-

Media Buyer Interview Series Part 1: Ed Montes, EVP/Managing Director, Havas Digital US

Not a day goes by where there isn't an article about the health of the broadband video industry - how viewer consumption is growing, how much ad revenue it's slated to generate (or not), and what content and infrastructure partnerships have been inked. With the lion's share of the industry ad supported, it's time to hear from the people who are in position to make or break projected revenue budgets: the media buyers.

This interview is with Ed Montes, EVP/Managing Director of Havas Digital US; it is the first of a series of interviews that The Diffusion Group's senior analyst, Mugs Buckley, is conducting with advertising's key media buyers.

WHAT TYPE OF ONLINE ADS DO YOU BUY?

We buy pre-rolls, mid-rolls, in-line video ads. The only thing we have not bought much of are ads around user-generated content.

WHO ARE SOME OF YOUR CLIENTS?

Sears, K-Mart, Fidelity Investments, Amtrak, Tyson, Choice Hotels, Volvo, Air France, and Reckitt Benckiser, to name a few.

ARE ALL OF YOUR CLIENTS BUYING VIDEO ADS?

Many of our clients are placing ads in online video.

IS IT A "MUST HAVE" ON THE MEDIA PLAN?

We're definitely see it grow in importance and yes, it is a "must have" on some media plans. What I can say with more certainty is that online video advertising is becoming, and for some clients is, as important as display advertising. What remains a more consistent "must have" are search buys.

WHAT ARE THE SIZES OF SOME OF YOUR BUYS? WHAT ARE THE CPM TRENDS?

A buyer considers two things: scale (will it reach enough people) and the size/cost of a buy. It depends on the overall size of the campaign. For instance, in a large campaign a buy is south of $50K, may not make the plan, unless we're going to do it for the intelligence of the buy or because the CPM is very discounted. On a smaller campaign $50K might be the entire campaign so you will see much smaller video purchases. There is a huge swing for CPM range depending on the content. Everything hinges on the content. We see CPMs ranging from $15-$40 for non-UGV content in-stream units. UGV, the lower-end quality content CPMs tend to be in the single digits. In-banner video is generally on the lower end of the single digit range.

HOW LABOR INTENSIVE IS AN ONLINE VIDEO AD BUY?

Relatively speaking, it is a lot more labor intensive than a broadcast buy. In the online world, there are a lot of steps in the process to create, buy, optimize, build and analyze a video ad campaign.

WHAT DO YOU WANT YOUR SELLERS TO KNOW BEFORE THEY COME AND PITCH YOU?

I'd like sellers to be informed about our clients, their campaigns, and goals so we can build the best possible idea. I want someone to bring me a solution, not just sell me their unsold inventory.

IS THE "BUY" ALL ABOUT SCALE?

I think it's about audience fragmentation, the inverse of scale. People buy TV because they can aggregate a large audience; it is the best mass media vehicle. As TV ratings decline, a buyer has to buy an increased mix of television to achieve the same scale they did previously. Now the consideration shouldn't just be TV, it should be all video.

WHO DOES THE BUYING? BROADCAST BUYER? ONLINE BUYER?

Both online buyers and broadcast buyers do the buying but like anything, it depends on the buy. Pure online purchases (like Hulu, Veoh, YouTube), the online buyers are in the lead. On the network side (such as buying from ABC), it's a little bit different because there are instances where media is bought by network buyers with the assistance of online buyers.

WOULD YOU BUY FROM AN INDEPENDENT WEB STUDIO OR THEIR CONTENT?

I would consider such a buy but it goes back to the issue of scale. Would we buy directly from the programmer or buy from a network? In a world where I'm trying to aggregate reach, they may fall out of the category due to their limited audience size.

QUOTE

"We're bullish on online video, the performance we've seen from it is highly encouraging."

Categories: Advertising, People

Topics: Havas, The Diffusion Group

-

New TDG Research Provides Details of Broadband Video Advertising's Growth

The Diffusion Group, a leading analytics and advisory firm specializing in broadband media and the digital home, is releasing a new report tomorrow entitled, "Online TV and the Future of Digital Video Advertising." VideoNuze is offering half a dozen slides as a complimentary download (note, VideoNuze has no financial interest in this report).

Though I haven't seen the full report, in a conversation with Mugs Buckley, the report's author (and also periodic VideoNuze contributor), I got a sneak peek at some of its key conclusions. The report is based on TDG's proprietary consumer research and modeling, interviews with industry executives, data from other firms and other secondary research. In sum, the report pegs '08 video ad revenue at $590 million, growing to $9.98 billion in 2013.

To establish some order, Mugs first identifies four types of video, estimating each one's current market share

in terms of stream count and ad revenue and then forecasting them through 2013. The four types are "user generated video," "long-form," "short clips" and "other" (which includes all paid models, adult content, corporate and educational videos, etc.).

in terms of stream count and ad revenue and then forecasting them through 2013. The four types are "user generated video," "long-form," "short clips" and "other" (which includes all paid models, adult content, corporate and educational videos, etc.). No surprise, UGV currently accounts for 42.4% of streams, but only 3.7% of ad revenues. Conversely, long-form accounts for only 2.2% of streams but 41.6% of ad revenues. Note the disparity would be lower if, instead of using streams (where one 40 minute TV show stream is equivalent to one 10 second clip stream on YouTube), the report used "minutes viewed" or another consumption-centric metric. I agree with Mugs though - in either case, the underlying point would still be true - long-form, higher-quality video is going to be where ad dollars are and will be concentrated.

The report's forecast reinforces the point: by 2013, long-form's stream share will roughly double to 4.1%, with its share of ad revenue growing to 69.4%. Conversely UGV's stream share grows a little bit, but its ad share shrinks to 1.8% . A wildcard in this mix is the role of short-clips, defined as 2-5 minute videos including everything from news/entertainment/sports videos to webisodes. Mugs is bullish on this segment, with its lower costs to produce and ability for users to watch spontaneously. This is where a lot of market activity and original programming is happening and it's still early to gauge its acceptance by users and advertisers.

A key input to the revenue forecast is the underlying CPM forecast. Mugs said her approach was to be relatively conservative with CPM's predicting little more than inflation-adjusted growth. For long-form that means CPMs growing from $40 today to $46 in 2013, which feels pretty modest, especially if targeting and engagement tactics pay off (see more on Disney's efforts in this post). On the UGV CPM forecast, it's important to note the $15 CPM refers to YouTube's announced CPM target for partners' video, NOT pure UGV.

There's lots more info in the slides, and if you're interested in the whole report, it's best to contact sales@thediffusiongroup.com or 469-287-8050.

Categories: Advertising

Topics: The Diffusion Group

-

The Reality of Web Video Advertising Just Doesn't Seem to Add Up

Today's post is from TDG's Mugs Buckley, who discusses the confusing state of video advertising projections.

The Reality of Web Video Advertising Just Doesn't Seem to Add Up

by: Mugs Buckley, Contributing Analyst, The Diffusion Group

I used to think I was pretty good at math, but after trying to make sense of recent forecasts regarding web video advertising, I'm beginning to doubt my skills. Let it be known that I'm a big believer in the growth potential of the Internet video ad business; I'm simply struggling to follow the numbers that have been reported. Since no single analysis offers an "apples-to-apples" industry comparison, I thought I'd offer up some of the available forecasts and offer a few thoughts.

So here's where I'm stuck.

The estimates and forecasts for only video ads are all over the place. For example:

- eMarketer estimates that US marketers spent $775M in 2007 and will spend $1.3B in 2008 for online video streaming and in-page ads.

- Jupiter Research predicts that 2008 online video ads in the US will yield $768M.

- comScore reported that online viewers consumed 9.8B videos in January 2008 (down from December 2007's 10.1B) of which 3.4B were Google/YouTube videos.

- In a November 2007 Financial Times article, a leading media buyer for Starcom Media Group (who is well aware of her buys and rates) predicted that the 2007 market for "The Big Four" broadcast networks was likely to generate around $120M.

So here's where it gets a bit confusing.

- If we use the 3.4B monthly view Google/YouTube view estimate for January and run that out for a 12-month period, add some growth for fun, we come up with about 45B views for all of 2008.

- YouTube charges $15 CPMs for their in-video overlay ads (down from the initial $20 CPMs used during beta testing).

- If 100% of the 45B Google/YouTube videos were sold at $15 CPMs, that would yield revenue of $675M. But that assumes 100% inventory sold, which won't happen for a variety for reasons (in particular because YouTube only sells overly ads on their contracted partner deals, not user-generated content).

- According to Bear Stearns, YouTube is set to generate $22.6M in revenue for video ads, about 3.3% of the possible $675M at 100% inventory sold.

Hmmm. So if YouTube (at 34% of all web video consumed) could generate $22.6M in revenue in 2008, and the Big Four were running about $120M in 2007, how does one arrive at these impressive near-billion dollar predictions? Where else is this revenue coming from?

Let's not rule out operator error - I'll quickly admit that I may have misinterpreted how these numbers were derived and what they represent. That being said, however, there doesn't seem to be a rational way to reconcile these disparate estimates. Can anyone out there help to square these numbers? Is it simply a matter of under- or over-reporting? Are the measurement systems currently in place so poor and mutually exclusive in methodology that they necessarily offer conflicting estimates?

Something just isn't adding up. Yes, this may seem to be a bit nit-picky on my part; the rambling of an analyst with too much time on her hands. Then again, without accurate revenue and usage estimates, it is impossible to know the real value of any form of advertising, much less an emerging model such as web-based video advertising.

Please let us know what you think!

Categories: Advertising

Topics: comScore, eMarketer, Jupiter Research, The Diffusion Group, YouTube

-

BBC's iPlayer a Model for U.S. Networks?

Today, I'm pleased to welcome the first post from Colin Dixon, Practice Manager, Broadband Media at The Diffusion Group, who is also a longtime industry executive.

I also want to highlight that as part of The Diffusion Group's 4th anniversary today, it is offering a special promotion for new clients of 4 reports for $4,000 (reports are usually $2,500 apiece) which also includes a 30 minute consult with founder/principal analyst Michael Greeson. The opportunity will be available for 4 hours, 4 minutes, from 12 noon U.S. Central Time today. Enjoy!

BBC's iPlayer a Model for U.S. Networks?

by Colin Dixon, The Diffusion Group

There's a lot of angst in Hollywood at the moment over broadband video. With video advertising models online in their infancy, the content providers are rightfully concerned about cannibalizing their linear channel ad revenue for unproven broadband models. Will eyeballs follow if a content provider puts all of its shows online? What's the right balance between too little and too much online content? With the variable quality of broadband connections, should a viewer be able to download the show for free rather than streaming it? Questions such as these are the source of much hand-wringing.

But what would happen if a major network were to throw caution to the wind and put everything they broadcast online and let their viewers download the shows for free to watch when and where they liked? Perhaps we can learn some lessons from the UK where the BBC, unfettered by the profit motive, is doing just that.

Late last year the BBC released its iPlayer through broadband connections to the British public. This proprietary client, available on PCs and iPods throughout the UK, makes available for free download every show broadcast on all of the BBC's many radio and television channels. Once downloaded, a show can be watched, ad free, anytime over the following 30 days (although once you start to watch a show, you have 7 days to finish viewing it.)

The British public, apparently, love it. In January, they downloaded some 11 million shows with usage of the service peaking at over a half million downloads in one day. Over 2 million people are perfectly comfortable relaxing in front of the PC catching up with the latest episode of "Doctor Who" or "EastEnders." And because the show is downloaded, not streamed, the quality is always great and the shows can be watched when and where it's convenient.

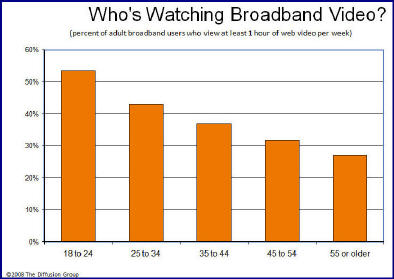

But perhaps this is just a British thing. Surely the same rules don't apply to the US market? Far from it. As we found when we surveyed broadband video users, there is strong evidence that US users will embrace online delivery with the same fervor as their UK brethren. When we surveyed nearly 2000 US broadband users, we found that 40% were watching an hour or more of broadband video. More amazing still is that 12% of broadband users were watching 25% or more of their television online. If you have a teenager in your home, I'm sure this will not come as a surprise to you!

Numbers like this are noteworthy in themselves. But it's important to remember that, in comparison to the BBC's iPlayer, the online viewing experience in the US is a mess. Shows are scattered over multiple websites and free ad supported show downloads are rare indeed. Broadband video viewing is an incredibly variable, often frustrating experience. What is clear is that given the same circumstances, the BBC's experience is likely to be repeated here.

The message for US content providers is clear: if you put it all online for free, and let people download and watch whatever, wherever and whenever they want, the eyeballs will follow. But with large numbers of people already devoting 25% or more of their TV viewing online, the issue of cannibalizing existing linear broadcast ad revenues is rapidly becoming irrelevant. The ad revenues will migrate to the Internet anyway!

One can only speculate what can happen when, as we predict for 2011, there are over 100 million households worldwide that are watching broadband video not from their PCs, but from broadband-enabled TVs.

What do you think? Post a comment and let everyone know!

Categories: Broadcasters, Downloads, International

Topics: BBC, iPlayer, The Diffusion Group

-

Fueling Over-the-Top Broadband Video

Today I'm very pleased to introduce Michael Greeson as a contributor to VideoNuze. Michael is the founding partner and Principal Analyst at The Diffusion Group, a leading analytics and advisory firm helping

companies in the connected home and broadband media markets. VideoNuze has partnered with TDG to bring key highlights of its research and opinions to VideoNuze readers on a regular basis. I'm confident that you'll find them valuable and, as always, look forward to your feedback.A Simple Way to Fuel Diffusion of Over-the-Top Broadband Videoby Michael Greeson

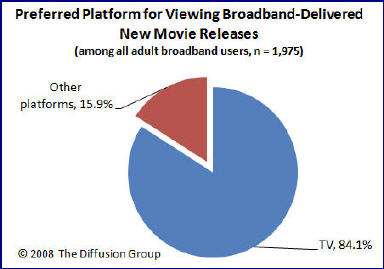

companies in the connected home and broadband media markets. VideoNuze has partnered with TDG to bring key highlights of its research and opinions to VideoNuze readers on a regular basis. I'm confident that you'll find them valuable and, as always, look forward to your feedback.A Simple Way to Fuel Diffusion of Over-the-Top Broadband Videoby Michael GreesonWith the web becoming more about media and entertainment, the rationale to get a broadband conduit into the living room is irrefutable - after all, that's where most consumers have their high-definition TV and their best sound system, it's the home's most comfortable media setting and remains the preferred platform for watching video. Not that a laptop PC in the den, a second TV and stereo in the master bedroom, or even an iPhone are not interesting as video consumption points; of course they are, but not as the primary or preferred setting. As noted below, when asked to choose between TVs, desktop PCs, notebook PCs, or mobile video platforms, close to nine in ten consumers prefer to watch movies on their living room TV.

Then why are those companies which are pushing a "three screen" video consumption strategy spending most of their energy and resources on the two "new" spaces (that is, PC-based or portable/mobile video consumption) and forgetting about the living room TV altogether? It seems as if open broadband to the TV is not sexy or cool enough for Silicon Valley; too mundane for such "cutting edge" companies.

Then why are those companies which are pushing a "three screen" video consumption strategy spending most of their energy and resources on the two "new" spaces (that is, PC-based or portable/mobile video consumption) and forgetting about the living room TV altogether? It seems as if open broadband to the TV is not sexy or cool enough for Silicon Valley; too mundane for such "cutting edge" companies.I've got news for them: watching video on the TV is not going away anytime soon, meaning that emerging new video models (the other two screens) will serve as supplements to the living room TV, not as replacements. Those pointing to TV's demise (a dubitable and specious position to hold) must know that, even if this happens, it will come about very, very slowly. The TV has proven an incredibly resilient and flexible viewing platform, one whose primacy will be reinforced by new media, not compromised.

For these reasons, I advocate a very simple strategy to help push broadband connectivity into the living room and broadband video into its rightful place. Forget about earmarking Internet connectivity as a "premium" feature reserved only for high-end CE, game consoles, or novel "new media" platforms like Apple TV. Think beyond adding Internet connectivity to a TV (which has a replacement cycle of six to eight years) or a high-def DVD player (a higher-end platform seen as unnecessary to most consumers).

Instead, add Internet connectivity to mainstream consumer electronic devices that are widely diffused, dependable, and which enjoy a more rapid replacement cycle - devices such as low-to-mid-range DVD players. Yes, it would increase the cost of the DVD player, but only slightly, and if there is legitimate value in delivering web-based media to the living room, the cost increase will be seen as tolerable. In the end, there is no better way to accomplish widespread, rapid diffusion than to tie a compelling new application to a trusted (existing) platform that's several hundred dollars cheaper than similarly-enabled platforms.

The argument I've presented above is relatively commonsensical: it is inherently easier to enhance incrementally the features and capabilities of a stable, widely diffused, well-loved platform (like a DVD player) than to try to sell consumers a completely new "black box" that enables a specific set of benefits that, while convincing, may not by themselves be sufficiently compelling to generate a purchase. Moreover, "new media" can benefit immensely by serving "traditional environments." While it is interesting to envision a future where anytime/anywhere video consumption is possible, at this point simply enhancing the primary video experience may be the most practical for "three screen" broadband video players. While not as "hot" or "cool," it will likely prove the most lucrative.

Categories: Aggregators, Devices

Topics: The Diffusion Group

Posts for 'The Diffusion Group'

Previous |