-

ABC Unveils "The VIEWer's Choice," Powered by Gotuit

Late yesterday, ABC unveiled "The VIEWer's Choice" an online library of video clips of every single topic, co-host, guest and segment from the popular daytime talk show "The View." Clips can be searched, and are also organized by playlist topics such as Celebs & Entertainment, Sex & Relationships, Mom's View, etc.

For fans of The View, the clips offer unparalleled access to the show's most memorable moments, which can also be shared easily through a dozen social media sites. For example, here you can see last Friday's episode featuring guest Melissa Etheridge. I played around with it a bit and was quickly able to find all the relevant clips with Tiger Woods and discussions about American Idol.

The VIEWer's Choice is powered by Gotuit Media Corp, a company I've written about in the past. Producers use Gotuit's Video Metadata Management System to set up the "virtual clips" from the source broadcast, based on time-based metadata. The metadata is used to both categorize the video clips into the playlists, to power search and to define ad inventory. Gotuit is used in other key sites like NBA.com's "Inside the NBA," ESPN's "Pardon the Interruption" and SI's "The Dan Patrick Show."

Almost 2 years ago I wrote a post "Non-Linear Presentation + Long-form Premium Video = Big Opportunity," in which I explained how deconstructing full-length programs into searchable clips offers big opportunities to drive fan engagement and new ad inventory. With the explosion of social media like Twitter and Facebook since, the opportunity to leverage clips to promote specific moments in programs is even higher now. Looking around the web though, I'm still surprised at how many full-length programs don't take advantage of this. As "The VIEWer's Choice" demonstrates, talk shows, news and sports programming are probably the most natural fit.

Engagement is the big idea behind The VIEWer's Choice; it is exactly the kind of initiative that bridges broadcast to the Internet, where more interactivity, choice and personalization are expected. As a side-note, I think it picks up nicely on what Martin Nisenholtz, SVP of The NYT's digital operations said in a recent speech at Wharton: "we've begun to view (engagement) as the essential moat around which our defenses are based; it is the emotional connection that our users have with us."

I think that point is right on the money - since Internet users are always just 1 quick click from moving on, the need to immerse them in the content experience is stronger than ever. The traditional metrics of ratings points, circulation, box office gross, etc will still be important, but going forward, measuring how solid the bonds are with audiences and users will become a key new currency when measuring a brand's value.

What do you think? Post a comment now (no sign-in required)

(Note - we'll be talking in-depth about engagement at the VideoSchmooze breakfast in LA on June 15th, where our topic is "How Hollywood Succeeds in the Digital Distribution Era." Among our panelists will be Albert Cheng, EVP of Digital Media at Disney/ABC Television and Ben Weinberger, CEO and co-founder of Digitalsmiths which is powering metadata creation and management for many studios. Please join us - early bird discounted registration is now available).Categories: Broadcasters, Technology

-

12 Questions for Akamai President and CEO Paul Sagan

Last week, Akamai Technologies reported a very strong first quarter of 2010, with revenue of $240 million, up 14% year-over-year, and net income of $40.9 million, up 10% year-over-year. The company pointed to 3 main drivers of its accelerated growth: developments in cloud computing, video distribution over the Internet and online advertising. To learn more about what Akamai is seeing specifically among its media & entertainment (M&E) customers and in online video, late last week I spoke to company president and CEO Paul Sagan. Following is an edited transcript of our call.

$40.9 million, up 10% year-over-year. The company pointed to 3 main drivers of its accelerated growth: developments in cloud computing, video distribution over the Internet and online advertising. To learn more about what Akamai is seeing specifically among its media & entertainment (M&E) customers and in online video, late last week I spoke to company president and CEO Paul Sagan. Following is an edited transcript of our call.

VideoNuze: Akamai just reported a very strong Q1, which as you explained on the earnings call, included accelerated growth in the company's large M&E business. What are the key trends Akamai is seeing from its M&E customers?

Paul Sagan: The most important thing M&E customers are focused on is how they can build a sustainable business online. For video it's all about engagement - how to get people to stay longer and make the model work. We believe the big driver of that is quality and more specifically HD. A number of recent things have happened that help HD - first is pervasive and consistently strong broadband in the last mile. Second is variable bit rate streaming. Third are all he new convergence devices connecting broadband to the TV. The key for customers is trying to get TV-like quality with interactivity. Just broadcasting an HD signal over the Internet isn't enough because TV works well already. It's the interactivity - things like multiple camera angles and instant DVR - that make the difference.

VN: You said on the earnings call that HD is driving double or higher engagement by viewers. That's an impressive data point.

PS: Yes, with live events where you can do a true A/B test - we're seeing roughly double the viewing time when delivering at 1-2 MB or higher. That's offering a big potential lift in time spent viewing for our customers.

VN: Does that mean Akamai's M&E customers using HD are also doubling their revenue as a result?

PW: I'm not sure they're doubling just yet, but HD delivery is making content into something that can be monetized more strongly - possibly through sponsorships as well as advertising and paid models. So it's not as simple as saying you sell double the number of banners. What HD also does is push people toward longer-form. An issue with some of the shorter-form content like 2-3 minute clips is that you just can't put that many ads in or it will be worse than TV for users. I'm not suggesting we should see 8 minutes of ads in a 30 minute show, but you can certainly do more.

VN: Speaking of business models for high-quality video - what do you hear from your customers as the emerging standard - ads, paid or a mix of both?

PS: It's a mix - some ad-supported, some per event payments or subscriptions, particularly with sports. Some movies will be more subscription-oriented. Online delivery and HD are unlocking a few different models, yet it's still early days for all models. Clearly some have struggled to date which is no surprise when you consider it's taken 15 years to get online viewing to just a 1% share - which is obviously pretty small. But given everything that's going on, I'm sure it won't take 15 more years to double again.

VN: On the customer front, Akamai is announcing Magnify.net as a new customer this morning, which has an interesting "video curation" model. Can you say more about how these kinds of non-traditional distribution models like Magnify's fit into the online video landscape?

PS: What we're seeing across a wide number of sites is a strong desire to add rich media. We're also seeing sites think about programming in a non-traditional way. The goal is how to keep the user experience compelling. That means adding audio and video when users expect it. That in turn drives higher engagement and monetization. We've evolved from a time when there was a "priesthood of 3 networks" who produced video and nobody else could, to today when there are lots of ways to produce video - including millions of hours of UGC. The curated model is so important because it helps sites get relevant content.

VN: How mature is the idea of curating online video from the web and non-traditional distribution models generally?

PS: Well, I haven't even figured out the etymology of "curation" - in the old days we used to call it "editing." But that was about journalistic sites. Many of today's sites are not purely "journalistic." So the video added isn't always "news," though it still has to be highly relevant. For example, biking video belongs on biking sites, not on hockey or baseball ones. How do we make those sites more compelling through video? That's what curation does. And Magnify's trying to make that easy. I've know (Magnify CEO) Steve Rosenbaum for 20 years and I'm thrilled that they appreciate how Akamai's quality, scale and reliability can be central to delivering the experience they want to achieve.

VN: Shifting topics to CDN pricing, which is of course widely discussed. Can you say more about Akamai's approach to pricing for its M&E customers - on balance, does Akamai try to keep prices stable or is it continually trying to push them down?

PS: I've gotten a question about CDN pricing every day for the 12 years that I've been here! My view in general is that unit prices in technology always come down and in this area they need to come down a lot because we're trying to enable our customers to deliver a lot more data. So we've been relentlessly driving the unit price of delivery down for years. For us it's not about keeping prices stable and reducing our costs solely for our own benefit. Rather, we've been driving the unit costs down every year and sharing that savings proportionately with our customers. That's worked out well in generating more traffic on our network every year. We plan to continue doing that because it creates a virtuous circle of ever-more traffic and reduced costs.

Categories: CDNs

Topics: Akamai, Magnify.net

-

Mark Your Calendars: VideoSchmooze Goes to LA for June 15th Breakfast

We had a huge crowd at this past Monday night's VideoSchmooze in NYC who were treated to an in-depth discussion about whether online video is shifting to the paid model, as well as a high-energy hour and half of networking and drinks.

With the NYC event behind us, I'm very pleased to unveil the first West Coast VideoSchmooze event - a breakfast in LA on June 15th at the ultra luxurious SLS Hotel at Beverly Hills. We have an incredible group of executives who will discuss "How Hollywood Succeeds in the Digital Distribution Era:"

VideoSchmooze event - a breakfast in LA on June 15th at the ultra luxurious SLS Hotel at Beverly Hills. We have an incredible group of executives who will discuss "How Hollywood Succeeds in the Digital Distribution Era:"- Darcy Antonellis - President, Technology Operations, Warner Bros. Home Entertainment

- Albert Cheng - EVP, Digital Media, Disney/ABC Television Group

- Gannon Hall - Chief Operating Officer, Kyte

- Ted Sarandos - Chief Content Officer, Netflix

- Ben Weinberger - CEO and Co-Founder, Digitalsmiths

Darcy, Albert and Ted are all key leaders driving the digital agenda at their respective companies. Among other things, Warner Bros. has led on day-and-date VOD distribution. Disney/ABC has been the most innovative of the broadcast TV networks in pursuing digital outlets, going back to their original iTunes deal. And of course Netflix, which I've written about often, has completely reinvented its model with Watch Instantly streaming. Meanwhile Ben's and Gannon's companies (which are co-lead sponsors of the breakfast), are each providing digital building block technologies to the industry and have in-depth knowledge of Hollywood's requirements and strategies.

For anyone in or around the Hollywood ecosystem, this is a must-attend breakfast, with ample time for networking included. I look forward to seeing you there!

Click here to learn more and register for early bird discount

Categories: Events

Topics: VideoSchmooze

-

Jobs on Flash - There's No Turning Back Now

Definitely make time to read Steve Jobs's blog post from yesterday, "Thoughts on Flash" - no doubt you'll conclude as I did that there's no turning back in this battle. Over the past few weeks the war of words between Adobe and Apple over the latter's lack of Flash support in iPhones, iPods and iPads has flared to new levels. Now Jobs's new post kicks things up another notch. Jobs's argument is mostly a technical/product one - "open" vs. "closed" systems, reliability, performance, security, battery life, touch attributes, etc. (Adobe posted a short response here)

But Jobs's last point is clearly the most important, as he acknowledges. Apple wants to control its own destiny to provide the best products possible and doing so requires eliminating any dependency on 3rd party tools. Lack of dependency on others is a hallmark of Apple's model more generally, but when it comes to the Flash war, the number of penalties Apple is imposing due to its uncompromising position is pretty remarkable: users' inability to view video at some of the web's most popular sites like Hulu, forcing these sites to offer their video in HTML5, marginalizing smaller content providers that don't have the resources to make the change, etc.

However, Apple's products are loved and only Jobs would have the single-mindedness and guts to force a pretty wrenching change in the video ecosystem. Until we see Android or other smartphones emerge as a counter-weight to the iPhone's hegemony, Adobe's role in video is bound to wane.

What do you think? Post a comment now (no sign-in required).Categories: Devices, Technology

-

Learning Best Practices in Video at Akamai Webinar

Earlier this week, while in NYC for VideoSchmooze, Akamai organized a first-class video webinar, "Constructing the Ultimate Online Video Experience, from the Inside Out" which included the following panelists:- Karsten Weide - VP, Digital Media & Entertainment, IDC

- Glenn Goldstein - VP, Media Technology Strategy, MTV Networks Digital Media

- Eric Black - Project Manager, NBCSports.com

- Emil Rensing - Chief Digital Officer, Epix

We had a very detailed discussion around topics like adaptive bit rate delivery, HD, formats, business models, live vs. on-demand, encoding strategies, consumer behaviors, etc. This group is on the front lines of making the online video experience work for their customers and there are a ton of really valuable points made. The webinar is free and the video quality is gorgeous (no surprise!).

Categories: Events

Topics: Akamai

-

VideoNuze Report Podcast #59 - April 30, 2010

Daisy Whitney and I are pleased to present the 59th edition of the VideoNuze Report podcast, for April 30, 2010.

In today's podcast Daisy and I discuss Tremor Media's new $40 million round led by DFJ Growth, announced earlier this week, and about broader investment trends in the online video and advanced advertising space. As I wrote a few weeks ago, money continues to pour into online video companies, and in today's podcast we talk about the key reasons why. Listen in to learn more!

Click here to listen to the podcast (13 minutes, 13 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Advertising, Deals & Financings, Podcasts

Topics: Podcast, Tremor Media

-

Online Video Viewing Rebounds in March According to comScore; Hulu Performance is Mixed

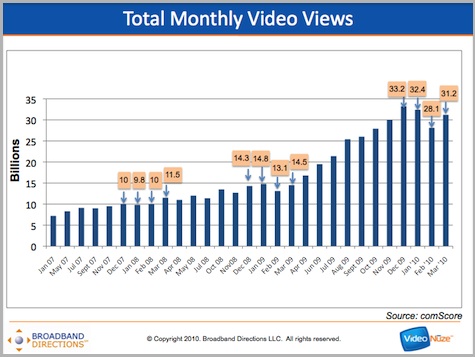

Online video viewing rebounded to 31.2 billion total streams in March '10 according to comScore's newly-released numbers. The March total marks an 11% increase in streams over February's 28.1 billion. As I wrote a couple of weeks ago, it also continues a leveling-dipping-rebounding pattern that has occurred in the Dec-Mar months for the last 2 years as shown in the chart below. If the pattern holds, we'll see strong growth for the next 6 months or so.

As always, YouTube was the top video site by a wide margin. In March it notched 13.1 billion views, up 10% vs. February's 11.9 billion. Its share was down just slightly to 41.8% from February's 42.5%. Still, it was the 21st consecutive month that YouTube's share has been plus or minus 2-3 percentage points of 40%, a remarkable run.

Hulu also bounced back strongly in March, recording its best month to date with 1.070 billion streams, up 7.5% vs. February's 912.5 million. But with Hulu viewers averaging 156 minutes, the minutes per viewer in March actually slipped to 5.84 from 6.18 in Feb. Hulu's average minutes has stayed stubbornly around 6 minutes for over a year now. In addition, total unique viewers came in at just over 40 million. As I've pointed out in the past, Hulu's viewership has been stuck around the 40 million mark now for a year. Absent a radical change, it seems that neither one of these metrics will break out of their respective range any time soon.

Lastly, on the ad network site, Tremor Media, which earlier this week announced a $40 million financing, saw its reach increase to 96 million viewers.

What do you think? Post a comment now (no sign-in required).Categories:

Topics: comScore, Hulu, YouTube

-

Comcast and Netflix in the Context of Cord-Cutting

There's likely no hotter debate in the online video world right now than how big "cord-cutting" - the concept of consumers dropping their pay TV service in favor of online-only options - might be in the future. To the extent that cord-cutting or "cord-shaving" trends develop (and despite some recent research findings, these are still highly uncertain), no company is in a better position to both drive and benefit from them than Netflix.

Netflix cannot be considered a pure substitute for today's pay TV services for many reasons, primarily because there's no live or sports programming, and also because it offers just a fraction of what's available on TV. However, Netflix can be considered a key building block for consumers motivated to cobble together multiple sources to meet their video needs (for example, viewers can augment Netflix with Hulu/YouTube, over the air antenna, iTunes/Amazon downloads, out-of-home viewing, etc.). This is the more likely scenario for would-be cord-cutters than a one-for-one replacement of current pay TV services.

considered a key building block for consumers motivated to cobble together multiple sources to meet their video needs (for example, viewers can augment Netflix with Hulu/YouTube, over the air antenna, iTunes/Amazon downloads, out-of-home viewing, etc.). This is the more likely scenario for would-be cord-cutters than a one-for-one replacement of current pay TV services.

If cord-cutting or cord-shaving did take off, then Comcast, with the largest number of video subscribers of any pay TV provider, would likely be hurt the most (though as the largest broadband ISP, it could actually benefit on that side of its business as users upgrade for more bandwidth).

In this context, and with both companies reporting their Q1 '10 earnings in the past week, it's interesting to look at their performance to consider what to expect going forward.

The natural place to start the comparison is purely the number of video subscribers each company has. Netflix has been on a tear, more than doubling the number of its paying subscribers from just under 7 million in Q1 '07 to just under 14 million in Q1 '10. The biggest chunk of that growth has come in the last 2 quarters alone, when Netflix has added 2.9 million subscribers. Conversely, in that same 3 year time period, Comcast has lost approximately 1.5 million video subscribers to end Q1 '10 at 23.5 million. At the current rates, Netflix could have approximately as many subscribers as Comcast by end of next year.

However, the companies' subscribers are very different. On the one hand, Netflix is seeing its strongest growth in its least expensive $8.99/mo tier, which is a compelling value since it also allows unlimited streaming. Netflix is using this tier to entice many new subscribers and also to defend itself against $1 DVD rental competition from Redbox. As a result its average revenue per subscriber is declining. On the other hand, Comcast has been steadily increasing the penetration of additional services its subscribers take, primarily through "triple play" bundling of video with voice and broadband Internet access. This is reflected in the growth of its average revenue per video subscriber from $107.20 in Q1 '08 to almost $123 in Q1 '10. This, plus other lines of business like advertising, business services and its own programming networks contributes to Comcast generating $9.2 billion in revenue in Q1 '10 compared with Netflix's $494 million.

The flip side of Comcast's drive to increase its ARPU is that it potentially opens up higher cord-cutting interest. Some subscribers who open their billing statements to see a monthly tab in the $200 or more range when premium channels, DVRs, additional set-top boxes, VOD purchases and the like are all added up are inevitably going to get "sticker shock" and start asking the question how much value do they get from their cable subscription? While the cable industry has always made a strong argument that the sheer volume of programming available each month makes it a great subscription value, my sense is that with the massive number of alternative viewing options consumers are now accessing, it's not pure volume that matters, but rather actual cable use, in particular relative to other options.

billing statements to see a monthly tab in the $200 or more range when premium channels, DVRs, additional set-top boxes, VOD purchases and the like are all added up are inevitably going to get "sticker shock" and start asking the question how much value do they get from their cable subscription? While the cable industry has always made a strong argument that the sheer volume of programming available each month makes it a great subscription value, my sense is that with the massive number of alternative viewing options consumers are now accessing, it's not pure volume that matters, but rather actual cable use, in particular relative to other options.

For example, consider a home with a couple of teenagers who rarely watch live TV any more and instead spend a lot of their free time on Facebook, YouTube, Hulu, etc. Say Dad is only a light sports fan and doesn't consider ESPN or Fox Sports essential, and has long since moved the bulk of his news consumption to online sources. He loves Jon Stewart, but is content to catch his jokes online the next day when he has a few minutes of downtime at work. He also loves some of the broadcast network shows, but can watch them sporadically on Hulu. Mom is into the shows on HBO, plus some favorites on ad-supported cable channels like USA, Bravo and Food Network. Still, she's been having less time lately to actually watch these recently and has also started to gravitate to back seasons that are now available on Netflix. Since the family's Nintendo/Blu-ray player/Roku allows streaming to the TV, it's as simple as cable to use. Net it all out and the family's cable usage has declined markedly in the last couple of years.

Does this example sound familiar to you? I believe this is the kind of situation where cord-cutting or cord-shaving starts to gain some interest. Families faced with the real opportunity to save a few bucks each month, though with clearly reduced program options and convenience, will have decisions to make in the coming years. How they make them and how Comcast, Netflix and others react will have huge implications on their performance.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Cable TV Operators