-

Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks

A monthly reminder that online video remains a work in progress is comScore's viewership data for online video ad networks. Even as someone who follows the industry closely, I find these reports confusing. The press

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service.

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service. comScore's traffic reports are extremely important for the online video industry's growth because they are a key source of data for advertisers, media buyers, agencies and others looking to tap into this new medium. Ad networks in particular are an important part of the online video ecosystem because they provide significant reach, targeting and delivery technology, all of which are required by prospective advertisers.

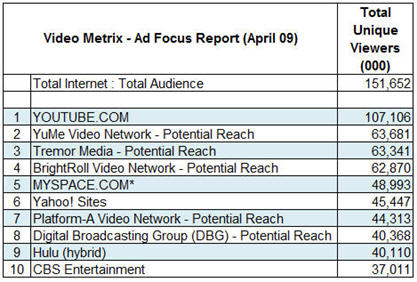

A key part of the current confusion is that each month comScore's Video Metrix Ad Focus report - which details the total audience of unique viewers for online properties and ad networks - combines both the actual audience of destination properties with the potential reach of video ad networks. For example, here's the top 10 for April:

As you can see, 5 of the top 10 listed are ad networks, whose measurement is potential, while the other 5 are actuals. "Potential" is supposed to represent the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However even the validity of this number is amorphous, because networks are only required to provide comScore proof of their relationships if the site accounts for more than 2% of all streaming or web activity.

Recognizing the need to provide more clarity, comScore has recently made available the option for networks to participate in a "hybrid" measurement approach, meant to track networks' actual viewership. To participate, networks need to place a 1x1 pixel, or "beacon" inside any video player where their ads appear. comScore takes the data reported by the beacons and combines it with its 2 million member panel of users whose behavior it tracks. It reconciles differences between the two through a "scaling" process that looks at the intensity of users' non-video behaviors.

To give a sense of the difference between potential and actual, comScore reports BrightRoll - which along with Nabbr are the only video ad networks to have implemented the beacons by April - as having 26M actual viewers vs. the 62M potential reported.

comScore's hybrid approach, which fits with its recently-announced "Media Metrix 360" service, is an important step forward in providing more clarity on how video ad networks are actually performing. Still, as Tania explained, even the hybrid approach has its own idiosyncrasies. For example, some publishers resist having a network's beacon incorporated into their video player, because they want to receive traffic credit themselves. Further, it is a voluntary program. Tania said that in addition to BrightRoll and Nabbr, other networks like BBE, YuMe and Tremor are all working through the implementation currently.

The actual numbers are important for buyers, so that ad networks' viewership can be assessed on an "apple to apples" basis with online properties, as well as non-video options. Tania said that media buyers tell comScore they value both potential and actual numbers. Though that sounds right to me, I think that for the online video medium to mature, buyers are going to put increasing emphasis on actual performance, particularly as it relates to existing media. That's why recent efforts from YuMe and Tremor to translate online video's impact into TV's gross rating points (GRP) paradigm are also important.

In short, comScore seems to be doing its part to improve reporting clarity. However, this isn't going to resolve itself overnight; the market will continue to experience reporting confusion for some time to come.

What do you think? Post a comment now.

Categories: Advertising

Topics: BBE, BrightRoll, comScore, Nabbr, Tremor Media, YuMe

-

4 Industry News Items Worth Noting

Looking back over the past week's news, there are at least 4 industry items worth noting. Here are brief thoughts on each:

Time Warner starts to acknowledge execution realities of "TV Everywhere" - I was intrigued to read this piece in Multichannel News covering comments that Time Warner Cable COO Landel Hobbs made about its TV Everywhere's plans being slowed by "business rules." Though I love TV Everywhere's vision, I've been skeptical of it because it's overly ambitious from technical and business standpoints. This was the first time I've seen anyone from TW begin to acknowledge these realities (though Hobbs insists "the hard part is not the technology"). I fully expect we'll see further tempered comments from TW executives in the months to come as it realizes how hard TV Everywhere is to execute.

VOD and broadband video vie for ad dollars - I've been saying for a while that broadband can be viewed as another video-on-demand platform, which inevitably means that it's in competition with VOD initiatives from cable operators. For both content providers and advertisers, a key driver of their decision to put resources into one or the other of the two platforms is monetization. And with VOD advertising still such a hairball, broadband has gained a decisive advantage. As a result, I wasn't surprised to read in this B&C article that ad professionals are imploring cable operators to get on the stick and improve VOD's ad insertion processes. Cablevision took an important step in this direction, announcing this week 24 hour ad insertion. Still, much more needs to be done if VOD is going to effectively compete with broadband video for ad dollars.Cisco sees an exabyte future - Cisco released an updated version of its "Visual Networking Index" which I most recently wrote about in February. Once again, Cisco sees video as the big driver of IP traffic growth, accounting for 91% of global consumer IP traffic by 2013. The fastest growing category is "Internet video to the TV" (basically the convergence play), while the biggest chunk of video usage will still be "Internet video to the PC" (today's primary model). Speaking to Cisco market intelligence people recently, it's clear that from CEO John Chambers on down, the company believes that video is THE growth engine in the years to come.

iPhone's new video capabilities - Daisy reviews this in her podcast comments today. It's hard to underestimate the impact of the iPhone on the mobile video market, and the forthcoming iPhone 3G S's video capabilities (adaptive live streaming, video capture/edit and direct video downloads for rental or own) mean the iPhone will continue to raise the mobile video bar even as new smartphone competitors emerge. Nielsen has a good profile of iPhone users here. It notes that 37% of iPhone users watch video on their phone, which 6 times more likely than regular mobile subscribers.

Categories: Advertising, Cable TV Operators, Mobile Video, Video On Demand, Worth Noting

Topics: Apple, Cablevision, Cisco, iPhone, Time Warner Cable, TV Everywhere

-

VideoNuze Report Podcast #20 - June 12, 2009

Below is the 20th edition of the VideoNuze Report podcast, for June 12, 2009.

This week I discuss the rampant innovation that I'm observing throughout the broadband video industry. My last few posts have provided several great examples of the technology, content and business model innovation now underway. These include product introductions from Blackwave and thePlatform, original online video from the Pennsylvania Tourism Office and syndicated product videos to online retailers from Invodo. Broadband video is far more than just a new entertainment medium!

Meanwhile Daisy discusses the Apple Worldwide Developers Conference, which was held this week in San Francisco. Among other things, the company unveiled several video-centric features for its new iPhone 3G S. These include adaptive live streaming, video capture/edit and direct video downloads for rental or own (i.e. a sideload from iTunes no longer required). Daisy explains that the video capture/edit capability positions the iPhone closer to the Flip video camera, setting up a new competitive dynamic for Flip and its new parent, Cisco.

Daisy sees the iPhone becoming a bona fide "media portal" that takes on some of the appeal of Amazon's Kindle. I agree with that comparison. Notwithstanding other smartphones launching like last week's Palm Pre, the iPhone will continue to have the greatest impact on the budding mobile video market.

Click here to listen to the podcast (14 minutes, 23 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Indie Video, Mobile Video, Podcasts, Technology

Topics: Apple, Blackwave, iPhone, Kindle, Podcast, thePlatform

-

Invodo Pursues New Model of Syndicating Product Videos to Online Retailers

Ever find yourself shopping online and wish that there was a video that showed you the product's key features and benefits, and maybe even showed the product in action? And assuming that the video educated you and in turn increased the likelihood that you actually followed through and bought the product, wouldn't that delight the online retailer because it increased their conversion rate?

This is the context that Invodo, an Austin, TX based company that recently hit my radar is banking on. Craig Wax, CEO and Trey Swain, President and COO briefed me on how Invodo's model works.

Invodo has built up a library of 20,000 product videos from 1,900 manufacturers that it is now syndicating for free to over 1,000 online retailers like Amazon, Sears, Buy.com and others. Craig said that they've been able

to build their video catalog in less than a year primarily by sending crews to industry trade shows, where they arrange to have company reps explain their products on camera. Though there was nothing fancy about the videos I randomly selected to watch, they did convey valuable product texture and would have helped in the purchase consideration process.

to build their video catalog in less than a year primarily by sending crews to industry trade shows, where they arrange to have company reps explain their products on camera. Though there was nothing fancy about the videos I randomly selected to watch, they did convey valuable product texture and would have helped in the purchase consideration process. My first inclination was to think Invodo should be charging for the videos, all the more so if they help drive higher conversion for the online retailers. However, Craig and Trey explained they've been most focused on scaling distribution and simply giving the video away to retailers for free is the best way to do that. That makes Invodo another example of the free business model that Chris Anderson discussed in his original Wired article, which will released as the book "Free" in a few weeks.

But giving away the core product (both the content and platform), with the goal of upgrading the customer to pay for premium features (the so called "freemium" model), means Invodo's business model depends on identifying valuable premium features that retailers will be willing to pay for.

There are two premium paths the company is pursuing. First it is offering a "buy now" button in the videos, which supports impulse buying, raising conversion. And second, it is offering an embedded player, so the video plays within the retailer's product page (as opposed to being a link to a new player window). The embedded player also provides features like ratings, sharing, etc. All of this too is meant to increase conversion rates.

With video becoming more pervasive and expected by users, it is only natural to think that retailers will embrace it as well. The only other company I can think of that is doing something vaguely similar is ExpoTV. But their product reviews are created by users, and I don't think they syndicate these videos to retailers.

It's clearly still very early days for Invodo and the category. I'll be curious to see how things work out.

What do you think? Post a comment now.

Categories: Commerce

-

Two More Great Examples of Online Video's Growing Pervasiveness

Spending half a day in New York City yesterday provided two more great examples of online video's growing pervasiveness.

First, as I was hustling down Seventh Avenue toward Penn Station to catch my train back to Boston, a billboard for "Peter Arthur Stories" caught my attention. It was one of those gigantic multi-story billboards that wrapped around a building and are frequently used to promote new films. But there was something slightly different about it - it seemed like an ad for a film, but it didn't have any actors' images or rating or "in theaters now." I was intrigued and made a mental note to check it out.

It turns out that "Peter Arthur Stories" is actually an online-only series of 4 short (6-8 minutes) episodes produced by the Pennsylvania Tourism Office which was released a few weeks ago. The series traces Peter Arthur (note his initials are "PA," also the abbreviation for Pennsylvania), as he traipses around the state in a sidecar searching for the waitress he's obsessed over since she served him a slice of Shoofly pie when he was 12 years-old. You see the state's lush landscape, farmlands and towns like Gettysburg and Jim Thorpe through his eyes and experiences. There's a campy but catchy musical score that is interwoven at various points. At the series' web site there's also a 4 question trivia contest which enters you into a sweepstakes for 12 different Pennsylvania getaways.

It's certainly a very unconventional campaign for a state tourism office. Think about it - the state bought hugely expensive billboard in a prime, heavily-trafficked Manhattan location solely to drive people to a web site to see its originally-produced video that only subtly promotes the state. That the state pursued this plan speaks volumes about how pervasive and accepted online video has become as a promotional medium. I have no idea if the campaign has worked for the state, but I give the people behind it huge credit for being on the leading edge.

My other experience came at an awards lunch I attended, at which David Walker, former U.S. Comptroller General and now president of the Peter G. Peterson Foundation was the featured speaker. Some of you may know that Walker has become the most outspoken critic of the U.S. government's financial policies and the debts that it has racked up

After giving a 15 minute talk, Walker implored the audience to learn more and get involved. How? He held up a DVD cover for the movie "I.O.U.S.A." and said go to http://www.iousathemovie.com/ and watch the 30

minute excerpt of this documentary, and then pass it along to your friends and family. I.O.U.S.A. is an 87 minute educational film that has been called "The Inconvenient Truth of Debt." As a sidenote, I watched part of the excerpt; it really is pretty frightening what's happening with America's finances.

minute excerpt of this documentary, and then pass it along to your friends and family. I.O.U.S.A. is an 87 minute educational film that has been called "The Inconvenient Truth of Debt." As a sidenote, I watched part of the excerpt; it really is pretty frightening what's happening with America's finances. Walker's recommendation is yet another illustration of how activists have turned to online video to generate excitement and action. In the old days passing a petition around to gather signatures was the way incent change; increasingly the tactic of choice is to distribute an online video and build a community around it.

Online video is becoming more pervasive and mainstream; it has far more potential than just being another entertainment outlet.

What do you think? Post a comment now.

Categories: Indie Video

Topics: I.O.U.S.A., IOUSA, Pennsylvania Tourism Office, Peter Arthur Stories

-

Robust Ecosystem Promises that Online Video Will Keep Looking Better and Better

I continue to be impressed with the ecosystem of technology companies whose products enable online video to be delivered better, cheaper and faster. Video quality has made incredible strides over the last ten years, evolving from grainy postage stamp-sized experiences to gorgeous HD or near-HD experiences that are becoming more routine. This is causing a powerful "virtuous cycle" to take hold: as users' video experiences improve they watch more video. As they watch more they help fuel more investment in the online video medium.

In particular, CDNs' ability to offer better service even as their delivery rates continue to plummet is based on continuous improvements in their infrastructure. Similarly, content providers' ability to offer higher-quality video is based on improving operational efficiencies and costs in their content management and publishing processes. Two announcements today illustrate both of these dynamics quite well.

First, Blackwave, a Boston-area early-stage provider of video storage and delivery systems that I've been following for a while, is announcing today the R6, its first production system, along with its first major CDN customer, CDNetworks. Last week, Andrew Grant, Blackwave's director of business development and Mike Killian, CTO gave me an update,

Blackwave's focus in on giving CDNs a more powerful, more efficient way of storing and serving high-

quality video content. The R6 reduces the CDN's hardware requirements by offering both higher-density and more intelligent storage. One example is that Blackwave continuously gauges the popularity of certain pieces of content. If their popularity increases, more resources are provisioned for higher-availability; if their popularity decreases (as for Long Tail content), they get fewer resources. Among other things, Blackwave is also able to support WMS and Flash streaming, FTP uploading for content ingest and "multi-tenancy" for customer resource sharing.

quality video content. The R6 reduces the CDN's hardware requirements by offering both higher-density and more intelligent storage. One example is that Blackwave continuously gauges the popularity of certain pieces of content. If their popularity increases, more resources are provisioned for higher-availability; if their popularity decreases (as for Long Tail content), they get fewer resources. Among other things, Blackwave is also able to support WMS and Flash streaming, FTP uploading for content ingest and "multi-tenancy" for customer resource sharing.The net effect of all this is that Blackwave believes it can deliver 10x improvements in both capex (through lower hardware requirements) and opex (through lower power, cooling, data center costs). All of this of course means that CDNs gain more financial flexibility to deliver ever higher quality content from their customers.

Separate, thePlatform (note a VideoNuze sponsor) is announcing today that it is launching mpsManage Ingest, a new streamlined feature for ingesting its customers' content. Marty Roberts, thePlatform's VP of Marketing told me last week that as video quality has increased - thereby causing an explosion of file sizes - the time and effort to ingest them has grown more burdensome and costly. This is particularly true for companies with large or dynamic video libraries.

mpsManage Ingest sets up "Watch Folders" where customers push their content via FTP, a feed reader for thePlatform to subscribe to updates and multi-format ingest adaptors. mpsManage Ingest carries no extra charge, and continues the company's recent efforts to lower the total cost of operating for video content providers (see earlier post on thePlatform's mpsManage Storage and mpsManageCDN offerings).

These are just two examples of how improved technology is enabling higher-quality video. There's plenty more happening; I recently received a briefing from Nokeena, which provides video caching, streaming and delivery intelligence for delivery across screens, a category that includes others like Verivue and EdgeWare, which I haven't spoken to yet. Then there is adaptive bit rate streaming from companies like Move Networks, Adobe and Microsoft, efficient transcoding from companies like Grab Networks, HD Cloud, mPoint and Encoding.com and file transfer and work flow acceleration from companies like Aspera and Signiant.

Adding it all up, the ecosystem of technology helping enable higher-quality, more efficient delivery of online video is impressive and its momentum is growing. Users will continue to benefit from all of these initiatives, as the quality line between conventional delivery and online delivery further blurs.

What do you think? Post a comment now.

Categories: CDNs, Technology

Topics: Blackwave, EdgeWare, Nokeena, thePlatform, Verivue

-

June 24th Webinar on Video Syndication

Please join me on Wednesday June 24th at 1:30pm EDT / 10:30am PDT for a free webinar, "Demystifying Online Video Syndication." As VideoNuze readers know, I've been writing about the emergence of the "syndicated video economy" for over a year now. During this time syndication has continued to grow in importance for all video content producers and technology providers. I hear almost daily about how strategic syndication has become for reaching fragmented online audiences.

I'll be sharing updated trends and data on video syndication, as well as thoughts on where the market is heading. The webinar is sponsored by Grab Networks, whose co-president Marcien Jenckes will provide information on its grabMediaOS solution that enables a "Create Once, Publish Anywhere" business model. Grab was formed from the Fall '08 merger of Anystream and Voxant and it recently announced a $12M financing. Grab works with hundreds of content providers and is one of the key players in driving the video syndication market.

If you're trying to understand the syndication opportunity and identify the right solutions to fit your needs, this webinar is for you!

Categories: Events, Syndicated Video Economy

Topics: Grab Networks

-

A New Old Model for Making Money with Original Online Entertainment Video

Today I'm pleased to introduce "VideoNuze Forums," a periodic opportunity for online video industry experts to contribute their thoughts and ideas to the VideoNuze community. I'm a firm believer that only through the industry's collective ideas and energy will online video reach its ultimate potential.

In this kickoff post, David Graves shares his thoughts on how advertisers can collaborate with online video producers to fund original online entertainment, while leveraging the syndication model. David is a veteran media executive who I've known for years; he's served in executive roles at Yahoo and Reuters, and more recently founded PermissionTV. He's now consulting with Global Capital Strategic Group.

Please contact me if you're interested in contributing. I can't guarantee I'll run everything, but I welcome your ideas.

A New Old Model for Making Money with Original Online Entertainment Video

by David Graves

In the very beginning of television, advertising agencies worked directly with creative people to produce the dramatic programs they wanted to put their ads in. Now, 60 years later, it's time for them to do so again, on the Web.

Between then and now, distributors such as TV networks have become the ones who financed and controlled video programming and acted as the middleman between creatives and advertisers. But today there aren't enough distributors with both the will and the resources to speculatively fund large volumes of online entertainment video.

There are many creative people who would like to produce for the new online medium, particularly now that it can be done for historically low costs. But it's hard to make money. Even so, some dramatic video like Strike.TV is getting produced on the hopes that it will attract an audience that might get sold to advertisers. This is nice but inefficient and usually unprofitable.

In order for the Internet to develop as a substantial platform for original entertainment video, a new model has to form that gives producers some additional upfront confidence. There needs to be a better chance of generating a profit in order to encourage Internet producers to produce and people with money to fund them. Since the paid model is still highly challenged, even for well-known, branded fare (e.g. broadcast network programs), advertising is the most likely source of revenue.

Advertisers are clearly open to the potential benefits of online video advertising. To begin with, they love TV commercials over every other form of advertising. Online, their ads can't be skipped, can be better targeted and offer the possibility of an immediate response or interaction on top of the branding value. What's not to like?

But experiments with advertiser-created programming have by and large been disappointing. That's because it doesn't make sense for advertisers to be the ones financing, creating or distributing video. It's not what they do. On the other hand, partnerships like that of Alloy Entertainment and Johnson & Johnson, to create the "Private" Web series for teen girls, which debuts next month, exemplifies the potential. Brands like Neutrogena will be subtly integrated into the shows.

The model that will work is one where advertisers hook up directly with creative programmers to help encourage show ideas they like. Some call this "branded entertainment" and it can take many forms. For example, it could be an advertising commitment at an agreed-upon CPM, contingent on seeing the finished product. Or a pre-buy that helps fund the production in return for a lower CPM. Even a smile and a wink would have value.

If a producer had an embedded advertiser at a decent CPM, they could arrange for distribution both on their own sites and through syndication. Given the state of ad sales today, offering syndicated sites free, high-quality video content with a built-in CPM split would be like offering the proverbial candy to a baby. Further, there will be syndicators like Pixsy and others who would no doubt be happy to take on the job of arranging distribution for a slice of the CPM.

This model is very similar to the way TV stations have been getting their first run syndicated content (like Oprah and Wheel of Fortune) for years. The programs come with a certain number of embedded commercials along with slots that the stations can sell themselves. It's called "syndicated barter." There are many advertisers who have used this method to ensure that their ads run in the right editorial environment. What they end up paying is the aggregate rating that the individual stations generate.

For original online video entertainment to flourish it seems inevitable that producers and advertisers will need closer partnerships to address the vacuum created by the lack of distribution funding.

What do you think? Post a comment now.

Categories: Advertising, Indie Video, Syndicated Video Economy, VideoNuze Forums

Topics: Alloy, Johnson & Johnson, Pixsy