-

4 Items Worth Noting for the Dec 7th Week (boxee's box, AT&T's iPhone woes, Nielsen data, 3D is coming)

Following are 4 items worth noting for the Dec 7th week:

1. Boxee's new box with D-Link - It was hard to miss the news from boxee this week that it will be launching its first box, in partnership with D-Link, in early 2010. Boxee has gained a rabid early adopter following, but the high hurdle requirement of downloading and configuring its software onto a 3rd party device meant it was unlikely to gain mainstream appeal. Strategically, the new box is the right move for the company.

For other standalone box makers such as Roku, boxee's box, with its open source ability to easily offer lots of content, is a new challenge (though note, still no Hulu programming and little cable programming will be available on the boxee box). The indicated price point of $200 is on the high side, particularly as broadband-enabled Blu-ray players are already sub-$150 and falling. Roku has set a high standard for out-of-the-box usability whereas D-Link's media adaptors have never been considered ease-of-use standouts. Boxee's snazzy, but very unconventional sunken-cube design for the D-Link box is also risky. While eye-catching, it introduces complexity for users already challenged by how to squeeze another component onto their shelves. If boxee only succeeds in getting its current early adopters to buy the box it will have gained little. This one will be interesting to watch unfold.

2. AT&T tries to solve its iPhone data usage problem - In the "be careful what you ask for, you might just get it" category, AT&T Wireless head Ralph de la Vega revealed an interesting factoid this week at the UBS media conference: 3% of its smartphone (i.e. iPhone) users consume 40% of its network's capacity. Of course video and audio capabilities were one of the big ideas behind the iPhone, so AT&T should hardly be surprised by this result. AT&T, which has been hammered by Verizon (not to mention its users) over network quality, thinks the solution to its problem is giving heavy users unspecified "incentives" to reduce their activity. No word on what that means exactly.

Mobile video has become very hot this year, largely due to the iPhone's success. But the best smartphones in the world can't compensate for lack of network capacity. While AT&T is adding more 3G availability, it's questionable whether they'll ever catch up to user demand. That could mean the only way to manage this problem is to throttle demand through higher data usage pricing. That would be unfortunate and surely stunt the iPhone's video growth. Verizon, with its line of Android-powered phones, could be a key beneficiary.

3. Q3 '09 Nielsen data shows TV's supremacy remains, though early slippage found - Nielsen released its latest A2/M2 Three Screen Report this week, offering yet another reminder that despite online video's incredible growth, TV viewing still reigns supreme. Nielsen found that TV viewing accounted for 129 hours, 16 minutes in Q3. While that amount is more than 40 times greater than the 3 hours, 24 minutes spent on online video viewing, it is actually down a slight .4% from Q3 '08 of 129 hours 45 minutes.

How much weight should we give that drop of 29 minutes a month (which equates to just less than a minute/day)? Not a lot until we see a sustained trend over time. There are plenty of other video options causing competition for consumers' attention, but good old fashioned TV is going to dominate for a long time to come. This is one of the key motivators behind Comcast's acquisition of NBCU.

4. 3D poised for major visibility - In my Oct. 30th "4 Items" post I mentioned being impressed with a demo from 3D TV technology company HDLogix I saw while in Denver for the CTAM Summit. This Sunday the company will do a major public demonstration, broadcasting the Cowboys-Chargers in 3D on the Cowboys Stadium's 160 foot by 72 foot HDTV display. HDLogix touts its ImageIQ 3D as the most cost-effective method for generating 3D video, as it upconverts existing 2D streams in real-time, meaning no additional production costs are incurred.

Obviously those watching from home won't be able to see the 3D streaming, but it will surely be a sight to see the 80,000 attendees sporting their 3D glasses oohing and aahing. Between this and James Cameron's 3D "Avatar" releasing next week, 3D is poised for a lot of exposure.

Enjoy the weekend!

Categories: Devices, Mobile Video, Sports, Technology, Telcos

Topics: AT&T, Boxee, D-Link, HDLogix, iPhone, Nielsen, Roku

-

VideoNuze Report Podcast #43 - December 11, 2009

Daisy Whitney and I are pleased to present the 43rd edition of the VideoNuze Report podcast, for December 11, 2009.

This week Daisy kicks us off, discussing key trends to look for from early adopters online in 2010, based on her recent interview with Bill Tancer, the author of Click, and the head of research at Hitwise. The insights may surprise you. Daisy also discusses what sites are heating up and tools that are available to help you detect trends yourself.

Then I dig into further detail on my post from yesterday, "Lack of Viewership Data Could Stall TV Everywhere," in which I outline concerns cable TV networks have regarding Nielsen's current inability to measure online viewership of TV programs. Until this is fixed, many networks will be reluctant to provide their primetime programs to TV Everywhere providers as they won't receive ratings credit for programs viewed online. If online viewership were to cannibalize on-air viewing, networks' ratings-based advertising revenues would suffer. Listen in to learn more.

Click here to listen to the podcast (14 minutes, 25 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories:

Topics: Hitwise, Nielsen, Podcast

-

Lack of Viewership Data Could Stall TV Everywhere

Based on a number of conversations I've had with cable programming executives, Nielsen's current inability to measure online viewing of TV programs and meld that data effectively with on-air viewing is emerging as a key stumbling block to successful rollouts of TV Everywhere services.

Cable networks are justifiably concerned that any viewership that potentially shifts from on-air to online that they are not credited for will adversely impact their ratings and therefore their advertising revenue. Until the issue is fixed cable networks will be reluctant to offer their most popular programs to TV Everywhere providers, in turn diluting TV Everywhere's appeal to consumers.

Nielsen, the de facto standard in TV ratings measurement, is well aware of these concerns and as

Multichannel News reported this past Monday, it plans to accelerate the deployment of its "TVandPC" software which measures online viewing to 7,500 of its National People Meter households by Aug. 31, 2010. While that's a start, as industry executives have told me, it's not just the online viewing data that's needed, but also the proper blending of that data with the on-air data that's critical.

Multichannel News reported this past Monday, it plans to accelerate the deployment of its "TVandPC" software which measures online viewing to 7,500 of its National People Meter households by Aug. 31, 2010. While that's a start, as industry executives have told me, it's not just the online viewing data that's needed, but also the proper blending of that data with the on-air data that's critical. Among the issues is how online viewing, which offers consumers the potential of much-delayed on-demand viewing, should be aligned with Nielsen's "C3" ratings, which captures up to 3 days playback on DVRs. Another issue is understanding and measuring new TV Everywhere viewership patterns (e.g. college students remotely watching shows on a laptop which has been authenticated by Mom and Dad's cable account). Then there's the question of whether the online ad loads are going to be comparable to those on-air (e.g. if the online share of a program's overall viewership carried far fewer ads than the on-air viewership, advertisers and media planners will want to know this). No doubt other issues loom as well.

Add it all up and the process of collecting and then blending online and on-air viewership data is non-trivial and will require a significant investment and testing on Nielsen's part to accomplish. From Nielsen's standpoint, it could be reluctant to make such an investment in overhauling its measurement service unless there were pre-commitments from some of its clients to accepting and buying the enhanced ratings service.

On the one hand, it would seem that cable networks' reluctance to embrace TV Everywhere until adequate measurement systems were in place would be a strong incentive for TV Everywhere providers to support Nielsen's enhancements. However, I've been told that when Nielsen previously made improvements to track Video-on-Demand viewership, not many service providers implemented necessary mechanisms to denote programs were VOD-based, and therefore Nielsen's investment yielded little return. Particularly given the tough economic times, that could make Nielsen more cautious about how it proceeds with online ratings. For now Nielsen has not disclosed its plans.

Still, Nielsen is under pressure to move forward given the formation of the Coalition for Innovative Media Measurement (CIMM), which is comprised of 14 TV networks, agencies and advertisers. CIMM's goal is to explore new methodologies for audience measurement, particularly for set-top box data and cross-platform media consumption. While some in the industry have tagged CIMM as a Nielsen challenger, its members have said they have no intention of trying to replace Nielsen. Regardless, the presence of an industry-backed group trying to wrap its arms around cross-platform audience measurement is likely to only accelerate Nielsen's online tracking efforts.

As VideoNuze readers know, I've been quite enthusiastic about TV Everywhere's potential, though I'm plenty cognizant of the challenges it faces. Measurement is surely near the top of that list. One of the benefits to Comcast of owning NBCU is that, if it chooses to, it can release NBCU's cable networks' programs for TV Everywhere viewing, absent complete online tracking. This would be comparable to what Hulu's owners have chosen to do by distributing their broadcast network shows online (they're at least partly motivated by the belief that online viewing augments on-air viewing). But Comcast won't take ownership of NBCU for another year or so. By that time Nielsen may well be close to rolling a blended online/on-air offering.

In sum, it could well be that 2010 ends up being more a year of experimentation for TV Everywhere while building blocks like audience measurement get put in place. VOD, which years since its launch still lacks many primetime programs as well as dynamic advertising insertion, offers a cautionary example for TV Everywhere providers of how a lack of investment can block the realization of a new medium's full potential. Cable networks in particular will keep looking for signals that TV Everywhere will be more robust than VOD before they get too enthusiastic about online distribution.

What do you think? Post a comment now.

Categories: Cable Networks, Cable TV Operators

-

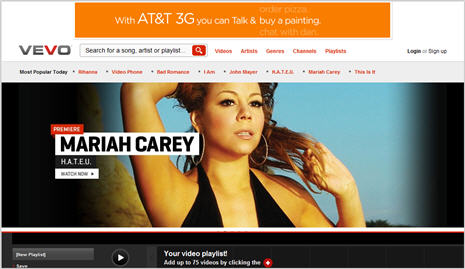

Vevo Launches: Decent Start, Lots of Work Ahead

Vevo, the much-heralded "Hulu for the music industry" venture backed by Universal Music Group, Sony BMG, Abu Dhabi Music Company and Google/YouTube (and with video provided by EMI as well) officially launched late last night. I've been browsing around the site this morning and my first reaction is that it's a decent start, but has a long way to go if it is to fulfill its lofty mission.

Conceptually, I like the idea behind Vevo. The music industry, which has suffered multiple blows over the last 10 years, is getting together to create a destination site where music videos are distributed legally, with a coherent ad strategy. YouTube's participation means that videos that have been watched in the labels' YouTube channels can be branded Vevo, giving the new site tons of visibility, and helping migrate traffic over time.

From a design standpoint, the Vevo site has a similar feel to Hulu: large, wide-screen images on the home page promoting certain videos/artists, thumbnails below, of top videos, playlists and artists, quick links to most popular today, and search/navigation. A nav bar at the bottom of the screen invites users to easily create new playlists by adding up to 75 videos with one click. Videos are embeddable and shareable, and there are quick links to buy the music at Amazon and iTunes. The site was periodically very slow to load and occasionally even gave me a server error page. I don't know how much of this to ascribe day 1 hiccups that will be worked out over time or really poor capacity planning.

Less clear to me is how Vevo distinguishes itself from a user experience standpoint from YouTube itself. This has been a question that's nagged at me since the Vevo concept was first unveiled - how do the partners plan to make 1+1=3? The partners have made references to being indifferent to whether users watch at Vevo.com or YouTube, presumably because there would be similar advertising on both with similar splits. Yet, my experience going back and forth between the sites, albeit very limited, reveals lots of inconsistencies and a lot of promotional leverage left untapped.

Focusing on U2, one of my personal favorites, I found only about a dozen of the band's music videos on Vevo. Switching over to YouTube, I found many more tracks, such as "Beautiful Day," "I Still Haven't Found What I'm Looking For" and "Where the Streets Have No Name," all in the Universal Music Group's channel. All of the videos were monetized: the first was preceded by a 15 second pre-roll ad for Chevy Malibu and the latter two carried an overlay ad to "Play Free Games" which was accompanied by a companion ad in the right column (the overlay was incredibly distracting, but that's another story). None of the videos had any Vevo branding whatsoever. It's also worth noting that even the UMG channel in YouTube has no Vevo branding or promotion.

Conversely, a search in YouTube for "All Because of You," a video that is available on Vevo, loads in YouTube with full Vevo branding. Above the video window are options to "Watch with Lyrics," "View Artist Profile," and "Create a Playlist." Clicking on any of these carries you over to the Vevo site. However, none of these actions are well-executed. "Watch with Lyrics" restarts the video, whereas a much slicker implementation would resume playing on Vevo from the point of drop-off. "View Artist Profile" simply displays a list other videos available, without any real artist profile information offered (background, upcoming concerts, etc.). And "Create a Playlist" just brings you to Vevo's home page, without any prompts for what to do next if indeed you want to actually want to create a playlist.

Elsewhere, the Vevo team hasn't even bothered to update its blog to officially announce the site's launch (it still says "Launching Tonight!" at the top). That's a missed opportunity, especially considering there was a splashy launch party in NYC last night (attendees ranging from Google's Eric Schmidt to Rhianna, Bono and Mariah Carey) and pictures and video from that event would have been a big drawing card. Come on - where's the Vevo PR team here?

How much of this should be forgiven to it being early days of Vevo's launch is a subjective call. From my vantage point though, I think the Vevo team could have done a lot more to think through and execute on the user experience. Back in November '07, when I looked at Hulu in its private beta, I gave it a solid B+. The Hulu team had clearly obsessed about each and every detail of the site - and have continued to do so. Hulu's user experience isn't perfect, but it has set the bar very high for those seeking to emulate it. For now Vevo probably rates around a C; much work is still ahead.

What do you think? Post a comment now.Update: Vevo's blog post that "It's awesome that millions of people are checking it out, but the response has been orders of magnitude larger than even our highest estimate" suggests poor capacity planning by the Vevo ops team. I mean,"orders of magnitude larger"? If that's really the case then the ops team gets serious demerits for a ridiculously big miss.Categories: Aggregators, Music

Topics: EMI, Google, Sony BMG, Universal Music, VEVO, YouTube

-

ExpoTV's New Research Service is Another Example of "Purpose-Driven" UGV

ExpoTV has formally launched "Kitchen Table Conversations," (KTC in my shorthand) a new research service in which certain members of its community provide video responses to a set of brand-sponsored research questions. The resulting video footage provides authentic, qualitative insights on actual consumers' habits, attitudes and behaviors. KTC is yet another example of "purpose-driven" user-generated video, a concept I began discussing in Fall '08 that continues to gain traction. I talked with Expo's president Bill Hildebolt yesterday to learn more about how the new research service works.

For those not familiar with Expo, it is a community-oriented site where consumers create videos of themselves reviewing products they've used. The site now offers a catalog of 300,000+ of these

"videopinions" on a wide diversity of products, generated by 60K+ community members. Over time Expo has evolved from being an outlet where users alone chose which products to review (which they can still do) to a model where sponsors are able to tap the community for video reviews of specific products. Members receive points in exchange for their video submissions and other activities.

"videopinions" on a wide diversity of products, generated by 60K+ community members. Over time Expo has evolved from being an outlet where users alone chose which products to review (which they can still do) to a model where sponsors are able to tap the community for video reviews of specific products. Members receive points in exchange for their video submissions and other activities. Bill explained that the KTC research service originated from sponsors approaching Expo with a desire to interact with community members on a deeper level. With KTC, the research sponsor (e.g. brand, ad agency, trade organization, etc.) can submit a series of questions and the respondent profiles they want to target. Expo then taps into its member database and offers invitations to participate. Because participants have a track record of submitting video to Expo, a minimum quality level is pretty well assured. As part of its service, Expo can edit the submitted videos into a package or just provide them raw to the research sponsor to use as they'd like.

While online research is not a new concept (how many of us have filled out surveys or email questionnaires), what's different here is the reliance on video, which provides a different level of insight. Bill said that for researchers, KTC fits between traditional focus groups (where a group of individuals is brought together in a room to discuss their views of a product) and "ethnography" (a process whereby professional researchers actually live with participants for a period of time studying and capturing their behaviors). Bill believes that KTC provides many of the same authentic, on-location benefits of ethnography, but at a price comparable to focus groups and in a far-quicker turnaround time of 2 weeks or less.

Expo has run half a dozen KTC research projects over the past 9-12 months, working to refine the process. The adjacent video, from one of the research projects (focusing on moms' grocery shopping habits), is a

good example of an edited result. In it, you see and hear women in their own homes, speaking authentically and showing specifics (e.g. a coupon folder, handwritten lists, etc.) of how they do their shopping. The video won't be mistaken for prime-time entertainment, but to researchers looking for nuggets of insight, it's golden. For agencies in particular, which can incorporate select segments of KTC video into their client pitches, it's a totally new approach to consumer research.

good example of an edited result. In it, you see and hear women in their own homes, speaking authentically and showing specifics (e.g. a coupon folder, handwritten lists, etc.) of how they do their shopping. The video won't be mistaken for prime-time entertainment, but to researchers looking for nuggets of insight, it's golden. For agencies in particular, which can incorporate select segments of KTC video into their client pitches, it's a totally new approach to consumer research.KTC is the latest example to hit my radar of how certain types of user-generated video can be used for very productive purposes. Regardless of what might be said about YouTube's and others' inability to monetize the user-generated video uploaded to their sites, one of the derivative benefits of all this user activity is that an army of amateur videographers has been created, many of whom are comfortable in front of and behind the camera. Their video won't win an Oscar or Emmy any time soon, but as Expo and others are proving, their skills and passion are valuable and can be tapped for various purposes.

What do you think? Post a comment now.

Categories: UGC

Topics: ExpoTV

-

Tiger Woods Scandal Gets Animated Video Treatment

It's hard not to be fascinated by the Tiger Woods "transgressions" scandal and the drip-drip-drip revelations that are keeping the story alive. Amid the hubbub, the big mystery remains what actually happened on the fateful night that Tiger plowed his Escalade into a neighbor's fire hydrant and tree.

As the NY Times reported over the weekend, the animation unit of the Taiwanese "infotainment" newspaper Apple Daily (owned by Hong Kong-based media company Next Media) has created an animated video re-enactment of the events. The video is available on YouTube, where it has already drawn 2 million+ views. Non-Chinese speakers are out of luck on what the narrator's saying, but the animation provides the gist. As many suspect to be the case, there's Elin chasing Tiger's car down the street bashing its rear window with a golf club, causing a distracted Tiger to lose control and run off the road.

Compared to animated feature films, the quality is pretty amateurish. But that's the least of its problems; more significant is that the events shown are not based on the police reports or known facts, but rather on the animators' conception of what happened. So while Daisy Li, the Apple Daily manager overseeing the animated videos is quoted as saying that the idea of the animated videos is to make news more accessible to young people who don't like to read newspapers, by any standard, the video cannot be considered a journalistic pursuit.

Notwithstanding, the significance of the Tiger animated video and the whole idea of animated video re-enactments in general is that they have the potential to hugely influence public opinion about actual news events. By publishing videos like this to sites such as YouTube that have global reach, non-journalistic animators can vie with bona fide news outlets to inform audiences. For purists that will feel alarming, though it should be remembered that this is hardly the first time performance has influenced opinion - consider for example, that many people formed an opinion of Sarah Palin last year not on her remarks, but on Tina Fey's imitation of them on SNL.

Whether it is fact, fiction or something in between, video's power lies in its ability to tell a story better than any other medium. The animators at Apple Daily appear to understand this, as will others who will inevitably try to emulate their success. Audiences beware.

What do you think? Post a comment now.

Categories: International, Newspapers, Sports

Topics: Next Media, Tiger Woods

-

4 Items Worth Noting for the Nov 30th Week (Alicia Keys on YouTube, Jeff Zucker's record, Comcast's Xfinity, SI's tablet demo)

Following are 4 items worth noting for the Nov 30th week:

1. Alicia Keys concert on YouTube is an underwhelming experience - Did you catch any of the Alicia Keys concert on YouTube this past Tuesday night celebrating World AIDS Day? I watched parts of it, and while the music was great, I have to say it was disappointing from a video quality standpoint -lots of buffering and pixilation, plus watching full screen was impossible.

I think YouTube is on to something special webcasting live concerts. Recall its webcast of the U2 concert from the Rose Bowl on Oct 25th drew a record 10 million viewers. That concert's quality was far superior, and separately, the dramatic staging and 97,000 in-person fans also helped boost the excitement of the online experience. It's still early days, but to really succeed with the concert series, YouTube is going to have to guarantee a minimum quality level. Notwithstanding, American Express, the lead sponsor of the Keys concert had strong visibility and surely YouTube has real interest from other sponsors for future concerts. It could be a very valuable franchise YouTube is building and is further evidence of YouTube's evolution from its UGC roots.

2. Being a Jeff Zucker fan is lonely business - In yesterday's post, "Comcast-NBCU: The Winners, Losers and Unknowns" I said I've been a fan of Jeff Zucker's since seeing him deliver a brutally candid and very sober assessment of the broadcast TV industry at the NATPE conference in Jan '08. My praise elicited a number of incredulous email responses from readers who vehemently disagreed, thinking Zucker's performance merits him being sent to the woodshed rather than to the CEO's office for the new Comcast-NBCU JV.

To be sure, NBC's abysmal performance under Zucker (falling from first place to fourth in prime-time), will be one of his legacies, but I take a broader view of his tenure. A good chunk of NBCU's cable network portfolio came to the company via the Vivendi deal around the time Zucker took over responsibility for cable. Since that time the networks have grown strongly in audience and cash flow has doubled from about $1 billion to a projected $2.2 billion in '09. NBCU added Oxygen (which combined with its iVillage property makes a strong proposition for women-focused advertisers) and The Weather Channel, in a joint buyout with two PE firms.

While Zucker's hiring of Ben Silverman to run NBC was a misstep, NBCU has enjoyed stability on the cable side, with two of the highest-regarded women in TV, Bonnie Hammer and Lauren Zalaznick cranking out hit after hit for their respective networks. A CEO's tenure is always a mixed one, with plenty of wins and losses. It can be hard to know how much of the wins to ascribe to the CEO personally, rather than the executives below, but at the end of the day, NBCU was transformed from a single network company to a cable powerhouse; even Zucker skeptics have to give him some credit for this.

3. Comcast rebrands On Demand Online to Fancast Xfinity TV - yuck! - Largely lost in the NBCU commotion this week was news that B&C broke that Comcast is changing the name of its soon-to-be-launched TV Everywhere service from On Demand Online to Fancast Xfinity TV. Yikes, the branding gurus need to head back to the drawing board, and quick. The name violates the first rule of branding: pronunciation must be obvious and easy. Not only is it unclear how you pronounce Xfinity, it's a an unnecessary mouthful that doesn't fit with any of Comcast's other workmanlike brands (e.g. "Digital Cable," "On Demand," "Comcast.net"). If we're talking about a new videogame targeted to teenage boys, Xfinity is great. If we're talking about a service that provides online access to TV shows, there's no need for something super-edgy. I'd suggest just sticking with "On Demand Online." But even more importantly, priority #1 is getting the product launched successfully.

4. Sports Illustrated demo builds tablet computing buzz - If you haven't seen SI's demo of its tablet version being shown off this week, it's well worth a look at the video here. Never mind that there isn't such a tablet device on the market yet, the rumors swirling around Apple's planned launch of one has created an air of inevitability for the whole category. As the SI demo shows, a tablet can be thought of a larger version of an iPhone (likely minus the phone), providing larger screen real estate to make the user experience even more interesting. It's fascinating to think about what a tablet could do for magazines in particular, along the lines of what the Kindle has done for books. The mobile video and gaming possibilities are endless. Judge for yourselves.

Enjoy the weekend!

Categories: Aggregators, Broadcasters, Cable TV Operators, Magazines, People

Topics: Comcast, NBCU, Sports Illustrated, YouTube

-

VideoNuze Report Podcast #42 - December 4, 2009

Daisy Whitney and I are pleased to present the 42nd edition of the VideoNuze Report podcast, for December 4, 2009.

Today's sole topic is of course the big news of the week, Comcast's acquisition of NBCU. Daisy and I chat about the winners/losers/unknowns that I detailed in my post yesterday. There are a lot of aspects to the Comcast-NBCU deal and the new entity will have wide-ranging implications for the media industry. Listen in to learn more.

Click here to listen to the podcast (15 minutes, 24 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings, Podcasts

Topics: Comcast, GE, Hulu, NBCU, Podcast