-

Eyespot Shifts Focus to Network Model and Mid-Tail Video Providers

Another sign of how quickly broadband video companies are adapting themselves to market conditions: Eyespot, which started by providing video editing capabilities to users of big branded web sites has evolved its focus to a network model, specializing in mid-tail sized video providers. CEO/co-founder Jim Kaskade explained their shift to me and why it's paying off.

Eyespot's core capability remains providing video editing and sharing tools, but it is now also offering them in a self-serve model, enabling small-to-mid sized sites to quickly get up and running. Jim sees at least 2 clear differentiators for Eyespot:

First, for sites which want to offer a user-contributed video capability, Eyespot addresses all the complexities such as handling multiple file formats, offering strong moderation and monetization. ExpertVillage is a good example of a site benefiting from this approach. EP's myriad "experts" contribute their how-to videos to the site using Eyespot's tools. In this model, Eyespot is fundamental video infrastructure, powering all of the video publishing at the site.

Depending on the business model the provider chooses for the user-contributed capability, all of their video can be included for syndication to other sites by Eyespot to others in the network. This includes options for delivery to mobile devices. Eyespot monetizes the network, currently at $4-8 CPM. In addition to powering user contributions, this capability is also appealing for mid-tail providers who just intend to upload and manage their own video.

A second differentiator, for providers who don't necessarily want to allow user uploads, is Eyespot's core video studio. In this offering, content providers offer their own library of media assets for users to mix and publish. NBA.com is an example of this implementation. When you go to NBA.com, in the video tab, there's an option for "NBA Highlight Mixer," where the user will find media that NBA has offered for mixing. A gallery of users' mixes is displayed, along with tools to share and embed your mixes. In this example, Eyespot augments the NBA's other video initiatives powered by Akamai's StreamOS.

Jim explained that the payoff from offering video personalization is in driving more video views and hence more ad revenue. Jim explained that a typical site might get 10 video views per unique visitor per month, while Eyespot-powered sites get around 80.

I've been bullish for a while about the potential of user contributions and editing, yet it seemed like the market was slow to catch on. With Eyespot's new approach making access to its tools much easier, this will hopefully accelerate adoption.

Categories: Technology, UGC

Topics: ExpertVillage, Eyespot, NBA

-

Nike's "Sixty-Million Dollar Man" is Well Worth a Look

A short piece in Brandweek caught my attention yesterday. It was about a new video entitled "The Sixty Million Dollar Man," produced by Phoenix Suns point guard Steve Nash to promote a Nike shoe that Nash has worn since February called the "Trash Talk." The shoe is environmentally-friendly as it is made out of leather scraps and waste. The release of the video coincided with Earth Day.

The video is well-worth checking out, not only because it is a very clever spoof of the original "Six Million Dollar Man" program from 30 years ago and has amazing special effects, but also because it demonstrates the continuing embrace of broadband by brand marketers. This is a trend that I've been covering for a while on VideoNuze (check out here and here for more).

Of course, Nike has long been one of the most innovative advertisers, mixing subtle brand promotion with compelling examples of athletic achievement. The new 90 second Nash spot, available on YouTube, follows Nash's first effort, entitled "Training Day," which itself now has about 300K views on YouTube are in keeping with these traditions. (Apparently Nash is an avid film-maker and also an environmentalist.) In both spots, the only Nike promotion is a swoosh in the closing frame. Both are great examples of sponsored, yet engaging entertainment that would be very expensive to execute on-air.

Broadband is opening all kinds of new doors for brand advertisers. Initiatives seem to fall into 2 buckets: original entertainment/informative videos like the Nash spots, and user-generated contests like the recent TideToGo and Heinz Top This efforts. I expect we'll see a lot more broadband experimentation from brands to come.

Categories: Brand Marketing, Indie Video, Sports

-

ClipBlast Playbox: Video Search and Syndication Wrapped in One

ClipBlast, an up-and-comer in video search, has quietly introduced its "Playbox" feature, which neatly wraps together video search and video syndication, two key mechanisms for increasing video usage. Gary Baker, ClipBlast's CEO gave me a sneak peek a few weeks ago and a demo earlier this week.

Playbox's key differentiator is that it provides a unified video experience across different video providers, while keeping users on-site. When clicking on any result which has video from the web that's embeddable or video from providers that ClipBlast has deals with, a floating window opens on top of the web page.

Playbox plays multiple video format (Flash, WMP, QuickTime) and correctly re-sizes each for the Playbox window. When you click back on the site and select another video it seamlessly loads right into the Playbox window. All of this contributes to a highly unified experience.

While that's pretty cool, the more interesting aspect of Playbox is that it drives frictionless video syndication. Here's how it works:

As ClipBlast distributes its video index and search bar to other sites, Playbox comes along (or not if the site declines it). This means that as ClipBlast's video search migrates from its site to the far corners of the web, Playbox's video syndication spreads too.

Here's an example: say you run a popular blog about auto racing and choose to offer ClipBlast video search and Playbox. A user of the site types "Danica Patrick" into the ClipBlast search bar (for those who missed it, she was the first woman to win an Indy car race, last weekend in Japan).

If the user clicks on the first result with a "Play" icon (with a rollover that says "play this video directly"), Playbox opens. In this example, the first video is from ESPN. When it's over, the user can click the "Details" button and a list of additional, related videos are displayed, from other providers such as AP, VidLife, YouTube, YES Network, etc. The point is that Playbox provides an easy-to-use container where related 3rd party videos can be played without the user ever leaving the auto racing blog.

So Playbox gives videos new exposure throughout the web. Again, if providers code their ads into the file, more views = more revenue. The Playbox window also shows small display ads at the bottom, which ClipBlast monetizes through ad networks. Depending on the video and search term, these slots lend themselves to contextually-targeted ads.

Playbox marries video search and video syndication, and is another mechanism for how video is going to be widely distributed around the web. I expect more of these initiatives to come.

Categories: Video Search

-

TV's Primetime Emmys Seek Interactive Entries

Further confirmation that the TV landscape is evolving is The Academy of Television Arts & Sciences' (the organization that puts on the primetime Emmys) recent announcement that the Primetime Emmy for Interactive Media will include two new areas of competition that tie user experience to either fiction or non-fiction programming.

This is not a technology award, but rather an award that honors outstanding creative achievement. In

addition to having been distributed by the traditional broadcast, satellite or cable platforms, the recipient of this award could have been born from a variety of new platforms including broadband and mobile, or a combination of platforms.

addition to having been distributed by the traditional broadcast, satellite or cable platforms, the recipient of this award could have been born from a variety of new platforms including broadband and mobile, or a combination of platforms.Why is this newsworthy? Because the door is now open for many broadband video-only programmers, such as Revision3, TikiBarTV, or perhaps LonelyGirl15, who haven't yet inked a deal with a studio, network, or pay TV operator. As long their content fits the interactive criteria, then programs like these could be submitted and become an Emmy contender. A seismic change from yesteryear's Emmy considerations.

To qualify, entries need to be an original program or series that were deployed commercially between June 1, 2007 and May 31, 2008. The Interactive Media Peer group will be judging in June and will select 5 finalists in the aforementioned categories. The Peer Group is looking for submissions that have participatory interactive features and demonstrate overall creative excellence, interactive storytelling, and a compelling user experience.

If you're reading this and you've produced a program or a series that fits this description, the May 30th deadline is fast approaching. And if you don't have content that fits these qualifications, get your game on for 2009. These are exciting times where the democratization of being a Primetime Emmy winner may no longer mean that you're of network ilk. Cool!

Categories: Broadcasters, Events, Indie Video

Topics: Emmys

-

Hulu's Kilar at NAB, My Reactions

One of the best hours I spent at NAB was the one listening to Hulu's CEO Jason Kilar. Too bad it was scheduled for 5pm on Day 3, resulting in a desultory crowd of only a 100 or so. Broadcasters and others could learn a lot from Kilar and Hulu's early experience.

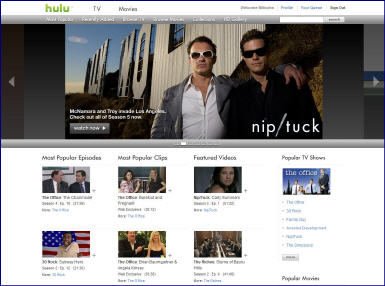

Hulu, which was derisively referred to as "Clown Co" prior to its launch, is anything but. In my previous review of its beta, I gave it a B+. One month since its official launch, I now move it up a notch to A minus, and as I'll explain later, an A is within reach.

Hulu is as well-thought out a broadband video enterprise as currently exists, for at least three reasons:

Clarity of purpose - While Hulu evokes Google with its lofty goal, "to help people find and enjoy the world's premium content, when, where and how they want to," it has provided discipline to keep Kilar and his team focused on meaningfully supportive differentiators.

Relentless user-focus - Hulu is Apple-esque in its devotion to what Kilar called an "atypically strong user experience." The team has sweated over and uses every design and technology lever available to make Hulu easy and enjoyable and accessible to the mainstream market.

Organizational capability - Hulu has a startup mentality where every decision is do-or-die. It may feel intangible if you've never worked in a startup, but personal ownership is an incredibly important advantage. Inculcating this ethos despite a $100 million investment and $1 billion valuation is no mean feat.

Several recent spins through Hulu showed how these come together. Hulu now has 50+ content partners, but is uncluttered by UGC. This is a place for only high-quality programming. Finding and playing video is a snap. Graphics and fonts are simple and clear. As Kilar said the site's 16:9 graphics, differentiated from standard square thumbnails, suggest this place is different from the rest (no "Tokyo at night" orientation here). Here you can also easily clip and share favorite scenes, which Kilar says has been done 100k+ times on 12K sites since launch.

And how about this - do a search for "Lost" - the popular ABC program which is NOT available on Hulu - and you'll get results pointing you offsite to ABC.com. Talk about putting the user first!

Hulu's real lesson to broadcasters and others is that if you create a high-quality user environment, you open up real opportunities and options. These include getting above average CPMs from advertisers (through effective units like the 7 second introductory "brand slate"), wringing value out of programs no longer on-air (example "Arrested Development" was #1 or #2 most popular on Hulu), pre-empting non-revenue producing/non-branded environments like file-sharing sites and YouTube, allowing new programs to be easily sampled and last but not least, re-capturing users who prefer online over the traditional on-air model.

Hulu still has major challenges ahead: massively building out its content library, proving its syndication value to content partners who could as easily go direct to distributors, making its overall economics work, and of course, navigating the treacherous political waters of its big media backers. If it does all of these, it gets an A. Hulu's impressive progress to date gives me every reason to believe it will.

What do you think of Hulu? Post a comment!

Categories: Aggregators, Broadcasters, Startups

Topics: Hulu

-

New Statistics Address Video Piracy, Importance of Quick Online Release of TV Programs

During very informative presentations at my NAB panel discussion yesterday, there were 2 slides that really caught my attention. Both shared statistics, new to me, about video piracy and user behavior patterns. These statistics illustrate the important early online window just following when a TV program is aired. Capturing this audience spike can dampen video piracy and also be a big revenue opportunity for providers.

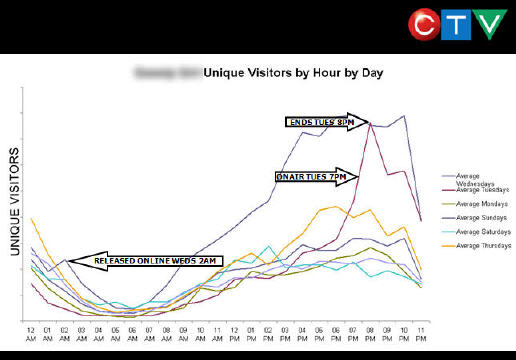

The first slide, shown below, was presented by Rob Adams, director of digital media operations at CTV, Canada's largest broadcaster. CTV offers both clips and full-length streaming episodes from its networks and select partner networks. In the slide below each line represents a single day's unique visitors for a specific TV series CTV offers.

I know the slide is a bit of an eye chart, so I'll summarize the phenomenon Rob explained. In this example a popular network show airs at 7pm on Tuesday. Notice how the purple usage line spikes during the hour of its run. Rob explained that users who go online to find the episode being aired realize it's not yet available and instead begin catching up on previous episodes. That new episode is posted around 2 am, and the spike in usage the following day is shown by the blue line.

Note the far lower behavior in the other lines and it is clear that the 24 hour window during and after airing a new episode is critical. It's also interesting to speculate on whether some users are beginning to look at online availability as pure VOD. If so, that would have implications on DVRs (i.e. why record a show when you've come to expect they'll all be posted quickly online?)

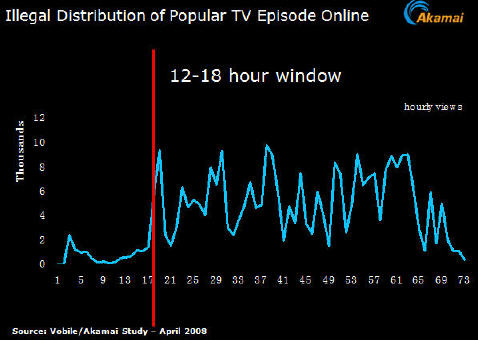

The second attention-getting slide was based on recent research by Akamai and Vobile, which used its digital fingerprinting technology to track the availability of illegal copies of an episode a popular program and their download volume. In the slide below, it is clear that although illegal copies are available immediately, the volume of downloads jumps by more than 500% the following morning (13 hours after broadcast).

What all of this demonstrates is that there is a real window of opportunity for premium video providers to slow video piracy and drive many new video views. By satisfying the obvious demand that users have for this content with legitimate distribution, providers can chip away at, though admittedly not eradicate, illegal sharing. If users gain confidence over time that their favorite programs will be available quickly, in high-quality and with a positive user experience (i.e. not overburdened with ads), the rationale to pursue the illegal route lessens. Conversely, video providers not responding to these viewer needs continue to leave themselves highly vulnerable to illegal behavior.

Categories: Broadcasters, P2P

-

Broadband, Broadcast Converge at NAB

Any question you may have had about whether the broadcast and broadband worlds are converging would be put to rest after spending a couple of days at the NAB Show being held in Las Vegas this week.

This year's NAB Show heavily emphasizes content in a technology-transformed world. For starters, NAB has set up "Content Central" a showcase section in the Main Central Hall featuring a cluster of new media

vendors. Within the Content Central area is a specially created "Content Theater" where back-to-back discussion panels run throughout the show, including one I'll be moderating this morning entitled "Broadband Media Workflow: Hitting the Viewing Window," with executives from MTV, CTV and Akamai.

vendors. Within the Content Central area is a specially created "Content Theater" where back-to-back discussion panels run throughout the show, including one I'll be moderating this morning entitled "Broadband Media Workflow: Hitting the Viewing Window," with executives from MTV, CTV and Akamai.Elsewhere at the show, there are numerous sessions with titles like "The New Hollywood! A New World of Entertainment!", "TV 2.0 - Video When, Where and How You Want It" and "Video Search for Unlimited Channels." In short, NAB has gone full throttle toward content, which in my opinion is a very good thing. That's because a key NAB constituency, local television broadcasters, have seen their market positions impacted by broadband, particularly as network TV programs are now widely accessible online. Broadcasters today are feeling the beginning of what local newspapers have felt as the Internet's use has become pervasive.

But by elevating the focus on content, NAB is helping local TV broadcasters better understand how broadband presents opportunities, not just challenges. With strong expertise in video production, deep local roots and longstanding advertising relationships, local TV broadcasters are in some ways actually well-positioned to benefit from broadband.

The key challenge for local broadcasters is to take a fundamentally different view of their businesses. No longer constrained by their local market's boundaries, local broadcasters can play on a bigger stage, distributing compelling content to viewers living thousands of miles away. One syndication example, between CBS's stations and Yahoo, already generates over 13 million video views per month, all incremental to those at CBS's own site.

NAB's focus on content in a technology-driven world, follows a similar focus by the Consumer Electronics Association and NATPE at their respective shows over the past few months. Taken together, local broadcasters are being given many opportunities to understand the changing video landscape and how to profit from it.

Categories: Broadcasters, Events

-

Video Ad Networks Coverage Continued: SpotXchange, YuMe

As evidence of the market's bullishness on ad-supported video, video-focused ad networks continue to flourish. I recently spoke to CEO/co-founders of two of the larger ones, SpotXchange and YuMe to learn more about their respective differentiators.

SpotXchange CEO Mike Shehan explains that his company has focused on building a real-time auction model for publishers to offer inventory and advertisers/agencies to bid on it. The 2 main verticals

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay.

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay. Though it's a fully self-service model, SpotXchange offers client service model as well for larger brand advertisers. Michael says there are now 300 publishers in the networks, reaching 50 million unique visitors per month. The company grew out of Booyah Networks, a search and interactive agency which has fully-funded its development.

Meanwhile, Jayant Kadambi, CEO of YuMe explains that the company spent the first 2 1/2 years from its

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo).

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo). Jayant says he's been pleasantly surprised at how much video content is monetizable, though he's not suggesting user-generated video will be monetized any time soon. YuMe's CPMs are in the $10-30 range. The company is now in the mode of building scale, which could involve marrying its ad management platform to others' networks using its "Adaptive Campaign Engine." In fact, one recent partnership that was announced to do this was with SpotXchange. YuMe has raised $16M from investors including Khosla Ventures, Accel Partners, BV Capital and DAG Ventures.

I'll have more on other video ad networks and how they fit into the larger broadband industry in the coming weeks.

Categories: Advertising, Technology

Topics: SpotXchange, YuMe