-

VideoNuze Report Podcast #21 - June 19, 2009

Below is the 21st edition of the VideoNuze Report podcast, for June 19, 2009.

Daisy discusses highlights from the OMMA Video conference that she organized in NYC this week. Daisy recaps the keynote from Eileen Naughton, Google's director of media platforms in which she said that child YouTube sensation "Fred" is pulling down a six-figure income. She also reviews comments by Andy Markovitz, Kraft's digital marketing and media director who recommended the online video ad industry needs more scale, better targeting and more format choices. Those sentiments were echoed by other speakers. Daisy has more details here.

This week I discuss my post from yesterday, "Does It Actually Matter How Much Money YouTube is Losing?" I recognize I took a somewhat contrarian standpoint here, and admit it feels a bit irresponsible to suggest that YouTube's losses don't matter much (except to Google of course). It's always been great sport to debate how much money YouTube is losing. But the fact is, as long as Google has the financial wherewithal to sustain YouTube's losses (whatever they actually are), and deems the site strategic in the long run (which I strongly believe it is), then the size of its losses is really pretty much irrelevant. I know lots of you disagree with my assessment; feel free to post a comment and explain why!

Click here to listen to the podcast (15 minutes, 40 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, Podcasts

Topics: Google, Podcast, YouTube

-

Does It Actually Matter How Much Money YouTube is Losing?

Guestimating how much money YouTube loses has been heavily debated since the company first burst on the scene. And even though YouTube has been part of Google for close to three years now, there are no signs the debate is letting up.

For example, this past April, Credit Suisse analyst Spencer Wang got a lot of attention asserting YouTube might lose $470M in 2009. Using these numbers, Fliqz CEO Benjamin Wayne generated a lot of buzz for his Business Insider post "YouTube is Doomed." Then earlier this week, in a much-noticed white paper, the IT outsourcing firm RampRate said the company's annual loss is closer to $174M, given a more accurate analysis of YouTube's true bandwidth costs.

No doubt the debate will continue to rage on. But does it really matter how much money YouTube is losing? I'd argue the answer is mainly no, with two caveats: first, that Google has the financial wherewithal to sustain YouTube's losses (whatever they may be), and second, that Google believes in YouTube's long-term strategic value.

With respect to Google's financial wherewithal, I think it's pretty much indisputable that Google can afford YouTube's losses, even if they exceeded Credit Suisse's estimate. In 2008 Google generated almost $8B in cash flow from operations, 36% more than in 2007. It currently has over $17B in cash. Its stock has bounced back from its $257/share low in the dark days of Dec. '08 to $415/share as of yesterday, translating to a market cap of over $130 billion and a P/E just north of 30. To be sure, Google is still a one-trick pony, relying on advertising alone to power its business model. But that pony has proven itself durable in the down economy and in the face of competitors, and the market has justifiably rewarded Google. If anyone thinks Google is being penalized for YouTube's estimated losses, I ask, where's the evidence?

Google's financial prowess gives it license to do what very few public companies are able to do: focus on the long-term. And that brings us to the second caveat, Google's belief in YouTube's long-term strategic value. Of course, none of us is privy to exactly what Google's executives believe on this front, but for my part, there's ample reason Google should be bullish, notwithstanding YouTube's current financial challenges.

First, and most important, YouTube maintains a dominant 40%+ share of online video viewership month in and month out, according to comScore. As I said in this recent post, YouTube has the best-known brand-name, deepest catalog, and best promotional reach of any online video site. In UGC it is in a rare "winner-take-all" position (even deep-pocketed Microsoft this week threw in the towel on Soapbox, its YouTube competitor). It would be unthinkable for anyone looking to upload video to not upload to YouTube, which is why the site gets an incredible 20 hours of video uploaded every minute.

What are these all worth in a market growing as fast as online video, where significant business model disruption lies ahead? A lot. YouTube would be the first partner of choice for any number of consumer and technology heavyweights now starting to slug it out for market share in the broadband era. Meanwhile, YouTube is well-entrenched in the cultural zeitgeist. It is the go to resource for presidential candidates, community organizers and lately, Iranian election protesters.

Sure, YouTube has its challenges. Hulu is crowding it out for access to premium content. UGC is a monetization drag (though a significant traffic driver). It doesn't have a bona fide or clearly articulated convergence strategy, as its recent YouTube XL initiative underscored. And it hasn't settled on an ad format that works. Regardless, YouTube has massive long-term strategic value. As long as Google recognizes this and has the financials to support it, then even in these recessionary times, how much money YouTube loses is largely irrelevant.

What do you think? Post a comment now.

Categories: Aggregators

Topics: Credit Suisse, Google, RampRate, YouTube

-

Aspera: Today Super-Fast Video File Transfers for the Media Industry. Tomorrow Super-Fast Video Downloads for Consumers?

Last week in "Robust Ecosystem Promises that Online Video Will Keep Looking Better and Better," I briefly mentioned a company called Aspera in the last paragraph. Aspera has been on my radar for quite some time, as I've had many industry colleagues mention to me the company's key role in the online video work flow process. Last week I got a chance to talk to Francois Quereuil, director of marketing to learn more.

Aspera addresses a key - and growing - operational problem in the online video work flow process: the time-consuming and resource-intensive step of moving around large video files, whether internally or to third-parties. This step has grown increasingly onerous as the number of files to be moved has expanded due to multiple bit rate encodings and multiple syndication partners. Further, the shift to higher-quality, HD video files has also made the file sizes bigger than ever.

When the company was started 5 years ago, Aspera's co-founders' premise was that the traditional approach for moving files, primarily by using FTP ("File Transfer Protocol"), was inherently inefficient because it was

optimized for text and used TCP, the underlying protocol that most Internet traffic relies on. Rather than trying to improve FTP or TCP as others have done, they instead designed their own protocol called "fasp" (Fast and Secure Access Protocol). By installing Aspera's fasp software at the file's send and receive points, large files can be sent over existing network infrastructure. fasp can send files 10 to 100s of times faster than FTP (there are charts here that show Aspera's tests).

optimized for text and used TCP, the underlying protocol that most Internet traffic relies on. Rather than trying to improve FTP or TCP as others have done, they instead designed their own protocol called "fasp" (Fast and Secure Access Protocol). By installing Aspera's fasp software at the file's send and receive points, large files can be sent over existing network infrastructure. fasp can send files 10 to 100s of times faster than FTP (there are charts here that show Aspera's tests). Francois explained that Warner Bros. became Aspera's initial customer, and that now every studio, CDN, aggregator, post-production house and many content providers use Aspera. A perfect example customer is Apple, which uses Aspera to ingest most of the HD video content it now makes available in iTunes. The media industry now accounts for 70% of Aspera's revenue, though there are other industries with large files such as government and biotech, for whom Aspera is also very appealing. For example, the oil and gas industry sends seismic data files that are terabytes in size using Aspera.

From the core fasp innovation, Aspera has built out a suite of products, including a web browser plug-in that lets remote users quickly upload their video files, a console product that allows multiple facilities running fasp to be centrally monitored and controlled, and a collaborative solution that allows drag and drop distribution of files to various end-points. Aspera seems well positioned to grow alongside increasing file complexity; the only company focusing on the media industry with file transfer acceleration that I'm aware of (and that Francois noted as competition) is Signiant, which I first wrote about here.

Clearly Aspera has already had a significant impact on powering high-quality video transfers and distribution, but what may still be ahead for the company could be even more interesting. Francois and I discussed the possibility that Aspera software could make its way into consumer devices like set-top boxes, gaming consoles, smartphones, etc. The company is in discussions with device manufacturers and service providers, but it is clearly still very early.

Still, the prospect of having Aspera-enabled devices could create what I think of as a "super-premium" video service, enabling near-instantaneous video-on-demand downloads. For over-the-top service providers this could be a meaningful differentiator. For incumbents like cable operators Aspera could have significant benefits in creating premium revenue opportunities and also capex savings by not having to continually upgrade their networks to deliver faster speeds and more capacity. Francois explained that fasp co-exists well with TCP-based networks and is distance-independent; this suggests that such premium services could be offered to all cable subscribers, not just those in select areas, and also that they could be centrally managed.

Exciting as the consumer-facing opportunity is, for now Aspera is mainly focused on its bread-and-butter business of improving the efficiency of large file transfers that are becoming more and more prevalent. Aspera is another perfect example of how innovative technologies up and down the stack are laying the foundation for an all-broadband future.

What do you think? Post a comment now.

Categories: Technology

-

June 24th Webinar on Online Video Syndication

Next Wednesday, June 24th at 1:30pm EDT / 10:30am PDT, I'll be presenting in a free webinar, "Demystifying Online Video Syndication." Video syndication continues to be one of the key trends in the online video market. I'll be sharing thoughts on where syndication is heading and where the main opportunities and challenges lie.

I've been writing about the emergence of the "syndicated video economy" for over a year now and during this time syndication has continued to grow in importance for all video content producers and technology providers.

The webinar is sponsored by Grab Networks, whose co-president Marcien Jenckes will present information about its grabMediaOS solution that enables a "Create Once, Publish Anywhere" business model. Grab works with hundreds of content providers and is one of the primary players in driving the video syndication market.

We have 260+ people registered for the webinar already, but there's plenty of room left. If you're trying to understand the syndication opportunity and identify the right solutions to fit your needs, this webinar is for you!

Categories: Events, Syndicated Video Economy

Topics: Events, Grab Networks, Webinar

-

Mobile Video Continues to Crystallize as Clearwire Launches 4G Service in Atlanta

The promise of high-quality video delivery to mobile devices continues to crystallize as Clearwire is officially launching its 4G service with Motorola in the Atlanta metro area today. It's the third official market launch (after Baltimore and Portland, OR), though Las Vegas was quietly kicked off a couple weeks ago. The company is calling Atlanta, with almost 3 million people spread over 1,200 square miles, "the largest Internet hot spot in the U.S." Clearwire still plans to roll out 80 U.S. markets reaching 120 million people by end of 2010.

The company's CLEAR WiMax service aims to deliver download speeds in the 4-6 Mbps range, bursting up to 15 Mbps. That range would put CLEAR on a par with broadband speeds most Americans receive now

from their cable companies. Recall that Clearwire, started by the wireless entrepreneur Craig McCaw, is now backed by 3 of the largest cable operators, Comcast, Time Warner Cable and Bright House Networks, along with other investors Intel, Google and Sprint.

from their cable companies. Recall that Clearwire, started by the wireless entrepreneur Craig McCaw, is now backed by 3 of the largest cable operators, Comcast, Time Warner Cable and Bright House Networks, along with other investors Intel, Google and Sprint. Of course there are lots of applications that benefit from high-speed mobile delivery, but video is right at the top of the list. This was the context for last month's alliance announcement between Cisco and Clearwire, whereby Cisco would become the primary IP network infrastructure provider and also build 4G devices. Cisco has made no secret of the fact that IP-delivered video is the key growth driver for the company in the coming years. Its recent research projects that almost 64% of the world's mobile data traffic will be video by 2013, based on an annual growth rate of 150% for the next 5 years.

The proliferation of inexpensive smartphones, led by the iPhone, is creating a massive need for robust mobile broadband infrastructure that Clearwire and others are rushing to provide. Mobile video consumption will lag fixed broadband usage for some time to come, but all the elements are falling into place for it to grow rapidly.

What do you think? Post a comment now.

Categories: Mobile Video

-

Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks

A monthly reminder that online video remains a work in progress is comScore's viewership data for online video ad networks. Even as someone who follows the industry closely, I find these reports confusing. The press

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service.

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service. comScore's traffic reports are extremely important for the online video industry's growth because they are a key source of data for advertisers, media buyers, agencies and others looking to tap into this new medium. Ad networks in particular are an important part of the online video ecosystem because they provide significant reach, targeting and delivery technology, all of which are required by prospective advertisers.

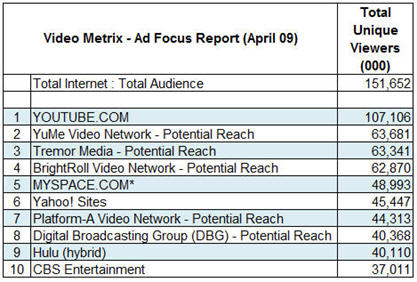

A key part of the current confusion is that each month comScore's Video Metrix Ad Focus report - which details the total audience of unique viewers for online properties and ad networks - combines both the actual audience of destination properties with the potential reach of video ad networks. For example, here's the top 10 for April:

As you can see, 5 of the top 10 listed are ad networks, whose measurement is potential, while the other 5 are actuals. "Potential" is supposed to represent the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However even the validity of this number is amorphous, because networks are only required to provide comScore proof of their relationships if the site accounts for more than 2% of all streaming or web activity.

Recognizing the need to provide more clarity, comScore has recently made available the option for networks to participate in a "hybrid" measurement approach, meant to track networks' actual viewership. To participate, networks need to place a 1x1 pixel, or "beacon" inside any video player where their ads appear. comScore takes the data reported by the beacons and combines it with its 2 million member panel of users whose behavior it tracks. It reconciles differences between the two through a "scaling" process that looks at the intensity of users' non-video behaviors.

To give a sense of the difference between potential and actual, comScore reports BrightRoll - which along with Nabbr are the only video ad networks to have implemented the beacons by April - as having 26M actual viewers vs. the 62M potential reported.

comScore's hybrid approach, which fits with its recently-announced "Media Metrix 360" service, is an important step forward in providing more clarity on how video ad networks are actually performing. Still, as Tania explained, even the hybrid approach has its own idiosyncrasies. For example, some publishers resist having a network's beacon incorporated into their video player, because they want to receive traffic credit themselves. Further, it is a voluntary program. Tania said that in addition to BrightRoll and Nabbr, other networks like BBE, YuMe and Tremor are all working through the implementation currently.

The actual numbers are important for buyers, so that ad networks' viewership can be assessed on an "apple to apples" basis with online properties, as well as non-video options. Tania said that media buyers tell comScore they value both potential and actual numbers. Though that sounds right to me, I think that for the online video medium to mature, buyers are going to put increasing emphasis on actual performance, particularly as it relates to existing media. That's why recent efforts from YuMe and Tremor to translate online video's impact into TV's gross rating points (GRP) paradigm are also important.

In short, comScore seems to be doing its part to improve reporting clarity. However, this isn't going to resolve itself overnight; the market will continue to experience reporting confusion for some time to come.

What do you think? Post a comment now.

Categories: Advertising

Topics: BBE, BrightRoll, comScore, Nabbr, Tremor Media, YuMe

-

4 Industry News Items Worth Noting

Looking back over the past week's news, there are at least 4 industry items worth noting. Here are brief thoughts on each:

Time Warner starts to acknowledge execution realities of "TV Everywhere" - I was intrigued to read this piece in Multichannel News covering comments that Time Warner Cable COO Landel Hobbs made about its TV Everywhere's plans being slowed by "business rules." Though I love TV Everywhere's vision, I've been skeptical of it because it's overly ambitious from technical and business standpoints. This was the first time I've seen anyone from TW begin to acknowledge these realities (though Hobbs insists "the hard part is not the technology"). I fully expect we'll see further tempered comments from TW executives in the months to come as it realizes how hard TV Everywhere is to execute.

VOD and broadband video vie for ad dollars - I've been saying for a while that broadband can be viewed as another video-on-demand platform, which inevitably means that it's in competition with VOD initiatives from cable operators. For both content providers and advertisers, a key driver of their decision to put resources into one or the other of the two platforms is monetization. And with VOD advertising still such a hairball, broadband has gained a decisive advantage. As a result, I wasn't surprised to read in this B&C article that ad professionals are imploring cable operators to get on the stick and improve VOD's ad insertion processes. Cablevision took an important step in this direction, announcing this week 24 hour ad insertion. Still, much more needs to be done if VOD is going to effectively compete with broadband video for ad dollars.Cisco sees an exabyte future - Cisco released an updated version of its "Visual Networking Index" which I most recently wrote about in February. Once again, Cisco sees video as the big driver of IP traffic growth, accounting for 91% of global consumer IP traffic by 2013. The fastest growing category is "Internet video to the TV" (basically the convergence play), while the biggest chunk of video usage will still be "Internet video to the PC" (today's primary model). Speaking to Cisco market intelligence people recently, it's clear that from CEO John Chambers on down, the company believes that video is THE growth engine in the years to come.

iPhone's new video capabilities - Daisy reviews this in her podcast comments today. It's hard to underestimate the impact of the iPhone on the mobile video market, and the forthcoming iPhone 3G S's video capabilities (adaptive live streaming, video capture/edit and direct video downloads for rental or own) mean the iPhone will continue to raise the mobile video bar even as new smartphone competitors emerge. Nielsen has a good profile of iPhone users here. It notes that 37% of iPhone users watch video on their phone, which 6 times more likely than regular mobile subscribers.

Categories: Advertising, Cable TV Operators, Mobile Video, Video On Demand, Worth Noting

Topics: Apple, Cablevision, Cisco, iPhone, Time Warner Cable, TV Everywhere

-

VideoNuze Report Podcast #20 - June 12, 2009

Below is the 20th edition of the VideoNuze Report podcast, for June 12, 2009.

This week I discuss the rampant innovation that I'm observing throughout the broadband video industry. My last few posts have provided several great examples of the technology, content and business model innovation now underway. These include product introductions from Blackwave and thePlatform, original online video from the Pennsylvania Tourism Office and syndicated product videos to online retailers from Invodo. Broadband video is far more than just a new entertainment medium!

Meanwhile Daisy discusses the Apple Worldwide Developers Conference, which was held this week in San Francisco. Among other things, the company unveiled several video-centric features for its new iPhone 3G S. These include adaptive live streaming, video capture/edit and direct video downloads for rental or own (i.e. a sideload from iTunes no longer required). Daisy explains that the video capture/edit capability positions the iPhone closer to the Flip video camera, setting up a new competitive dynamic for Flip and its new parent, Cisco.

Daisy sees the iPhone becoming a bona fide "media portal" that takes on some of the appeal of Amazon's Kindle. I agree with that comparison. Notwithstanding other smartphones launching like last week's Palm Pre, the iPhone will continue to have the greatest impact on the budding mobile video market.

Click here to listen to the podcast (14 minutes, 23 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Indie Video, Mobile Video, Podcasts, Technology

Topics: Apple, Blackwave, iPhone, Kindle, Podcast, thePlatform