-

Vevo Launches: Decent Start, Lots of Work Ahead

Vevo, the much-heralded "Hulu for the music industry" venture backed by Universal Music Group, Sony BMG, Abu Dhabi Music Company and Google/YouTube (and with video provided by EMI as well) officially launched late last night. I've been browsing around the site this morning and my first reaction is that it's a decent start, but has a long way to go if it is to fulfill its lofty mission.

Conceptually, I like the idea behind Vevo. The music industry, which has suffered multiple blows over the last 10 years, is getting together to create a destination site where music videos are distributed legally, with a coherent ad strategy. YouTube's participation means that videos that have been watched in the labels' YouTube channels can be branded Vevo, giving the new site tons of visibility, and helping migrate traffic over time.

From a design standpoint, the Vevo site has a similar feel to Hulu: large, wide-screen images on the home page promoting certain videos/artists, thumbnails below, of top videos, playlists and artists, quick links to most popular today, and search/navigation. A nav bar at the bottom of the screen invites users to easily create new playlists by adding up to 75 videos with one click. Videos are embeddable and shareable, and there are quick links to buy the music at Amazon and iTunes. The site was periodically very slow to load and occasionally even gave me a server error page. I don't know how much of this to ascribe day 1 hiccups that will be worked out over time or really poor capacity planning.

Less clear to me is how Vevo distinguishes itself from a user experience standpoint from YouTube itself. This has been a question that's nagged at me since the Vevo concept was first unveiled - how do the partners plan to make 1+1=3? The partners have made references to being indifferent to whether users watch at Vevo.com or YouTube, presumably because there would be similar advertising on both with similar splits. Yet, my experience going back and forth between the sites, albeit very limited, reveals lots of inconsistencies and a lot of promotional leverage left untapped.

Focusing on U2, one of my personal favorites, I found only about a dozen of the band's music videos on Vevo. Switching over to YouTube, I found many more tracks, such as "Beautiful Day," "I Still Haven't Found What I'm Looking For" and "Where the Streets Have No Name," all in the Universal Music Group's channel. All of the videos were monetized: the first was preceded by a 15 second pre-roll ad for Chevy Malibu and the latter two carried an overlay ad to "Play Free Games" which was accompanied by a companion ad in the right column (the overlay was incredibly distracting, but that's another story). None of the videos had any Vevo branding whatsoever. It's also worth noting that even the UMG channel in YouTube has no Vevo branding or promotion.

Conversely, a search in YouTube for "All Because of You," a video that is available on Vevo, loads in YouTube with full Vevo branding. Above the video window are options to "Watch with Lyrics," "View Artist Profile," and "Create a Playlist." Clicking on any of these carries you over to the Vevo site. However, none of these actions are well-executed. "Watch with Lyrics" restarts the video, whereas a much slicker implementation would resume playing on Vevo from the point of drop-off. "View Artist Profile" simply displays a list other videos available, without any real artist profile information offered (background, upcoming concerts, etc.). And "Create a Playlist" just brings you to Vevo's home page, without any prompts for what to do next if indeed you want to actually want to create a playlist.

Elsewhere, the Vevo team hasn't even bothered to update its blog to officially announce the site's launch (it still says "Launching Tonight!" at the top). That's a missed opportunity, especially considering there was a splashy launch party in NYC last night (attendees ranging from Google's Eric Schmidt to Rhianna, Bono and Mariah Carey) and pictures and video from that event would have been a big drawing card. Come on - where's the Vevo PR team here?

How much of this should be forgiven to it being early days of Vevo's launch is a subjective call. From my vantage point though, I think the Vevo team could have done a lot more to think through and execute on the user experience. Back in November '07, when I looked at Hulu in its private beta, I gave it a solid B+. The Hulu team had clearly obsessed about each and every detail of the site - and have continued to do so. Hulu's user experience isn't perfect, but it has set the bar very high for those seeking to emulate it. For now Vevo probably rates around a C; much work is still ahead.

What do you think? Post a comment now.Update: Vevo's blog post that "It's awesome that millions of people are checking it out, but the response has been orders of magnitude larger than even our highest estimate" suggests poor capacity planning by the Vevo ops team. I mean,"orders of magnitude larger"? If that's really the case then the ops team gets serious demerits for a ridiculously big miss.Categories: Aggregators, Music

Topics: EMI, Google, Sony BMG, Universal Music, VEVO, YouTube

-

ExpoTV's New Research Service is Another Example of "Purpose-Driven" UGV

ExpoTV has formally launched "Kitchen Table Conversations," (KTC in my shorthand) a new research service in which certain members of its community provide video responses to a set of brand-sponsored research questions. The resulting video footage provides authentic, qualitative insights on actual consumers' habits, attitudes and behaviors. KTC is yet another example of "purpose-driven" user-generated video, a concept I began discussing in Fall '08 that continues to gain traction. I talked with Expo's president Bill Hildebolt yesterday to learn more about how the new research service works.

For those not familiar with Expo, it is a community-oriented site where consumers create videos of themselves reviewing products they've used. The site now offers a catalog of 300,000+ of these

"videopinions" on a wide diversity of products, generated by 60K+ community members. Over time Expo has evolved from being an outlet where users alone chose which products to review (which they can still do) to a model where sponsors are able to tap the community for video reviews of specific products. Members receive points in exchange for their video submissions and other activities.

"videopinions" on a wide diversity of products, generated by 60K+ community members. Over time Expo has evolved from being an outlet where users alone chose which products to review (which they can still do) to a model where sponsors are able to tap the community for video reviews of specific products. Members receive points in exchange for their video submissions and other activities. Bill explained that the KTC research service originated from sponsors approaching Expo with a desire to interact with community members on a deeper level. With KTC, the research sponsor (e.g. brand, ad agency, trade organization, etc.) can submit a series of questions and the respondent profiles they want to target. Expo then taps into its member database and offers invitations to participate. Because participants have a track record of submitting video to Expo, a minimum quality level is pretty well assured. As part of its service, Expo can edit the submitted videos into a package or just provide them raw to the research sponsor to use as they'd like.

While online research is not a new concept (how many of us have filled out surveys or email questionnaires), what's different here is the reliance on video, which provides a different level of insight. Bill said that for researchers, KTC fits between traditional focus groups (where a group of individuals is brought together in a room to discuss their views of a product) and "ethnography" (a process whereby professional researchers actually live with participants for a period of time studying and capturing their behaviors). Bill believes that KTC provides many of the same authentic, on-location benefits of ethnography, but at a price comparable to focus groups and in a far-quicker turnaround time of 2 weeks or less.

Expo has run half a dozen KTC research projects over the past 9-12 months, working to refine the process. The adjacent video, from one of the research projects (focusing on moms' grocery shopping habits), is a

good example of an edited result. In it, you see and hear women in their own homes, speaking authentically and showing specifics (e.g. a coupon folder, handwritten lists, etc.) of how they do their shopping. The video won't be mistaken for prime-time entertainment, but to researchers looking for nuggets of insight, it's golden. For agencies in particular, which can incorporate select segments of KTC video into their client pitches, it's a totally new approach to consumer research.

good example of an edited result. In it, you see and hear women in their own homes, speaking authentically and showing specifics (e.g. a coupon folder, handwritten lists, etc.) of how they do their shopping. The video won't be mistaken for prime-time entertainment, but to researchers looking for nuggets of insight, it's golden. For agencies in particular, which can incorporate select segments of KTC video into their client pitches, it's a totally new approach to consumer research.KTC is the latest example to hit my radar of how certain types of user-generated video can be used for very productive purposes. Regardless of what might be said about YouTube's and others' inability to monetize the user-generated video uploaded to their sites, one of the derivative benefits of all this user activity is that an army of amateur videographers has been created, many of whom are comfortable in front of and behind the camera. Their video won't win an Oscar or Emmy any time soon, but as Expo and others are proving, their skills and passion are valuable and can be tapped for various purposes.

What do you think? Post a comment now.

Categories: UGC

Topics: ExpoTV

-

Tiger Woods Scandal Gets Animated Video Treatment

It's hard not to be fascinated by the Tiger Woods "transgressions" scandal and the drip-drip-drip revelations that are keeping the story alive. Amid the hubbub, the big mystery remains what actually happened on the fateful night that Tiger plowed his Escalade into a neighbor's fire hydrant and tree.

As the NY Times reported over the weekend, the animation unit of the Taiwanese "infotainment" newspaper Apple Daily (owned by Hong Kong-based media company Next Media) has created an animated video re-enactment of the events. The video is available on YouTube, where it has already drawn 2 million+ views. Non-Chinese speakers are out of luck on what the narrator's saying, but the animation provides the gist. As many suspect to be the case, there's Elin chasing Tiger's car down the street bashing its rear window with a golf club, causing a distracted Tiger to lose control and run off the road.

Compared to animated feature films, the quality is pretty amateurish. But that's the least of its problems; more significant is that the events shown are not based on the police reports or known facts, but rather on the animators' conception of what happened. So while Daisy Li, the Apple Daily manager overseeing the animated videos is quoted as saying that the idea of the animated videos is to make news more accessible to young people who don't like to read newspapers, by any standard, the video cannot be considered a journalistic pursuit.

Notwithstanding, the significance of the Tiger animated video and the whole idea of animated video re-enactments in general is that they have the potential to hugely influence public opinion about actual news events. By publishing videos like this to sites such as YouTube that have global reach, non-journalistic animators can vie with bona fide news outlets to inform audiences. For purists that will feel alarming, though it should be remembered that this is hardly the first time performance has influenced opinion - consider for example, that many people formed an opinion of Sarah Palin last year not on her remarks, but on Tina Fey's imitation of them on SNL.

Whether it is fact, fiction or something in between, video's power lies in its ability to tell a story better than any other medium. The animators at Apple Daily appear to understand this, as will others who will inevitably try to emulate their success. Audiences beware.

What do you think? Post a comment now.

Categories: International, Newspapers, Sports

Topics: Next Media, Tiger Woods

-

4 Items Worth Noting for the Nov 30th Week (Alicia Keys on YouTube, Jeff Zucker's record, Comcast's Xfinity, SI's tablet demo)

Following are 4 items worth noting for the Nov 30th week:

1. Alicia Keys concert on YouTube is an underwhelming experience - Did you catch any of the Alicia Keys concert on YouTube this past Tuesday night celebrating World AIDS Day? I watched parts of it, and while the music was great, I have to say it was disappointing from a video quality standpoint -lots of buffering and pixilation, plus watching full screen was impossible.

I think YouTube is on to something special webcasting live concerts. Recall its webcast of the U2 concert from the Rose Bowl on Oct 25th drew a record 10 million viewers. That concert's quality was far superior, and separately, the dramatic staging and 97,000 in-person fans also helped boost the excitement of the online experience. It's still early days, but to really succeed with the concert series, YouTube is going to have to guarantee a minimum quality level. Notwithstanding, American Express, the lead sponsor of the Keys concert had strong visibility and surely YouTube has real interest from other sponsors for future concerts. It could be a very valuable franchise YouTube is building and is further evidence of YouTube's evolution from its UGC roots.

2. Being a Jeff Zucker fan is lonely business - In yesterday's post, "Comcast-NBCU: The Winners, Losers and Unknowns" I said I've been a fan of Jeff Zucker's since seeing him deliver a brutally candid and very sober assessment of the broadcast TV industry at the NATPE conference in Jan '08. My praise elicited a number of incredulous email responses from readers who vehemently disagreed, thinking Zucker's performance merits him being sent to the woodshed rather than to the CEO's office for the new Comcast-NBCU JV.

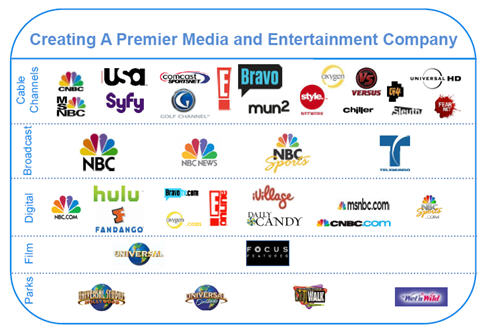

To be sure, NBC's abysmal performance under Zucker (falling from first place to fourth in prime-time), will be one of his legacies, but I take a broader view of his tenure. A good chunk of NBCU's cable network portfolio came to the company via the Vivendi deal around the time Zucker took over responsibility for cable. Since that time the networks have grown strongly in audience and cash flow has doubled from about $1 billion to a projected $2.2 billion in '09. NBCU added Oxygen (which combined with its iVillage property makes a strong proposition for women-focused advertisers) and The Weather Channel, in a joint buyout with two PE firms.

While Zucker's hiring of Ben Silverman to run NBC was a misstep, NBCU has enjoyed stability on the cable side, with two of the highest-regarded women in TV, Bonnie Hammer and Lauren Zalaznick cranking out hit after hit for their respective networks. A CEO's tenure is always a mixed one, with plenty of wins and losses. It can be hard to know how much of the wins to ascribe to the CEO personally, rather than the executives below, but at the end of the day, NBCU was transformed from a single network company to a cable powerhouse; even Zucker skeptics have to give him some credit for this.

3. Comcast rebrands On Demand Online to Fancast Xfinity TV - yuck! - Largely lost in the NBCU commotion this week was news that B&C broke that Comcast is changing the name of its soon-to-be-launched TV Everywhere service from On Demand Online to Fancast Xfinity TV. Yikes, the branding gurus need to head back to the drawing board, and quick. The name violates the first rule of branding: pronunciation must be obvious and easy. Not only is it unclear how you pronounce Xfinity, it's a an unnecessary mouthful that doesn't fit with any of Comcast's other workmanlike brands (e.g. "Digital Cable," "On Demand," "Comcast.net"). If we're talking about a new videogame targeted to teenage boys, Xfinity is great. If we're talking about a service that provides online access to TV shows, there's no need for something super-edgy. I'd suggest just sticking with "On Demand Online." But even more importantly, priority #1 is getting the product launched successfully.

4. Sports Illustrated demo builds tablet computing buzz - If you haven't seen SI's demo of its tablet version being shown off this week, it's well worth a look at the video here. Never mind that there isn't such a tablet device on the market yet, the rumors swirling around Apple's planned launch of one has created an air of inevitability for the whole category. As the SI demo shows, a tablet can be thought of a larger version of an iPhone (likely minus the phone), providing larger screen real estate to make the user experience even more interesting. It's fascinating to think about what a tablet could do for magazines in particular, along the lines of what the Kindle has done for books. The mobile video and gaming possibilities are endless. Judge for yourselves.

Enjoy the weekend!

Categories: Aggregators, Broadcasters, Cable TV Operators, Magazines, People

Topics: Comcast, NBCU, Sports Illustrated, YouTube

-

VideoNuze Report Podcast #42 - December 4, 2009

Daisy Whitney and I are pleased to present the 42nd edition of the VideoNuze Report podcast, for December 4, 2009.

Today's sole topic is of course the big news of the week, Comcast's acquisition of NBCU. Daisy and I chat about the winners/losers/unknowns that I detailed in my post yesterday. There are a lot of aspects to the Comcast-NBCU deal and the new entity will have wide-ranging implications for the media industry. Listen in to learn more.

Click here to listen to the podcast (15 minutes, 24 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings, Podcasts

Topics: Comcast, GE, Hulu, NBCU, Podcast

-

Comcast-NBCU: The Winners, Losers and Unknowns

With Comcast's acquisition of NBCU finally official this morning (technically, it's not an acquisition, but rather the creation of a JV in which Comcast holds 51% and GE 49%, until GE inevitably begins unwinding its position), it's time to assess the winners, losers and unknowns from the deal, the biggest the media industry has seen in a long while. I listened to the Comcast investor call this morning with Brian Roberts, Steve Burke and Michael Angelakis and reviewed their presentation.

Here's how my list shakes out, based on current information:

Winners:

1. Comcast - the biggest winner in the deal is Comcast itself, which has pulled off the second most significant media deal of the decade (the first was its acquisition in 2002 of AT&T Broadband, which made Comcast by far the largest cable operator in the U.S.), for a relatively small amount of upfront cash. Comcast has long sought to become a major player in cable networks, but to date has been able to assemble an interesting, but mostly second tier group of networks (only one, E! has distribution to more than 90 million U.S. homes).

The deal moves Comcast into the elite group of top 5 cable channel owners, alongside Disney, Viacom, Time Warner and News Corp, with pro-forma 2010 annual revenues of $18.2 billion and operating cash flow of $3 billion. It also provides Comcast with a huge hedge on its traditional cable/broadband/voice businesses, as the JV, on a pro-forma basis would be 35% of Comcast's overall 2010 revenue of $52.1 billion, though importantly only 18% of its cash flow of $16.5 billion. On the investor call, Roberts emphasized that the deal should not be seen as the company diminishing its enthusiasm for the traditional cable business, but given the downward recent trends in fundamentals (vividly shown in slides from my "Comcast's Digital Transformation Continues" post 3 weeks ago), the conclusion that Comcast will be relying on its content business for future growth is inescapable.

2. Cable networks' paid business model/TV Everywhere - With Comcast's executives' platitudes about cable networks being "the best part of the media business," the fact that cable networks will contribute 80%+ of the JV's cash flow and the ongoing travails of the ad-supported broadcast TV business, the deal puts an exclamation mark on the primacy of the dual-revenue stream cable network model and Comcast's commitment to defending it (see "The Cable Industry Closes Ranks" for more on this.)

The deal can also be seen as cementing the paid business model for online access to cable networks' programs. Comcast is committed to having online distribution of TV programs emulate the cable model, where access is only given to those consumers who pay for a multichannel subscription service. Much as they may resist acknowledging it, Hollywood and the larger creative community must see Comcast as doing them a huge service by preserving the consumer-paid model, helping the video industry avoid the financial fate of newspapers, broadcasters and music. To be sure, some consumers will cut the cord and be satisfied with what they can get for free online, however it is unlikely to be a large number any time soon. As for aspiring over-the-top providers, they'll need to look outside the cable network ecosystem to generate competitive advantage.

3. Jeff Zucker - The current head of NBCU will migrate into the role of CEO of the JV, greatly expanding his portfolio and influence. Zucker has fought the good fight to preserve the NBC network's status, rotating in new creative heads, shifting Leno to primetime, backing Hulu, etc, but the reality, as he pointed out earlier this year, is that NBCU in his mind has long since become a cable programming company. I've been a Zucker fan since seeing him speak at NATPE in '08 when he laid out a sober assessment of the broadcast business. Through solid acquisitions and execution, Zucker has proved himself to be far more than the wonderboy of "Today" - he's going to fit in well at Comcast and be a great addition to its executive team.

Losers:

1. NBC broadcast network and the JV's 10 owned and operated stations - While Comcast executives said they "don't anticipate any need or desire to divest any businesses" and "take seriously their responsibility" to the iconic NBC brand, the reality is that with the broadcast business contributing just 10% of the JV's pro-forma annual cash flow, the network, and especially the stations, are not just in the back seat of the JV, they're in the third row. Though broadcast contributes 38% of the JV's pro-forma revenue and the deal is being struck near the bottom of the advertising recession, it's hard to see things improving much. Exceptions are the sports division (more on that below), the TV production arm and possibly the news division. The only thing saving the stations is retrans and Comcast's need to appease regulators to get the deal done and keep the regulators at bay thereafter.

2. Other cable operators, telcos and satellite operators - It's never good news when one of your main competitors owns the rights to a good chunk of the key ingredients in your product, yet that's the reality for all other cable operators, telcos and satellite operators. Sure Comcast must be disciplined about throwing its weight around too much, but if these distributors cried when NBCU (and other big network owners) forced bundling and drove fee increases, they haven't seen anything until Comcast runs the renewal processes. With 6 channels having 90+ million homes under agreement plus many others in the JV's portfolio, Comcast is in a very strong negotiating position. As the world moves online, the threat that Comcast eventually says to hell with other distributors and goes over the top itself (a scenario I described here), other distributors have even bigger problems ahead.

3. GE - Yes GE gets about $15 billion in cash and a graceful exit from NBCU, but 20 years since incongruously acquiring NBC, the question burns even brighter, what was GE doing in the entertainment business in the first place? Hasta la vista GE, time to focus on manufacturing turbines and unraveling the woes at GE Capital.

Unknowns:

1. Do content and distribution go together any better this time around - With the disastrous results of AOL-Time Warner still fresh in the mind, it's fair to ask whether vertical integration will work any better this time around. Sensitive to the issue and no doubt anticipating questions on it, Roberts said on the call that this is "a different time and a different deal" and, pointing to News Corp-DirecTV, noted that sometimes vertical integration does work. In addition, he highlighted that the deal's financials are not predicated on achieving any elusive synergies. Still, aside from the obvious benefits of getting bigger in cable networks, the primary reasons cited for Comcast pursuing the deal still have synergy at their core: a slide that clearly says that "Distribution Benefits Content" and "Content Benefits Distribution." As always there are plenty of opportunities to pursue in theory; the challenge is executing on them given the rampant conflicts and turf battles that inevitably ensue.

2. Hulu's future - the online aggregator was literally not mentioned once in the Comcast presentation and its logo only appears on just one of the 36 slides in the deck, yet its presence is hard to underestimate. Hulu is the embodiment of the free, ad-supported premium video model that Comcast is so fiercely committed to combating. So how does it fare when one of its controlling partners soon will be Comcast? In response to a question, Steve Burke said he sees "broadcast content going to Hulu" and that "Hulu and TV Everywhere are complementary products." He also tersely dismissed the much-rumored idea of a Hulu subscription offering. It's impossible to know what becomes of Hulu, but with such divergent interests among the owners, it wouldn't surprise me if Hulu is unwound at some point post closing.

3. ESPN's role - With the JV's NBC Sports assets, plus Comcast's Versus, regional sports networks and Golf Channel, the new JV is primed to play a bigger role in national sports. While Fox Sports and TNT have skirmished for high-profile rights deals with ESPN, the new JV has a much stronger hand to play. It's fair to wonder whether Comcast, which likely sends Disney a check for $70-80 million each month to carry ESPN to its 24 million subscribers, won't at some point say, "hey we can do some of this ourselves" and move to become a bona fide ESPN competitor. In fact, ESPN figures into a far larger Comcast vs. Disney story line in the media industry going forward. The two companies are incredibly dependent on each other, and yet are poised to become even tougher rivals. Expect to hear much more about this one.

4. Consumers - last but not least, what does the deal mean for consumers? Likely very little initially, but over time almost certainly an acceleration of digitally-delivered on-demand premium content - but at a price. Comcast has the best delivery infrastructure, with the JV, soon premier content assets and a persistent, if sometimes incomplete (as with VOD, for example) commitment to shape the digital future. I expect that will mean lots of experimentation with windows, multiplatform distribution and co-promotion across brands. Washington will scrutinize the deal thoroughly, but with continued public service assurances from Comcast, will eventually bless it. Then it will be vigilant for anything that smacks of anti-competitiveness. Consumers should buckle up, the next stage of their media experience is about to begin.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings

Topics: Comcast, GE, Hulu, NBCU

-

Flip's New FlipShare TV Will Likely Flop

With today's unveiling of FlipShare TV, the folks behind the enormously popular Flip video cameras are betting that users want to watch their personal videos on their big-screen TVs and also be able to share their videos with friends and family. I think Flip is 100% right about users' interests, but the company's proprietary and expensive FlipShare TV approach is off the mark, and will likely flop. Flip would have had more success by partnering with key players in the video ecosystem, benefiting from both their momentum and numerous co-branding opportunities, while also avoiding costs incurred to develop and market FlipShare TV.

FlipShare TV consists of 3 items: a small base station that connects to the TV via HDMI or composite cables; a USB stick that has a proprietary 801.11n wireless interface so that videos on the computer can be

streamed to the base station (and hence viewed on the TV); and a remote control. Included FlipShare software lets users create "Flip Channels" which are groups of videos. FlipShare TV costs $150, a not-insignificant amount given Flip video cameras themselves have MSRPs of $150-$230, but can often be found for far less via online deals (I bought my daughter one for $60 recently).

streamed to the base station (and hence viewed on the TV); and a remote control. Included FlipShare software lets users create "Flip Channels" which are groups of videos. FlipShare TV costs $150, a not-insignificant amount given Flip video cameras themselves have MSRPs of $150-$230, but can often be found for far less via online deals (I bought my daughter one for $60 recently).The problem with FlipShare TV is that it takes a grounds-up approach to solving problems that could have been solved instead through smart partnerships and relatively straightforward integrations. Flip should have created a free or nearly free TV viewing and sharing feature that would have helped distinguish Flip's video cameras from the extensive list of competitive products hitting the market rather than creating a whole new product.

FlipShare TV's core proposition is of course making users' videos viewable on their TVs. The most obvious approach to doing so would have been to just partner with convergence product companies who are jockeying for position in the living room. The first partner in this space would have been Roku, which just released open APIs to support its Channel Store. I anticipate many other convergence players (e.g. Blu-ray, Internet TVs, gaming consoles, etc.) will similarly offer APIs to inexpensively broaden their offerings. As this occurs, Flip could have piggybacked on these devices. Netflix is doing this pre-emptively in the absence of APIs through brute force integrations; if it had wanted to, Cisco, Flip's parent, could have afforded to do so as well.

FlipShare TV's other value proposition of sharing could have been addressed through partnerships with companies such as Motionbox, iMemories and Pixorial which are targeting the family's "Chief Memory Officer." Motionbox is in fact already on Roku's Channel Store, which would have meant one less Flip integration. These companies are agnostic about how users capture their video, but all would have likely been eager to partner with well-known Flip to add to their brand awareness and their own value propositions.

YouTube would have been another obvious partner to enhance sharing. Granted YouTube lacks a strategy for getting onto the TV, but its online reach is unparalleled and features that would have enhanced YouTube uploading which is already prevalent among Flip users could have been valuable.

A major kink in FlipShare TV's sharing approach is that the sharee (e.g. grandma and grandpa) themselves also have to buy a FlipShare TV so they have the base station to connect to their TVs. Pew recently estimated 30% of seniors now have broadband Internet access (a number that's likely far higher for grandparents who have tech-forward, Flip-buying kids and grandkids). My guess is that sharing videos via a private YouTube channel would have been adequate for most of them if faced with the alternative of spending $150 for a proprietary setup.

All of these potential opportunities somehow didn't register with the Flip team. Their focus on a proprietary approach seems so complete that they didn't even choose to leverage existing wireless home networks among their target audience (Pew estimates home wireless penetration at about 40% for all broadband homes; it's likely double that or more in homes where a Flip camera's been purchased). Instead, additional cost was added to FlipShare TV system with the proprietary USB wireless stick.

I could be way off base on this and underestimating consumers' willingness to buy proprietary hardware, but I suspect I'm not. FlipShare TV's underlying concept of viewing on TVs and sharing is right on, but my guess is that its execution will yield little success. The lesson here: when partnerships are readily available, capitalize on them.

What do you think? Post a comment now.

Categories: Devices

Topics: Flip, FlipShare TV, iMemories, Motionbox, Pixorial, Roku, YouTube

-

LiveRail Lands PBS for Video Ad Management

LiveRail, a video ad management company, notched a high-profile customer win yesterday, announcing that PBS will use the company's platform to deliver sponsor messages on its recently launched PBS.org video

portal and its 356 member stations' online video outlets. PBS is making an aggressive play in online video and has gained many positive reviews of its portal, which provides access to all of its full-length programs and more.

portal and its 356 member stations' online video outlets. PBS is making an aggressive play in online video and has gained many positive reviews of its portal, which provides access to all of its full-length programs and more.LiveRail's CEO Mark Trefgarne and EVP Nic Pantucci explained to me yesterday that they're building a suite of tools that equally addresses all 3 constituencies in the ecosystem - publishers, advertisers and ad networks. The company is focused on the following 3 differentiators to separate itself in a pretty crowded video ad management space:

- Enhanced optimization that allows simultaneous querying of multiple ad sources to determine the highest effective CPM ad to serve (Mark and Nic said that using LiveRail one customer saw an jump in their ad fill rate from 40% to 90%)

- More flexibility in distributing and customizing ads to affiliates, based on a sub-account authorization system (this was particularly valuable for PBS with its hundreds of member stations and multitude of sponsor messages)

- Integration with the broadest set of 3rd party ad networks, using an extensive series of open APIs (this helps with time to market and reducing cost of integrations)

Of course, the real way to validate these benefits and compare LiveRail to others is by getting hands-on and trying the platform out. I've offered similar advice in the past when assessing the variety of online video platforms.

LiveRail was started in 2007, has 15 employees and has raised $1.5 million to date, though it sounds like there may be financing news upcoming. The video ad management space includes others like FreeWheel, Adap.tv, Tremor Media (with its Acudeo product), Auditude and others.

What do you think? Post a comment now.

Categories: Advertising, Technology