-

Cable's Faster Broadband Speeds Make Google's Fiber Project Look Even Sillier

Google's recently-announced fiber-to-the-home experiment (which I estimated could cost the company $750 million or more) looks even sillier in the context of continued announcements by cable operators of faster broadband deployments. As an example, this week brought news that Virgin Media, a large U.K. cable operator, is launching 100 megabit/second service by the end of this year, and also intends to expand its trial of 200 megabits/second service. Virgin's announcements came on top of Shaw Communications (a large Canadian cable operator) news from last week that it would soon test expanding its current 100 megabit/second service to 1 gigabit/second, a 10x increase. And big U.S. cable operators themselves continue deploying "DOCSIS 3.0" equipment to offer ever-faster broadband services.

Google's recently-announced fiber-to-the-home experiment (which I estimated could cost the company $750 million or more) looks even sillier in the context of continued announcements by cable operators of faster broadband deployments. As an example, this week brought news that Virgin Media, a large U.K. cable operator, is launching 100 megabit/second service by the end of this year, and also intends to expand its trial of 200 megabits/second service. Virgin's announcements came on top of Shaw Communications (a large Canadian cable operator) news from last week that it would soon test expanding its current 100 megabit/second service to 1 gigabit/second, a 10x increase. And big U.S. cable operators themselves continue deploying "DOCSIS 3.0" equipment to offer ever-faster broadband services.Google pegged one gigabit as the target for its fiber-to-the-home project, but doesn't the question beg - if cable operators (and telcos) themselves are continuing to improve the speeds of their broadband services to approach 1 gigabit, what is the point of a small, isolated Google experiment? As I pointed out, consumers have benefited from continuous improvements in bandwidth over the years and, even absent net neutrality regulations, enjoy open, unfettered access to all legal content and services. What Google is contributing to the broadband ISP business with its fiber trial remains a complete mystery to me. At some point I have to believe Google shareholders and Wall Street analysts covering the company are going to want more clarity too.

What do you think? Post a comment now (no sign-in required).

Categories: Broadband ISPs, Cable TV Operators, International

Topics: Google, Shaw, Virgin Media

-

Cablevision's "PC to TV Media Relay" Service Could Have Broad Implications

This week brought yet another new twist in the sizzling broadband-to-the-TV convergence space, as Cablevision unveiled a technical trial of its "PC to TV Media Relay" service. Cablevision didn't release a lot of details, but from what it said, it seems that users will download software to their computer which will allow them to then share content to their Cablevision digital set-top box for viewing on TV.

If it works - and of course that's an if for now - Media Relay could have broad implications, first and foremost for those trying to either sell standalone convergence boxes (e.g. Roku, soon Boxee, Apple TV, etc.) and other CE devices trying to leverage convergence functionality (e.g. gaming consoles, Blu-ray players,

Internet TVs). Depending on how Cablevision prices Media Relay, it may make a lot more sense for consumers to use it than to go buy a convergence device. Online content providers and aggregators like Netflix and Hulu would also benefit from seamless TV-based viewing. While TV Everywhere seeks to expand access to cable programming outside the home, Media Relay complements it by offering online content within the home, on the TV. It's a very interesting development and worth keeping an eye on to see if others emulate it.

Internet TVs). Depending on how Cablevision prices Media Relay, it may make a lot more sense for consumers to use it than to go buy a convergence device. Online content providers and aggregators like Netflix and Hulu would also benefit from seamless TV-based viewing. While TV Everywhere seeks to expand access to cable programming outside the home, Media Relay complements it by offering online content within the home, on the TV. It's a very interesting development and worth keeping an eye on to see if others emulate it. What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, Devices

-

U.K. Theaters Will Show "Alice in Wonderland" Ending DVD Early Release Flap

The brinksmanship between Disney and the 3 largest U.K. theater chains over whether they would show Tim

Burton's new "Alice in Wonderland" film is officially done, with all 3 chains now signed on. As I described last week in "In Trying to Preserve DVD Sales, Studios Are in a Tight Spot," in a bid to boost DVD sales, Disney was looking to trim the DVD release of "Alice" to just 12 1/2 weeks after its opening, from the customary 16 1/2. British and other European theaters revolted, angry that the move would diminish their box-office take, a particular hot-button in light of significant investments they've recently made in digital technologies.

Burton's new "Alice in Wonderland" film is officially done, with all 3 chains now signed on. As I described last week in "In Trying to Preserve DVD Sales, Studios Are in a Tight Spot," in a bid to boost DVD sales, Disney was looking to trim the DVD release of "Alice" to just 12 1/2 weeks after its opening, from the customary 16 1/2. British and other European theaters revolted, angry that the move would diminish their box-office take, a particular hot-button in light of significant investments they've recently made in digital technologies. Specific details of the Disney-U.K. deals aren't known, but as the Guardian reported, it appears that Disney has agreed to cap the number of movies that will get earlier-than-usual DVD releases and provided some improved financial terms. Despite the U.K. resolution, some other European chains are still holding out, as is the AMC chain in the U.S. Regardless of the final outcome of the "Alice" situation, early DVD releases are going to remain a priority for Hollywood studios who are desperate to stanch the fall-off in DVD sales brought about by the recession and the shift by consumers to rental, subscription and online viewing options. There are many more chapters to be written in this saga.

What do you think? Post a comment now (no sign-in required).

Categories: FIlms, International, Studios

Topics: Alice in Wonderland, Disney

-

WSJ Launches "Digits" Video Series; Continues to Lead Newspapers in Online Video

This week The Wall Street Journal launched a video companion series to its popular "Digits" blog, continuing to prove that online video opens up exciting new opportunities for newspapers. Airing at 1pm each weekday, and thereafter on demand, the series is hosted by MarketWatch's Stacey Delo and showcases others in the Dow Jones family like Walt Mossberg and Kara Swisher. The Digits video series follows last fall's launch of News Hub, a video news series which in January already accounted for 1 million of the WSJ Digital Network's 5.5 million streams.The Journal is right on the mark with its video strategy, and is nicely demonstrating how newspapers can leverage their brands, journalists and advertising relationships into online video. There's nothing fancy about any of this video as the Journal is using cost-effective technologies like Skype and personal video cameras, plus a simple, yet functional set in its newsroom. The Digits video series would not be mistaken for broadcast journalism, but for the web, where real-time original analysis is key, it's well above the quality bar. Obviously the WSJ is a unique property, and it is complimented by other DJ resources. Still, all newspapers should be looking closely at its video strategy and applying its lessons. I've insisted for a long while that online video is anything but a death knell for print publications; the Journal is proving it in spades.

What do you think? Post a comment now (no sign-in required).

Categories: Newspapers

Topics: WSJ

-

VideoNuze Report Podcast #51 - February 26, 2010

Daisy Whitney and I are pleased to present the 51st edition of the VideoNuze Report podcast, for February 26, 2010.

First up this week Daisy discusses the Beet TV online video roundtable in which she participated this week. Beet got a bunch of industry executives together for a discussion moderated by Kara Swisher of AllThingsD. Daisy talks about what she learned and the one-on-one interviews she conducted which will be available soon at the Beet site.

Then we discuss my post from yesterday, "Sezmi is Slick; Marketing It Will Be the Big Challenge," in which I reviewed the opportunities and challenges that Sezmi, the recently-launched next-gen video service provider is facing. Sezmi is now available in the entire LA area, with expansion to other U.S. geographies in store for later this year. I delve into why I think the skeptics are getting ahead of themselves in their downbeat assessments.

Click here to listen to the podcast (14 minutes, 52 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Cable TV Operators, People, Podcasts

-

Sezmi is Slick; Marketing It Will Be the Big Challenge

While in LA this week, I caught up with Phil Wiser, Sezmi's president and co-founder and got another good look at the Sezmi service, which just officially launched in the entire LA market with Best Buy. I've been covering Sezmi for over 3 years, and from a technical and product standpoint, I continue to be impressed with what it has accomplished, especially for a 1.0 launch. Out-of-the box set up is very straightforward and a series of intuitive menus quickly creates a personalized user profile complete with recommended shows based on your interests and selections from linear and on-demand channels.

Sezmi gained my attention early on because unlike other broadband-only devices (e.g. Roku, Vudu, ZillionTV, AppleTV, gaming consoles, etc.), Sezmi's goal has always been to become a full replacement for existing multichannel video programming distributors ("MVPDs"). That "boil the ocean" strategy has

required it to develop its own hybrid broadcast/broadband content delivery system, sign up local broadcasters for access to their bandwidth, ink carriage deals with cable networks and design the user experience from scratch, among other things. Having done much of that work (with a key exception being to still get the remaining cable channels from Disney/ESPN, Fox, Scripps and A&E into the line-up), Sezmi's next challenge is to actually market the service and add subscribers cost-effectively. This could well prove to be Sezmi's biggest challenge.

required it to develop its own hybrid broadcast/broadband content delivery system, sign up local broadcasters for access to their bandwidth, ink carriage deals with cable networks and design the user experience from scratch, among other things. Having done much of that work (with a key exception being to still get the remaining cable channels from Disney/ESPN, Fox, Scripps and A&E into the line-up), Sezmi's next challenge is to actually market the service and add subscribers cost-effectively. This could well prove to be Sezmi's biggest challenge.The market for multichannel video subscriptions has never been more competitive than it is today. Deep-pocketed cable operators, satellite operators and telcos (and in some places 3rd party "overbuilders" like RCN) are beating the hell out of each other in many U.S. geographies. For example, here in the Boston area we're bombarded daily with ads on radio, in newspapers, in direct mail, through door-hangers and other means, to switch providers. While there are a lot of noisy promotional offers, there are plenty of product and technology-based pitches as well - more HD channels, faster broadband speeds, better VOD and so on. The "triple play" bundle of video, voice and data is a significant marketing lever. I don't know what the marketing cost per acquired customer is for Comcast or Verizon these days, but I have no doubt it has never been higher.

This is battleground that Sezmi is now entering after nearly four years of development. Many people are skeptical about Sezmi's odds of success (read TDG president Michael Greeson's well-done piece from last week for a rundown of the issues), at least as Sezmi is currently configured. Some of these concerns are very valid, in particular Sezmi's $299 upfront equipment fee (which is pretty much unique in the industry), its currently incomplete channel lineup (note also that HBO, Showtime and Starz are also not available) and the $20/mo rate which is marginally better than alternatives (but is likely to increase anyway as more channels and especially expensive ones like ESPN are added).

No question, Sezmi faces a steep marketing challenge. Still, I believe there are reasons for optimism. First, as Sezmi has said many times, it is not a box company and Best Buy isn't its only route to market. It plans deals with telco and ISP partners who will not only bundle its pricing but also erase the upfront charge through a rental model. The rental could be very aggressive depending on the partner's goals, opening up more pricing competitiveness for Sezmi. Second, Sezmi's user interface and certain product features are very compelling differentiators. Granted, incumbent MVPDs are not standing still (see Cablevision's "Media Relay" announcement just yesterday), but the fact that Sezmi owns its whole system from end to end gives it more control and flexibility to enhance the product (for example in VOD it is not relying on traditional vendors).

Lastly, and I'll admit this is where things get fuzzy, but I do think there's a segment of existing MVPD customers who hunger for something new, better and lower cost than is currently available. I've made the analogy for Sezmi to what JetBlue has done in the airline industry and I think that still holds. Depending on how distinctive Sezmi's positioning and messaging is, I think it could really resonate with younger, urban, tech-savvy users. One Sezmi feature alone - access to all YouTube videos - is a totally new value proposition. Phil and I quickly searched YouTube yesterday for "Alec Baldwin Hulu Super Bowl Ad" and in seconds there it was. Can any other MVPD offer that today?

There are plenty of reasons to discount Sezmi's chances of success, but I think that's premature thinking, especially given how dynamic the video landscape is today. But even if Sezmi doesn't thread the needle and fully surmount the marketing challenges ahead, the company still has a lot of value in its technology and products. If Vudu fetched a reported $100 million from Wal-Mart, and Sling got $380 million from DISH as announced a couple years ago, then there should be a palatable financial exit in store for Sezmi as well, even with $75 million or so invested to date. Of course its investors and executives are hoping for far more than just a "palatable" final chapter. The real test of what's in store for Sezmi is just now beginning.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, Satellite, Telcos

Topics: Comast, SezMi, Sling, TDG, Verizon, VUDU

-

Why Did Online Video Consumption Spike in 2009?

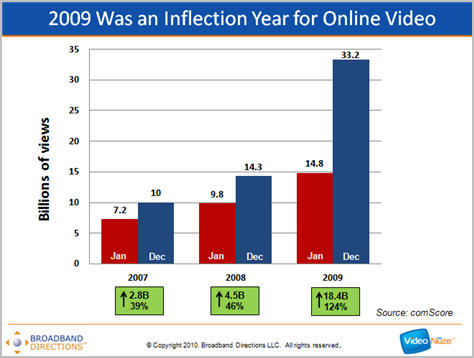

If you want to get a sense of how significant an inflection year 2009 was for online video, have a look at the chart below.

As you can see, according to comScore data, while Jan-Dec growth in 2007 (up 2.8 billion views or 39%) and 2008 (up 4.5 billion views or 46%) were impressive by any standard, the Jan-Dec 2009 growth of 18.4 billion views, up 124%, completely blows them away. Growth was so significant in 2009 that I think years down the road it will be pointed to as the year that online video really turned the corner.

But if that's the case, the question begs, "Why did growth accelerate so much in 2009 vs. prior years?" That's what I've been asked several times by industry colleagues since posting "comScore Data Shows 2009 Was a Blistering Year for Online Video" 2 weeks ago. It's a great question and though I don't have a really precise answer, here's my best sense of what happened.

No surprise, the most important contributor to the year's growth was YouTube. It zoomed from 6.3 billion views in Jan '09 to 13.2 billion in Dec. '09. That increase of 6.9 views accounts for 38% of the 18.4 billion delta between Jan and Dec. So what did YouTube do to generate such significant growth? Part of the reason is surely organic; more people uploading, sharing and viewing YouTube videos. But in 2009 YouTube also made strides in professionalizing the content on YouTube, broadening its value proposition to users. For example, its "Content ID" program, which lets media companies manage and monetize user-uploaded videos, has largely addressed the copyright infringement concerns from past years (the Viacom suit is a notable exception).

In 2009, among other things, YouTube also signed up Disney/ESPN, Univision and others as content partners, began implementing FreeWheel's ad system so 3rd party content providers could better monetize their views, engaged a number of leading brands to use it as a promotional platform, and with "YouTube Direct" engaged news organizations as partners. In short, YouTube continues to immerse itself into the fabric of the Internet. Whether users are viewing videos at its site or through its wildly popular embeds, YouTube has become omnipresent. YouTube now also claims to be the 2nd largest search site.

A second, but distant contributor to 2009's growth was Hulu, which saw its views increase by over 763 million from Jan to Dec, accounting for about 4% of the 18.4 billion increase in total views during that period. Hulu's mindshare leaped following its 2009 "Evil Plot" Super Bowl ad featuring Alec Baldwin and the subsequent ones. No doubt the addition of ABC programs throughout the year, plus other new content partners, also helped generate more viewership, along with the hugely popular SNL clips.

Once you get beyond these top 2 sites, the individual contributions to 2009's growth are more dispersed. The comScore data shows that across all video sites, usage intensified significantly during the year. For example, the number of videos viewed per viewer increased from 101 in Jan to 187 in Dec. The number of minutes watched jumped from 356 in Jan (almost 6 hours) to 762 in Dec (more than 12 1/2). There were also 31 million more U.S. Internet users watching video in Dec vs. Jan (178 million vs 147 million).

Looking beyond the numbers and thinking more qualitatively, it's also fair to conclude than in '09 online video reached a certain level of awareness that made it almost ubiquitous. There is just so much video online, and it is shared so widely, and highlighted so frequently by mainstream media, that it is unavoidable, even for the least technically-savvy among us. People are increasingly entertaining themselves with online video, but they're also finding new uses for it in their daily personal and professional lives.

I think it's unlikely we'll see the same level of growth in 2010 as in 2009, but I do believe the growth curve over the next 5 years will be very steep. The primary contributor will be convergence devices (e.g. game consoles, Blu-ray players, Roku, etc.) that are bridging online video to the TV where longer-form consumption will be the norm. Another key contributor will be TV Everywhere services, which are just now getting off the starting blocks. Lastly, I think growth in mobile consumption will be another important contributor. Add them all up and the 33.2 billion videos viewed in Dec. '09 will look relatively small 5 years from now.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators

Topics: comScore, Hulu, YouTube

-

Wal-Mart's Acquisition of Vudu Makes Little Difference

Yesterday's announcement by retailing giant Wal-Mart that it was acquiring Vudu, the on-demand movie service, generated a flurry of reactions from industry commentators. Some think it gives Wal-Mart the juice it needs to finally be a major digital media player. Others believe that Wal-Mart's miserable record in digital media suggests that the deal will be much ado about nothing. I'm in the latter camp, but not because of Wal-Mart's track record, but rather because of Vudu's own shortcomings.

Vudu's problem is that its value proposition is hamstrung by both the deals the Hollywood studios insist on to give Vudu access to their titles and by the current state of technology. Each of Vudu's 2 movie delivery

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.The rental model is primarily handicapped by the ongoing provision that the rental period "expires" 24 hours after the movie was started. That means that if real life (e.g. a crying child, a call from an old friend, a household emergency) interrupts the Vudu's users' planned viewing window, they're out of luck. It's an absurd restriction, but all online movie rentals are laboring under it. Then there's the provision that most new releases aren't available for rental until 30 days after they debut on DVD. This kind of delay doesn't mean as much for a subscription service like Netflix (which of course just agreed to a new 28-day "DVD sales window" with Warner Bros.), because it has a huge back catalog to offer. But for Vudu (and Redbox) these delays are very noticeable to users.

The download-to-own model is even more challenged. First off, tech-savvy and value-conscious consumers are increasingly focused on cost-effective rentals or subscriptions, not purchasing films. The demise of DVD sales is ample evidence of this. The idea of creating a movie "collection" in a fully on-demand world is already on the verge of seeming as archaic as creating a CD collection has been for a while. And with download-to-own prices of approximately $20, which are more than a DVD costs, consumers will be even more hesitant.

But the real killer for download-to-own is the technology limitations, more specifically the lack of portability and interoperability. Say you're actually inclined to own movies using Vudu. What do you do, download them to an external hard drive? And when you travel, do you lug that thing around with you? When you get to your destination, what device will actually let you play back your movie from your hard drive? The issues go on. The reality is that ubiquitous, cheap DVD players and the compact size of the discs themselves have created a very high bar for digital delivery to exceed. "Digital locker" concepts like DECE and Disney's KeyChest are desperately needed to move digital downloads along, but even they are just a part of a larger CE puzzle.

So, although the Vudu service is very impressive, with a slick user experience and really nice quality video, the reality is that unless Wal-Mart is able to break through these challenges, the Vudu service is going to be marginally attractive to consumers at best. That means the Wal-Mart acquisition, in fact, makes little difference.

Maybe Wal-Mart has the clout to move the studios, but given mighty Apple's own difficulties doing so, I'm skeptical that Wal-Mart will have better luck. I continue to believe that Netflix's model - which combines the full selection of DVDs with the convenience and growing selection of online delivery (including TV shows by the way) - is a far better approach. Netflix may not have all the HD and user interface bells and whistles that Vudu has, but it's a far better value proposition for consumers. This is partly why Netflix has doubled in size, to 12.3 million subscribers, in the last 3 years.

What do you think? Post a comment now (no sign-in required).

Categories: Deals & Financings, FIlms, Studios

Topics: Apple, DECE, Disney, KeyChest, Netflix, VUDU, Wal-Mart