-

1 Week Left for Early Bird Discount Tickets to March 17th NYC Leadership Event

A reminder that early bird discounts will end next Fri, Feb. 20th for VideoNuze's next event, the Broadband Video Leadership Evening on Tuesday, March 17th in New York City. If you're trying to make sense of the noise and excitement of the rapidly-evolving video landscape, this event is a must-attend. But why pay full fare - register today to get the early bird discount!

The evening will start with a "VideoSchmooze" cocktail/networking reception from 6pm - 7:30pm, followed

by a panel discussion I'll moderate from 7:30pm - 9pm titled, "Broadband Video '09: Building the Road to Profitability." We have panel of top-tier digital media executives including:

by a panel discussion I'll moderate from 7:30pm - 9pm titled, "Broadband Video '09: Building the Road to Profitability." We have panel of top-tier digital media executives including:- Albert Cheng, EVP, Digital Media, Disney/ABC Television Group

- Greg Clayman, EVP, Digital Distribution & Business Development, MTV Networks

- Karin Gilford, SVP, Fancast and Online Entertainment, Comcast Interactive Media

- Curt Hecht, President, VivaKi (Publicis Groupe)

- Tom Morgan, Chief Strategy Officer, Move Networks

Click here to learn more and register for the early bird discount

All of these companies are industry leaders, pushing the edge of the broadband envelope. Among their recent initiatives, ABC just released consumer research about ad frequency in its player, VivaKi has launched "The Pool" with high-profile brands and content providers to improve video standards and Move just powered a live pre-telecast of the Grammy awards.

The event will be held at the Hudson Theater, a beautifully-renovated venue on West 44th Street just off Times Square. I'm pleased to have NATPE, VideoNuze's partner since launch, on board for the event. And I'm extremely grateful to lead sponsor Move Networks and supporting sponsors ExtendMedia, Horn Group, mPoint and PermissionTV who are making the evening possible.

I've set up a Facebook group so you can start meeting other attendees and also keep up to date on all the recent broadband news we'll discuss on the panel. Friend me on Facebook and you can join!

Note this event is on the evening before the start of the McGraw-Hill Media Summit in NYC; if you're coming in for that, plan accordingly to join us as well!

Click here to learn more and register for the early bird discount

Categories: Events

Topics: Broadband Video Leadership Evening, VideoSchmooze

-

NBA Plans Mobile/Broadband Blowout for All-Star Game this Weekend

Sports continues to be on the front lines of the broadband video revolution and with its All-Star game this weekend it's the NBA's turn to show its stuff. Not to be outdone by the Olympics, MLB or NHL, the NBA is going all out with mobile and broadband video supplements to this weekend's game festivities, building on last year's "TNT OverTime Extra" initiative.

Among other features, there will be 4 additional camera angles available in OverTime Extra. There's an

integration with Facebook (similar to what CNN did with the inauguration) which will build community interaction during the game. New also is the NBA.com All-Star Live app which will allow iPhone users to watch the extra 4 camera angles live on their iPhones. (hmm, I wonder what AT&T thinks of all that network consumption?) And there's "All-Star Scene" offering a range of fan-generated content and interactivity.

integration with Facebook (similar to what CNN did with the inauguration) which will build community interaction during the game. New also is the NBA.com All-Star Live app which will allow iPhone users to watch the extra 4 camera angles live on their iPhones. (hmm, I wonder what AT&T thinks of all that network consumption?) And there's "All-Star Scene" offering a range of fan-generated content and interactivity.Broadband is continuing to prove itself as a highly valuable companion to traditional on-air sports coverage, opening up significant new engagement and monetization opportunities. Much more is yet to come.

What do you think? Post a comment now.

Categories: Sports

-

VideoNuze Report Podcast #6 - Feb 13, 2009

Below is the 6th edition of the VideoNuze Report podcast, for Feb. 13, 2009.

This week Daisy Whitney and I discuss the growth of mobile video and specifically new research that Cisco released earlier this week indicating massive increases in traffic over the next 5 years.

Of course mobile video has never suffered from a shortage of hype, but with the popularity of the iPhone and other smartphones, mobile video usage finally seems to be crystallizing in '09. Daisy and I discuss several apps, including one coming up this weekend from NBA.com and TNT whereby users will be able to watch 4 additional camera angles of the All-Star game on their iPhones.

In addition, we also touch on thePlatform's announcement earlier this week of newly reduced delivery and storage pricing targeted mainly for its small-to-medium sized business customers. In this economic climate reducing customer costs is critical and we discuss what thePlatform's moves mean for the market.

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Mobile Video, Podcasts

Topics: Cisco, iPhone, NBA, Podcast, thePlatform

-

Crunching comScore's Video Data Yields Market Insights

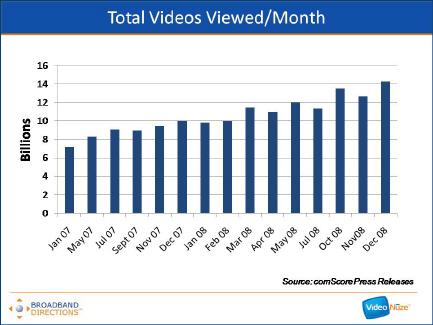

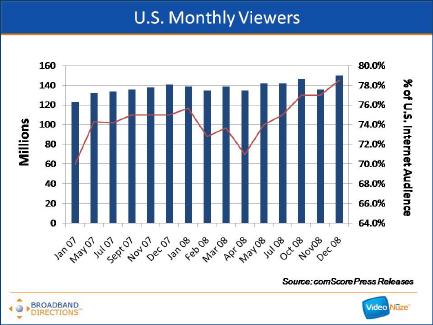

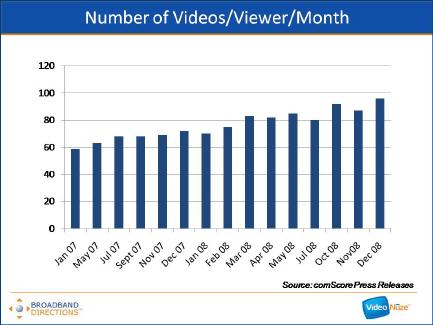

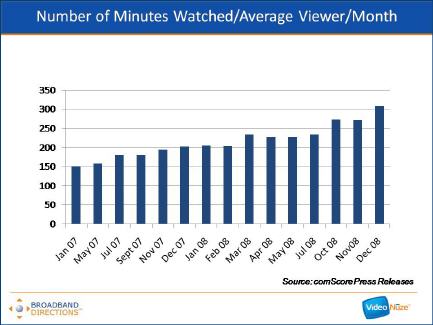

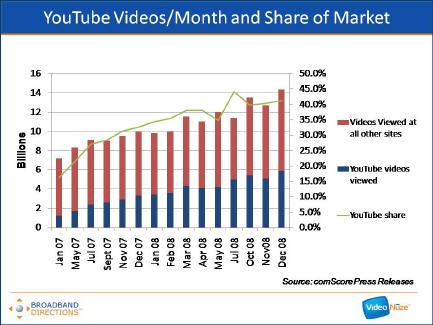

Last week when comScore announced data from its Video Metrix service for December '08, I made a note to myself to go back and look at all the video usage data comScore has released and see what it reveals. Below are 5 charts that I've compiled from comScore's press releases covering January 2007 - December 2008 (note comScore didn't report on every single month during this 24 month period so there are some holes in the graphs).

The first graph shows the growth in total videos viewed per month, roughly doubling from 7.2 billion views in Jan. '07 to 14.3 billion views in Dec. '08.

That growth is driven by a number of factors including an increase in the number of monthly viewers from 123 million in Jan. '07 (70% of U.S. Internet users) to 150 million in Dec. '08 (78.5% of U.S. Internet users).

It also reflects an increase in the number of videos viewed per viewer from 59 in Jan. '07 to 96 in Dec. '08.

Which further translates into the growth of total number of minutes the average viewer watched per month from 151 minutes per month in Jan. '07 to 309 minutes per month in Dec. '08.

Aside from the sheer growth of the market over the last two years, the most striking thing about the comScore data is the growth in usage and market share by YouTube. Back in Jan. '07, YouTube generated approximately 1.2 billion video views per month for a 16.2% share of all videos viewed. Two years later in Dec. '08 YouTube generated approximately 5.9 billion video views per month for a 41.2% market share. YouTube's share growth is staggering: in every month but 1 during this period YouTube increased its sequential monthly views and in all but 3 months it increased its sequential monthly market share.

Aside from the sheer growth of the market over the last two years, the most striking thing about the comScore data is the growth in usage and market share by YouTube. Back in Jan. '07, YouTube generated approximately 1.2 billion video views per month for a 16.2% share of all videos viewed. Two years later in Dec. '08 YouTube generated approximately 5.9 billion video views per month for a 41.2% market share. YouTube's share growth is staggering: in every month but 1 during this period YouTube increased its sequential monthly views and in all but 3 months it increased its sequential monthly market share.

Recall that Google closed on the YouTube acquisition in Nov. '06 and at $1.65 billion, many thought Google had grossly overpaid. Some may still believe this as YouTube is still very much a work in progress in terms of how it generates revenue. But there's no questioning the phenomenal two-year run it has had in terms of its usage and market share growth. This is one of the reasons why I continue to believe YouTube is one of the most powerful platforms for eventually disrupting the traditional video distribution value chain.

If these slides are hard to view, I've uploaded them all to SlideShare.

What do you think? Post a comment now.

Categories: Aggregators

Topics: comScore, Google, YouTube

-

Surging Video Consumption Drives Cisco's Mobile Traffic Forecast

Last summer I wrote about Cisco's Visual Networking Index, a model that the company originally built to forecast traffic for its own internal planning, but which it now releases externally as well. Cisco's methodology is to combine analyst projections with data that it collects from its own customers.

Yesterday Cisco released an updated forecast focused on mobile traffic, which is an area of intense interest

for many, in light of the huge success of the iPhone and the App Store. Once again Cisco has given me permission to make available the forecast slides for complimentary download. It was a pretty long deck so I've culled out the most salient slides.

for many, in light of the huge success of the iPhone and the App Store. Once again Cisco has given me permission to make available the forecast slides for complimentary download. It was a pretty long deck so I've culled out the most salient slides. Cisco is forecasting mobile traffic will grow 66x from 2008-2013 to 2.5 million terabytes/mo. The primary driver of that growth is video, which it believes will account for 64% of mobile traffic in '13, more than triple data's 19% share. Cisco believes that most of the mobile video consumed will be on demand, not streamed live.

As for devices that will fuel all this growth, Cisco believes that handsets (primarily smartphones) will account for 53% of traffic, and portable devices (primarily laptops using aircards) will account for 40%. According to its analysis, smartphones generate at least 30x the mobile traffic that standard handsets do, while laptops generate 450x the traffic of handsets. The forecast slides also break out growth by traffic type in each region of the world.

I've said in the past that although mobile video is lagging broadband fixed line video today, it is poised to quickly catch up. All of this traffic growth of course creates both issues and opportunities for wireless carriers. Soon enough consumers are going to expect that they can take their full video experience on the road with them. It's an exciting vision.

What do you think? Post a comment now.

Categories: Mobile Video

Topics: Cisco

-

VMIX Reports Growth, Adds Staff

In this economic environment, it's always refreshing to see signs of growth and progress. VMIX, a white-label video management and publishing platform is reporting both today. It has added Ted Utz, formerly VP of National Sales for CBS Televisions Stations Digital Media Group to open its New York office along with other new headcount in its main office in San Diego.

Mike Glickenhaus, VMIX's CEO told me the earlier this week that the company is also continuing to expand beyond its original media vertical. It is working with Pure Digital, JVC, Toyota's Scion and will be announcing deals in other verticals soon. This is partly the result of a new reseller program that's beginning to pay dividends.

Mike noted that while he believes VMIX's technology is competitive with that of others, the company has also been able to differentiate itself through its focus on monetization, service and experience with user-generated content. As I've written before, the video platform space is quite crowded, but it looks as though VMIX is continuing to win its share of business.

Categories: Technology

Topics: VMIX

-

Surging Video Consumption Drives Cisco's Mobile Traffic Forecast

Last summer I wrote about Cisco's Visual Networking Index, a model that the company originally built to forecast traffic for its own internal planning, but which it now releases externally as well. Cisco's methodology is to combine analyst projections with data that it collects from its own customers.

Yesterday Cisco released an updated forecast focused on mobile traffic, which is an area of intense interest

for many, in light of the huge success of the iPhone and the App Store. Once again Cisco has given me permission to make available the forecast slides for complimentary download. It was a pretty long deck so I've culled out the most salient slides.

for many, in light of the huge success of the iPhone and the App Store. Once again Cisco has given me permission to make available the forecast slides for complimentary download. It was a pretty long deck so I've culled out the most salient slides. Cisco is forecasting mobile traffic will grow 66x from 2008-2013 to 2.5 million terabytes/mo. The primary driver of that growth is video, which it believes will account for 64% of mobile traffic in '13, more than triple data's 19% share. Cisco believes that most of the mobile video consumed will be on demand, not streamed live.

As for devices that will fuel all this growth, Cisco believes that handsets (primarily smartphones) will account for 53% of traffic, and portable devices (primarily laptops using aircards) will account for 40%. According to its analysis, smartphones generate at least 30x the mobile traffic that standard handsets do, while laptops generate 450x the traffic of handsets. The forecast slides also break out growth by traffic type in each region of the world.

I've said in the past that although mobile video is lagging broadband fixed line video today, it is poised to quickly catch up. All of this traffic growth of course creates both issues and opportunities for wireless carriers. Soon enough consumers are going to expect that they can take their full video experience on the road with them. It's an exciting vision.

What do you think? Post a comment now.

Categories: Mobile Video

Topics: Cisco

-

AnySource Media Seeks to Power Broadband TVs

Last month's CES brought a wave of news from TV manufacturers about plans to integrate broadband access directly into their new sets. There's going to be growing momentum around this capability and I believe it's inevitable that broadband connectivity will one day be a standard feature in virtually all HDTVs.

The wrinkle in this scenario is that for broadband video on TV to be a compelling experience for consumers there must be a user-friendly environment to discover and navigate to desired video. Simply offering an Ethernet jack or wireless connection is insufficient. In fact a strong UI becomes even more important as video choices expand.

Seeking to solve the problem of how to organize, present and deliver broadband video via connected TVs is an early-stage company called AnySource Media that I believe is going to be getting a lot of attention over the next couple of years. I saw a demo of their service last fall and recently I talked to Mike Harris, AnySource's CEO to learn more.

The first and most important thing to know about AnySource is that its executive team has deep and

successful roots in the consumer electronics (CE), video processing and semiconductor industries. As a result, it has the relationships, technical understanding and subtle know-how to get things done with the opaque CE industry. For example, a key question for me with the new crop of connected TVs has been whether new, specialized chips would be required in the TVs. These would inevitably cause upward retail price pressure, thereby suppressing consumer demand. Mike was able to walk me through the specific capabilities of chipsets commonly found in digital set-top boxes, how they are already migrating into TVs and how AnySource intends to leverage them to avoid creating new costs for the manufacturers.

successful roots in the consumer electronics (CE), video processing and semiconductor industries. As a result, it has the relationships, technical understanding and subtle know-how to get things done with the opaque CE industry. For example, a key question for me with the new crop of connected TVs has been whether new, specialized chips would be required in the TVs. These would inevitably cause upward retail price pressure, thereby suppressing consumer demand. Mike was able to walk me through the specific capabilities of chipsets commonly found in digital set-top boxes, how they are already migrating into TVs and how AnySource intends to leverage them to avoid creating new costs for the manufacturers. There are two pieces to the AnySource Internet Video Navigator (IVN) solution: a software client freely embedded into the TV's chipset, and a back-end data center that aggregates and streams/downloads the content, creates metadata, organizes the presentation experience and passes on relevant advertising or commerce information.

AnySource's goal is not to disrupt the underlying content provider's experience or require any new encoding; it simply passes through whatever the content provider wants to make available. At CES it demo'd with 80 content providers and Mike said over 200 deals are in the works. Given the simplicity of its pitch, I think that as AnySource's footprint expands content providers will be very interested partners. AnySource doesn't plan to obtain revenue shares from content providers, rather its business model is to sell its own ads in the presentation screens.

The key to AnySource's model is of course is getting TV manufacturers to embed the IVN software. Mike was reluctant to get into specifics, but at CES AnySource demo'd on a Sylvania set from Funai. The goal is be in the market with at least 2-3 TV brands in '09 with more in '10. Obviously if AnySource's model gets traction, further deals will become a lot easier to get done. Unlike other devices which require new remotes or keyboards, AnySource-powered content will be available using the TV's remote control.

The connected TV space is the most exciting frontier in the broadband video landscape because it holds the potential to unlock vast new value for consumers and content providers. We've started to see some traction from third party devices like Xbox, TiVo, Roku, etc, but long-term the market will only achieve ubiquity when TVs themselves come with user-friendly broadband access. It's a highly disruptive scenario, and one which AnySource could well be a central player in.

What do you think? Post a comment now.

Categories: Devices, Technology

Topics: AnySource Media, CES, Funai