-

CBS TV Stations Get Broadband Under Leess

(Note: This is the third in a series of posts with companies participating in the 2008 Media Summit, a premier industry event starting tomorrow in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select analysis and news coverage.)

A few months ago, in a post I wrote called "Broadcast TV Stations Most Threatened By Broadband/On-Demand," I asserted that broadband was bringing a perfect storm to the world of local TV stations.

These thoughts were in the background when I spoke last week with Jonathan Leess, President and GM of CBS TV Stations Digital Media Group. CBS owns 29 stations around the U.S. mostly in bigger markets. Leess has been in his role since April '04 and by all accounts has done an admirable job leading the CBS stations into the broadband era.

Most significant is the delicate balance he's tried to strike in centralizing certain online/broadband responsibilities while keeping others at the local level. This is no easy feat. Succeeding online requires scale and common technology platforms. Yet historically local stations enjoy wide autonomy in decision-making as long as they meet their numbers.

Leess explained that in broadband he's focused his corporate group on accessing and providing new non-local content, creating an internal syndication network for stations, developing technology and tools for all stations to use, focusing on national ad sales and training for local sales reps, and importantly generating new viewership by syndicating local stations' video to third parties.

A key part of executing the balancing act has been a relentless focus on work-flow and supporting technologies. Leess explained that the broadband activities at CBS TV Stations are a 24/7 operation involving hundreds of people around the country. Turning all of this into a well-oiled operation, particularly in the context of long-standing operational biases, has been an enormous operational challenge that Leess seems to have embraced.

His efforts seem to be paying off. CBS TV Stations drove 89 million video views from their own sites in '07, an average of around 8 million video views/mo from their own sites, a 71% increase over '06. It's gaining an additional 10 million video views/mo through syndication partners. The primary current contributor to

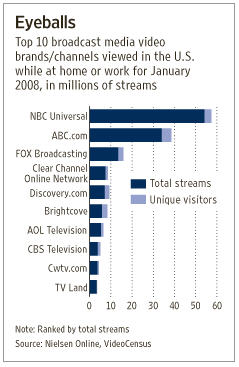

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com.

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com. In addition, video clips are a big part of CBS TV Stations' success, as it is posting around 520/day and now offers a searchable library of 350K clips.

Meanwhile the Yahoo deal has been so successful that CBS TV Stations has clearly gotten syndication religion, with several significant announcements planned for the coming weeks. Leess explained how these syndication deals drive unprecedented consumption from out-of-market viewers while also creating valuable ad inventory. For pre-rolls, CBS is getting between $28-75 CPM, with banners fetching $8-18 CPM. Importantly, CBS TV Stations are aggressively bundling on-air/online/broadband packages, having sworn off broadband as a pure "value-add" some time ago.

While I stand by my assertion that local TV stations are most vulnerable to broadband's rise, it is also true that broadband offers stations fresh opportunities. CBS TV Stations' offensive approach shows that with the right leadership, strategy and operational plan, executing a successful transition to the broadband era is quite possible.

What do you think? Post a comment and let everyone know!

Categories: Broadcasters, Portals

Topics: CBS, CBS TV Stations Digital Media Group, Yahoo

-

Yahoo Acquires Maven, First Hilmi Ozguc Interview

The rumor mill of the past 2 weeks proved correct, as Yahoo announced this morning that it has acquired

Maven Networks for $160M. By my count this is the biggest pure-play broadband video deal to date, and is an excellent validation of broadband video's growing importance in the media and technology landscape.

Maven Networks for $160M. By my count this is the biggest pure-play broadband video deal to date, and is an excellent validation of broadband video's growing importance in the media and technology landscape. Hilmi Ozguc, Maven's CEO and co-founder, provided me with an exclusive briefing about the deal, his first comments following the announcement this morning. (As a quick disclaimer, I did some business development and product strategy consulting work for Maven and Hilmi in the company's early days. I didn't have any current financial relationship with Maven.)

As Hilmi says below, and as I've said before (most recently in "My Rant About Super Bowl Ads"), broadband video is increasingly becoming the terrain of the big guys - the biggest brands, publishers, technology providers, networks, etc. As the broadband medium continues to mature, its ability to attract ad

dollars from incumbent media, particularly TV, is going to strengthen. This process will be accelerated by Yahoo as it seeks to drive Maven's capabilities into its customer and partner base.

dollars from incumbent media, particularly TV, is going to strengthen. This process will be accelerated by Yahoo as it seeks to drive Maven's capabilities into its customer and partner base. Following is a summary of my briefing with Hilmi:

Why did you sell the company?

Broadband video is increasingly going to be a game fought between titans because billions of dollars are at stake and the question is how do you get to the top 50 or 100 global media brands and advertisers? We've focused on building tools and technologies that these media companies need. The time to sell was excellent as was the return for our investors.

Can you describe the sale process?

We had several high profile bidders, although I can't identify them. It was gratifying to see multiple companies validate the product initiatives we put in motion 2 to 2 1/2 years ago. Yahoo has the resources to buy anyone. They took a deliberate approach and looked far and wide and concluded that Maven was the right company to buy. The whole process took several months from start to finish. The deal was for $160M, mostly in cash and it officially closed yesterday.

What group will Maven report into?

Maven will be integrated very quickly and deeply into Yahoo because video is so key to what Yahoo is doing in terms of advertising. This will not end up being a little business unit off to the side somewhere. Our engineering team will be part of Yahoo's engineering team. All Maven executives including me will be staying and have similar responsibilities to what we've been doing. A lot of work has already gone into the integration.

Who do you report into?

I'm not sure I'm at liberty to discuss that, as it would be a little too revealing of Yahoo's strategy, but I think it's in the right place to be within the company.

What does Yahoo bring to Maven?

Enormous reach, 500M visitors around the world per month. An incredible roster of advertisers and publishers who are already in their ecosystem. Interesting and complimentary engineering capabilities. A sheer ability to scale this massively. This deal is all about getting our stuff into the hands of the biggest media, publishing and advertising companies and having it exposed to a massive audience. We started as a media technology company, and evolved to mostly an advertising business. So combining with the leader in display advertising was very logical. Being plugged deeply into a company that sells close to $2B of advertising every 90 days is a huge opportunity for us. It's a massive advertising machine.

Does Yahoo-Maven portend more consolidation?

Absolutely. I just don't see how as a small startup you can have a significant enough piece of the pie when all the giants have now woken up and have video as front and center. Other big players are going to come in more aggressively.

What are the implications of Microsoft's takeover bid of Yahoo on Maven?

We need to stay focused at Maven, and as long as we do that I'm not concerned about any distractions. And I shouldn't really talk about the Microsoft deal either!

What are the 2-3 lessons you've learned about the broadband video market in 5 1/2 years since starting Maven?

When we started virtually nobody really believed in video being delivered on the Internet. We had a singular vision that said, look, once broadband is in enough homes, video is going to take off. So that was our first mission: delivery of bits, playback, HD-quality, etc. As the market evolved, the Akamais of the world solved a lot of the delivery problems, so we shifted our focus to publishing and content syndication, advertising and monetization. Basically, how does a media company generate revenue from broadband? So we evolved along with the market. We tried to stay focused on advertising, professional video and largest media companies.

This is your second successful startup - what lessons do you have for entrepreneurs?

1. Focus is the most important thing and ignoring the naysayers. It's natural to want to hedge, but you have to be bold enough to make decisions. Markets do take time to develop. We were early no question, but the market caught up and we were at right place at right time when it did. 2. Agility is also important and being analytical about what the market is saying. So the ability to shoot a direction and switch. And do it fearlessly. Trial and error is key. 3. Bet on the right people. The wrong people can steer you down the wrong path. So you essentially have to be the world's most capable talent scout, to build a team of people at all levels of the organization. A great team will figure it out.

Where's the broadband video market going from here?

Startups got this space going and created a lot of the core technology and innovation, but this is no longer a game of startups. Big media companies want to deal with big technology companies and networks. Big advertisers want to work with biggest publishers. To achieve this scale independently would be very difficult.

What are the key challenges for broadband video market?

I don't want to say the "R" word that everyone's talking about, but if it comes, I hope it's a mild one. As we know, advertisers cut back quickly in difficult economies. Though I don't think this will happen in broadband because it is so promising and it's still pretty small. Another challenge is getting ad agencies and advertisers to think of broadband as being interactive and capable of more than TV ads. You've talked about that a lot at VideoNuze. And finally the need to scale the technology and infrastructure so it's rock-solid and dependable. That's what Yahoo and Maven will focus tightly on. And I think we have all the tools between us to grab the undisputed leadership position in this, if we move fast enough.

So are you going to do startup #3?

My focus for now is on integration and marshalling all these terrific resources. Yahoo has a great team and has been chomping at the bit to have a competitive video offering to sit alongside their display offerings. They have a killer ad sales force, along with great relationships with the biggest publishers. They have mastered how to play on the media company side, and in being a partner to other media companies. We can't wait to get going.

Congrats again.

Categories: Deals & Financings, Portals, Technology

-

Microsoft, Yahoo and Broadband Video

Well, here I was waiting for news to officially cross the wire that Yahoo was acquiring Maven Networks for $150-$170 million (heavily rumored in the blogosphere yesterday and for weeks now) so that I could weigh in, when instead what emerged this morning was that Microsoft is making an unsolicited offer for Yahoo. Quite a day for Yahoo. (Note, I'll have more on Yahoo-Maven if and when that becomes official).

Today's big news is Microsoft's unsolicited $44.6B offer for Yahoo. Talks between the companies have been off and on for a long time, and it looks like Microsoft finally got fed up with the dithering at Yahoo and

decided to make a pre-emptive move. Steve Ballmer's letter to Yahoo's board and today's release is here.

decided to make a pre-emptive move. Steve Ballmer's letter to Yahoo's board and today's release is here. The deal is all about increasing scale to compete more effectively with Google in the online advertising space. Both Microsoft and Yahoo have lagged Google badly and have spent billions in the past year on ad infrastructure acquisitions. Yahoo immediately brings MSN lots of new traffic, which can be monetized with both search and display advertising.

Though Ballmer's letter also highlights "emerging user experiences" such as video, mobile, online commerce, social media and social platforms" down the list, as the fourth area of potential synergies, I would argue that

the upside in video is actually the most strategic benefit of the deal. Why?

the upside in video is actually the most strategic benefit of the deal. Why?The concept of scale, i.e. being able to both reach gigantic audiences and drive massive traffic from them, is absolutely essential for broadband video advertising to become core part of the marketing mix for big brands. Unlike search-based advertising, which has been driven by long-tail advertisers, broadband video advertising is going to be driven by big brands. That's because, notwithstanding the growth of overlays and other formats, pre-, mid- and post-roll ads are going to be with us for a while to come, and they are expensive to produce. The average garage-sized business isn't going to be making them.

Big brands spend tens of billions of dollars on TV ads. Shifting a meaningful part of this spending to broadband delivery is essential for broadband's growth. Brands spend on TV because that's been the only way for them to buy enough audience reach. Though they're beginning to trickle some spending over to broadband, the central obstacle to increasing their broadband spending is that there simply is not enough high quality, targeted video inventory for them to buy in order to achieve their reach objectives and therefore materially impact their businesses.

This is a theme I hear all the time, and just heard many times in the ad-related sessions I attended at NATPE earlier this week. Microsoft knows that to tap the long-term broadband ad opportunity in branded video advertising, it must offer advertisers greater reach, along with interactivity, reporting, social features, etc. This is all the more urgent because MSN and Yahoo are already playing catch-up to YouTube which still drive approximately 40% of all video views, a dominant market position.

MSN has worked hard to cross-promote MSN video in the rest of the site, and this has driven improved user experiences and impressive traffic gains. Yahoo, which has been mired down with a dysfunctional and bloated bureaucracy, has been far less coordinated and effective in video, leaving lots of room for MSN to make improvements.

You won't hear much about video as a key motivator for the deal because Wall Street, which is Microsoft's key audience to persuade, doesn't give a whit about long-term strategic positioning. It only cares about short-term financial metrics like dilution, earnings growth, cost-reductions and so forth. But behind the scenes, I'm giving credit to Microsoft. I think it is reading the tea leaves correctly about how the broadband video ad market is going to unfold and how to get MSN positioned properly for long-term success.

What do you think? Post a comment!

Categories: Advertising, Deals & Financings, Portals

-

Comcast Announces Moves at CES; Still Missing Key Strategic Piece

In his CES keynote today, Comcast CEO Brian Roberts will outline several Comcast's initiatives (under the umbrella "Project Infinity") to stay competitive in the fast-changing video arena.

These include:

"Wideband"- New "wideband" broadband technology which allows much faster downloads (this is impressive, though was previously displayed at '07 National Cable Show). Wideband is aimed at blunting criticism that telcos' fiber networks have more capacity and faster speeds.

HD expansion - Plans for a 10-fold increase in the number of HD movies available in its VOD library to 3,000, with at least 6,000 total titles, including SD programming, eventually available. This is all meant to offset the widely held view that satellite and telco have surpassed cable in current HD offerings, a key value prop to millions of Americans now bringing home shiny new HD TV sets.

Fancast - Comcast's video portal will include 3,000 hours of streaming TV content, from NBC, Fox, CBS and others. These moves will help bring Fancast to parity with other syndicated partners of the networks which are themselves trying to proliferate their programs everywhere. Fancast will also allows remote scheduling of DVRs (both Comcast's and TiVo's), a feature that has been widely available at sites like TiVo.com and Yahoo for years now.

All of these actions are intended to help restore Comcast's reputation as the leading provider of entertainment programming, amid the swirl of changes that have enveloped the company. Despite its formidable size, Comcast is fighting competitive fires on virtually every front: fierce multichannel competition from satellite and telcos, rising expectations of HD content, consumer behavior shifts to broadband video consumption (premium and UGC) and place-shifting/time-shifting/device-shifting. The list goes on. Amid these changes, and with a slowing of the American economy, Wall Street has punished Comcast's stock price, cutting it in half in the last year.

While I applaud today's announcements, there is still one big strategic piece missing which Comcast has yet to comprehensively address: what are its plans to allow subscribers using its digital set-top boxes to seamlessly watch broadband video content as they do broadcast and cable programs?

As many of you know, I have been on a "broadband-to-the-TV" jag recently (see here, here and here) analyzing different options and their potential, or lack thereof. I continue to maintain that incumbents with boxes already in the home - mainly cable, satellite, telcos - are best-positioned to bridge the current divide between broadband and TV.

A breakthrough value proposition for Comcast would be allowing its subscribers to gain easy access on their TVs to YouTube, Break.com, Metacafe, NYTimes.com and all the others broadband sites that have surged in popularity. In theory, Comcast and other cable operators have always been about providing more video choices to subscribers. But the caveat has been those choices are only offered when Comcast makes a deal to carry these new channels. With broadband it's a wide open world. Any video provider - deal or no deal would gain access. This "openness" is a fundamental paradigm change for Comcast and other "walled garden" loyalists.

Surmounting this change to its business and cultural model are in fact Comcast's #1 strategic challenge. How to effectively respond to customers' broadband desires, while maintaining a robust economic and competitive model? When Brian Roberts, and others in the cable industry are finally ready to address the question of how they'll integrate broadband into their TV-based user experience, that will be a keynote well worth watching.

Categories: Broadcasters, Cable Networks, HD, Portals, Telcos

Topics: Comcast

-

MTV Networks Dips Toe Into Syndication Waters

I was very happy to see news today of MTVN striking a big video syndication deal for its multiple networks' content with AOL Video.

Recently I praised Comedy Central's launch of TheDailyShow.com, but I took it to task for what appeared to be a destination-centric strategy, which was further supported by some executives' remarks. In this age of syndication, I thought that was a wrong-headed approach. Coupled with Viacom's misguided lawsuit against Google/YouTube, it felt like further evidence that MTVN was falling out of step with key broadband opportunities.

Today's news shows renewed hope that this may not be the case. I know these deals don't get done in a day, but I'd really like to see more syndication momentum from MTVN (and other content providers for that matter) to spread its content far and wide. Broadband Internet users don't expect to have to go to destination sites to get their favorite videos, they want them accessible where they already frequently visit. Hulu and CBS, to name two content providers that are solidly focused on syndication understand this, as do many others.

Categories: Cable Networks, Partnerships, Portals

Topics: AOL, CBS, Google, Hulu, MTVN, TheDailyShow.com, Viacom, YouTube

-

Dailyshow.com: Third-Party Distribution Isn't an Either/Or Decision

First things first, congrats to the folks at MTVN, Comedy Central and The Daily Show. The newly unveiled Dailyshow.com is fabulous. It is the best TV program-centric web site I have yet seen. As a long-time Jon Stewart fan, being able to see all the old clips is nirvana, and will no doubt send fans over the moon.

First things first, congrats to the folks at MTVN, Comedy Central and The Daily Show. The newly unveiled Dailyshow.com is fabulous. It is the best TV program-centric web site I have yet seen. As a long-time Jon Stewart fan, being able to see all the old clips is nirvana, and will no doubt send fans over the moon.However, a bigger picture question that Dailyshow.com's launch raises is how these direct-to-consumer initiatives work vis-a-vis third-party distribution deals. With media companies newly empowered to engage directly with their audiences using the Internet and broadband, many analysts have predicted the result will be diminishing relevance of third-party aggregators, including everyone from Comcast to Yahoo to Joost to you name 'em.

It's pretty apparent that MTVN/Comedy Central is coming down on the side of heavily emphasizing direct-to-consumer as its broadband video strategy when you combine Viacom's ongoing lawsuit against Google/YouTube, MTVN EVP Erik Flannigan's comment ("People should be reacting to 'The Daily Show' on its own site...God bless them for doing it everywhere else, but this should be the epicenter of it") and a company spokesman's comment ("that a few selected clips could become available on sites through syndication deals").

Count me among those who think this is both the wrong approach and one that will ultimately under-optimize the value of the Daily Show and other franchises in the broadband era. Quite simply, building out a strong direct-to-consumer presence like Dailyshow.com is NOT an either/or decision relative to also developing strong third-party distribution relationships.

In fact, the reality is that strong third-party distribution is essential in the Internet era, because Internet usage is both highly distributed among millions of web sites and also concentrated at a few large portals. Media companies' goal should be to proliferate their content (under the right deals of course) into all the nooks and crannies of the Internet while also striking deals with big portals to maximize exposure, usage and ad revenue.

But don't think distributors get a free ride in the Internet era. They need to prove they can leverage their audience devotion and traffic to drive value for content providers. Those that do will succeed. Proof of this is already emerging. One senior broadband executive recently told me that over 80% of his traffic comes from YouTube and other distribution partners, with his own site's traffic in the minority.

Not aggressively pursuing third-party distribution, as it appears is MTVN's plan, in essence requires that users reorient their behavior to come solely to one uber destination site like Dailyshow.com. To me this smacks of classic traditional media thinking where consumer convenience or preference gets short shrift in the name of what's supposedly "best" for the brand. My guess is if you asked Jon Stewart off the record what his preference is, he'd likely say, "make my stuff available everywhere!"

So kudos to the folks behind Dailyshow.com. But don't let your good works end now. Go out and find the best third-party distributors you can and let them help you extend the Daily Show franchise even further.

Categories: Cable Networks, Portals

Topics: Comedy Central, Daily Show, Google, Jon Stewart, MTVN, Viacom, YouTube

-

Lifetime Debuts Programs on Yahoo, iTunes, How Long Will These Happy Faces Prevail?

B&C carried word yesterday that Lifetime will be the latest cable network to eschew unveiling its new programs or seasons on air, preferring instead to go the online route. This follows similar recent moves by Discovery/TLC, FX (in partnership with cousin company MySpace) and others, with plenty, I suspect, yet to come.

B&C carried word yesterday that Lifetime will be the latest cable network to eschew unveiling its new programs or seasons on air, preferring instead to go the online route. This follows similar recent moves by Discovery/TLC, FX (in partnership with cousin company MySpace) and others, with plenty, I suspect, yet to come.For now, there seem to be happy faces all around the cable industry regarding these online premieres. Cable networks argue that online generates upfront buzz leading to higher awareness and ratings for on air. This in turn builds value in multichannel subscription services. This was the point that Bruce Campbell, Discovery's president of digital media made at the recent CTAM NY panel I moderated. Of course, networks are doing the right thing following audiences online, all the while continuing to proclaim that their traditional affiliates (cable and satellite operators) are their most important customers.

Maybe I'm missing something, but I doubt all these happy faces will prevail for long. My guess is that at some point next year the lights are going to go on in the cable operator community that the portals and other new distributors are getting access to programs that operators' monthly affiliate fees pay for in the first place. Of course gone are the days of cable exclusivity, but if and when operators flex their muscles and express their change of heart about online premieres, my bet is they'll stop.

Operators should know that, at some point, the law of "there's only 24 hours in a day" kicks in - so if someone caught the premiere online, they don't actually need to tune in for the on air debut. And of course, do cable operators really want to allow viewers to grow accustomed to seeing high-quality long form programming online and/or through portals?

I think we'll see lots more of this activity until the cable operators call "foul". In the meantime, operators would be smart to start getting some of these premieres on their own portals, to bolster their own online positions.

Categories: Cable Networks, Partnerships, Portals

Topics: Discovery, FX, Lifetime, MySpace, TLC

-

MSN Improves Pre-roll Experience

Kudos to MSN for evolving the pre-roll format by announcing they'll only insert at the beginning of a session and then only every three minutes. This "capping" policy is yet another effort to make pre-rolls more digestible.

Like it or not, pre-rolls are here to stay. They're an easy re-use of expensive creative. They're straightforward to see, because they're easily understandable by buyers. And while few viewers will admit they want ads, with better targeting, they're actually a familiar experience for viewers and could be useful.

Everyone I talk to agrees. Especially in the broadcast community. So while overlays and other formats will make inroads on pre-roll's turf, significant attention should be focused on improving the pre-roll experience and effectiveness, because that's where a lot of the ad dollars will remain.

So moves like MSN's are welcome. The question of course is, what effect does this capping policy have on their inventory and economics? The question of fleshing out the ad-based broadband video business model persists. If MSN can demonstrate viewership and satisfaction increase, and the economics work, I expect other aggregators and providers will experiment with this approach as well.

Categories: Advertising, Portals

Topics: MSN, MSN Video, pre-roll ads

-

Josh Freeman Moves from AOL to Discovery

File this one under "AOL's loss is Discovery's gain." Today Discovery announced that Josh Freeman, who had been an SVP of AOL Video, has joined Discovery as its Executive Vice President, Digital Media.

Josh and I did business together when I was consulting for TotalVid and we signed a distribution/promotion deal with AOL Video. Josh is among the smartest, most experienced people in the broadband video space and will no doubt have a huge impact on Discovery's growth in the area.

From the release:

"As Discovery's top digital media strategist, Freeman will be responsible for growing Discovery brands across digital platforms globally. Charged with seeking out new technology and strategic alliances, and developing new business models and markets, he is expected to help Discovery expand its footprint through the role and visibility of its world-class portfolio of brands online, on mobile and through other digital platforms."

At Discovery Josh will report to Bruce Campbell, President, Digital Media and Business Development. Coincidentally, Bruce, who's also relatively new to Discovery, will be on my CTAM NY Blue Ribbon Breakfast panel in 2 weeks, joining other panelists Dallas Clement (Cox), David Eun (Google), Herb Scannell (Next New Networks) and Matt Strauss (Comcast). The session promises to be a blockbuster and is already fully sold out.

Categories: Cable Networks, People, Portals

Topics: AOL, Discovery, Josh Freeman

-

Good Riddance to Google Video Store

On Friday, AP carried the news that Google intends to stop offering paid downloads at Google Video and that it will discontinue support for any downloads made since its launch. Thus ends one of the most anachronistic initiatives I've observed in the broadband video industry.

I was at CES in January 2006 when Google co-founder Larry Page delivered a keynote in which he launched Google Video Store. The press release is here. My recollection of the event is still quite vivid. First, it was such a mob scene that just finding a place to watch the speech was an exercise unto itself. I ended up watching it in a courtesy tent packed cheek-to-jowl with hundreds of others.

As Larry introduced Google Video Store, I kept thinking to myself, "How is that a company with Google's IQ could have made such a startlingly bad product decision?"

Go back to that time for a moment, and imagine that you are Google. You are the foremost company in the world at monetizing content through advertising. You have the ability to meet with the CEO of every major media company in the world -- companies whose video is disproportionately supported by advertising. You have the opportunity to suggest trials, experiments and potentially longer-term deals to bring these companies' video online in an ad-supported manner. You can tantalize them with online riches beyond what they currently collect on-air. And you can be their trusted partner, with the Internet's leading technology, to help figure it all out.

(By the way, at the time, Google's official word was that their choice of the paid model was the only way they could get their hands on full length programs. Yet, just 3 months later, Disney/ABC announced online distribution of ad-supported full length programs. So this was clearly already in the works before January, 2006).

Instead of doing all of this though, you decide to launch using a commerce model, thus completely turning your back on all of the company's massive online advertising horsepower. In doing so, you choose to compete with Apple's iTunes, which has dominant market share and is seamlessly married to the wildly popular iPod. And in an act of arrogance and silliness, you decide to launch your own player, thus rendering all of the premium video incompatible with WMP, Flash, Real and other devices.

And yet, all of this is exactly what Google did. Somehow it managed to persuade premium content providers like Sony BMG, the NBA and Charlie Rose to partner. And it even managed to get Les Moonves, CBS's CEO to come on stage with Larry and make a fawning speech about how excited he was to be a part of all this action.

Now in August, 2007, 20 months later, Google Video Store is dead. Hallelujah. What a ridiculous distraction it has been. I have written over and over that I believe Google is one of the best-positioned companies to exploit broadband video. And yet, like Yahoo most prominently, I still view Google (outside of its YouTube acquisition) as all thumbs in this important new market.

For example - whatever happened to Google's deal with MTV to syndicate its content through the AdSense network? Did anything important come out of that, which might be used for other partners? What's going on with "click-to-play" video ads? And, any updates on Google for TV ads announced in April with EchoStar? Then there's the overhang of the Viacom lawsuit and the introduction of ‘fingerprinting' technology from Google to deter copyright violators. Recently it's looked like its introduction is imminent, and yet no firm timetables have been established.

I'm still expecting big things out of Google in the broadband video area, and I was encouraged to see Gabriel Stricker say in the AP piece that "The current change is a reaffirmation of our commitment to building out our ad-supported...models for video." I hope Google means it.

Categories: Advertising, Downloads, Portals

Topics: Google

-

AOL Video To Get a Refresh

Video continues to be a big focus for AOL. On Monday it will announce an update to its AOL Video portal (soft launch now available here)

According to AOL, the main benefits are:

- A redesigned main page that makes it easier for consumers to discover, search for and find millions of videos from across the Web;

- A redesigned video search experience that leverages industry-leading TruveoTM video search technology and features better presentation of Web search results to help users more easily find what they are looking for and;

- A new embedded playback experience where consumers can find and watch videos from other popular video sites on the AOL Video site.

I continue to find Truveo to be a real differentiator for AOL (recall that AOL acquired Truveo back in January, 2006). The quality of the search results is consistently better than anyone else's. Just try running a "Tiger Woods" video search on all the different services. Truveo also helps AOL maintain a hybrid "open/closed" approach (my term) - with AOL simultaneously offering access to video anywhere on the web while also operating a walled garden of video supplied by numerous partners.

AOL noted that over the past nine months, skyrocketing consumer demand for online video has propelled the number of unique visitors on AOL Video to grow by 300% to eight million uniques per month.

I have no idea how that traffic divides up, but my guess is that a lot of those uniques are coming to AOL Video to run video searches. AOL pops a new browser window for video found at other places so it doesn't entirely lose the visitor.

In my firm's recent report on broadband video aggregators, AOL was among the 12 companies we identified as most likely to emerge as successes. I continue to like how they're blending web content with in-network content, branded with UGC, search with browse, free with paid and streaming with download. I think of Yahoo and MSN as their two closest portal competitors. While MSN is doing a respectable job, AOL is well out in front of Yahoo from a user experience standpoint. With the recent shakeup at Yahoo, I expect them to better capitalize on their considerable potential.

Categories: Portals

Topics: AOL

-

5 Reasons Why Comcast Should Take Out Yahoo. Now.

Terry Semel's departure as CEO of Yahoo has again raised speculation that Yahoo is acquisition bait. Of course this rumor's been flying for ages. So here's my point of view: Comcast should acquire Yahoo. And they should do it now.

Some of you will recall that in my September, 2005 e-newsletter, "Why Comcast Should Acquire AOL" I laid out the case for Comcast to push aggressively into the online media business. At the time I thought an acquisition of AOL would be a bold stroke. While I had no inside knowledge of Comcast's plans, shortly afterwards it came to light that Comcast had indeed sniffed around AOL. Now, again, I have no knowledge of Comcast's possible interest in Yahoo, but it wouldn't surprise me if we saw something surface soon. It would be a very smart deal for Comcast. Following are my 5 key reasons. Judge for yourself.

1. The offensive case: Comcast needs more exposure to the online media business

Comcast is a company that urgently needs more long-term exposure to the online media business. In the last few years online usage and online advertising have exploded. A more recent category of burgeoning growth is of course, broadband-delivered video. I believe the trends around both online and broadband usage are only going to gain further momentum in the years ahead.

To see why, it is critical to understand the shift in media consumption patterns occurring among young people today. As one data point, JupiterResearch recently reported that online users under 35 spend more time online than watching TV. Meanwhile Magid just released figures showing that 80% of 18-24 year old males watch broadband video at least once a week, with 35% watching on a daily basis.

Today's young people live online. There is scarcely an aspect of their lives (except sleeping, eating, and other obvious activities) that they do not look to the Internet and mobile technologies to fulfill for them. All of this activity has also fueled their general product/service expectations. Accustomed to significant personalization, choice and price competition, this group is going to be the toughest customer base to please and the least tolerant of products/services that don't meet their specific needs. How does all this relate to cable? I believe that when many young people set up their own apartments, they will increasingly conclude that cable operators' basic programming tiers do not meet their personalized needs and will be looking online for programming alternatives.

Any company in the media or related industries that is not positioning itself squarely in the middle of the online media space, and broadband video in particular, is making a huge mistake. Some of you have heard me say this before: when companies get on the wrong side of fundamental changes in customer behavior, they are sure to meet with peril in the future. For just one example, consider the catastrophic state the U.S. auto industry now finds itself in because it failed to understand shifting consumer tastes 30 years ago (tastes which Japanese makers grasped and have mercilessly capitalized on).

To be fair, it's not as if Comcast has ignored online media and broadband video. It has acquired thePlatfom and Fandango, has started Ziddio and will soon be launching Fancast. And its Comcast.net portal gets strong traffic. However, I believe that even when all these activities are combined, they do not give Comcast enough exposure to online media.

A Yahoo deal is all about Comcast being positioned properly and with the right scale to exploit the inexorable shift to online and broadband usage. Alternatives that do not do so as quickly or forcefully are by definition sub-optimal.

2. The defensive case: Comcast must pre-empt another Yahoo acquirer

As important as the offensive case is for Comcast, the defensive one may be even stronger. Comcast simply cannot allow Yahoo to fall into either Microsoft's or (heaven forbid), Google's hands (though that prospect would face steep FTC objections).

To see why this is so important it is necessary to understand a fundamental change happening in the media business, which is that the economics of media are rapidly shifting away from consumer-paid models (i.e. subscriptions, a la carte purchases, etc.) toward ad-supported models.

There are at least two important and interrelated reasons for why this is happening. First, the efficiency and effectiveness of the advertising business are both improving dramatically. Online targeting technologies (search/keyword, contextual, behavioral and other mechanisms) enable marketers to get unprecedented returns on their spending. As marketers spend more online and compete with each other for limited high-quality ad inventory, publishers in turn are able to monetize their content better than ever. This dynamic is the backstory behind online advertising's resurgence. I believe it is not only going to continue, but quickly spread into the video business, which has, to date, been well-insulated from the Internet revolution.

The second and interrelated reason for the shift in media economics is that various technologies (digitization, storage, bandwidth) are all making it lower-cost (and in some cases, virtually no-cost) for companies to provide at least an introductory tier of their services for free. With costs so low, it is possible for providers to employ much more flexible business models and still generate adequate financial returns.

As a result, a genuine pattern is developing whereby traditionally premium services (i.e. those paid for by consumers) are becoming free, either with ads, or in some cases, without. The examples abound. Start with my favorite - online access to broadcast TV programs. Just over a year ago the only way to watch a broadcast program online was to buy it, likely at iTunes. Now over 40 hit broadcast programs are freely available - on an ad-supported basis - with more coming all the time. Broadcasters have quickly recognized that advertising is a far better business than paid downloads.

There are plenty of other examples. You can now make a 411 call without charge, courtesy of Jingle Networks and others, supported by ads. Or get an email account with unlimited storage for free, with ads. Or send receive a free fax. And the list goes on.

Given all of this, I believe that an important future competitive advantage in the media industry (in fact, quite possibly, the most important competitive advantage) will be expertise in content monetization through increasingly sophisticated advertising mechanisms. Companies that have this capability will be the media industry's ultimate winners. Of course, in search, that's the position that Google has expertly dominated to date, driving its lofty stock price. And by the way, Google and Microsoft have each just doubled-down on this advertising theme, recently spending a combined $9B to acquire DoubleClick and aQuantive respectively (which had combined revenues of less than $600 million in 2006).

So stop and consider a company like Comcast, which in 2006, generated about 60% ($15.1B) of its overall revenues from cable TV subscriptions. High speed Internet kicked in another 20% ($5B), voice 3.6% ($913M), programming networks (all TV-based) 4.2% ($1.05B) and local advertising 6.1% ($1.5B). By my calculations, Comcast's ratio of consumer subscription revenue (cable + Internet access + voice = $21B) to advertising revenue (programming + local advertising = $2.55B) is around 8:1 (note I didn't deduct affiliate fees its programming networks take in). That means that as cable TV networks inevitably offer more of their programming for free to consumers (which is already happening in the recent Joost deals) and more content choices are available through broadband , Comcast's cable TV subscription business becomes increasingly vulnerable and along with it, Comcast's overall financial health.

So if you buy my logic that content monetization through ads is critical, that Comcast doesn't have enough expertise in this area and that its current subscription TV business is vulnerable long-term, the question becomes how does Comcast re-position itself to compete properly down the road?

Could Comcast build out its own content monetization and advertising capability? Sure, anything's possible. But consider how long Yahoo itself (with its deep roots in Internet search) has been laboring over Panama (its next generation ad system) just to gain parity to Google and you get a sense of the enormity of the challenge. An alternative would be for Comcast to partner for this capability. That's possible too, but sub-optimal. If you believe that content monetization is going to be as critical in the future as I do, how could a company with Comcast's reach not have this as a core internal competency?

So here again, a Yahoo deal would not only give Comcast these crucial capabilities, but also preclude another company from gaining access to Yahoo's content monetization technologies and skills. This would remove the threat of that company competing more strongly against Comcast in the future.

3. Yahoo enables Comcast to become THE next generation video aggregation leader

Acquiring Yahoo would allow Comcast to take a leadership role as THE next-generation, cross-platform video aggregator. This is the most exciting reason for the acquisition. As content distribution continues to shift to broadband delivery, there are going to be innumerable new competitors to Comcast, each offering a different consumer value proposition. One thing is for certain - each and every one of them is going to be freely riding Comcast's (and other cable operators') broadband pipes into users' homes.

I have written about these "over-the-top" or "cable bypass" services in the past, and they represent a real long-term threat to Comcast and others. Sure, very few people are dropping their cable subscriptions today to cobble together broadband content in bits and pieces. However, I can tell you anecdotally, judging by the number of friends OUTSIDE the industry who have asked my opinion, there is significant consumer interest in dropping cable service and piecing together a more personalized lineup.

To defend itself, Comcast is in a unique position - able to both deliver standard and high definition digital TV signals to a set-top boxes and also IP-based, broadband video to over 10 million high-speed Internet subscribers today, and growing. There are very interesting bundling opportunities between these services, which will offer far greater value to Comcast subscribers, but at little additional cost to the company. In addition, there are unique ways for the company to use broadband to offer enhanced distribution to programmers eager to expand their share of Comcast's subscribers' viewership.

The key to defining this next-generation aggregation role is for Comcast to have a robust Internet suite of services and capabilities to build from and tie into. Succeeding in the video aggregation business in the future is going to be about far more than piping channels into consumers' homes. Rather, it's going to be about wrapping all kinds of related services, interactive/social networking capabilities and advanced advertising around the core video. So one capability that I described above that is needed is content monetization through ads. But there are many others, among which Yahoo has significant market shares. These include email, social networking, photos, travel, maps, jobs, personals and others. Marrying some or all of these to Comcast's current services, particularly at the local level, will create new and highly differentiated video offerings that "over-the-top" providers will be hard-pressed to match.

In short, Yahoo gives Comcast a whole new range of services to leverage in order to become THE leading next-generation video aggregator.

4. Yahoo gives Comcast a much-needed international presence

In the old days, a cable operator thought it was becoming international when it decided to add Telemundo or Univision to its channel lineup. (You think I'm joking!)

Today, being an international company means tapping into fast-developing economies all over the world. It is a simple fact that in developing economies, tens of millions of people are joining the middle class, bestowed with newfound spending power. This of course is why there are daily announcements from American companies trumpeting their new international ventures.

Yahoo and all the other major Internet companies have recognized this, operating essentially borderless businesses and offering their services in multiple languages. Yahoo has hundreds of millions of international users and in 2006 generated over $2B in international revenues. It provides its service in over 20 languages and has offices in over 20 markets around the world.

Comcast, on the other hand, offers its services only in America. It's tempting to say that's OK, since the markets in which Comcast operates are fundamentally local and have been mainly insulated from international competition. Yet, when you look at households across America, there are at least three concerns. First is that Comcast passes a defined number of them, so its addressable market is limited. Second is that there is real spending fatigue in many homes. Both of these diminish opportunities for top line revenue growth for services cable operators offer. Finally, with the spread of digital distribution technologies, Comcast faces new video competitors from all over the world vying to deliver video to homes within Comcast's footprint.

So sure, adoption of voice services is currently driving double-digit cash flow growth for Comcast and others, but how long will that last? These new revenues represent a market share shift from telcos, not new net market growth. They are nothing to sneeze at, but telcos are preparing their own market share assault on cable's video customers. And then of course there are wireless broadband services like WiMax, which will inevitably cut into Comcast's (and others') current market shares.

International exposure would provide Comcast with a whole new growth story. And Yahoo would provide this platform immediately. And by the way, there's another angle on international expansion. For anyone paying attention to the raging immigration debates here, our own American communities are becoming more and more ethnically mixed themselves. So for example, wouldn't it be cool for Comcast to have access to advertisers in China who want to insert their ads on Comcast's cable systems here in the U.S.? As the world becomes a global village, Comcast needs to fully participate in it.

5. Comcast needs more technology DNA, Yahoo provides it

Last but not least, Comcast needs more online and technology DNA in its culture and Yahoo can provide it. Mind you, I know many outstanding people at Comcast who are totally immersed in the online and broadband realms. However, they are an island in a sea of thousands of customer service reps, field technicians and operating executives steeped in the cable business. In fact, virtually all of Comcast's senior management team comes from within the cable industry, if not from within the company itself. To fully capitalize on its online and broadband opportunities, Comcast needs more people with more perspectives. People who aren't rooted in the core business and the traditional way of doing things. People who have more experiences operating within the very companies Comcast will increasingly be competing against.

As well, Yahoo would also bring Comcast access to the Silicon Valley ecosystem and culture of innovation. While there are plenty of other pockets of innovation around the U.S. and the world, the Valley is still the epicenter of the action and Yahoo's right in the middle of it. Becoming immersed in this culture would allow Comcast to learn first hand about the faster development cycles that characterize Web 2.0 initiatives and pull those talents into the company. This may seem like soft stuff, but building corporate cultures attuned to larger market circumstances is critical for all companies to succeed. Though Yahoo is already a Comcast partner, this relationship, no matter how strong, will never be sufficient to change Comcast's DNA.

Wrapping Up

OK, that was a mouthful. Obviously I think there are many compelling reasons for Comcast to go forward. Less clear is whether Yahoo would be interested. New CEO Jerry Yang obviously loves this company - he's not only a co-founder, he's stayed around all these years. So he'd likely be a reluctant seller. Susan Decker gets rave reviews and would likely want her turn to run the show. That said, shareholders are restive and their recent action clearly help stir the waters for Terry Semel's departure. So at the right price, shareholders would probably be motivated sellers.

So let's say Yahoo is willing. Could Comcast win this deal, particularly when there would likely be a spirited bidding war? Clearly Comcast would need to bring a full wallet to compete with the likes of Microsoft and others. Today Comcast's market capitalization is about $87B, while Yahoo's is currently around $37B. So say it takes a 30% premium to win the company. That's a deal worth around $50B. In short, a very big bite for Comcast, and very dilutive, given Yahoo's '06 revenues were a little over $6B (compared with Comcast's $25B). However, I'm a believer that Yahoo stock isn't going to get any cheaper. Despite its recent woes, Yahoo is a tremendous franchise that would be virtually impossible to replicate. If Comcast is going to make a move, it should do so now.

A key to success would be Comcast messaging the deal properly to the Street. Comcast did a disastrous job at this with its Disney bid in 2004, which not only failed, but cratered the stock for a long time after. Having the Street's support, in the form of a sturdy Comcast stock price, would be very important to Comcast's success.

Let's see how things play out.

Categories: Cable TV Operators, Deals & Financings, Portals

Topics: AOL, Comcast, Google, Microsoft, Yahoo

-

The TV Industry’s New Call Letters: Y-A-H-O-O, M-S-N, A-O-L and M-Y-S-P-A-C-E?

Today’s announcement from NBC and News Corp, that they have set up a venture to distribute full length programs plus promotional clips through 4 major distributors (with more to come) heralds a potentially new, and radically different era, for the broadcast, and possibly the cable TV industries.

In one fell swoop, 2 of the major broadcast networks have granted distribution rights to four of the Internet’s most-trafficked sites. If one assumes that it is inevitable that the broadband/PC world will be linked up with consumers’ living room TVs (whether through AppleTVs, Xboxes, Slingcatchers, etc.), then it sure seems to me as though we are on the brink of seeing a full-scale digital replica of the analog broadcast TV affiliate model being born. If that’s the case, what does that mean for existing players, most notably local broadcast TV stations? And how about cable TV and satellite operators, who have long relied on retransmitting high-quality feeds local broadcast feeds of network programming as a staple of their value proposition?

I’ve been writing about how the video distribution value chain is being impacted by broadband video for a while now. My March 2006 newsletter, “How Broadband is Changing Video Distribution” recapped my firm’s Q1 2006 report, “How Broadband is Creating a New Generation of Video Distributors: The Market Opportunity for Google, Yahoo, Microsoft, AOL, Apple and Others”. In this report we identified these companies as a so-called ‘Group of 5” which were best-positioned to benefit as new broadband-centric distributors and explained our reasons for this conclusion.

Flash forward one year. Today’s announcement cements the distribution heft of 3 of the 5 (Yahoo, MSN and AOL). Meanwhile, Google’s acquisition of YouTube has strengthened its distribution prowess. If it can build on initial partnerships with the many content providers with which it works, its power will only grow. And of course, Apple now boasts almost 60 TV networks and content producers providing programming to iTunes. Its launch of AppleTV strengthens its hand as the hardware provider-of-choice in linking up the broadband and TV worlds.

We’re exploring all of this in a report we’re (quite coincidentally) working on right now, which examines broadband’s impact on the video distribution value chain. It both updates the Q1 2006 report, and also expands it to include the roles of emerging players such as Joost, BitTorrent, Wal-Mart and others. We’ve been very fortunate to have access to many of the players in the space to gain unparalleled insights into their plans. The report is due out soon. I’ll keep you posted on its progress.

Categories: Aggregators, Broadcasters, Partnerships, Portals

Topics: AOL, MSN, MySpace, NBC, News Corp, Yahoo, YouTube

-

Google Ramping Up AdSense Video Distribution

Google is finally starting to ramp up the use of its AdSense distribution network to deliver video. As today's NYTimes piece describes, Dow Jones, Conde Nast and others are participating. This follows on previous announcements with MTV, Sony BMG and Warner Music Group. As I said in "7 Broadband Video Trends for 2007", Google is extremely well-positioned to lead the nascent video syndication market by leveraging both AdSense and AdWords. Clearly while the major networks grapple with how to deal with Google/YouTube, other media companies seeking to harness Google's distribution might are moving ahead.

Categories: Advertising, Portals

Topics: Google

Posts for 'Portals'

Previous |