-

NBCU's Zucker: "We're at digital dimes now"

NBCU CEO Jeff Zucker provided the opening keynote interview at the Media Summit in NYC this morning with Businessweek Executive Editor Ellen Pollock. I've seen him speak a number of times and true to form he was pragmatic, quite candid and humorous. Highlights below:

"We're at digital dimes now" - Zucker of course famously worried aloud about the risk of "exchanging analog dollars for digital pennies," the notion that half-baked online delivery models would only serve to cannibalize traditional profitability. Zucker sees progress, saying Hulu is "well ahead of plan" and is yes, is now making money. Zucker repeatedly praised the success of the company's wide-ranging digital initiatives, but also noted often there is still a lot of work to do. He also wondered aloud whether digital would ever be a 1 to 1 revenue substitute for traditional revenue streams, but that further cost rationalization would help drive profitability.

"We're in process of finding new economic models" - On the above point, Zucker was candid in saying that the work to be done on new economic models is still experimental and that "a lot of success is often accidental." He readily concedes that nobody has all the answers, and that a key challenge is bridging from the traditional business models to new ones, balancing the interests of older audiences comfortable with the status quo with younger ones that are aggressively embracing the new. Describing his own kids' media activity, which focuses on Hulu, generating their own content and being interactive must give Zucker ample perspective.

"Technology is unbelievably exciting" - Zucker has always emphasized the importance of technology on NBCU's various businesses and today was no exception. He noted that technology is increasing access to TV programs and movies in unprecedented ways, which is a good thing. However he also candidly observed that it has fundamentally changed the broadcast business, primarily through consumers' use of DVRs and online delivery. All of that, plus NBC's lagging primetime performance, has caused it to completely re-think the broadcast model. He observed that newspapers' current woes can be traced to them not being willing to quetion the fundamentals of their model and the role of technology. Like other video providers, he seems determined to confront realities and avoid repeating this mistake.

"NBCU is first and foremost a cable programming company" - Zucker has often highlighted the benefits of the two revenue stream cable programming model (affiliate fees and advertising), but this was the first time I've heard him so clearly position the company as being mainly in the cable business. NBCU's stable of channels, USA, SciFi, Oxygen, MSNBC, Bravo, etc. contributed 60% of NBCU's operating profit last year. The networks' ability to "outperform the market, especially in women's programming and news" is key to NBCU's overall success. Zucker noted that USA is increasingly a "must buy" for advertisers, and with its mass appeal, should justifiably be considered the 5th broadcast network.

"We're hopeful we'll resolve TV.com-Hulu issues soon" - Zucker only briefly touched on Hulu's recent decision to pull its programming from TV.com, which is fast emerging as a Hulu competitor. As has been previously reported, Hulu's attorneys obviously believe TV.com compromised its Hulu distribution agreement as part of its new configuration subsequent to CBS's acquisition of CNET. With a battle looming between aggregators especially in the down economy, I think it remains to be seen whether a settlement can be found.

Categories: Advertising, Aggregators, Broadcasters

Topics: NBCU

-

Quick Review of Broadband Video Leadership Evening

Over 250 people came out last night for VideoNuze's Broadband Video Leadership Evening in NYC, with a great cross-section of media and technology companies in attendance. For me it was great to actually meet people in person who I've only known from email and phone exchanges.

A highlight of the evening was our panel discussion with Albert Cheng (Disney-ABC Television), Daina Middleton (Moxie Interactive/Publicis Groupe), Greg Clayman (MTV Networks), Karin Gilford (Comcast) and Dan Beldy (Steamboat Ventures) sitting in for John Edwards.

The panel covered a lot of ground including how broadcast networks are trying to achieve economic parity for online viewing vs. on-air viewing of their programs, if/how/when more cable networks' programming will find its way online, what changes must occur for advertisers to shift more of their spending to broadband video, why it's hard and getting harder for independent video producers to succeed online and why '09 is going to bring a shakeout to video aggregators.

Today I'm at the Media Summit (waiting now for the Jeff Zucker keynote interview), so I'll hold off until later summarizing my conclusions from the panel. I also have plenty of pictures, and we'll try to get the video posted shortly as well.

Categories: Events

Topics: Broadband Video Leadership Evening

-

See You Tonight at the Broadband Video Leadership Evening

I'm looking forward to seeing many of you tonight at VideoNuze's Broadband Video Leadership Evening at the Hudson Theater in NYC.

We'll kickoff at 6pm with our "VideoSchmooze" networking reception, and then at 7:30pm we'll begin our panel discussion with Albert Cheng (Disney-ABC Television), Daina Middleton (Moxie Interactive/Publicis

Groupe), Greg Clayman (MTV Networks), John Edwards (Move Networks) and Karin Gilford (Comcast) and me moderating.

Groupe), Greg Clayman (MTV Networks), John Edwards (Move Networks) and Karin Gilford (Comcast) and me moderating. The session is titled "Broadband Video '09: Building the Road to Profitability" and we have tons of topics to discuss. I'm looking forward to hearing all of the panelists weigh in with their insights and experience. There will be ample time for audience Q&A as well.

If you're planning to attend, I encourage you to come early, as there are over 290 people now registered, and it's going to be a bit chaotic. For those of you unable to come, we'll be recording the entire event and will post the video as soon as possible. I'll also try to share some key takeaways and pictures in tomorrow's VideoNuze email.

Categories: Events

Topics: Broadband Video Leadership Evening

-

Yahoo May Be Finally on to a Winning Original Video Strategy

The NY Times is reporting that Yahoo is ramping up its original broadband video offerings, with the impending launch of "Spotlight to Nightlight," a new series showcasing celebrity moms, hosted by former Miss USA Ali Landry and sponsored by State Farm Insurance. The new show highlights how far Yahoo has evolved from its era of failed dreams of grandeur directed by former Yahoo Media Group head Lloyd Braun. Before you say, "ugh, its Yahoo, they'll never succeed with video," I'd suggest that their new plan has some merit.

As we all know, Yahoo has suffered through all kinds of recent challenges and significant management turnover. But it is still one of the most popular online brands - the 2nd most-trafficked web site with over 146 million monthly unique visitors, the #3 search engine (now just behind YouTube) with a 21% market share and operator of the second-largest ad network behind Platform A.

Despite these strengths, I've thought Yahoo has been somewhat unimpressive in the video area. It has focused heavily on aggregating and distributing others' content in a bland, mechanical manner though still

managing to become a highly popular video streaming destination. I've sometimes wondered whether anyone really "owned" the video experience at Yahoo or whether it had been diffused over so many managers that it had been orphaned along the way. It's not been uncommon for me to see broken links, repetitious ads, 30 second pre-rolls adjacent to under 1 minute clips, and other annoyances that can quickly turn off users.

managing to become a highly popular video streaming destination. I've sometimes wondered whether anyone really "owned" the video experience at Yahoo or whether it had been diffused over so many managers that it had been orphaned along the way. It's not been uncommon for me to see broken links, repetitious ads, 30 second pre-rolls adjacent to under 1 minute clips, and other annoyances that can quickly turn off users.In the midst of this confusion, a bright spot on the original video front has been "Primetime in No Time" a short, energetic TV recap show that has gained a sizable following plus other series in specific verticals like sports and finance. On the flip side, in a sign of the mixed internal signals, it also killed "The 9" a recap show of top online content, which had both a following and a sponsor in Pepsi.

With "Spotlight to Nightlight" Yahoo seems to be further recognizing that it is sitting on mounds of data that, if properly analyzed, can reveal lots of clues about what kinds of programming would match up with its users' and advertisers' interests. Given Yahoo's size and resources, there are few online companies that should be better tuned in to what's hot and could be the strong basis for a new series.

Yahoo's opportunity is to capitalize on this information by creating short, upbeat (and humorous where possible) series that appeal to users' demonstrated interests. It should then promote the shows like crazy in appropriate vertical areas of its site (as "Spotlight to Nightlight" will be with Yahoo's "OMG"), and adjacent to relevant searches.

Recently I wrote about Demand Media, which has built a "content factory" by doing many of these same kinds of things. Yahoo could create a stable of inexpensively produced but high-quality broadband-only series that can instantly find their natural audiences. Advertisers looking for adjacency to premium video that aggregates sought-after audiences, would soon follow.

New Yahoo CEO Carol Bartz has a lot of issues on her plate to resolve, but also plenty of opportunities. Video is a big one that has been largely untapped by the company. If Yahoo builds a cohesive video strategy that relies on the significant data it has unrestricted access to, it may finally be on a winning video path.

What do you think? Post a comment now.

Categories: Portals

Topics: Yahoo

-

VideoNuze Report Podcast #10 - March 13, 2009

Happy Friday the 13th...

Below is the 10th edition of the VideoNuze Report podcast, for March 13, 2009.

This week Will adds some detail to his recent post, "Clarifying Comcast's and Time Warner's Plans to Deliver Cable Programming via Broadband to Their Subscribers." These plans are not fully locked in, but since there have been a lot of questions about them, it seemed worthwhile to provide a quick update.

Also, Daisy discusses a recent article she wrote about Clearleap, a new broadband-to-the-TV technology company that recently announced its platform. The whole broadband-to-the-TV area has been really hot recently and we expect a lot more activity to come.

Since this is the 10th edition of the VideoNuze Report podcast, we thought it would be a good time to check in with listeners and get you reactions. What do you think of the format and length? We thought the most meaningful content approach would be to provide some additional insight about what we've written recently, but does this feel fresh and substantive enough? Would it be better if we discussed recent market activities that we haven't necessarily written about yet? Or maybe answered some listener questions? Or something else?

The podcast format is very flexible and Daisy and I view the VideoNuze Report as a work in progress. We'd love to hear what listeners think and how we can change and improve. Either drop me an email (wrichmondATvideonuze.com) or leave a comment.

Click here to listen to the podcast (14 minutes, 29 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Cable TV Operators, Podcasts, Technology

Topics: Clearleap, Comcast, Podcast, Time Warner

-

Why March Madness on Demand is Such a Winner

The first round games of the NCAA's March Madness are a week from today and the hype surrounding the tournament is in full swing. But the tournament itself is no longer the only story; the broadband-delivered "March Madness on Demand" has become a big part of the 3 week experience as well. Since converting from a subscription service to a free, ad-supported format 4 years ago, CBS Sports and the NCAA have made MMOD a huge winner, providing plenty of lessons for others. These include:

1. Under the right circumstances, free with ads beats paid with subscriptions. It was big news back in '06 when CBS converted MMOD from subscription access to free, ad-supported. In retrospect, it looks like a stroke of genius. The $30M in ad revenue MMOD will generate for CBS this year would have required 1.5

million of the old $20 subscriptions. Hitting that subscription number would have been miraculous. With the free model, instead of allocating scarce marketing dollars and resources on acquiring temporary subs, CBS can focus on promoting the games, selling ads and striking high-quality distribution deals - 3 things that networks do very well. Free vs. paid will be a perpetual debate for premium video, but solid market research, well-thought out business cases and a willingness to experiment can lead to big payoffs, as MMOD has shown.

million of the old $20 subscriptions. Hitting that subscription number would have been miraculous. With the free model, instead of allocating scarce marketing dollars and resources on acquiring temporary subs, CBS can focus on promoting the games, selling ads and striking high-quality distribution deals - 3 things that networks do very well. Free vs. paid will be a perpetual debate for premium video, but solid market research, well-thought out business cases and a willingness to experiment can lead to big payoffs, as MMOD has shown.2. Well-executed online access burnishes the brand. Following the above, MMOD is a huge win for the CBS brand and for the NCAA. Fans love MMOD and appreciate the easy online access. Of course, anything for free is always well-received, especially in a down economy. Large audiences mean lots of cross-promotional opportunities for other CBS programs. Abundant media coverage means the brand gets tons of free promotion. And the list goes on.

3. Advertisers love being a part of engaging, high-quality online experiences. The increase in MMOD ad revenue from $4M in '06 to $30M this year speaks to advertisers' interest. It's no surprise that big brands are increasingly challenged to access large target audiences and have their messages heard (that's why the Super Bowl maintains its massive appeal). MMOD offers an exciting, immersive and interactive avenue to augment brands' on-air tournament spending. MMOD gives CBS ad sales teams a formidable differentiator. As AdAge notes, that helped CBS retain wounded GM as an advertiser, while the company dropped the Super Bowl and the Academy Awards from its media plan.

4. User experience matters, a lot. MMOD is a hugely complex undertaking for CBS, but delivering a positive experience that lives up to the hype is ultimately what matters. In the past, not knowing how many simultaneous users to expect or what bandwidth would be required, CBS cautiously proceeded with its so-called "waiting room" model. That's now been eliminated, and everyone can watch on-demand. This year CBS is also offering a high quality or "HQ" option, powered by Silverlight. Overall, CBS's player is clean and easy to use. My experience in the past has been that the ads are obvious, but not overwhelming. All of this registers with users and contributes to a positive experience.

5. The side dishes complement the main meal. There's no question that the games themselves are the primary attraction. But CBS has been clever in augmenting the games with lots of other stuff that contribute to the overall experience. For example, if you go to the site now, you can see highlights of past championship games. Then on Sunday will come the selection show. There's a Facebook integration, widgets and the "Selection Sunday Challenge." And this year CBS is also introducing mobile access, albeit for a fee. Add it all up and CBS has been able to build a far larger franchise around MMOD than just offering the games themselves.

What do you think? Post a comment now.

Categories: Broadcasters, Sports

Topics: CBS, CBS Sports, March Madness on Demand, NCAA

-

Last Call: March 17th NYC Broadband Video Leadership Evening

We're less than a week away from VideoNuze's Broadband Video Leadership Evening, on Tuesday, March 17th in New York City. There are over 230 people now registered and I expect it to be a high-energy evening of networking with industry colleagues and learning from our panel of top-tier digital media executives. (And yes, in honor of St. Patrick's Day, Guinness will be available at the bar...)

Lots of great media and technology companies will have people in attendance. In addition to the list I posted last week, companies represented include: Akamai, Babelgum, blinkx, Clearleap, Dolby, FAST, 5Min, Google, HealthiNation, Hearst-Argyle, Kaltura, NeuLion, Ogilvy, Sezmi, Starz, thePlatform, Tremor Media and many others.

We'll start with a "VideoSchmooze" cocktail/networking reception from 6pm - 7:30pm, followed by a panel discussion I'll moderate from 7:30pm - 9pm titled, "Broadband Video '09: Building the Road to Profitability." The panel includes:

- Albert Cheng, EVP, Digital Media, Disney/ABC Television Group

- Greg Clayman, EVP, Digital Distribution & Business Development, MTV Networks

- John Edwards, President and CEO, Move Networks

- Karin Gilford, SVP, Fancast and Online Entertainment, Comcast Interactive Media

- Daina Middleton, SVP, Moxie Interactive, Publicis Groupe

Click here to learn more and register now!

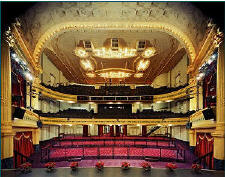

The event will be held at the Hudson Theater on West 44th Street just off Times Square. NATPE, VideoNuze's partner since launch, is on board for the event. And I'm extremely grateful to lead sponsor Move Networks and supporting sponsors AnySource Media, ExtendMedia, Horn Group, mPoint and PermissionTV who are making the evening possible.

I've set up a Facebook group so you can start meeting other attendees and also keep up to date on all the recent broadband news we'll discuss on the panel. Yesterday I contributed a column to MediaPost which outlines the challenges and opportunities broadcast networks face in the broadband era, a key topic of our discussion.

I hope to see you there...

Categories: Events

Topics: Broadband Video Leadership Evening

-

Broadband Subscriptions Chug Along in 2008

Last Friday, Leichtman Research Group released is quarterly roundup of broadband subscription growth sorted by major cable operators and telcos. LRG, run by my former colleague and friend Bruce Leichtman, has long been the bible for many in the industry for tracking broadband subscriber growth. LRG's numbers continue to demonstrate why broadband video has become such an exciting new distribution medium while adding context to Comcast's and Time Warner's recent moves to begin making online access to cable programming available to their subs.

To highlight a few key numbers, at the end of '08 the top broadband ISPs had 67.7 million subscribers, with top cable operators accounting for about 54.5% and top telcos the remainder. Top cable operators continue to maintain their edge in subscriber acquisition as well, grabbing 59% of all new broadband subs in '08.

And no surprise to anyone, with the rising penetration levels, the annual increases in total new subs have continued to slow: in '06 top cable and telco ISPs added 10.4M subs, in '07, 8.5M subs and in '08, 5.4M subs. Still, in the teeth of harsh economic downturn in Q4 '08, these ISPs were still able to add over 1M subs, growth that contracting industries like autos, retail and home-building would no doubt have killed for.

Broadband has long since become a utility for many American homes, a service that is as much expected as essentials like electricity and plumbing. A key reason broadband video is enjoying the success it is owes to the fact that broadband subscriptions have been driven for other reasons (e.g. faster email access, music downloads, always-on connectivity) over the years. Video has only recently become an additional and highly-valued benefit, which broadband ISPs now expect will drive interest in faster (and more expensive) broadband service plans.

Broadband's importance to the cable industry is demonstrated by the chart below showing #1 cable operator Comcast's performance over the last 2 years, which I originally posted on last November ("Comcast: A Company Transformed).

Note the company has now lost basic cable subscribers for 7 straight quarters, even as it continues to add digital video subs and broadband subs (and voice subs) at a healthy clip. I expect these trend lines will continue in their current pattern. No doubt this is the kind of picture that has helped spur Comcast (and #2 operator Time Warner Cable) to begin planning online distribution of cable programming, a feature that I believe will provide highly popular. Operators are in a tremendous position to capitalize on the shifting interests of their subscribers.

What do you think? Post a comment now.

Categories: Broadband ISPs, Cable TV Operators

Topics: Comcast, Leichtman Research Group, Time Warner Cable