-

Good Riddance to Google Video Store

On Friday, AP carried the news that Google intends to stop offering paid downloads at Google Video and that it will discontinue support for any downloads made since its launch. Thus ends one of the most anachronistic initiatives I've observed in the broadband video industry.

I was at CES in January 2006 when Google co-founder Larry Page delivered a keynote in which he launched Google Video Store. The press release is here. My recollection of the event is still quite vivid. First, it was such a mob scene that just finding a place to watch the speech was an exercise unto itself. I ended up watching it in a courtesy tent packed cheek-to-jowl with hundreds of others.

As Larry introduced Google Video Store, I kept thinking to myself, "How is that a company with Google's IQ could have made such a startlingly bad product decision?"

Go back to that time for a moment, and imagine that you are Google. You are the foremost company in the world at monetizing content through advertising. You have the ability to meet with the CEO of every major media company in the world -- companies whose video is disproportionately supported by advertising. You have the opportunity to suggest trials, experiments and potentially longer-term deals to bring these companies' video online in an ad-supported manner. You can tantalize them with online riches beyond what they currently collect on-air. And you can be their trusted partner, with the Internet's leading technology, to help figure it all out.

(By the way, at the time, Google's official word was that their choice of the paid model was the only way they could get their hands on full length programs. Yet, just 3 months later, Disney/ABC announced online distribution of ad-supported full length programs. So this was clearly already in the works before January, 2006).

Instead of doing all of this though, you decide to launch using a commerce model, thus completely turning your back on all of the company's massive online advertising horsepower. In doing so, you choose to compete with Apple's iTunes, which has dominant market share and is seamlessly married to the wildly popular iPod. And in an act of arrogance and silliness, you decide to launch your own player, thus rendering all of the premium video incompatible with WMP, Flash, Real and other devices.

And yet, all of this is exactly what Google did. Somehow it managed to persuade premium content providers like Sony BMG, the NBA and Charlie Rose to partner. And it even managed to get Les Moonves, CBS's CEO to come on stage with Larry and make a fawning speech about how excited he was to be a part of all this action.

Now in August, 2007, 20 months later, Google Video Store is dead. Hallelujah. What a ridiculous distraction it has been. I have written over and over that I believe Google is one of the best-positioned companies to exploit broadband video. And yet, like Yahoo most prominently, I still view Google (outside of its YouTube acquisition) as all thumbs in this important new market.

For example - whatever happened to Google's deal with MTV to syndicate its content through the AdSense network? Did anything important come out of that, which might be used for other partners? What's going on with "click-to-play" video ads? And, any updates on Google for TV ads announced in April with EchoStar? Then there's the overhang of the Viacom lawsuit and the introduction of ‘fingerprinting' technology from Google to deter copyright violators. Recently it's looked like its introduction is imminent, and yet no firm timetables have been established.

I'm still expecting big things out of Google in the broadband video area, and I was encouraged to see Gabriel Stricker say in the AP piece that "The current change is a reaffirmation of our commitment to building out our ad-supported...models for video." I hope Google means it.

Categories: Advertising, Downloads, Portals

Topics: Google

-

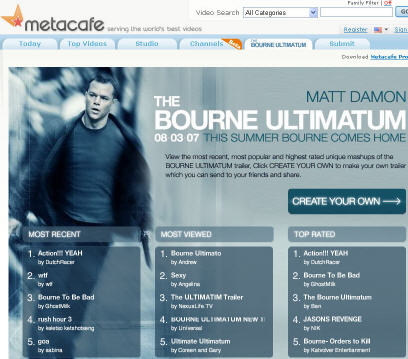

Metacafe’s “Bourne Ultimatum” Mashup Will Spur Imitators

The Metacafe team posted a progress update on its "Bourne Ultimatum" mashup initiative, launched with Universal Pictures on July 23rd. To date, over 1,000 mashups have been posted, with the most popular ones highlighted on the site. Metacafe and Universal teamed up with Diffuse Media Group for the simple-to-use mashup tool.

These kinds of mashups are such a winning idea, it’s amazing to me that they still haven't gained a ton of market momentum. I think it’s just a matter of time, it’s so easy to execute.

Here, Universal provided a collection of scenes and music from the movie. Fans can express their enthusiasm by mixing them up as they please overlaying the music tracks provided. Especially for a franchise like "Bourne", where rabid fans eagerly await each sequel, allowing these folks to participate in the promotional buildup is a real win-win. Tomorrow, when "Bourne" opens everywhere, there will already have been tens (hundreds?) of thousands of people talking up the flick who have seen the mashups or created their own.

Compare this level of fan engagement and promotion to the traditional process of producing 1 trailer and then paying for expensive TV time to promote it. That model seems so yesterday by the standards of what broadband video and Web 2.0 are enabling.

Specifically, broadband is enabling a whole new element of the marketing mix to take root. And the possibilities for where mashups go from here are limitless. Consider: how about letting fans mix in their own voice-overs of certain scenes or mix in their own video clips or have the studio create contests to showcase and reward winning mashups (e.g. Matt Damon-signed, collector’s edition DVD for the winner and such). The list goes on.

I’m expecting lots of smart marketers are going to be increasing their mashup activity quite soon.

Categories: Brand Marketing, FIlms, Partnerships, UGC

Topics: Bourne, MetaCafe, Universal Pictures

-

WSJ's Video Approach is Right

WSJ continues to distinguish itself among all newspapers in how well they’re executing on their broadband video opportunities. I did a case study on WSJ’s video efforts last quarter with Bob Leverone, their VP in charge, so I’m very familiar with their operation and approach. It’s very sophisticated.

Most recent case in point: A few days ago I was perusing the WSJ Online (to which I subscribe) and there was a headline about Barclays Bank raising money from China and Singapore to help fund its attempted $90B+ takeover of ABN Amro, a Dutch bank. Ordinarily I wouldn’t care much about this kind of story, but because a good buddy of mine works for Barclays in London, I thought I’d take a moment to understand what it all means.

From the graphic above, you can see that the Journal has an embedded video player (theirs is from Brightcove, but could as easily be from Maven, PermissionTV, thePlatform, etc. depending) with a 5 minute interview being conducted by Dennis Berman, WSJ’s M&A reporter with Bob Diamond, Barclay’s president.

Prominently weaving this interview in with the customary text-based reporting is a textbook example of how NON-VIDEO publishers are using broadband to distinguish themselves and why existing video providers (namely cable & broadcast channels) have a mountain of credible competition coming their way.

Mr. Berman expertly led Mr. Diamond through the interview betraying no evidence that he’s actually a print reporter. In fact I liked his open collar, non-made-up appearance, it felt quite authentic. The overall package delivers a multi-dimensional view of the story. And note the byline is actually from 3 other reporters, not Mr. Berman. So the Journal is tapping his expertise for the video contribution, creating a new twist on newsroom collaboration.

Meanwhile, the Journal’s video has opened up an entirely new revenue stream. And with its unparalleled reader/viewer base, they’ve been able to monetize their inventory at $75+ CPM, certainly among the highest rates around. The Journal’s broadband potential and how it will support Fox Business News’s upcoming launch has to be squarely on Rupert’s radar as he attempts to take over Dow Jones.

Categories: Newspapers

Topics: WSJ

-

TiVo: The Comeback Kid

If some kind of ratio could be calculated to measure consumers’ love for a product in relation to that product’s actual market success, TiVo’s score would undoubtedly top the list. Few products have ever achieved such undying fervor from their owners as have TiVo’s. Yet at the same time, few companies have underachieved their market potential as dramatically as has TiVo since its inception ten years ago.

If some kind of ratio could be calculated to measure consumers’ love for a product in relation to that product’s actual market success, TiVo’s score would undoubtedly top the list. Few products have ever achieved such undying fervor from their owners as have TiVo’s. Yet at the same time, few companies have underachieved their market potential as dramatically as has TiVo since its inception ten years ago.Despite my own love for my TiVo Series 2 box, not that long ago when I was asked by a friend what the future held in store for TiVo, I responded that with deep regret, I was hard-pressed to envision a happy ending for this plucky little company.

However, that was before last week when I had the opportunity to spend an evening with Jeff Klugman, TiVo’s Senior VP, General Manager of its Service Provider and Advertising Engineering Division and David Sandford, TiVo’s Vice President, Marketing & Product Management, Service Provider and Media & Advertising Divisions.

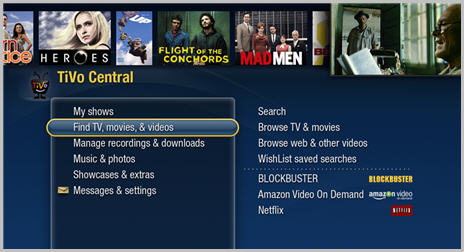

In addition to this time together, I also saw a presentation and demo of TiVo’s new integrated cable TV digital set-top box offering and also hosted them for a "fireside chat." All of this happened at a CTAM of New England-organized session at a cable TV industry conference in Newport, R.I.

Much as I thought I’d never say this, hear me now: TiVo is going to be the Comeback Kid. And it’s completely clear why. Read on to understand my logic.

The Old TiVo: Making Buyers "Crawl Across Broken Glass" to Enjoy the ProductAn immutable law of TiVo ownership has always existed: once you get one set up, you will fall in love with it. With its simple program recording process, tantalizing ad-skipping capability, intuitive user interface and more recently, its endless series of innovations (home networking readiness, remote scheduling, TiVoToGo portability, WishLists, Amazon Unbox downloads, Universal Swivel Search, TiVoCast broadband video channels, etc. etc.) TiVo is a blockbuster consumer value proposition.Despite all this, TiVo has always suffered from a problem that Jeff Klugman astutely describes: the company has essentially made prospective buyers "crawl across broken glass" to get from purchase decision to completed setup. Such a harsh assessment is well-earned. Consider: first TiVo required the user to find their way to a retail store (or go online) to buy the TiVo box, further cluttering the precious shelf space beneath the TV set. Then it required the buyer to select a monthly service plan that was on top of what the consumer already paid for cable TV or satellite service (to add insult to injury, TiVo did away with its $300 "Lifetime"plan a while ago). This change meant that a consumer’s choice to have a one-time bloodletting was replaced with a requirement that TiVo stick its probe into your credit card for as long as you wished to continue getting the service.

But that wasn’t all. Get the TiVo box home and you faced the oh-so-pleasurable task of contorting your body to access the back of your TV, while fending off that embarrassing swarm of dust bunnies lurking back there, all the while juggling a flashlight to figure out how TiVo’s gaggle of wires should marry up to your existing gaggle of wires. Your persistent fear was that not only might you end up not actually getting TiVo to work, you might find that you irreversibly tampered with your existing set-up, reducing your TV to a snow-and-static haze. Factor in your family members glowering at you while you puzzled through this process and it’s a pretty daunting and ugly picture.

This picture became even uglier when cable and satellite operators introduced a viable alternative to TiVo several years ago: simply pay a few extra bucks to them and you can have DVR features (ok, a sucky imitation of TiVo to be sure) built right into your new digital set-top box. So no contorting, fretting, glowering and of course, no extra box to buy and install.

TiVo’s Picture Darkens FurtherGiven this rigmarole, it’s no surprise that, despite the love fest people have for TiVo, it has only managed to sell a few million standalone boxes over the years, a relatively minor market impact. In fact, by far the majority of its market presence is through a deal with DirectTV, which contributes several million TiVo-enabled set-top boxes deployed. However, growth with DirectTV is over, with the company instead choosing to use technology from former sister company NDS instead.The sudden popularity of high definition TV brought yet another huge challenge for TiVo. Eventually, as consumers fully understand HD, they will all want an HD set-top box, capable of delivering real HD programming. Right on the heals of HD, people will want DVR features - of course HD-capable. Cable and satellite operators figured this out a few years ago and stepped up by offering their HD-DVR integrated set-top boxes for just a few extra dollars per month.

But TiVo only recently managed to release its own standalone HD-capable box, the "Series 3." And while the box is a marvel of product design, it weighed in with an $800 price tag, a price completely discordant for consumers whose expectations have been set by the fact that DVD players can now be had for as little as $13 at their local Wal-Mart. Coincidentally, it’s worth noting that just today TiVo announced a $300 version of the Series 3, which, while helping relieve upfront sticker shock, still requires the additional monthly service fees. And also the contorting, puzzling and glowering aspects of the installation process.

And Now for the Silver Lining in this StoryBy now you’re probably wondering how all of this doom-and-gloom is going to give way to the "Comeback Kid" scenario.In fact, the secret to TiVo’s success is, and has always been, jettisoning its hardware business model and becoming a software company. In other words, stop making boxes and instead just license the TiVo software to others whose boxes stand a better chance of being accepted by consumers (i.e. video providers). This was the vision from the start. I recalled reading a trenchant New York Times magazine piece that Michael Lewis (of Liar’s Poker and Moneyball fame) wrote 7 summers ago in August, 2000 on TiVo and Replay, its competitor at the time. I was able to dredge it up (thanks, Google) and in it, Jim Barton, TiVo’s co-founder, and current CTO plainly put it, "We’ll know we’ve succeeded when the TiVo box vanishes."

With TiVo’s promising, but ultimately unfulfilling deal with DirectTV unraveling, the company’s real potential to deliver on its vision lay with making deals with the cable industry. For a variety of reasons not worth recounting here, those deals proved elusive until early 2005 when TiVo struck a deal with Comcast. Things started looking even better for this game plan when the TiVo appointed Tom Rogers, who has significant cable bona fides, as CEO in mid-2005.

Flash forward 2 years later and it is looking increasingly likely that TiVo is on the cusp of executing its original strategy, positioning itself, at long last, for its moment in the sun.

TiVo + the Cable Industry, A Match Made in ARPU HeavenAs summer turns to fall, Comcast, by far the largest cable operator in the US and Cox, the third largest, are planning their initial rollouts of TiVo-enabled HD set-top boxes.After all these years, a more perfect time for TiVo and the cable industry to get together can scarcely be imagined. The incentives for these deals to succeed are very strong all around.

The cable industry is fighting hard to convince consumers to resist switching to Verizon and AT&T in the communities in which these telcos have rolled out their wizzy new video services. With telcos offering stiff price competition, ARPU (average revenue per unit) growth can only happen through new services, not price increases. Further, Comcast in particular has been working overtime to convince Wall Street that Video-on-Demand is its killer competitive advantage to satellite even while it struggles with its poorly-designed user interfaces which serve to impede, not assist, its subscribers’ discovery of valuable VOD programming.

Enter TiVo. TiVo offers Comcast/Cox/the cable industry one of the best-known and best-loved consumer brands with which to align itself on a de-facto exclusive basis. As mentioned, DirectTV’s deal is over. EchoStar’s relationship with TiVo is toxic due to mammoth patent litigation between the two companies. Verizon and AT&T barely have the resources to get their networks up and running much less take on the challenge of how to integrate their set-top boxes with TiVo software.

Meanwhile, the cable industry continues to grapple with how to get more consumers to sign on for digital cable service. Years after its introduction, digital still remains a sketchy value proposition for many. But TiVo gives cable operators a powerful feature to goose demand. Further, since Jeff showed how elegantly TiVo has incorporated VOD navigation and recording into its UI, integrated TiVo service also offers the promise of addressing that cable operators’ challenge in that area.

Last, but not least, on the assumption that TiVo service will carry an upsell charge of around $3-4 per month to the consumer (which are completely my estimates, with nothing having been disclosed by TiVo or its partners at this point), and assuming 2/3 of that goes to the cable operator, TiVo provides tantalizingly high-margin new ARPU growth for cable operators. Those high margins are made possible through the magic of OCAP, the cable industry’s new standard for remotely downloading applications like TiVo to tens of millions of currently-deployed set-tops (i.e. no expensive truck rolls).

That Sweet Sound of Ka-Ching, Ka-ChingTo help understand the revenue and margin potential of the cable deals for TiVo, consider the following:Pick your favorite analyst’s forecast for DVR growth. Forrester, for example believes that by 2011 there will be 65 million DVR homes, up from somewhere around 15-17 million today. So net adds of around 50 million homes. Comcast and Cox together pass about 58 million or 53% of all American homes. So their proportionate share of those 50 million DVR net adds should be at least 26 million. If they market the service right, it’s probably fair to assume that over time, at least 80% of DVR users are going to prefer the TiVo solution to cable’s crummy homegrown DVR alternative (if this option even survives). If so, then these deals’ potential is about 21 million homes taking the TiVo cable service by 2011.

Again, say the TiVo service costs an incremental $3 per month and then assume TiVo keeps a $1 of that, which is my approximation for the combination of its per sub and technology licensing fees. So, eventually 21 million new TiVo homes x $1 month x 12 months. Just from Comcast and Cox that would eventually total $252 million of annual revenue for TiVo. Now factor in when all the other cable operators smell the coffee and abandon their homegrown DVR solutions in favor of TiVo. And then of course it’s inevitable that TiVo will sign up Verizon and AT&T. However in those deals TiVo should be able to negotiate to keep maybe half the monthly fee instead of just a third as they did with the cable crowd (hey, it’ll be a proven service, plus the telcos will be playing catch-up, as usual).

To put all of this in context, for the fiscal year ending 1/31/07, TiVo’s revenues were $259 million, so if the Comcast and Cox deals alone succeed to even a fraction of their fullest potential, they should still have a major impact on the company’s financials. And bear in mind that if the cable strategy succeeds, then along the way TiVo’s retail hardware business would have been euthanized, erasing all that low margin box revenue. What would be left is a high-margin software licensing and services powerhouse, ready to go international, add portable applications and generate all kinds of new features, such ramping up its already solid broadband programming lineup.

But perhaps most important, with TiVo able to track the viewing behavior of all of those millions of homes, its long-held vision of building out an ad-based revenue business based on precise user viewing suddenly seems attainable. Of course it’ll be a little cheeky of TiVo to be pitching agencies and advertisers on these ad services after TiVo all but wrecked their traditional model with its ad-skipping features. But what choice will these folks really have if they want to succeed? And these meetings are already happening, and according to Jeff, who oversees all this, it sounds like all is forgiven and good progress is already being made.

What’s the Catch?The catch here is that initially TiVo is almost entirely dependent on Comcast and Cox putting enough marketing muscle behind this new service and executing it properly. So will Comcast and Cox do this? Though it’s way too early to tell, given all of the aforementioned incentives, there’s ample reason to believe that both will. For Comcast alone, which has borne the brunt of two years of arduous technical integration work with TiVo, failure to follow through with strong marketing would be a huge and embarrassing blunder. So I’m betting these savvy cable guys will get the marketing part right (if you’re really interested in how, keep scrolling to see the below Addendum for a couple of sample marketing scenarios).And if they do, then you heard it here first— TiVo is well-poised to become The Comeback Kid.

ADDENDUM: 2 MARKETING SCENARIOS FOR COMCAST

To make TiVo’s potential more tangible, consider the following 2 scenarios. In both cases you just bought a 42 inch LCD or plasma TV. Of course you now need an HD-capable set-top box. You call Comcast to order one and here’s what should happen:

Scenario 1: You own or have owned a TiVo Series 1 or 2 box

You’re told that an HD set-top will run you $5.00 more per month than your current box. Then you say you’re interested in DVR capability. "Ah," the Comcast rep says, "have you ever owned a TiVo?". You say "Yes." "Well", she continues, "did you know that you can now get the same (mostly) awesome TiVo service - including the familiar user interface, remote control and blooping sounds as you program the box AND have all Video-on-Demand programming expertly integrated into the service, only from Comcast? It is one of our most popular services, and I can offer it to you today for just another $8 more per month than the HD set-top box you want." You say, "let me get this straight, I’m already used to paying $13/month for my TiVo Series 2 service, so instead of paying that, I would pay $8 per month and get virtually all the same benefits of TiVo, but don’t have to go out and buy another TiVo box? And this isn’t the crummy DVR service I saw at my neighbor’s house that I know you also offer, right?" "No sir, it’s TiVo." "Any other sneaky upfront charges?" "No." "Any disconnect charges if I want to drop it?" "No." "Am I missing something here?" "No." "WOW, sign me up - what a great offer. Thanks Comcast."

Scenario 2: You’ve never owned a TiVo box, but you have some familiarity with the product because any number of friends, neighbors, relatives and co-workers have been bragging to you for years that it’s the greatest thing since sliced bread.

You’re told that an HD set-top will run you $5.00 more per month than your current box. Then you say, "I’m kind of interested in this whole DVR thing everyone keeps talking about." After the Comcast rep verifies you’ve never actually owned a TiVo, but that you’re sort of familiar with what it does, she says, "Well, Comcast has a very special offer for you. TiVo DVR service has become one of our most popular services and we think if you experience it for yourself, you’ll see why. So I’d like to offer you 90 days of free TiVo service. If you don’t like it, simply call us at any time and we’ll remotely remove it from your box. That means you don’t need to wait at home for a technician to disable TiVo service for you." You ask what it will cost per month and upon hearing the answer ($8 more per month than the HD box base rate) you make a mental note to ask your friends, neighbors, relatives how much they pay, to see what kind of deal you’re getting (later they’ll confirm it’s the same as they’re currently paying for their Series 1 or 2 monthly plans). You see no downside to trying it, so you do. After you and your family use TiVo for approximately 3 days, you all fall in love with it and wonder how you could have ever lived without it. You call Comcast to say thanks.

Categories: Cable TV Operators, Devices, Partnerships

-

Paltalk Releases Beta of “Screening Rooms”

Paltalk, a company I've written about previously, has released the beta version of a new service it has dubbed "Screening Rooms." Yesterday I got a demo of the service and a briefing with Joel Smernoff, President and COO. After you've registered at Paltalk, you navigate your way (not entirely straightforward, but this is by design for now to suppress demand during beta) to "Finding a Room", and then selecting a "Screening Room." Currently there's a choice of rooms with video from blip.tv, Heavy.com, IFL, Mania TV and Paltalk video.Upon entering a room you're basically in a public IM session with a video window playing. The experience is part of what Paltalk calls "socialcasting", whereby users are able to interact while watching the video. So it sort of emulates watching TV together - collectively chuckling, groaning and critiquing what's on. Basically allowing online engagement to occur around broadband-delivered video.Though it's still early, I think Paltalk's socialcasting theme is very aligned with a concept I've had in mind for some time --- that broadband video is more than just another pathway to bring video into the home, rather it's an entirely new medium to create new consumer experiences. Paltalk's sees it this way too. Their strategy for Screening Rooms is meant to experiment with lots of different types of content. So they're partnering with folks like blip and Heavy, creating their own live events with comedians such as Ray Ellin and possibly developing new shows in hot categories such as travel, cooking, martial arts, etc. Then of course there are the UGC opportunities - uploading your own home movies and inviting friends into a private room for you to narrate.According to Joel, the secret sauce here is really around scalability --- being able to support thousands of participants per room with thousands of rooms running. With 4M active users, Paltalk should have the chops to handle this, but they're taking a go-slow approach for now to make sure there are no big surprises.Categories: Indie Video, Video Sharing

Topics: Paltalk

-

Charter Redesigns Portal, Emphasizes Video

Tomorrow morning Charter Communications will announce a redesigned version of Charter.net, the company's portal for its broadband Internet subscribers. I got a sneak preview of the press release and the new site along with a briefing with Himesh Bhise, VP &GM of High-Speed Internet for Charter, who oversees the portal.

According to Himesh, this redesign is the first key milestone for three main themes the company is pursuing for its portal: improved functionality and feature accessibility on its home page, increased video availability and more extensive TV listings.

I'm impressed with the direction Charter's taking. Charter's goals of enhancing the value of its bundle of video and online services is right on the money. I've said for a while that cable operators are potentially going to be the biggest beneficiaries of broadband video because they already have longstanding relationships with cable TV networks and video consumers, plus a huge base of broadband subscribers (Charter has over 2.5 million).

Charter's in synch with this thinking. They've done deals with a range of partners from biggies like Nickelodeon, HBO and FX to smaller ones like IFC, ResearchChannel.org and HAVOC. Charter's bringing selected video clips into its portal and will also offer some exclusive premieres of certain programming. Other cable operators like Comcast, Time Warner and Cablevision are already down this road with similar activities. Charter's initiatives add further momentum to this trend.

While I'm a fan of these moves, I would love to see the cable guys step up their broadband video activities even further. For example, Himesh and I engaged in an interested mini-debate about the definition and value of "exclusive" broadband programming. To me there's an terrific opportunity for cable operators to negotiate and obtain the broadband rights, at least for a defined window, for certain programs exclusively for their Internet subscribers. This would mean their subscribers get video they just can't get elsewhere. (Btw, that's kind of the way the cable TV world used to work until Congress stepped in with the "program access rules" in the '92 Cable Act).

Some kind of exclusive broadband programming would differentiate cable's portals from the Joosts and other next-gen broadband aggregators coming into the market. I think it's inevitable we're going to see some jousting for these kinds of rights, especially as things get more competitive.

Categories: Cable Networks, Cable TV Operators, Partnerships

Topics: Charter, FX, HBO, IFC, Nickelodeon

-

Navy JAG Corps Uses Video to Snag New Recruits

I’m always on the lookout for innovating uses of broadband video and examples of organizations new to the video world.

So when Peter Marx, an acquaintance of mine forwarded me the following link, I was very intrigued:

http://www.jag.navy.mil/Multimedia/JAGMultimedia.html

Turns out the Navy JAG corps (basically the Navy’s in-house legal team) believes that video can tell a far more compelling story to potential recruits than simple text and graphics. After reviewing the video, I’d certainly agree. If I were a recent grad looking for some adventure beyond sitting in a window-less associate’s cubicle, the JAG opportunity looks pretty enticing!

Peter gave me a few further details. The JAG corps plans to use the video as a centerpiece of their recruiting efforts. It’ll be on their web site, in PowerPoint presentations, linked in emails, etc. It’s only been up for 2 weeks, but is already getting a very positive reaction. He expects they’ll do more videos now that they see how well this one's worked out.I think they’re on the right track. Younger people (certainly the age of their target recruits) are being fed a YouTube diet – video is the quickest way to appeal to them. My only suggestions to Peter were that the video have embed code, so guys like me, and others, can put the player right on my page, instead of using a link. And, half-jokingly, that the video should really include scenes of JAGs in the brig working with their clients…nothing like seeing your clients, in situ, to put a fine point on what JAGs get into!Btw, to see more of Peter's fine work, check out:

Categories: Miscellaneous

Topics: Navy JAG

-

New iSuppli Report on Broadband TV is Relevant for Apple TV and Others

A new report out by iSuppli, written up in EETimes, caught my attention yesterday. I haven't read the report, but the highlights are that an iSuppli survey showed that "61% of respondents agreed or strongly agreed that they wanted the ability to network the Internet to their televisions, while 71% of male respondents agreed or strongly agreed. How is this relevant to Apple TV?Last December, in my "7 Trends for '07" newsletter, I argued that Apple TV would only succeed if Apple adopted an "open" content model. In fact I suggested that Apple TV's key value proposition would be allowing users to access web-based content easily and quickly. Unfortunately Apple chose the opposite approach and made Apple TV essentially an extender of the closed, "walled-garden" iTunes. More recently it has opened open slightly, incorporating YouTube videos.I continue to believe that Apple TV would rule if the product gave users what the iSuppli report underlines - i.e. a way to see their favorite broadband video right on their TVs. This is a problem begging to be solved. Untangling the UI, hardware and software issues is what Apple excels at. I really hope they see the light on this soon. It would help convert Apple TV from a "hobby" as Steve Jobs recently put it, to a product with real potential. If Apple doesn't do this soon, someone else will.

A new report out by iSuppli, written up in EETimes, caught my attention yesterday. I haven't read the report, but the highlights are that an iSuppli survey showed that "61% of respondents agreed or strongly agreed that they wanted the ability to network the Internet to their televisions, while 71% of male respondents agreed or strongly agreed. How is this relevant to Apple TV?Last December, in my "7 Trends for '07" newsletter, I argued that Apple TV would only succeed if Apple adopted an "open" content model. In fact I suggested that Apple TV's key value proposition would be allowing users to access web-based content easily and quickly. Unfortunately Apple chose the opposite approach and made Apple TV essentially an extender of the closed, "walled-garden" iTunes. More recently it has opened open slightly, incorporating YouTube videos.I continue to believe that Apple TV would rule if the product gave users what the iSuppli report underlines - i.e. a way to see their favorite broadband video right on their TVs. This is a problem begging to be solved. Untangling the UI, hardware and software issues is what Apple excels at. I really hope they see the light on this soon. It would help convert Apple TV from a "hobby" as Steve Jobs recently put it, to a product with real potential. If Apple doesn't do this soon, someone else will.Categories:

Topics: AppleTV, iSuppli, iTunes