-

Google's Fiber-to-the-Home Experiment Could Cost $750 Million or More

I hope for Google's sake that it understands the cost to build its 1 gigabit/second ultra high-speed fiber network experiment announced today could be $750 million or more. Even for Google that's a very big number, especially considering the company has said it has no intention of actually pursuing this as a business. Of course, we don't know exactly what Google is forecasting its project costs to be, but using Verizon's FiOS numbers wouldn't be a bad starting point to do the math. So here goes.

Google said it would offer the gigabit service to between 50,000 and 500,000 people. Let's start at the high end of that range. Verizon has disclosed that it will spend $18 billion to pass approximately 18 million homes in its footprint with its FiOS fiber-to-the-home network. It's not fair to do a straight average and assume that Verizon is still paying $1,000/home passed given that its costs have no doubt declined over the years.

However, in Google's case, since it has approximately zero experience laying fiber in neighborhoods, and won't get the same level of vendor discounts that Verizon enjoys, it is probably fair to assume Google will spend at least $1,000 per home passed. So if it goes all the way to 500,000 homes, that's $500 million in neighborhood build-out costs.

However, in Google's case, since it has approximately zero experience laying fiber in neighborhoods, and won't get the same level of vendor discounts that Verizon enjoys, it is probably fair to assume Google will spend at least $1,000 per home passed. So if it goes all the way to 500,000 homes, that's $500 million in neighborhood build-out costs. But that's only to wire the neighborhoods, then the service has to be deployed in the homes themselves. That means in-home wiring, on-premise equipment, labor, trucks, insurance, overhead, etc. Estimates for Verizon's per home cost vary, but $500 is in the range often cited. In Verizon's case they're also deploying a set-top box to deliver TV, which Google hasn't announced plans to do (more on that below), so that cost should be deducted. But on the flip side, once again, because Google has never wired a consumer's home (that I'm aware of anyway) it has a steep learning curve ahead of it, meaning its costs could be much higher than Verizon's.

But to make things easy, let's just use the $500 per installed home. So 500,000 homes at $500 apiece, another $250 million for the project. Add it to the $500 million for the neighborhood build-outs and the total is $750 million. This assumes Google decides to go all the way to 500,000. Obviously if it stopped at 50,000, the costs would be a lot lower.

However, there's another big caveat that could drive Google's costs far higher: passing 500,000 homes does not equal having 500,000 customers. It's impossible to predict what percentage of a community's residents would take the Google experimental service. One way of thinking about it is that around 65% of American homes currently subscribe to broadband Internet service. What percentage of those will Google lure? Say it's around 15%. So in a community with 100,000 residents for example, Google may get only get 9,750 people to take its gigabit service (100,000*.65*.15). That means Google may need to pass fiber by 10 homes for every one it gets as a participant in its experiment. Put another way, the $500 million homes passed budget could increase by a factor of 10x. (In case you're wondering, by comparison, Google's 2009 net income was $6.5 billion.) Each subscriber's home would have cost Google approximately $10,750 to connect.

Executives at cable operators and telcos - who build and operate residential networks for a living - are very familiar with modeling network deployment costs. But I wonder, how familiar do you think Google is? Does it know what it has bitten off here? And for what benefit exactly - to test next-generation apps? Hmm. Everyone knows video is the biggest bandwidth hog; an expensive experiment isn't going to change that. And also remember, Google only plans to sell broadband Internet access, not a full bundle with TV or voice. It says it will do this at competitive prices, which means around $50-$100/mo. At these revenue levels and with operating costs that I haven't even mentioned, it's inconceivable to me that there's a positive business case for Google's gigabit experiment.

I'm all for innovation and for pushing competitors along. But Google's experiment really has me scratching my head. No doubt the folks at Verizon, Comcast and other big broadband ISPs are wondering as well. It's one thing for Google to throw $2.5-$3 million at a 52-second Super Bowl ad, but quite another to be contemplating a $750 million experiment with ambiguous goals. What am I missing?

What do you think? Post a comment now (no sign-in required).

Categories: Broadband ISPs, Technology

Topics: Comcast, Google, Verizon

-

Paltalk Releases SuperIM URLs for Clientless Video Chatting

Paltalk, the long-time video chat technology provider, is announcing its Paltalk 9.9 beta release today, which includes a feature called SuperIM URLs, which allow users to initiate 1-click, in-browser video conferences without any client download. It's a clever feature that promises to drive higher adoption of personal video conferencing. Paltalk's CEO Jason Katz walked me through a demo yesterday.

SuperIM URLs work like this: say I'm a registered Paltalk user (either free or paid) so I've already downloaded the Paltalk software. I then select a personalized SuperIM address, for example http://www.wrichmond.superim.me. Then I begin publicizing the URL to friends, say through tagging my email signature, Facebook page or business card. People who see the URL simply click on it and, as long as they have a webcam, are instantly connected via video chat with me. Just so I don't have people barging in on me on a bad hair day, I can set privacy controls to always require accept/decline. I can also password-protect the link so I only hear from people I want to. I can also set it so only audio comes on first and I have to manually start the webcam.

I can have up to 10 people in a video chat and display the participants in different mosaics. The most obvious competition for SuperIM URLs is Skype, which I use for video calls. Jason agreed that while Skype does a lot of things really well, Paltalk SuperIM's big differentiator is that it does not require the caller to have downloaded any software to participate.

With SuperIM, the caller simply clicks on the URL provided and is connected. In effect, the conferencing capability is brought to users instead of the other way around. The goal is to make it so easy that anyone's "grandmother can use it" as Jason put it. Even though Paltalk has had its client downloaded some 70 million times, Jason acknowledged that it's a "busy Internet," and it's getting harder and harder to induce people to download any new software.

Another differentiator is Paltalk's multi-party capability, which Skype doesn't offer. This means that a Paltalk user could set up a multi-party video chat around a specific event simply by sending out the SuperIM URL to friends, asking them to click-through at a certain time (think "virtual Super Bowl party").

Going forward, Jason said Paltalk plans to eliminate the step of even having the initial user download the Paltalk software. Paltalk wants to become ubiquitous for mobile users and other portable devices like the iPad. Jason also makes an interesting point that with the spread of $300 Internet-connected netbooks with built-in webcams, personal video conferencing has become more accessible than ever. Paltalk is also aiming for tighter integration with Facebook, so users can initiate video chats to their friends.

I vividly remember that George Jetson's video phone was just about the coolest thing I'd ever seen when I was a kid. SuperIM URLs are yet another indication that the Jetsons' world is upon us.

What do you think? Post a comment now (no sign-in required).

Filckr image via writetechnology

Categories: Technology

-

"Media and the Money Trail" Webinar on Feb. 16th

Next Tues, Feb 16th at 10am PT / 1pm ET, Microsoft Enterprise Search (a VideoNuze sponsor) will be presenting a complimentary webinar, "Media and the Money Trail: Connecting with the New Digital Consumer" with Greg Clayman, MTV's EVP of Digital Distribution and Jennifer Kavanagh, Oxygen's VP of Digital & New Media.

Greg and Jennifer will be sharing a deep-dive look into how their companies are re-thinking their business models, experimenting with new ways to engage their audiences and assessing new technologies. The webinar promises an excellent opportunity for industry professionals to learn from two companies on the leading edge of the digital revolution.

Categories: Webinars

Topics: Microsoft, MTV, Oxygen, Webinar

-

comScore Data Shows 2009 Was a Blistering Year for Online Video (Slides Available)

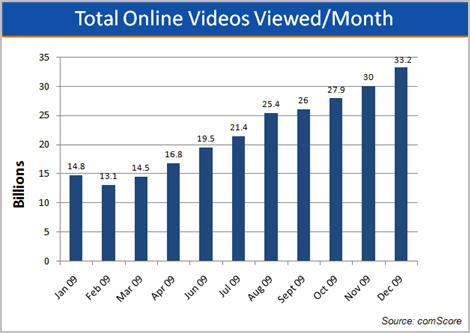

Last Friday, comScore released its Dec. '09 data for online video usage. I've been tracking comScore's data for the last 3 years and Dec put an exclamation mark on what many of us already knew: 2009 was a blistering year of growth in online video consumption. Below are graphs of the most important data (Click here if you'd like a complimentary PDF download of all of the slides.)

The first graph shows total online video views more than doubled from 14.8 billion in Jan '09 to 33.2 billion in Dec '09. The historical growth is even more impressive. Just two years ago, in Dec '07, comScore reported 10 billion video views.

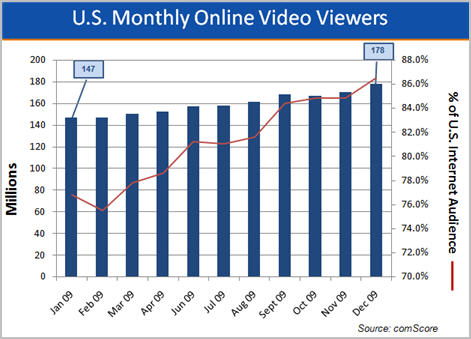

Online video usage is now nearly ubiquitous in the U.S. According to comScore, in Dec '09, 86.5% of all U.S. Internet users watched online video, up nearly 10 percentage points from the 76.8% in Jan '09. That translates to 178 million people watching video in Dec '09, up from 147 million in Jan '09. Back in Jan '07, there were 123 million viewers.

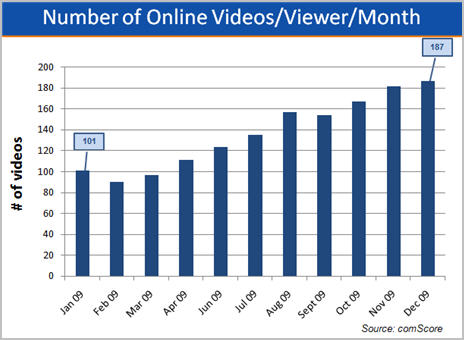

Those users are watching a whole lot more videos as well. For Dec '09, comScore reported that 187 videos were watched per average viewer, up 85% from 101 in Jan '09, and more than triple the 59 watched in Jan '07.

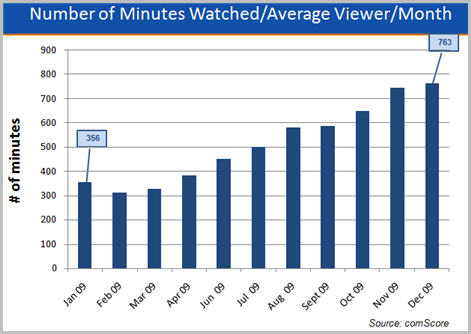

As well, those viewers spent a lot more time watching online video. In Dec '09 comScore said that the average online viewer watched 762.6 minutes or 12.7 hours, more than double the 356 minutes viewed on average in Jan '09. Here's the really incredible stat: back in Jan '07, comScore pegged this number at just 151 minutes or about 2 1/2 hours, meaning average viewing time has more than quintupled in the last 3 years.

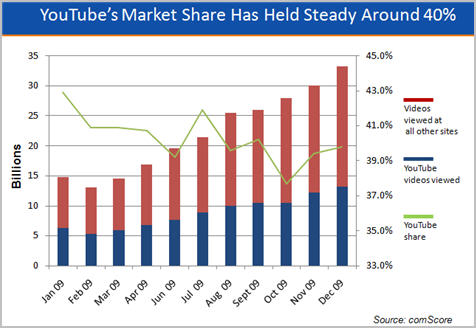

I've talked many times about how YouTube is the 800 pound gorilla of the online video market, and 2009 only further cemented this. Videos viewed at YouTube surged from 6.3 billion in Jan '09 to 13.2 billion in Dec '09. To put this in perspective, Google closed its acquisition in Nov '06. In Jan '07 (the first month comScore publicly released online video data), YouTube notched 1.2 billion views. That means that in the 3+ years that Google has owned YouTube, it has grown more than 10x in size. More amazing is that even with all the growth by other sites (particularly Hulu), YouTube has kept up its approximate 40% share of the overall online video market, starting the year at 42.9% and ending at 39.8%.

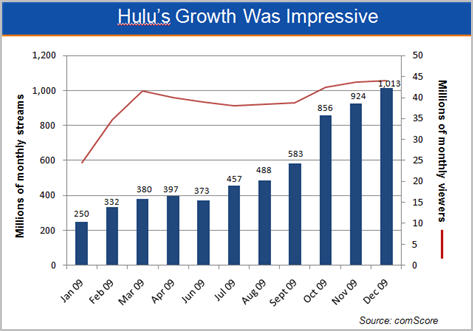

Speaking of Hulu, in its first full year of operation, the site surged from 250 million views in Jan '09 to 1,013 billion views in Dec '09. Unique viewers increased from 24.4 million in Jan '09 to 44.1 million in Dec '09. But if you look at the red line in the graph below, you'll see that uniques jumped to 41.6 million by Mar '09 which I believe must be due, at least in part, to a likely measurement change by comScore. Since Mar you'll notice that uniques hovered right around 40 million each month, dipping below during the summer and then bouncing back in Q4.

A few months ago I speculated that Hulu's relatively flat pattern in uniques could suggest that, in its current configuration, Hulu may have saturated the market for its content and user experience (for example, contrast Hulu with YouTube, which grew its uniques by 33% in '09 to 135.8 million by Dec '09). I'll be looking to see if Hulu can notch more noteworthy increases in uniques during '10; if not, then I think my thesis will be proven correct.

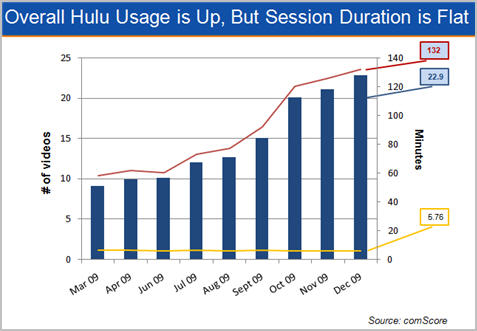

Nonetheless, Hulu's viewers clearly love the site, with average number of videos per viewer more than doubling to 22.9 in Dec '09, up from 9.8 in Dec '08. Users are spending more time on Hulu, increasing the amount of total minutes on the site from 58 in Mar '09 to 132 in Dec '09. What's remarkable though is that the average minutes watched per video (the yellow line below), has stayed virtually constant at around 6 minutes each month. That shows that while there's plenty of long-form consumption happening at Hulu, clips are still very popular too.

comScore is a great source of month in and month out online video data, but as always my caveat is that no third party can ever track usage as closely as the sites themselves, so take these numbers with a small grain of salt!

Click here if you'd like a complimentary PDF download of all of the slides.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators

Topics: comScore, Hulu, YouTube

-

From an Online Video Perspective, Super Bowl Ads Are a Mixed Bag

The great Super Bowl game last night was once again not matched by the quality of the ads, at least when viewed for how well they leveraged online video. For several years now, I've been arguing that the $2.5-3 million that advertisers spend on their 30 second Super Bowl spots could yield a far higher ROI if they figured out how to extend their experiences through online video. So once again this year I've reviewed all of the Super Bowl ads - not for how funny, creative or gross they were - but for how well they took advantage of the benefits online video offers.

First, some basic stats: of the 58 ads that ran during the game last night (which I viewed this morning at CBSSports.com), 38 of them were tagged with a URL and 20 were not. On a percentage basis that's about equal to last year, when 37 of the 56 ads carried a URL. Of the 38 ads with a URL, only 4 of them explicitly urged the viewer to see more or watch more at their web sites:

-

Focus On the Family - The controversial Tim Tebow advocacy ad invites viewers to visit the Focus web site to see the full Tebow story. The site has a long interview with Tebow's parents along with lots of other video. Regardless of your politics, the ad works well as a friendly teaser for viewers to learn more about the organization.

-

Boost Mobile - Jim McMahon and the hilarious rapping NFL players take it to a new level by actually ending their rap with the line "Go online to find the rest of our jam," then exposing the URL. Further videos at the site continue the fun.

-

GoDaddy - The web site hosting company was back with its ads featuring Danica Patrick and teasing viewers to "See more now at GoDaddy.com." The scantily-clad GoDaddy girls concept is a little stale now, but for the male-dominated game audience, there's no doubting its appeal.

- HomeAway.com - My personal favorite, this vacation home rental company bought back Chevy Chase and Beverly D'Angelo as The Griswolds for "Hotel Hell," a spoof of the famous "Vacation" movie series. The ad is totally focused on getting viewers to see the film at HomeAway.com. Chase is a classic and the videos are very clever.

Outside of these four, a handful of others are on my honorable mention list. From a user involvement standpoint, CareerBuilder's provocative ad with workers walking around in their underwear (which was the result of its "Hire My TV Ad" contest) was a winner and built on the success Doritos has had with its own $1 million user-generated contest. Monster.com has an interesting engagement opportunity at its site, allowing users to create their own "Fiddle a Friend" music videos with their violin-playing beaver. Speaking of animals, you had to love Bridgestone Tires' "Whale of a Tale" ad featuring 3 guys trying to drive a whale back to the ocean - Bridgestone makes behind the scenes clips here.For more behind the scenes, Dove's new Men Care line features an interview with MVP Drew Brees, who's also shown lathering up in the shower (a blatant pitch to women as well as men). E-Trade was back with its talking babies, but this year with a twist, allowing site visitors to send their own "Baby Mail" emails. The new Honda Accord Crosstour features a well-produced video of the car, though no mention of the video is made in its game ad. And how about the futuristic Vizio ad trumpeting its Internet-connected TVs? It's surely a sign of many more connected device ads to come in future years.

Lastly, a few real misses. First up, what's the deal with Budweiser? It ran 9 ads and not one of them carried a URL. These folks are mistaken in thinking that viewers wouldn't be interested in more about the Clydesdales on the web. Beyond the horses, it would have been cool to learn more about how Bud made the human bridge ad, or did the voice effects in the T-Pain spot. Ditto for Denny's which was promoting its Grand Slam breakfast hard, but didn't do any web tie-ins. The movie ads make me nuts too. They roll the credits so fast at the end of the ad and the text is so small that it's nearly impossible to find a URL to learn more about the movie, even if you wanted to.

The Super Bowl is the biggest event on the sports and advertising calendars, yet as evidenced by this year's performance, most brands and agency creative types still don't fully understand the power of online video. Sure, the post-game galleries drive millions of additional views, but I continue to contend they could be so much more. Oh well, onto Super Bowl XLV.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Sports

Topics: Boost Mobile, Focus on the Family, GoDaddy, HomeAway.com, Super Bowl

-

-

Watching Hulu Content on Facebook Through ClipBlast's App is Cool

Here's something cool: ClipBlast updated its Facebook app yesterday to now include access to practically all of Hulu's content. ClipBlast's CEO/founder Gary Baker walked me through a demo and I was quite impressed. Once you've added the app, you can favorite certain Hulu shows and they appear as tiles which you can then easily scroll through. It's a huge step forward from Hulu's own mediocre Facebook app. You can also choose video from over 8,500 other sources that ClipBlast offers.

Though I'm personally not a huge Facebook user, the app resonated with me because it makes discovering and sharing video even more powerful as Facebook friends are just a click away. Of course Hulu has offered embedding from the start, but to get almost the whole Hulu library into Facebook, in front of a potential audience of 400 million users is classic "syndicated video economy" thinking. In the SVE, instead of solely trying to bring audience to your content (the traditional media model), efforts are also focused on bringing your content to the audience, wherever they live. All of Hulu's ads flow through as well, so views are still fully monetized. What's missing is full screen viewing, which Gary said is coming shortly.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Syndicated Video Economy, Video Sharing

Topics: ClipBlast, Facebook, Hulu

-

Replay of Yesterday's Net Neutrality Webinar is Now Available

Yesterday VideoNuze and The Diffusion Group hosted "Demystifying Net Neutrality," the first in our 2010 webinar series. Our guests, Barbara Esbin, Senior Fellow and Director, Center for Communications and Competition Policy, Progress & Freedom Foundation (against) and Chris Riley, Policy Counsel for Free Press (for) did an outstanding job advocating their positions. Net neutrality is extremely complex and we had a flood of questions, which our guests did a great job of addressing.

Though Chris made his points well, personally I'm still not persuaded that net neutrality regulations are needed now. As I wrote last fall, my core concern is that no sustained pattern of broadband ISP behavior has been proven. Colin and Chris argue that "corporations can't be trusted" and that inevitable biases will arise for the biggest broadband ISPs who are also the biggest video service providers. All of that may be true. But until it's proven, it's dangerous business to start tinkering with the well-functioning Internet. The FCC should stay vigilant, but not pursue net neutrality regulation now.

What do you think? Post a comment now (no sign-in required).

Categories: 4 Items, Broadband ISPs, Regulation, Webinars

Topics: FCC, Net Neutrality, Webinar

-

Will This Year's Super Bowl Ads Finally Leverage Online Video?

It's Super Bowl time again, which means it's time for me to write my annual post wondering whether this will

be the year that Super Bowl advertisers really embrace online video and social networking opportunities. Four years ago, I speculated that at some point a Super Bowl ad could go for $10 million apiece, because the online video extensions could drive the ROI so much higher than what a traditional 30 second ad alone delivers. Nonetheless, advertisers and their agencies have been painfully slow to get with the online video program, and I've been ranting about the missed opportunities (see here and here) year after year.

be the year that Super Bowl advertisers really embrace online video and social networking opportunities. Four years ago, I speculated that at some point a Super Bowl ad could go for $10 million apiece, because the online video extensions could drive the ROI so much higher than what a traditional 30 second ad alone delivers. Nonetheless, advertisers and their agencies have been painfully slow to get with the online video program, and I've been ranting about the missed opportunities (see here and here) year after year.As this NY Times piece describes though, this could finally be a breakthrough year. I like the way that Kathy O'Brien, VP for personal care at Unilever put it, "The Super Bowl is an element of a complete, 360-degree campaign." That's smart thinking. On Monday I'll tally up the score to see how this year's Super Bowl advertisers did with their online video and social networking extensions.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Sports

Topics: Super Bowl