-

Doritos Up UGV Ante with $1 Million Prize for Top-Rated 2009 Super Bowl Ad

The frenzy around user-generated video ads hit a new peak yesterday as Frito-Lay announced it is offering a $1 million prize to an amateur who creates a Doritos ad that scores the highest rank in USA Today's Super Bowl Ad Meter.

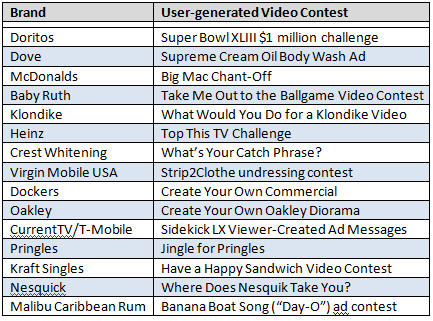

I believe the new campaign, which comes on top of 2 previously successful Super Bowl user-generated video ("UGV") ad contests from Doritos, is a sure-fire winner for the brand. It reflects some very smart thinking by Doritos' executives and will further accelerate the very significant trend around brand-sponsored UGV contests (see chart below for examples of UGV contests that have run in the past year). I've been writing about the UGV ad craze for a while now on VideoNuze and I see it driving continued evolution in brand-agency relations.

The new Doritos UGV campaign works for a variety of reasons. First and foremost, the top prize, and the four finalist prizes of $25,000 and a trip to the Super Bowl, are all very enticing awards, certain to drive tons of submissions. Winning the top prize - which requires the #1 rank in the USA Today Ad Meter - is a big-time challenge, but it is seriously aided by all the pre-game publicity this contest will be receiving. Doritos is cleverly stoking things by positioning the ad as an opportunity to "take down the big guys" - an obvious reference to Anheuser-Busch which has won the #1 rank for the last 10 years. With "Yes We Can" and "Yes We Will" political slogans ascendant, "power to the people" pitches like the one Doritos is making have a nice tailwind on their side.

This pre-game buzz means Super Bowl viewers are specifically going to be on the lookout for the Doritos UGV ad, helping its rank. Of course if you're an advertiser, especially in this ad-skipping era, viewer anticipation for your ad is close to nirvana as it gets. It builds brand awareness, engagement and presumably sales...3 big wins when you're spending an estimated $3 million for a 30 second Super Bowl ad. And of course, just think about all the free market research Doritos is collecting along the way, as loyal buyers showcase their thoughts and feelings about the product and brand.

In fact, it's Doritos' decision to morph a conventional Super Bowl ad buy into a broadband-centric, user-oriented campaign that's truly noteworthy here. VideoNuze readers know that I've been ranting for 3 straight Super Bowls that broadband opens up all kinds of new creative avenues for brands to extract new value from their game-day spending and generate a far-better ROI on the insane prices they're required to pay for this once a year extravaganza.

I have been appalled at how few Super Bowl advertisers have actually seized their broadband opportunities (note having ads playing in post-game online galleries is nice, but nowhere near what broadband is capable of). All of this has caused me to wonder whether agencies, and brands, were hopelessly oblivious to broadband's emerging role.

Doritos clearly is not among those trapped in yesterday's advertising thinking. It seems to get what broadband can do for its brand and its Super Bowl ad strategy. With its new UGV campaign, the ROI that Doritos will get on its actual game-day spend will far surpass those of its competitors. With luck that should help spur others to focus more on broadband in their future Super Bowl ads.

What do you think? Post a comment!

Categories: Brand Marketing, Sports, UGC

Topics: Anheuser-Busch, Doritos, Frito-Lay

-

Associated Press Ratchets Up Syndication Efforts with thePlatform

Another day, and another milestone reached in the market's ongoing embrace of video syndication.

Yesterday's significant news was that the Associated Press, which has built arguably the largest private broadband syndication network, including over 2,000 affiliates which receive thousands of video clips each month, has signed up thePlatform to power its Online Video Network. The deal effectively replaces Microsoft, which has been AP's partner for OVN for the past several years. AP uses OVN primarily to feed daily video clips to its newspaper and broadcast partner web sites which it monetizes through ads. Yesterday I caught up with Ian Blaine, thePlatform's CEO to learn more about the deal.

Ian explained that while the scale of AP's video syndication model is far more extensive than anything his company has supported in the past, thePlatform's ability to handle similar kinds of issues that AP faces was crucial in winning the deal. First and foremost is providing a workflow model that allows video assets to be ingested, encoded, tagged and distributed to the whole OVN in under 15 minutes. In the news business, obviously every second counts.

Beyond workflow efficiency, Ian explained that AP has a dizzying set of business rules that apply to its

syndicated video, depending upon the particular outlet. So AP producers also have to be able to expeditiously apply policies and track each video accordingly. AP is also enabling its affiliates to upload their own videos, which are melded with AP video in the affiliate's player. So that required some of thePlatform's tools to be extended to affiliates, along with some basic video player customization.

syndicated video, depending upon the particular outlet. So AP producers also have to be able to expeditiously apply policies and track each video accordingly. AP is also enabling its affiliates to upload their own videos, which are melded with AP video in the affiliate's player. So that required some of thePlatform's tools to be extended to affiliates, along with some basic video player customization.The obvious question here is whether and when AP will extend OVN to the thousands of sites beyond its 2,000 current affiliates. Like Google Content Network which has virtually infinite end points, or even Anystream-Voxant which has 30,000+ publishing partners, why should AP restrict itself, particularly when news video is one of the hottest categories around? While hesitating to speak for AP's roadmap, Ian's sense was that AP first wants to master syndication to its own affiliates before considering opening up a full-blown video marketplace.

As I've written previously, my enthusiasm for the Syndicated Video Economy is tempered by the reality that significant operational, financial and strategic friction still impedes the model. Coincidentally, late yesterday someone asked me:"How will this syndication friction be resolved and how long will it take?" My response: "I can't say how long it will take, but the more experience the broadband ecosystem gets with real-world syndication, the faster the model will mature." In this respect, partnerships between big content providers like AP and capable technology partners like thePlatform will help move the model forward for everyone.

What do you think? Click here to post a comment.

Categories: Syndicated Video Economy, Technology

Topics: Associated Press, thePlatform

-

Startup Unigo Harnesses "Purpose-Driven" User-Generated Video to Drive Disruption

I was absolutely riveted by an article I read in this past Sunday's NY Times Magazine entitled "The Tell-All Campus Tour," about Unigo, a tiny startup which threatens major disruption to the college guidebook industry. In particular, the company's emphasis on user (i.e. college student) generated video caught my attention. It got me thinking again about the business value that "purpose-driven" UGV has when it is properly channeled.

I've touched on this theme in the past, with respect to brand marketers' UGV contests that have unleashed all kinds of "amateur" creativity (see "Baby Ruth Hits a Home Run..." or "And the Oscar Goes To...Dove"). These contests have demonstrated that, with the proper incentives, users' passions and video know-how can lead to really compelling results. Now, upon reading about Unigo, I've become further convinced that there are bona fide startup opportunities in leveraging purpose-driven UGV.

To put this in context, YouTube struck gold by enabling, for the first time, random, and largely

unmonetizable, user generated video. Now a new generation of startups like Unigo can build on the YouTube phenomenon by focusing on purpose-driven UGV. To succeed, I think these companies will have 3 common elements: a reasonably large existing market that can be disrupted through the use of purpose-driven video (mixed with other web 2.0 features), a critical mass of amateur video creators who are self-motivated to produce high-quality, authentic video, and a group of advertisers eager to reach targeted audiences through new alternatives to traditional channels.

unmonetizable, user generated video. Now a new generation of startups like Unigo can build on the YouTube phenomenon by focusing on purpose-driven UGV. To succeed, I think these companies will have 3 common elements: a reasonably large existing market that can be disrupted through the use of purpose-driven video (mixed with other web 2.0 features), a critical mass of amateur video creators who are self-motivated to produce high-quality, authentic video, and a group of advertisers eager to reach targeted audiences through new alternatives to traditional channels. That's a mouthful, so let me use Unigo to break this down a bit. For starters, the company was founded by a precocious 23 year-old whose can-do energy and deep understanding of the college market is equally matched by his lack of real-world experience and formal company financing. All of that illustrates lesson #1 for purpose-driven UGV entrepreneurs: the barriers to creating these kinds of startups is shockingly low.

Somewhat buried in the 3,400+ word article is what resonated for me: Unigo bought a hundred Flip video cameras ($90 apiece at Amazon, fyi) and strategically distributed them to students at over 100 campuses nationwide, with no clear instructions on what to do next. The resulting student-created videos (which are continually submitted) span the gamut from slice-of-life to panoramic to comedic to everything in between. Unigo features text-based student submissions and photos, which, when combined with the videos, form an unvarnished - and unprecedented - user-generated multimedia guide to the America's campuses.

Simply put, Unigo is a product created by the YouTube/Facebook generation for the YouTube/Facebook generation. It offers a simple, breakthrough value proposition that will no doubt attract a large audience. And that large audience will be extremely interesting to all manner of advertisers.

Unigo's business value could make it a TripAdvisor-like, must have resource that initially augments, but could eventually squeeze traditional guidebooks and ratings services. While it is still way too early to call Unigo a success by any traditional standards, the work it has done to date offers a fascinating window into the emerging purpose-driven UGV-centric business model. That makes it well worth keeping an eye on.

What do you think? Click here to post a comment.

Topics: TripAdvisor, Unigo, YouTube

-

Anystream and Voxant Merge, Making Big Bet on Syndicated Video Economy's Future

This morning Anystream, a leading digital media management and production company and Voxant, a content syndication network, have announced their merger. The deal marks an important milestone: it's the first M&A transaction that I'm aware of which is predicated on the Syndicated Video Economy dominating the future broadband video landscape.

NewCo's combined capabilities are noteworthy on many levels, one of which is its potential to disrupt the

competitive dynamics of the video content management and publishing space by providing fundamental new value to content producers. There has been a lot of capital invested in this space, and by my recent count at least 18 companies are playing in or around it. With the broadband gold rush underway, there's been enough business to go around. Competition for new business has mainly focused on features and pricing/business models.

competitive dynamics of the video content management and publishing space by providing fundamental new value to content producers. There has been a lot of capital invested in this space, and by my recent count at least 18 companies are playing in or around it. With the broadband gold rush underway, there's been enough business to go around. Competition for new business has mainly focused on features and pricing/business models. Anystream has traditionally (and somewhat quietly) focused on digital media transcoding and workflow for more than 700 companies around the world. It too has moved up the stack into content management and publishing, lately handling the video management for NBC's Olympics on-demand distribution, and prior to that announcing deals with Hearst-Argyle Television and others. On the other hand, Voxant has been a mid/long tail syndicator, having built out a distribution network with 30,000 publishers gaining rights-cleared content from 400+ providers. These publishers generate 35 million video views per month, making the Voxant network #15 in video views according to comScore.

NewCo's belief is that the bilateral syndication deals we've seen to date (e.g. CBS-Yahoo, ESPN-AOL, Next New Networks - Hulu, among many others) has whetted the market's appetite for this emerging business model, but that there is still far too much friction for syndication to really take off. That fits with what I hear from even the most aggressive content syndicators, one of whose CTOs said on a recent panel I moderated that his company is overwhelmed just trying to fully implement the handful of deals its already done.

NewCo's belief is that the bilateral syndication deals we've seen to date (e.g. CBS-Yahoo, ESPN-AOL, Next New Networks - Hulu, among many others) has whetted the market's appetite for this emerging business model, but that there is still far too much friction for syndication to really take off. That fits with what I hear from even the most aggressive content syndicators, one of whose CTOs said on a recent panel I moderated that his company is overwhelmed just trying to fully implement the handful of deals its already done.So, much as I've considered the Syndicated Video Economy solidly into its first phase of development, I've been sobered by the reality that the operational overhead of negotiating deals, implementing them through distributors' often heterogeneous sub-systems, and monitoring their performance requires so much human intervention that the whole syndication concept could end up collapsing under its own weight. (Side note, this is why the Google Content Network which I wrote about last week also has so much potential).

NewCo seeks to blend Anystream's and Voxant's capabilities, offering to content producers a seamless solution to manage, publish AND distribute clips and programs, at scale, to the Internet's widely dispersed audience. As I see it, NewCo is also a potential two-pronged market disrupter if - and for now this is still a big if - it can monetize premium video at scale through advertising.

First, these new revenues could put NewCo in a position to cross-subsidize its technology platform, thereby altering some of the fundamental economics in the platform space. This could trigger possible price-cutting by others solely dependent on platform revenue. Given the vast number of players in the space, and everyone's hunger for market share, this scenario isn't unreasonable to imagine. Second, NewCo could create steep switching barriers for its media customers. Upon getting a taste for turnkey NewCo-driven syndication revenues, content producers would almost certainly be less enticed by new platform-centric features that other competitors may offer. Combined, these disruptions would create a markedly new competitive dynamic.

Yet don't expect competitors to stand still; many of them are examining how to capitalize on their own distinct advantages to alter the dynamics still further. NewCo's abundantly strong management team must now execute on its vision and help its media customers realize syndication's real value. The Anystream-Voxant merger is a bold and possibly game-changing bet on the Syndicated Video Economy being fully realized over time. If that happens, NewCo will surely be among the industry's long-term winners.

What do you think? Click here to post a comment.

(Disclosures: Anystream is a VideoNuze sponsor and I also provided very brief "sounding-board" reactions to this merger prior to its closing.)

Categories: Advertising, Deals & Financings, Syndicated Video Economy, Technology

Topics: Anystream, Google, Voxant

-

CNN is Undermining Its Own Advertisers with New AC360 "Live Webcasts"

Here's an example of how convoluted broadband's use can be.

On CNN's AC360 program last night, Anderson Cooper was promoting "live webcasts" with news anchor Erica Hill, which would run during on-air commercial breaks. As explained here, the idea is that CNN viewers can go "behind the scenes" to continue their AC360 experience by watching the live stream on their computers. I dutifully did this and watched Hill and Cooper somewhat mindlessly chatting/flirting for several minutes.

But wait: if CNN is urging on-air viewers to turn their attention to these "webcasts" during commercial breaks, then that means that CNN is diverting attention from its own on-air advertisers. That undermines CNN's all-important advertiser value proposition. That of course begs the question: is CNN's ad sales team on board with these webcasts? And if so, what are they thinking??

I guess the argument could be made that CNN believes anyone who would jump online would be multi-tasking, so they'd still have their TV on. Yet at a minimum they'll mute their TV's audio (as I did) to hear the webcast's audio. That means the users' eyes and ears are now focused online instead of on-air.

CNN has been laudably in the forefront of weaving online technology into their on-air programs. Tune in to anchor Rick Sanchez's show some time and you'll him juggling an orgy of on-air Twittering, Facebook emailing and YouTube video sharing. Cooper too has been relentlessly flogging his AC360.com web site since its recent relaunch.

That all works, in my opinion. But the "live webcasts" do not. They might work after or before the on air program, but not during. At a time when advertiser relationships are more tenuous than ever due to the rise of DVRs, VOD and broadband, the last thing a network should be doing is undermining their value proposition any further. Someone at CNN no doubt thought, "hey these will be really cool." That may be, but in my opinion, they're not smart business. Broadband should complement existing franchises not undermine them.

What do you think? Post a comment.

Categories: Cable Networks

Topics: CNN

-

VideoNuze Back Up and Running - Hopefully

Some of you may have noticed the VideoNuze site was down intermittently this week, and also that you did not receive emails from me this past Monday or yesterday. That's because VideoNuze was the target of a persistent and vicious hacker. What a nightmare. If you've ever been on the receiving end of a hacker's onslaught, I know you'll be able to relate. If you haven't, consider yourself lucky.

Suffice to say it's been a week I'd like to forget. We've scrambled to make a series of fixes. VideoNuze isn't out of the woods yet, so you may still see some interruptions of service. But our blood pressure is returning to some semblance of normalcy and we're in a better position than we were a week ago. Thanks for your patience.

Categories: Miscellaneous

-

Google Content Network Has Lots of Potential, Implications

Many of you know that Google has recently begun distributing short animated videos from Seth MacFarlane (creator of TV's "Family Guy") to a wide network of sites that previously only received ads from Google, through their participation in AdSense. The company dubs this the "Google Content Network" (GCN for short), and from my vantage point, it has a lot of potential and implications for other players in the video distribution value chain. Yesterday, I spoke to Alexandra Levy, Google's Director of Branded Entertainment, and the point person for driving this initiative.

The first thing that resonates for me about GCN is that Google's vision for it harmonizes perfectly with my concept of the "Syndicated Video Economy." VideoNuze readers know that last March I introduced the SVE concept to capture a trend that I was noticing: an ecosystem was forming to distribute broadband video widely across the Internet, in contrast to the traditional, narrower distribution model.

Alex echoed the SVE, saying that in her many conversations with content producers, finding an audience is their top challenge. Great content, unwatched, is like the proverbial tree that falls in the forest when nobody is around to hear it.

So enter GCN, which Google rightly sees as a "media distribution platform." To understand its implications fully, you have to evaluate its potential to all relevant constituencies: Users get great updated content served to them at the sites they already visit. Those sites benefit from offering premium content, while also receiving a revenue share on the accompanying ads. The content provider benefits from leveraging Google's vast AdSense network to have video "pushed" to relevant audiences, increasing viewership and engagement. And advertisers' brands benefit from adjacency to premium content that is sought after and compelling.

Of course, last but not least, Google benefits from being the intermediary in this whole process. We all know from Google's massive success in web search that being the intermediary in a model where all constituent interests are neatly aligned creates near-infinite economic value. While Alex concedes the MacFarlane video (which is sponsored by Burger King and was brokered by Media Rights Capital) is still an "experiment," GCN sure does seem to bear a lot of resemblance to Google's traditional search model in the alignment of constituent interests.

Another twist here is that users who click for more video are driven back to MacFarlane's YouTube channel (already the 69th most subscribed channel, with almost 70K subscribers), which drives habituation, a key lever for ongoing video success as any network TV executive will admit. In this light, GCN gives Google a way of finally tying its powerful AdSense engine to YouTube. I'm not suggesting that Google is sweating the ROI on its $1.6 billion YouTube acquisition, but GCN surely looks like a way to move YouTube far beyond its roots as everyone's favorite UGC aggregator.

Alex is quick to point out that GCN does not budge Google from its often-stated position that it is not a content creator. Rather, it's using GCN to connect brands, content producers and users. If that connecting process drives audiences and generates revenues for content producers - and admittedly the proof is not yet in - that would give Google a lot of disruptive capital to help shape the video landscape. Just so nobody gets carried away, Google announced a similar experiment 2 years ago with MTV that fizzled out. So the company has yet to prove its experiment works and that it is fully committed to the GCN model.

Still, I continue to believe that video syndication - and the accompanying benefits to all - is a key, key driver of how the broadband video landscape is going to unfold. As a small teaser, there will be more interesting news on the syndication front early next week. Stay tuned.

(And note that the syndicated video economy will be one of the main topics of discussion at the Broadband Video Leadership Breakfast "How to Profit from Broadband Video's Disruptive Impact" with our A-list group of panelists, including Google's David Eun, on November 10th. Click here to learn more and register for special early bird rate.)

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Indie Video, Syndicated Video Economy

Topics: Google, Google Content Network, Seth MacFarlane, YouTube

-

Palin Interview: ABC News Misses Many Broadband Video Opportunities

ABC's Sarah Palin interview from late last week may have been a broadcast ratings success, but in my opinion ABCNews.com has missed out on many big broadband opportunities. ABC's broadband implementation shortfalls span the full gamut of navigation, usability and delivery quality, offering a further data point that many media companies have not yet recognized or capitalized on broadband's full potential.

The biggest interview of the political season was tailor made for on-demand consumption. No doubt millions of people flocked to ABC.com (the site most people would associate with ABC) to find the interview. However, ABC.com is the company's entertainment site, and there is currently no promotion of the interview at all. The visitor is required to guess that clicking on the "news" link in the main navigation will get them to the interview.

Sure enough, that links to abcnews.go.com where a large banner "SARAH PALIN: THE INTERVIEW" promises the opportunity to "WATCH NOW" (note also that by clicking the banner a pop-under ad is triggered, which is a very unusual ad implementation for a premium video site, not to mention highly annoying.) There's just one small thumbnail in the upper right linking to the Palin interviews.

Oddly, clicking on the banner brings you to a 2,300 word text story about the interview, with a few thumbnail images sprinkled about. That's a key implementation error in my opinion. Instead of text, that page should be a well-laid out assortment of videos, beginning with the option to watch the full interview either by its 3 segments or as one long episode. A link to ABC's text story would be great to offer, but not be the main focus of the page when users were expecting video.

Clicking on one of the various thumbnails launches the ABCNews.com video player, which then displays the 3 segments' thumbnails at the bottom. Here the issue is that there are no bite-sized clips displayed with specific interview topics (e.g. earmarks, abortion, foreign policy) of likely interest. Plus there is no way to search on those topics specifically. You'd have to watch each of the full 6-8 minute segments the Q&A section to happen upon the part you're particularly interested in. (Note that creating topical clips from the full 22 minute interview using a metadata management tool like Gotuit's VideoMarker Pro would have probably taken ABC News just an hour or so.)

Meanwhile, there's also no way for the user to clip out custom segments, as Hulu and other sites currently allow. Enabling this would have been wildly popular among bloggers - and led to lots of viral distribution. The lack of topical clips creates another missed opportunity as ABC could have aggregated comments and video from other sites tightly related to these specific clips in order to create a really comprehensive user experience on a topic-by-topic basis.

Net, net, it's great that ABCNews.com is making the Palin interview available online. But taken as a whole, the user experience ends up being little more than a TiVo-like interview replay, leaving tons of engagement opportunity - and revenue - on the table. I recognize that doing the kinds of things I'm describing requires a robust content management system and staff. Many companies have not yet made these kinds of commitments to broadband - which just provides more evidence of how nascent the broadband medium still is.

What do you think? Post a comment.

Categories: Broadcasters

Topics: ABC