-

2009 Prediction #1: The Syndicated Video Economy Accelerates

To kick off my 2009 broadband video predictions, here's one that won't surprise loyal VideoNuze readers: the "Syndicated Video Economy" will accelerate in the new year.

This is hardly a controversial assertion given how much I've written in '08 about the SVE, which I first introduced last March. As a refresher, the SVE describes an ecosystem of content providers, distributors and all those who facilitate their relationships. In the SVE, content providers seek widespread distribution of their video. They understand that the Internet itself is a highly fragmented medium and that to optimize viewership, they must shift from "aggregating eyeballs" to a central destination site to instead focus on "accessing eyeballs" wherever target viewers may spend their time: on social networks, with portable devices or game consoles, on personalized portal pages, on vertical subject-driven web sites and myriad other places.

Underlying this transition to widespread distribution is the recognition that, at least for now, advertising is the primary business model for the vast majority of broadband video content providers. Massive scale and accurate targeting are the two key ingredients to optimizing the ad model. While the SVE is still nascent and its ultimate potential is still far off, in '08 a diverse array of SVE enablers began laying the foundation for its future success.

Two of the more interesting initiatives kicked off in '08 were Google Content Network and Adconion.TV, both of which seek to blend content, distribution and advertising into one scalable bundle. I expect more of these kinds of initiatives in '09, especially from ad networks, which are ideally positioned to distribute video to their partner sites. Plenty of others are also distributing premium video into the "mid tail" and "long tail" of web sites such as Grab Networks (a company formed by the Sept '08 merger of Anystream and Voxant), 1Cast, Jambo Media, ClipBlast, Magnify.net and Syndicaster.

An important part of understanding the SVE is that, unlike traditional distribution which was focused on long-form episodes, the SVE is particularly well-suited to targeted distribution of video clips or short series. Creating, bundling and matching these clips to their appropriate audiences is where companies like 5Min, EveryZing, Digitalsmiths, Gotuit and others all play roles. Of course these clips must be managed coherently as part of a content providers' larger catalog, which is why many of the leading content management and publishing platforms like Brightcove, thePlatform, WorldNow, VMIX and others that cater to large media companies also offer syndication features.

With the explosion of video syndication, content providers need the ability to enforce their business rules, measure usage and accurately carry ads even when video is played offline or on mobile devices. These needs are being filled by companies like FreeWheel, Visible Measures, comScore, WebTrends, Kiptronic, Volo Media, Transpera and Azuki Systems. As video is further married to the burgeoning social media landscape, companies like YouTube, KickApps, blip.tv, Slide, RockYou, ClearSpring, Facebook, MySpace and others are all pioneering innovative new forms of community building and user participation.

Thought much of this activity only just started in '08, some of the SVE's rewards are already becoming clear. As one example, Hulu's October traffic as measured by comScore attests to how syndication is powering Hulu's impressive growth.

The innovation and product development that's happening in the SVE, coupled with the broad investment focus on it cause me to be confident about syndication's future. I expect much more activity from all of the companies mentioned above, plus plenty of others I haven't been exposed to yet. In '09 the SVE's foundation will continue to get built out, with users being the ultimate beneficiaries.

What do you think? Post a comment now.

Categories: Syndicated Video Economy

Topics: Syndcated Video Economy

-

NFL.com's "Game Rewind" Feature is Pretty Cool

I got a tip yesterday about "Game Rewind," a feature that NFL.com has apparently launched in the last week or so. For a mere $20/season, you can now watch full, commercial-free replays of all the season's games. The video is delivered in terrific quality by Move Networks, and as seen below, also offers a side window that shows a synopsis of the game's scoring. I'm not a huge football fan, but since I missed the exciting end of last week's Patriots-Seahawks game, I simply dragged to the fourth quarter and sat back and enjoyed (btw, how nice is it to watch commercial-free?!).

One suggestion for the NFL team: introduce EveryZing's MetaPlayer, Gotuit VideoMarkerPro or Digitalsmiths (or someone else's metadata-based search technology) so that fans can quickly retrieve only the highlights they care about (especially for the fantasy crowd). If I just want to see Matt Cassel's touchdown passes, it would sure be nice to enter that phrase and be shown those specific highlights only. Still, Game Rewind is a very cool new feature, of course only possible courtesy of broadband delivery.

What do you think? Post a comment now.

Categories: Sports

Topics: Digitalsmiths, EveryZing, Gotuit, Move Networks, NFL

-

Hulu's Impressive 2008 Growth

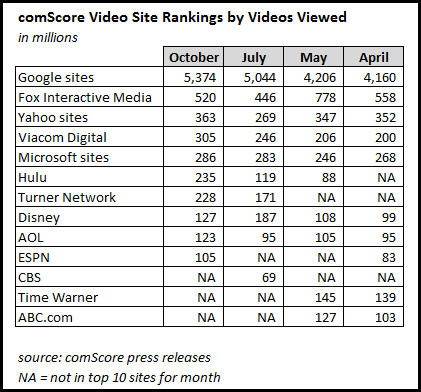

comScore's latest video traffic rankings came out earlier this week, and it was hard to miss Hulu's big growth in 2008. As the chart below show, the site, which only launched officially in March landed in the #6 spot with 235 million video streams in October, up from 119 million in July, 88 million in May and not in comScore's top 10 in April.

While Hulu's latest stats benefited from the SNL political skits, it's worth noting that in October Hulu delivered more streams than Viacom, Disney, AOL, ESPN, Time Warner and ABC.com as recently as April (when Hulu wasn't yet in the top 10). As Todd Spangler points out, Hulu's success is also a very significant syndication data point: in October it generated "only" 5.3 million uniques on its own site with the remainder of its 24 million uniques coming from partners.

By anyone's standards Hulu's off to a pretty amazing start. Hulu's pre-launch naysayers have been proven dead wrong. A year ago I gave Hulu's beta a solid B+; it has now become one of the best out there. In '09 its key challenge is to maximize the revenue from all that traffic.

What do you think? Post a comment now.

Categories: Aggregators

Topics: Hulu

-

Local Broadcast TV Stations are Hurting

To get a sense of how grim these last two weeks have been in the local broadcast TV industry, do a quick scan of the "Stations" section of TVNewsday, one of my favorite aggregators of broadcast-related news. Layoffs are rampant as stations are buffeted by the economic slowdown, which has only added to their long list of woes, topped by declining network ratings, massive audience fragmentation and steady migration to online/DVR viewing.

I've long thought that local broadcasters are among the most vulnerable industries in the digital era, as broadband has created many similar challenges as the Internet itself created for their local newspaper brethren. Back in April I wrote in "Broadband, Broadcast Converge at NAB" that local broadcasters needed to reimagine their businesses to capture opportunities broadband offers beyond their local geographies. The urgency needle is now in the red zone. This industry's fundamentals have permanently changed.

What do you think? Post a comment now.

Categories: Broadcasters

Topics: NAB

-

Reviewing My 6 Predictions for 2008

Back on December 16, 2007, I offered up 6 predictions for 2008. As the year winds down, it's fair to review them and see how my crystal ball performed. But before I do, a quick editorial note: each day next week I'm going to offer one of five predictions for the broadband video market in 2009. (You may detect the predictions getting increasingly bolder...that's by design to keep you coming back!)

Now a review of my '08 predictions:

1. Advertising business model gains further momentum

I saw '08 as a year in which the broadband ad model continued growing in importance as the paid model remained in the back seat, at least for now. I think that's pretty much been borne out. We've seen countless new video-oriented sites launch in '08. To be sure many of them are now scrambling to stay afloat in the current ad-crunched environment, and there will no doubt be a shakeout among these sites in '09. However, the basic premise, that users mainly expect free video, and that this is the way to grow adoption, is mostly conventional wisdom now.

The exception on the paid front continues to be iTunes, which announced in October that it has sold 200 million TV episode downloads to date. At $1.99 apiece, that would imply iTunes TV program downloads exceed all ad-supported video sites to date. The problem of course is once you get past iTunes things fall off quickly. Other entrants like Xbox Live, Amazon and Netflix are all making progress with paid approaches, but still the market is held back by at least 3 challenges: lack of mass broadband-to-the-TV connectivity, a robust incumbent DVD model, and limited online delivery rights. That means advertising is likely to dominate again in '09.

2. Brand marketers jump on broadband bandwagon

I expected that '08 would see more brands pursue direct-to-consumer broadband-centric campaigns. Sure enough, the year brought a variety of initiatives from a diverse range of companies like Shell, Nike, Ritz-Carlton, Lifestyles Condoms, Hellman's and many others.

What I didn't foresee was the more important emphasis that many brands would place on user-generated video contests. In '08 there were such contests from Baby Ruth, Dove, McDonald's, Klondike and many others. Coming up in early '09 is Doritos' splashy $1 million UGV Super Bowl contest, certain to put even more emphasis on these contests. I see no letup in '09.

3. Beijing Summer Olympics are a broadband blowout

I was very bullish on the opportunity for the '08 Summer Games to redefine how broadband coverage can add value to live sporting events. Anyone who experienced any of the Olympics online can certainly attest to the convenience broadband enabled (especially given the huge time zone difference to the U.S.), but without sacrificing any video quality. The staggering numbers certainly attested to their popularity.

Still, some analysts were chagrined by how little revenue the Olympics likely brought in for NBC. While I'm always in favor of optimizing revenues, I tried to take the longer view as I wrote here and here. The Olympics were a breakthrough technical and operational accomplishment which exposed millions of users to broadband's benefits. For now, that's sufficient reward.

4. 2008 is the "Year of the broadband presidential election"

With the '08 election already in full swing last December (remember the heated primaries?), broadband was already making its presence known. It only continued as the year and the election drama wore on. As I recently summarized, broadband was felt in many ways in this election cycle. President-elect Obama seems committed to continuing broadband's role with his weekly YouTube updates and behind-the-scenes clips. Still, as important as video was in the election, more important was the Internet's social media capabilities being harnessed for organizing and fundraising. Obama has set a high bar for future candidates to meet.

5. WGA Strike fuels broadband video proliferation

Here's one I overstated. Last December, I thought the WGA strike would accelerate interest in broadband as an alternative to traditional outlets. While it's fair to include initiatives like Joss Wheedon's Dr. Horrible and Strike.TV as directly resulting from the strike, the reality is that I believe there was very little embrace of broadband that can be traced directly to the strike (if I'm missing something here, please correct me). To be sure, lots of talent is dipping its toes into the broadband waters, but I think that's more attributable to the larger climate of interest, not the WGA strike specifically.

6. Broadband consumption remains on computers, but HD delivery proliferates

I suggested that "99.9% of users who start the year watching broadband video on their computers will end the year no closer to watching broadband video on their TVs." My guess is that's turned out to be right. If you totaled up all the Rokus, AppleTVs, Vudus, Xbox's accessing video and other broadband-to-the-TV devices, that would equal less than .1% of the 147 million U.S. Internet users who comScore says watched video online in October.

However, there are some positive signs of progress for '09. I've been particularly bullish on Netflix's recent moves (particularly with Xbox) and expect some other good efforts coming as well. It's unlikely that '09 will end with even 5% of the addressable broadband universe watching on their TVs, but even that would be a good start.

Meanwhile, HD had a banner year. Everyone from iTunes to Hulu to Xbox to many others embraced online HD delivery. As I mentioned here, there are times when I really do catch myself saying, "it's hard to believe this level of video quality is now available online." For sure HD will be more widely embraced in '09 and quality will get even better.

OK, that's it for '08. On Monday the focus turns to what to expect in '09.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Brand Marketing, Devices, HD, Indie Video, Politics, Predictions, Sports, Technology, UGC

Topics: Amazon, Apple, AppleTV, Barack Obama, Hulu, iTunes, NBC, Netflix, Olympics, Roku, VUDU, XBox

-

7 Broadband/Mobile CEOs Explain How to Raise Money in the Down Economy

Amidst all the gloomy economic news, there are actually still some earlier stage companies that are raising new money. To learn more about their how they're doing it, I emailed the CEOs of seven broadband/mobile video companies which have collectively raised nearly $80M in the last 3 months. I asked 3 basic questions:

- What are the key success factors for raising money given the difficult economic climate?

- What are the biggest challenges?

- Is there any specific advice you'd offer to those trying to raise money these days?

While there were some common themes in their answers (many of which echoed the usual fundraising maxims), there was plenty of variety and a few outliers. Space constraints don't allow for me to share all of their specific answers, so I've tried my best to summarize the common themes and highlight key nuggets of wisdom below. If you have any questions, drop me an email.

The seven CEOs who graciously took time out of their busy days to contribute their thoughts (along with the recent rounds they've raised) are:

- Amir Ashkenazi, Adap.tv ($13M Series B, 9/23/08)

- Frank Barbieri, Transpera ($8.25M Series B, 11/13/08)

- Alex Blum, KickApps ($14M Series C, 11/25/08)

- Dean Denhart, BlackArrow ($20M Series B, 10/6/08)

- Keith Kocho, ExtendMedia ($10M Series C, 12/2/08)

- Steve Rosenbaum, Magnify.net ($750K Series A1, 11/21/08)

- Ben Weinberger, Digitalsmiths ($12M Series B, 11/13/08)

1. What are the key success factors for raising money given the difficult economic climate?

The answers that dominated were all around revenue, profitability and cash flow. All the CEOs mentioned, in one way or another, that being able to demonstrate real revenue growth and momentum is essential. Some noted that in the past traffic or usage may have been sufficient, but now the "premium is on paying customers," and how get to profitability and cash flow breakeven using reasonable assumptions. Several mentioned that investors are as risk averse as ever, which of course comes as no surprise. They want to see concrete, well thought-out plans.

Investors have also become more sophisticated about the whole broadband video sector and expect entrepreneurs to be able to explain where they fit into the ecosystem and what their points of differentiation are. Importantly, they are looking for proven models (unfortunately an oxymoron for a pure startup), or at least some minimal history of success that goes "beyond PPT slideware."

A couple of CEOs noted that investors have shifted from asking "how fast can you scale?" to "how will you get through this crisis?" They no longer expect a quick exit. They are looking for a real plan which includes contingency tactics if for example, competitors do something desperate like cut their prices in half.

2. What are the biggest challenges?

The prevailing theme here was uncertainty, starting with investors' own business models. They're focused on how much of their funds to hold in reserve to shore up existing portfolio companies. They're trying to gauge their own limited partners' appetite for venture investing given the credit squeeze. Then of course they're trying to understand the impact of broadband market drivers like ad spending and user adoption. One CEO lamented the difficulty of persuading people to put new money to work on the very day the stock market's dropping by 500 points. Still another noted that all of this can lead to a "self-fulfilling prophecy" where everything freezes and missed opportunities abound.

With respect to the broadband market specifically, one CEO said the key challenge is showing how "you monetize video for your clients." Absent that, "it will not only be hard to raise money, but harder still for your client to spend money with you."

Another said that the level of scrutiny has gotten so high that it's not even worth talking to any investor which doesn't have its own track record of investing in the broadband video sector. It's just too hard to educated people in this environment. Another CEO added that your model needs to be "brilliant and bulletproof, with an A-level management team already in place." Boy, there's a steep hurdle to clear.

3. Is there any specific advice you'd offer to those trying to raise money these days?

Many of the answers to this question reflected fundraising basics: understand your business thoroughly, put a balanced team in place, seek out investors you know first, have a solid plan, and bootstrap as much as possible first.

With respect to the raising money in the current lousy market, there was a broad range of sentiment. One CEO said "Don't...the terms are going to suck..." while another said to be "incredibly realistic about how much to raise, your burn rate and valuation." On the more optimistic end of the spectrum, one said "The market's poor performance means that investors are looking for new opportunities. Ignore all the negative energy and naysayers." And another remarked that "Even during the tech disaster of 2001-2003, angel investors, VCs and tech behemoths were still putting money to work in promising sectors." Another heavily emphasized the value of loyal and supportive existing investors (if there are any) in helping making the case to new investors.

More tactically, one CEO said that the more you "minimize uncertainty that surrounds your business specifically, the better off you'll be." Another said to make the transaction as simple as possible, and to "get the big items off the table first." Still another said to demonstrate "you're indispensable to customers, helping them weather the downturn." Finally one cautioned to be ready to take a lot more meetings than usual and expect a lot deeper follow up..."it may require you to go well beyond investors in your backyard to find the right fit."

Hopefully some of this is helpful to those of you trying to raise money right now, or thinking about doing so in the near future. Broadband video remains one of the hottest sectors out there; even still, if you're not getting a lot of love right now, you're not alone...

What do you think? Post a comment now.

Categories: Deals & Financings

Topics: Adap.TV, BlackArrow, Digitalsmiths, ExtendMedia, KickApps, Magnify.net, Transpera

-

Learning from Jeff Zucker's Example

The corporate seismograph measuring activity coming out of NBCU lately has shot off the charts.

NBCU's tectonic moves have included: the "mini-merger" of NBC Entertainment and Universal Media Studios, together with the ouster of Katherine Pope, UMS's president and others; ongoing job cuts as part of its previously-stated plan to reduce its workforce by 3% or 500 positions, a move that itself was part of a larger $500M expense reduction program; and the planned shift of Jay Leno to the 10pm slot, the first-time ever a "stripped" program has moved to prime-time. And one can bet the changes are far from over.

The moves indicate that NBCU's president and CEO Jeff Zucker has concluded not just that the traditional rules of the media game are over for good, but that nothing short of a radical transformation of NBCU's business will ensure its future survival.

I don't know Zucker or the executives he's shuffling around so I'm not in a position to say whether the

personnel actions he's taking are the right ones specifically. But what I can say fairly is this: Zucker's unvarnished realism and willingness to make wrenching organizational changes should be viewed as a model for other industry CEOs to follow.

personnel actions he's taking are the right ones specifically. But what I can say fairly is this: Zucker's unvarnished realism and willingness to make wrenching organizational changes should be viewed as a model for other industry CEOs to follow. I was impressed with Zucker back in January '08, upon listening to his keynote at NATPE. I wrote in "Zucker Preparing NBC for Broadband Era" that I appreciated him saying "technology is transforming every part of our business" and that the "historic economic model supporting broadcast TV is wounded." Most famously, he said that the "number one challenge for everyone in this industry is...not trading analog dollars for digital pennies." I concluded that Zucker "got it."

While I am very sympathetic to those being affected by the change underway throughout the NBCU empire, I am thrilled to see Zucker acting as a leader. One would assume that when an individual has ascended to the highest ranks of their organization, they must actually be a real leader. However, the sad truth is that real leadership has been in desperately short supply throughout corporate and federal America in recent times. In fact, if we'd had more real leaders over the last 30-odd years we wouldn't have a crippled U.S. auto industry, an avaricious, self-destructive financial services sector, a tragically warming planet or a country bloated by a large and ever-growing debt burden.

In short, leaders see the world as it is. Not as it used to be. Not as they wish it could be. And not as they manufacture it to be so that in the short term they can maximize their financial reward. Zucker's ability to be a clear-eyed realist, and his willingness to take the actions required for future success, are critical to tens of thousands of NBCU employees and their families, the vast web of suppliers reliant on the company's continued good health and myriad investors whose confidence is the lifeblood of NBCU's parent company GE.

From my parochial position, broadband is at the top of the list of the company's challenges. Broadband and on-demand digital distribution, together with DVRs and fragmenting consumer behaviors strike at the core of the broadcast industry's longstanding success formula. The recent economic crisis and accompanying ad spending slowdown have simply accelerated their importance.

On the broadband front, so far NBC has responded admirably. By co-founding Hulu as its broadband spear tip, hiring top-notch executives for it, funding it generously and providing it ample autonomy, NBC has given Hulu the room to get off to a strong start. Though I have my concerns with how Hulu's monetizing its streams and worry about its affect on NBC's P&L, I'm hopeful that the Hulu team understands the big picture. In '09 I expect there will be a shakeout among the online aggregators of premium-quality video but I'm confident Hulu will be among those left standing.

In the meantime, I don't envy Jeff Zucker, or any of the other big media CEOs who are tasked with navigating their proud organizations into an unfamiliar and deeply unsettling new era. Personally I wouldn't have the stomach for it. But, based on what I've seen to date, if I were an NBCU stakeholder, I'd be glad that Zucker is at the helm.

What do you think? Post a comment now.

Categories: Broadcasters

Topics: NBCU

-

New Thwoop.com Uses Broadband to Invert Content/Commerce Model

Brand Performance, a large player in the market for licensed character products for kids, is announcing Thwoop.com today, using broadband to invert the traditional model for content and commerce. I got a briefing from Ty Simpson, the company's CEO.

First a little background. Whenever you walk into a store like Toys-R-Us, you'll see rows and rows of products from hit kids programs like Ben10, Cars, Hannah Montana, etc. Licensing the characters and images from these shows to product manufacturers is a key source of revenue for program creators. If you have young kids as I do, you can attest to their popularity.

As Ty explains it, the industry is traditionally very hit driven. That means there is only a relatively small amount of room on TV for all of the character-driven programs that are produced. Similarly, big-box retailers allocate their finite shelf space to only the hottest properties. Ty recognized this latter scarcity several years ago and set up Tystoybox.com to focus exclusively on providing distribution for a broad range of licensed character products, many of which cannot get physical distribution. The site and its sister, AllAboardToys.com, have become the two largest independent online stores for these products.

With Thwoop.com, Ty is capitalizing on the scarcity of on-air shelf space for the programs themselves. The site aims to create a new kids entertainment experience, offering full program episodes of various kids programs along with trailers and other video. The first partner is NCircle, producer of Animal Atlas, Hermie & Friends and other shows. Thwoop.com's goal is to be a destination site where video can be seen and purchased, social networking and interactivity is promoted and user-generated product reviews are uploaded.

What's really unique here is that the whole site is supported by commerce, not advertising. On-air these programs are all ad-driven and the licensed products are considered ancillary. But Thwoop.com inverts the model, with commerce supporting the video. Ty explained that he's become a strong believer in broadband's potential to dramatically open up video availability, and that product sales will naturally follow. Presenting a strong user experience was a top priority, and Thwoop has partnered with Magnify.net to power the entire site. Magnify's CEO Steve Rosenbaum said his company is unveiling its "theater-mode" and full-screen player as part of the launch.

As a parent Thwoop.com raises some interesting questions. For example, my son is a Ben 10 fanatic. I like the idea of a site where he can watch the old episodes and immerse himself in the characters, and maybe even interact with other kids (assuming the right safeguards were in place). On the other hand, I have to admit, it scares the bejeezus out of me that he would get even more exposure to the licensed products. As my wife likes to remind me, we hardly need any more Ben 10 paraphernalia in our house...

Regardless, Thwoop.com is exactly the kind of new, innovative experience that broadband enables. Clever entrepreneurs like Ty recognize that broadband resolves traditional distribution scarcities, opening up completely new business models. When I put my VideoNuze hat on, I'm excited to see it launch.

What do you think? Post a comment.

Categories: Commerce

Topics: Brand Performance, Magnify.net, Thwoop.com