-

Ralph Lauren's Broadband Mini-Site Supports Brand, Drives Sales

Ralph Lauren is the latest brand to harness broadband video as part of its marketing mix.

I discovered the company's lush "Sports of Summer" mini-site after noticing the same rich media skyscraper ad in the NYTimes.com's Wimbledon coverage. Clicking through brings you to the Lauren mini-site, which highlights 4 sports that Lauren is sponsoring this summer: Wimbledon, The Olympics, the US Open (tennis) and the Black Watch polo team. On closer inspection, I noticed that the mini-site has actually just become the main part of the regular Lauren web site.

The structure of the mini-site is consistent across the four sports with each containing both video and text/photo content. At the bottom are three panels offering a rotating choice of content, which when clicked play in the large center section of the page. The content includes interviews, old highlights reels and other sport-related information. The content is drawn from RL magazine, a quarterly the company puts out, and also from RLTV, which is a series of celebrity interviews, fashion show footage, sports, commercials and other video.

Broadband is particularly powerful for Lauren because the company's marketing strategy has always been focused on immersing customers in the highly-aspirational Lauren lifestyle. Lauren has been masterful at conveying those attributes through print ads. Broadband takes it to the next level. For example, when you click on the Wimbledon tab and see the very 1920's British-looking Lauren models frolicking to classical music (what is that piece?!), you really get the full impact of the brand's sensibilities. That the same 30 second piece plays over and over again however is a drawback; it would have been nice if Lauren had created at least 2 or 3 others to break the repetition....

Still, the point is that the broadband-centric mini-site lets Lauren go beyond what it ordinarily would have been able to do with TV ads, and surely at a fraction of the cost. By embedding the mini-site in the navigation of the regular Lauren web site, you can easily access the product catalog for all-important shopping. So thought of another way, the ad on NYTimes.com and the mini-site content are really just ways of setting the stage and driving traffic to the site for users to buy products. While most e-commerce companies might be running online ads blurting "SALE!" to drive traffic, Lauren's more subtle approach is in keeping with its brand image.

Broadband is opening up a whole new lever for brands to experiment with. I expect we'll continue to see a lot more activity from them. If you know of some good examples, send them along!

Categories: Brand Marketing

Topics: Ralph Lauren

-

June '08 VideoNuze Recap - 3 Key Topics

Wrapping up a busy June, I'd like to quickly recap 3 key topics covered in VideoNuze:

1. Execution matters as much as strategy

I've been mindful since the launch of VideoNuze to not just focus on big strategic shifts in the industry, but also on the important role of execution. I'm not planning to get too far into the tactical weeds, but I do intend to show examples where possible of how successful execution can make a difference. This month, in 2 posts comparing and contrasting Hulu and Fancast (here and here) I tried to constructively show how a nimble upstart can get a toehold against an entrenched incumbent by getting things right.

While great execution is a key to successful online businesses, it may sometimes feel pretty mundane. For example, in "Jacob's Pillow Uses Video to Enhance Customer Experience" I shared an example of an arts organization has begun including video samples of upcoming performances on its web site, improving the user experience and no doubt enhancing ticket sales. A small touch with a big reward. And in this post about the analytics firm Visible Measures, I tried to explain how rigorous tracking can enhance programming and product decisions. I'll continue to find examples of where execution has had an impact, whether positive or negative.

2. Cable TV industry impacted by broadband

As many of you know, I believe the cable TV industry is a crucial element of the broadband video industry. Cable operators now provide tens of millions of consumer broadband connections. And cable networks have become active in delivering their programs and clips via broadband. Yet the broadband's relationships with operators and networks are complex, presenting a range of opportunities and challenges.

On the opportunities side, in "Cable's Subscriber Fees Matter, A Lot," I explained how the monthly sub fees that networks collect put them on a firm financial footing for weathering broadband's changes and an advantageous position compared to broadband content startups which must survive solely on ads. Further, syndication is offering new distribution opportunities, as evidenced by Scripps Networks syndication deal with AOL in May and Comedy Central's syndication of Daily Show and Colbert Report to Hulu and Adobe. Yet cable networks are challenged to exploit broadband's new opportunities while not antagonizing their traditional distributors.

For operators, though broadband access provides billions in monthly revenues, broadband is ultimately going to challenge their traditional video subscription business. In "Video Aggregators Have Raised $366+ Million to Date," I itemized the torrent of money that's flowed into the broadband aggregation space, with players ultimately vying for a piece of cable's aggregation revenue. These and other companies are working hard to change the video industry's value chain. There will be a lot more news from them yet to come.

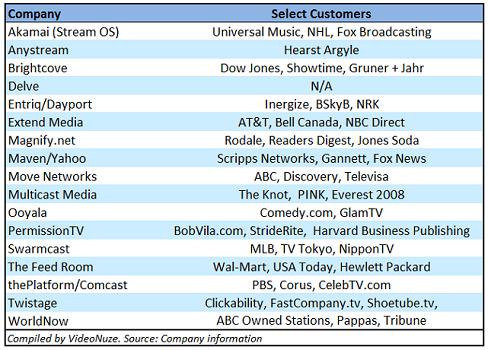

3. Video publishing/management platforms continue to evolve

Lastly, I continued covering the all-important video content publishing/management platform space this month, with product updates from PermissionTV, Brightcove and Entriq/Dayport. Yesterday, in introducing Delve Networks, another new player, I included a chart of all the companies in this space. I put a significant emphasis on this area because it is a key building block to making the broadband video industry work.

These companies are jostling with each other to provide the tools that content providers need to deliver and optimize the broadband experience. The competitive dynamic between these companies is very blurry though, with each emphasizing different features and capabilities. Nonetheless, each seems to be winning a share of the expanding market. I'll continue covering this segment of the industry as it evolves.

That's it for June; I have lots more good stuff planned for July!

Categories: Aggregators, Cable Networks, Cable TV Operators, Technology

Topics: AOL, Brightcove, Comedy Central, Delve, Entriq, Fancast, Hulu, Jacobs Pillow, PermissionTV, Scripps, Visible Measures

-

Delve is Latest Entrant in Video Platform Space

A couple of weeks ago, Delve Networks, a company formerly known as Plugg'd, which had focused on podcasting, announced that it was switching gears to jump into the video content management/platform space. I have long thought that this area was pretty crowded, so I was interested to learn from Delve's CEO/founder Alex Castro, what he believes makes Delve different and how it can win business vs. more established players.

Just to give a sense of who's already playing in this market, here's a quick overview (apologies to anyone I've left out...):

Alex described two principal ways that Delve is going to try to distinguish itself. The first is by enabling its customers to provide an improved user experience. The key to this is Delve's proprietary technology that allows users to see the most relevant part of a video stream. Delve uses both speech recognition and semantic approaches to create a "heat map" (see demo) above the video controls, indicating the most relevant segments to viewers. Of course speech recognition and accompanying techniques are used by Digitalsmiths, EveryZing, ScanScout and others to enhance discovery. I asked Alex about these and he contended that nobody has yet pulled these technologies into a comprehensive product.

Alex believes Delve's other differentiator is its user interface and workflow tools for content producers. Alex pointed to market research that Delve commissioned, which he said showed dissatisfaction with competitors' tools. He thought this was surprising given how long other players have been in the market and how much money has been invested to date. He sees the subpar results as creating opportunity for Delve.

In addition to the producer side, he thinks the consumer side UI of video is also an area in need of improvement. In addition to improved discovery, he cited the so-called "video ghettos" created by dedicated video player/channel environments. Note this an area Brightcove is looking to re-cast as well through its recent Brightcove3 beta release. (Alex is pretty blunt in his assessment of Brightcove; some thoughts are here on his blog)

All of this leads Alex and the Delve team to think that it's still very early in the broadband video industry's evolution with much opportunity still out there. Yet I suggested that most major media companies have long since done their due diligence and begun standardizing on certain platforms. Somewhat agreeing, Alex maintained that Delve has a full pipeline of remaining major media companies who have been mostly experimenting to date, plus a large assortment of non-traditional video publishers and smaller players all taking meetings with Delve.

Of course Alex is right that it is still early in the grand scheme of things and few would consider their current platform decisions fully locked in. But the question for Delve remains whether it can truly capitalize on the above differentiators while also being competitive on the full range of other features incumbents now offer. It will be interesting to watch what happens, especially with Alex's colorful commentary along the way.

What do you think? Post a comment now!(Note: Swarmcast and Magnify.net were inadvertently omitted from the original chart above.)

-

The Incredibly Growing YouTube

Closing out the week, I missed this blurb from Information Week yesterday reporting YouTube's staggering dominance of broadband video traffic. New numbers out from Hitwise show that in May '08 YouTube garnered 75% of the 10 million visits to 63 video sites that Hitwise is tracking. That's 9 times the traffic of #2 MySpaceTV and more than 20 times that of the #3 site which is Google's other video property (remember it?)

According to Hitwise YouTube's share rose 26% from a year ago compared with drops by all the others in the top 5 sites except Veoh, which rose by 32% from a year ago.

It's just mind-boggling to think that one site could have such market share, particularly when a lot of the

networks' programs cannot be found there. I think it speaks to how strong users' appetites are for UGC and viral content remain, how YouTube has become a de facto video platform for lots of smaller players in the industry (and consumers) and how the company is likely beginning to enjoy some early success with its partners' channels.

networks' programs cannot be found there. I think it speaks to how strong users' appetites are for UGC and viral content remain, how YouTube has become a de facto video platform for lots of smaller players in the industry (and consumers) and how the company is likely beginning to enjoy some early success with its partners' channels. A few months ago, in "YouTube: Over-the-Top's Best Friend" I wrote that YouTube is quickly becoming the perfect ally for all those makers of new broadband-to-the-TV devices. These companies desperately need content and credible brands to help pull through consumer demand. YouTube offers both. In this sense, YouTube has huge value yet to be tapped (of course demonstrating that it can monetize its massive audience wouldn't hurt its partnership value...)

However, looked at another way, YouTube's success should be very encouraging to other players. To start with, YouTube is doing a marvelous job educating the world about the virtues of broadband video. And while YouTube is the market's 800 pound gorilla, it is still leaving key opportunities open for other players to differentiate themselves. Potential areas include high-quality delivery, ad-based and paid monetization and offering content that YouTube simply doesn't have (examples: Comedy Central programs like "The Daily Show" and "Colbert Report")

Volumes are yet to be written about YouTube. Whether it turns its market-leading traffic into a financially-explosive franchise or forever remains a red-ink spewing blip on Google's P&L is yet to be seen. Either way, when the history of broadband video is written, YouTube will be featured prominently.

Categories: Aggregators, UGC, Video Sharing

Topics: Comedy Central, Hitwise, MySpaceTV, Veoh, YouTube

-

MySpace-NBC's Decision '08 Contest: Elevating User Generated Video

Yesterday came a further positive sign that user-generated video may be elevated from the domain of karaoke-singing cats, faux-skateboarding accidents and exploding soda bottles.

That positive sign was MySpace, NBC and MSNBC's announcement of a new citizen journalism initiative dubbed the "Decision '08 Convention Contest." In it, MySpace users are encouraged to submit short videos answering one of three questions, "Why do you vote?" "Why are you the best person for this job?" or "How will you stand out in the crowd and get the scoop no one else can?"

The submissions will first be judged by a panel of experts from MySpace and NBC, with five finalists revealed for the MySpace community to vote on. Two winners will be selected, one to attend the Democratic convention this summer, and the other to attend the Republican convention.

To learn more about the contest and the motivations behind it, yesterday I spoke to Liba Rubenstein, MySpace's Manager of Public Affairs, who is essentially the product manager for the IMPACT channel, MySpace's hub for civic and social engagement. Liba explained that MySpace has used this type of contest frequently, and to much success. MySpace community members love getting involved and expressing their creativity. The two level judging process is meant to balance the experts' high editorial standards with members' passion and enthusiasm. Liba added that in particular MySpace and NBC are gaining insights about how to fuse traditional media with web 2.0. (And in a classic "doing well by doing good" vein, maybe NBC will discover the next Tim Russert in the contest.)

I like the Decision '08 contest for a variety of reasons. First and most importantly, it allows UGV to be directed to an important social use: increasing citizens' involvement in the democratic process. In this way it continues on what YouTube's YouChoose '08 pioneered by allowing its users to upload video questions in the recent primary debates. It may sound somewhat idealistic, but I really like the notion of broadband video doing its part to strengthen the functioning of America's democracy - even more so as we approach July 4th in this election year.

Further, I think the convention contest provides an example for how others outside the political realm might consider harnessing the creativity and passion of their members to use UGV in a directed purpose. One example that comes right to mind is in the education field. For example, wouldn't it be cool if educators uploaded UGV of themselves in action, explaining and demonstrating their proven teaching methods? I got a glimpse of some of this happening already, while doing a project last summer for the George Lucas Educational Foundation. There's no shortage of other examples.

There has been much hand-wringing about whether UGV can ever be monetized through advertising, a debate that will no doubt rage on. Alternatively, I for one would like to see more energy put into purpose-driven UGV projects like the MySpace-NBC convention contest. While I enjoy the cats, skateboarders and soda bottles as much as the next guy, I continue to believe the UGV medium can ultimately be so much more.

What do you think? Post a comment now!

Categories: Broadcasters, Partnerships, Politics, UGC

-

Crackle Notches an Early Win with "Jace Hall" Show

The broadband content provider Crackle is notching a win with its new comedy/interview series "The Jace Hall Show." I received a press release that it generated 500K visitors in the first two days following its launch on June 5th and a million to date. I'm always intrigued with what kinds of original broadband programs are working - and why - so I grabbed some time yesterday with Mary Ray, Crackle's VP of Marketing to learn what's behind Jace's success.

For those of you like me who are not gamers, Jason "Jace" Hall is probably unfamiliar. But Mary explained that if you're in the gaming community he's a fairly well-know producer who has a wide network of relationships in the industry. His show brings you into the world of his relationships, making you feel more connected to gamers' movers and shakers. And since he has his finger on the pulse of what the young male gamer audience is looking for, that gives him a real edge. Plus Mary believes that Hollywood still hasn't paid much attention to this market, despite gaming's huge following.

In the program's first episode Jace provided a sneak peek at a Duke Nukem Forever game that has reputedly been in development for 12 years. Gaining this type of access is practically like having exclusive content. Mary said that Crackle didn't do any advance paid marketing for the show; rather the audience was driven purely by word-of-mouth and buzz-building. I joked with Mary - spend no money but gain a big audience - the show sounds like a marketer's dream!

I asked Mary what she thinks the most important takeaway from Jace's early success is. Her feeling was that tapping into what the audience is hungry for is the key. While I agree, I'd go a step further. I think that trying to find talent that already has a following - whether in gaming, TV or some other medium - is a genuine way to improve a program's odds of success. I'm not necessarily talking about A-list talent per se, but rather talent that is at least known within some kind of niche (e.g. finance, comedy, woodworking, etc). That's not say "don't go with unknown talent looking to break out," but I do think it's important to recognize that doing so carries more risk.

The whole area of original broadband content is surging with players like Crackle, Next New Networks, 60Frames, ManiaTV, Break, Heavy, MyDamnChannel, FunnyorDie and lots of others pioneering the model. It's going to be very interesting to learn more about what works and why.

What do you think works in original broadband video? Share your comments now!

Categories: Games, Indie Video

Topics: 60Frames, Break, Crackle, FunnyorDie, Heavy, Jace Hall, ManiaTV, MyDamnChannel, Next New Networks

-

Comcast/Fancast, Hulu and the Role of Great Execution, Part 2

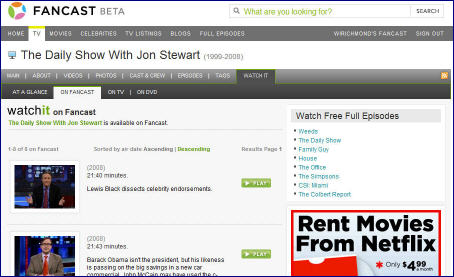

A couple of weeks ago in "Hulu Out-Executing Comcast in On-Demand Programming?" I took Comcast's Fancast to task because Hulu was first to implement its deal with Comedy Central for full episodes of "The Daily Show" and "Colbert Report." It was a missed opportunity for Fancast, which had previously announced a deal with Comedy Central for these shows. Hulu gained a bonanza of favorable press attention, likely spiking its usage.

Well fair is fair and so I'm now happy to report that Fancast has also posted these programs. But at the risk of sounding like a Fancast scourge (which I'm really not trying to be) Hulu continues to distinguish itself with a superior user experience. For those looking to succeed in broadband video the execution differences between these two sites provide key lessons.

First, after searching for The Daily Show on Hulu, the site automatically displays the most recent episodes first (beginning with last night's episode). When starting the player, Hulu's quick 7 second "brand slate" runs and then the program starts. This emphasis on a quick payoff no doubt reflects lessons Hulu's CEO Jason Kilar learned from his years at Amazon, which, like all great e-commerce sites knows that a distraction-free checkout process results in more completed transactions.

Conversely, at Fancast, after doing a search for Daily Show, the results are "Sorted by air date Ascending | Descending." Ascending is pre-selected, and the first episode shown is from April 9th, with Lewis Black. Huh - why such an old episode being shown first by default? And is the average user really going to be familiar with these sorting terms? Why not just offer choices like "Newest" and "Oldest" with "Newest" as the default?

When I tried watching several episodes I encountered more distractions and inconsistency. I alternatively saw a 30 second pre-roll, a 15 second pre-roll and once I even got back-to-back 15 second pre-rolls (of the same A1 steak sauce ad no less). Contrast this with Hulu where each time I knew to expect the voiceover intoning "The following program is brought to you...." Hulu understands that positive online experiences emphasize usability and consistency.

Separately, Hulu offers the ability to send a link to the full episode to a friend or clip just a segment, which can also be posted easily to a number of social networking sites. The features worked flawlessly and when done the video resumed playing automatically. On the other hand, an envelope icon at Fancast reveals 2 sharing options, "Beginning of Video" or "Current Scene." Yet after clicking on both they seem to reveal the same screen. So what's the difference? Worse, after finishing up sharing, the video was frozen, forcing me to close the browser and start all over again. Ugh.

Just to be clear, I don't expect perfection and I do recognize that Fancast is still in beta. To put all this in some context and explain why I'm dragging you into the weeds with this part 2 post, I've long believed that broadband's openness will allow new aggregators to emerge, attempting to compete with incumbents like cable and satellite operators. Differentiating themselves is no small feat considering, as in this case, the underlying content they have will likely be similar to what's available elsewhere.

Hulu is differentiating itself through great execution - particularly noteworthy for such a young site. My

guess is that execution and usability DNA run very deep within the Hulu team. On the other hand, Fancast has not yet demonstrated comparable execution mastery and as a result is leaving the competitive door ajar for its customers to give Hulu a try. Winning Hulu users back to Fancast will be tougher than winning them now.

guess is that execution and usability DNA run very deep within the Hulu team. On the other hand, Fancast has not yet demonstrated comparable execution mastery and as a result is leaving the competitive door ajar for its customers to give Hulu a try. Winning Hulu users back to Fancast will be tougher than winning them now. Broadband aggregation is going to be a battleground with big eventual payoffs. As a powerful incumbent, Comcast must do everything possible to preclude users from seeking out Hulu and other aggregators. (Truth be told, it is unlikely these broadband aggregators would have raised close to the $366+ million I recently reported in the first place had Comcast and other incumbents proactively seized the online aggregation space several years ago. But that's a story for another day.)

For all the time I spend talking about strategy at VideoNuze, I've always been a big believer that competition is mostly won in the trenches. That's especially true in online where great execution and usability separate winners from the rest. For Comcast, the competitive bar is far higher than it has ever been. To succeed, it must significantly improve its execution.

Categories: Aggregators, Cable Networks, Cable TV Operators

-

New Strategy Analytics Research Underscores Video Consumption Shifts Among Young

I recently attended a presentation by Martin Olausson, Director of Digital Media Strategies at Strategy Analytics, who shared key findings from his firm's recently fielded digital media survey. Strategy Analytics

is a research and consulting firm specializing in information, communications and entertainment. In a follow-up chat, Martin provided a little more color on the data and he also agreed to share a half dozen slides as a complimentary download for VideoNuze readers.

is a research and consulting firm specializing in information, communications and entertainment. In a follow-up chat, Martin provided a little more color on the data and he also agreed to share a half dozen slides as a complimentary download for VideoNuze readers.Click here to download the slides.

Some of the most interesting data confirms the shifts that are well underway in how younger people consume video. For example, the weekly TV reach for 15-19 year olds is 64%, while for 35-49 year olds it's 82%. Conversely, the weekly reach for broadband video averages around 25-26% for those in the 15-29 age brackets, but at 35-49 it drops to 15%, and then for 50+ it drops again to just 5%. Broadband consumption clearly skews younger, suggesting a more permanent shift as this group ages.

In addition, 16-18% of 15-29 year olds said they'd be interested/very interested in paying for TV online, while only 11% of those 35-49 said so, and only 3% of those 50+ said so. Similarly, 21-22% of 15-29 year olds said they'd be interested/very interested in paying for movies online, while only 16% of those 35-49 said so, and only 5% of those 50+ said so.

Media and marketing executives need to focus on what opportunities this creates. For example, this might suggest that special offers to download TV programs and movies that have particular appeal to younger people might help accelerate the paid business model. Or that co-marketing deals with other brands that already have credibility and reach into these age groups would help open up the market.

Strategy Analytics also included a revenue forecast for various business models for 2008-2012. The four paid categories, "Download to Own: Movies," "Download to Own: TV," "Download to Rent: A-La-Carte" and "Download to Rent: Subscription" total up to approximately $3.87 billion by 2012, while the ad-supported category totals to $3.48 billion by then.

Martin is most bullish on the subscription model as the big driver of paid revenues, and focuses on Netflix in particular as having a strong online delivery opportunity. While I haven't created my own revenue projections, I still bias toward thinking ad-supported will outstrip paid in the next 3-4 years. If I look longer-term, say 5-10 years out, I can see that shifting to the paid model as today's issues (portability, rights, mass broadband connectivity to TVs, etc.) are resolved at scale.

Taken together, the data adds to our understanding of what's happening in the market today and where things may be heading. If you want further information about the survey, Martin's contact information is on the cover slide.

Categories:

Topics: Strategy Analytics