-

YouTube's Meager Sundance Rental Revenues Really Weren't That Surprising

This week brought news that YouTube's recent foray into rentals netted the company a whopping $10,709.16. I wasn't surprised by the results, as YouTube only made 5 Sundance films available for 10 days. As I suggested 2 weeks ago, even with YouTube's massive audience, it would be unreasonable to expect too

much. Still, it was great promotion for the indie film producers and no doubt a learning experience for YouTube.

much. Still, it was great promotion for the indie film producers and no doubt a learning experience for YouTube. I'm not religiously opposed to YouTube broadening its model beyond free and ad-supported video, but I do think YouTube needs to be wary of spending a lot of time trying to secure me-too rights for distribution of Hollywood's prime TV and movie output. That's highly competitive ground, and Netflix for one, has enormous advantages given its robust subscription model. YouTube is in the pole position when it comes to the ad-supported online video model and it needs to be relentlessly focused on proving it can make the model profitable.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Indie Video

Topics: Sundance Film Festival, YouTube

-

VideoNuze Report Podcast #48 - February 5, 2010

Daisy Whitney and I are pleased to present the 48th edition of the VideoNuze Report podcast, for February 5, 2010.

This week we get started with me reviewing yesterday's post about FreeWheel now serving close to 2 billion video ads per month and signing up MLB Advanced Media as their newest customer. FreeWheel's Doug Knopper told me that it is benefitting from both its new customers and also from year-over-year increases in ads served for existing customers. FreeWheel is also in the middle of the "syndicated video economy" that I've written before, having integrated with big third parties such as YouTube, AOL, MSN, Fancast and others.

Then Daisy describes her interview from last week's NATPE show with Chloe Sladden, director of media partnership for Twitter. The company is planning to launch its Media Developer's Platform later this year, along with new measurement tools. Daisy shares what she learned.

Click here to listen to the podcast (12 minutes, 38 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Podcasts, Technology

Topics: FreeWheel, MLB, Podcast, Turner, Twitter, VEVO

-

Exclusive: FreeWheel Serving Almost 2 Billion Video Ads/Mo, MLB is Newest Customer

FreeWheel is on a roll, now serving almost 2 billion video ads/month, doubling its volume just since November, 2009. In addition, the company has added Major League Baseball Advanced Media to its customer roster and began implementing ads during the fall playoff season. The MLB win comes on top of recently announced customers Turner Broadcasting System and VEVO. FreeWheel's co-CEO/co-founder Doug Knopper brought me up to speed on all the news late last week.

Doug said that part of the increase in FreeWheel's volume is attributable to the additional customers that have come on board, but he's also very excited about the year-over-year growth in ad volume FreeWheel is

seeing for longer-term customers ("same store sales" if you will). FreeWheel is seeing big increases due to 3 factors: customers posting greater quantities of video, plus deepening viewership of that video (all of this borne out by comScore's '09 video consumption data); customers' improving ability to actually sell ads against these videos (reflecting the shift of budgets to the online video medium); and reduced friction through the emergence of "accepted practices" in ad operations.

seeing for longer-term customers ("same store sales" if you will). FreeWheel is seeing big increases due to 3 factors: customers posting greater quantities of video, plus deepening viewership of that video (all of this borne out by comScore's '09 video consumption data); customers' improving ability to actually sell ads against these videos (reflecting the shift of budgets to the online video medium); and reduced friction through the emergence of "accepted practices" in ad operations. FreeWheel is also benefiting from its specialization in helping content providers monetize their video on third-party sites (e.g. YouTube, AOL, MSN, Fancast, etc.). More and more content executives are realizing that sizable viewership opportunities exist by syndicating their video outside of their own properties. Doug said that every content company FreeWheel is now talking to is interested in some kind of syndication.

Doug described 3 types of syndication he's seeing: (1) across a family of sister corporate sites, such as PGA.com providing CNN.com video, which are both owned by Turner; (2) between affiliated entities like local MLB teams providing video to the main MLB.com hub and (3) externally, to unaffiliated 3rd parties, such as WMG music providing videos to YouTube. Given all this syndication activity, I was interested to learn from Doug what percentage of the ads FreeWheel serves fall into each of these 3 buckets vs. what percentage are served on the customer's sites themselves. Doug said that FreeWheel is pulling those numbers together in a way that ensures its customers privacy and will get back to me when he has them.

In addition to the above syndication activity, FreeWheel is seeing experimentation with delivering ads to mobile devices, convergence/CE players and Internet-enabled TVs. In all these cases, customized ad policies determine who sells what ad inventory and how revenue is shared and reported. Powering all of this has been part of FreeWheel's core mission from inception, making it a key player in what I've called the 'syndicated video economy."

FreeWheel's growth echoes what I've been hearing lately from both video ad network executives and video content providers. They too are talking about rapidly rising volumes and improving monetization. As I wrote recently, I've been impressed lately by efforts to make video ads more engaging and provide a better ROI, a trend I see continuing. Taken together, while it's still relatively early days, online video advertising seems to be making great strides.

What do you think? Post a comment now (no sign-in required)

Categories: Advertising, Sports

Topics: FreeWheel, MLB, Turner, VEVO

-

Interview with Will Richmond on Beet.TV

For those of you who read my words each day, but haven't actually heard or seen me, Beet.TV has a short interview with me below. Daisy Whitney asked me a few questions about the future of online video at the recent NATPE conference in Las Vegas and I offered up 3 key trends to watch. Please, don't throw any virtual tomatoes at me!Categories: People

Topics: Will Richmond

-

Join Me for Net Neutrality Webinar with TDG Tomorrow, Feb. 4th

Please join me for the complimentary "Demystifying Net Neutrality" webinar tomorrow, Thurs, Feb. 4th at 11am PT / 2pm ET. This is the first of six webinars VideoNuze is presenting in 2010, in partnership with The Diffusion Group, one of the leading digital media research firms. The webinars are sponsored exclusively by ActiveVideo Networks

TDG's Colin Dixon and I will host the webinar, and we will have 2 expert guests with us who are on opposite sides of the net neutrality debate: Barbara Esbin, Senior Fellow and Director, Center for Communications and Competition Policy, Progress & Freedom Foundation (against) and Chris Riley, Policy Counsel for Free Press (for). Barbara and Chris will advocate their positions and then Colin and I will question each of them before opening it up to audience Q&A.

The webinar promises to be a deep-dive educational session examining all of net neutrality's pros and cons. For anyone with a stake in broadband/online content delivery and over-the-top video specifically, it will be a must attend session.

Categories: Broadband ISPs, Regulation, Webinars

Topics: Net Neutrality, TDG, Webinar

-

KickApps Lands NBCU for Social Video Sites

KickApps and NBCU are announcing a licensing deal this morning which includes KickApps' App Studio and Premium Social Video Platform. The deal enables all of NBCU's entertainment properties to use KickApps' social software solution, expanding upon a prior relationship between the companies which has primarily focused on NBC's local media properties.

As Marc Siry, NBCU's SVP, Digital Products and Services explained to me, KickApps's key differentiator was its self-service App Studio which allows NBCU's brands to quickly create customized, socially-oriented sites and video players using drag-and-drop tools. Marc said that the self-service aspect to the App Studio was

particularly important as each NBCU property has its own customization requirements. With resources tight, it was key to be able to have each property be somewhat self-sufficient. Marc said that social wrapping is essential to all media today, and that no other online video platform that NBCU evaluated offered the same capabilities.

particularly important as each NBCU property has its own customization requirements. With resources tight, it was key to be able to have each property be somewhat self-sufficient. Marc said that social wrapping is essential to all media today, and that no other online video platform that NBCU evaluated offered the same capabilities. (As a side note, I have always thought of KickApps as a social platform first and foremost, which also offered video functionality. As a result it's not really a pure OVP, though with its NBC win, KickApps is showing that for some customers, it is a bona fide OVP competitor.)

NBC has strongly pursued social interaction on its local sites, encouraging users to submit comments, video, and other engagement opportunities. With local media impacted by audience fragmentation, efforts to re-invent how to connect with audiences have been crucial. Looking ahead - though unable to get too specific for now - Marc told me that NBCU already has several projects in the works that will leverage KickApps: a fan site from Telemundo, a new video portal emphasizing "secondary" non-TV program content with rabid fan interest, and a celebrity-oriented user-generated site. Parent company GE is even planning to use KickApps as an enterprise solution for video sharing among internal units.

Marc said that one other appealing aspect of KickApps was its embrace of Adobe's Open Source Media Framework ("OSMF"). For those not familiar with OSMF (formerly known as "Strobe") it is a public, pre-release initiative aimed at allowing developers to use pluggable components to create rich Flash-based playback experiences. It is still early days for OSMF and it represents something of a challenge to many online video platforms which offer similar integrations as part of their product or through professional services.

But as Marc explained, OSMF is valuable to NBCU because it is seeing more and more requirements from its brands and advertisers to do custom creative and OSMF gives it a baseline of functionality on which to build. Prior to KickApps, NBCU properties relied mainly on homegrown software for video applications, which Marc said had limited flexibility.

KickApps's NBCU win is yet another example of how dynamic the market for video solutions is today. I am continually hearing about how specific content providers each have their own unique requirements, so an individual video platform provider can be a perfect fit in one situation, but be less than optimal in another. While some requirements are converging, I anticipate a level of individuality will persist for some time to come, sustaining the OVP fragmentation we've seen to date.

What do you think? Post a comment now (no sign-in required).

Categories: Broadcasters, Technology

-

thePlatform Unveils New "mpx" Beta and mpx Dev Kit

This morning, thePlatform is marking its 10th anniversary by unveiling a new version of its video management and publishing system, dubbed 'mpx" (the prior version was called "mps" for Media Publishing System) and mpx Dev Kit, a complete set of APIs and documentation. Last week Marty Roberts, thePlatform's VP of Marketing, gave me an overview of mpx and a short demo.

thePlatform had 3 primary customer goals in mind with mpx: (1) to provide more efficient management of large content libraries, (2) to enable personalized work flow options and (3) to re-orient the publishing process so

the beginning point is the outlet or "publishing profile." As Marty explained, over the course of the 10 years that thePlatform has been in business, the world of online video has become far more complex, with longer viewing durations, more distribution options, bigger content libraries, and more money at stake. Since thePlatform works primarily with big content providers and distributors, improving the ingest process to accept multiple simultaneous files, and then the navigation of existing files, was a key focus of mpx's development.

the beginning point is the outlet or "publishing profile." As Marty explained, over the course of the 10 years that thePlatform has been in business, the world of online video has become far more complex, with longer viewing durations, more distribution options, bigger content libraries, and more money at stake. Since thePlatform works primarily with big content providers and distributors, improving the ingest process to accept multiple simultaneous files, and then the navigation of existing files, was a key focus of mpx's development.In addition, having done lots of research on how its users interacted with mps, thePlatform found that they each used it in somewhat different ways and that ease-of-use remained a pain point. This led thePlatform to devote substantial resources to enabling users to create their own work flows, personalized depending on their specific role in the video management and publishing process. In the demo, Marty showed how different people, tasked with different assignments, could configure their own views of mpx's 3-pane publishing console, so that just those things they cared about were visible and accessible. Multiple views can be created and then saved, so the user can quickly return to and cycle through their various tasks.

Most interesting though, is mpx's re-orientation to start the publishing process by creating a "publishing profile" such as a pre-configured video player, or a mobile device, or a third-party syndication partner. In each case, the user first configures the outlet and then specifies exactly what types of assets are required, including encoding specs, formats, sizes, etc. Then, as video is ingested and marked for its destination, the system takes over and automatically runs the various required processes in order to deliver the required files to their destination. The same occurs for assets already in the system; the user finds what's required, associates a publishing profile and prompts the system to run the processes. It's a pretty slick approach, and no doubt will be a real time-saver for users.

Marty explained that thePlatform dedicated 70% of its engineering team to mpx's development for the last 2 years. Scale and reliability have also been key goals, as the company's large customers, especially service providers, have "5 9's" or 99.999% availability requirements. While thePlaftorm is cognizant of the range of online video platform competitors, the company believes the lessons learned over the years, which help it operate at huge scale, are a real differentiator.

Interestingly, Marty echoed what I continue to hear - that homegrown systems are still the most significant competition. However, the advent of TV Everywhere and the rise of paid media appear to be tipping these holdouts toward third-party platforms. With the online and mobile video worlds getting more complex by the day, this can be expected to continue.

What do you think? Post a comment now (no sign-in required).Note- thePlatform is a VideoNuze sponsor.Categories: Technology

Topics: thePlatform

-

It's Official: Netflix Has Entered a "Virtuous Cycle"

Looking at Netflix's Q4 '09 and full year '09 results released late last Wednesday, plus Netflix's performance over the last 3 years, I have concluded the company has officially entered a "virtuous cycle." For those of you not familiar with the term, a virtuous cycle is when a single change or improvement leads to a cascading series of follow-on benefits which both reinforce themselves and add further momentum to the original change (a hyper "one good thing leads to another" scenario, if you will). Virtuous cycles are extremely rare in business, and when they happen they have profound implications.

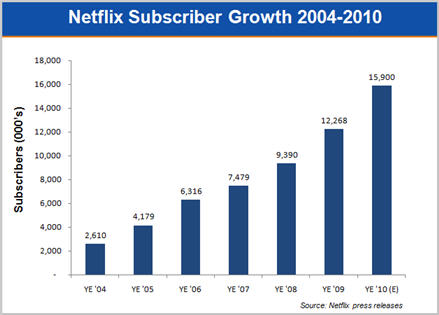

The start of Netflix's virtuous cycle is obvious: the company's introduction of its free "Watch Instantly" streaming feature in January, 2007. Streaming has fundamentally changed the Netflix service offering and consumers are increasingly aware of this. Traditionally, Netflix subscription plans were defined by limits - 1 DVD out at a time for $8.99/mo, 2-out for $13.99/mo or 3-out for $16.99/mo. But with the company's decision to remove the confusing original caps it placed on streaming consumption and move to an unlimited model, Netflix is now providing enormous new value at the same DVD rental price points. Netflix has also changed how it advertises its services, strongly emphasizing streaming (see its home page for example). The "unlimited streaming" message is breaking through and Netflix subscriber growth momentum over the last 3 years reflects this.

Subscribers grew to 12.3 million at the end of '09, 31% higher than YE '08. To get a sense of Netflix's momentum, '09 growth handily beat '08 (26%) and '07 (18%) growth. The 2.9 million subs added in '09 was 85% above the company's own 2009 beginning year forecast of 1.56 million sub additions. Looking ahead, the mid-point of Netflix's forecast for '10 is for another 30% growth in subs.

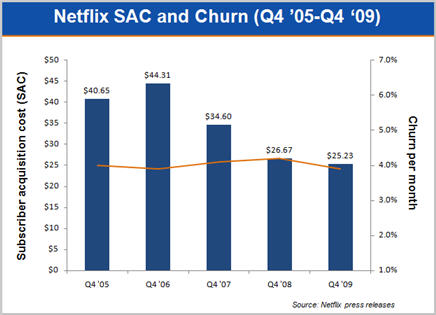

As the streaming benefits have resonated, it's very important to note that subscriber growth is actually getting progressively cheaper for Netflix to accomplish. As the following graph shows, Netflix's subscriber acquisition cost (SAC) has decreased by an impressive 43% from $44.31 in Q4 '06 to $25.23 in Q4 '09 (the 2nd lowest SAC in the company's history). Better still, the quality of these new subs seems high; average monthly churn in Q4 '09 was 3.9%, equal to the lowest churn the company has ever achieved. While Netflix isn't "buying" growth with low-quality additions (an old trick for subscription-oriented businesses), it is however putting more emphasis on the "1-out" service, which, with the addition of unlimited streaming, is an outstanding value for the low-end of the market. Netflix is eager to penetrate this segment, to whom $1 Redbox rentals are very attractive.

While Netflix's financials already reflect the virtuous cycle impact streaming is having on the business, it is likely there is much more to come as streaming takes further hold. Netflix revealed that 48% of its subscribers streamed at least 15 minutes/mo in Q4 '09, up from 41% in Q3 '09 and 26% in Q4 '08 (Incidentally, I think it's conceivable that 80% or more of recently-added subscribers are streaming). But it's just in the last year that Netflix streaming has begun to make the move from computer-only consumption to TV-based consumption, truly making it a mainstream experience. Netflix has inked deals with all the major game consoles (with a Wii marketing campaign beginning in '10), plus numerous CE devices, Blu-ray players, etc. Just ahead is a future where Wi-Fi will be ubiquitous in all new TVs and Netflix's deals with all the major TV manufacturers will ensure it is even more front and center for consumers.

To make streaming attractive, Netflix has had to essentially build a second content library. As I've suggested in the past, this isn't easy, as the company must navigate a thicket of pre-existing Hollywood rights and business relationships. Most notably, Netflix has run into the premium cable networks (HBO, Showtime, Starz and Epix) which have a monopoly on Hollywood's output for their release window. Netflix's deal with Starz was an important first step but still, I've been skeptical that Netflix would land streaming deals with the others.I'm now gaining more confidence that this will indeed happen, especially for these networks' original productions. Netflix is simply getting too big to ignore. It represents a whole new revenue opportunity for premium channels, plus an important loyalty-building outlet. Further out though, while Netflix CEO Reed Hastings says he wants the company to be a distributor for these premium channels, I think it's nearly inevitable that Netflix will compete head-on with them for Hollywood's output. Economics dictate that eventually it makes more sense for Netflix to bid directly for Hollywood rights than work through a premium channel middleman.

In fact, Netflix already has tons of Hollywood relationships, and its recent deal with Warner Bros, creating a 28-day DVD window is emblematic of how Netflix looks at streaming content acquisition going forward. In that superb deal, which was ludicrously criticized by some, Netflix simultaneously helped a critical partner sustain its DVD sales window, while gaining cheaper access to more DVD copies on day 29 and increased streaming rights for catalog titles. As Hastings pointed out on the Q4 earnings call, given the inconsistencies in DVD release strategies, most consumers have little-to-no idea when a title becomes available on DVD, so, while still early, opening up the 28 day window has caused no subscriber complaints. And the company's analysis of subscriber "Queues" indicates, just 27% of requests are for newly-released titles.

Importantly, Netflix's strategy is to pour savings from its DVD deals into streaming content acquisition. As I noted recently, Netflix's detailed subscriber data and usage analysis gives it a huge asymmetric advantage in negotiating additional streaming licenses from Hollywood. Netflix can surgically concentrate its resources on only those titles it knows its subscribers will value. Over time, as DVD sales continue to collapse, Netflix will be there to offer its subs a broader and broader rental selection.

The biggest challenge to Netflix for streaming content acquisition is how much it chooses to spend. Netflix's relatively small size among giants like Comcast and others is what prompted me to suggest over a year ago that Microsoft would acquire Netflix. I'm officially retracting that prediction now, as 2009 demonstrated how much streaming progress Netflix can make on its own. In fact, I think all rumors of a possible Netflix acquisition are off-base; I see the company remaining independent for some time to come.

Netflix is now riding a serious wave and its executives recognize the mile-wide opportunity ahead of it. The product is immeasurably stronger and more appealing with unlimited streaming included. That's in turn leading to impressive sub growth with much-reduced SAC and improving churn. The number of devices bridging Netflix to the TV is growing and portends ubiquity at some point down the road as these devices further leverage Netflix's platinum consumer brand. Streaming content selection is improving, bringing side benefits of reduced DVD postage and inventory costs. With millions of subscribers Netflix now has both the economics and the scale to be a very significant player in the video ecosystem.

Last but not least is a very favorable competitive climate. Aside from a hobbled Blockbuster, astoundingly, Netflix doesn't have any other direct DVD subscription/online streaming hybrid competitor (Amazon and Apple, are you paying attention?). And while Comcast and other multichannel video programming distributors ("MVPDs") are rolling out TV Everywhere services (5 years later than they should have, in my opinion), these are still early stage, and still encumbered by archaic regional limitations. Indeed, Netflix's growth may well cause these companies to consider their own over-the-top plans, as I've suggested.

For years I have been saying that broadband video is the single most disruptive influence on the traditional video distribution value chain. Netflix's success with streaming and the consequences that are yet to play out are resounding evidence of this. Above and beyond YouTube, Hulu, Amazon, Apple and others, Netflix is by far the most important video distributor to watch.

What do you think? Post a comment now (no sign-in required)

Categories: Aggregators, Devices

Topics: Comcast, Netflix, Warner Bros.