-

Zipidee Buys TotalVid; Guns for Long Tail Video Dominance

This morning Zipidee, a company formed earlier this year, is announcing its acquisition of TotalVid from

Landmark Communications. With the deal Zipidee is gunning to become the king of the long tail, enthusiast video, using a strictly paid model. Yesterday I spoke with Zipidee CEO Henry Wong, and TotalVid President Karl Quist about the deal and the opportunity going forward.

Landmark Communications. With the deal Zipidee is gunning to become the king of the long tail, enthusiast video, using a strictly paid model. Yesterday I spoke with Zipidee CEO Henry Wong, and TotalVid President Karl Quist about the deal and the opportunity going forward.  Zipidee's strategy is to create a digital marketplace for video, audio and ebooks. As Henry puts it, we're "eBay meets iTunes", enabling content providers to set the business rules around how their content can be accessed. Like TotalVid, Zipidee's intent is to open up the broadband distribution market to the many smaller, independent producers who have traditionally relied on inefficient and hard-to-access DVD distribution channels.

Zipidee's strategy is to create a digital marketplace for video, audio and ebooks. As Henry puts it, we're "eBay meets iTunes", enabling content providers to set the business rules around how their content can be accessed. Like TotalVid, Zipidee's intent is to open up the broadband distribution market to the many smaller, independent producers who have traditionally relied on inefficient and hard-to-access DVD distribution channels. I am very familiar with TotalVid, having worked as a part-time biz dev consultant for them for a while, helping pull together a number of distribution deals. TotalVid started up in the relatively early days of broadband video, almost 4 years ago. Karl and his team did a fabulous job gaining access to specialty video in tons of categories such as action sports, martial arts, instruction, etc, eventually aggregating over 500 different content providers providing over 5,500 different titles. This library is very complimentary to Zipidee, which itself has done hundreds of content deals aggregating a library of over 5,000 titles. As Henry explained it, there is virtually zero duplication.

Henry resolutely believes that the paid approach for accessing this type of longer-form, specialty content is preferable to ad-supported. In general I agree with him - this kind of stuff isn't just random low-quality clips and consumers should expect that it won't come free.

However, as many VideoNuze readers know, I believe there are real challenges succeeding with the paid model right now. Chief among them is that the Internet is awash with free video, continuously raising the bar for how to get users to crack open their wallets and pay for anything, no matter how useful or sought after it might be. So this leads to a real marketing and customer acquisition challenge. Meanwhile DVD is a robust format and few people are yet familiar or comfortable with how a paid download works (e.g. is it portable? how does it get moved to other machines, can it be watched on TV?) So there's a big customer education challenge.

Nonetheless, I'm rooting for Zipidee. If they can surmount these and other challenges, they'll have created a hugely valuable digital distribution franchise.

Categories: Aggregators, Deals & Financings, Downloads, Startups

Topics: Landmark Communications, TotalVid, Zipidee

-

Building B Has Cable and Satellite in its Crosshairs

Building B is major league stealthy company with an audacious vision for how consumers will access video content in the future. If it succeeds current multichannel video service providers (namely cable and satellite providers) will feel the brunt.

Building B has a blue chip executive team and pantheon of accomplished investors and advisors. It made headlines a few months ago when it announced a $17.5M funding round led by Morgenthaler Ventures, OmniCapital and Index Ventures.

Last week I had a briefing with Buno Pati, CEO/Co-founder and Phil Wiser (Chairman/President/Co-founder). They are both highly-experienced and successful technology executives who are also quite PR savvy. They know how to stay on message and close to their stealthy script. I needed to use my "virtual crowbar" persistently to try to pry a few new morsels of information out of them. From what I learned, it's a pretty cool story. Following is what I learned about what the company.

The company's plan rests on a number of key assumptions:- TV must be the center of the consumer video experience, and today's service must be redefined

- Access to broadcast content is critical for success

- On demand, high def is in, linear, standard def is out

- Open access to robust wireless networks will be prevalent

- Advertising will be key value driver in the future

- Price of storage is going to virtually zero;

Given all this, in Buno's words, "Building B's opportunity is to unify, simplify and deliver a video experience to consumers at a more palatable price." This simple sounding statement belies an excruciatingly tall order.

The company is creating a next generation set top box of sorts that will deliver the gamut of video: TV, movies and broadband. Buno and Phil don't see their box as comparable to ones from say Akimbo, Vudu or Apple TV. These are really broadband-only augments, whereas Building B aspires to be a full-on substitute for cable or satellite. Their box will be able to access content through both wired and wireless delivery infrastructures. One engineering challenge is to match content with the optimal delivery network. So for example, one-to-many broadcast networks might be delivered over wireless while niche and interactive content would use broadband.

But Building B doesn't see a model selling the box at retail (though Phil concedes this might be a secondary outlet). Others have tried and failed at retail. Rather, its go-to-market strategy contemplates partnering with service providers like telcos and ISPs which want or need to be in the video business, but don't have the stomach or cash to upgrade their networks to do so.

Building B plans to develop a video entertainment service offering incorporating its box which can be made available turnkey to partners. These partners could include smaller telcos, particularly in rural areas, which have traditionally stapled on a satellite offering to fill out their triple play bundle. Or they could be larger telcos like AT&T or Verizon, who might augment their fiber rollouts with Building B's approach. Or they could be broadband ISPs, portals and others who aspire to be in the video business.

A key hurdle for Building B is assembling a fully competitive video lineup to what today video providers offer. This is no easy feat. Cable programmers in particular are reluctant to make advantageous deals with new distributors for fear of antagonizing existing cable and satellite affiliates. Yet Buno feels confident that Building B will gain access to major cable networks' fare, on demand, and on deal terms that are both economic to the company and non-disruptive to these networks' current arrangements. Accomplishing these deals alone would be noteworthy.

Lastly, Building B envisions delivering a personalized and easy-to-access service. Buno speaks of having a "dumbed down approach" aimed at satisfying only primary consumer needs and routines. Given its emphasis on HD, this is the part of the Building B vision that must necessitate a colossal hard drive in the box to cache content for ready access. Indeed, Buno said the company is "betting heavily that the price of storage is going to zero." If this assumption is off the bill of materials on storage alone could bust the box's budget.

Listening to Building B's vision, it's hard not to get enthusiastic about the world it seeks to create. As a consumer it would be thrilling. Yet the technology landscape is littered with ambitious would-be contenders whose aspirations foundered when faced with real-world engineering, marketing and business model challenges. Building B is simultaneously climbing tall mountains in multiple directions. If it succeeds, it will become a big-time disruptor of today's business models. It's going to be fun to watch it try.

Categories: Cable Networks, Cable TV Operators, Devices, Startups, Technology

Topics: Building B, Index Ventures, Morgenthaler Ventures, OmniCapital

-

ClipBlast 3.0 Beta Released; Further Video Search Improvements

Next week ClipBlast, a player in video search space, will announce that is has launched a beta of its 3.0 product. It's actually now live and I've had a chance to play around with it for the last couple of days. I also got a briefing and demo when I met up with Gary Baker, ClipBlast's CEO, at Digital Hollywood a few weeks ago.

Video search has been a murky, yet fast-evolving area. You have to get way down into the weeds to fully understand the nuances, but here is the gist. First, video isn't nearly as searchable as text is. Video search primarily relies on metadata, which describes what's inside the video itself. This metadata can be created by the content provider or by the video search engine itself using techniques like speech-to-text processing. A key challenge for video search engines has been returning results in which the context matches what the user was intending. This is no easy feat, as the same word can obviously be used in many different contexts, yielding lots of useless results.

ClipBlast's 3.0 beta is crawling 10,000 different video providers now and they've continued to make many enhancements to their metadata processing. They've also done a lot of work to improve user navigation so that browsing is a viable complement to search. (This gets to how users actually interact with video search engines, which is yet another issue in the video search world). ClipBlast now places all videos into 70 different categories, which have easy scrolling thumbnails, showcases featured clips and featured partners and today's most popular searches.

ClipBlast has also introduced more personalization features such as saving providers, categories, searches and results. You can also configure your own personal home page and set email alerts for when new video matching your search criteria. Perhaps most fun is a new widget feature, allowing ClipBlast widgets to be embedded on your desktop and blog with customized video. Gary demo'd this for me and it's quite cool. It's only available for Macs right now with a PC release coming soon.

I'm planning a deeper dive into video search in December and will have more detailed analysis on the category then. In the mean time I suggest the best way to get into it and evaluate which video search engine is best for you is to run the same search across some of the more popular video search engines. A good list would include: Truveo (now owned by AOL), Google (still officially in "beta"), blinkx, SearchForVideo, EveryZing, Dabble, Pixsy, Fooooo and others I'm sure I'm missing.

I'm interested in what you find, so please post a comment or email me.

Categories: Video Search

Topics: AOL, Blinkx, Dabble, EveryZing, Fooooo, Google, Pixsy, SearchForVideo, Truveo

-

How to Monetize a Video Archive? XONtv and Gotuit Show the Way.

I'm very jazzed about an initiative being announced this morning by XONtv.tv and Gotuit Media Corp available at http://www.xontv.tv/(Xtreme Outdoor Network, a broadband programmer).

If you're sitting on a video archive and looking to monetize it more fully with an immersive broadband user experience, it's well worth checking out.

I have been very bullish on broadband's ability to create libraries of searchable segments carved out of longer-form programming. That's one of the reasons I was excited about Comedy Central's recent launch of TheDailyShow.com, which is packed with 19,000 clips from all of the show's episodes. However, Comedy Central 'fessed up that it took a team of 16 working double shifts over many months to create the site's clip library. This labor intensity shows that monetizing an archive has been a non-trivial pursuit.

And that's where Gotuit's solution comes in. Yesterday I got an update from Patrick Donovan, their VP of Marketing, about the XONtv deal.

First, to understand Gotuit (to which I am a minor advisor), the company has created an indexing work flow platform that allows entry-level staffers to quickly churn out clips using metadata guidelines developed by the specific content provider. Each segment has a title, a text description, a series of customizable preset attributes (or tags), thumbnails and time-code start/stop points.

One thing that's critical to understand is that Gotuit-powered clips are really "virtual clips." When a user accesses a clip, the Gotuit platform is making an XML call to the CDN to begin streaming from the original video file at the time-code starting point. So no new tangible clip asset has actually been created in the Gotuit workflow. That means that unlike TheDailyShow.com, which now has 19,000 new assets to manage (likely created using standard video editing software), with Gotuit, there are new no "assets", just files with metadata descriptors. Needless to say, this approach drastically simplifies ongoing management, especially for content providers with vast libraries. By following the metadata guidelines, playlists can be created which allow multiple entry points into each video segment.

XOXtv partnered with Gotuit as a service provider, shipping Gotuit 300+ hours of XONtv's video programming. Gotuit took about 1 1/2 weeks to crank out all the clips. At the XONtv site you'll see 13 "channels", each of which is then sub-divided into programs, "episodes" and the segments themselves. All content is in the clear right now, soon XONtv will be pursuing a subscription-based business model.

Other benefits of the Gotuit approach include no buffering, full-screen option, embedding, bandwidth detection and sequential play-out. All of this means a more immersive experience, driving more viewership and value. On the monetization side, Gotuit has integrated with a number of broadband ad management/servers, and obviously offers rich targeting against specific segments otherwise unavailable. Alternatively, as XONtv intends, paid models are also supported.

Gotuit can work as a service bureau for the content provider or license the platform and let the content provider use their own resources to index their video. (I happen to believe this would be a perfect off-shore project, with the right training). In either service bureau or license model Gouit charges an ongoing platform fee plus usage fees tied usually tied to video consumption. Beyond XONtv, Gotuit has announced deals with Fox Reality, SI.com, NHL.com and others.

The XONtv implementation is a great reminder of how broadband enables deeper user engagement, business model flexibility and re-use opportunities never before possible. Wrap a robust social/community-building suite around this and the value proposition for content providers becomes even stronger.

Categories: Indie Video, Partnerships, Technology

Topics: Comedy Central, Gotuit, TheDailyShow.com, XONtv

-

Blockbuster Movies on Mobile Handsets? No Way.

A piece of news that emerged about Blockbuster courting mobile handset makers to make movies available strikes me as wrong-headed. And note this is from someone who's sometimes been accused of being insufficiently critical of even the most new-fangled video delivery concepts.

However, this idea stretches the mind too far. Watching a 2 hour movie on a mobile handset's tiny screen. How many people are going to be willing to do that? And to run their battery down for this pleasure? Not many is my guess. Not to mention that mobile content is all about short-form, bite-sized chunks. You know - you find yourselves with 5-10 minutes of downtime waiting for your plane, your kid or your coffee. So watch some news or sports clips. But a whole movie? Forget it.

These days people are so enthusiastic about broadband and mobile as opening up new market opportunities that they often focus too quickly on the technology-based, "Cool, we can really do this?" question, instead of the consumer-based, "Is there really a need to be filled?" question. My bet is that more of the latter and less of the former will lead to success. Hopefully Blockbuster will realize this soon and not waste too many cycles on this idea.

Categories: Aggregators, FIlms, Mobile Video

Topics: Blockbuster

-

Survey: Broadband To Lag TV in 2012. Forget It.

This piece in today's Hollywood Reporter about a newly-released survey ("Broadband Won't Overtake TV, Execs Say") caught my eye because it continues a highly speculative, and largely irrelevant debate pervasive throughout the industry about future video consumption patterns.

Why's the debate highly speculative? Because truly, none of us has any idea how people will consume video in 2012. There are just too many variables and too many unknowns to make an accurate prediction. Here's a point of comparison: let's say 5 years ago, in 2002, you were asked what percentage of Americans would consume broadband video in a given month? How many (or few!) of us would have predicted a whopping 75%? (the correct answer according to comScore in July '07). Better yet, how many of us would have guessed that over 25% of this consumption would be at just one site (YouTube) - a site that didn't even exist in 2002? Given these examples, who's to predict what 2012 will bring?

And why's the debate largely irrelevant? Because, in my opinion, it presupposes a continuation of the existing paradigm: an either/or choice of TV consumption OR broadband consumption. Yet these traditional lines of demarcation are already fading. Broadband programming is starting to migrate to networks, as in the recent case of Quarterlife's move from MySpace to NBC, while at the same time network TV programming is increasingly being consumed online. Meanwhile shorter form programming, not bound by traditional advertising pods is on the rise, further confusing industry definitions. Sites like Metacafe, blip.tv, Veoh and others are driving a whole new category of video that could eventually be a more popular format than 30 or 60 minute programs.

These days consumers themselves are driving this "broadband or TV" debate into irrelevance. They're busy accessing programming on demand - whether "broadband" or "TV" - through a host of devices and services whose popularity is only going to skyrocket in the future. These include TiVo, Xbox, Netflix, Amazon Unbox and many others. Yet traditional thinking is still pervasive. For example, just this week, the chairman of the FCC has attempted to enact new regulations governing how cable programming might be unbundled. Fortunately this initiative collapsed, but take heed, market forces will eventually cause cable operators to offer programming as consumers want it, not how tradition dictates.

I think Jim Denney, a TiVo product management VP whom I spoke with yesterday hit the nail on the head. Jim said TiVo's philosophy is to have their users "not worry about where any particular video's coming from, but rather just have all choices easily available." That strikes me as a winning business approach for the turbulent and converging 5 years that lie ahead. In my view, those companies which think about how to deliver value to consumers on their terms, rather than being guided by increasingly artificial distinctions, will be the ones to emerge as the winners in 2012.

Categories: Broadcasters

Topics: blip.TV, comScore, MetaCafe, MySpace, NBC, Veoh, YouTube

-

ExtendMedia Powers SanDisk Broadband Video Initiatives

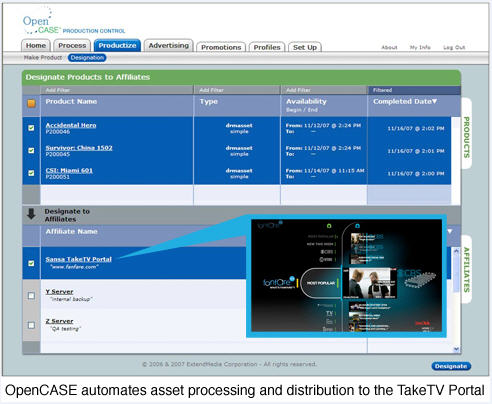

I recently caught up with Keith Kocho, founder of ExtendMedia to discuss how Extend is supporting SanDisk's recently announced Sansa TakeTV player and companion Fanfare application. In a recent review, I was impressed with SanDisk's approach, which is somewhat akin to the iPod-iTunes pairing. Extend (disclaimer, a VideoNuze sponsor) is playing a key behind-the-scenes role, which will become especially important as FanFare transitions from its current trial model to a hybrid ad-supported and paid download approach.

Keith explained that Extend's OpenCASE product is providing the ability for SanDisk to manage Fanfare's content catalog, create the business rules for each piece of content and deliver encryption depending on the rules. OpenCASE also allows SanDisk to bake ads into the video file as its currently doing, or dynamically insert them as SanDisk intends to do in the next phase.

The screen grab below illustrates how a piece of content uploaded to OpenCASE can be delivered into Fanfare with appropriate rules.

Kate Purmal, SanDisk's SVP/GM for Digital Content offered this perspective, "OpenCASE is seamless and flexible and has proven to be truly 'plug and play; with our encryption and DRM software with Extend's business rules layered on top. As we expand into our next phase with more content and commerce options, OpenCASE is going to be able to easily scale up with Fanfare."

I think Kate's latter point hits the nail on the head: in the future, for any of these digital video stores to succeed - whether they are tied to a device, as Take TV is to Fanfare, or they aren't - the digital video stores of the future are going to all offer hybrid approaches for consumer to access content.

The concept of an iTunes, which only offers an a la carte purchase/download model is going to quickly become antiquated. Instead consumers will be offered choices including a la carte downloads, ad-supported downloads, ad-supported streaming, ad-supported and paid subscriptions and more. This is one of the hallmarks of broadband - that it offers content providers and aggregators unlimited monetization flexibility depending on the circumstances and rights. As such, I think that platforms such as OpenCASE and others that can support flexible models are going to become increasingly valuable.

Categories: Devices, Technology

Topics: ExtendMedia, SanDisk

-

YouTube Used for Toy Safety Advocacy

YouTube's role in our lives just keeps expanding.

A little blurb I read in the newspaper lead me to this humorous/serious video created by a liberal group named Campaign for America's Future now posted at YouTube.

The video spoof shows Ken and Barbie hooking up in a bar and then talking by phone a week later. In that conversation, Barbie tells Ken that she's having some "symptoms", but the twist is they are not what you're expecting. She says she is suffering from lead poisoning.

The video then cut to messages focused on the importation of 2 million toys from China with toxic levels of lead paint, why our inspection regulations aren't sufficient and that Nancy Nord, Acting Chairman of the Consumer Product Safety Commission should be dumped.

Regardless of where you are on these questions, this little video again demonstrates how ingrained YouTube has become in our lives. It also illustrates how video is the most persuasive method for advocacy. How long will it be before producing videos for YouTube distribution is a standard part of any PR/advocacy campaign? Not very.

Categories: Video Sharing

Topics: YouTube