-

Online Video Viewing Rebounds in March According to comScore; Hulu Performance is Mixed

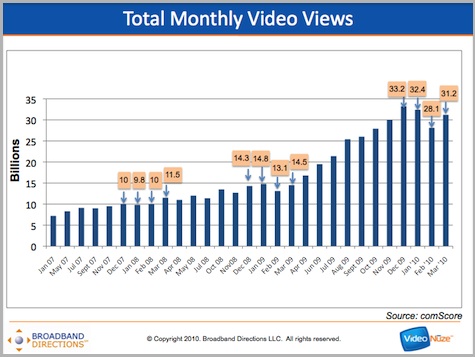

Online video viewing rebounded to 31.2 billion total streams in March '10 according to comScore's newly-released numbers. The March total marks an 11% increase in streams over February's 28.1 billion. As I wrote a couple of weeks ago, it also continues a leveling-dipping-rebounding pattern that has occurred in the Dec-Mar months for the last 2 years as shown in the chart below. If the pattern holds, we'll see strong growth for the next 6 months or so.

As always, YouTube was the top video site by a wide margin. In March it notched 13.1 billion views, up 10% vs. February's 11.9 billion. Its share was down just slightly to 41.8% from February's 42.5%. Still, it was the 21st consecutive month that YouTube's share has been plus or minus 2-3 percentage points of 40%, a remarkable run.

Hulu also bounced back strongly in March, recording its best month to date with 1.070 billion streams, up 7.5% vs. February's 912.5 million. But with Hulu viewers averaging 156 minutes, the minutes per viewer in March actually slipped to 5.84 from 6.18 in Feb. Hulu's average minutes has stayed stubbornly around 6 minutes for over a year now. In addition, total unique viewers came in at just over 40 million. As I've pointed out in the past, Hulu's viewership has been stuck around the 40 million mark now for a year. Absent a radical change, it seems that neither one of these metrics will break out of their respective range any time soon.

Lastly, on the ad network site, Tremor Media, which earlier this week announced a $40 million financing, saw its reach increase to 96 million viewers.

What do you think? Post a comment now (no sign-in required).Categories:

Topics: comScore, Hulu, YouTube

-

Comcast and Netflix in the Context of Cord-Cutting

There's likely no hotter debate in the online video world right now than how big "cord-cutting" - the concept of consumers dropping their pay TV service in favor of online-only options - might be in the future. To the extent that cord-cutting or "cord-shaving" trends develop (and despite some recent research findings, these are still highly uncertain), no company is in a better position to both drive and benefit from them than Netflix.

Netflix cannot be considered a pure substitute for today's pay TV services for many reasons, primarily because there's no live or sports programming, and also because it offers just a fraction of what's available on TV. However, Netflix can be considered a key building block for consumers motivated to cobble together multiple sources to meet their video needs (for example, viewers can augment Netflix with Hulu/YouTube, over the air antenna, iTunes/Amazon downloads, out-of-home viewing, etc.). This is the more likely scenario for would-be cord-cutters than a one-for-one replacement of current pay TV services.

considered a key building block for consumers motivated to cobble together multiple sources to meet their video needs (for example, viewers can augment Netflix with Hulu/YouTube, over the air antenna, iTunes/Amazon downloads, out-of-home viewing, etc.). This is the more likely scenario for would-be cord-cutters than a one-for-one replacement of current pay TV services.

If cord-cutting or cord-shaving did take off, then Comcast, with the largest number of video subscribers of any pay TV provider, would likely be hurt the most (though as the largest broadband ISP, it could actually benefit on that side of its business as users upgrade for more bandwidth).

In this context, and with both companies reporting their Q1 '10 earnings in the past week, it's interesting to look at their performance to consider what to expect going forward.

The natural place to start the comparison is purely the number of video subscribers each company has. Netflix has been on a tear, more than doubling the number of its paying subscribers from just under 7 million in Q1 '07 to just under 14 million in Q1 '10. The biggest chunk of that growth has come in the last 2 quarters alone, when Netflix has added 2.9 million subscribers. Conversely, in that same 3 year time period, Comcast has lost approximately 1.5 million video subscribers to end Q1 '10 at 23.5 million. At the current rates, Netflix could have approximately as many subscribers as Comcast by end of next year.

However, the companies' subscribers are very different. On the one hand, Netflix is seeing its strongest growth in its least expensive $8.99/mo tier, which is a compelling value since it also allows unlimited streaming. Netflix is using this tier to entice many new subscribers and also to defend itself against $1 DVD rental competition from Redbox. As a result its average revenue per subscriber is declining. On the other hand, Comcast has been steadily increasing the penetration of additional services its subscribers take, primarily through "triple play" bundling of video with voice and broadband Internet access. This is reflected in the growth of its average revenue per video subscriber from $107.20 in Q1 '08 to almost $123 in Q1 '10. This, plus other lines of business like advertising, business services and its own programming networks contributes to Comcast generating $9.2 billion in revenue in Q1 '10 compared with Netflix's $494 million.

The flip side of Comcast's drive to increase its ARPU is that it potentially opens up higher cord-cutting interest. Some subscribers who open their billing statements to see a monthly tab in the $200 or more range when premium channels, DVRs, additional set-top boxes, VOD purchases and the like are all added up are inevitably going to get "sticker shock" and start asking the question how much value do they get from their cable subscription? While the cable industry has always made a strong argument that the sheer volume of programming available each month makes it a great subscription value, my sense is that with the massive number of alternative viewing options consumers are now accessing, it's not pure volume that matters, but rather actual cable use, in particular relative to other options.

billing statements to see a monthly tab in the $200 or more range when premium channels, DVRs, additional set-top boxes, VOD purchases and the like are all added up are inevitably going to get "sticker shock" and start asking the question how much value do they get from their cable subscription? While the cable industry has always made a strong argument that the sheer volume of programming available each month makes it a great subscription value, my sense is that with the massive number of alternative viewing options consumers are now accessing, it's not pure volume that matters, but rather actual cable use, in particular relative to other options.

For example, consider a home with a couple of teenagers who rarely watch live TV any more and instead spend a lot of their free time on Facebook, YouTube, Hulu, etc. Say Dad is only a light sports fan and doesn't consider ESPN or Fox Sports essential, and has long since moved the bulk of his news consumption to online sources. He loves Jon Stewart, but is content to catch his jokes online the next day when he has a few minutes of downtime at work. He also loves some of the broadcast network shows, but can watch them sporadically on Hulu. Mom is into the shows on HBO, plus some favorites on ad-supported cable channels like USA, Bravo and Food Network. Still, she's been having less time lately to actually watch these recently and has also started to gravitate to back seasons that are now available on Netflix. Since the family's Nintendo/Blu-ray player/Roku allows streaming to the TV, it's as simple as cable to use. Net it all out and the family's cable usage has declined markedly in the last couple of years.

Does this example sound familiar to you? I believe this is the kind of situation where cord-cutting or cord-shaving starts to gain some interest. Families faced with the real opportunity to save a few bucks each month, though with clearly reduced program options and convenience, will have decisions to make in the coming years. How they make them and how Comcast, Netflix and others react will have huge implications on their performance.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Cable TV Operators

-

Tremor Media Raises $40 Million; Biggest Recent Deal in Online Video Sector

This morning the online video ad network and management company Tremor Media is announcing a monster $40 million financing, bringing total capital in Tremor to $82 million. I've been tracking venture capital investments in the online and mobile video sector for the past 5 quarters and I believe this is the largest recent private company deal yet (I think the only one bigger is Ustream's $75 million deal last quarter, but only $20 million was upfront). Draper Fisher Jurveston Growth Fund is leading the new round, with participation from existing investors. Last night I talked to Jason Glickman, Tremor's CEO and exchanged emails with Randy Glein, managing director at DFJ Growth to learn more.

online and mobile video sector for the past 5 quarters and I believe this is the largest recent private company deal yet (I think the only one bigger is Ustream's $75 million deal last quarter, but only $20 million was upfront). Draper Fisher Jurveston Growth Fund is leading the new round, with participation from existing investors. Last night I talked to Jason Glickman, Tremor's CEO and exchanged emails with Randy Glein, managing director at DFJ Growth to learn more.

Jason explained that since Tremor raised $20 million last year and turned profitable, it actually didn't need the money. However, the team believes that online video advertising is at an inflection point and so the decision to really step up and "go for it" as Jason said. Primarily, that means adding more features for publishers and advertisers and enhancing the Acudeo management platform. It also means pursuing a 3 screen strategy to encompass mobile and TV platforms.

Randy said that DFJ has known Tremor for over 2 years and is motivated by the transformation underway in the advertising industry, driven by exploding online video usage to both computers and other connected devices. The shift in ad spending from traditional TV to online video is just beginning, and Randy sees Tremor - with its huge network and ad management platform - as being positioned right in the middle of all this change.

Jason further explained that the company now has the scale to attract 6 and 7-figure campaigns from brands that are increasingly drawn to the online video medium. Key challenges going forward include proving brands with the data that their online campaigns not only reach their intended targets, but also provide required brand lift and ROI. In particular, Jason said Tremor's ability to optimize against certain audiences or by metrics objectives is an important part of its success.

At VideoSchmooze on Monday night there was considerable discussion around hybrid pay/ad-supported models for premium video content. Clearly, if a content provider can garner consumer payments they should. However, the new Tremor financing is further evidence to me of the innovation and excitement around online video advertising that will make it far more valuable than TV advertising ever was. As brands come to recognize online video advertising's value proposition I see monetization per viewer (or whatever other metric of advertising success that's preferred) going up over time.

(Separate, note also that online video management provider KIT Digital yesterday also completed what is probably the largest public company financing in the online video sector - raising $55 million from the sale of over 4.2 million shares.)

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Deals & Financings

Topics: KIT Digital, Tremor Media

-

Ooyala Integrates YouTube Access For Customers

Online video platform Ooyala has unveiled an interesting new feature that allows its customers to add videos from YouTube to their Backlot account and then have them displayed right alongside their own videos in their Ooyala player. All of the analytics that are available for the customer's own videos extend to the YouTube videos as well. Alex Holub, senior product manager at Ooyala gave took me on a quick tour last week of how it works. It appears simple and well thought-out.

Alex explained that the impetus here was that a lot of Ooyala customers were already trying to incorporate YouTube videos, but there wasn't an easy or integrated way to do so. With the new feature, a customer can search and gather relevant YouTube videos from within the Backlot platform and then add them to their account, where they can subsequently add metadata. The videos can also be syndicated along with other owned video. The YouTube videos are displayed in a chromeless player, which means the Ooyala look and controls remain. The main thing that separates the YouTube videos is that per YouTube rules they cannot be directly monetized. So Ooyala's ad rules pre-empt any pre-roll or overlays; instead on-page ads only are allowed.

Ooyala's move is further recognition of valuable YouTube's library has become for many publishers. There is just so much content on YouTube, and tons more being added every day that is freely available that for many YouTube is an irresistible augment to their own content. The only other OVP that I'm aware of that has done something like this with YouTube and other sources is Magnify.net, with has been all about enabling its customers to curate the best video from around the web from the outset. I expect we'll see other OVPs offer this capability too.

Ooyala is offering the new YouTube feature free until May 31st for customers.

What do you think? Post a comment now (no sign-in required).Categories: Technology

-

FreeWheel Raises $16.8 Million; Steamboat is Lead Investor

Video ad management provider FreeWheel just announced a new $16.8 million financing, led by Steamboat Ventures, which is affiliated with Disney, with participation from existing investors Turner Broadcasting System, Battery Ventures and Foundation Capital. It's another big win for FreeWheel is which is the clear leader in ad management in the syndicated video economy.

participation from existing investors Turner Broadcasting System, Battery Ventures and Foundation Capital. It's another big win for FreeWheel is which is the clear leader in ad management in the syndicated video economy.

Doug Knopper and Jon Heller, co-CEOs, who are 2 of FreeWheel's 3 co-founders will be at VideoSchmooze tonight, along with many other from their team. Join us!Categories: Advertising, Deals & Financings

Topics: FreeWheel, Steamboat Ventures

-

See You Tonight At VideoSchmooze and Tomorrow for Akamai Webinar

I'll be hosting the next "VideoSchmooze" Broadband Video Leadership Evening from 6pm-9pm tonight at the Hudson Theater in New York City. The event includes networking, open bar, hors d'oeuvres and a full educational program. You can buy a ticket online until 3pm today or at the door (cash and check only) - both options are the same price of $75.

program. You can buy a ticket online until 3pm today or at the door (cash and check only) - both options are the same price of $75.

We have a great panel discussion, which I'll moderate, whose title is "Money Talks: Is Online Video Shifting to the Paid Model?" Panelists include:- Jeremy Legg - SVP, Business Development, Turner Broadcasting System, Inc.

- Damon Phillips - Vice President, ESPN3

- Avner Ronen - CEO and Co-founder, boxee

- Fred Santarpia - General Manager, VEVO

Click here to learn more and register

There is no shortage of topics to discuss; just in the past few weeks there has been news of Hulu's planned subscription service, Turner collaborating with CBS on a long-term $10.8 billion "March Madness" deal, Conan moving to TBS, Netflix signing 28-day DVD release deals with Fox and Universal (plus adding 1.7 million subs in Q1 '10), and lots of other activity. The landscape for online delivery of premium is changing rapidly; our panel will help us make sense of where the market is heading.

We'll also have a 15-minute stage-setting presentation by Emily Nagle Green, President and CEO of Yankee Group, a leading industry market research and consulting firm. Emily is the author of the recently published book, "Anywhere - How Global Connectivity is Revolutionizing the Way We Do Business." Emily will share key data from Yankee's research and her book, which will set the stage for the panel to follow.

From 6-7:30pm, prior to Emily's presentation, we'll have open bar (wine/beer/soda), hors d'oeuvres and networking. We have a very large group, with executives from many key media companies like MTV Networks, Rainbow Media, HealthiNation, CBS Interactive, NBCU, Scripps, HBO, NBA, 5Min, Disney, Comcast, Epix, WWE, Fox Sports and many others, plus tons of industry technology providers.

Thanks to lead sponsor Akamai Technologies and supporting sponsors FreeWheel, Horn Group, Irdeto, NeuLion, Panvidea and ScanScout for their support. Once again VideoSchmooze is being held in association with NATPE. You can follow VideoSchmooze and get updates that evening on Twitter at hashtag #vidooze.

I look forward to seeing you tonight!

Click here to learn more and register

Whether or not you're able to make it tonight, please join me for a complimentary live video webinar Akamai is hosting tomorrow at 1pm ET, "Constructing the Ultimate Online Video Experience - From the Inside Out." On the panel with me will be:- Emil Rensing - Chief Digital Officer, Epix

- Glenn Goldstein - VP Media Technology and Strategy, MTV Networks Digital Media

- Karsten Weide - VP Digital Media and Entertainment, IDC

- Eric Black - NBCU

Categories: Events

Topics: Akamai, VideoSchmooze

-

Hulu Missed Its Window for Subscription Success

Unless Hulu has something very unpredictable up its sleeve in the $9.95/mo subscription service it's rumored to begin testing in May, the bad news for the site is that it has already missed its window of opportunity for subscription success. In a one sense it's not Hulu's fault; as a startup 3 years ago, it had to choose what strategy to focus on and execute. Hulu chose the free, ad-supported route, with widespread distribution that has made it the 2nd most-used video site.

success. In a one sense it's not Hulu's fault; as a startup 3 years ago, it had to choose what strategy to focus on and execute. Hulu chose the free, ad-supported route, with widespread distribution that has made it the 2nd most-used video site.

The problem is that the world has changed significantly since Hulu was started 3 years ago, and launching a successful online subscription service now is far harder to do now than it would have been then. Here are some of the top reasons why:

Subscription competition - 3 years the online video subscription field was wide open, but now there's Netflix to contend with. As the company's blowout Q1 '10 results amply demonstrate, Netflix is firing on all cylinders. By providing unlimited streaming as a value add even for its $8.99/mo subs, Netflix has muddied the waters for any would-be online-only subscription competitor, which has to articulate a value prop to prospects of why they should pay the same or more for online-only access, for what will likely be a smaller catalog initially. Netflix also has the device partnerships, 28-day studio deals for more content, well-baked UI/recommendations and deep financial resources. 3 years ago it had none of this; back then it was still imposing confusing online usage caps and pursuing its own set-top box with LG Electronics.

TV Everywhere - 3 years ago cable operators were contemplating their navels when it came to online video delivery, now with TV Everywhere they have a game plan (though admittedly not a lot of actual success just yet). For most cable networks, preserving their relationships in the cable ecosystem is paramount. Taking a leap by licensing content for a Hulu subscription service isn't going to be very appealing. Absent cable content, Hulu will be pitching a monthly subscription to archived commercial free broadcast network programs; that's a pretty narrow value prop.

Comcast-NBCU deal - 3 years ago Comcast was still licking its wounds from its ill-considered bid for Disney; now it has a deal to acquire NBCU, one of Hulu's original partners and a top-tier cable network owner. While Comcast will say all the right things during the deal's review process, I've wondered how long Comcast would even retain its Hulu stake once the deal is completed. Hulu's free "ad-lite" model is antithetical to Comcast's belief in subscriptions and bottom line accountability. A Hulu subscription service is unlikely to help either. Why would Comcast want another competing subscription offer in the market, much less one that would tempt would-be "cord-cutters?"

Lack of ownership will - 3 years ago, NBCU and News Corp were full of platitudes about their new online video baby. But in addition to NBCU's changed status, News Corp has become the most vocal content provider for the paid online content model. MySpace's travails are rumored to have soured Rupert Murdoch's appetite for chasing fickle online users. Meanwhile, Disney, the last partner to the Hulu venture, is plenty interested in subscriptions, but it wants to offer them directly. Then there's Hulu's key financial partner, Providence Equity Partners. I've never quite understood their investment decision given Hulu's limited exit opportunities, but one thing's for sure - they're unlikely to be motivated to help fund the considerable development and marketing expenses Hulu must undertake to make subscriptions succeed.

Retransmission consent - 3 years ago, the idea of broadcasters getting paid for their content still seemed like a stretch. But broadcasters are winning their chosen high-stakes battles, and given their success, are far more inclined to pursue a wholesale model (i.e. getting distributors to pay them monthly) than back a retail, subscription model. Plus, a Hulu subscription model departs from the message of free broadcast service that the broadcast lobby is using with the FCC and Congress to justify why it should retain its excess spectrum, rather than yielding it to mobile data providers under the National Broadband Plan's reclamation program.

User expectations - As if these weren't enough to contend with, the single biggest impediment Hulu faces is likely itself. Having invested its brand heavily in the free ad-supported positioning (and computer-based viewing only) Hulu lacks what experts would call "brand permission" to now pursue subscriptions. Companies are frequently chastened to find out what their customers really think when stretching for new products or business models. Moving customers from free to paid is one of the hardest things any company can do (just ask YouTube which is attempting to do the same); trying to pull it off from a cold start is nearly impossible in my mind. Hindsight is 20-20, but what Hulu probably should have done 3 years ago is offered a "freemium" model that would have immediately conditioned its users to thinking Hulu stands for both free and paid.

I've learned to never say never in this business, but to succeed, Hulu has to surmount the above challenges and more. If it can do so, it will be a significant win for the company. If it can't it will be yet another reminder of how treacherous things are even for well-funded startups trying to navigate a quickly-shifting competitive landscape.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators

Topics: Comcast, Disney, FCC, FOX, Hulu, NBC

-

VideoNuze Report Podcast #58 - April 23, 2010

Daisy Whitney and I are pleased to present the 58th edition of the VideoNuze Report podcast, for April 23, 2010.

In today's podcast Daisy and I focus on Netflix's Q1 '10 results, which were the best in the company's history. I posted an analysis here, and in our discussion we dig in further to the competitive dynamics Netflix finds itself in and what consumers can expect going forward. Then Daisy takes us on a quick tour of what she saw at Ad:Tech.

Click here to listen to the podcast (15 minutes, 19 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Aggregators, Podcasts

Topics: Ad:Tech, Netflix, Podcast