-

Is Comcast Inching Toward Its Own Over-the-Top Play?

Question: How much difference is there between Comcast offering its TV Everywhere service to its own multichannel video subscribers in its geographical footprint, who have chosen to get their broadband Internet service from another company (e.g. Verizon, AT&T, etc) vs. Comcast offering TV Everywhere services to consumers who similarly get their broadband Internet service from one of these companies (or another cable operator), but happen to also get their multichannel video service from another company (e.g. another cable operator operating in a non-Comcast geographical area)?

If you answered "not that much," then you'll likely have the same reaction that I did upon reading last week's Light Reading article, "Comcast to Expand 'Xfinity' to DSL Subs," which describes Comcast's plan to offer its Fancast Xfinity TV (which I call FXTV) TV Everywhere service to those of its video subscribers who use DSL or some other method to connect to the Internet instead of Comcast's own broadband service by the second or third quarter of 2010.

(As quick background, in December, Comcast launched the beta of its FXTV service, but it's only been available to homes that subscribe to both broadband and video, which is about 14 million out of the 24

million who subscribe to Comcast's video service. Of that 10 million difference, using the 70% national broadband penetration rate, I'd estimate there are about 3 million of Comcast's multichannel video subscribers who use Verizon, AT&T or someone else for their broadband access.)

million who subscribe to Comcast's video service. Of that 10 million difference, using the 70% national broadband penetration rate, I'd estimate there are about 3 million of Comcast's multichannel video subscribers who use Verizon, AT&T or someone else for their broadband access.)When I read the article, my reaction was: if Comcast is going to target this group of users, wouldn't the next logical step in FXTV's rollout be to offer it to non-Comcast video subscribers? This is the concept I suggested back in September in, "How TV Everywhere Could Turn Cable Operators and Telcos Into Over-the-Top's Biggest Players." In that post I argued that with sizable revenue per subscriber gains largely behind it, Comcast' big growth opportunity is to expand into other cable operators' territories, by offering FXTV as a TV Everywhere 2.0 over-the-top service in those areas.

To be sure, I noted that this type of move would be a serious breach of protocol in the insular cable industry, and with today's incomplete FXTV offering it wouldn't be viable competitively just yet anyway. But given nationally-oriented competitors like DirecTV, DISH Network and newer OTT alternatives like Netflix mobilizing, it seems logical that somewhere down the road, Comcast, whose geographical reach today only encompasses about 25% of American homes, will have to go national to stay even.

When Comcast's executives have been asked about the possibility of FXTV as an OTT service they have denied any intentions. With their hands full making sure FXTV is working properly for its current subscribers, that's probably the case, at least for now. Plus, with the NBCU deal facing regulatory scrutiny and the net neutrality debate heating up again, Comcast certainly isn't going to hint at anything that would further expand its dominance. But still, given competitive issues, will limiting FXTV access to its own multichannel video subscribers remain the case? It will be interesting to see if and when this changes.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators

Topics: Comcast, TV Everywhere

-

4 Items Worth Noting for the Jan 11th Week (Real's Rob Glaser, ESPN Mobile, Broadband's impact, Vail goes 360)

1. Goodbye to RealNetworks' Rob Glaser - For broadband veterans like myself, this week's news that RealNetworks' founder and CEO Rob Glaser is stepping down from the CEO role after 16 years brought to mind how far the online video and audio worlds have come, in a relatively short time. Having done a fair amount of work with Real back in my Continental Cablevision days, some of my first memories of seeing video delivered through the Internet were with the RealPlayer.

There is no question Rob was one of the pioneers of the online video industry, and everyone working in the industry today owes him and Real a debt of gratitude. In the Internet's first wave, Real was out ahead of everyone in audio and video. Unfortunately for the company, Microsoft's decision to roll out its own media player (and to bundle WMP with Windows) scrambled Real's future and set off years of antitrust litigation. Over the years Real has tried many things, some of which worked and some of which were serious head-scratchers (Ryan Lawler recounts 5 of the company dumbest moves here).

Personally, it's been a while since any video I wanted to watch required the RealPlayer download. And the last time I did download it, I was so incessantly bombarded with offers that I uninstalled it and swore I'd never download it again. Nonetheless, Real remains one of the largest digital media and technology companies, with $140 million in Q3 '09 revenues and almost $400 million in cash and short term investments. The new CEO will inherit all this, plus the challenge of how to make Real a more significant player in a broadband-dominated world that Rob envisioned so many years ago.

2. ESPN: "Mobile will be bigger than the web" - I'm always on the lookout for insights from content executives charged with building their company's mobile initiatives (and mobile video more specifically) and so I found MocoNews.net's interview with John Zehr, ESPN's SVP and GM of Mobile a worthwhile read. ESPN has made a ton of progress in mobile since its MVNO was shut down and the post provides growth stats on some of ESPN mobile's most successful efforts.

Reflecting the key shift in mobile away from "on-deck" carrier-focused distribution deals to a more open Internet-like environment, Zehr said ESPN's mobile revenue model is built on payments from aggregators like FLO TV and MobiTV, advertising and app sales. That sounds a lot like the traditional cable model of affiliate fees, advertising and ancillary revenues like commerce. And just like in cable ad sales, ESPN sells all of its mobile ads itself, avoiding third-party ad networks that it believes would commoditize the ESPN brand. ESPN is clearly bullish on mobile, with Zehr saying "Not too far in the future, mobile will be bigger than the web." With the Apple vs. Google mobile war getting underway there's a lot of momentum building. Still, to keep things in perspective, we're a long way from mobile eclipsing the web.

3. Does broadband help the economy or not? - I was intrigued by this piece in Network World, reviewing a new study, "Does Broadband Boost Economic Development?" which makes the case that where broadband connectivity is available, it helps local economies, though it doesn't necessarily help the individuals who live there. I'll admit, this is pretty wonky stuff, but as broadband becomes ever more central to our economy and to video in particular, it's important to understand broadband's impact. This is true all the more so as we have a major net neutrality debate looming this year, which could have far-reaching consequences for both content providers and network operators.

4. Vail introduces 360 degree video, it's almost like being there - Finally, on a lighter note, if you've been itching for that ski trip to Colorado this winter, or just want to escape the daily grind for a few minutes of pleasure, check out Vail's new virtual video clips, shot in 360 degree splendor with partner Immersive Media. The company's Dodeca spherical camera system captures video from 11 different sensors, allowing the viewer to click on the controls to switch angles.

Immersive caught my attention recently with music concerts they've captured and plus their work with brands like Red Bull, Armani and Mercedes. The company offers a full suite of capture, production and distribution services. In Vail's case, you get to experience some of the mountain's best runs alongside other skiers. It's great marketing for Vail and though it's no substitute for actually being there, your legs won't hurt afterwards either!

Enjoy the weekend!

(Note - The VideoNuze Report podcast with Daisy Whitney will resume next week)

Categories: Cable Networks, Mobile Video, People, Technology

Topics: ESPN, Immersive Media, RealNetworks, Vail

-

ActiveVideo Networks Helping Blockbuster on Demand Deliver a Converged Experience

Amid all of the attention Netflix has been receiving for embedding its streaming software in one consumer electronics device after another (the Wii just yesterday) and its recent Warner Bros. deal, it's been easy to overlook the fact that Blockbuster has been getting some online traction itself. One announcement at CES last week, by ActiveVideo Networks, caught my attention as it has the potential to leapfrog Blockbuster On Demand's user experience past Netflix's Watch Instantly.

Much as I'm a big fan of Netflix's Watch Instantly streaming feature, one of its limitations is that the user experience is very segregated between computer and TV. You browse and search online for titles - just as you would for DVDs - and then when you've made your choices, they show up in your Instant Queue online and on your connected TV (via Roku, Blu-ray, Xbox or other device). While it's a perfectly functional approach, wouldn't it be nice if you could do the entire process of search, discovery, previewing, selection and viewing on the TV itself?

That's the experience that ActiveVideo Networks' CloudTV will be helping Blockbuster on Demand deliver to its users. As ActiveVideo's CEO Jeff Miller explained to me yesterday, when deployed, the Blockbuster on Demand app (developed using ActiveVideo's JavaScript/HTML authoring kit), will give Blockbuster's users a web-like experience of search, discovery and previewing on their TVs, via connected devices. In addition, it will present viewing options - streaming, download-to-own and in-store rental (via an API it will even show current availability in selected stores).

The requirements are that ActiveVideo's thin client has been integrated with the device, and that Blockbuster has its own deal with to distribute through the specific device manufacturer. Navigation is via the remote control using an on-screen keypad (see example screen shots below from last week's CES demos).

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.Similarly, ActiveVideo is also focused both on CE (currently through a partnership with middleware provider Videon Central) and on cable. It has deployed on set-top boxes with Cablevision and Oceanic Time Warner Cable in Hawaii, reaching an audience of 5 million homes. Content providers that have developed apps include Showtime, HSN and Fox, among others. No doubt ActiveVideo and Blockbuster will synch up their biz dev activities to proliferate the Blockbuster on Demand app as widely as possible.

I have to admit that I haven't been paying too much attention to Blockbuster, as it has worked to re-position itself, aiming to close another 1,000 stores by the end of the year and installing more kiosks to compete with Redbox. Of course, it can ill afford to allow Netflix to get too far out in front of it in digital delivery as DVD rentals are poised to be supplanted by streaming down the road.

But Blockbuster has an ubiquitous, if somewhat dated, brand that could be skillfully leveraged into the digital era, provided it has the right services in its arsenal. In this respect, the potential to bring a converged user experience between online and connected TVs is a meaningful differentiator. No initial joint customers have yet been announced by Blockbuster and ActiveVideo, though I expect that soon. And, as online video and TV continue to converge, ActiveVideo is likely to find itself in the middle of a lot of action. All of this is worth keeping an eye on.

Update: Looks like I'm 1 step behind on Netflix's Xbox implementation. Apparently in Aug '09 it was updated to allow full browsing and search for the Watch Instantly catalog. I'm used to the Roku and Blu-ray experiences. Hat tip to Brian Fitzgerald for bringing to my attention.

What do you think? Post a comment now.(Note - ActiveVideo Networks is a VideoNuze sponsor)

Categories: Aggregators, Devices, FIlms, Partnerships

Topics: ActiveVideo Networks, Blockbuster, Mediacom, Netflix, Suddenlink, Videon

-

Encoding.com Moves to The Rackspace Cloud; Video Encoding Service Evolves

Encoding.com, one of the earliest companies to offer video encoding/transcoding as a service, announced yesterday that it would now be using The Rackspace Cloud as its primary cloud computing environment, a switch from Amazon's EC2. The move is significant as it is another indicator of how the still nascent video encoding as a service is evolving to fit into the overall encoding landscape. Jeff Malkin, Encoding.com's COO and Chandler Vaughn, The Rackspace Cloud's director of product development, gave me an update yesterday.

Media companies have traditionally done their encoding and transcoding in-house, using software from companies like Anystream, Telestream, Digital Rapids, Rhozet and others. As I originally wrote last April, companies like Encoding.com, mPoint and HD Cloud have begun offering alternatives that allow these processes to occur in the "cloud." The idea is that media companies can essentially rent encoding/transcoding capabilities as needed for a fee from companies who do their processes on a third party's infrastructure such as The Rackspace Cloud or Amazon's EC2. For media companies, the new encoding/transcoding service providers' primary value propositions are lower overall cost (both opex and capex), elimination of on-site responsibility for hardware and software, and flexibility.

Jeff reported that Encoding.com is now serving 400 customers, with user-generated content sites like StreetFire still a meaningful part of its business. The company has encoded 3.5 million videos to date and is

now encoding 30K source videos/day. Jeff said that established companies like MTV and Brightcove are using Encoding.com's services, but noted that larger media companies are still just dipping their toe into encoding as a service. In particular Jeff said that given turnaround times, the ability to do encodes for full-length HD-quality files on a service basis is not yet practical.

now encoding 30K source videos/day. Jeff said that established companies like MTV and Brightcove are using Encoding.com's services, but noted that larger media companies are still just dipping their toe into encoding as a service. In particular Jeff said that given turnaround times, the ability to do encodes for full-length HD-quality files on a service basis is not yet practical. This echoes what an executive at a large encoding software company told me recently - that for the biggest media companies, which have large files that need to be turned around quickly, encoding in the cloud doesn't yet make sense. Another issue is the reluctance to move source files outside the media company's firewall.

Encoding.com's move to Rackspace begins to address some of these issues. Jeff highlighted 3 primary reasons for the switch - Rackspace's CPU bursting capability, which can offer 2x the processing performance of EC2 (The Bitsource just posted a performance comparison analysis); closer proximity to customer's files, as Rackspace is the managed hosting provider for thousands of web sites; and Rackspace's customer support, which improves Encoding.com's ability to deliver on its service level guarantees.

With the volume of online and mobile video exploding, this will be a key part of the market to watch. It is still early days for encoding as a service, but as Encoding.com and others continue to strengthen their operations and maintain attractive pricing, it seems likely that they will eventually gain attention from additional media companies.

What do you think? Post a comment now.

Categories: Technology

Topics: Encoding.com, HD Cloud, mPOINT, The Rackspace Cloud

-

Ooyala Expands Into Japan with NTT Partnership

Online video platform provider Ooyala unveiled a partnership yesterday with NTT SMARTCONNECT that expands the company into Japan. Under the non-exclusive deal, the two companies will collaborate to create a localized and co-branded version of Ooyala's Backlot platform. Marketing and sales are set to begin in February.

As part of the announcement Ooyala also provided some 2009 updates: contracted customers grew from 30

to 300, self-serve customers grew five-fold, the Ooyala player now delivers hundreds of millions of streams/mo to 50 million unique users/mo, it transcodes 60K hours of video/mo and the company now has 70+ employees.

to 300, self-serve customers grew five-fold, the Ooyala player now delivers hundreds of millions of streams/mo to 50 million unique users/mo, it transcodes 60K hours of video/mo and the company now has 70+ employees. Ooyala also said that 50% of its customers are marketers, and outside of the traditional media space. The company cited Electronic Arts, for which it powers video on 30 different properties, General Mills and Cerner. The non-media focus parallels what Brightcove recently told me, that over half its business now comes from non-media customers (e.g. business, government and education).

As I wrote recently, despite all the growth in the online video platform space, it's still relatively early days. To be in the top tier as the market matures will require providers to scale their operations, including international expansion and serving customers outside the core media market. It looks like Ooyala understands this as well.

What do you think? Post a comment now.

Categories: International, Partnerships, Technology

Topics: NTT SMARTCONNECT, Ooyala

-

Top Rental Data from Netflix is More Evidence that Warner Bros. Deal is a Win

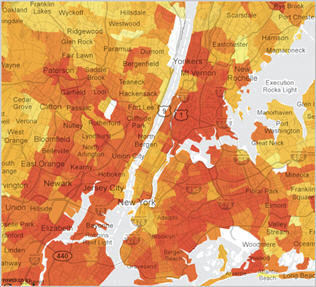

Following my 2 posts late last week (here and here) about how Netflix's new deal with Warner Bros is win for everyone, the NYTimes has posted a terrific interactive map showing the top rentals in 12 geographic areas of the U.S., sorted by zip code. The map is based on data that Netflix provided to the NYTimes. Playing around with the map, you'll quickly hunger for more details, but you'll also get a sense of the mountain of viewership data Netflix maintains on its 11 million+ subscribers. This data, when combined with the Netflix's algorithms for predicting its users' preferences, further demonstrates how valuable a deal like the one with WB could be for Netflix as it emphasizes streaming.

In the digital era, data is king because when used properly, it can dramatically improve the quality of the product delivered, in turn driving user satisfaction and profitability. Netflix has always used data very

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users.

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users. While a lot of attention was focused last week on the new 28-day "DVD window" which precludes Netflix from renting recently-released WB titles, I believe more attention should be paid instead to how effectively Netflix will be able to use its trove of data to selectively tap into WB's catalog of titles to boost its streaming selection. Using the data it has collected on physical rentals and search queries, for example, Netflix should be able to literally request title-by-title streaming rights from WB. That's not to say Netflix will necessarily receive access to those particular titles, but by being able to focus its requests, Netflix avoids wasting energy asking for things that are unlikely to have much appeal to its users.

It's interesting to talk to friends who are Netflix users, including those who don't work in technology-related industries. They have an amazingly high awareness and usage of Netflix's streaming and recognize that it represents the company's future. It's also obvious to them how meager the options are in Watch Instantly as compared with DVD and desperately want more choice. Netflix knows all this, as Netflix CEO Reed Hastings said last week, "our number one objective now is expanding the digital catalog." But Netflix is in a tight position to get new releases due to existing output deals that Hollywood studios maintain with HBO and other premium channels for electronic delivery. So, as with the WB deal, and others likely to follow, Netflix is trying to be clever about how it builds its streaming catalog by tapping into older, but still valuable titles.

It's unclear whether Netflix will conclude similar deals with other Hollywood studios. If it can't then the above-described benefits will be limited. In fact, as a couple of people pointed out to me last week, with Hollywood also highly dependent on cable, it's not readily apparent that helping Netflix build its streaming selection is actually in their interest as TV Everywhere services continue to roll out. WB is actually an interesting example; on the one hand, Time Warner's CEO Jeff Bewkes has been the strongest proponent of TV Everywhere, but on the other hand, WB's deal with Netflix creates more competition for it. In short, Hollywood will have its hands full trying to recast its distribution strategy in the digital era.

DVDs are not going away overnight, but the user data Netflix has will be an enormously valuable tool in helping transition its business to digital delivery and add more value to its subscribers. As long as Netflix complies with its users' privacy expectations, that gives it a big strategic advantage.

What do you think? Post a comment now.

Categories: Aggregators, Studios

Topics: Netflix, Warner Bros.

-

Recapping 2010 CES Video-Related News

The 2010 Consumer Electronics Show (CES) is now behind us. There were tons of announcements to come out of this year's show, including many in the online and mobile video areas. Increasingly a core focus of new devices is how to playback online and mobile-delivered video, how to move it around the consumer's house and how to make it portable. Following is a filtered list of the product announcements (or pertinent media coverage if no release was available) that I found noteworthy. They are listed in no particular order and I'm sure I've missed some important ones - if so, please add a comment with the relevant link.

Boxee box internals revealed. NVIDIA Tegra 2 FTW

Syabas Announces Popbox for Big Screen Everything

Sling Media Announces Support for Adobe Flash Platform in Hardware and Software Products

LG Electronics Expands Access to Content-on-Demand with New High-Performance Blu-ray Disc Players

ESPN 3D to show soccer, football, more

TV Makers ready to test depths of market for 3D

DirecTV is the First TV Provider to Launch 3D

DISH Network Introduces TV Everywhere

Microsoft Unites Software and Cloud Services to Power New TV Experiences

FLO TV and mophie to Bring Live Mobile TV to the Apple iPhone and iPod Touch

Broadcom Drives the Transition to Connected Consumer Electronics at 2010 International CES

New NVIDIA Tegra Processor Powers the Tablet Revolution

Digital Entertainment Content Ecosystem (DECE) Announces Key Milestones

Disney offers KeyChest, but where is the KeyMaster?

DivX Launches New Internet TV Platform to Redefine the Future of Entertainment

Blockbuster, ActiveVideo Announce Agreement for Cloud-based Online Navigation

Skype Ushers in New Era in Face-to-Face Online Video Communication

Aside from CES, but also noteworthy last week:

Apple Acquires Quattro Wireless

AT&T Adds Android, Palm to Its Lineup

Tremor Media Launches New Video Ad Products That Enhance Consumer Choice and Engagement

Categories: 3D, Advertising, Aggregators, Cable Networks, Devices, FIlms, Mobile Video, Satellite, Telcos

Topics: CES

-

4 Items Worth Noting for the Jan 4th Week (Netflix-WB Continued, comScore Nov. '09 stats, TV Everywhere, 3D at CES)

Following are 4 items worth noting for the Jan 4th week:

1. TechCrunch disagrees with my Netflix-Warner Bros. deal analysis - In "Netflix Stabs Us In The Heart So Hollywood Can Drink Our Blood," (great title btw) MG Siegler at the influential blog TechCrunch excerpts part of my post from yesterday, and takes the consumer's point of view, decrying the new 28 day "DVD window" that Netflix has agreed to in its Warner Bros deal. Siegler's main objection is that "Hollywood thinks that with this new 28-day DVD window deal, the masses are going to rush out and buy DVDs in droves again." Instead, Siegler believes the deal hurts consumers and is going to touch off new, widespread piracy.

I think Siegler is wrong on both counts, and many of TechCrunch's readers commenting on the post do as well. First, nobody in Hollywood believes DVD sales are going to spike because of deals like this. However, they do believe that any little bit that can be done to preserve the appeal of DVD's initial sale window can only help DVD sales which are critical to Hollywood's economics. Everyone knows DVD is a dying business; the new window is intended to help it die more gracefully. And because new releases are not that critical to many Netflix users anyway, Netflix has in reality given up little, but presumably gotten a lot, with improved access for streaming and lower DVD purchase prices.

The argument about new, widespread piracy by Netflix users is specious. With or without the 28 day window, there will always be some people who don't respect copyright and think stealing is acceptable. But Netflix isn't running its business with pirates as their top priority. With 11 million subscribers and growing, Netflix is a mainstream-oriented business, and the vast majority of its users are not going to pirate movies - both because they don't know how to (and don't want to learn) and because they think it's wrong. Netflix knows this and is making a calculated long-term bet (correctly in my opinion) that enhancing its streaming catalog is priority #1.

2. comScore's November numbers show continued video growth - Not to be overlooked in all the CES-related news this week was comScore's report of November '09 online video usage, which set new records. Key highlights: total video viewed were almost 31 billion (double Jan '09's total of 14.8 billion), number of videos viewed/average viewer was 182 (up 80% from Jan '09's 101) and minutes watched/mo were approximately 740 (more than double Jan '09's total of 356).

Notably, with 12.2 billion views, YouTube's Nov '09 market share of 39.4% grew vs. its October share of 37.7%. As I've previously pointed out, YouTube has demonstrated amazingly consistent market dominance, with its share hovering around 40% since March '08. Hulu also notched another record month, with 924 million streams, putting it in 2nd place (albeit distantly) to YouTube. Still, Hulu had a blowout year, nearly quadrupling its viewership (up from Jan '09's 250 million views). But with 44 million visitors, Hulu's traffic was pretty close to March '09's 41.6 million. In '10 I'm looking to see what Hulu's going to do to break out of the 40-45 million users/mo band it was in for much of '09.

3. Consumer groups protest TV Everywhere, but their arguments ring hollow - I was intrigued by a joint letter that 4 consumer advocacy groups sent to the Justice Department on Monday, urging it to investigate "potentially unlawful conduct by MVPDs (Multichannel Video Programming Distributors) offering TV Everywhere services." The letter asserts that MVPDs may have colluded in violation of antitrust laws.

I'm not a lawyer and so I'm in no position to judge whether any actions alleged to have taken place by MVPDs violated any antitrust laws. Regardless though, the letter from these groups demonstrates that they are missing a fundamental benefit of TV Everywhere - to provide online access to cable TV programming that has not been available to date because there hasn't been an economical model for doing so. In the eyes of people who think that making money is evil, the TV Everywhere model of requiring consumers to first subscribe to a multichannel video service seems anti-consumer and anti-competitive. But to people trying to make a living creating quality TV programming, the preservation of a highly functional business model is essential.

These advocacy groups need to remember that consumers have a choice; if they don't value cable's programming enough to pay for it, then they can instead just watch free broadcast programs.

4. 3D is the rage at CES - I'll be doing a CES recap on Monday, but one of the key themes of the show has been 3D. There were two big announcements of new 3D channels, from ESPN and Discovery/Sony/IMAX. LG, Panasonic, Samsung and Sony announced new 3D TVs. And DirecTV announced that it would launch 3 new 3D channels by June 2010, with Panasonic as the presenting sponsor. 3D sets will be an expensive proposition for consumers for some time, but prices will of course come down over time.

Something that I wonder about is what impact will 3D have on online and mobile video? Will this spur innovation in computer monitors so that the 3D experience can be experienced online as well? And how about mobile - will we soon be slipping on 3D glasses while looking at our iPhones and Android phones? It may seem like a ridiculous idea, but it's not out of the realm of possibility.

Enjoy your weekend!

Categories: 3D, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms, Studios

Topics: 3D, comScore, Netflix, TV Everywhere, Warner Bros.