated video economy" is becoming.

None of this is to suggest that VM's data will replace programmers' and advertisers' creative instincts, but it would surely provide some real world augments to help offset the inherent guesswork involved in the creative process. (for more specifics about how VM works, see the below video from DEMO '08)

For advertisers specifically, today VM is announcing both its "VisibleCampaign" solution to measure ad campaigns' performance and also a collaboration with Dynamic Logic to track how these campaigns affect a brand's perception. Both initiatives are important in helping advertisers and agencies gain more insight about the broadband video medium and why it's important to invest. As someone who has expressed concern that the broadband ad business needs to mature quickly to support the myriad startup and established media companies relying on it, VM's will surely help decision-makers across the board gain comfort in shifting over more of their budgets.

VM is a perfect example of innovation needed to help optimize a new medium as it takes root. The company has raised $19 million through three rounds and is based in Boston. Based on what I've seen I'm quite enthusiastic about its odds of success.

Categories: Advertising, Startups, Technology

Topics: Dynamic Logic, Visible Measures

-

Hulu Out-Executing Comcast in On-Demand Programming?

The crew over at Hulu must be gleefully fist-bumping each other this week as Hulu scored a key strategic and public relations coup in adding to its lineup two of Comedy Central's most popular programs, "The Daily Show with Jon Stewart" and "The Colbert Report." Though officially positioned as a test, Hulu still deserves big-time kudos as the deal is an endorsement of its value proposition.

The deal and Hulu's execution illustrate a larger point that I've been making for a while: one of broadband's three key disruptions is that it enables new aggregators to gain an edge on larger incumbents by changing the dynamics of competition. To be more specific, in this case, I think that Hulu has out-executed Comcast, America's #1 cable operator by delivering new value to consumers and gaining important PR momentum. Here's why:

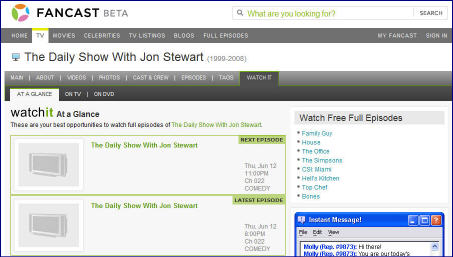

Fancast, which is Comcast's online portal (in beta), actually announced a deal with Comedy Central back on May 19th for access to these same programs and others. Yet go to Fancast and search for "Daily Show" and, as shown below, you won't find any Daily Show full episodes available, just an assortment of short clips and times when it's on TV. A Comcast spokesperson told me that Comcast's implementation is imminent, but its delay in getting the programs up and running is accentuated when you consider that Comedy Central must have done its distribution deal with Fancast BEFORE its deal with Hulu.

Second, and more concerning is that, as a Comcast digital subscriber, when I tried to find The Daily Show and Colbert in Comcast's VOD menu, all that is available are five older Colbert clips and 1 older Daily Show clip. My guess is these haven't been updated in a while. No full-length Daily Show or Colbert programs are available at all in VOD.

While the Comcast spokesperson told me that the company works closely with its programming partners like Viacom to figure out the optimal mix of programming to make available on VOD, I think an unavoidable conclusion here is that Comcast (and other cable operators) is constrained by its inability to monetize VOD programming with advertising (what this week's "Project Canoe" is meant to address) and to easily add new programming on the VOD menu. These programming gaps create opportunities for upstarts like Hulu to capitalize on.

It may be unfair to zero in so narrowly on Comcast's execution with Daily Show/Colbert, yet things weren't much different when I searched for MTV's popular "The Hills" on Hulu, Fancast and Comcast's VOD. While Hulu doesn't appear to have a deal for full episodes of "The Hills" it masks this cleverly by providing thumbail images and easy navigation back to MTV's site where the video lives, for over 50 episodes (this is tactic Hulu uses for ABC's shows as well). On the other hand, Fancast displays just 5 full episodes, 2 from this season and 3 from last. And on VOD there are also just 5 episodes, though all from this season.

I think it's pretty significant that Hulu, a site that only went live 3 months ago can not only gain access to hit Comedy Central programs like Daily Show/Colbert, but can execute quickly. Hulu is using its advantages - flexible technologies, interactive features (clipping, embedding, sharing), monetization capability, savvy PR and startup pluck to compete with far-larger incumbents like Comcast.

Of course Comcast racks up billions of VOD views each year and has vast resources, making it an important player in on-demand programming. Yet Hulu has managed to make Comcast's advantages look a little less intimidating. I asked the Comcast spokesperson about this. She acknowledged Hulu's progress, but maintained that Comcast believes its mulit-platform approach is stronger.

In the big picture that's true, but when it comes to winning consumers' hearts and minds, it's often execution, not broad strategy that carries the day. And don't forget, when Hulu is unshackled from the PC - with its content freely riding Comcast's broadband pipes all the way to the TV - execution will matter even more.

This week Hulu provided a textbook example of how broadband-only aggregators can gain a foothold against well-established incumbents. Comcast and other incumbents should be taking notice and getting their game on.

What do think? Post a comment and let everyone know!

Categories: Advertising, Aggregators, Cable Networks, Cable TV Operators

Topics: Comcast, Comedy Central, Fancast, Hulu, The Colbert Report, The Daily Show, Viacom

-

More on Heavy's Spinout of Husky Media

Late last week, news broke that Heavy Media, which operates Heavy.com, one of the leading destination sites for men 18-34 was spinning off its Husky Media unit as a standalone ad management and network company. I found the deal intriguing and followed up with David Carson, co-CEO to learn more and see how it plays into larger trends I've been tracking.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.With this context in mind, a key question is "does the world really need another video ad management and network?" David patiently explained that they've received a lot of outside interest in their units, namely the "barn doors" that are shown before the video plays, the subsequent skin that remains on the sides while the video plays, and the playlist-like queuing of video with ads judiciously interspersed (which Heavy calls its Video Guide). Heavy has avoided pre-rolls entirely. This interest spurred them to separate Husky.

David believes that each of these units offers superior value. As compared with pre-rolls, where David said "bounce" or early termination rates can be 50% (resulting in the actual content never being seen), with Husky's approach, there's a 90% completion rate, and particularly when users come through the Husky "Video Guide", the number of videos consumed can be 3-6 times greater. David also said they're seeing click-throughs averaging 1.6%, above industry norms.

So of course the next question is, if these units perform so well, what's to stop others from introducing them as well? In fact, David would encourage this, as he believes it would help educate the market and maybe help establish these as preferred units. As long as Husky continues to get its fair share that would be a win. Husky has patents on the skin, and how it works with various video players.

David said investor meetings are underway and he anticipates the company completing its own financing. Husky will have its own separate management team. Heavy also announced last week a syndication deal for its Burly Sports show to CBSSports.com, and, no surprise, Husky will be the ad platform. To the extent that Heavy can do other syndication deals where Husky gets included, that will help it gain market share.

Clearly there continues to be a huge amount of experimentation in the broadband video ad market. The Husky deal further shows that sometimes developing technology for your a site's own use can, if successful, end up creating larger financial value.

Categories: Advertising, Deals & Financings, Indie Video

Topics: Adap.TV, CBSSports.com, Heavy.com, Husky, Tremor

-

Cable's Sub Fees Matter, A Lot

In my recent post "Revisiting the Long Tail and Broadband" I explained how broadband is the next step in an evolution of video distribution systems and that now, after many years of growth, cable networks' niche, but collective audiences are exceeding those of the broadcasters.

Several readers emailed suggesting I append an important footnote to this analysis: there is a key business model difference between today's fledgling broadband video providers and cable networks. That difference is that cable networks benefit from monthly "sub fees" or "affiliate fees" that all distributors (cable TV and satellite operators, telcos, etc.) must pay to carry cable's programming. These fees are collected in addition to the advertising these networks sell. No such sub fees are available to broadband video providers (or broadcasters for that matter), at least not yet.

Having been in and around the cable industry for 20 years, I fully appreciate that sub fees matter a lot to cable networks. Since the beginning of the cable industry, they have served as a financial firewall for networks. Sub fees now range from pennies per month to over $3 for ESPN. Even on the low-end a "fully distributed" cable network (reaching approximately 80 million+ U.S. homes) reaps millions of sub fee dollars per month. And remember, that money comes in regardless of how well the network's ratings were that month. (btw, for an explanation of the genesis of sub fees, have a look at "Cable Cowboy," Mark Robichaux's biography of TCI's John Malone).

Cable networks' financial security continues to be translated into improved programming quality. Recently, in "Golden Age for TV? Yes, on Cable," the NY Times' David Carr lamented that broadcast TV seems to be on a degenerative slide to offer "all manner of contests and challenges," yet noted that cable is ascendant with Emmy and Oscar-winning talent dotting its innovative new dramas. No surprise to anyone, financial muscle translates into programming quality.

All this helps to explain why, whenever I moderate a panel including cable network executives, they fall all over themselves to declare their allegiance to their current, paying distributors. Cable networks are stepping gingerly into the broadband era, careful not to upset their enviable business model.

Conversely, broadband upstarts have no incumbent customers to consider. While this frees them to strike creative and wide-ranging distribution deals, as best I can tell, they're going to be totally dependent on advertising for a long time to come. This is why I continue urging that broadband video advertising must mature further, and fast.

While broadband upstarts scramble and broadcasters struggle, cable networks will keep chugging along, nicely fueled by their consistent sub fees.

Categories: Broadcasters, Cable Networks, Cable TV Operators, Indie Video

Topics: ESPN

-

SF Chronicle Provides Video Compilation of Clinton Campaign

Last Thursday I remarked on a really professional documentary video that the NY Times produced which offered a retrospective on Hillary Clinton's candidacy. The Times promoted it on page one, which I thought was pretty significant evidence of how newspapers are capitalizing on broadband video's news opportunities.

I just noticed another great example of a newspaper's involvement with video. Check out what the SF Chronicle posted on its SFGate.com site last Friday. Rather than producing their own documentary video,

they culled about a dozen videos (mainly from YouTube) that were turning points in the campaign.

they culled about a dozen videos (mainly from YouTube) that were turning points in the campaign. The accompanying article makes great points about how important broadband video is becoming in the political process. It also notes that video's uncontrolled and unscripted nature are important differences that candidates need to understand and embrace. The article is spot on and well-worth a read.

Categories: Newspapers

Topics: San Francisco Chronicle, SFGate

-

Understanding TakeTV/Fanfare's Demise

Late last week came news that SanDisk has discontinued its TakeTV device and companion Fanfare content aggregation web site, which were unveiled last October. TakeTV was an inexpensive USB PC-TV connector that allowed users to grab video from Fanfare, for easy playback on their TVs.

I gave TakeTV and Fanfare a moderately positive review and thought that as a low-end product it could gain some traction. I thought of it as having "stocking stuffer" appeal - a relatively cheap gadget that would find its market. I've done a little asking around to try to understand what happened.

From what I've gathered, it sounds like SanDisk ultimately recognized the reality that TakeTV was really

peripheral to their core focus of marketing memory products. Too much customer education would be required to move this product, especially in the face of quasi-competitors like AppleTV, Vudu, Xbox and others. In addition, minimums from Hollywood to gain top-notch content has continued to raise the bar for startup devices like these to succeed.

peripheral to their core focus of marketing memory products. Too much customer education would be required to move this product, especially in the face of quasi-competitors like AppleTV, Vudu, Xbox and others. In addition, minimums from Hollywood to gain top-notch content has continued to raise the bar for startup devices like these to succeed. Yet, my bet is that we haven't seen the last of SanDisk's involvement in the broadband video market. Like hard-drives, processors and PCs themselves, memory products rely on ever-larger applications to drive the consumer purchase cycle. For SanDisk, video has to be right at the top of their list in terms of the apps that will create demand for its increasingly capacious storage products. So stay on the lookout for SanDisk to resurface somewhere in the video landscape.

Categories: Devices, Technology

Topics: SanDisk

-

Entriq-DayPort Deal Broadens Product Offerings

Though I've been predicting a wave of consolidation among broadband vendors for a while, deals in the space have only been sporadic. I think that's been due to investors continuing to fund independent companies and a sufficient amount of business to go around for most everyone.

One deal that did close in the last few months was Entriq's acquisition of DayPort. I recently had a briefing with Guy Tennant, Entriq's COO and Cory Factor, DayPort's former CEO and now CTO of the combined entity to understand their joint strategy and a recently-expanded deal with Inergize Digital Media.

I've been familiar with Entriq for a while as it was primarily focused on enabling media companies to support paid business models. It specialized in things like rights management, DRM, security, business rules and the like. Yet as advertising as emerged as the business model of choice for many, Entriq has been on a bit of a roller-coaster; there has been some senior management turnover and also I've heard of layoffs.

I've been familiar with Entriq for a while as it was primarily focused on enabling media companies to support paid business models. It specialized in things like rights management, DRM, security, business rules and the like. Yet as advertising as emerged as the business model of choice for many, Entriq has been on a bit of a roller-coaster; there has been some senior management turnover and also I've heard of layoffs. By acquiring DayPort, which supports advertising, Entriq expands its capabilities, allowing it to serve customers regardless of business model choice. This would also include hybrid pay/ad-supported models, which I continue to hear more and more about. The combined company is focusing on verticals like broadcasting (where DayPort always had a presence), independent producers and long-form content, particularly sports. Syndication is another key focus of the combined companies, mirroring the trend that I've written about in the past.

The recently-expanded deal with Inergize builds on a prior relationship DayPort had with the company. Inergize itself provides online solutions to broadcasters and Entriq has now integrated its combined capabilities more deeply with Inergize to serve the market. The two companies are also trying to deeply tie in to existing broadcast work-flow and production operations. One joint customer Guy and Cory cited was Newport Television, which recently acquired the Clear Channel TV stations which as deployed the Inergize/Entriq products.

Entriq-DayPort is competing in the very crowded broadband video content management/publishing space, which I've described previously. Yet by combining, the two companies have certainly strengthened their hand. As the market continues to evolve, they'll be fighting for their share.

Categories: Broadcasters, Deals & Financings, Technology

Topics: DayPort, Entriq, Inergize Digital Media

-

The NewsMarket Finds a Profitable Corner of the Broadband Video Market

While much attention in the broadband video industry has been focused on consumer-oriented companies, The NewsMarket is showing that there are other profitable niches for those with deep domain knowledge and creative business models. When I was in NYC last week I caught up with Romina Rosado, its Global Head of Marketing over lunch to learn more.

The NewsMarket's fundamental insight was recognizing that broadband would be a great platform for news video to be disseminated and that broadband's growth would eventually change both the roles of public relations/corporate communications professionals and the media's coverage of news.

On the one hand, PR people would need to offer up more video assets to augment their traditional text and images-based materials. And on the other hand, as consumer penetration of broadband increased, the news media would need improved access to video assets to help them cover stories online in a way that met changing consumer expectations. As its name implies, The NewsMarket's vision was to serve these two worlds, helping marry PR and news reporting to broadband in an efficient, cost-effective manner.

But executing on this vision has been turbulent. Founded in the dot com heyday, The NewsMarket clung to life in the early 2000's waiting for the market to stabilize and catch up. The good news is that not only has this happened, but The NewsMarket is now using its core competencies and relationships to expand its services.

The way The NewsMarket works is that companies, government agencies and other providers pay a fee to upload and have their videos (e.g. product demos, executive interviews, etc.) hosted at a secure site, where pre-approved media outlets are then able to download and edit. There are now 17,000 media outlets in 193 countries accessing video. Broadband's progress is evident, as Romina explained that a year ago NewsMarket videos were used in the same proportion by traditional broadcasters and online news outlets. Now the latter account for 80% of usage, including many newspaper sites as heavy users.

About a year ago The NewsMarket addressed bloggers by making a portion of its total videos available in a product called VideoCafe. But in response to the blurring demarcations of media and bloggers' displeasure at the limited quantity, The NewsMarket is shifting course to give bloggers access to the full library. It's also adding lots of HD video as sources are increasing their video quality.The NewsMarket has also expanded its portfolio by providing white label "broadcast newsroom" services for others' sites. About 70 customers have signed up for this. Microsoft is one example (not login needed). The NewsMarket has taken the next logical step by introducing its BrandTV product, whereby brands and others can set up their own channels in custom environments. YouTube is an obvious alternative for companies considering a quick and cheap alternative. But its unmanaged environment poses obvious issues, particularly for the growing list of companies getting more serious about using video to deliver their messages.

The NewsMarket's lessons are not only to be persistent in the face of adversity, but also to be creative in thinking about what kinds of macro changes broadband forces and how inventive business models can take advantage of them.

Categories: Aggregators

Topics: The NewsMarket