-

Vogue.TV's Model.Live: A Magazine Bets Big on Broadband

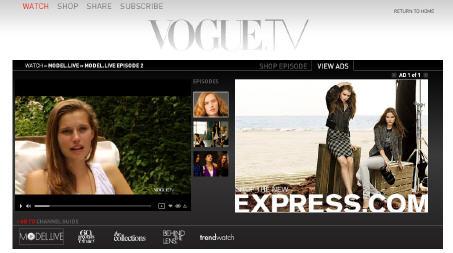

I've been writing for a while now that broadband gives non-video media companies a whole new strategic growth opportunity. This is especially true for magazines with well-defined brands, strong advertising relationships and sought-after audiences. Few magazines fit that description as well as Vogue, Conde Nast's high-end fashion bible. So I was pleased to read about a month ago that Vogue intended to launch Model.Live, a 12 episode original broadband-only series, in a partnership with IMG.

Model.Live went live recently, and I've caught the first couple of 8 minute episodes. Shot in a reality/documentary style, Model.Live follows the lives of 3 young and aspiring models. With a budget of $3 million, these productions do not feel like run-of-the-mill low-end indie video. There are multiple camera angles, great lighting, and extensive on-location shoots. Absent are the high-end graphics and faux cliff-hanger moments typically seen on TV contest shows.

While many will find the subject matter and dialogue insipid (19 year-old Dutch model Cato's mildly defiant "I can party when I'm 30..." justification for deferring college is a classic eye-roller); my guess is that for Vogue readers and for those interested in the fashion world, these authentic behind-the-scenes peeks will be quite intriguing. For example, in episode 2 we hear Cato's mother expressing her authentic unease with the modeling world's fame and glamour (of course, her star-struck sister more than offsets these reservations).

The video player allows sharing through email, and easy downloading to iPods. Curiously though, there's no commenting or rating available, two tools now widely used to generate audience interactivity. Also missing is any email or RSS alert function so it's not clear how a fan would know when the next episode will be released. There's not even a teaser for what's coming next, a standard promotional tool for serialized TV shows.

Still, Vogue has definitely nailed certain things. It is smartly distributing Model.Live on the social network Bebo, which is sure to gain the show widespread visibility among targeted younger audiences (it is supposed to be available on Hulu and Veoh as well, though searches at both sites yielded no results). And, for a deal in the reported "low seven figures," it signed up Express to be the program's sponsor. Express gets huge visibility in the right panel of the video player, with clothing purchases a few clicks away. Vogue's ability to drive awareness and revenue for Express will certainly influence whether Model.Live continues on after its first season.

Model.Live actually follows several other programs Vogue has released ("Behind the Lens," "The Collections," Trend Watch") yet, it is clearly the most ambitious. These kinds of shows are a natural extension for the brand, and I believe are essential as Vogue seeks to engage an increasingly online audience seeking out video. Other magazines should be taking note.

What do you think? Post a comment.

Categories: Advertising, Indie Video, Magazines

Topics: Bebo, Conde Nast, Express, IMG, Vogue

-

Tanglewood and BSO Pioneer Broadband Use for Arts/Cultural Organizations

Tanglewood, the summer home of the Boston Symphony Orchestra (BSO), and also the host of world-renowned musical training programs, has expanded its use of broadband video, helping pioneer how arts and cultural organizations can tap into the power of this new medium. I talked recently with Rich Bradway, Associate Director of Ecommerce and New Media to learn more.

First, for those unfamiliar with Tanglewood, it is a lush former estate in Western Massachusetts' Berkshire Mountains containing an outdoor theater and other performance buildings. Open only for the summer, it hosts a mostly classical program, but also features performances by the contemporary Boston Pops and others like James Taylor (whose annual concerts draw over 20,000 fans). For many the Tanglewood experience means elaborate picnics on its expansive lawn, followed by a moonlit night or lazy afternoon of beautiful music.

This summer, the BSO has created TanglewoodWebTV.org, with its first "episode" around the centenary of the birth of Elliott Carter, a well-known composer who's being celebrated in Tanglewood's 2008 Festival of Contemporary Music. Previously the BSO has launched BostonPops.TV, and both are powered by PermissionTV. Rich explained that Tanglewood and the BSO are using broadband to build awareness, reach a younger and more global audience and drive new revenues.

The episode includes performances along with interviews, documentaries and behind-the-scenes footage. The presentation is very non-linear with an overlay menu providing easy navigation to other video segments, so the user can sample at will. Rich said prior to launch the episode was seeded with archival video, and then during the Festival week it was updated continuously. Since broadband is new for the Tanglewood team a key goal was understanding what's involved in the digital media workflow and how to scale the process over time.

With BostonPops.TV and TanglewoodWebTV.org, the BSO is helping prove in broadband's benefits for other arts and cultural organizations. Yet, as Rich and I talked, I mentioned that it seems to me the really big opportunity here is to stream live concerts from Tanglewood, and then make them available on-demand afterwards. This would extend the full Tanglewood experience to remote users in the same way that the Saturday afternoon radio broadcasts of the New York Metropolitan Opera have been doing for decades. Consistent with that model, the streaming should be free and sponsored, rather than paid by the user.

Rich said that the BSO and Tanglewood have been doing the spade work to enable paid concert downloading, focusing on both technology infrastructure and addressing rights issues with the orchestra itself. Rich reminded me that this is all very new territory for a traditional organization. I understand that and the value of a "walk before you run" approach. Still, for arts and cultural organizations like the BSO and Tanglewood, broadband is presenting exciting opportunities to extend their brands and build new revenues; I believe that these should be pursued as aggressively as possible.

What do you think? Post a comment.

Categories: Indie Video

Topics: BSO, Tanglewood

-

American Political Conventions are Next Up to Get Broadband Video Treatment

As the first "Broadband Olympics" begin to wind down, the American political conventions are next up to get the broadband video treatment. While certainly not Olympian in their popularity, the conventions still have a rabid following among many, and given the particular dynamics of this year's election cycle, they are attracting far broader interest than usual.

The conventions have evolved a lot over the years. Traditionally they were a high-stakes drama culminating

in a roll call vote whose outcome was often uncertain. They have become a largely drama-free corporate-sponsored schmooze-fest punctuated by a few high-profile keynote and nominee acceptance speeches. Broadcasters have taken note, steadily reducing their coverage and opening the door to cable networks to do the primary convention coverage.

in a roll call vote whose outcome was often uncertain. They have become a largely drama-free corporate-sponsored schmooze-fest punctuated by a few high-profile keynote and nominee acceptance speeches. Broadcasters have taken note, steadily reducing their coverage and opening the door to cable networks to do the primary convention coverage.  In '04 the Internet crashed the conventions, primarily in the form of bloggers reporting on every convention utterance made. The bloggers will be out in full force at the '08 conventions too, but this time around broadband coverage is going to be the big story. Here's a partial list of what's on tap:

In '04 the Internet crashed the conventions, primarily in the form of bloggers reporting on every convention utterance made. The bloggers will be out in full force at the '08 conventions too, but this time around broadband coverage is going to be the big story. Here's a partial list of what's on tap:Democrats plan to deliver live, gavel-to-gavel HD streaming at their site. Republicans plan live streaming as well and announced Ustream.tv as their official partner.

The Democrats also plan a Spanish language simulcast produced by Comcast, to be available online and also on-demand for Comcast subscribers. The Dems are also producing a 15 minute daily show called "Countdown to America's Future" available through Comcast VOD and online.

CBS anchor Katie Couric is taking on broadband assignments, delivering web-only specials for the first time.

Politico.com and Yahoo have partnered with the Denver Post and St. Paul Pioneer Press to host a series of eight political forums which will be streamed live.

Corporate siblings WashingtonPost.com and Newsweek.com will deploy a team of journalists providing live streaming via their cell phones using an application from Comet Technologies.

Meanwhile, in the lead-up to the conventions, the YouTube Convention video contest, asked users to answer the question, "Why are you a Democrat/Republican in 2008?" Winners are here and here.

For those that don't take their politics too seriously, Jon Stewart, Stephen Colbert and many other comedians will no doubt have viral clips flying around the 'net. Going one comedic step further, Generate and MSN announced just this week the premiere of "Republicrats" a satirical broadband-only series with 24 episodes running though Election Day.

I'm sure there's more broadband convention coverage I've missed, so please post a comment regarding further coverage.

Categories: Politics

Topics: Comcast, Generate, MSN, Newsweek.com, Political conventions, WashingtonPost.com, YouTube

-

Pre-Roll Video Advertising Gets a Boost from 3 Research Studies

Pre-roll video ads' effectiveness and user acceptability is getting a boost from 3 different research studies this week. Results were released by Break/Panache and Tremor Media and by Jupiter Research, which focused on the European market. Taken together, they are an encouraging sign for the many broadband video providers who have chosen ad-supported over paid as their business model of choice.

A key highlight of all three reports concerns user acceptance and engagement with pre-roll ads. This format, whether 15 or 30 seconds, has accounted for the bulk of video ad revenues to date, and yet has been a key source of tension in the industry. Advertisers like pre-rolls because they feel like the well-understood TV model and in fact, where off-the-shelf TV ads are often just re-used (for better or worse). The downside of the interruptive pre-roll approach is that previous research has shown users hate the format. Contributing to users' feelings was the fact that many content providers have been undisciplined about implementing frequency caps or any sort of targeting (I myself have seen far too many tampon ads!).

Yet the Break/Panache results show that 78% of users viewed pre-roll ads for more than 15 seconds and the click-through rate averaged an impressive 10%. Similarly, the Tremor research showed completion rates for both 15 and 30 second ads of approximately 80%, a level it believes is reached because of its ad targeting and focusing on premium content only.

Meanwhile the story was about the same in Europe. According to Jupiter's research (as reported by AdAge), audience drop-off upon the introduction of pre-rolls is under 5%. Jupiter also makes the important point that at least 10% of users drop off after 15 seconds even when there's no ad present, simply because they're in channel surfing mode. That means some percentage of abandonment is due simply to behavior, not a specific ad type. This makes sense when you think about it.

I attribute much of these new positive results to users recalibrating their expectations about broadband video and the presence of ads. Here's what I think has happened:

Since the Internet's introduction, there's been a sense among users that "content is free." And with the exception of annoying popup ads, I think many users have learned to look past unrelated banner ads on standard web pages so they've come to perceive their whole online experience as largely "ad-free" as well. (If you don't believe me, ask yourself when you last clicked on a banner ad unrelated to your work.)

But as broadband video usage has grown, pre-roll ads that actually did interrupt the content experience felt jarring for many users. Naturally, when asked, users said, "ugh, we hate them." Fair enough. But consumers are smart, and have quickly recognized that, just like TV, to get high-quality video programming, someone has to pay, and since most users would rather that not be them, they've become more accepting of all ads, pre-rolls included. With premium sites employing some targeting now and becoming more judicious in their insertion practices (ABC.com and Hulu are great examples), users have become more accepting. Hence these positive research results.

To the extent that pre-roll business practices continue to improve, I think research will continue to show positive results. Whether you personally love pre-rolls or hate them, I see them very much here to stay.

What do you think? Post a comment.

Categories: Advertising

Topics: Break, Jupiter, Panache

-

Kiptronic Accelerates Video Ad Insertion with DART and Atlas Integrations

Kiptronic, a dynamic ad insertion service provider for broadband-delivered video and audio has announced integrations with the two dominant ad management systems, DoubleClick's DART for Publisher and Microsoft's Atlas Ad Manager. This allows Kiptronic customers to traffic their ads from within these familiar ad management consoles beyond browser/PC-based environments.

Kiptronic plays an important role delivering ads against video that's increasingly consumed outside the

browser/PC. These days video consumption is being fragmented to widgets, smartphones, downloaded apps like Adobe Media Player, gaming devices, Internet-connected TVs and more coming as the syndicated video economy gains steam.

browser/PC. These days video consumption is being fragmented to widgets, smartphones, downloaded apps like Adobe Media Player, gaming devices, Internet-connected TVs and more coming as the syndicated video economy gains steam. While more viewership is obviously a plus for content providers, this new heterogeneity creates headaches for ad operations staff tasked with running the correct ads wherever the video is consumed. Kiptronic's secret sauce is inserting both in-browser and also in these disparate environments after recognizing their specific attributes. I'm only aware of one other company in this space, which is Volo Media, but as I understand it, they only insert in downloaded video.

Last week Bill Loewenthal, Kiptronic's President and CEO, and Jonathan Cobb, the company's founder and CTO briefed me on the new integrations as a follow up to a background call Bill and I had about a month ago. Kiptronic's customers are mainly premium content providers such as divisions of Fox, CBS, Time Warner and Sony BMG who place a high value on control and who have their own sales teams.

Kiptronic's key mantra has been enabling ad insertion to all these new environments without requiring any changes to customers' publishing processes. However, to date Kiptronic had required customers to use its proprietary management tool to insert their ads. For customers who use DART and Atlas, these new integrations now eliminate this step, likely boosting Kiptronic's appeal.

The whole concept of video consumption outside the PC/browser domain is a fascinating topic that content providers need to be mindful of. In the next couple of months Kiptronic is going to make data available showing the breakdown of all the places its ads are served. It's a pretty accurate data set given Kiptronic's role. Bill gave me a preview and it is definitely eye-opening. I'll be sharing the info as soon as it's available.

What do you think? Post a comment.

Categories: Advertising, Technology

Topics: Atlas, DoubleClick, Kiptronic, Microsoft

-

New Akamai-KickApps Partnership Stakes Out Advantages in Video Management/Publishing

More news today in the fiercely competitive video management, publishing and delivery space. KickApps, a social media platform provider and Akamai, the leading content delivery network, have announced a partnership integrating KickApps's Video Player Studio with Akamai's Stream OS video management system. On Friday I spoke to Michael Chin, KickApps's SVP of Marketing to learn more about the joint offering's benefits.

I look at this deal as a front-end/back-end marriage, bringing together the two companies' complimentary

capabilities as they seek to stake out new advantages in this market. KickApps, which has a roster of media companies, sports teams and others using its turnkey social media applications, has recently released its Video Player Studio, enabling customers to build on-demand customized video players for their sites.

capabilities as they seek to stake out new advantages in this market. KickApps, which has a roster of media companies, sports teams and others using its turnkey social media applications, has recently released its Video Player Studio, enabling customers to build on-demand customized video players for their sites. Meanwhile Akamai's Stream OS has been focused on the back-end tasks of video management and publishing, such as uploading/storing/editing video and metadata, distributing video

through managed RSS feeds, and controlling syndication through business rule creation and geo-targeting.

through managed RSS feeds, and controlling syndication through business rule creation and geo-targeting.Michael sees the joint offering's key differentiators as comprehensive out-of-the box functionality, improved flexibility/time to market and integrated social media features (rating, tagging, commenting, etc.).

KickApps is also counting on financial benefits to lure customers. It uses pay-as-you-go CPM-based pricing vs. the typical platform license fee model used by others. Large media companies usually buy out their entire KickApps-generated inventory at an agreed-upon CPM, while smaller companies stick to an ad revenue share approach. Another financial lever in the deal is that KickApps has negotiated very favorable CDN pricing from Akamai, which gives it more pricing flexibility for customers.

Michael believes that between the broader feature set and pricing advantages, the KickApps-Akamai joint offering will be well-positioned to appeal to customers of competitors like Brightcove, Maven (Yahoo) and thePlatform (Comcast), not to mention smaller players in the space who have narrower feature sets.

The KickApps-Akamai partnership continues to raise the competitive bar in this space. These are important, real differentiators the companies are using. That said, this space is very fluid, and in the coming weeks there will be at least 3 other companies which I've spoken to recently which will raise the bar in still other ways. This is a space that continues to evolve, as customer needs shift and their revenue pressures intensify. More news coming soon.

What do you think? Post a comment now.

(Note: Akamai is a current VideoNuze sponsor and KickApps is a former sponsor)

Categories: Partnerships, Technology

-

A Week In, "Broadband Olympics" are Exceeding Expectations

Last Friday, in "Get Ready for the Broadband Olympics," I posited that the '08 Beijing Games would be looked back upon as the first "Broadband Olympics." NBC has made a massive investment in delivering the portions of the Games both live and on-demand via NBCOlympics.com and other outlets. A week into the Games, the broadband coverage and user experience is exceeding my and others' expectations.

First the numbers, which are staggering. NBC has been pumping out news releases on a daily basis touting

their Total Audience Measurement Index or "TAMi" rating, broadcast audience records and online usage. Focusing just online, through yesterday NBCOlympics.com has attracted 25 million unique visitors, driving 456 million page views and 22 million video streams which total 3.5 million hours of video consumed. These figures easily outpace the '04 Athens Games.

their Total Audience Measurement Index or "TAMi" rating, broadcast audience records and online usage. Focusing just online, through yesterday NBCOlympics.com has attracted 25 million unique visitors, driving 456 million page views and 22 million video streams which total 3.5 million hours of video consumed. These figures easily outpace the '04 Athens Games.A major drawing card in the '08 Games is of course Michael Phelps's drive for 8 golds. And so far the peak dramatic event in the Phelps narrative was the 4x100 freestyle relay in which teammate Jason Lezak swam the split of his life. That thrilling video alone has been viewed over 2 million times, providing a textbook example of how unique Olympic moments are tailor-made for broadband on-demand coverage. (Note, while not a big swimming fan myself, I have to admit I've watched the last leg of that race a half dozen times. If you haven't seen it, it's an absolute must)

Meanwhile, the live streaming has been a fun element of NBCOlympics.com. I've found myself periodically perusing the little red "LIVE" flags on NBC's home page and tuning in briefly to sample sports I have no affiliation to, but are neat to dip into briefly (e.g. women's badminton or table tennis).

Overall, the user experience is excellent. Beyond the well thought-out navigation, a key part of the experience owes to Microsoft Silverlight which enables totally new broadband video capabilities. Picture-in-picture, 4 live concurrent streams, zero-buffer rewinding, and of course glorious video quality (even in large-screen mode) are all breakthroughs. So far I haven't seen or heard about any delivery or viewing glitches.

I do have some nits: way too many pre-roll ads (for example, that AT&T "We" ad is killing me), some non-intuitive and unexplained transitions between viewing modes, a limited assortment of "most viewed" videos displayed and an occasional delay in video loading particularly in "Live Video Control Room." Then of course there's been the grousing (unwarranted in my opinion) about NBC's decisions to show certain sports online, while not others. Net, net though, one week in, the first Broadband Olympics are redefining broadband's potential and setting a new quality bar for future events.

What do you think? Post a comment.

Categories: Broadcasters, Sports

-

comScore Gets Its Act Together on Ad Network Traffic Reporting

I was pleased to see comScore announce on Tuesday that beginning this month it will report two sets of numbers for online ad networks: "potential reach" and "actual reach."

Potential reach will represent the unduplicated visitors to all sites that an ad network has under contract to

deliver ads to (based on written documentation), while actual reach will represent the number of ads actually served (based on a tagging mechanism that comScore will require the ad networks to implement to be counted). This is a welcome development, particularly in the intensely competitive video ad network space. In fact, it seems such an obvious move, one wonders why comScore has been so tardy in introducing it.

deliver ads to (based on written documentation), while actual reach will represent the number of ads actually served (based on a tagging mechanism that comScore will require the ad networks to implement to be counted). This is a welcome development, particularly in the intensely competitive video ad network space. In fact, it seems such an obvious move, one wonders why comScore has been so tardy in introducing it. Followers of VideoNuze and other industry blogs know that comScore's measurement deficiencies recently set off a tempest after comScore ranked YuMe, one of the large video ad networks, #8 in reach in its Ad Focus report. With YuMe trumpeting its ranking, other industry players challenged it by noting that the full audience of MSN (a site that YuMe serves ads to) had been counted. The confusion was caused by the fact that comScore had not been delineating "potential" from "actual" reach or providing apples-to-apples numbers for all networks. Chastened, comScore re-ranked YuMe, sending it plummeting in the rankings.

All of this of course only served to create more confusion for media buyers who are trying to cobble together media plans that achieve their broadband video reach and frequency goals within budget, while minimizing their time invested. Though I'm a huge advocate of the ad-supported model dominating the broadband video landscape well into the future, I'm cognizant that the friction media buyers currently encounter is the single biggest challenge the ad model currently faces in its bid to scale and redirect spending from traditional outlets.

So comScore's new reporting is a step forward after two recent steps back. Let's hope for more forward progress.

What do you think? Post a comment.

Categories: Advertising