-

Video Behavior Changes Suggest "Evolution," Not "Revolution" For Now

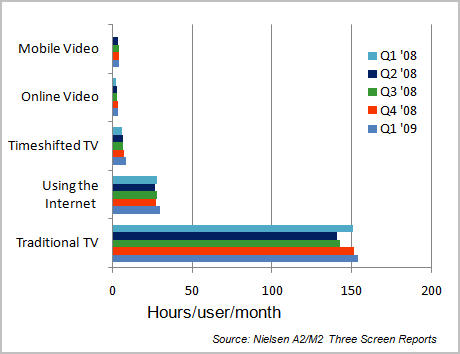

Last week's latest Nielsen A2/M2 Three Screen Report confirmed what I've been saying for a while: when it comes to characterizing changes in consumers' overall video behaviors, "evolution" is a better descriptor than "revolution." To be sure there are certain age segments and behaviors where change is happening very fast. But the overall Nielsen tracking data suggests that until a significant catalyst comes along, major market changes will play out quite gradually.

I've been tracking Nielsen's periodic releases of its Three Screen reports since last year, and the graph below captures the data during this period.

No surprise, time spent watching online video experienced the biggest year-to-year jump (53%) to 3 hours/month. That's solid growth, but even at this rate, it would be a long time before online video viewing takes a significant overall share of the video market. Part of the reason is that time spent on traditional TV just keeps on increasing, nudging up almost 3 hours in the last year to almost 153 1/2 hours/month. That trend has to keep a lot of TV executives smiling.

Still, industry participants have to be watching younger viewers, where adoption of alternate viewing platforms is on the leading edge. For example, 18-34 year olds consume 70% more online video (5 hours, 7 minutes per month) than average, 12-17 years consume 85% more mobile video (6 hours, 30 minutes per month) than average and 25-34 year olds consume 109% more timeshifted TV (12 hours, 12 minutes per month) than average. All of these segments are most coveted by advertisers and their more-rapidly shifting behaviors are clearly (and correctly) driving major media to experiment with new broadband and mobile models.

The "x factor" that would scramble these trends is the introduction of significant market catalyst, like the iPhone, which has ignited mobile video market. In online video viewing specifically, a market catalyst would be a convergence device or enabler that would allow seamless broadband connectivity to TVs. I've talked about this a lot on VideoNuze, and there are many different approaches underway. When one begins experiencing serious adoption, as the iPhone has, I expect Nielsen Three Screen Data will reflect it.

Until then we can expect broadband, mobile and timeshifting to have a significant, yet gradual impact on the overall market.

What do you think? Post a comment now.

Categories:

Topics: Nielsen

-

VideoNuze Report Podcast #17 - May 22, 2009

Below is the 17th edition of the VideoNuze Report podcast, for May 22, 2009.

This week Daisy takes on 2 topics: how book publishers are (finally!) embracing video to promote their authors and titles, and also what NBC's local media division is doing to roll out new web sites to support its ten owned stations. They're adding lots of original content (including from 3rd parties), video, social media features and more community emphasis. No surprise syndication is a real push. Local stations have been really hammered by the recession and also by the shift to broadband distribution, so it's good to see NBC being aggressive.

Separate but related NBC.com is my focus on this week's podcast. Specifically, I add more detail to my post this week about how NBC.com is leveraging its existing online/broadband infrastructure to support its mobile video efforts by using Kiptronic, a mobile video ad insertion company.

Coincidentally, Kiptronic was just acquired by Limelight, further validating that mobile video is a rising priority for many video providers. I've been digging into mobile video and though it's still well behind the broadband adoption curve, the iPhone and other video-ready mobile devices are creating a lot of momentum. (Recall that mobile video taking off was one of my 5 predictions for '09)

For those of you celebrating the long Memorial Day weekend, and the official start of summer, enjoy! I'll see you on Tuesday.

Click here to listen to the podcast (13 minutes, 21 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, CDNs, Deals & Financings, Mobile Video, Podcasts

Topics: Kiptronic, Limelight, NBC.com, Podcast

-

Limelight Acquires Kiptronic; Positions Itself for Mobile Video Growth

This morning Limelight announced it has acquired Kiptronic for cash and stock. Just yesterday I wrote about how Kiptronic is helping NBC.com insert ads into its mobile video streams by plugging into NBC.com's existing work flow and DART ad infrastructure.

While NBC.com is on the leading edge of blending its broadband and mobile video infrastructures, based on my conversations with other video content providers, I suggested this is going to be a significant future

trend. David Hatfield, Limelight's SVP of Products, Marketing and Sales, who I spoke to earlier today about the Kiptronic deal, echoed that sentiment.

trend. David Hatfield, Limelight's SVP of Products, Marketing and Sales, who I spoke to earlier today about the Kiptronic deal, echoed that sentiment. While mobile video is still in the early stages, David said that for "all of its customers, mobile and Internet-connected devices are top-of-mind" and that they are looking to partners like Limelight to cost-effectively address new 3 screen opportunities, as well as challenges like audience fragmentation.

David explained that having worked with Kiptronic for 3+ years, they shared a common vision of the importance of blending broadband/online infrastructure to support the mobile/Internet-connected device world. Both companies also emphasize open video ecosystems, and Limelight intends to continue supporting other CDNs that Kiptronic has been working with. As I said yesterday, the iPhone has been responsible for driving a lot of today's mobile video usage, but with other smartphones and devices coming on strong, mobile viewership is poised to broaden and intensify. With Kiptronic under its tent, Limelight will be better positioned to serve its customers' mobile needs, and augment its core CDN services.

Categories: CDNs, Deals & Financings, Mobile Video

-

Origin Digital's New Business TV Solution is Like Hulu-for-the-Enterprise

Switching gears a bit, lately it has become apparent to me that broadband video is not just proliferating for consumers, it is also beginning to change how businesses communicate with their constituencies. As people spend more of their time watching video at sites like YouTube, Hulu and others, it was probably inevitable that businesses would embrace video as well. This is the context for Origin Digital's new business TV solution, which can be thought of as a "Hulu-for-the-Enterprise" solution. Origin's Darcy Lorincz recently walked me through their strategy and showed me a demo at NAB.

Origin has been managing large scale corporate video events for 10+ years, and was recently acquired by Accenture. With the business TV solution it is leveraging that experience and its relationships to present a one stop solution for companies to communicate their messages. The solution is a hosted white-label video content management system, player, customizable UI/template and social media features, rolled into one. In a sense the business TV solution turns enterprises into video publishers presenting TV-like experiences.

Origin's goals are to help companies improve on how key messages and information are communicated to constituencies and save on face-to-face meetings and travel budget. Darcy explained how Accenture itself has used the business TV solution to build 11 internal "channels." The most active is for human resources, a crucial function in a professional services firm with offices worldwide.

In the HR channel I saw, supporting written materials are still available (with some neat zooming options) and they are arranged alongside relevant videos. Topics include HR policies and procedures, training classes offered, company updates, etc. The business TV solution can also integrate with existing ERP and SAP resources. Other channel examples are executive communications, marketing, sales, investor relations, etc. Users can save specific videos, create playlists, embed, download, share and comment.

Of course, to make use of something like this presupposes that the company has a library of video assets, and/or is ready to commit to shooting ongoing video. Darcy said feedback it has received suggests that a lot of big companies already have lots of video; the problem is there's been no easy way to organize and present it. Further, with the cost of producing high-quality video becoming cheaper and more available through companies like TurnHere and StudioNow, this will become less of any issue over time. Still, it's a paradigm change that will take time to adjust to.

Interestingly, Origin's is just one of many business-focused initiatives hitting my radar. Brightcove told me recently that they've set up a group focused on non-media (i.e. business/government/education) sectors which is getting traction. KickApps has also shared with me they've seen an uptick in corporate communications interest, with an emphasis on social media/interactivity (Alcatel Lucent's Network Cafe is an example). Lastly, a consumer-oriented video platform company recently explained to me confidentially that they're planning a full shift of their model to support business video.

If you happen to be going to next week's All Things D conference, Origin will be demo'ing its business TV solution. If not, there's a pretty good overview video here. Between it and all of these other business-focused initiatives, there could be a lot of Hulu-like activity coming soon.

What do you think? Post a comment now.

Categories: Business Apps

Topics: Accenture, Brightcove, Business TV, KickApps, Origin Digital

-

NBC.com Bolsters Mobile Video Ad Model with Kiptronic's Help

While broadband video consumption continues to surge, mobile video usage is also now showing strong signs of growth, mainly due to the iPhone's popularity. In fact Nielsen just reported last week that iPhone users are 6 times as likely to watch mobile video as are other mobile subscribers. And for Q4 '08, it reported that 11.2M people watched mobile video, with 51% stating they're new to the medium, viewing for less than 6 months. This is still small compared with the 150M or so people (U.S.) watching broadband video each month, but with an onslaught of new or upgraded video-capable smartphones hitting the market, mobile video is poised to grow rapidly.

All of this is very good news for content providers, for whom this "3rd screen" (after TV and PC) opens up all kinds of new opportunities. Many have been participating to date in carrier-provided (e.g. VCast, FLO TV) and other (e.g. MobiTV) subscription services that have achieved solid growth. But with still advertising the primary business model for many content providers, they've been eager make ad-supported video available to growing base of mobile video users as well.

NBC for example has been pursuing ad-supported mobile video, and last summer, made a big mobile push with its Summer Olympics coverage. Still, as Stephen Andrade, NBC.com's SVP and GM and Robert Angelo director web/mobile, told me recently, inserting ads in its mobile-distributed video has been painfully laborious and grossly underoptimized. To address these issues, NBC recently struck a deal with Kiptronic, an ad serving firm that specialized in non web-based content.

Stephen and Robert explained that their overarching goal with NBC.com video is to "publish once, distribute everywhere" - a goal I often hear from other video content providers as well. However mobile-distributed video was siloed and not fully incorporated into its online/broadband work flows. This was especially problematic on the ad side, where mobile inventory wasn't exposed in DART, on which NBC has standardized its ads. As a result a lot of mobile inventory was unsold, and even when it was sold, advertisers were required to jump through a bunch of new hoops to get their ads to NBC, which itself then "hand-stitched" the ads to its mobile-distributed video.

After looking at multiple solutions to address these issues, NBC chose Kiptronic's kipMobile. Stephen and Robert said the key was kipMobile's flexibility in plugging into NBC's existing content management system

and work flow. Now when an NBC producer uploads video, upon preset instructions kipMobile transcodes the HD source file into relevant mobile formats and transfers them to Akamai (NBC's CDN). When a mobile user calls for a video, kipMobile determines which format is best-suited for that particular device, dynamically grabs appropriate ads from DART and combines the two into a file which Akamai then serves to the user.

and work flow. Now when an NBC producer uploads video, upon preset instructions kipMobile transcodes the HD source file into relevant mobile formats and transfers them to Akamai (NBC's CDN). When a mobile user calls for a video, kipMobile determines which format is best-suited for that particular device, dynamically grabs appropriate ads from DART and combines the two into a file which Akamai then serves to the user. Beyond dramatically simplifying NBC's work flow, Stephen and Robert are also excited about the new revenue potential, given NBC's booming mobile usage (Q1 '09 video streams jumped to 9.6M from 2.5M in Q1 '08 with mobile page views increasing from 32M to 96M in the same period). Looking deeper into the usage patterns, NBC sees more than half the mobile video usage occurring at home, as users increasingly look at their mobile device as an alternative screen when the TV isn't available. While 75% of NBC mobile usage is iPhone-based today, they're seeing strong adoption by non iPhone devices. Though still early, geo-identification is creating yet another ad opportunity unique to mobile.

NBC and many other content providers are going to be riding the wave of surging mobile video consumption. kipMobile and other monetization solutions will become increasingly important as these content providers seek to unify their online/broadband and mobile work flows and to fully monetize their views.

What do you think? Post a comment now.(Updated May 21st: Things move fast - Limelight just announced it has acquired Kiptronic.)Categories: Advertising, Broadcasters, Mobile Video, Technology

-

Other Analysts Waking Up to Concerns About Hulu's Business Model

I have to say, I chuckled a little when I read this morning's Online Media Daily story, "Opening a Pandora's Boxee" about a new report from Laura Martin at Soleil Securities titled "Content's $300B Gamble." I haven't read the report, but the article says that it expresses concern that ad revenues for programs watched online could be 60% lower than when watched on-air, "threatening TV's the TV platform's price umbrella."

The reason I chuckled is because I've been saying the same things for months now (for example, see "Broadcast Networks' Use of Broadband is Accelerating Demise of Their Business Model" and "OK, Hulu Now Has ABC. But When Will It Prove Its Business Model?") It's nice to see others starting to understand these important issues as well.

Recently I've had a number of conversations with TV and broadband executives who are similarly concerned about what role Hulu is going to play longer term for the broadcast industry, given the current absence of a proven business model for the site. There are some pretty strong feelings out there, ranging from "Hulu is totally misguided and will be the downfall of the broadcast industry" to "the Hulu team is so smart, they're bound to figure it out." One way or the other, with Hulu's growing popularity, I continue to believe that the broadcast industry's fortunes are increasingly tied to Hulu's financial success.

What do you think? Post a comment now.

Categories: Advertising, Aggregators

Topics: Hulu

-

Made-for-Broadband Video and VOD are Looking Like Peanut Butter and Chocolate

Remember "two great tastes that taste great together," the slogan from the classic Reese's ads featuring the mixing of peanut butter and chocolate? Recent developments suggest that independently produced/made-for-broadband video and Video-on-Demand could be another Reese's-like combination, bringing together two disparate worlds that have attracted loyal audiences in an offering that could have significant consumer appeal.

Consider, last week Multichannel News reported that Verizon plans to bring over 7 million broadband video clips from providers like blip.tv, Veoh and Dailymotion to its FiOS service, which users can browse with their set-top boxes. Also last week, AnySource Media, a software company that powers broadband-connected TVs, announced content deals with TheStreet.com, Break.com, Revision3 and Next New Networks, creating hundreds of "virtual VOD channels." And yesterday, Clearleap, a startup technology platform I recently profiled, announced its own deals with blip.tv, Revision3 and Next New Networks, providing content that cable operators can meld with their VOD offerings.

This push among made-for-broadband producers, technology companies and incumbent video service providers is not coincidental. While they each have their own motivations, their alignment could signal a winning proposition for viewers.

For the indie content producers, on-demand access on TVs augments their viewing experience and access to their programming. Given how difficult the environment has become for independents (Daisy had a good piece on this topic yesterday) on-demand access is a real differentiator. For cable operators and telcos, popular indie video gives them a targeted pitch to the tech-savvy, younger audiences who have become loyal fans of indie content. Down the road this group is probably most up-for-grabs for alternative "over-the-top" services, so focusing on defending them is smart. And for technology providers, a big market opportunity looms trying to connect the previously disparate worlds of broadband and VOD.

In fact, in a conversation I had last week with Braxton Jarratt, CEO/founder of Clearleap, he explained that cable operators get all this. They're looking for quality "mid-tail" video from broadband producers, including clips and short-form programs. The company's technology is currently feeding broadband video to a couple hundred thousand cable VOD homes, with a backlog of "double digit" markets pending deployment. Braxton has a lot of content deals on Clearleap's docket, creating a menu for its cable customers to pick and choose from to incorporate into their VOD offerings. Clearleap also offers an ad insertion platform, so indie video can be monetized, not just offered as a value add.

Meanwhile, VOD has long proven itself popular with viewers. Comcast recently announced it has delivered 11B views since it launched VOD. It has continued to augment its library and add more HD titles. While VOD hasn't really been a money-maker itself, it has become a strong part of the digital value proposition and a defensive move against other viewing alternatives. By incorporating popular broadband video into its VOD choices, its appeal is only strengthened.

While the tectonic plates of "convergence" continue to shift, examples of broadband video making its way to the TV continue to happen. TiVo has been at this for a while with its "TiVoCast" service, along with technology providers like ActiveVideo Networks and others. The likelihood for independently-produced broadband video and VOD to get together seems poised to increase.

What do you think? Post a comment now.

Categories: Cable TV Operators, Indie Video, Technology, Telcos

Topics: ActiveVideo Networks, AnySource Media, Clearleap, Comcast, TiVo, Verizon

-

Recent Cable, Broadcast Financial Performance Suggests Hulu Subscription Model Should be Coming

As the annual "upfronts" - the TV industry's program preview and ad sales extravaganza - kick off today, the recent financial performance of the network TV industry and the cable TV industry continue to diverge. The cable network model, powered by both ad sales and monthly affiliate fees, is proving very durable in the Great Recession, while the ad-only network TV model has been hammered. One conclusion from these numbers is that Hulu's owners must be pushing to figure out how the site can introduce a paid subscription model.

I pulled together financial information for a select group of companies comparing performance for the recently concluded March 31 quarter vs. a year ago.

As the chart shows, operating income increased for all the cable networks and revenue was up for all of them as well, except Scripps Networks, where it was flat. The press release commentary from these cable networks was the same: affiliate revenues are up, with ad sales soft, but not disastrous. Cable operators like Comcast and Time Warner Cable also fared well in the quarter with both revenue and operating income/cash flow increasing.

Contrast this with the broadcast TV numbers for Disney, Fox and CBS, all of which operate both TV networks and own local TV stations. Disney fared the best, with revenues down 2% and operating income down 38%. CBS followed with revenues down 12% and operating income down 49%. Fox was affected the worst, with revenues down 29% and operating income down 99%. As two examples of purely local station performance, Gannett's broadcasting segment revenues were down 16% and operating income down 24%, with Sinclair's revenues down 19% and operating income down 43% (before an impairment charge). The commentary from all the broadcasters was the same: the ad market is terrible, and they're doing their best to contain costs (meaning laying off staff).

As the TV industry gears up to sell billions of dollars of ad time this week, a clear lesson from the above financial performance is that it is essential to diversify into the paid subscription ecosystem instead of relying on advertising alone. Disney, Fox and NBCU have recognized this for a while and have strongly built up their portfolio of cable networks.

With ad sales in the doldrums, it's hard not to wonder what Disney, Fox and NBCU, the three major owners of Hulu, are thinking about with respect to Hulu's own business model, which is of course currently 100% reliant on ads. I mean, if your incumbent business model is frayed, wouldn't it make sense, when essentially "starting over" online, to aggressively pursue the one that is resilient even in the recession?

Hulu's exclusive online lock on high-quality programming from 3 of the 4 broadcast networks would seem to position the company perfectly for a subscription play. If its owners looked hard at the divergent fortunes of cable vs. broadcast, it seems inevitable we'll see some type of paid subscription offering from Hulu - either directly or through distributors - sometime in the near future.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks

Topics: CBS, Disney, FOX, Hulu, NBCU