-

Brightcove Alliance Launches

Brightcove is unveiling "Brightcove Alliance" today, a wide-ranging ecosystem of technology, distribution and solution partners who have integrated with and/or are building applications on the the company's platform. Jeremy Allaire, Brightcove's CEO briefed me last week.

As he explained it, Brightcove 3, the recently released, latest generation of the company's platform,

represented a new push on openness and extensibility which are the key requirements for building out an ecosystem. Alliance partner benefits include platform APIs, training, support and improved access to Brightcove's long list of content provider customers through pre-built integrations.

represented a new push on openness and extensibility which are the key requirements for building out an ecosystem. Alliance partner benefits include platform APIs, training, support and improved access to Brightcove's long list of content provider customers through pre-built integrations. The company is announcing more than 80 partners today, covering just about every aspect of the broadband world. The press release includes supporting quotes from a dozen partners and customers and Jeremy added that many others expressed interest and will be included subsequently.

The only other large and formalized industry ecosystem I'm aware of is thePlatform's Framework program, which was announced last February and added to in September. It now totals over 60 companies and includes some overlapping names with Brightcove.

Having been involved in several alliance programs in the past, my take has always been that the litmus test for their success is whether they generate real revenue for partners. Too often what you get is the initial "Barney" press releases (i.e. "I love you, you love me") but little more in the way of actual new business.

Brightcove has two advantages to help it avoid a similar trap: (1) a lengthy list of existing customers who will likely welcome pre-integrated partner products and services that can be easily and inexpensively accessed and (2) a large group of partners, who, given the lousy economy, will be aggressive in pursuing Brightcove to identify customer opportunities. Brightcove should capitalize on both to expand its market position.

What do you think? Post a comment now.

Categories: Partnerships, Technology

Topics: Brightcove, thePlatform

-

Sony's Internet-to-the-TV Plans Are Confusing (and the NYTimes Coverage Isn't Helping Any)

Catching up on some reading last night, I got a chance to re-read a NYTimes piece by Saul Hansell from this past Tuesday rather sensationally entitled "How Comcast Controls Sony's Internet TV Plans." When I scanned it on Tuesday before posting a link to it from VideoNuze, I had one of those "This makes absolutely no sense, I need to read this again closer" reactions. Now, upon re-reading it, I'm having one of those "This really makes no sense" reactions.

The piece - which initially concerns Sony's efforts to bring broadband video to TVs, but then veers off into a somewhat unrelated discussion of the company's negotiations with the cable industry's tru2Way and CableCard technologies - quotes Sony Electronics U.S. president Stan Glasgow as saying: "We've worked with the cable companies for five years to develop a system that would allow us and the rest of the television manufacturers to have alternative content on the TV."

Why would Sony devote five years to such an undertaking? Because, again in Mr. Glasgow's words, "If you have to ask a consumer to switch sources constantly between cable and another source, it is not the normal consumer experience...There has to be a more integrated way to have cable and Internet content on the same user interface."

I'm all for making things easy on the consumer, but let's get this right: Sony devoted five years to negotiating with the cable industry so it could avoid viewers having to push the "Source" or "Input" button on their remote controls to toggle to broadband-delivered content via Sony devices?

Hello? According to comScore's recent numbers, 142 million people in the U.S. alone watched 558 million hours of online video. But amid that massive adoption, Sony thinks it might be setting the bar too high for its potential buyers if it asked them to push a button on their remotes so that they could enjoy some of that video on their TVs instead of on their PCs?

Is it just me, or does it appear that Sony completely misjudged both its potential buyers' technical aptitude and also their strong motivation to consume broadband-delivered video on their TVs?

While you consider those questions, let's also go back to basics: why is once-mighty Sony even bothering to integrate its Internet-to-the-TV products with the cable industry in the first place? The whole point of these kinds of Internet-to-the-TV devices is to disrupt the cable (and satellite and telco) industry's hold on consumer viewing time and spending for in-home video programming. Countless companies (Netflix, Hulu, Microsoft/Xbox, Apple/AppleTV, Vudu, Netgear, Sezmi, 2Wire, Blockbuster, LG, Samsung, Neuros, etc.) get this fundamental point and are implicitly or explicitly driving toward this goal each day.

That Sony doesn't seem to understand this suggests that the correct title of Saul's piece really should have been "Comcast Benefits by Exploiting Sony's Misguided Internet TV Plans."

What's profoundly different about the broadband era is that neither Comcast nor any other incumbent controls how consumers get video on their TVs, just as neither the NYTimes nor any other single news provider has ever controlled how we've gotten our news. If would-be "over-the-top" competitors don't get this basic idea - and instead waste precious time and resources on perpetuating the traditional world order - then shame on them.

What do you think? Post a comment now.

Categories: Cable TV Operators, Devices

-

Blockbuster Online with New 2Wire MediaPoint Player Has a Tough Climb Ahead

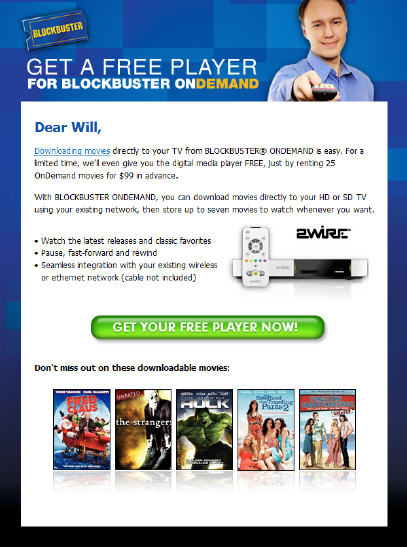

Have you received the email pitch from Blockbuster Online yet, to rent 25 movies and get the new 2Wire MediaPoint Digital Media Player "free?" I've received a couple already this week (see below), and after reviewing the offer and its details, and comparing it to other alternatives, my conclusion is that the new service has a tough climb ahead.

The new 2Wire box itself is in the same general family as other single-purpose boxes such as AppleTV, Vudu and Netflix's Roku. There are some differences among them in hard drive size, pricing, outputs and streaming vs. downloading orientation. But they all serve the same basic purpose: connecting you via your home broadband connection to one source of "walled garden" premium-quality video content.

VideoNuze readers know I've been quite skeptical of the standalone box model, especially when box prices start in the $200-300 range. There's no question there's an upscale, early adopter audience that will buy in, but mainstream consumers will be uninterested for all kinds of reasons including: financial considerations (especially in this economy), resistance to connecting another box in already crowded consoles, perceived technical complexity, strong existing substitutes (e.g. cheap ubiquitous DVD players) and indistinct value propositions.

My judgment is based on a pretty simple set of criteria I rely on to gauge a new product or service's likelihood of success: Does it offer meaningful new value (some combination of better price, quality or speed) with minimal adoption effort required? Can a large target audience for this new value be clearly defined, served and acquired in an economically-reasonable manner? Is this new value attainable without sacrificing meaningful benefits of existing alternatives?

Miss on any one of these and the odds of success lengthen. Miss on any two and you're in long-shot territory. Miss on all three and you're dead on arrival. After evaluating the Blockbuster Online/MediaPoint current offer, my sense is that it misses on at least two and possibly all three.

Value: As explained below, for certain movies renters, the offer is valuable. It provides convenience at a relatively low financial commitment for the new device. But explaining these benefits just to the relevant target audience at an economic cost per acquisition is going to be nearly impossible. I'm dubious that even in-store promotions - which on the surface seem Blockbuster's strength - will work. First, there may be franchisee issues, as there were with previous "Total Access" promotions. And second, Blockbuster has closed so many stores in prime target neighborhoods - due to the rise of Netflix and other options eroding their business - that they'll be missing many prospects (example: in my upscale home town of Newton, MA there is not a single Blockbuster store left).

Audience: There's only one real target audience I can see for this offer, and it seems very narrow to me: low-volume renters of movies only, who are not iTunes users. Think about it - if you rent a lot of movies, you've likely been subscribing to Netflix for years (more so if you also rent TV shows). If you want to own your content instead of rent it, then you buy DVDs or maybe more recently have been buying digital version, most likely with iTunes primarily. If that's the case, then when it comes to watching on TV, you're going to buy an Apple TV (even then, few have done so to date), not a 2Wire MediaPoint. The eligible target audience left for Blockbuster/MediaPoint seems pretty slim.

Sacrificing existing benefits: Inevitably all digital distribution options need to be compared to the incumbent DVD format, which is remarkably strong (no wonder a billion units have been shipped to date). Against the DVD standard, Blockbuster/MediaPoint is inferior in a number of ways: limited viewing windows (the usual online limitations of 24 hour expiration after starting, and 30 day automatic file deletion), no portability to view rented movies on other TVs not connected to a MediaPoint, no TV shows available for rent, and at this point, smallish storage that only keeps up to 5 movies at a time.

Add it all up, and it's a pretty daunting set of issues. To be sure, much of this isn't specific to Blockbuster. To succeed, all new digital delivery options must be mindful of the above criteria as well.

What do you think? Post a comment now.

Categories: Aggregators, Devices

Topics: 2Wire, AppleTV, Blockbuster, Netflix, VUDU

-

5Min Unveils VideoSeed, a Clever Syndication Tool

5Min, one of the many well-funded entrants in the video-based how-to/knowledge space which I wrote about last Feb, has recently introduced VideoSeed, a clever syndication tool that has already helped drive its video to dozens of partner sites aggregating 110 million unique visitors per month. VideoSeed is another indicator that the Syndicated Video Economy is helping shape product development priorities throughout the broadband industry. I spoke to Ran Harnevo, 5Min's CEO/co-founder yesterday to learn more.

VideoSeed's goal is to give 5Min's partners relevant and complimentary video that can be easily inserted into

text-oriented pages with little-to-no editorial oversight. As Ran explained it, a partner signs up, specifies which pages it wants video inserted into, selects parameters of 5Min video it wants to allow and templates for how the video should appear. 5Min editors rank all of its videos 1-5 according to an internal quality scale while rigorously assigning metadata to each.

text-oriented pages with little-to-no editorial oversight. As Ran explained it, a partner signs up, specifies which pages it wants video inserted into, selects parameters of 5Min video it wants to allow and templates for how the video should appear. 5Min editors rank all of its videos 1-5 according to an internal quality scale while rigorously assigning metadata to each.VideoSeed semantically scans all of the partner-submitted pages and matches and inserts relevant 5Min video. (Examples can be seen at Answers.com and wikiHow) As new, relevant videos are added to 5Min, they automatically rotate into the partners' pages. Videos can be viewed on the site or through 5Min's "SmartPlayer" which has features like super slow motion, zooming, etc.)

5Min currently has a library of about 40K videos, of which Ran thinks 80% are sufficiently high quality to be of interest to partners. 5Min commissions some videos and aggregates others. Ran eschews terms like "premium" and "UGC" as they've found some of the best videos come from pure amateurs.

5Min sells ads across the syndication network, using its own team and third-party ad networks. It's using overlays and pre-rolls to date. Revenue is shared with the content providers and publishing partners. Advertisers benefit by reaching a targeted, engaged audience across dozens of sites while only having to make one buy decision.

Text-oriented how-to/knowledge-based sites and subject-driven specialty sites lend themselves perfectly to accepting complimentary syndicated video. But as Ran points out, shooting video, hosting/serving it and selling ads against it is a lot of effort for most text-oriented sites. This is especially true in a down economy when resources are tight. These factors have helped contribute to 5Min expanding its partner audience rapidly to 110 million uniques, with 2-3 new partners coming on board daily.

I could also see the VideoSeed technology being interesting in other categories (celebrity video comes immediately to mind), though for now Ran says 5Min's staying focused on knowledge, and also isn't looking to license VideoSeed externally. No doubt others will watch its progress and look to emulate it. But as Ran notes, to really succeed, they must first focus on assigning highly accurate metadata so the matching process works as intended and users truly get relevant, high quality video.

What do you think? Post a comment now.

Categories: Aggregators, Indie Video, Syndicated Video Economy

Topics: 5Min

-

Video is the Killer App Driving Coming Bandwidth Explosion

A short interview in Multichannel News with Rouzbeh Yassini before the Thanksgiving break last week caught my eye.

Rouzbeh's name is likely unfamiliar to many of you. But for others who have been in and around the cable and broadband industries since the '90s, he is semi-famous. In those days Rouzbeh ran a company called LANCity, which was a pioneer in designing and manufacturing cable modems. These of course are the devices that now reside in tens of millions of homes around the world, enabling broadband Internet access and the high-quality video services like YouTube, Hulu, iTunes and others that run through them.

Though it's only been about 15 years, the early-to-mid '90s seem like another age entirely. Can you remember dial-up Internet access? Busying up your phone line if you wanted to be online? Listening to all those weird tones as your creaky 56K modem connected you to Prodigy, CompuServe, AOL, or eventually this thing everyone seemed to be talking about called the "World Wide Web?"

In my opinion, Rouzbeh deserves as much credit as anyone for the transformation of the dial-up Internet era

to the broadband world we now enjoy. He played a crucial role in articulating broadband's business potential to scores of senior cable executives who barely knew what a computer was, much less this new-fangled thing called the Internet. Importantly, he was a key technical architect of modern cable networks, which today barely resemble the passive, one-way networks of old.

to the broadband world we now enjoy. He played a crucial role in articulating broadband's business potential to scores of senior cable executives who barely knew what a computer was, much less this new-fangled thing called the Internet. Importantly, he was a key technical architect of modern cable networks, which today barely resemble the passive, one-way networks of old. In short, I've learned to take notice of Rouzbeh's prognostications. Though he can be irrepressibly optimistic, he's directionally right more often than not.

All of that brings me to his Multichannel interview. Rouzbeh now envisions the era of gigabit or 1,000 megabit Internet access within a decade. To put this in perspective, today's cable modems typically deliver around 10 megabit service or 1% of a gigabit. Spurred by competitive pressures, Comcast has recently announced the rollout of 50 megabit service to certain regions, with expansion to its entire footprint by 2010. These new rollouts are part of the cable industry's "DOCSIS 3.0" standards, covering a new generation of modems and channel management techniques.

There's an axiom in the broadband industry that usage always rises to the level of bandwidth provided. Yet when we're talking 1 gigabit service, one has to rightly ask, "what in the world are people going to do with all that bandwidth?" Rouzbeh posits things like corporate networking, remote offices, medical services and the like, but only touches briefly on video delivery.

From my perspective, video is the killer application that will drive this bandwidth explosion. As I wrote recently in "Video Quality Keeps Improving - What's it All Mean?" we are on the front end of a shift toward dramatically higher video quality, with near HD delivery already becoming common (Hulu, Netflix and Vudu are among the most recent to announce HD initiatives). This shift will only accelerate going forward. And to accommodate it will require lots more bandwidth from network providers.

In reality, the trickiest part of bandwidth expansion is less the technology development and deployment and more the business models that support the investments and make the most strategic sense. Questions abound: Is the right model to charge $150/mo for 50 megabit access as Comcast plans? Or to build a content service available only to those high-powered users? Or act like a CDN and provide services so as to charge content providers themselves to deliver higher-quality video? Maybe some hybrid of these, or some other model? And of course, what impact do these models have on the incumbent multichannel subscription video offering?

While there's murkiness now, like Rouzbeh, I'm a big believer that these things will ultimately be worked out and that bandwidth expansion is inevitable. Just as we now look back on the dial-up era and wonder how we got by, eventually we'll look at the mid-to-late 2000s and wonder how we survived on so little bandwidth.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Cable TV Operators, People

Topics: Comcast, DOCSIS, Hulu, Netflix, VUDU

-

Podcast with Will Richmond

Ever wonder if I actually have a real voice, in addition to the written "voice" you read each day on VideoNuze? The answer is yes, and for proof, check out a podcast interview I did with Phil Leigh of Inside Digital Media.

I discuss some of the ideas I've written about recently in "The Cable Industry Closes Ranks" and "Cutting the Cord" such as why full online episodes from cable networks aren't coming any time soon, what devices are likely to bridge broadband-to-the-TV and how important sports are to the current TV business model.

Do podcasts add value? Should I try to do more of them? Please let me know!

Categories: Cable Networks, Cable TV Operators

Topics: Inside Digital Media, Will Richmond

-

November '08 VideoNuze Recap - 3 Key Themes

Welcome to December and to the home stretch of 2008. Following are 3 key themes from VideoNuze in November:

Cable programming's online distribution narrows - Last month I concluded that cable programmers (e.g. Discovery, MTV, Lifetime) are going to become much more sparing when it comes to distributing their full programs online. As noted in "The Cable Industry Closes Ranks," after hearing from industry executives at the CTAM Summit and on the Broadband Video Leadership Breakfast, it has become apparent that the industry is going to defend its traditional multichannel video subscription model from broadband and new "over-the-top" incursions.

Both programmers and operators have a lot vested in this successful model, and are surely wise to see it last as long as possible. Subscription and affiliate fees are particularly precious in this economy, as the WSJ wrote on Saturday. Still, many VideoNuze readers pointed out the music industry's folly in trying to maintain its business model, only to see it turned upside down. Many predicted the cable industry is doomed to follow suit. Truth-be-told though, as I wrote in "Comcast: A Company Transformed," major cable operators are already far more diversified than they used to be. Broadband, phone and digital TV (+ add-ons like DVR, HD and VOD) have created huge new revenue streams. Surging broadband video consumption only helps them, even as "cord-cutting" looms down the road.

Netflix moves to first ranks of cord-cutting catalysts - Three posts in November highlighted the significant role that Netflix is poised to play in moving premium programming to broadband distribution. Most recently, in "New Xbox Experience with Netflix Watch Instantly: A 'Wow' Moment," I shared early reactions from a VideoNuze reader (echoed by many others) to receiving a subset of Netflix's catalog through Xbox's recently upgraded interface. Netflix CEO Reed Hastings highlighted the increasing importance of game devices in bridging broadband to the TV in his keynote at NewTeeVee Live this month (recapped here).

Still, Netflix lacks the rights to deliver many movies online, a problem unlikely to be rectified any time soon given Hollywood's stringent windowing approach. As such, in "Netflix Should be Aggressively Pursuing Broadcast Networks for Watch Instantly Service," I offered my $.02 of advice to the company that it should build on its recent deal with CBS to blow out its online library of network programs. In this ad-challenged environment, I believe networks would welcome the opportunity. Hit TV programs would help drive device sales, which is crucial for building WI's adoption. While the Roku box is a modest $99, other alternatives are still pricey, though becoming cheaper (the Samsung BD-P2500 Blu-ray player is down $100, now available at $300, I spotted the LG BD300 over the weekend for $245). A robust Netflix online package would be poised to draw subscribers away from today's cable model.

Lousy economy still looms large - Wherever you go, there it is: the lousy economy. Though the market staged a nice little rebound over the last 5 days, things are still fragile. Across the industry broadband companies are doing layoffs. This is only the most obvious of the side effects of the economic downturn. Another, more subtle one could be downward price pressure. As I wrote in "Deflation's Risks to the Broadband Video Ecosystem," economists are now growing concerned that the credit crunch could lead to collapsing prices and profits across the economy. I noted that such an occurrence would be particularly damaging for the broadband industry, where business models are still nascent, so ROIs and spending are softer.

Here's to hoping for some good economic news in December...

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Games

Topics: CBS, Comcast, LG, Microsoft, Netflix, Roku, Samsung, XBox

-

Giving Thanks and Keeping Perspective

If ever there was a year for giving thanks - and for trying to keep perspective - this is surely it. For the last several months or more, all of us have been buffeted by the economic meltdown to one extent or another. It isn't fun for anyone, and regrettably, if you believe the experts, things aren't going to turn around anytime soon.

Still, as I mentioned in last week's "Deflation's Risks to the Broadband Video's Ecosystem," for those of us who make our living focused in one way or another on broadband video, there are reasons to remain optimistic. Consumers continue to shift their behavior toward on demand, broadband-delivered alternatives. Clever entrepreneurs are introducing ever-more innovative technology-based products and services. Large pools of existing revenues are shifting around, in search of better, higher ROI ways to be allocated. And investors recognize all of this, motivating them to continue funding companies throughout the broadband ecosystem.

These are all things to be thankful for, and hopefully allow us to keep a little perspective. For those of us old enough to remember past downturns, it is also important to keep in mind that there have been difficult times in the past, and fortunately, eventually, things do correct. That doesn't relieve the current pain, but at least gives us a measure of hope for better days ahead.

Speaking of giving thanks, I want to give a shout out to the 30 companies that sponsored VideoNuze or its events in 2008. VideoNuze is just over a year old now, and I've been truly gratified by the support its received from both sponsors and the community of readers and participants.

VideoNuze is not immune from the economic meltdown, so I'd like to also mention that we're offering some great sponsorship specials going into '09. If you're interested in reaching a highly-targeted, broadband-centric group of senior decision-makers, VideoNuze is an outstanding value. I welcome your calls or emails.

Thanks to our '08 sponsors below. Happy Thanksgiving and see you on Monday.

ActiveVideo Networks, Adap.tv, Adobe, Akamai, Atlas Venture, Anystream (Grab Networks), Brightcove, ChoiceStream, Critical Media (Syndicaster), Digitalsmiths, ExtendMedia, EyeWonder, FAST Search & Transfer, Flybridge Capital Partners, Goodwin Procter, Gotuit, Jambo Media, KickApps, Kiptronic, Macrovision, Move Networks, Multicast Media, PermissionTV, Signiant, Silicon Valley Bank, thePlatform, Tremor Media, VMIX, WorldNow and Yahoo

Categories: Miscellaneous

Topics: ActiveVideo Networks, Adap.TV, Adobe, Akamai, Anystream (Grab Networks), Atlas Venture, Brightcove, ChoiceStream, D, Syndicaster