-

Terrific Webcast About Broadband Video Ad Formats on Wed.

From time to time I'll take the opportunity to bring worthwhile industry events to your attention. In this spirit, there will be a terrific complimentary webcast this Wed, Dec. 12, entitled, "Pre-Roll vs. Overlay: Consumer Reaction to New Online Video Advertising Formats."

The webcast is hosted by the Internet TV Advertising Forum and Maven Networks. If you're motivated to learn about what real consumers think about different types of broadband video ad formats, then I believe this 1 hour webcast will be well worth your time.

(Note: I have no financial interest in the Forum, this webcast or Maven Networks.)

The Internet TV Advertising Forum, which was founded by Maven, includes a group of leading companies such as Digitas, DoubleClick, Fox News Digital, Microsoft, Oglivy, Scripps Networks Interactive, TV Guide, 24/7 Real Media and 4Kids Entertainment. The Forum is working to define the next generation of broadband video advertising strategies, formats and best practices.

The Forum conducted a series of usability tests in October, 2007, to study new, interactive ad formats designed for broadband video. During the webcast, Jeff Rosenblum, co-president of Questus, the market research firm that oversaw the usability testing, will share the data and conclusions.

As many of us would agree, 2007 has been marked by an increasing awareness that ad-support is going to be the primary business model for broadband video, at least in the near-term. Yet there is still much uncertainty about how best to capitalize on the advertising opportunity. So I view events like this, which further industry participants' understanding of what consumers want, as crucial to building consensus and standards necessary for the broadband video medium to succeed.

Maven has graciously invited me to share some context about the broadband video industry at the beginning of the webcast. Again, I have no financial stake in this event. Rather, I view it merely as an opportunity to share some thoughts, learn alongside all of you about the conclusions of this usability testing and participate in the follow-up Q&A session.

If you're interested in this complimentary webcast, click here to register.

Categories: Advertising, Events

Topics: Internet TV Advertising Forum, Maven Networks

-

Horowitz Study: Broadband Video Usage Jumps

At least once a week or so I try to sort through all the research-related press releases I get to see if there was any new information of note. One report that caught my eye was from Horowitz Associates, "Broadband Content and Services 2007." I haven't read the study, but there are some pretty juicy morsels in the release about how pervasive broadband video is becoming.

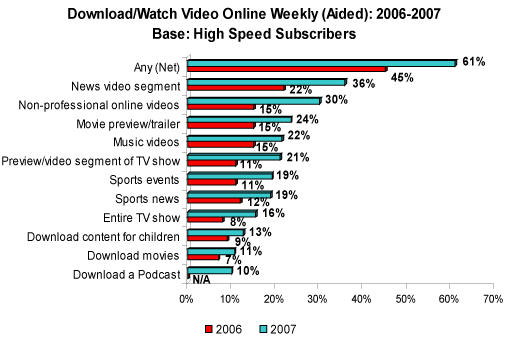

Below is a graph that summarizes some of the key data.

Look at the top line - a whopping 61% of high speed Internet users watch or download broadband video content at least once per week, up from 46% last year. The number jumps to 86% for users who watch at least once per month. These are very impressive numbers and they speak to how significant broadband video has become and how quickly it has gotten there.

Beyond the top line, one can see that every category of video experienced an increase in usage over the past year. Not surprisingly, news leads the way, with 36% usage, but non-professional online videos are not far behind at 30%. YouTube and the like are obviously showing ongoing appeal, even in the face of all the professional video that's come online recently.

Further down the list, how about the fact that 16% of high speed users are now watching an entire TV episode online at least once per week, double what it was a year ago? TV networks have been aggressively promoting their hit programs online, and these efforts seem to be paying off.

One of the conclusions stated in the press release is that "television is still the preferred platform for traditional TV content." I think that makes sense, but dig a little deeper and consider what happens when broadband-accessed programs can easily be viewed on TVs. I continue to say that viewers don't care how the programming gets into their house, as long as it's high-quality, available on their terms and priced correctly. Once broadband-delivered network programs can be viewed on TVs, everyone who has a stake in the status quo (local TV stations, cable & satellite operators, etc.) is going to be facing a very different landscape. See this post for more on that.

Studies like this that chart the continued adoption of broadband video are well worth following. In the past year I've heard industry executives make sweeping statements like "pay TV isn't going away" or "there will always be a place for the networks." This may be true, but as this study shows, day-after-day, week-after-week, month-after-month broadband is chipping away at how all media businesses operate.

Categories:

Topics: Horowitz Associates

-

Metacafe Drives Community-Based Programming Model

Metacafe continues to march to the beat of its own drummer and with around 30 million unique visitors/month, do quite well at it. It steadfastly refuses to be lumped in as yet another "UGC/video-sharing" site, instead considering itself an online entertainment destination that is focused on short-form programming largely selected by an elaborate community-based selection process.

Last week I caught up with CEO Erick Hachenburg to get an update on the business and more particulars about how the community acts as the site's content curator. Erick asserts that no other site does community curation as deeply as Metacafe and I'm inclined to agree with him. With this community emphasis and short-form focus, Metacafe presents yet another example of how broadband is re-shaping consumers' video choices and expectations.

Metacafe maintains a volunteer panel of about 80,000 users, a small subset of which receives alerts to review each new video submission to the site. Their opinions and behavior determine which ones make it onto the site, and get elevated to prominent positions. Metacafe's "VideoRank" algorithm takes account not only of the panel's ratings for each video, but also the specifics of each panelist's behavior with the video. This includes things like: how often was the video watched and forwarded to friends, each session's length and other factors that proxy for the video's quality.

The result of this process is that only a very small percentage of video submissions actually make it onto the site, dramatically enhancing the quality. The community is also very adept at weeding out pirated material. These two features alone distinguish Metacafe from sites in the UGC/video sharing space.

Erick believes a key driver of all behavior is the "cultural difference in the ecosystem" of Metacafe's users and producers. Since Metacafe offers payments for top producers and the process for getting approved is well-understood, there is a strong incentive for producers to put their best material forward. Between Metacafe's community-based editorial process and policy not to fund any content development, it's really a sink-or-swim environment for producers looking to succeed.

True to its short-form orientation, the average video length is just 90 seconds, and the top producers have come to understand which categories or genres perform best. For example, the top producer focuses exclusively on "entertaining how-to" videos.

Categories: Indie Video

-

Broadcast TV Stations Most Threatened by Broadband/On-Demand

Last week a journalist interviewing me for a story asked: "Which industry or industries are potentially threatened the most by the rise of broadband video and on-demand usage?"

It's a tough question to answer because there are so many different variables at play. However, if pressed, my answer would have to be local broadcast TV stations. Taking aside the current WGA strike which exposes yet another industry vulnerability, local TV stations find themselves on the short end of just about every macro trend being driven by broadband and on-demand adoption. To thrive in the future, stations are going to have to radically reinvent their business models. It's by no means an impossible task, but it is going to require savvy and aggressive strategic moves.

Consider the perfect storm local stations are up against:

1. Broadcast networks (ABC, CBS, FOX, NBC) are avidly pursuing broadband distribution of their hit shows, creating competition to the traditional model of geographic programming exclusivity for local stations. Initiatives such as Hulu and CBS's Audience Network can be thought of as 'digital replicas" of the old analog affiliate model. Networks have gotten broadband religion; notwithstanding their finessed protestations, they're only going to be increasing their digital bets, leaving their affiliates with new competition for eyeballs at every turn.

2. On demand viewing is shattering prime time viewership and the all important "lead-in" to late news broadcasts. Between DVRs and VOD, more and more of the world is habituating itself to watching programs when they want to, not when they originally ran. So appointment viewing is out and along with it the concept of audience aggregation. Strip out prime time and the local station needs to build audience for its own shows and newscasts by itself.

3. Local news, weather and sports content are the mainstays of local newscasts, yet the availability of this kind of content is becoming pervasive and conveniently accessible. Remember when you had to stay up late to find out what the scores were? Doesn't that seem quaint now? These days every spec of information about these key categories is just a click away, further undermining local newscasts' value.

4. Advertisers have more options than ever and are gradually going to move spending to approaches that are both more ROI-centric (e.g. Google) and a better match for their customers' media behavior. Think about it - if you're a Honda, Scion or Volkswagen dealer targeting younger demos, is local TV really the best way to reach this audience? The range of options for local advertisers is already robust and is only going to become more so in the future.

All of this said, however, all is not lost by any stretch. With the right leadership, I happen to believe that local stations can find ways to manage their way through the chaotic days ahead. Tops on my list would be embracing broadband as a new programming platform to leverage their local expertise, blasting their content out through every possible distribution path, radically re-training their ad sales teams to be Internet-literate, cross platform-obsessed warriors and re-creating their brands' perceptions for the broadband and on-demand era.

Broadcast TV stations need to look no further than their cross-town rival newspapers to understand the gale-force competitive winds coming their way. Hopefully with these examples plainly visible, they'll prepare themselves appropriately.

Categories: Broadcasters

Topics: ABC, CBS, CBS Audience Network, FOX, Hulu, NBC, News Corp

-

Clueing in FCC Chairman Kevin Martin

Somebody needs to seriously clue in Kevin Martin, the chairman of the Federal Communications Commission, who has somehow gotten it into his head that America's cable TV industry needs to be burdened by all kinds of new regulations, despite the fact that competition is coming at the industry from every direction imaginable.

On the probability that you don't think too much about the FCC's actions, nor what they might mean to you, I have a reminder for you: when America's top communications regulator seeks to drive the industry that is America's #1 provider of broadband Internet service into a regulatory ditch, that's a problem for anyone who works in the media, entertainment, telecommunications and technology industries. Mr. Martin's cockeyed plans threaten to do this.

First, a quick recap. In the last several weeks Mr. Martin has sought to use hand-selected (and highly questionable) data to resurrect an arcane FCC prerogative known as the "70/70" rule. It is not worth reviewing what this rule is or whether or not it applies. What is important to know is that Mr. Martin has sought to use this rule to introduce regulations forcing cable companies to submit to federal arbitration to resolve carriage disputes with cable networks and to reduce the prices of certain leased access channels by upwards of 75%. Lingering in the background are further regulations, such as forcing "a la carte" unbundling of cable channels for unfettered consumer choice.

Last week wiser heads prevailed with the other FCC commissioners, many members of Congress and the White House intervening to check-mate Mr. Martin's plans. In fact, so perturbed by Mr. Martin's recent actions is the House Energy and Commerce Committee chairman John Dingell that has opened an investigation into Mr. Martin's handling of the FCC's affairs.

Now, in retreat, Mr. Martin has come up with a new regulation capping any one cable operator's U.S. coverage at 30%. This is particularly targeted at Comcast, which, with 27% coverage, is just a whisker away from hitting the proposed cap.

In criticizing Mr. Martin, let me make clear that I'm no cable apologist nor am I a regulatory libertarian, against all forms of government intervention. I worked in the cable industry from 1990-1998 and know the good, the bad and the ugly of the industry quite well. The government has intervened in the past to correct legitimate market failures caused by clear industry bad actors. But those days are past. Now the cable industry is fighting for its life against the triple threat of satellite, telco and broadband "over the top" competition.

So how is it possible that Mr. Martin has so completely "missed the memo" that America's consumer communications services - video, broadband Internet access and voice - are more competitive today than ever, and that re-regulation is completely wrong-headed? And that technology is enabling a wealth of new services that are causing traditionally distinct industries to compete against one another, with the ultimate winner being consumers? And that real, skilled, high-paying, American jobs which are tied to the innovative media, entertainment, technology and communications markets he oversees will certainly be adversely affected by these onerous new regulations he is proposing?

Of course, I cannot get inside Mr. Martin's head to explain his actions. All I can guess is that somehow he arrogantly believes that Washington's bureaucracy is better suited to sort out the hyper-competition and innovation sweeping these industries than are the free markets and myriad technologies being introduced. How profoundly incorrect that belief is. Last time I checked Mr. Martin's bio, he personally has exactly ZERO day-to-day business operating experience, so maybe someone can remind me what his particular expertise is in these matters? As if all this isn't enough, don't forget about how reckless it is for a regulator to mess around with one of the few remaining vibrant pockets of the American economy.

Mr. Martin's recent actions have shown him to be just another in a long line of seemingly intelligent, but ultimately clueless presidential appointees. Particularly in these tenuous economic times, America can ill-afford to have poor judgment in its chief policy-makers. For all of us who work in the media, entertainment, technology and telecom industries, let's hope the checks-and-balances system continues to work and Mr. Martin's misguided re-regulatory policies don't gain any traction.

Categories: Broadband ISPs, Cable Networks, Cable TV Operators, Regulation

Topics: Comcast, FCC, Kevin Martin

-

Zipidee Buys TotalVid; Guns for Long Tail Video Dominance

This morning Zipidee, a company formed earlier this year, is announcing its acquisition of TotalVid from

Landmark Communications. With the deal Zipidee is gunning to become the king of the long tail, enthusiast video, using a strictly paid model. Yesterday I spoke with Zipidee CEO Henry Wong, and TotalVid President Karl Quist about the deal and the opportunity going forward.

Landmark Communications. With the deal Zipidee is gunning to become the king of the long tail, enthusiast video, using a strictly paid model. Yesterday I spoke with Zipidee CEO Henry Wong, and TotalVid President Karl Quist about the deal and the opportunity going forward.  Zipidee's strategy is to create a digital marketplace for video, audio and ebooks. As Henry puts it, we're "eBay meets iTunes", enabling content providers to set the business rules around how their content can be accessed. Like TotalVid, Zipidee's intent is to open up the broadband distribution market to the many smaller, independent producers who have traditionally relied on inefficient and hard-to-access DVD distribution channels.

Zipidee's strategy is to create a digital marketplace for video, audio and ebooks. As Henry puts it, we're "eBay meets iTunes", enabling content providers to set the business rules around how their content can be accessed. Like TotalVid, Zipidee's intent is to open up the broadband distribution market to the many smaller, independent producers who have traditionally relied on inefficient and hard-to-access DVD distribution channels. I am very familiar with TotalVid, having worked as a part-time biz dev consultant for them for a while, helping pull together a number of distribution deals. TotalVid started up in the relatively early days of broadband video, almost 4 years ago. Karl and his team did a fabulous job gaining access to specialty video in tons of categories such as action sports, martial arts, instruction, etc, eventually aggregating over 500 different content providers providing over 5,500 different titles. This library is very complimentary to Zipidee, which itself has done hundreds of content deals aggregating a library of over 5,000 titles. As Henry explained it, there is virtually zero duplication.

Henry resolutely believes that the paid approach for accessing this type of longer-form, specialty content is preferable to ad-supported. In general I agree with him - this kind of stuff isn't just random low-quality clips and consumers should expect that it won't come free.

However, as many VideoNuze readers know, I believe there are real challenges succeeding with the paid model right now. Chief among them is that the Internet is awash with free video, continuously raising the bar for how to get users to crack open their wallets and pay for anything, no matter how useful or sought after it might be. So this leads to a real marketing and customer acquisition challenge. Meanwhile DVD is a robust format and few people are yet familiar or comfortable with how a paid download works (e.g. is it portable? how does it get moved to other machines, can it be watched on TV?) So there's a big customer education challenge.

Nonetheless, I'm rooting for Zipidee. If they can surmount these and other challenges, they'll have created a hugely valuable digital distribution franchise.

Categories: Aggregators, Deals & Financings, Downloads, Startups

Topics: Landmark Communications, TotalVid, Zipidee

-

Building B Has Cable and Satellite in its Crosshairs

Building B is major league stealthy company with an audacious vision for how consumers will access video content in the future. If it succeeds current multichannel video service providers (namely cable and satellite providers) will feel the brunt.

Building B has a blue chip executive team and pantheon of accomplished investors and advisors. It made headlines a few months ago when it announced a $17.5M funding round led by Morgenthaler Ventures, OmniCapital and Index Ventures.

Last week I had a briefing with Buno Pati, CEO/Co-founder and Phil Wiser (Chairman/President/Co-founder). They are both highly-experienced and successful technology executives who are also quite PR savvy. They know how to stay on message and close to their stealthy script. I needed to use my "virtual crowbar" persistently to try to pry a few new morsels of information out of them. From what I learned, it's a pretty cool story. Following is what I learned about what the company.

The company's plan rests on a number of key assumptions:- TV must be the center of the consumer video experience, and today's service must be redefined

- Access to broadcast content is critical for success

- On demand, high def is in, linear, standard def is out

- Open access to robust wireless networks will be prevalent

- Advertising will be key value driver in the future

- Price of storage is going to virtually zero;

Given all this, in Buno's words, "Building B's opportunity is to unify, simplify and deliver a video experience to consumers at a more palatable price." This simple sounding statement belies an excruciatingly tall order.

The company is creating a next generation set top box of sorts that will deliver the gamut of video: TV, movies and broadband. Buno and Phil don't see their box as comparable to ones from say Akimbo, Vudu or Apple TV. These are really broadband-only augments, whereas Building B aspires to be a full-on substitute for cable or satellite. Their box will be able to access content through both wired and wireless delivery infrastructures. One engineering challenge is to match content with the optimal delivery network. So for example, one-to-many broadcast networks might be delivered over wireless while niche and interactive content would use broadband.

But Building B doesn't see a model selling the box at retail (though Phil concedes this might be a secondary outlet). Others have tried and failed at retail. Rather, its go-to-market strategy contemplates partnering with service providers like telcos and ISPs which want or need to be in the video business, but don't have the stomach or cash to upgrade their networks to do so.

Building B plans to develop a video entertainment service offering incorporating its box which can be made available turnkey to partners. These partners could include smaller telcos, particularly in rural areas, which have traditionally stapled on a satellite offering to fill out their triple play bundle. Or they could be larger telcos like AT&T or Verizon, who might augment their fiber rollouts with Building B's approach. Or they could be broadband ISPs, portals and others who aspire to be in the video business.

A key hurdle for Building B is assembling a fully competitive video lineup to what today video providers offer. This is no easy feat. Cable programmers in particular are reluctant to make advantageous deals with new distributors for fear of antagonizing existing cable and satellite affiliates. Yet Buno feels confident that Building B will gain access to major cable networks' fare, on demand, and on deal terms that are both economic to the company and non-disruptive to these networks' current arrangements. Accomplishing these deals alone would be noteworthy.

Lastly, Building B envisions delivering a personalized and easy-to-access service. Buno speaks of having a "dumbed down approach" aimed at satisfying only primary consumer needs and routines. Given its emphasis on HD, this is the part of the Building B vision that must necessitate a colossal hard drive in the box to cache content for ready access. Indeed, Buno said the company is "betting heavily that the price of storage is going to zero." If this assumption is off the bill of materials on storage alone could bust the box's budget.

Listening to Building B's vision, it's hard not to get enthusiastic about the world it seeks to create. As a consumer it would be thrilling. Yet the technology landscape is littered with ambitious would-be contenders whose aspirations foundered when faced with real-world engineering, marketing and business model challenges. Building B is simultaneously climbing tall mountains in multiple directions. If it succeeds, it will become a big-time disruptor of today's business models. It's going to be fun to watch it try.

Categories: Cable Networks, Cable TV Operators, Devices, Startups, Technology

Topics: Building B, Index Ventures, Morgenthaler Ventures, OmniCapital

-

ClipBlast 3.0 Beta Released; Further Video Search Improvements

Next week ClipBlast, a player in video search space, will announce that is has launched a beta of its 3.0 product. It's actually now live and I've had a chance to play around with it for the last couple of days. I also got a briefing and demo when I met up with Gary Baker, ClipBlast's CEO, at Digital Hollywood a few weeks ago.

Video search has been a murky, yet fast-evolving area. You have to get way down into the weeds to fully understand the nuances, but here is the gist. First, video isn't nearly as searchable as text is. Video search primarily relies on metadata, which describes what's inside the video itself. This metadata can be created by the content provider or by the video search engine itself using techniques like speech-to-text processing. A key challenge for video search engines has been returning results in which the context matches what the user was intending. This is no easy feat, as the same word can obviously be used in many different contexts, yielding lots of useless results.

ClipBlast's 3.0 beta is crawling 10,000 different video providers now and they've continued to make many enhancements to their metadata processing. They've also done a lot of work to improve user navigation so that browsing is a viable complement to search. (This gets to how users actually interact with video search engines, which is yet another issue in the video search world). ClipBlast now places all videos into 70 different categories, which have easy scrolling thumbnails, showcases featured clips and featured partners and today's most popular searches.

ClipBlast has also introduced more personalization features such as saving providers, categories, searches and results. You can also configure your own personal home page and set email alerts for when new video matching your search criteria. Perhaps most fun is a new widget feature, allowing ClipBlast widgets to be embedded on your desktop and blog with customized video. Gary demo'd this for me and it's quite cool. It's only available for Macs right now with a PC release coming soon.

I'm planning a deeper dive into video search in December and will have more detailed analysis on the category then. In the mean time I suggest the best way to get into it and evaluate which video search engine is best for you is to run the same search across some of the more popular video search engines. A good list would include: Truveo (now owned by AOL), Google (still officially in "beta"), blinkx, SearchForVideo, EveryZing, Dabble, Pixsy, Fooooo and others I'm sure I'm missing.

I'm interested in what you find, so please post a comment or email me.

Categories: Video Search

Topics: AOL, Blinkx, Dabble, EveryZing, Fooooo, Google, Pixsy, SearchForVideo, Truveo