-

Global TV Shipments Down 6% in 2013 As Streaming Sticks Raise New Challenges

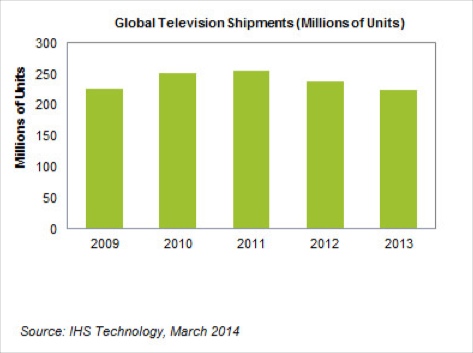

These are highly uncertain times for global TV manufacturers. As IHS reported last week, sales of TVs declined by 6% in 2013 to 225.1 million units, following a 7% contraction in 2012, creating first ever back-to-back down years for the global TV industry. IHS pinned the blame for the declines mainly on market saturation and difficult economic times.

To rebound from the doldrums, TV manufacturers are betting heavily on consumers upgrading to 4K TV and Smart TVs. 4K, or Ultra-High Definition TV, has significant challenges with content availability, price and picture quality differentiation it must overcome to go mainstream. Meanwhile, although the price premium for Smart TVs has shrunk, bringing them closer to conventional HDTVs, their value proposition is still not widely understood by consumers and access to online content is still very limited.

In this already difficult climate, another challenge for TV manufacturers is now taking shape from a whole new category of devices: low cost streaming sticks.Categories: Devices

Topics: Amazon, Chromecast, IHS, Roku

-

IHS: Audience Data is Competitive Differentiator for Video Content Providers

Late last week research firm IHS and video ad platform provider Videoplaza released a new report asserting that video content providers need to become "audience architects" - mining their user data to fully capitalize on the shift to programmatic trading of video advertising. The report is based on IHS's forecasts of the Western European video ad business, but many of its conclusions are equally applicable to US-based video content providers.

IHS believes the primary driver of change is the exploding array of video-capable devices, which in Western Europe it forecasts growing from 340 million in 2008 to 1.1 billion in 2017. As video consumption away from TVs increases, and in particular moves to mobile devices, new challenges around limited ad space and lower ad loads have arisen.Categories: Advertising, International

Topics: IHS, Videoplaza

-

VideoNuze Podcast #203 - Observations from BroadbandTV Con

I'm pleased to present the 203rd edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. This week, Colin and I were in Hollywood at BroadbandTV Con, which brought together a large crowd of digital media executives. In the podcast we discuss some of our key observations including AOL's success in online video, the role of online video advertising in funding long-form high-quality originals, whether sports will leak out of the traditional pay-TV ecosystem and how one studio executive thinks there's no going back to appointment TV viewing.

At the beginning of the podcast we also touch on this week's new IHS forecast that global TV shipments will decline for the second straight year, the first time this has ever happened.

Listen in the learn more!

Click here to listen to the podcast (17 minutes, 3 seconds)

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Topics: BroadbandTV Con, IHS, Podcast

-

IHS: Global TV Shipments to Fall in 2013 For Second Consecutive Year

Research firm IHS has updated its forecast for 2013 global TV shipments, now predicting a decline of 5% for the full year. This would be the second consecutive down year, following a 7% falloff in 2012 (I'm confirming whether this is the first time IHS has ever seen consecutive year declines. UPDATE: IHS has confirmed this is the first-ever 2 year consecutive decline). Shipments for 2013 are now estimated at 226.7 million units. IHS believes 2014 shipments will increase by just 1% in 2014 to 229 million units.

IHS analyst Jusy Hong noted that there are a number of reasons for the 2013 decline, but the main ones are global economic weakness and maturity of the TV market in advanced regions. Just last week, IHS released a survey on Smart TVs, showing relatively high awareness, but low purchase intent in the U.S. as price emerged as the top decision-making driver, eclipsing screen size.Categories: Devices

Topics: IHS

-

VideoNuze Podcast #202 - Smart TVs Face Challenge From Connected TV Devices

I'm pleased to present the 202nd edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia.

This week we dig into why Smart TVs are going to be increasingly challenged by connected TV devices like Chromecast, Roku, Apple TV and others. As my colleague Jose Alvear wrote yesterday, new IHS research shows relatively low purchase intent for Smart TVs, despite high awareness. Price has emerged as the top driver for consumers, which means inexpensive connected TV devices will become more attractive alternatives for OTT viewing.

This is all part of a larger context for how TVs will be integrated with mobile devices in the home. Colin notes that discovery is best suited to mobile devices, but the critical link to the TV's set-top box is still missing. Some operators like Comcast are fixing this, but for tens of millions of homes the TV remains essentially an island unto itself. This is certain to change in the years ahead as new devices proliferate.

Listen in to learn more!

Click here to listen to the podcast (19 minutes, 15 seconds)

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!(Note: Colin and I will both be in LA next week at BroadbandTV Con. If you're attending, send us a note and let's meet up. VideoNuze readers get $75 off registration using the code "VideoNuze.")

Topics: Digitalsmiths, IHS, Podcast

-

Survey: Price Sensitivity and Connected TV Devices Cloud Picture for Smart TV Adoption

Today I'm pleased to introduce the newest VideoNuze contributor, Jose Alvear, who is a research analyst specializing in the pay-TV and online video industries. Jose has authored research reports on content delivery networks, IPTV, OTT video, cloud-based TV and social TV for leading firms in the industry. Jose is currently working on a book focusing on the disruption of the TV industry.

Survey: Price Sensitivity and Connected TV Devices Cloud Picture for Smart TV Adoption

by Jose Alvear

Researcher IHS released survey results earlier this week suggesting a muted forecast for Smart TVs amid rising consumer price sensitivity and a proliferation of inexpensive connected TV devices. IHS found that 73% of U.S. consumers are not interested in buying a Smart TV in the next 12 months. IHS said that once consumers are educated about Smart TVs and learn more about their features, interest does increase. Overall awareness of Smart TVs is high, at 86%, with 30% expressing purchase intent over the next 12 months.

But how intent translates into actual purchase is always tenuous and in this case, particularly so. That's because IHS also found that price has now vaulted to the top position as a driver for TV purchases, surpassing "screen size," which had been cited by more than 50% of respondents in 2012.Categories: Devices

Topics: Apple TV, Chromecast, IHS, Roku

-

Study: 73 Cable TV Networks Offering TV Everywhere, NBCU Leads, Discovery Lags

Market researcher IHS has released its first study of TV Everywhere deployments in the U.S., finding that 73 different cable networks are now allowing authenticated online/mobile access for on-demand viewing. Per the chart below, NBCU leads among the ad-supported segment, with 15 of its 18 networks offering some TVE VOD option, followed by Time Warner (Turner) with 9 networks and News Corp. and Viacom each with 6. Discovery is the only major cable network group not yet offering TVE, but IHS expect that to change soon.

Categories: Cable Networks, Cable TV Operators, TV Everywhere

Topics: IHS, TV Everywhere

-

Digital Movie Purchase and Rental Activity Remains Anemic

Earlier this week IHS Screen Digest Media Research released market share information for the top 5 U.S. digital/online movie stores for the first half of 2011, which together represent approximately 96% of the market. In addition, IHS released information on revenues generated for both purchase/download (Electronic sell-through or "EST") and rental (Internet video on demand or "iVOD").

In the chart below, I've taken the IHS data a step further to estimate each of the top 5 stores' revenues and transaction volume from EST and iVOD (note IHS only provides combined EST+iVOD market share information so for simplicity I have assumed each individual store's share is the same for both EST and iVOD though no doubt there are some variations). The data leads to a clear conclusion that years after movies have been available for digital purchase/download and rental, activity remains anemic, suggesting very low levels of consumer interest, particularly as compared with DVD purchase or rental/subscription options.

Categories: Aggregators, Commerce, FIlms

Topics: Amazon, IHS, iTunes, Microsoft, Sony, VUDU, Wal-Mart

Posts for 'IHS'

|