-

Mark Your Calendars: VideoSchmooze Goes to LA for June 15th Breakfast

We had a huge crowd at this past Monday night's VideoSchmooze in NYC who were treated to an in-depth discussion about whether online video is shifting to the paid model, as well as a high-energy hour and half of networking and drinks.

With the NYC event behind us, I'm very pleased to unveil the first West Coast VideoSchmooze event - a breakfast in LA on June 15th at the ultra luxurious SLS Hotel at Beverly Hills. We have an incredible group of executives who will discuss "How Hollywood Succeeds in the Digital Distribution Era:"

VideoSchmooze event - a breakfast in LA on June 15th at the ultra luxurious SLS Hotel at Beverly Hills. We have an incredible group of executives who will discuss "How Hollywood Succeeds in the Digital Distribution Era:"- Darcy Antonellis - President, Technology Operations, Warner Bros. Home Entertainment

- Albert Cheng - EVP, Digital Media, Disney/ABC Television Group

- Gannon Hall - Chief Operating Officer, Kyte

- Ted Sarandos - Chief Content Officer, Netflix

- Ben Weinberger - CEO and Co-Founder, Digitalsmiths

Darcy, Albert and Ted are all key leaders driving the digital agenda at their respective companies. Among other things, Warner Bros. has led on day-and-date VOD distribution. Disney/ABC has been the most innovative of the broadcast TV networks in pursuing digital outlets, going back to their original iTunes deal. And of course Netflix, which I've written about often, has completely reinvented its model with Watch Instantly streaming. Meanwhile Ben's and Gannon's companies (which are co-lead sponsors of the breakfast), are each providing digital building block technologies to the industry and have in-depth knowledge of Hollywood's requirements and strategies.

For anyone in or around the Hollywood ecosystem, this is a must-attend breakfast, with ample time for networking included. I look forward to seeing you there!

Click here to learn more and register for early bird discount

Categories: Events

Topics: VideoSchmooze

-

Jobs on Flash - There's No Turning Back Now

Definitely make time to read Steve Jobs's blog post from yesterday, "Thoughts on Flash" - no doubt you'll conclude as I did that there's no turning back in this battle. Over the past few weeks the war of words between Adobe and Apple over the latter's lack of Flash support in iPhones, iPods and iPads has flared to new levels. Now Jobs's new post kicks things up another notch. Jobs's argument is mostly a technical/product one - "open" vs. "closed" systems, reliability, performance, security, battery life, touch attributes, etc. (Adobe posted a short response here)

But Jobs's last point is clearly the most important, as he acknowledges. Apple wants to control its own destiny to provide the best products possible and doing so requires eliminating any dependency on 3rd party tools. Lack of dependency on others is a hallmark of Apple's model more generally, but when it comes to the Flash war, the number of penalties Apple is imposing due to its uncompromising position is pretty remarkable: users' inability to view video at some of the web's most popular sites like Hulu, forcing these sites to offer their video in HTML5, marginalizing smaller content providers that don't have the resources to make the change, etc.

However, Apple's products are loved and only Jobs would have the single-mindedness and guts to force a pretty wrenching change in the video ecosystem. Until we see Android or other smartphones emerge as a counter-weight to the iPhone's hegemony, Adobe's role in video is bound to wane.

What do you think? Post a comment now (no sign-in required).Categories: Devices, Technology

-

Learning Best Practices in Video at Akamai Webinar

Earlier this week, while in NYC for VideoSchmooze, Akamai organized a first-class video webinar, "Constructing the Ultimate Online Video Experience, from the Inside Out" which included the following panelists:- Karsten Weide - VP, Digital Media & Entertainment, IDC

- Glenn Goldstein - VP, Media Technology Strategy, MTV Networks Digital Media

- Eric Black - Project Manager, NBCSports.com

- Emil Rensing - Chief Digital Officer, Epix

We had a very detailed discussion around topics like adaptive bit rate delivery, HD, formats, business models, live vs. on-demand, encoding strategies, consumer behaviors, etc. This group is on the front lines of making the online video experience work for their customers and there are a ton of really valuable points made. The webinar is free and the video quality is gorgeous (no surprise!).

Categories: Events

Topics: Akamai

-

VideoNuze Report Podcast #59 - April 30, 2010

Daisy Whitney and I are pleased to present the 59th edition of the VideoNuze Report podcast, for April 30, 2010.

In today's podcast Daisy and I discuss Tremor Media's new $40 million round led by DFJ Growth, announced earlier this week, and about broader investment trends in the online video and advanced advertising space. As I wrote a few weeks ago, money continues to pour into online video companies, and in today's podcast we talk about the key reasons why. Listen in to learn more!

Click here to listen to the podcast (13 minutes, 13 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Advertising, Deals & Financings, Podcasts

Topics: Podcast, Tremor Media

-

Online Video Viewing Rebounds in March According to comScore; Hulu Performance is Mixed

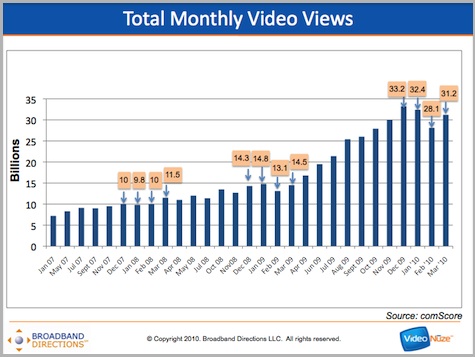

Online video viewing rebounded to 31.2 billion total streams in March '10 according to comScore's newly-released numbers. The March total marks an 11% increase in streams over February's 28.1 billion. As I wrote a couple of weeks ago, it also continues a leveling-dipping-rebounding pattern that has occurred in the Dec-Mar months for the last 2 years as shown in the chart below. If the pattern holds, we'll see strong growth for the next 6 months or so.

As always, YouTube was the top video site by a wide margin. In March it notched 13.1 billion views, up 10% vs. February's 11.9 billion. Its share was down just slightly to 41.8% from February's 42.5%. Still, it was the 21st consecutive month that YouTube's share has been plus or minus 2-3 percentage points of 40%, a remarkable run.

Hulu also bounced back strongly in March, recording its best month to date with 1.070 billion streams, up 7.5% vs. February's 912.5 million. But with Hulu viewers averaging 156 minutes, the minutes per viewer in March actually slipped to 5.84 from 6.18 in Feb. Hulu's average minutes has stayed stubbornly around 6 minutes for over a year now. In addition, total unique viewers came in at just over 40 million. As I've pointed out in the past, Hulu's viewership has been stuck around the 40 million mark now for a year. Absent a radical change, it seems that neither one of these metrics will break out of their respective range any time soon.

Lastly, on the ad network site, Tremor Media, which earlier this week announced a $40 million financing, saw its reach increase to 96 million viewers.

What do you think? Post a comment now (no sign-in required).Categories:

Topics: comScore, Hulu, YouTube

-

Comcast and Netflix in the Context of Cord-Cutting

There's likely no hotter debate in the online video world right now than how big "cord-cutting" - the concept of consumers dropping their pay TV service in favor of online-only options - might be in the future. To the extent that cord-cutting or "cord-shaving" trends develop (and despite some recent research findings, these are still highly uncertain), no company is in a better position to both drive and benefit from them than Netflix.

Netflix cannot be considered a pure substitute for today's pay TV services for many reasons, primarily because there's no live or sports programming, and also because it offers just a fraction of what's available on TV. However, Netflix can be considered a key building block for consumers motivated to cobble together multiple sources to meet their video needs (for example, viewers can augment Netflix with Hulu/YouTube, over the air antenna, iTunes/Amazon downloads, out-of-home viewing, etc.). This is the more likely scenario for would-be cord-cutters than a one-for-one replacement of current pay TV services.

considered a key building block for consumers motivated to cobble together multiple sources to meet their video needs (for example, viewers can augment Netflix with Hulu/YouTube, over the air antenna, iTunes/Amazon downloads, out-of-home viewing, etc.). This is the more likely scenario for would-be cord-cutters than a one-for-one replacement of current pay TV services.

If cord-cutting or cord-shaving did take off, then Comcast, with the largest number of video subscribers of any pay TV provider, would likely be hurt the most (though as the largest broadband ISP, it could actually benefit on that side of its business as users upgrade for more bandwidth).

In this context, and with both companies reporting their Q1 '10 earnings in the past week, it's interesting to look at their performance to consider what to expect going forward.

The natural place to start the comparison is purely the number of video subscribers each company has. Netflix has been on a tear, more than doubling the number of its paying subscribers from just under 7 million in Q1 '07 to just under 14 million in Q1 '10. The biggest chunk of that growth has come in the last 2 quarters alone, when Netflix has added 2.9 million subscribers. Conversely, in that same 3 year time period, Comcast has lost approximately 1.5 million video subscribers to end Q1 '10 at 23.5 million. At the current rates, Netflix could have approximately as many subscribers as Comcast by end of next year.

However, the companies' subscribers are very different. On the one hand, Netflix is seeing its strongest growth in its least expensive $8.99/mo tier, which is a compelling value since it also allows unlimited streaming. Netflix is using this tier to entice many new subscribers and also to defend itself against $1 DVD rental competition from Redbox. As a result its average revenue per subscriber is declining. On the other hand, Comcast has been steadily increasing the penetration of additional services its subscribers take, primarily through "triple play" bundling of video with voice and broadband Internet access. This is reflected in the growth of its average revenue per video subscriber from $107.20 in Q1 '08 to almost $123 in Q1 '10. This, plus other lines of business like advertising, business services and its own programming networks contributes to Comcast generating $9.2 billion in revenue in Q1 '10 compared with Netflix's $494 million.

The flip side of Comcast's drive to increase its ARPU is that it potentially opens up higher cord-cutting interest. Some subscribers who open their billing statements to see a monthly tab in the $200 or more range when premium channels, DVRs, additional set-top boxes, VOD purchases and the like are all added up are inevitably going to get "sticker shock" and start asking the question how much value do they get from their cable subscription? While the cable industry has always made a strong argument that the sheer volume of programming available each month makes it a great subscription value, my sense is that with the massive number of alternative viewing options consumers are now accessing, it's not pure volume that matters, but rather actual cable use, in particular relative to other options.

billing statements to see a monthly tab in the $200 or more range when premium channels, DVRs, additional set-top boxes, VOD purchases and the like are all added up are inevitably going to get "sticker shock" and start asking the question how much value do they get from their cable subscription? While the cable industry has always made a strong argument that the sheer volume of programming available each month makes it a great subscription value, my sense is that with the massive number of alternative viewing options consumers are now accessing, it's not pure volume that matters, but rather actual cable use, in particular relative to other options.

For example, consider a home with a couple of teenagers who rarely watch live TV any more and instead spend a lot of their free time on Facebook, YouTube, Hulu, etc. Say Dad is only a light sports fan and doesn't consider ESPN or Fox Sports essential, and has long since moved the bulk of his news consumption to online sources. He loves Jon Stewart, but is content to catch his jokes online the next day when he has a few minutes of downtime at work. He also loves some of the broadcast network shows, but can watch them sporadically on Hulu. Mom is into the shows on HBO, plus some favorites on ad-supported cable channels like USA, Bravo and Food Network. Still, she's been having less time lately to actually watch these recently and has also started to gravitate to back seasons that are now available on Netflix. Since the family's Nintendo/Blu-ray player/Roku allows streaming to the TV, it's as simple as cable to use. Net it all out and the family's cable usage has declined markedly in the last couple of years.

Does this example sound familiar to you? I believe this is the kind of situation where cord-cutting or cord-shaving starts to gain some interest. Families faced with the real opportunity to save a few bucks each month, though with clearly reduced program options and convenience, will have decisions to make in the coming years. How they make them and how Comcast, Netflix and others react will have huge implications on their performance.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Cable TV Operators

-

Tremor Media Raises $40 Million; Biggest Recent Deal in Online Video Sector

This morning the online video ad network and management company Tremor Media is announcing a monster $40 million financing, bringing total capital in Tremor to $82 million. I've been tracking venture capital investments in the online and mobile video sector for the past 5 quarters and I believe this is the largest recent private company deal yet (I think the only one bigger is Ustream's $75 million deal last quarter, but only $20 million was upfront). Draper Fisher Jurveston Growth Fund is leading the new round, with participation from existing investors. Last night I talked to Jason Glickman, Tremor's CEO and exchanged emails with Randy Glein, managing director at DFJ Growth to learn more.

online and mobile video sector for the past 5 quarters and I believe this is the largest recent private company deal yet (I think the only one bigger is Ustream's $75 million deal last quarter, but only $20 million was upfront). Draper Fisher Jurveston Growth Fund is leading the new round, with participation from existing investors. Last night I talked to Jason Glickman, Tremor's CEO and exchanged emails with Randy Glein, managing director at DFJ Growth to learn more.

Jason explained that since Tremor raised $20 million last year and turned profitable, it actually didn't need the money. However, the team believes that online video advertising is at an inflection point and so the decision to really step up and "go for it" as Jason said. Primarily, that means adding more features for publishers and advertisers and enhancing the Acudeo management platform. It also means pursuing a 3 screen strategy to encompass mobile and TV platforms.

Randy said that DFJ has known Tremor for over 2 years and is motivated by the transformation underway in the advertising industry, driven by exploding online video usage to both computers and other connected devices. The shift in ad spending from traditional TV to online video is just beginning, and Randy sees Tremor - with its huge network and ad management platform - as being positioned right in the middle of all this change.

Jason further explained that the company now has the scale to attract 6 and 7-figure campaigns from brands that are increasingly drawn to the online video medium. Key challenges going forward include proving brands with the data that their online campaigns not only reach their intended targets, but also provide required brand lift and ROI. In particular, Jason said Tremor's ability to optimize against certain audiences or by metrics objectives is an important part of its success.

At VideoSchmooze on Monday night there was considerable discussion around hybrid pay/ad-supported models for premium video content. Clearly, if a content provider can garner consumer payments they should. However, the new Tremor financing is further evidence to me of the innovation and excitement around online video advertising that will make it far more valuable than TV advertising ever was. As brands come to recognize online video advertising's value proposition I see monetization per viewer (or whatever other metric of advertising success that's preferred) going up over time.

(Separate, note also that online video management provider KIT Digital yesterday also completed what is probably the largest public company financing in the online video sector - raising $55 million from the sale of over 4.2 million shares.)

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Deals & Financings

Topics: KIT Digital, Tremor Media

-

Ooyala Integrates YouTube Access For Customers

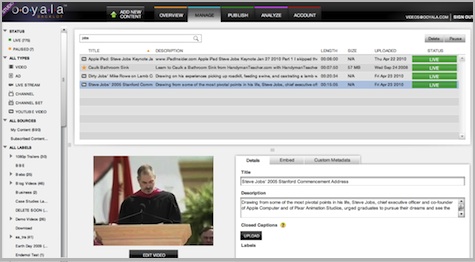

Online video platform Ooyala has unveiled an interesting new feature that allows its customers to add videos from YouTube to their Backlot account and then have them displayed right alongside their own videos in their Ooyala player. All of the analytics that are available for the customer's own videos extend to the YouTube videos as well. Alex Holub, senior product manager at Ooyala gave took me on a quick tour last week of how it works. It appears simple and well thought-out.

Alex explained that the impetus here was that a lot of Ooyala customers were already trying to incorporate YouTube videos, but there wasn't an easy or integrated way to do so. With the new feature, a customer can search and gather relevant YouTube videos from within the Backlot platform and then add them to their account, where they can subsequently add metadata. The videos can also be syndicated along with other owned video. The YouTube videos are displayed in a chromeless player, which means the Ooyala look and controls remain. The main thing that separates the YouTube videos is that per YouTube rules they cannot be directly monetized. So Ooyala's ad rules pre-empt any pre-roll or overlays; instead on-page ads only are allowed.

Ooyala's move is further recognition of valuable YouTube's library has become for many publishers. There is just so much content on YouTube, and tons more being added every day that is freely available that for many YouTube is an irresistible augment to their own content. The only other OVP that I'm aware of that has done something like this with YouTube and other sources is Magnify.net, with has been all about enabling its customers to curate the best video from around the web from the outset. I expect we'll see other OVPs offer this capability too.

Ooyala is offering the new YouTube feature free until May 31st for customers.

What do you think? Post a comment now (no sign-in required).Categories: Technology