-

VideoNuze Report Podcast #29 - August 28, 2009

Daisy Whitney and I are pleased to present the 29th edition of the VideoNuze Report podcast, for August 28, 2009.

In this week's podcast we discuss comScore's rankings of video ad networks' potential reach for July, 2009. I offered a first look at these rankings in Wednesday's post. As I pointed out, these rankings represent the aggregate reach of each ad network's publisher list. This is different from a ranking of actual reach, which comScore is working on, and plans to begin releasing at some point in the near future. Daisy and I remind listeners that potential reach is an imperfect measure, but it is still an important filter for media buyers trying to gain insight into who the major video networks are.

Unrelated, I touch base on last week's podcast in which Daisy and I discussed the Southeastern Conference's shortsighted ban on fan-generated video in stadiums. I raise the topic because earlier this week I had the pleasure of taking my 9 year-old daughter to Fenway Park to see a Red Sox-White Sox game. All around us were people taking pictures and video. And go to YouTube and you'll find plenty of fan video of key Red Sox moments.

Somehow fan video doesn't seem to bother MLB as it does the SEC. I don't claim to understand the difference in thinking, but Daisy notes that MLB has been among the most forward-looking sports leagues around. Daisy is so peeved at the SEC that she's protesting by vowing never to attend an SEC game (a relatively insignificant threat since she's in fact never attended an SEC game and lives on the other side of the country!)

Click here to listen to the podcast (13 minutes, 53 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts, Regulation, Sports

Topics: comScore, MLB, Southeastern Conference

-

First Look at comScore's July '09 Video Ad Networks' Rankings

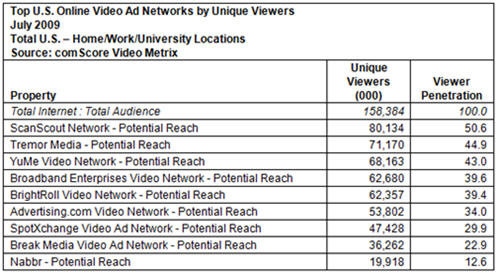

Below is a first look at comScore's rankings for video ad networks' "potential" reach for July '09. The rankings, which have not yet been publicly shared, reveal a relatively tight clustering of 5 video ad networks - ScanScout, Tremor Media, YuMe, Broadband Enterprises and BrightRoll - with ScanScout capturing the number 1 spot in its first month being fully measured by comScore.

The "potential reach" aspect of these rankings is important to understand. As I explained in June in "Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks," the potential reach numbers account for the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However, as I discussed with Tania Yuki, comScore's director of product management, it's not a perfect measure, though comScore is continually trying to improve it.

The rankings are determined through a combination of the ad networks' self-reported publisher list and comScore's own tracking. If a video network reports that any one publisher accounts for 2% or more of its viewers, comScore requires a letter proving the business relationship. There is also a self-policing mechanism as comScore provides a "dictionary" of all publishers that each ad network reports. Competitors can review the dictionary and appeal to comScore if something appears amiss. Still, there's some looseness in the methodology, and having spoken to a number of industry executives, also a fair amount of concern that it is accurately portraying the industry's true performance.

comScore recognizes the limitations of the potential reach approach and that it is just one way of understanding a video ad network's value. Actual monthly performance is equally important, and comScore has been working with ad networks to implement this reporting as well. As I wrote in June, the "hybrid" approach requires ad networks to insert a 1x1 beacon in their video players. Though this approach also has its limitations, many of the biggest video ad networks are now implementing the beacon, and soon comScore will likely begin reporting actual as well as potential reach.

Video ad networks are a very important part of the online video ecosystem, responsible for placing millions of dollars of ads each month. Importantly they allow a level of targeting and reach that brands seek, but are often unable to attain on their own with a handful of direct site relationships. With the online video medium still relatively new, buyers require data helping them understand their options. However, the comScore data is just a first filter, diligent buyers still must dig in to understand how each network, or individual site meets their needs.

What do you think? Post a comment now.

Categories: Advertising

Topics: BrightRoll, Broadband Enterprises, ScanScout, Tremor Media, YuMe

-

Channels.com Launches "Web Video DVR"

Inevitably, the explosion of broadband video programming has led to the problem of how to keep viewers' favorites organized and receive updates when new episodes appear. Recognizing this problem and believing it is likely to become even more acute as more mainstream users adopt video and choices continue to grow, Channels.com is launching today, positioning itself as "your web video DVR." Last week, Sean Doherty, Channels.com's CEO and founder gave me an overview.

I've known Sean since our cable days in the mid-'90s, and he's been tweaking Channels for a couple of years, providing me periodic sneak peeks. The best way to think of Channels is analogously: Channels is for video what RSS readers are for text. Sean's insight was that most serialized video is now published with MRSS, RSS 2.0 or iTunes feeds which can be collected and then presented well in a central viewing environment. Channels is like a feed reader that is optimized for video.

Importantly, Channels doesn't touch the source video or the accompanying ads; everything is passed through as is. That means for content providers Channels increases reach and ad inventory without

disrupting the experience. Channels also doesn't actually record web shows, making its "DVR" tagline and references to "recording" somewhat misnomers. More accurately Channels is a "network DVR" since it's simply organizing feeds that exist in the cloud. Channels' secret sauce is how it crawls the web searching for feeds that may contain video "enclosures" or files. Those that do are then incorporated into the Channels directory with searchable metadata. Sean reports that Channels now includes 160K+ shows, including 400+ TV shows.

disrupting the experience. Channels also doesn't actually record web shows, making its "DVR" tagline and references to "recording" somewhat misnomers. More accurately Channels is a "network DVR" since it's simply organizing feeds that exist in the cloud. Channels' secret sauce is how it crawls the web searching for feeds that may contain video "enclosures" or files. Those that do are then incorporated into the Channels directory with searchable metadata. Sean reports that Channels now includes 160K+ shows, including 400+ TV shows.I've been playing around with Channels and my experience has been mostly positive. I was quickly able to find and view recent episodes of some of my favorite shows like David Pogue from the NY Times, "The Daily Show with Jon Stewart," "Barely Political" and a couple Revision 3 shows I dip in and out of like "AppJudgment." On the flip side, it was hard to find shows like "Heroes" and "Lost" although Sean says they're still in the process of loading up all the content.

Though a display advertising model is readily at hand, Sean says he has no immediate plan to monetize Channels. For now he's focused on building traffic, optimizing the user experience and seeing how the video landscape unfolds. Once past its development phase, Channels is a pretty low-burn rate operation, self-funded by Sean and other angels. A key part of building its distribution and use is by incenting video providers to place a Channels "chicklet" on their sites, so video can be instantly added to users' Channels playlists.Valuable as Channels and others trying to organize the web video user experience are for computer-based viewing, where they will really resonate is when web video moves to the TV. A significant navigation challenge lies ahead in the living room, compounded by lack of keyboards and mice there. In fact after using Netflix's Watch Instantly feature to send content to my Roku, I'm becoming more convinced that the convergence paradigm may be that you organize/choose content on your computer and navigate/consume on your TV.

All of these issues still lie ahead. For now Channels has introduced a neat new way of making the most of the broadband video viewing experience.

What do you think? Post a comment now.

Categories: Startups, Technology

Topics: Channels.com

-

iStockphoto Pioneers Lucrative Microstock Video Marketplace

A lot of my time at VideoNuze is spent exploring how broadband's massive penetration has opened up new opportunities for video distribution to consumers. But a recent conversation with Kelly Thompson, COO of iStockphoto served as a reminder that broadband is also beginning to play an important role for professionals seeking stock video footage.

For those not familiar, the "stock" industry refers to photographs, images, audio and video that creators make available for use by others under various license arrangements. Stock assets are often used by creative professionals in lieu of having to create their own because of time and expense limitations.

iStockphoto pioneered a new "microstock" online marketplace which allows stock assets to be downloaded for as little as a dollar apiece. The company has grown rapidly, anticipating $200M in revenues this year

delivering over 30M assets, or about 1 every second of every day. iStockphoto splits between 20-40% of each download fee with its contributors depending on terms the contributor has chosen. This year it will pay out over $60M to thousands of contributors. Kelly noted that some contributors' whole income is derived from iStockphoto payments (top contributors can make $300K-400K/year). Getty Images, the largest stock house in the world, bought iStockphoto in 2006 for $50M.

delivering over 30M assets, or about 1 every second of every day. iStockphoto splits between 20-40% of each download fee with its contributors depending on terms the contributor has chosen. This year it will pay out over $60M to thousands of contributors. Kelly noted that some contributors' whole income is derived from iStockphoto payments (top contributors can make $300K-400K/year). Getty Images, the largest stock house in the world, bought iStockphoto in 2006 for $50M.What caught my eye is iStockphoto's move into stock video distribution. Though video has been available for just 3 years, Kelly anticipates it will account for $20M or 10% of revenues in '09. Kelly explained that there's been a massive increase in the need for stock video, as demand for it to be included in PowerPoint presentations, web sites and online campaigns has surged.

Buying stock video at iStockphoto is easy. After setting up an account, you enter keywords or just browse the video catalog. You're presented with thumbnail images, which expand to play the full video when you roll over them. Payments are made using "credits," iStock's currency. Videos are offered in different quality and prices, depending on the user's needs. A lower res video might be around $15 to download while the same in HD quality might be $75.

Kelly explained that widespread broadband access and inexpensive HD cameras that produce amazing video are the key contributors to making iStock's stock video downloads take off. With the market for stock video growing rapidly, competition is heating up from well-funded players like Fotolia and Thought Equity Motion, which specializes in video collections from premium providers like MGM Studios, National Geographic and NBC News.

Still, with broadband's rise, and now mobile video's increasing popularity, the market for stock video seems like it has a lot of growth ahead. Clever companies continue to recognize how broadband creates different types of opportunities to distribute video to various end users.

What do you think? Post a comment now.

Categories: Commerce

Topics: Fotolia, iStockphoto, Thought Equity Motion

-

4 Items Worth Noting from the Week of August 17th

Following are 4 news items worth noting from the week of August 17th:

CBS's Smith says authentication is a 5 year rollout - I had a number of people forward me the link to PaidContent's in-depth coverage of CBS Interactive CEO Quincy Smith's comments at the B&C/Multichannel News panel in which he asserted that TV Everywhere/authentication won't gain critical mass until 2014.

I was asked what I thought of that timeline, and my response is that I think Smith is probably in the right ballpark. However, these rollouts will happen on a company by company basis so timing will vary widely. Assuming Comcast's authentication trial works as planned, I think it's likely to expect that Comcast will have its "On Demand Online" version of TV Everywhere rolled out to its full sub base within 12 months or so. Time Warner Cable is likely to be the 2nd most aggressive in pursuing TV Everywhere. For other cable operators, telcos and satellite operators, it will almost certainly be a multi-year exercise.

NFL makes its own broadband moves - While MLB has been getting a lot of press for its recent broadband and mobile initiatives, I was intrigued by 2 NFL-related announcements this week that show the league deepening its interest in broadband distribution. First, as USA Today reported, DirecTV will offer broadband users standalone access to its popular "Sunday Ticket" NFL package. The caveat is that you have to live in an area where satellite coverage is unattainable. The offer, which is being positioned as a trial, runs $349 for the season. With convergence devices like Roku hooking up with MLB.TV, it has to be just a matter of time before the a la carte version of Sunday Ticket comes to TVs via broadband as well.

Following that, yesterday the NFL and NBC announced that for the 2nd season in a row, the full 17 game Sunday night schedule will be streamed live on NBCSports.com and NFL.com. Both will use an HD-quality video player and Microsoft's Silverlight. They will also use Microsoft's Smooth Streaming adaptive bit rate (ABR) technology. All of this should combine to deliver a very high-quality streaming experience. But with all these games available for free online, I have to wonder, are NBC and the NFL leaving money on the table here? It sure seems like there must have been some kind of premium they could have charged, but maybe I'm missing something.

Metacafe grows to 12 million unique viewers in July - More evidence that independent video aggregators are hanging in there, as Metacafe announced uniques were up 67% year-over-year and 10% over June (according to comScore). I've been a Metacafe fan for a while, and their recent redesign around premium "entertainment hubs" has made the site cleaner and far easier to use. Metacafe's news follows last week's announcement by Babelgum that it grew to almost 1.7 million uniques in July since its April launch. Combined, these results show that while the big whales like YouTube and Hulu continue to capture a lot of the headlines, the minnows are still making swimming ahead.

Kodak introduces contest to (re)name its new Zi8 video camera - It's not every day (or any day for that matter) that I get to write how a story in a struggling metro newspaper had the mojo to influence a sexy new consumer electronic product being brought to market by an industrial-era goliath, so I couldn't resist seizing this opportunity.

It turns out that a review Boston Globe columnist Hiawatha Bray wrote, praising Kodak's new Zi8 pocket video camera, but panning its dreadful name, prompted Kodak Chief Marketing Officer Jeffrey Hayzlett to launch an online contest for consumers to submit ideas for a new name for the device, which it intends to be a Flip killer. Good for Hayzlett for his willingness to change course at the last minute, and also try to build some grass roots pre-launch enthusiasm for the product. And good for the Globe for showing it's still relevant. Of course, a new name will not guarantee Kodak success, but it's certainly a good start.

Enjoy your weekend!

Categories: Aggregators, Broadcasters, Cable TV Operators, Devices, Indie Video, Sports

Topics: Babelgum, Boston Globe, CBS, Comcast, Kodak, MetaCafe, MLB, NFL, Roku, Time Warner Cable

-

VideoNuze Report Podcast #28 - August 21, 2009

Daisy Whitney and I are pleased to present the 28th edition of the VideoNuze Report podcast, for August 21, 2009.

In this week's podcast, Daisy and I first tackle the subject of the Southeastern Conference's new media policy fumble that I wrote about on Wednesday this week. For the upcoming football season, the SEC first banned all social media in the stadiums by game attendees, and later revised it to just exclude fan-generated video of game action.

I took the SEC to task, suggesting that the policy was wrongheaded because it limits the role that fan video could play in expanding the game experience and incorrectly assumes that fan video might actually compete with live game feeds from partners ESPN and CBS. Further, the policy is completely impractical to enforce, requiring security officers to frisk entering students and examine cell phones for video capability.

Daisy raises the example of when YouTube posted the infamous SNL "Lazy Sunday" clip, and NBC ordered it to take the clip down, foregoing tons of free promotion. That incident occurred almost 4 years ago, and since then major media companies have come a long way in adopting the role of user-generated video and video sharing as a promotional tool (see this week's Time Warner-YouTube clip deal as further evidence). On the other hand, the SEC still appears to be living in the stone ages. Somebody there needs to get their game on.

Shifting gears, Daisy explores the idea of how technology is helping video producers collaborate far more extensively than ever before. Producers and creators are now able to share images and raw footage to an unprecedented degree, which is making the creative process far more efficient. That in turn leads to more extensive creative output. Daisy identifies a slew of technology providers who are active in this emerging space.

Click here to listen to the podcast (13 minutes, 50 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts, Sports, Technology

Topics: CBS, ESPN, Southeastern Conference, XOS

-

Motionbox, Others Target Families' "Chief Memory Officers"

If your family or extended family is like most, then someone in your home is what Josh Grotstein, CEO of Motionbox, refers to as a "Chief Memory Officer" or family "CMO." That's the person who's responsible for toting the camera/camcorder, uploading, developing and distributing the family's photos and videos to family and friends, and storing the treasures for future use.

And just as the proliferation of digital cameras launched Ofoto, Shutterfly and SnapFish (plus sites like Flickr, Picassa, etc.), who targeted the family CMO to help manage and create further value from their growing digital photo collections, the advent of inexpensive video cameras is creating a new set of companies looking to help CMOs manage their family's video assets.

While still early days, the impending explosion of video-capable smartphones, coupled with cheaper HD camcorders and popular low-end video cameras (e.g. Flip, etc.), all suggests this is yet another growing

corner of the market fueled by broadband video's adoption. To learn more I spoke last week with Josh and with Andres Espineira, President and co-founder of Pixorial, which recently emerged from private beta.

corner of the market fueled by broadband video's adoption. To learn more I spoke last week with Josh and with Andres Espineira, President and co-founder of Pixorial, which recently emerged from private beta. These companies and others in the space like iMemories, provide a number of key features and value propositions - uploading new or archived digital video (or sending physical tapes), easy transcoding from multiple formats into multiple formats, storage, online editing to create short movies which can be shared online and offline, and customized hard goods/gifts

The primary play here is to get the CMO engaged in the act of editing raw video footage, to stay organized

and/or optimize their memories. Sharing becomes a pretty logical extension though, as does getting other stakeholders involved. For example, these stakeholders could include other moms/dads uploading video from their kids' soccer games to multiple wedding guests who shot their own video. Getting these people to mix and edit (and then share and order hard goods/gifts) is the behavior these companies hope to engender. Since most people don't fancy themselves as video editors, the online tools need to be extremely easy-to-use.

and/or optimize their memories. Sharing becomes a pretty logical extension though, as does getting other stakeholders involved. For example, these stakeholders could include other moms/dads uploading video from their kids' soccer games to multiple wedding guests who shot their own video. Getting these people to mix and edit (and then share and order hard goods/gifts) is the behavior these companies hope to engender. Since most people don't fancy themselves as video editors, the online tools need to be extremely easy-to-use. Another point of commonality is that these companies all use some type of "freemium" model, where a base level of service is offered for free, with the goal of converting a percentage of freebies to paid services tiers. The freemium model has become widely used online, and has been further popularized recently by Chris Anderson's new book "Free," which contends "freemium" is the way of the future.

Yet as Josh explained, freemium creates a delicate balance, where user behavior must be carefully monitored. The biggest cost driver is storage, so as more free users look to these services as providing back-up redundancy, a higher percentage of them need to be converted to paying in order to make the whole model work. Josh explained that Motionbox (which has raised $17M to date and is the granddaddy of the category with 2M+ registered users) has continuously tweaked its model to optimize the conversion process. It is moving to a model where free users get a finite number of free uploads, and then beyond that you have to pay. In a world where YouTube is the free standard for video sharing, creating and effectively communicating the value of being a premium sub is all-important.

Assuming this hurdle can be surmounted, the proliferation of convergence devices suggests even more tailwind for the category. Think about being able to easily share and access your movies online through devices like Roku, Xbox, Internet-connected TVs, etc. Even incumbent service providers (cable/satellite/telco) could find value in offering personal video services, white-labeled by these companies.

While video is a more complex media format than photos, as more CMOs shoot more video that they want to save and share, it's likely this category will continue to see plenty of growth.

What do you think? Post a comment now.

Categories: Technology, Video Sharing

Topics: iMemories, Motionbox, Pixorial

-

Fan Video is Odd Man Out in Southeastern Conference's Confusing New Media Policy

The college football season hasn't yet officially begun, but the Southeastern Conference (SEC) has already fumbled the ball a couple of times with its confusing new media policy which bans fan-generated videos at games.

The confusion began when the SEC told its member universities that "Ticketed fans can't produce or disseminate (or aid in producing or disseminating) any material or information about the Event, including,

but not limited to, any account, description, picture, video, audio, reproduction or other information concerning the Event." As Mashable and others noted, the policy effectively - and bizarrely - barred all social media activity at games. The policy was widely translated to mean that Facebook updates, Tweets, photo uploads and of course YouTube clips would be verboten.

but not limited to, any account, description, picture, video, audio, reproduction or other information concerning the Event." As Mashable and others noted, the policy effectively - and bizarrely - barred all social media activity at games. The policy was widely translated to mean that Facebook updates, Tweets, photo uploads and of course YouTube clips would be verboten. But, faced with a sharp backlash, the SEC softened its stance, allowing "personal messages and updates of scores or other brief descriptions of the competition throughout the Event." Further, it allowed photos to be taken, as long as their "distributed solely for personal use..." But while Twitter, Facebook and the like would be allowed under the new policy, fan-recorded game action videos would still be prohibited.

In an interview with The Buzz Manager Blog, Charles Bloom, the SEC's Associate Commissioner of Media Relations explained, "the intent of the policy....is trying to protect our video rights, as they pertain to our television and media partners. So, someone in the stadium can enter Twitter feeds or Facebook entries and photographs, but the game footage video is something that we will try to protect." He added further "We're in the new year, the first year of our television and digital rights agreement, so there was a feeling that we needed to push this through pretty quickly..."

The SEC indeed has two big money contracts - a $2 billion, 15 year deal with ESPN, and an $800M+, 15 year deal with CBS, which includes an assortment of wireless, VOD, and data rights. The SEC also recently announced a partnership with XOS Digital to launch the SEC Digital Network, intended to be the "largest online library of exclusive and comprehensive SEC sports content available anytime, anywhere." With so much on the line, the SEC pursued the hardline path - pre-emptively prohibiting fan-generated video.

Is this a smart policy? Does fan-generated video really "compete" with professionally-captured video? And is the policy even enforceable? I'd argue the answers are no, no and no, making the SEC look both paranoid and out of touch.

First off, fan video serves to enhance the overall event experience, a key goal of the sports-crazy SEC. One can imagine fans at various locations in the stadium capturing compelling new angles that the TV producers may have missed or edited out. A curated collection of these clips could be added to the SEC Digital Network, possibly in a well-marked, "Fan Zone." Note this would be free content the SEC would be getting, that could also be monetized.

Second, it's ridiculous to think fan-generated video "competes" with the networks' feed. The limited zoom and audio capabilities of an iPhone or Flip video camera mean the fan videos captured in a raucous 90,000+ seat stadium are going to be iffy at best. That's not to say these videos won't have value, but please - nobody is going to turn off their HDTV to watch some fan's live stream. At some point technology may evolve so that a fan's inexpensive video camera can produce comparable video to a professional's; but that point is still a ways off.

Third, the video policy is impossible to enforce. Is security at the stadiums going to frisk students before entering and then confiscate phones with video capabilites, while letting others pass through? All while it tries to hustle tens of thousands of rambunctious fans through the gates? Bedlam would result.

While the SEC rightfully wants to protect the value of its TV contracts, its lack of understanding for how its policy plays out in the real world is plainly obvious. If the SEC - and others - looked at social media and user-generated video as an opportunity rather than a threat then the policies they created would make a lot more sense.

What do you think? Post a comment now.

Topics: CBS, ESPN, Southeastern Conference, XOS